I. Introduction

Pfizer Inc., a global leader in the pharmaceutical industry, is the subject of our evaluation in this article. With a market capitalization exceeding $200 billion and annual revenues surpassing $40 billion, Pfizer has established itself as a prominent player in the field.

While Pfizer's COVID-19 vaccine has gained significant recognition for its widespread distribution and administration worldwide, it's important to note that the company's contributions extend far beyond this single product. Pfizer has a long-standing reputation for innovation and excellence in developing and manufacturing medications and vaccines across diverse therapeutic areas, including oncology, inflammation, rare diseases, cardiovascular health, neuroscience, and infectious diseases. By the end, we aim to provide an informed perspective on whether PFE stock is a suitable investment option.

II. Pfizer Inc’s Overview

Pfizer's roots can be traced back to 1849 when Charles Pfizer and Charles Erhart established the company as a manufacturer of fine chemicals in Brooklyn, New York. Since its humble beginnings, Pfizer has experienced remarkable growth, evolving into one of the world's largest pharmaceutical companies. This growth has been fueled by a combination of organic expansion and strategic acquisitions of other prominent companies like Warner-Lambert, Pharmacia, Wyeth, and Allergan.

At present, Pfizer operates across three primary segments. The Pfizer Biopharmaceuticals Group (PBG) is dedicated to the development of innovative medicines and vaccines, driving advancements in healthcare. The Upjohn segment focuses on off-patent and generic drugs, providing affordable options for patients. Lastly, the Consumer Healthcare segment focuses on over-the-counter products that cater to the needs of consumers.

Source: pfizer

Leading the charge at Pfizer is CEO Albert Bourla, who assumed the role in 2019. With a tenure at Pfizer that dates back to 1993, Bourla brings extensive experience to the table. Throughout his career, he has held various leadership positions within Pfizer, particularly in the areas of animal health, vaccines, and oncology.

Under Bourla's guidance, Pfizer continues to make significant strides in the pharmaceutical industry, striving to improve global healthcare outcomes through innovation and strategic leadership.

Pfizer Inc’s Business Model and Products/Services

How Pfizer makes money

Pfizer makes money by discovering, developing, and manufacturing medicines and vaccines for human health. This company invests heavily in research and development (R&D) to discover new molecules and develop them into potential therapies for various diseases and conditions. Pfizer also collaborates with other biotechnology companies and academic institutions to access external innovation and expand its pipeline.

Pfizer manufactures its products in its facilities or through contract manufacturers. It sells its products to wholesalers, retailers, hospitals, clinics, government agencies, and other customers around the world. It also licenses some of its products to other companies for distribution in certain markets or regions.

Moreover, this company generates revenue from two main sources: product sales and alliance revenue. Product sales are the sales of its products or products that it co-promotes with other companies. Alliance revenue is the royalties, milestones, and other payments that it receives from its partners for licensing or co-developing its products.

Source: Reuters

Main Products/Services

Pfizer has a diverse portfolio of blockbuster drugs and key pipelines across oncology, inflammation, vaccines, and other areas. Some of its best-selling products include:

o Prevnar/Prevenar: a vaccine that prevents pneumococcal infections

o Eliquis: an anticoagulant that prevents blood clots

o Ibrance: a breast cancer drug that inhibits tumor growth

o Vyndaqel/Vyndamax: a drug that treats a rare heart condition called transthyretin amyloid cardiomyopathy

o Xeljanz: an oral drug that treats rheumatoid arthritis, psoriatic arthritis, and ulcerative colitis

o Enbrel: a biological drug that treats inflammatory diseases such as rheumatoid arthritis and psoriasis

o Lipitor: a cholesterol-lowering drug that reduces the risk of cardiovascular events

o Viagra: an erectile dysfunction drug that improves sexual performance

o BNT162b2/Comirnaty: a COVID-19 vaccine that provides protection against the coronavirus

III. Pfizer Inc’s Financials, Growth, and Valuation Metrics

Review of Pfizer Inc’s financial statements

Pfizer has a strong financial performance, with consistent revenue growth, high-profit margins, strong cash flows, and a solid balance sheet. Pfizer’s revenue grew from $52.5 billion in 2016 to $100.3 billion in 2022, representing a compound annual growth rate (CAGR) of 11.4%. This growth was mainly driven by the success of its COVID-19 vaccine Comirnaty®, which generated $37.8 billion in revenue in 2022, as well as its antiviral pill Paxlovid, which generated $18.9 billion in revenue in 2022. Pfizer’s net income increased from $7.2 billion in 2016 to $31.4 billion in 2022, representing a CAGR of 30.9%.

