SMCI News

Constantly Impressive and Inherently Resilient Performance

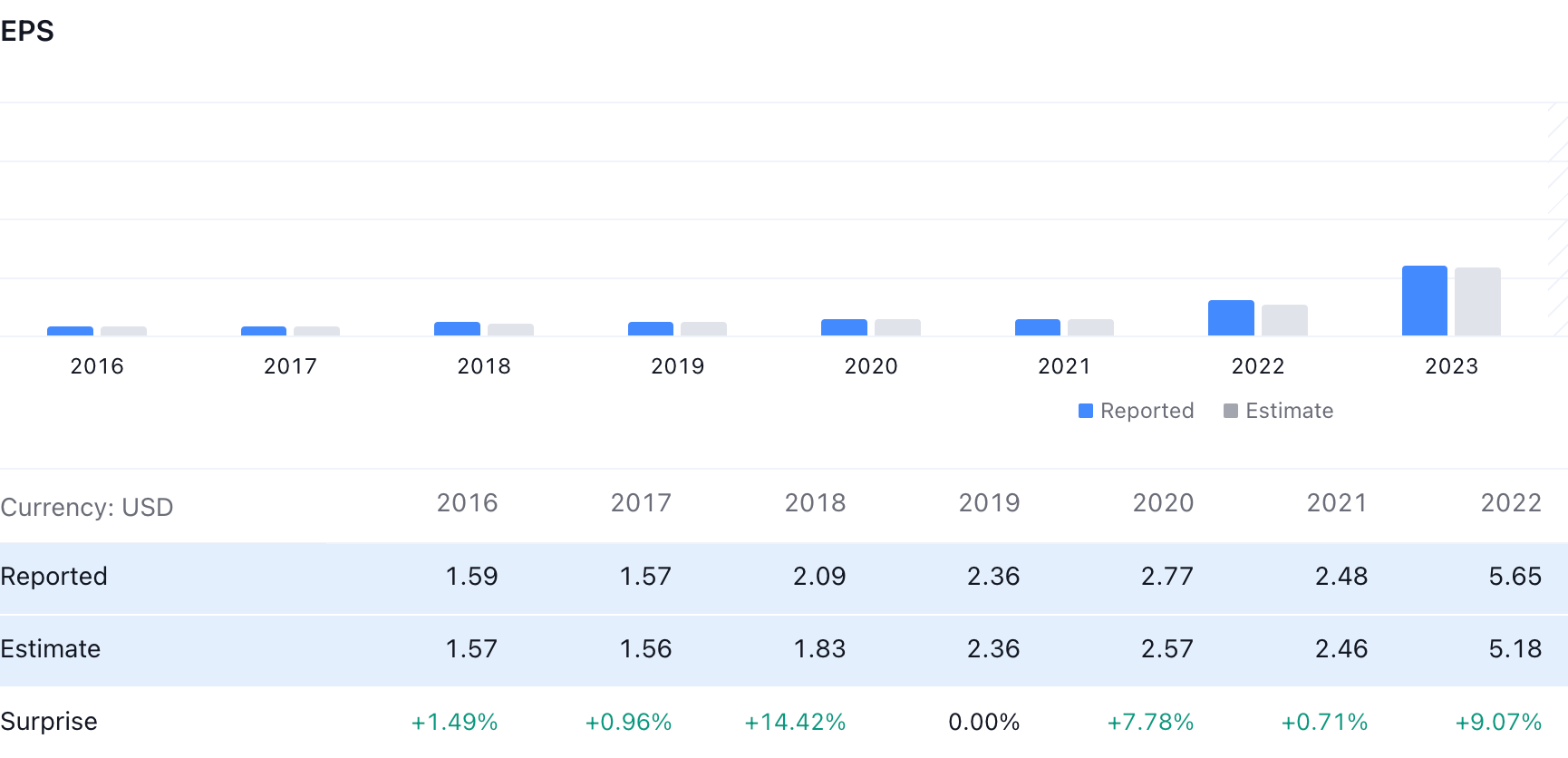

For its existence, Super Micro (NASDAQ SMCI) has consistently exhibited remarkable expansion, as evidenced by its impressive 35% compound annual growth rate (CAGR) in earnings per share (EPS) and 22.01% CAGR in revenue over the previous decade.

