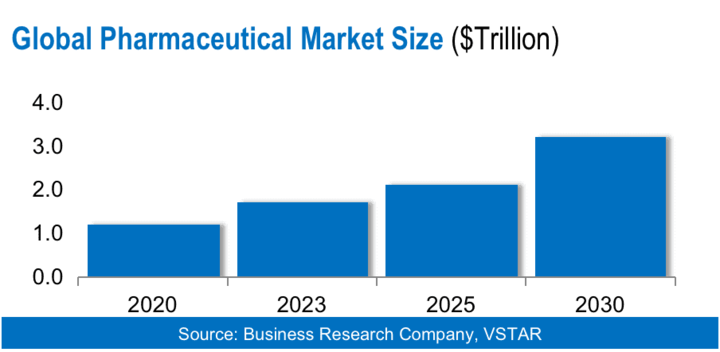

The pharmaceutical industry presents a huge profit opportunity for investors. The global pharmaceutical market size is estimated to be worth $1.7 trillion in 2023 and is forecast to grow to $2.1 trillion by 2025 and $3.2 trillion by 2030.

Pharmaceutical companies large and small stand to benefit from this huge revenue opportunity. Many pharmaceutical stocks offer generous dividend yields, and others offer significant upside potential.

If you're looking for the best pharmaceutical stocks to buy now, it helps to thoroughly evaluate your options. This article examines the top pharmaceutical stocks to help you decide which one is best for you. It looks at both traditional big pharma companies and a new generation of pharmaceutical companies with the potential to disrupt the industry.

1. Pfizer Inc. (NYSE: PFE)

Investors looking for the best pharmaceutical stocks to buy now would do well to consider Pfizer Inc. (NYSE: PFE). This American multinational pharmaceutical giant is headquartered in New York City. Founded in 1849, Pfizer went public in 1942.

With a market capitalization of more than $200 billion, Pfizer is one of the largest pharmaceutical companies in the world. The company produces medicines for various diseases and conditions. It has more than 300 drugs to its name. The company also has dozens of drug candidates in its pipeline.

Pfizer is best known for its market-leading COVID-19 vaccine called Comirnaty, which it co-developed with BioNTech (NASDAQ: BNTX). Sales of Comirnaty will generate $37.8 billion in revenue for Pfizer in 2022.

Pfizer's stock is listed on the NYSE and trades under the ticker symbol "PFE".

Pfizer (NYSE: PFE) Stock News

- Pfizer has invested $25 million in Caribou Biosciences (NASDAQ: CRBU) stock and appointed its representative to Caribou's advisory board. The funding will help Caribou advance the development of its drug candidate for patients with multiple myeloma.

- Pfizer has tapped Samsung Biologics to manufacture certain drugs on its behalf at facilities in South Korea. The manufacturing agreement is worth nearly $900 million and includes the production of biosimilar medicines in categories ranging from oncology to immunotherapy.

- The EU selected Pfizer for a contract to produce emergency vaccines. As part of its preparedness for future pandemics, the EU has sought agreements with Pfizer and other pharmaceutical companies to ensure its ability to supply vaccines in the event of a global health emergency.

Pfizer's Financials

In 2018, Pfizer made $11.2 billion in profit on $40.8 billion in revenue. In 2022, profit will increase to $31.4 billion and revenue will jump to $100.3 billion. The company's revenue has grown at a compound annual growth rate of 20% over the past 5 years.

Pfizer had $196 billion in assets as of April 2023, including $20 billion in cash. The company has paid a quarterly dividend for many years. The next dividend payment is scheduled for September 5 and will be $0.41 per share. Pfizer offers an above-average dividend yield of 4.56%.

Pfizer (NYSE: PFE) Stock Performance

Pfizer soared to an all-time high of $60 in 2021, as Pfizer's lucrative COVID-19 vaccine business drew many investors to the stock. But the stock has fallen 30% since the start of 2023, a sign that some investors are taking profits on one of the best pharmaceutical stocks.

PFE stock has ranged from $35 to $55 over the past year. Currently trading around $36, PFE stock is barely above its 52-week low and remains 35% below its 52-week high. The average PFE stock price target of $46 implies almost 30% upside. The PFE stock price target of $75 implies more than 100% upside.

2. Johnson & Johnson (NYSE: JNJ)

Johnson & Johnson (NYSE: JNJ) is worth considering for investors looking for the best pharmaceutical stocks to invest in 2023. The company develops and sells a wide range of healthcare products, from pharmaceuticals to medical devices. With a market capitalization of more than $400 billion, Johnson is one of the top healthcare companies in the world.