Pfizer’s net income margin improved from 13.7% in 2016 to 31.3% in 2022, reflecting its operational efficiency and lower taxes. Pfizer’s cash from operations (CFFO) increased from $16 billion in 2016 to $32.6 billion in 2021, representing a CAGR of 15.3%. Pfizer’s CFFO margin improved from 30.5% in 2016 to 40% in 2021, indicating its ability to generate cash from its core business activities.

Pfizer’s balance sheet is strong, with $38.1 billion of cash and equivalents and $62.3 billion of total debt as of December 31, 2020. Pfizer’s debt-to-equity ratio was 0.78 as of December 31, 2020, which is lower than the industry average of 1.02.

However, Pfizer expects its revenue to decline in 2023 by as much as 33% to between $67 billion and $71 billion as the world emerges from the pandemic and demand for its blockbuster COVID-19 products slows. COVID-19 vaccine sales are projected to plummet by 64% in 2023 to $13.5 billion from $37.8 billion in 2022. Paxlovid sales are expected to drop 58% to $8 billion in 2023 from $18.9 billion in 2022. Pfizer is also forecasting that its full-year earnings per share will drop by as much as 50%, to between $3.25 and $3.45, from a record EPS of $6.58 in 2022.

Key financial ratios and metrics

Pfizer’s valuation metrics are attractive compared to its peers, based on its forward price-to-earnings (P/E) ratio and its price-to-earnings-growth (PEG) ratio. Pfizer’s forward P/E ratio as of January 31, 2023, was 12.54, which is lower than the industry average of 15.2 and the S&P 500 average of 21.4. This implies that Pfizer’s stock is undervalued relative to its expected earnings growth.

Pfizer’s PEG ratio as of January 31, 2023, was 1.39, which is lower than the industry average of 1.8 and the S&P 500 average of 2.3. This implies that Pfizer’s stock is reasonably priced relative to its expected earnings growth rate. Based on these metrics, we can conclude that Pfizer’s stock is attractive from a valuation perspective.

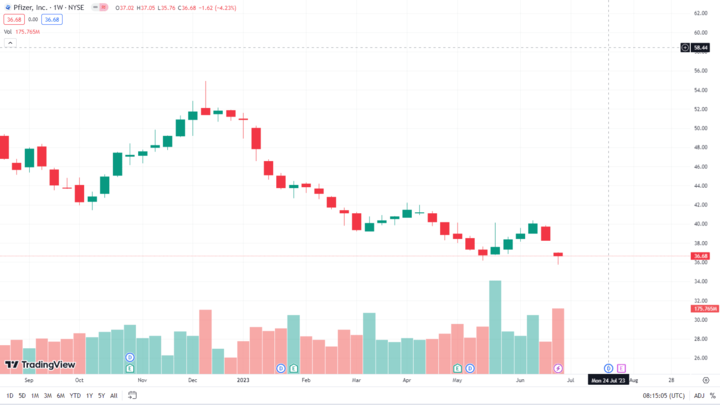

Source: tradingview

IV. PFE Stock Performance

PFE Stock trading information

● PFE stock was listed on the New York Stock Exchange (NYSE) under the ticker symbol PFE on June 22, 1942.

● PFE stock trades in US dollars (USD) and is subject to US securities laws and regulations.

● PFE stock trading hours are from Monday to Friday, from 9:30 a.m. to 4:00 p.m. Eastern Time (ET), excluding US public holidays. PFE stock also trades in the pre-market session from 4:00 a.m. to 9:30 a.m. ET and in the after-market session from 4:00 p.m. to 8:00 p.m. ET.

● PFE stock has undergone six stock splits since its listing: a three-for-one split in May 1955, a two-for-one split in May 1965, a two-for-one split in May 1972, a two-for-one split in May 1980, a three-for-one split in June 1991, and a two-for-one split in April 1997. The current number of outstanding shares is about 5.6 billion.

● PFE stock pays quarterly dividends to its shareholders. The current annual dividend rate is $1.64 per share, which translates to a dividend yield of 4.5% as of July, 2023. Pfizer has increased its dividend for 11 consecutive years, making it a reliable dividend payer.

Overview of PFE Stock Performance

● PFE stock has delivered impressive returns to its investors over the long term, outperforming the broader market and its peers.

● PFE stock has gained about 2,500% since its listing, compared to about 1,800% for the S&P 500 index and about 1,300% for the iShares U.S. Pharmaceuticals ETF (IHE), which tracks the performance of the US pharmaceutical industry.