In addition, Super Micro sustains a strong cash position, as evidenced by its cash balance of $725.66 million at the end of the December quarter, which is substantially greater than its short-term and long-term debt levels of $276.31 million and $99.32 million, respectively.

Leveraging the Expansion of AI

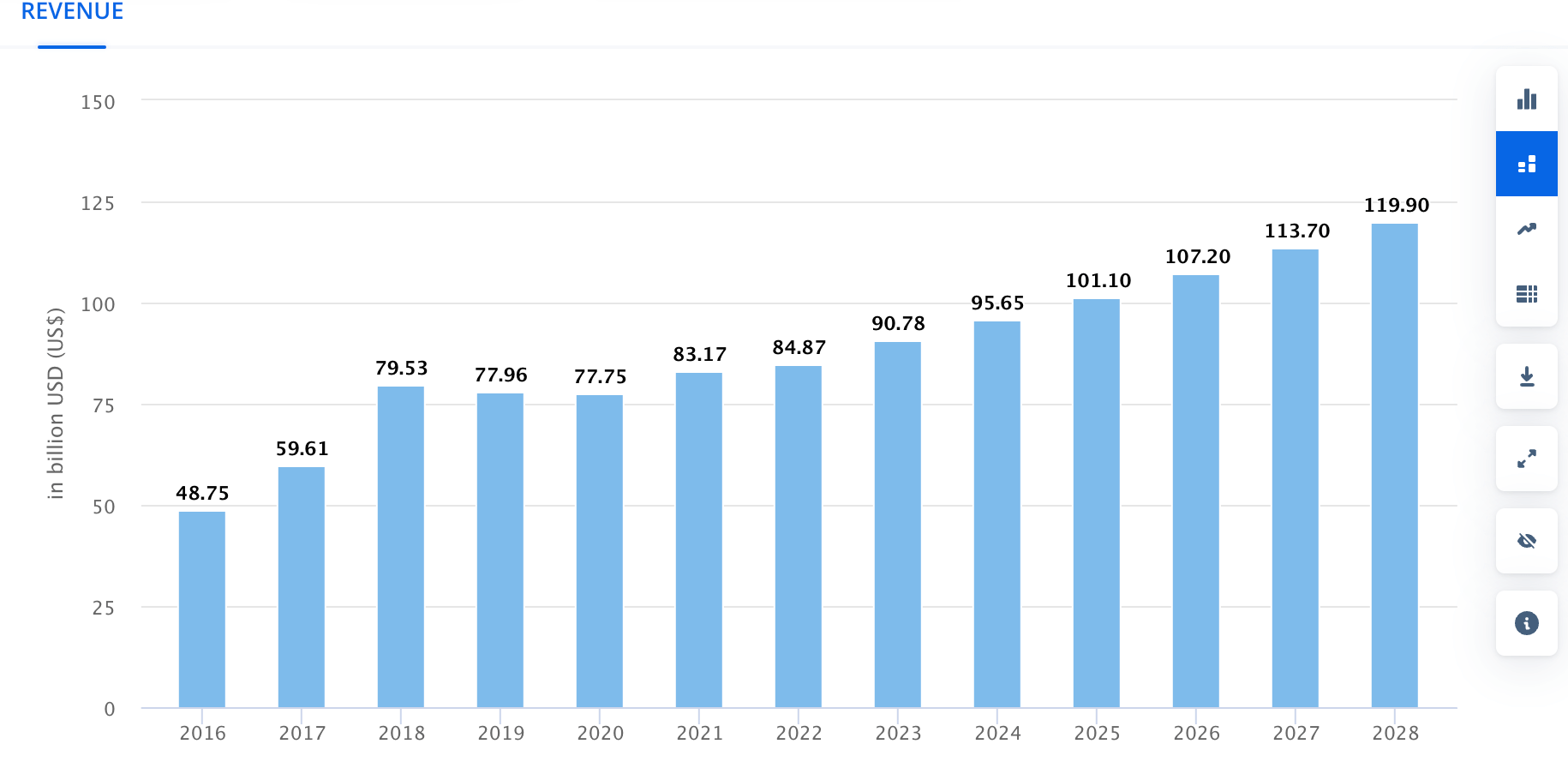

Super Micro, participating in a market for exponential expansion propelled by AI, stands to gain substantially. SMCI is well positioned for market expansion in the global data center market, which is anticipated to reach nearly $500 billion by 2028. This is due to the company's emphasis on research and development, AI expertise, and agility.

Super Micro, a dynamic participant in the expanding data center market, is anticipated to be a significant beneficiary of this industry megatrend. The company will fortify its standing in the ever-changing business environment by capitalizing on its commitment to customer satisfaction and innovative strategies.

I. Super Micro Computer's Overview

What does SMCI do

Super Micro Computer, Inc. distributes and manufactures information technology solutions and other computer products. Its products include twin solutions, MP servers, GPU and coprocessor, MicroCloud, AMD solutions, power supplies, SuperServer, storage, motherboards, chassis, super workstations, accessories, SuperRack, and server management products.

The company was founded by Charles Liang, Yih-Shyan Liaw, Sara Liu, and Chiu-Chu Liu Liang in September 1993 and is headquartered in San Jose, CA.

The above image shows that SMCI ownership includes 50.20 million free-floating shares, while 14.27% is closely held.

Let's look at some key milestones for the company in the last four years:

- 2020- Super Micro Computer (SMCI) responded to the COVID-19 pandemic by adapting operations, launching new products, and facing challenges in a changing market.

- 2021- Super Micro has prioritized sustainability through eco-friendly servers and lower emissions. As a part of the process, the company partnered with other tech companies to improve their products or reach new markets. Additionally, Super Micro has explored new areas like edge computing or AI to broaden its customer base.

- 2022- Super Micro continued to innovate with cutting-edge processors and technologies while ensuring regulatory compliance and security. It also has grown through acquisitions or mergers to expand its reach and offerings.