Johnson & Johnson (NYSE: JNJ) Stock News

- Johnson sold its Blink eye drop business to Bausch + Lomb for more than $106 million. In addition to generating additional cash, the deal will allow Johnson to focus on its core businesses.

- Johnson's Janssen Pharmaceutical unit partnered with Nanobiotix (NASDAQ: NBTX) to co-develop a cancer drug. The drug candidate in the deal is currently in a Phase 3 trial.

Johnson & Johnson Financials

In 2018, Johnson made a profit of $15.3 billion on revenue of $81.6 billion. In 2022, the profit rose to $18 billion and revenue jumped to $94.9 billion. Johnson's revenue has grown at a compound annual rate of 3% over the past 5 years.

As of April 2023, Johnson's balance sheet showed $187 billion in assets, including more than $23 billion in cash.

Johnson has paid increasing dividends for the past 14 consecutive years. It currently offers an above-average dividend yield of 2.87%.

Johnson & Johnson (NYSE: JNJ) Stock Performance

JNJ stock has traded in a range of $150 to $180 over the past year. At around $160, the stock is 7% above its 52-week low, but 10% below its 52-week high. The JNJ stock price target of $195 implies more than 20% upside.

3. Merck & Co Inc (NYSE: MRK)

Merck & Co (NYSE: MRK) is one of the largest pharmaceutical companies in the world, making it one of the top pharmaceutical stocks for investors. It has a market capitalization of nearly $280 billion. The company produces drugs and vaccines for various diseases.

Its product portfolio includes drugs for cancer and diabetes, as well as vaccines for chickenpox. Founded in 1891, Merck is headquartered in New Jersey and has a global presence.

Merck & Co (NYSE: MRK) Stock News

- Merck has partnered with Moderna Inc (NASDAQ: MRNA) to develop a cancer vaccine. The vaccine candidate showed impressive results in a Phase 2 trial and is now moving into Phase 3.

- Merck is seeking additional markets for its COVID-19 drug Lagevrio. The company is working to get the drug approved in the EU, where an initial application met with regulatory resistance.

Merck Financials

With many blockbuster drugs, Merck is a highly profitable pharmaceutical company. In 2018, it made a profit of $6.2 billion on revenue of $42 billion. In 2022, the profit rose to $14.5 billion and revenue jumped to $59 billion. Merck’s revenue has grown at a compound annual rate of 7% over the past 5 years.

As of March, Merck had $108 billion in assets on its balance sheet, including $10 billion in cash. The company has a long history of paying dividends. It has paid increasing annual dividends for the past 14 consecutive years. Merck stock offers an above-average dividend yield of 2.62%.

Merck & Co (NYSE: MRK) Stock Performance

MRK's stock price has ranged from $84 to $120 over the past year. At $109, the stock is 30% above its 52-week low, but still 10% below its 52-week high. The average MRK price target of $123 implies an upside of more than 13%. The maximum price target of $135 implies an upside of 20%.

4. Bristol-Myers Squibb Co (NYSE: BMY)

Bristol-Myers Squibb (NYSE: BMY) is one of the world's leading pharmaceutical companies and a favorite of many investors. The company develops medicines for a wide range of diseases and health conditions, including cancer, diabetes, hepatitis, arthritis and psychiatric disorders.

Founded in 1887 and based in New York, Bristol-Myers is best known for its blood thinner Eliquis.

Bristol-Myers Squibb (NYSE: BMY) Stock News

- Bristol-Myers' efforts to expand the label for its cancer drug Opdivo may be succeeding. In a recenttrial, Opdivo was found to improve survival in people with a certain type of blood cancer.

- Bristol-Myers has joined Merck in an effort to fight the U.S. government's attempt to lower the prices paid for their drugs under the Medicare program. The government spends more than $12 billion annually on Bristol-Myers' popular drug Eliquis for Medicare patients.

Bristol-Myers Financials

The company made a profit of $4.9 billion on revenue of $22.6 billion in 2018. In 2022, the profit soared to $6.3 billion and revenue jumped to $46 billion. The company's revenue has grown at a compound annual growth rate of 15% over the past 5 years.

As of March 2023, Bristol-Myers had $94 billion in assets, including $9.3 billion in cash. The company has a long dividend history and has paid increasing annual dividends for the past 14 consecutive years. BMY stock currently offers an above-average dividend yield of 3.6%.

Bristol-Myers Squibb (NYSE: BMY) Stock Performance

Over the past year, BMY stock has traded in a range of $62 to $81. At about $63, the stock is trading about 20% below its 52-week high. The average price target for BMY stock of $76 implies an upside of more than 20%. The highest price target for BMY stock of $92 implies 45% upside.

