Oracle’s innovative ability has allowed it to survive as one of the top tech companies since it was founded in 1997 and till today, it remains a relatively stable company having survived some of the worst economic conditions. But compared to other leaders in the space such as Google, Microsoft, and Amazon, can Oracle Corp compete? And is Oracle stock predictions for 2023 positive?

The company has succeeded in managing its revenue growth and other key metrics over the years but with renewed plans for expansion and better investor sentiment, Oracle stock could see an impressive rise this year and this is something traders can benefit from.

How Oracle Corp Started

On June 1977 in California, Larry Ellison, Ed Oates, and Bob Miner created Software Development Laboratories to develop software. The original goal was to create software that would work in line with IBM’s database products. However, IBM was secretive and didn’t share its error codes which led SDL to create its own SQL database.

The name of the company was later changed to Oracle inspired by the CIA project they worked on under the same name. The CIA became Oracle’s first client and they kept improving and releasing various versions of their product.

The company eventually went public in 1986 with $55 million in revenue and put up 2.1 million shares at $15 each. Oracle would go on to make many achievements including becoming one of the first software companies to give an Internet Strategy and release the first ever 64-bit RDBMS.

Source: TechGoing

It is now one of the largest software companies in the world based in Austin Texas and with a market cap of $316.29 billion. Larry Ellison remains the Executive Chairman & CTO with Jeff Henley as Vice Chairman and Safra Catz as the CEO.

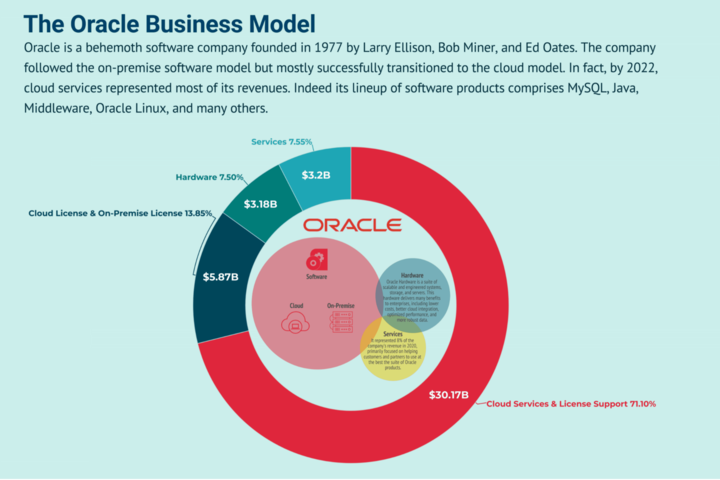

Business Model and Products

Oracle Corp provides products and services that are meant to aid businesses, educational institutions, government agencies, and resellers in enterprise information technology (IT) environments. The software company uses a mixed business model that combines specific elements of a traditional sales-based business model and a subscription-based one. Oracle creates different products and services that are tailored to meet the unique needs of different customer segments. It has a wide range of services for businesses regardless of their size. Apart from identifying the needs of each customer segment, Oracle focuses on providing those customers with high-quality and secure solutions to help them achieve their goals.

Source: FourWeekMBA

Products/Services

Oracle Corp has effectively developed a variety of products and services to serve several segments. It sells data-based software, and cloud-engineered systems, along with enterprise software products, and infrastructure products delivered with the use of flexible IT deployment models.

These products help businesses and government agencies to build, manage, and run their external and internal products and business operations. In addition to software products, businesses can purchase hardware such as storage systems, networking equipment, and servers as standalone products or part of a larger solution package together with its software. To ensure that its products are always in good shape, customers can pay an annual fee for maintenance and support services which includes training, software updates, and technical support.

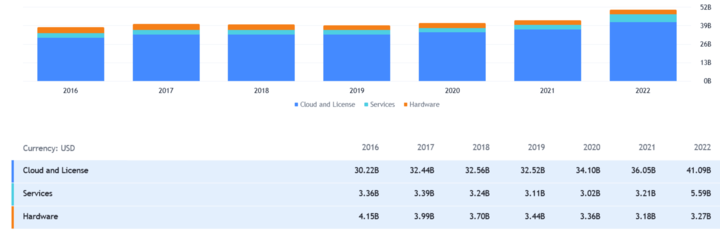

How is Oracle doing financially?