- 2023- Super Micro had a strong financial performance in 2023 due to its ability to navigate challenges and capitalize on growth opportunities. It continued to invest in innovation and was recognized by the industry for its efforts. This focus on innovation included areas like cloud computing and cybersecurity, which are important for its customers.

II. Supermicro's Business Model and Products/Services

A. How Supermicro makes money

Supermicro primarily earns revenue by selling high-performance, energy-efficient server and data center solutions.

The company offers a comprehensive portfolio of server systems designed to meet diverse computing requirements, including rack servers, blade servers, tower servers, and GPU servers. Additionally, Supermicro provides storage solutions such as storage servers and JBODs (Just a Bunch Of Disks), catering to high-capacity and high-performance storage needs. Networking equipment, including switches and network interface cards (NICs), further complements its product offerings.

Supermicro also generates revenue by selling accessories and components like power supplies, chassis, cooling solutions, and server management software. Furthermore, the company offers deployment assistance, technical support, and warranty services, enhancing customer satisfaction and recurring revenue streams. Supermicro maintains a steady revenue stream within the competitive hardware market through these diversified product lines and service offerings.

B. Main Products and Services

Supermicro's main products include

- Server Systems: Comprehensive range of server solutions, including rack servers, blade servers, tower servers, and GPU servers designed for diverse computing workloads.

- Storage Solutions: High-capacity and high-performance storage solutions such as storage servers, JBODs (Just a Bunch Of Disks), and storage appliances.

- Networking Equipment: Switches, network interface cards (NICs), and other networking hardware optimized for data center environments.

- Accessories and Components: Various accessories and components, including power supplies, chassis, cooling solutions, and server management software, complement its main product lines.

III. Supermicro Computer's Financials, Growth, and Valuation Metrics

A. Review of Supermicro's financial statements

Super Micro Computer has a strong market dominance as the company's current market cap is $44.19 billion.