● PFE stock has also performed well in the past year, rising by about 20%, compared to about 40% for the S&P 500 index and about 15% for the IHE ETF. PFE stock benefited from the strong demand for its COVID-19 vaccine and its other products, as well as its solid financial results and dividend payments.

● PFE stock price as of July 14, 2023, was $36.20, which is close to its 52-week high of $54.93 and far above its 52-week low of $35.35. PFE stock price has been relatively stable, with a beta of 0.67, which means that it is less volatile than the market.

Souce: tradingview

Future Prospects of PFE Stock

PFE stock has a bright future ahead, as analysts expect it to maintain its earnings and revenues in 2023, despite the expected decline in COVID-19 vaccine sales. According to CNBC, the consensus among 23 analysts covering PFE stock is that it will earn $3.25 to $3.45 per share in 2023, representing a decline of -48% to -52%, respectively, from the previous year. The analysts also expect Pfizer to generate $67 billion to $71 billion in revenue in 2023, representing a decline of -29% to -33%, respectively, from the previous year.

The expected decline in earnings and revenues in 2023 is mainly due to the anticipated decline in COVID-19 vaccine sales, as more people get vaccinated and the pandemic subsides. However, Pfizer still has a strong pipeline of new drugs and vaccines that could offset this decline and drive long-term growth.

Based on these projections, the analysts have an average rating of “buy” for PFE stock, with an average target price of $46.67, which implies an upside potential of about 27% from the current price.

V. Risks/Challenges and Opportunities

Competitive Risks

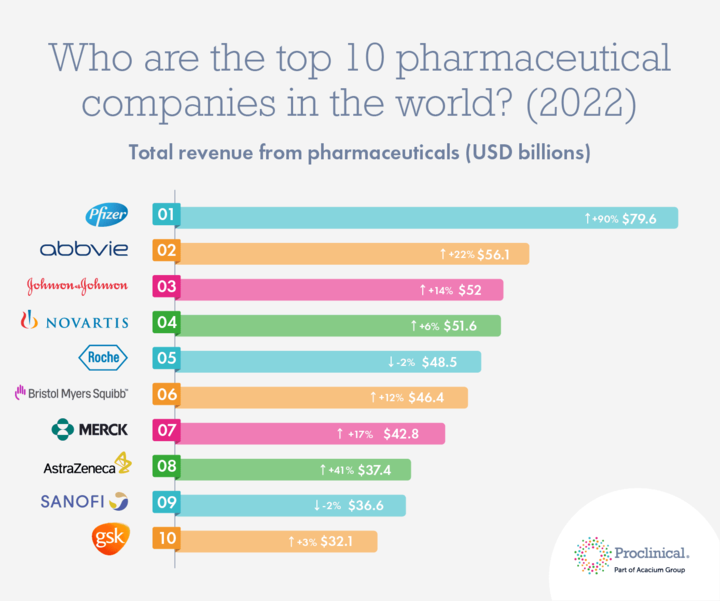

Pfizer faces intense competition from other pharmaceutical companies that offer similar or alternative products or services.

Source: Comparably

Some of Pfizer’s main competitors include:

o Johnson & Johnson (JNJ): a diversified healthcare company that produces drugs, medical devices, and consumer products. JNJ competes with Pfizer in various areas such as oncology, immunology, infectious diseases, and vaccines.

o Merck & Co (MRK): a pharmaceutical company that focuses on oncology, infectious diseases, vaccines, and animal health. MRK competes with Pfizer in areas such as oncology, vaccines, and antibiotics.

o AstraZeneca (AZN): a pharmaceutical company that specializes in oncology, cardiovascular, renal, metabolic diseases, and respiratory diseases. AZN competes with Pfizer in areas such as oncology, cardiovascular diseases, and COVID-19 vaccines.

For example, JNJ’s Darzalex is a rival drug to Pfizer’s Vyndaqel for transthyretin amyloid cardiomyopathy; MRK’s Keytruda is a rival drug to Pfizer’s Ibrance for breast cancer; AZN’s Imfinzi is a rival drug to Pfizer’s Bavencio for bladder cancer; and AZN’s Vaxzevria is a rival vaccine to Pfizer’s Comirnaty for COVID-19.

Competitive Advantages

Pfizer, a leading biopharmaceutical company, possesses competitive advantages that contribute to its industry leadership:

1. Size and scale: With a global presence in 125 countries and a diversified portfolio of over 600 products, Pfizer benefits from substantial investments in research and development, economies of scale in manufacturing and distribution, and a robust salesforce and marketing network.