By increasing its product offerings to serve different customer segments over the past decade, Oracle Corp has succeeded in growing their annual revenue from $22 billion to $49.95 billion with total quarterly returns growing 17% year over year. The company also reached an all-time high of $50 billion in revenue by the end of Q1 2023. However, from 2012 till now, Oracle’s revenue growth CAGR has been relatively slow, increasing by only 1.35% compared to its peers like Microsoft which has grown faster during that same period.

Source: TradingView

Net income has reached $1.19 per share or $3.32 billion and operating cash flow at $17.2 billion. Its GAAP operating income is $13.1 billion while its non-GAAP operating income is $20.9 billion. Oracle fair value is projected to be within the range of $126.6 - $236.62 billion indicating a 31.1% upside.

The company’s balance sheet is also relatively stable but debt has increased to $90.5 billion from $75.9 billion last year with long-term liabilities of $109.7 billion. Offsetting this is 134.4 billion in assets which is sufficient to cover its current liabilities.

Key Financial Ratios and Metrics

To determine whether or not Oracle stock is undervalued, we’ll have to compare it to some of its biggest rivals in the tech industry.

Oracle vs Amazon

Oracle revenue growth has seen more increase on a YoY basis growing by 16.86% compared to Amazon’s 9.37%. But when you consider the actual revenue itself, Amazon brought in $127.36 billion in revenue as of March 2023 and that of Oracle is 9 times less at $13.84 billion. For the P\E ratio, Amazon is also much higher standing at 314.1 with Oracle at 36.5

Oracle vs Microsoft

Oracle has seen higher revenue growth rising 16.86% YoY compared to Microsoft’s 7.08%. However, in terms of numbers, Microsoft is doing much better bringing in revenue of $52.86 billion as of March 2023 while Oracle brought in less than half of Microsoft’s revenue at $13.84 billion.

Both Oracle and Microsoft do have quite similar P\E ratios at 36.5 and 36.48 respectively.

At $116.02, Oracle stock is properly valued considering that its competitors tend to have better fundamental metrics overall which accounts for their higher share prices.

ORCL Stock Performance

Trading Information

Oracle is listed on the New York Stock Exchange as NYSE: ORCL. It is based in the United States, and the American dollar (USD) serves as its primary currency. Since it went public in 1986, oracle stock has undergone 10 splits and also pays out $0.40 as dividends every quarter.

For trading purposes, you can trade ORCL stock in the Pre-Market (4:00-9:30 am) and After-Hours Market (4:00-8:00 pm ET).

Overview of ORCL Stock Performance

Despite 11 acquisitions in 5 years, Oracle has seen no substantial revenue growth for almost a decade leading some investors to believe that the old cloud giant could end up like IBM. But despite the relatively modest revenue growth, Oracle’s stock performance has skyrocketed over the last 3 years reaching an all-time high of $126.55 in June 2023. It has rewarded investors with a return of 27% in the last 12 months, which is significantly higher than the 18% annual return it has maintained over the last 5 years.

At $116.02, Oracle is trading 33 times higher than its trailing 12-month earnings and 20 times more than its one-year forward expected earnings. Right now it is mostly benefiting from the high growth rate of Oracle cloud services and the fact that its business is relatively diversified. Oracle stock outlook is relatively positive and its potential profitability in the cloud space along with steady growth of its other business areas could help in boosting its stock price.

Key Drivers of ORCL Stock Price

Cloud Services

Oracle Corp recently reported its total revenue for its fiscal year 2023 and it went up by 18% to nearly $50 billion. This growth is mostly due to their cloud applications and infrastructure businesses that have grown significantly over the last 5 years. Oracle has slowly become one of the fastest-growing cloud providers even though it is still largely a small player in the market.

Alliance with Cohere

As an answer to Microsoft’s partnership with OpenAI, Oracle has also invested in Cohere, an AI startup that intends to compete directly with OpenAI. The software giant plans to use Cohere as a key piece in catching up to bigger cloud service providers by using the startup’s software to add AI features to its products.

Source: GEANT CONNECT Online - GEANT

Generative AI Capabilities

Oracle has upgraded its existing HR processes by including generative AI capabilities. This helps to boost productivity, improve employee and client experience, and streamline HR processes.