During the fiscal second quarter of 2024, the company demonstrated exceptional performance, exceeding anticipated revenue and earnings levels. New customer acquisitions drove the more than doubling of net sales from the previous year's $1.80 billion to $3.66 billion. SMCI disclosed earnings per share (EPS) of $5.59, representing an exceptional year-over-year growth of 71.5% and exceeding the consensus estimate of $3.26. SMCI has notably surpassed earnings per share (EPS) forecasts in the previous four quarters.

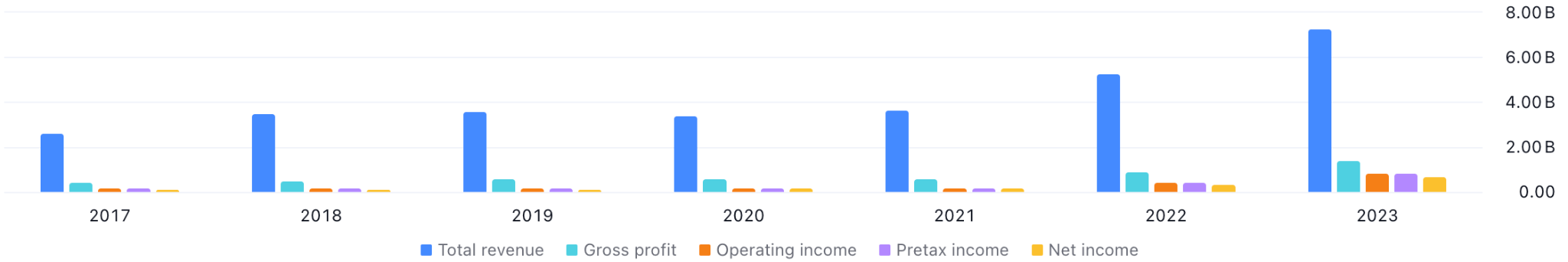

The company's revenue growth has remained stable for the last six years. The latest data suggests a net revenue of $7.12 billion in 2023, higher than $5.2 billion in the previous year.

