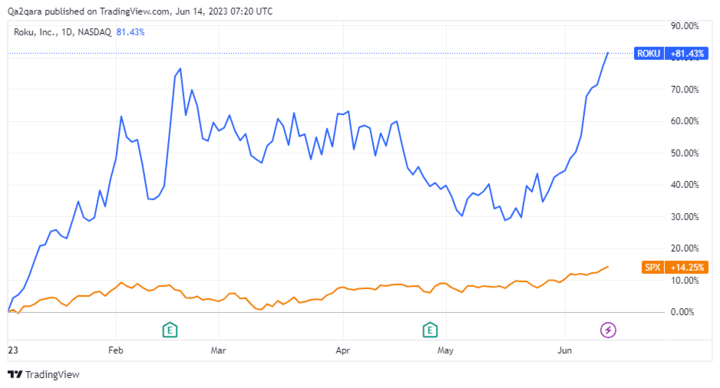

Those who invested in Roku (NASDAQ: ROKU) stock at the start of the year have every reason to cheer. The stock has soared 80% year-to-date. Despite the recent spike, Roku stock price is still more than 80% below its all-time high.

If you're a curious investor looking for the best streaming stocks to buy now, questions like these might come to mind at this point: Should I buy Roku stock? Is Roku stock a buy or sell at the current price? What is the Roku stock forecast?

Read on to find out whether Roku stock is a good investment.

Roku News

Former Amazon Executive Jeff Blackburn Joins Roku Board

Roku has added longtime Amazon executive Jeff Blackburn to its board of directors. Blackburn recently retired from Amazon where he led the company's global media operations, including overseeing brands such as Prime Video, Amazon Music, and Audible. Blackburn brings a wealth of digital media experience to Roku that could bolster the company's streaming technology and content strategies.

Source: Roku

Amazon Could Join Netflix With Ad-Supported Plans on Roku

Amazon is considering offering an ad-supported plan for its Prime Video service, following in the footsteps of Netflix and Disney. Prime Video is among the major streaming video services distributed through Roku's platform. Considering that the bulk of Roku's revenue comes from advertising, the company stands to benefit if Amazon introduces an ad-supported plan for Prime Video.

Roku Company Overview

What is Roku

Roku is best-known for its digital media streaming devices. The company also operates a video streaming platform. Founded in 2002, Roku is headquartered in San Jose, California. Roku's founder and CEO Anthony Wood is a former Netflix executive. Netflix Inc (NASDAQ: NFLX) was an early investor in Roku and the companies once shared an office block.

Roku's Key Milestones

|

Year |

Milestone |

|

2014 |

First Roku-branded smart television set released. |

|

2017 |

Roku stock IPO Roku Channel launched as an ad-supported video streaming platform. |

|

2020 |

Roku Channel launched in the UK as part of international expansion. |

|

2021 |

Roku acquires Quibi and gets dozens of original content. |

Roku's Business Model and Products

Business Model

Roku (NASDAQ: ROKU) sells hardware products and provides video advertising services. Because the advertising business contributes the bulk of its revenue, Roku sells its streaming hardware products cheaply to attract more people to join its platform to watch ads.

Since Roku primarily serves third-party video content on its platform, it takes a 30% cut of the advertising revenue that partners generate through its network.

Roku also makes money from selling subscriptions to premium video services like Netflix, Disney+, and Amazon Prime Video. It takes an estimated 20% cut of subscription sales.

Source: Roku

Additionally, Roku gets paid to include branded buttons on its remote controls. For example, Netflix, Disney+, and Hulu have branded buttons on the Roku remote.

Moreover, Roku earns from licensing its technology to television set manufacturers.

Main Products and Services

Roku hardware: The company's hardware product lineup includes streaming devices, smart TV sets, home monitoring cameras, video doorbells, and smart lights. Roku sells its hardware products directly to consumers through its online store and through retailers Amazon and Walmart.

Roku Channel: This platform features free content from various partners. The content ranges from movies to television shows to news broadcasts. Roku displays ads within the content to make money.