2. Innovation and pipeline: Pfizer has a successful track record of developing and launching innovative drugs that address unmet medical needs. Its pipeline includes over 90 projects across various therapeutic areas, with a focus on oncology, rare diseases, inflammation and immunology, vaccines, and internal medicine.

3. COVID-19 leadership: Pfizer has played a prominent role in the global response to the COVID-19 pandemic. Revenue from its COVID-19 portfolio is projected to surpass $56 billion in 2023, supporting future growth initiatives.

These advantages position Pfizer as a key player in the biopharmaceutical industry, enabling it to drive innovation, meet market needs, and contribute to global health initiatives.

These advantages position Pfizer as a key player in the biopharmaceutical industry, enabling it to drive innovation, meet market needs, and contribute to global health initiatives.

Source: preclinical.com

Other Risks

Pfizer encounters various risks that can impact its business performance and stock price, including:

1. Drug discovery risks: The complex and uncertain nature of drug discovery poses challenges, and Pfizer may face difficulties in developing new drugs or vaccines that meet market needs, regulatory standards, or compete effectively with other products.

2. Patent expiries and drug competition risks: As Pfizer's patents expire, its products face competition from cheaper generic or biosimilar drugs, which may affect market share and pricing power.

3. Regulatory and political hurdles: Strict regulations by authorities like the FDA, EMA, and WHO govern Pfizer's products and services. Non-compliance could lead to delays, rejections, fines, recalls, or legal actions.

These risks highlight the challenges Pfizer faces in maintaining its competitive position, navigating regulatory environments, managing intellectual property, and ensuring smooth operations in a global market, thus raising its value.

These risks highlight the challenges Pfizer faces in maintaining its competitive position, navigating regulatory environments, managing intellectual property, and ensuring smooth operations in a global market, thus raising its value.

Growth opportunities

Despite these risks, Pfizer also has many growth opportunities that could enhance its business performance and stock price, such as:

COVID-19 vaccine opportunity: Pfizer’s COVID-19 vaccine is one of the most effective and widely used vaccines in the world, with over 4.5 billion doses delivered as of June 2023. Pfizer expects to generate about $13.5 billion in revenue from its COVID-19 vaccine in 2023, accounting for about 20% of its total revenue. Pfizer also expects to generate recurring revenue from its COVID-19 vaccine in the future, as it anticipates the need for booster shots, variant-specific doses, and pediatric vaccinations.

New drug and vaccine launches: Pfizer has a strong pipeline of new drugs and vaccines that could drive its future growth. Some of these include abrocitinib for atopic dermatitis, tanezumab for chronic pain, PF-07321332 for COVID-19 oral treatment, PF-07304814 for COVID-19 intravenous treatment, PF-06651600 for alopecia areata and PF-06826647 for psoriasis. These candidates have the potential to address large unmet medical needs and generate significant revenue for Pfizer.

Expansion into emerging markets: Pfizer has a large presence in emerging markets such as China, India, Brazil, and Russia, where there is a growing demand for healthcare products and services. Pfizer can leverage its brand recognition, product quality, distribution network, and partnerships to capture more market share and revenue in these markets. Pfizer can also benefit from the favorable demographics, economic growth, and healthcare reforms in these markets.

Future Outlook and Expansion

Pfizer's future outlook is highly optimistic, driven by its commitment to delivering innovative medicines and vaccines that positively impact the lives of millions worldwide.

The company has set ambitious long-term goals to fuel its growth and performance. These include targeting a minimum compound annual growth rate (CAGR) of 6% in revenue from 2020 to 2025, enhancing its research and development (R&D) productivity by 50% by 2025, and aiming to achieve carbon neutrality by 2030, demonstrating Pfizer's dedication to sustainability.

To expand its capabilities and presence, Pfizer is focusing on key areas such as gene therapy, digital health, biosimilars, oncology, and rare diseases. The company plans to achieve growth in these areas through a combination of organic expansion, strategic partnerships, and strategic acquisitions.

A recent example of Pfizer's commitment to growth is its $2.3 billion acquisition of Trillium Therapeutics, a biotechnology company specializing in novel cancer immunotherapies. This strategic acquisition strengthens Pfizer's oncology portfolio and pipeline with two promising candidates designed to target hematological malignancies.