5. AstraZeneca PLC (NASDAQ: AZN)

It is hard to ignore AstraZeneca (NASDAQ: AZN) when looking for the best pharmaceutical stocks to buy now. AstraZeneca is a British multinational pharmaceutical company with a wide range of operations.

It develops drugs for diseases in categories such as oncology, respiratory, cardiovascular, and gastrointestinal. AstraZeneca is one of the manufacturers of COVID-19 vaccines.

AstraZeneca (NASDAQ: AZN) Stock News

- AstraZeneca is developing a lung cancer drug that has shown promise in clinical trials. It is partnering the project with Daiichi. If successful, the drug could add billions of dollars to AstraZeneca's top line.

- AstraZeneca may spin off its China business into a separate company and list its stock in Hong Kong. The spin-off plan is part of AstraZeneca's attempt to reduce risks to its China business amid geopolitical tensions.

AstraZeneca Financials

In 2018, AstraZeneca generated $22 billion in revenue, which resulted in a profit of $2.2 billion. In 2022, revenue soared to $44 billion and profit jumped to $3.3 billion. The company’s revenue has grown at a compound annual rate of 15% over the past 5 years.

AstraZeneca had $97 billion in assets at the end of March, including $6.5 billion in cash. AstraZeneca is one of the best pharmaceutical stocks for dividends. It currently offers an above-average dividend yield of 2.2%.

AstraZeneca (NASDAQ: AZN) Stock Performance

AZN stock has traded between $52 and $76 over the past year. At around $65, the stock is up 25% from its 52-week low, but remains 15% below its 52-week high. The average AstraZeneca price target of $79 implies a 20% upside. The maximum price target for AstraZeneca stock of $89 implies an upside of 30%.

6. Tilray Brands Inc (NASDAQ: TLRY)

You might be surprised to see Tilray Brands (NASDAQ: TLRY) on the list of the best pharmaceutical stocks to buy. Tilray is an American multinational cannabis company with a strong interest in the pharmaceutical business.

Founded in 2013, Tilray is headquartered in New York City. The company provides cannabis-based consumer goods and medical cannabis products. In addition to the U.S., Tilray has operations in Canada, Australia, Germany, Portugal, and Latin America.

With a market cap of more than $1 billion, Tilray is one of the largest cannabis pharmaceutical companies. Tilray has partnered with several companies to develop cannabis-based medicines for a variety of medical conditions, including epilepsy, glioblastoma, and post-traumatic stress disorder.

Tilray Brands (NASDAQ: TLRY) Stock News

Tilray recently completed the acquisition of HEXO Corp., solidifying its position as Canada's largest cannabis company by revenue and market share. The company estimates that the transaction will generate nearly $30 million in cost synergies.

Tilray Financials

The company isn't profitable and doesn't pay a dividend yet, but its revenue is growing rapidly. It generated $43 million in revenue in 2018. In 2022, revenue soared to $628 million, representing a compound annual growth rate of 70% over the past five years.

Tilray has plenty of room to grow its revenue and potentially become profitable as it expands internationally. The global medical marijuana market was valued at $6.8 billion in 2020 and is projected to exceed $53 billion by 2030.

As of February 2023, Tilray had $4.4 billion in assets, including more than $400 million in cash.

Tilray Brands (NASDAQ: TLRY) Stock Performance

Tilray stock has traded in a range of $1.50 - $5.12 over the past year. At around $1.72, the stock is up 15% from its 52-week low, but remains 65% below its 52-week high. The average forecast price target of $2.83 implies an upside of over 60% from the current price.

7. Canopy Growth Corp (NASDAQ: CGC)

Canopy Growth Corp (NASDAQ: CGC) is one of the world's most recognized cannabis companies. Founded in 2013 and headquartered in Ontario, Canada, Canopy provides cannabis for the consumer and medical markets.

The company has a medical-focused division called Spectrum Therapeutics. The unit provides medical cannabis products and works with external partners to develop cannabis-based medicines. Because of the Spectrum Therapeutics division, Canopy stock is increasingly attracting interest from investors looking for the best pharmaceutical stocks to buy.

Canopy Growth Corp (NASDAQ: CGC) Stock News

Canopy is selling some of its facilities in an effort to both raise cash and reduce operating costs. It aims to raise C$150 million from facility sales by the end of September 2023.

Canopy Growth Financials

The company reported revenue of $402.9 million for its fiscal 2023 ended March 31, up from $226 million in fiscal 2019. This represents a compound annual growth rate of 12% over the past five years.

As of March, the company's balance sheet showed more than $2.4 billion in assets, including $784 million in cash. The company's liabilities totaled $1.6 billion.