Subscription marketplace: Ruko lets customers subscribe to premium video services such as Showmax and Netflix through its platform. It receives a cut of the subscription sales.

Technology licensing: Ruko allows television set manufacturers such as TCL and Hisense to integrate its operating system into their products. The company makes money on every sale of a television set with its technology.

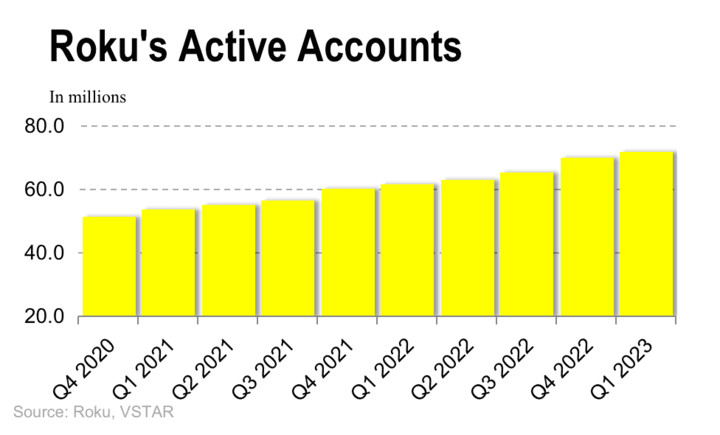

Roku recently reached a milestone of 72 million active user accounts across its network.

Roku's Financial Performance

The quality of the financial results that Roku (NASDAQ: ROKU) reports has a huge impact on its stock price. For a company that depends on advertising dollars, the economic condition weighs heavily on Roku's financial performance. Read on to find out more about Roku's revenue, profitability, and balance sheet condition.

Roku Earnings

Revenue

Roku generated revenue of $741 million in Q1 2023. The revenue increased from $734 million a year ago, surpassed internal expectation of $700 million, and exceeded the consensus estimate of $708.5 million.

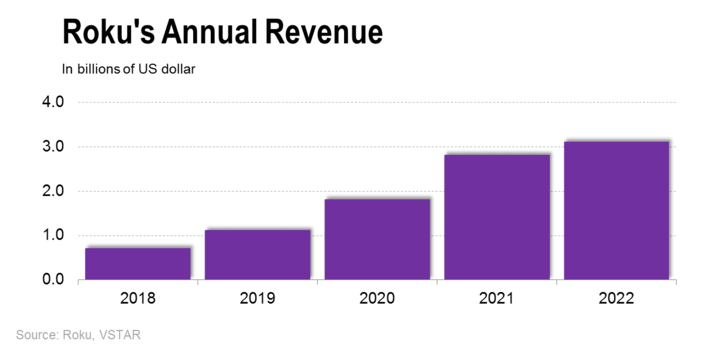

The company delivered annual revenue of $3.1 billion in 2022, which increased 13% from the previous year. Roku's revenue has increased at a compound annual growth rate of 33% over the past 5 years. The chart below illustrates Roku's annual revenue trend.

For Q2 2023, Roku anticipates revenue of $770 million, representing a modest increase from $764.4 million in the same period the previous year. Wall Street expects Roku's annual revenue to grow about 5% to about $3.3 billion in 2023. The topline growth is forecast to generate to 16%, driving revenue to $3.8 billion in 2024.

Net Income

Roku made a net loss of $193.6 million in Q1 2023, which narrowed from a loss of $237.2 million in the previous quarter. The company made a loss of $498 million. Roku aims to become profitable in 2024. The surge in Roku stock price is partly attributed to investors welcoming the profit promise.

