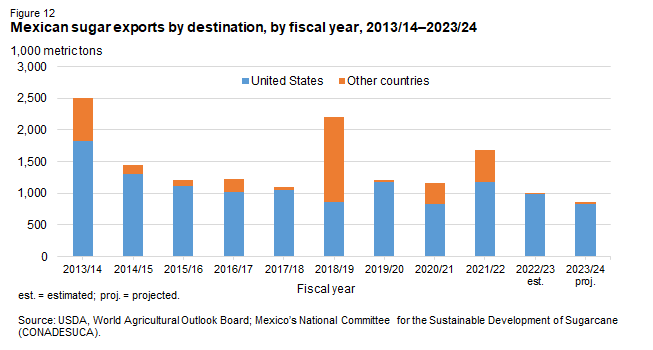

- 墨西哥對美國的食糖出口減少,影響市場,預測跌至七年來的最低水平。

- 美國通過增加進口進行補償,使總供應量增加了 12 萬短噸。

- 預計美國食糖出口增加 6.5 萬短噸,影響庫存與用量比率。

- 美國庫存與用量比率達到12.8%,可能影響長期價格走向。

在全球動態波動的情況下,美國農業部 數據 揭示了墨西哥和美國之間食糖貿易的關鍵轉變 隨着墨西哥出口量降至七年來的最低點,而美國則通過增加進口來補充其供應,食糖市場即將迎來一個有趣的階段。對這些變化的分析揭示了對糖價和市場穩定的潛在影響。

資料來源:ers.usda.gov

墨西哥對美國的食糖出口減少

受糖質量(極性低於 99.2)的影響,墨西哥食糖產量減少了 528.3 萬噸,加上對美國的出口量預測降低(83.1 萬噸),創下 7 年來的新低。墨西哥出口量減少 19.5 萬噸可能會導致美國市場出現短缺,從而可能影響供應鏈和價格。

美國食糖供應動態

2023/24年度美國食糖供應增加12萬短噸,主要是由於進口增加以及美國貿易代表辦公室重新分配世貿組織關稅配額後原糖進口激增。儘管從墨西哥的進口量減少,但美國將通過增加原糖進口來彌補,從而增加總供應量。路易斯安那州和德克薩斯州等州的蔗糖產量略有增加。

美國食糖出口和庫存與使用比率

美國出口量預計將增加 6.5 萬短噸,主要出口至墨西哥。出口量的增加導致總使用量總體增加了 6.5 萬短噸。因此,美國食糖市場的庫存與用量比率預計為 12.8%,高於上個月的 12.4%。

短期價格影響

墨西哥出口減少造成稀缺:墨西哥食糖出口減少可能會在美國市場造成短期赤字,並可能因供應量減少而導致價格上漲。儘管墨西哥出口減少,但美國原糖進口激增可能會通過補償短缺來緩解眼前的價格壓力,從而在短期內穩定價格。

長期價格方向

庫存用量比:美國庫存用量比的增加(12.8%)表明供需平衡略有改善,長期來看,由於庫存充足,可能對糖價構成下行壓力。美國供應增加(儘管部分來自進口增加)可能有助於價格穩定,如果生產保持強勁,甚至可能導致價格下降。