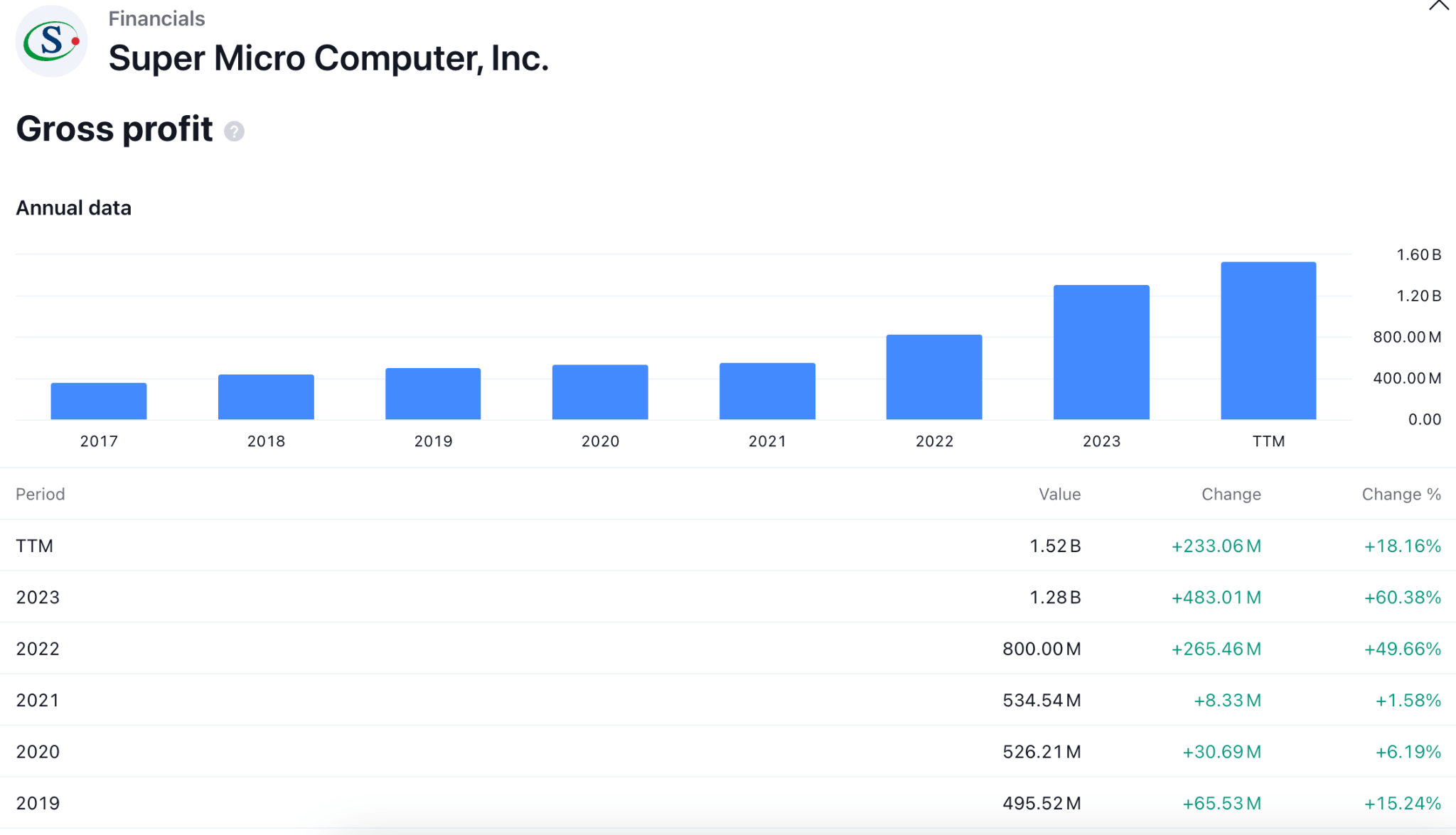

In other revenue factors, the Gross Profit margin shows a positive outlook, as the recent data suggests an ongoing surge in the GP margin.

In 2023, the yearly Gross profit margin surged by 60.38%, the highest in the last six years. The average gross profit margin in the last four years is 26.2%, which is above the satisfactory 20.00% level.