Profit Margins

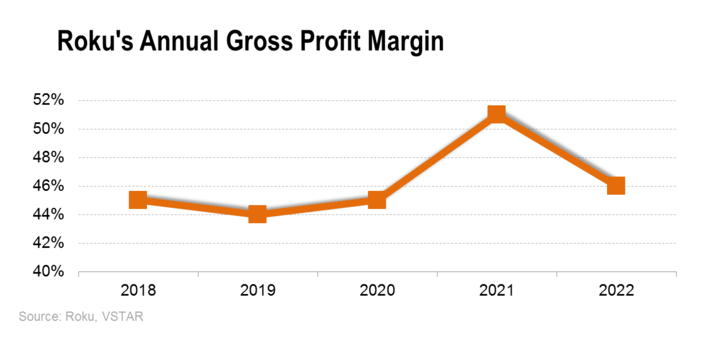

Roku achieved a gross profit margin of 46% in Q1 2023, which improved from 42% in the previous quarter. Although Roku's gross margin fluctuates as you can see in the chart below, the company has maintained its annual gross margin above 43% over the past 5 years. Ruko has turned to tightening spending and cutting costs, including through job reductions, to expand its profit margins.

Cash Position and Balance Sheet Condition

Roku (NASDAQ: ROKU) ended Q1 2023 with nearly $1.7 billion in cash. The company's balance sheet shows $4 billion in assets against $1.5 billion in total liabilities. Roku's current ratio of 3.12 and debt-to-equity ratio of 0.23 show that the balance sheet is in great shape.

Roku Stock Analysis

ROKU Stock Trading Information

Roku went public in September 2017 at an IPO price of $14 per share. Roku's CEO Anthony Wood owned a stake of more than 27% of Roku stock at the time of the IPO. Roku has a market cap of more than $10 billion.

Roku shares trade on the Nasdaq exchange under the ticker symbol "ROKU".

Regular trading in Roku stock begins at 9:30 a.m. and ends at 4 p.m. eastern time on weekdays. Investors looking to have more time trading Roku shares can take advantage of extended trading sessions. Roku premarket trading starts at 6.30 a.m. and the aftermarket session extends to 8 p.m.

There has been no Roku stock split since the IPO. Moreover, Roku doesn't currently pay dividends.

Roku Stock Performance

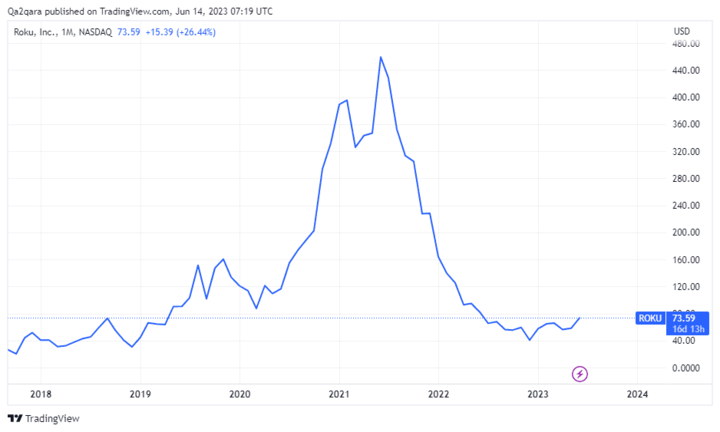

Debuting at the IPO price of $14, Roku stock soared almost 70% on the first day of trading to close at $23.50. The chart above shows the ROKU stock price chart since the IPO. The stock price crossed $70 in 2018, surpassed $150 in 2019, and reached the all-time high of $479.50 in July 2021.

After hitting that peak, Roku stock began a steady decline until recently when it started rebounding. The stock has gained more than 35% over the past month and climbed 80% year-to-date, dwarfing the 14% gain for the S&P 500 over the same period as you can see in the chart above.

These are some of the factors that impact Roku stock price:

Financial results: Roku stock goes up on strong earnings results and declines on weak earnings. Investors particularly focus on revenue figures to see whether the company is growing.

Economic conditions: An economic slowdown can cause consumer and business spending cuts that diminish demand for Roku's products and weigh on the stock price.

Partner actions: Roku stock tends to rise when the company's partners take steps that investors believe would bring it more business. For example, the launch of ad-supported plans by Disney and Netflix has excited Roku investors.

Company news: Roku stock tends to go up when the company launches a new product, adds strong talent to its board or management, or takes actions to control costs with the view of improving profitability.

Roku Stock Forecast

Roku's rebound has many investors wondering how high the ROKU stock price could go.