Canopy Growth Corp (NASDAQ: CGC) Stock Performance

Canopy's stock price has ranged from $0.38 to $4.77 over the past year. Currently trading at about $0.60, CGC stock has climbed nearly 60% above its 52-week low, but remains more than 85% below its 52-week high. The average price target for CGC stock of $0.78 implies more than 40% upside. The highest price target of $1.55 implies almost 160% upside.

8. Aurora Cannabis Inc (NASDAQ: ACB)

Aurora Cannabis (NASDAQ: ACB) is a Canadian multinational cannabis company with strong pharmaceutical interests. The company sells medical cannabis products under brands such as MedReleaf and CanniMed.

While not a traditional pharmaceutical company, Aurora stock is on the radar of many investors looking for the best pharmaceutical stocks to buy. With a market cap of approximately $270 million, Aurora is one of the largest medical cannabis companies in the world.

Aurora Cannabis (NASDAQ: ACB) Stock News

- Aurora, along with Ethypharm, has been selected to supply certain cannabis products to a French medical cannabis pilot program. The cannabis supply contract is expected to run until March 2024.

- Aurora has expanded its medical cannabis portfolio in Germany with the introduction of two new products. The company said the additional products will enable it to meet the growing medical needs of its patients.

Aurora Cannabis Financials

In 2018, Aurora generated $55 million in revenue. In 2022, revenue had grown to more than $221 million, representing a compound annual growth rate of 30% over the past five years.

As of March 2023, Aurora's balance sheet showed $926 million in assets against $410 million in liabilities. It had $235 million in cash. The company doesn't pay a dividend yet.

Aurora Cannabis (NASDAQ: ACB) Stock Performance

Aurora stock has been trading in a range of $0.49 - $1.94 over the past year. Currently trading at $0.58, Aurora is up 18% from its 52-week low, but is still trading 70% below its 52-week high. The average Aurora stock price target of $0.85 implies an upside of 45%. The ACB stock price target of $1 implies an upside of 72%.

Top 8 Best Pharmaceutical Stocks to Buy Quick Stats

|

Market cap |

5-year revenue growth |

PS ratio |

PB ratio | |

|

Pfizer |

$203 billion |

20% |

2.19 |

2.01 |

|

Johnson & Johnson |

$412 billion |

3% |

4.28 |

5.82 |

|

Merck |

$275 billion |

7% |

4.77 |

5.89 |

|

Bristol-Myers |

$132 billion |

15% |

2.88 |

4.15 |

|

AstraZeneca |

$201 billion |

15% |

4.59 |

5.62 |

|

Tilray Brands |

$1.2 billion |

70% |

2.02 |

0.35 |

|

Canopy Growth |

$324 million |

12% |

1.11 |

0.59 |

|

Aurora Cannabis |

$205 million |

30% |

1.26 |

0.58 |

While Tilray, Canopy, and Aurora have lower price-to-sales (P/S) and price-to-book (P/B) ratios, they aren't profitable yet. Pfizer, which is profitable and growing revenue at a healthy pace, appears to have the most favorable valuation among the pharmaceutical stocks featured.

Trade Pharmaceutical Stocks CFDs with VSTAR

CFD trading offers light exposure to stocks and presents a smart way to capture profit from short-term price movements.

Rather than buying and holding stocks, CFD trading simply involves predicting the direction of stock prices over short periods of time, such as an hour, a day or a week. As a result, CFD trading requires less initial capital than traditional investment methods.

If you're ready to start trading pharmaceutical stocks CFDs, consider VSTAR. Designed for beginners and professional traders alike, VSTAR is a fully regulated and highly rated CFD broker offering low trading fees and tight spreads. It has a minimal initial capital requirement of just $50. VSTAR offers leverage, allowing traders with limited funds to increase their positions and maximize profits.

For new traders, VSTAR offers a demo account with up to $100,000 in free virtual money to practice trading. Consider opening a VSTAR account today and start trading pharmaceutical stocks CFDs.

Conclusion

Some of the best pharmaceutical stocks to consider for investment in 2023 are Pfizer Inc. (NYSE: PFE), Johnson & Johnson (NYSE: JNJ), Merck & Co Inc (NYSE: MRK), Bristol-Myers Squibb Co (NYSE: BMY), and AstraZeneca (NASDAQ: AZN). If you're looking beyond the Big Pharma stocks, consider Tilray Brands (NASDAQ: TLRY), Canopy Growth (NASDAQ: CGC), and Aurora Cannabis (NASDAQ: ACB).

The pharmaceutical industry continues to expand with the growing demand for better medicines, making it an exciting place to invest. Trading CFDs is a flexible way to profit from pharmaceutical stocks. Start Trading Pharmaceutical Stocks CFDs with VSTAR today.