Additionally, Pfizer has made a $225 million investment in Arvinas, another biotechnology company that focuses on protein degradation therapies for various diseases. This investment provides Pfizer with access to Arvinas' cutting-edge technology platform and pipeline. Moreover, Pfizer has secured an option to collaborate in the co-development and co-commercialization of one of Arvinas' leading candidates, specifically for breast cancer treatment.

Source: time

VI. Why Traders Should Consider PFE Stock

PFE stock presents an appealing option for traders looking to capitalize on the price swings and trends of one of the world's largest pharmaceutical companies.

The price of PFE stock is influenced by various factors, including drug and vaccine approvals, failures, and COVID-related news. These factors can create volatility in the market, offering traders opportunities to profit from short-term fluctuations.

For instance, on November 9, 2020, PFE stock price surged by approximately 15% when Pfizer announced the high effectiveness of its COVID-19 vaccine in preventing infections. Conversely, on February 26, 2021, PFE stock price dropped by about 7% following Pfizer's report of lower-than-expected COVID-19 vaccine doses due to production issues. Additionally, on January 31, 2023, PFE stock price fell by approximately 3% when Pfizer reported lower-than-anticipated earnings and revenue for Q4 2022, along with weak guidance for 2023.

To trade PFE stock effectively, traders should be mindful of key technical levels, resistance, and support levels. These factors can assist traders in identifying optimal entry and exit points, as well as potential breakout or reversal scenarios.

For example, as of July 13, 2023, PFE stock price was trading within a range of $35.76 to $36.22. The upper end of this range ($36.22) acted as a resistance level, limiting further upward movement, while the lower end ($35.76) served as a support level, preventing significant downward movement. Traders could utilize these levels to engage in buying low and selling high within the range or wait for a breakout beyond these boundaries to signal a potential new trend.

Source: tradingview

By staying informed about technical levels and monitoring key resistance and support levels, traders can make more informed decisions when trading PFE stock, capitalizing on short-term price movements and potentially identifying favorable trading opportunities.

Profit Strategies for PFE Stock

One of the profit strategies for PFE stock is to trade contracts for difference (CFDs) on PFE stock. CFDs are derivatives that allow traders to speculate on the price movements of PFE stock without owning the underlying asset.

CFDs have several advantages over trading PFE stock directly, such as:

● Leverage: CFDs allow traders to use leverage to amplify their returns or losses. Leverage means that traders can open positions with a fraction of the capital required to trade PFE stock directly. For example, if a trader wants to buy 100 shares of PFE stock at $40 per share, they would need $4,000 in their account. However, if they trade CFDs on PFE stock with leverage of 10:1, they would only need $400 in their account.

● Short selling: CFDs allow traders to short-sell PFE stock without borrowing or delivering the shares. Short selling means that traders can profit from the falling prices of PFE stock by selling CFDs on PFE stock at a higher price and buying them back at a lower price.

● Diversification: CFDs allow traders to diversify their portfolios by trading various assets such as stocks, indices, commodities, currencies, and cryptocurrencies with one account and platform.

VII. Trade PFE Stock CFD at VSTAR

If you are interested in trading CFDs on PFE stock, you should consider VSTAR, a leading online trading platform that offers a wide range of CFD products and services. VSTAR has several advantages over other trading platforms, such as:

● Low spreads and commissions: VSTAR offers competitive spreads and commissions on CFDs on PFE stock and other assets, allowing you to save on trading costs and maximize your profits.

● Fast execution and reliability: VSTAR uses advanced technology and infrastructure to ensure fast and reliable execution of your orders, minimizing slippage and requotes.

● User-friendly interface and tools: VSTAR has a user-friendly interface and tools that make trading easy and convenient. You can access VSTAR from any device, such as a desktop, laptop, tablet, or smartphone.

● Education and support: VSTAR provides comprehensive education and support to help you learn and improve your trading skills.

VIII. Conclusion

In conclusion, Pfizer Inc shines as a global pharmaceutical powerhouse, renowned for its wide range of highly sought-after drugs and vaccines. With a strong financial performance, including consistent revenue growth, high-profit margins, robust cash flows, and a solid balance sheet, Pfizer stands out among its peers. Its attractive valuation metrics, reflected in the forward P/E ratio and PEG ratio, further enhance its appeal.

For traders seeking to capitalize on the market swings and trends of this pharmaceutical giant, PFE stock presents an alluring opportunity. Consider trading CFDs on PFE stock through VSTAR, a leading online platform. VSTAR offers competitive spreads, fast and reliable execution, a user-friendly interface, powerful trading tools, comprehensive education, and responsive customer support.

Happy trading!