Roku Price Target

Wall Street analysts' price targets for Roku stock range from $41 to $115. The peak ROKU stock price prediction of $115 suggests nearly 60% upside potential. The base Roku stock price forecast of $41 implies more than 40% downside.

Roku's Challenges and Opportunities

Roku (NASDAQ: ROKU) is aiming to grow its revenue and improve its profitability. The results of these efforts could see Roku stock price exceed expectations or fall short of the targets. To succeed in its efforts, Roku will need to navigate various challenges while making the most of its opportunities.

Roku's Weaknesses and Challenges

Reliance on third-party content: Roku primarily serves content from third-party providers. If these partners decide to pull their content from the Roku platform, they could disorient the company's business model.

Programming disputes: Roku's reliance on third-party content comes with another problem. Disputes with content providers can lead to channel outages and cause Roku to lose users and revenue. For example, a disagreement with Google's parent company, Alphabet, led to YouTube TV going dark on Roku for some time.

Regulations: The digital media industry is subject to rapidly evolving regulations in areas like privacy and competition. As a market leader, Roku can be an easy target of antitrust regulations. Increased regulatory requirements can slow down Roku's growth and increase its costs.

High competition: Roku operates in an industry with low barriers to entry. Consequently, the company is exposed to increasing competition. Moreover, some of Roku's partners run competing businesses, creating a delicate balancing act for the company. These are some of the major Roku competitors and the risks they pose.

|

Roku Competitor |

Threat Posed |

|

Pluto TV |

Paramount's Pluto TV competes with Roku for advertising dollars. |

|

Tubi TV |

Offering on-demand movies and television series, Fox Corporation's Tubi TV battles Roku for advertising revenue. |

|

Amazon |

The Fire TV hardware from Amazon competes with Roku for media streaming device market share. |

|

Alphabet |

Google's parent company not only competes with Roku for advertising dollars, but also for video streaming device market share with its Chromecast hardware. |

|

Samsung |

Roku competes with Samsung for the smart TV operating system market share. It also competes with Google's Android in that market. |

Roku's Competitive Advantages

1. Leading Market Share

Roku controls the largest share of the video streaming hardware market in North America. For example, its 50% share of the connected TV device market significantly dwarfs the combined market share of its closest competitors Samsung and Amazon at 34%. Moreover, Roku dominates the smart TV operating system market.

2. Strong Brand Recognition

As the pioneer of television streaming, Roku has not only come to amass a large share of the streaming hardware and software market, but also grown to a household brand. While many competitors are entering the streaming TV market, it will take them many years to achieve Roku's brand position.

3. Growing User Base

Ruko has a large and steadily growing subscriber base. With 72 million active accounts, Ruko's user base has expanded by a whopping 20 million accounts in only two years. Roku only had 17 million active accounts at the time of its IPO in 2017. The expanding user base bodes well for the company's advertising business.

4. Diversified Business

Although it started out as a television streaming hardware provider, Roku has diversified into other businesses. In its flagship hardware segment, Roku now makes a wide range of products including smart home devices like video doorbells and smart lights. Roku has also ventured into technology licensing and ad-supported video streaming.

5. Strong Balance Sheet

With substantial cash and a lightly leveraged balance sheet, Roku is largely on solid financial grounds. Not only does Roku have the financial flexibility to fund its growth programs, it also has the financial strength to weather an economic slowdown better than many of its competitors.

Roku's Opportunities

Source: Roku

1. International Expansion

Roku's business is currently concentrated in North America, but the company has a large international market opportunity to explore. As more people get access to the internet in developing countries, there will be a wider market for Roku products as cord-cutting accelerates.

2. Original Content

As Netflix's content strategy has shown, original programming can be a powerful tool for building a large and loyal customer base. By producing its own original content, Roku can both break its reliance on third-party content and boost its profit margin by keeping all the revenue from its in-house production.

3. Advertising

Marketers are shifting to video advertising budgets from traditional television commercials to online video platforms where Roku is. As a result, Roku stands to benefit from the trend of premium video streaming providers like Netflix, Disney, and Amazon adding ad-supported plans.