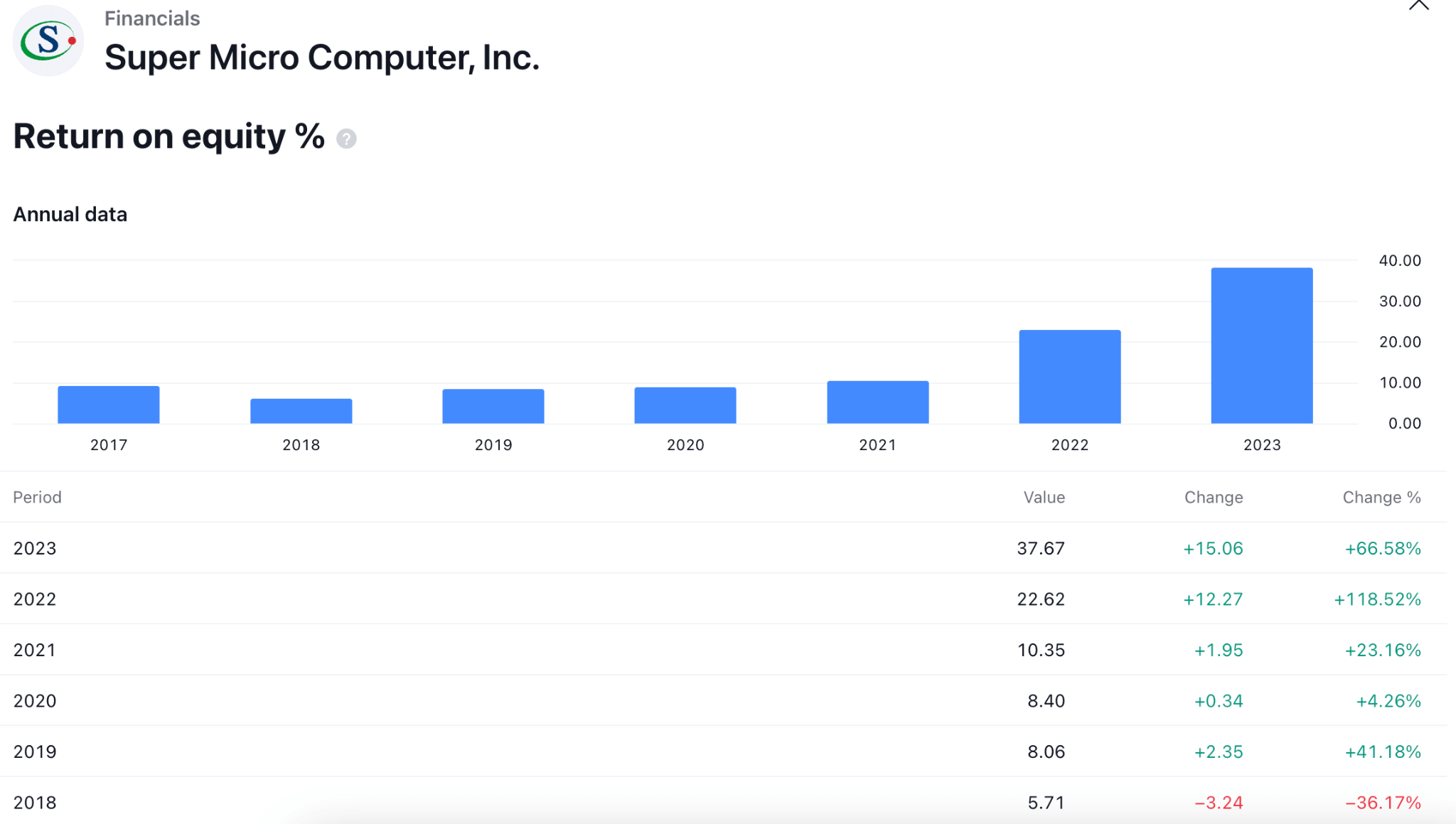

Looking at the Return on Equity- the company entered the positive zone in 2019, by 41.18% change to 8.06. Since then, growth has been sustained, while the latest year shows a value of 37.67, representing a 66.58% gain.

The average gain in ROE is 43% in the last 4 years, which is above the industry average. If the company maintains the gain, we may expect a strong price appreciation for SMCI investors.

After its strong profitability and liquidity, SMCI has not compromised its gearing position. The debt-to-equity ratio keeps moving higher and reached its highest level in 2022 by reaching 0.44. However, the value decreased by 66.18% within a year, representing a change to 0.15.

The lower debt-to-equity ratio suggests that the company has enough liquidity to run the day-to-day business, and there is less requirement to meet the need from the debt finance.

B. Key financial ratios and metrics

According to the discounted cash flow (DCF), the company's present value is $28.6 billion, with 58.6 million outstanding shares.

Based on the DCF method, Super Micro stock price is trading higher, where the DCF value is $488.64 a share. Based on this, the SMCI is 43% overvalued than its current trading price.