Future Prospects of ORCL Stock

So now to the main question: should I buy Oracle stock? Oracle stock price has seen a massive increase this year and continued to maintain its growth after the company released its earnings report so, it is fair to say that investors are excited about the company’s prospects. The stock has been in an uptrend for the past 1 year and is already up by over 50% this year alone. Oracle stock analysis places the stock as a Hold and is expected to keep trading at a steady price range as the software company expands its position in the cloud infrastructure market. Analysts placed Oracle share price target at an average of $132.20 with a high estimate of $150 over the next 12 months. If it does drop, it is expected to go no lower than $82.50.

Risks and Opportunities

Competitive Risks

Intense Competition: Oracle faces strong competition from other technology companies like Google, Amazon, and Microsoft.

Data privacy regulation: As a company in the tech space, the importance of consumer data can never be overestimated because it helps Oracle identify the needs of its consumers and areas they can improve on. The collection of such valuable consumer data is now harder due to strict data privacy regulations.

Price of products and services: Oracle’s products and services typically come at high prices and they require a bit of skill to use which might not make it attractive to consumers. In addition, Oracle is still up and coming in emerging industries and customers might prefer to go with companies with lower prices while offering the same quality.

Source: DNC

Growth Opportunities

Extensive product portfolio: Oracle has been in the tech space for quite some time and has developed a wide range of products and services that can meet the needs of a variety of customers. Such a comprehensive portfolio improves Oracle financials, reduces the risk of revenue loss, and also maneuvers changes in market demand.

Research and development facilities: Oracle Corp has invested heavily in research and development. This allows them to remain in line with the trend and develop new products to suit customer needs

Pushing tech adoption: Oracle has partnered with system integrator and solutions provider Soft Alliance to push the digital economy forward and drive technology adoption, especially in developing countries.

Future Outlook and Expansion

Due to the increased demand for cloud computing services, Oracle is planning to spend billions over the next few years in expanding its cloud data centre infrastructure. The software giant is committed to investing $1.5 billion in Saudi Arabia. With the capital, data centres will be built at strategic locations that can easily be accessed by its major customers.

Source: Gulf Business

In addition, there are plans to strengthen the company’s presence in South East Asia by opening another second cloud region in Singapore. Over time, 10 more locations will be opened in other regions to add to the 41 regions Oracle currently operates. The company is also set to challenge Intel Corp by releasing the latest version of its database software that can be used on servers with chips from Ampere Computing. This wasn’t the case in the past as Oracle’s database could work with AMD and Intel processors and this change will affect Intel’s iron grip on the data centre processor market.

Oracle stock rating is also modest, receiving an average rating of 2.25 and it is regarded as a moderate buy and hold.

Trading Strategies for ORCL Stock

There are several strategies for trading ORCL stock but the most basic strategy available is the support and resistance trading strategy. It is useful for both beginners and expert traders because it is simple to use and also very effective. Having a support and resistance strategy also works well when trading Oracle stock CFD because you can develop a trading strategy that doesn’t depend on waiting for the trend to appear and can make an accurate Oracle stock forecast from the available data.

From the chart, it is clear that support and resistance setups won’t always look clean and perfect. Most setups tend to be messy which is why wide zones are used to capture relevant reversal points. After identifying the key support and resistance levels like this, the most straightforward method is to sell when the price nears the support zone and buy when it nears the resistance or breaks through from it. To get smaller profits, you can also trade the price movement within either the support or resistance zones.

Trade ORCL Stock CFD at VSTAR

Get a head start in the market by trading Oracle stock CFD with a wide range of tools, educational resources, and guides at VSTAR. The trading platform is designed to guarantee traders easy access to markets by trading over 1000 assets while paying zero commissions after making profits.

If you want to perfect your skills or test out a new trading strategy, you can practice using its demo account and trade with funds of up to $100,000.

Conclusion

So, is Oracle a buy? From a financial perspective, Oracle Corp is relatively stable and their rapid growth in the cloud computing space is something to note. In the coming years, analysts expect Oracle EPS to grow at mid-double digits until 2026 along with an increase in its annual revenue. Therefore, its stock is also likely to see a strong increase within the next 3 to 4 years and something you might want to consider adding to your portfolio.