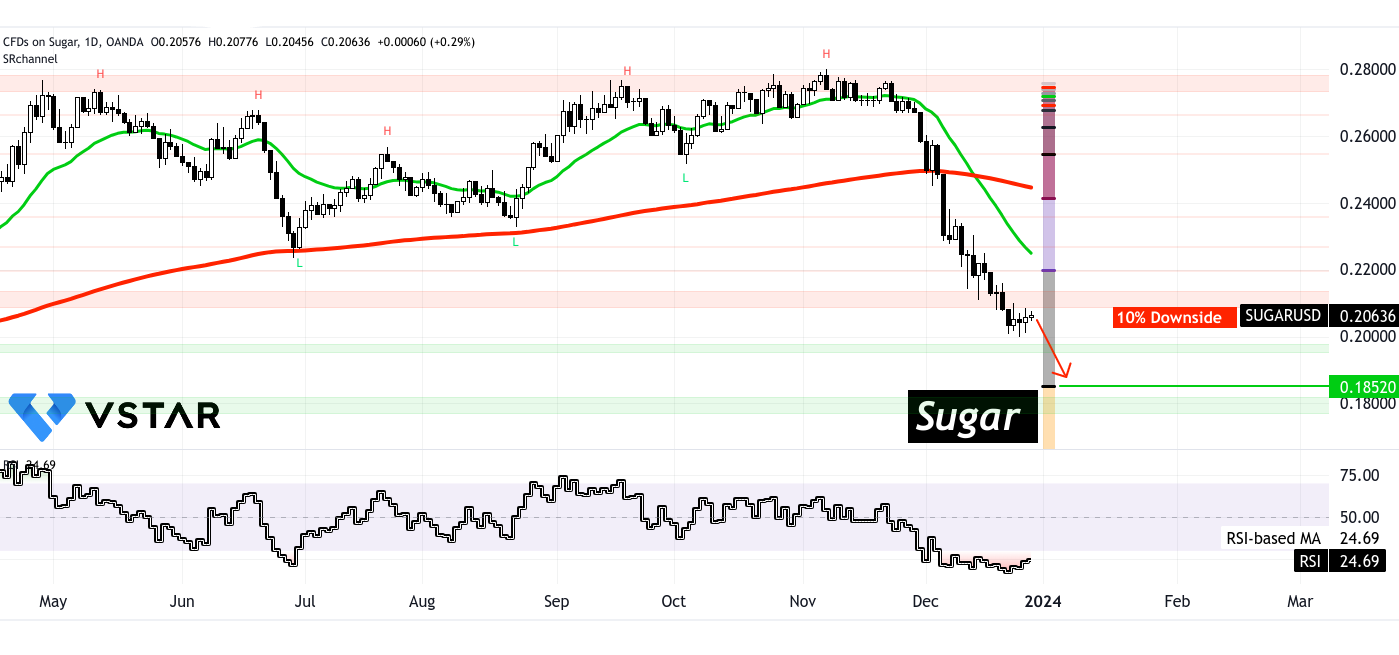

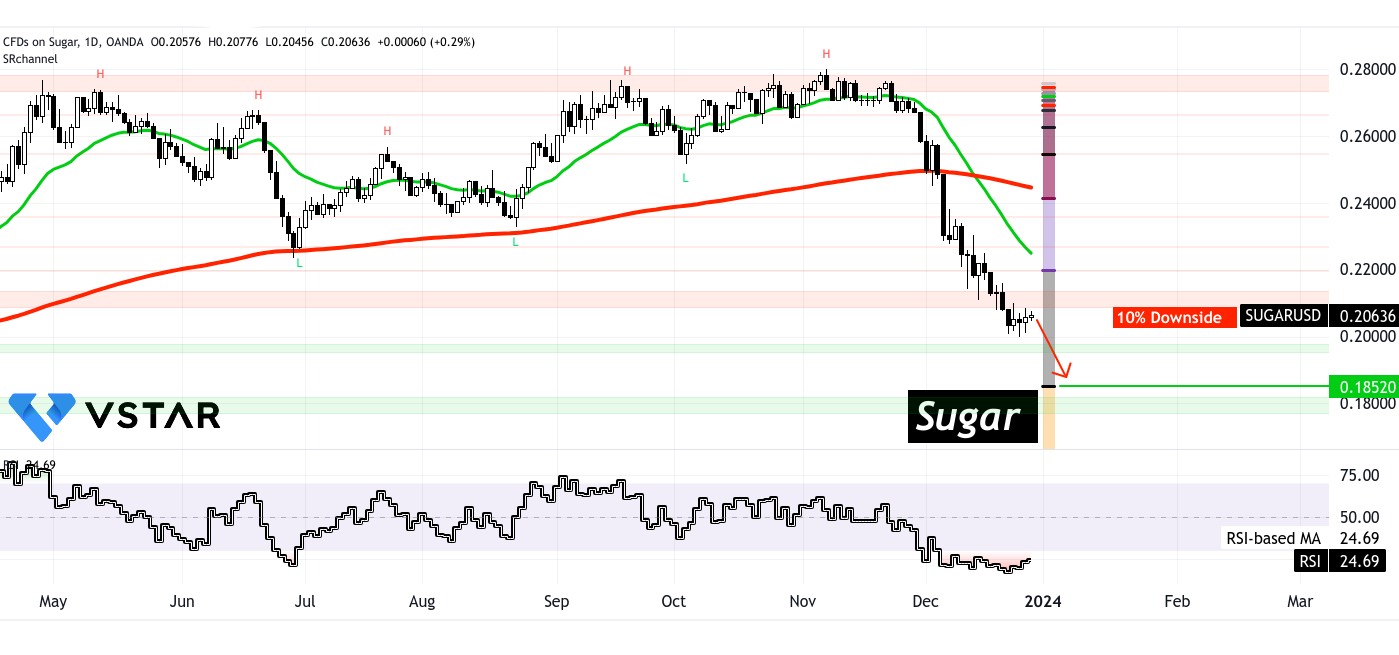

糖差價合約:技術分析

糖差價合約的價格處於下降趨勢。從技術角度來看,相對強弱指數(RSI)表明缺乏明顯的背離。同樣,22 天和 260 天指數移動平均線 (EMA) 預示着激進且長期的下降趨勢。但RSI徘徊在25水平,表明做空機會已所剩無幾。因此,未來幾天可能會開始吸籌階段。具體而言,斐波那契回撤位仍呈現10%的下行空間,這與食糖供需方程的基本面發展相符。

總體而言,目前的糖價水平表明空頭頭寸已進入部分獲利預定階段。

資料來源:tradingview.com

總之,美國農業部的數據表明,由於墨西哥對美國出口減少,糖價短期可能上漲,但由於庫存比改善,長期價格方向可能會穩定甚至下降。使用率和美國供應量增加。然而,這些趨勢取決於影響全球食糖市場的各種持續因素,要求食糖差價合約交易者和投資者保持警惕。