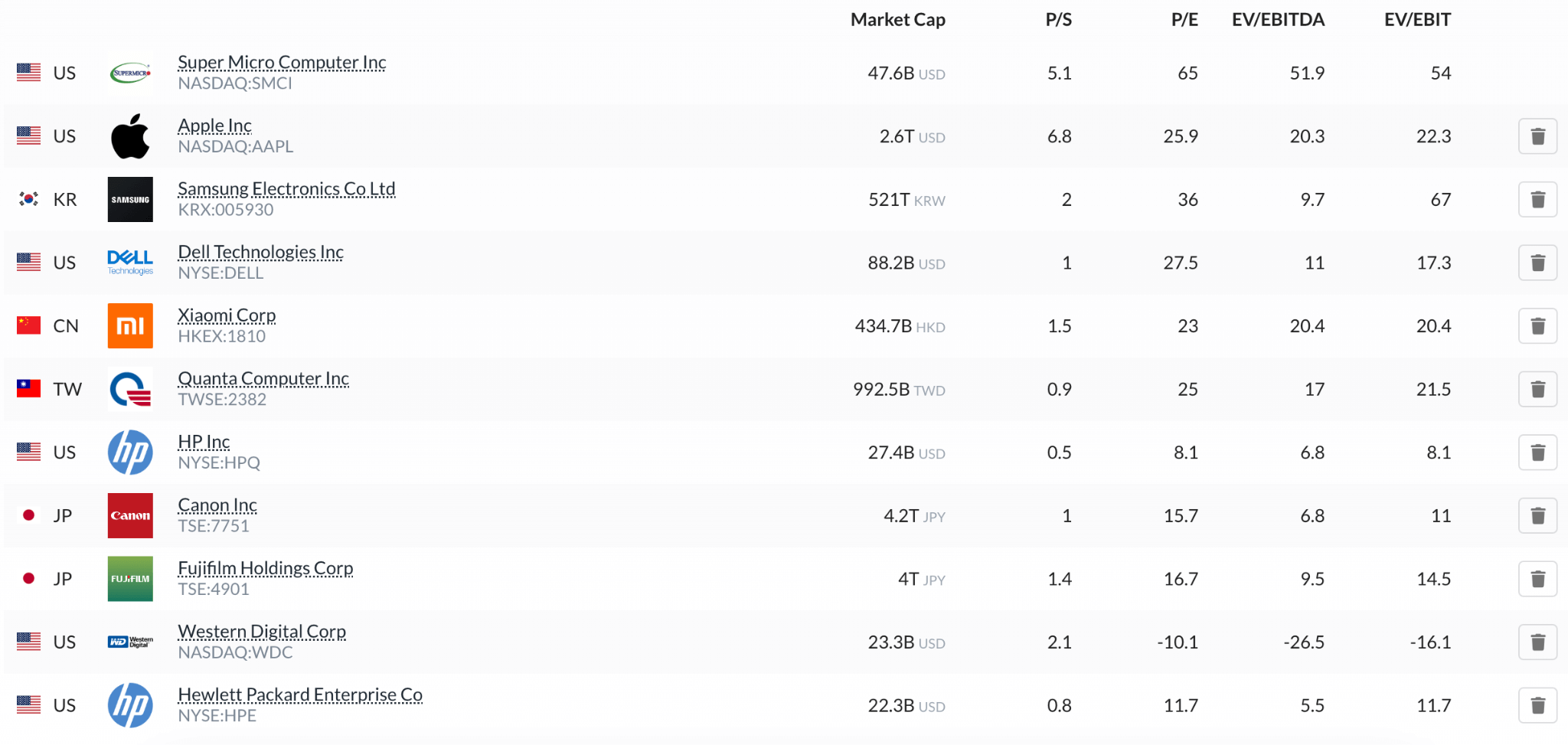

As per the above image, the company maintained a strong position in terms of the P/S and P/E ratios.

The current PS ratio is 5.1, which is lower than Apple's 6.8 but higher than Samsung's 2.0. The P/E ratio shows the highest level in the industry at 65.00. The closest to this company is the 27.50 level achieved by Dell Inc.

As per the relative value, the stock is trading higher, indicating an overvalued condition of 43%.

IV. SMCI Stock Performance Analysis

A. Super Micro Computer Stock trading information

- IPO Time: March 29, 2007

- Primary Exchange & Ticker: NASDAQ: SMCI

- Country & Currency: United States; USD (U.S. Dollar)

- Trading Hours: Monday to Friday, 9:30 AM to 4:00 PM Eastern Time (ET)

- SMCI PreMarket: Monday to Friday, 4:00 AM to 9:30 AM Eastern Time (ET)

- SMCI After Hours: Monday to Friday, 4:00 PM to 8:00 PM Eastern Time (ET)

SMCI Stock Split

Besides, Super Micro Computer Stock (SMCI) has never split its stock before. Also the company does not pay any dividend.