4. Merchandising

Roku can leverage its strong brand to run a highly profitable merchandising business. Merchandising opportunities exist for Ruko in clothing, toys, posters, stickers, and other items. In addition to generating extra money for Roku directly, merchandising can also help the company improve its brand position and boost customer loyalty.

Roku Stock Trading Tips

Choose the Right Investment Method

Investing success begins with choosing the approach that works best for you. Your investment time horizon, investment goal, amount of capital, and risk tolerance are all important factors to consider when choosing an investment method. There are two ways to approach investing in Roku stock:

1. Buying and Holding Roku Shares

This method works well for those with long investing timelines, like if you're expecting to see returns on your investment after several years. Purchasing and holding Roku shares can appeal to those investing for retirement, saving for a house purchase, or building an education fund for children's college tuition.

This investing method requires a large starting capital but gives you voting rights and makes you eligible for potential dividends. You can apply the dollar-cost averaging strategy to steadily expand your holding in Roku stock.

2. Trading Roku Stock CFD

This method is ideal for those looking for short-term profit opportunities, such as those seeking income to fund living expenses. CFD trading requires little initial capital and allows you to earn profits over short periods of time, such as a day, week or month.

With Roku CFD trading, you can profit by correctly predicting the direction of Roku stock price movements. Since CFD trading involves only price predictions, you can profit whether Roku stock goes up or down. The downside of CFD trading is that you don't receive any dividends or voting rights.

Control the Risks

Whether you're chasing long-term gains or pursuing short-term profits with Roku, it helps to control your risks. Here are some risk management techniques you can apply:

Diversify your portfolio: If you're investing for the long-term, consider holding Roku and other stocks in your portfolio. If you're trading Roku CFD, you can also diversify your trades. This can be as simple as opening multiple CFD trade positions with varying timelines. A diversified portfolio spreads your risks.

Set stop-loss points: If you're trading Roku stock CFD, consider using the stop-loss feature if your broker offers it. A stop-loss feature allows you to automatically close your trade and limit potential losses if an adverse market movement reaches a certain level.

Apply the 1% rule: This risk control technique goes along with diversifying trades. This rule requires that you don't invest more than 1% of your capital in a single trade. It is designed to limit your exposure if the market moves against you.

Trading Roku Stock CFD with VSTAR

If you prefer capturing short-term profits with Roku stock over long-term exposure, consider trading Roku stock CFD with VSTAR.

A fully licensed and regulated CFD broker, VSTAR is designed for frequent traders seeking high-speed order executions. The platform offers tight spreads and low trading fees to maximize traders' profits.

You can start trading Roku stock CFD on VSTAR with as little as $50 and use leverage to expand your position. VSTAR offers various risk management tools, including the stop-loss feature.

For those new to CFD trading, VSTAR offers a demo account with up to $100,000 in virtual money.

Consider opening a VSTAR account today. You only need an email address or mobile phone number to register for a VSTAR account and start trading Roku stock CFD. VSTAR accepts all the popular funding methods, including credit cards, digital wallet deposits, and bank transfers.

Final Thoughts

Roku (NASDAQ: ROKU) stock's rebound has caught the attention of many investors. But looking at the Roku stock price target range, Wall Street analysts are sharply divided on the stock's outlook. This presents a challenge for those considering a long-term position in Roku stock. But those trading Roku CFD can profit both from the stock's uptrend and downtrend.

FAQs

1. Is Roku a Buy or a Hold?

Roku may be considered a buy or hold for long-term investors, but the stock may continue to be volatile in the near term.

2. Is Roku stock expected to go up?

Many analysts are optimistic about Roku's future growth potential in the streaming market, but forecasts vary. Some see the stock price going up over the next few years, while others are more cautious.

3. What is the Roku stock forecast 2025?

Roku stock price predictions for 2025 range widely from around $100 per share on the low end to over $200 per share on the high end, based on various analyst estimates. The current stock price is around $55.

4. What will Roku stock be worth in 5 years?

In 5 years, Roku stock could potentially be worth between $150 and $250 per share, according to some analysts' bullish forecasts. However, there is uncertainty, and the stock could also trade lower if growth slows.