B. SMCI Stock Price Performance since its IPO

- All-time high: $1188.07 (March 13, 2024)

- 52-week high: $1229.00

- 52-week low: $101.71

- Current Supermicro Stock Price: $782.72 (as of May 06, 2024)

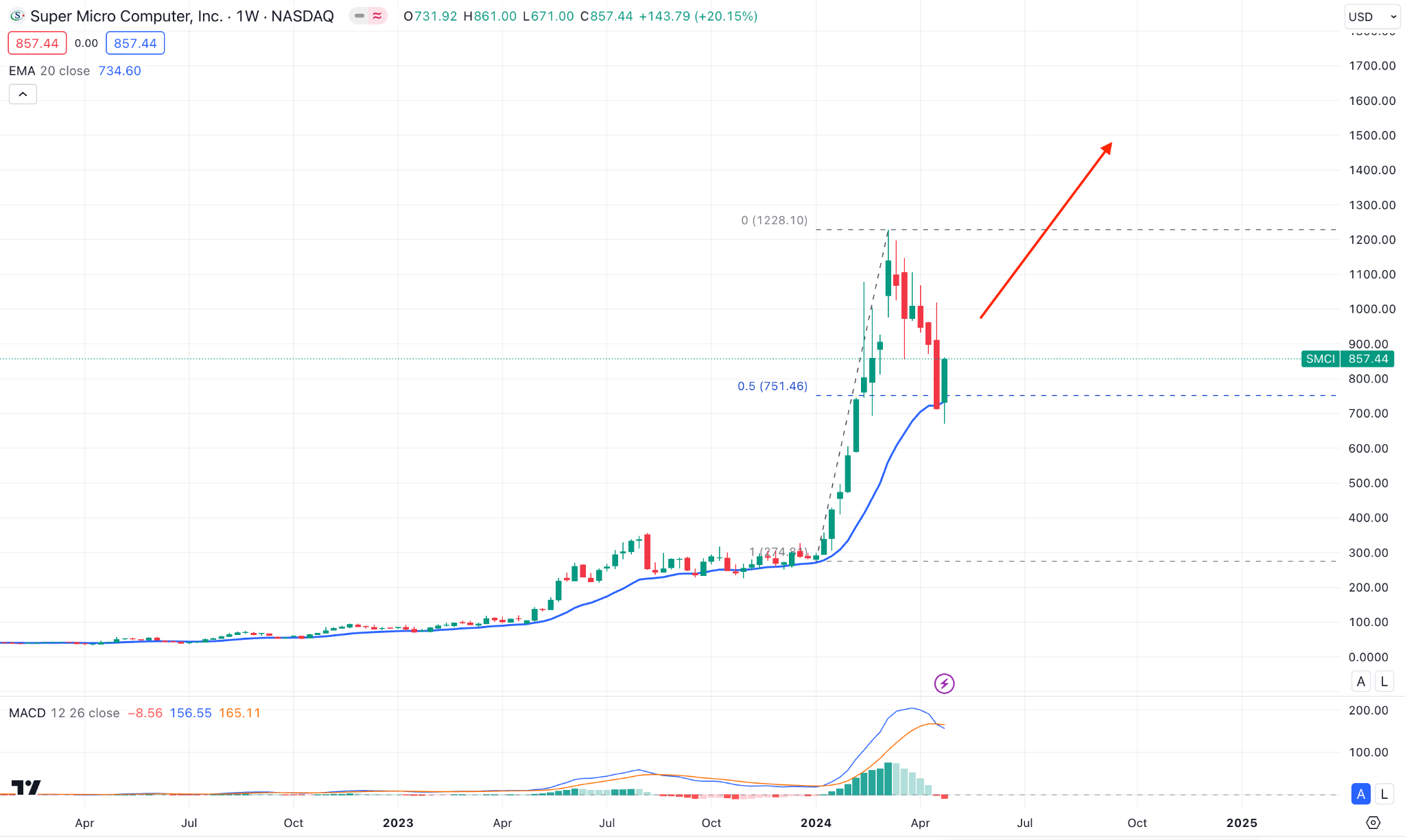

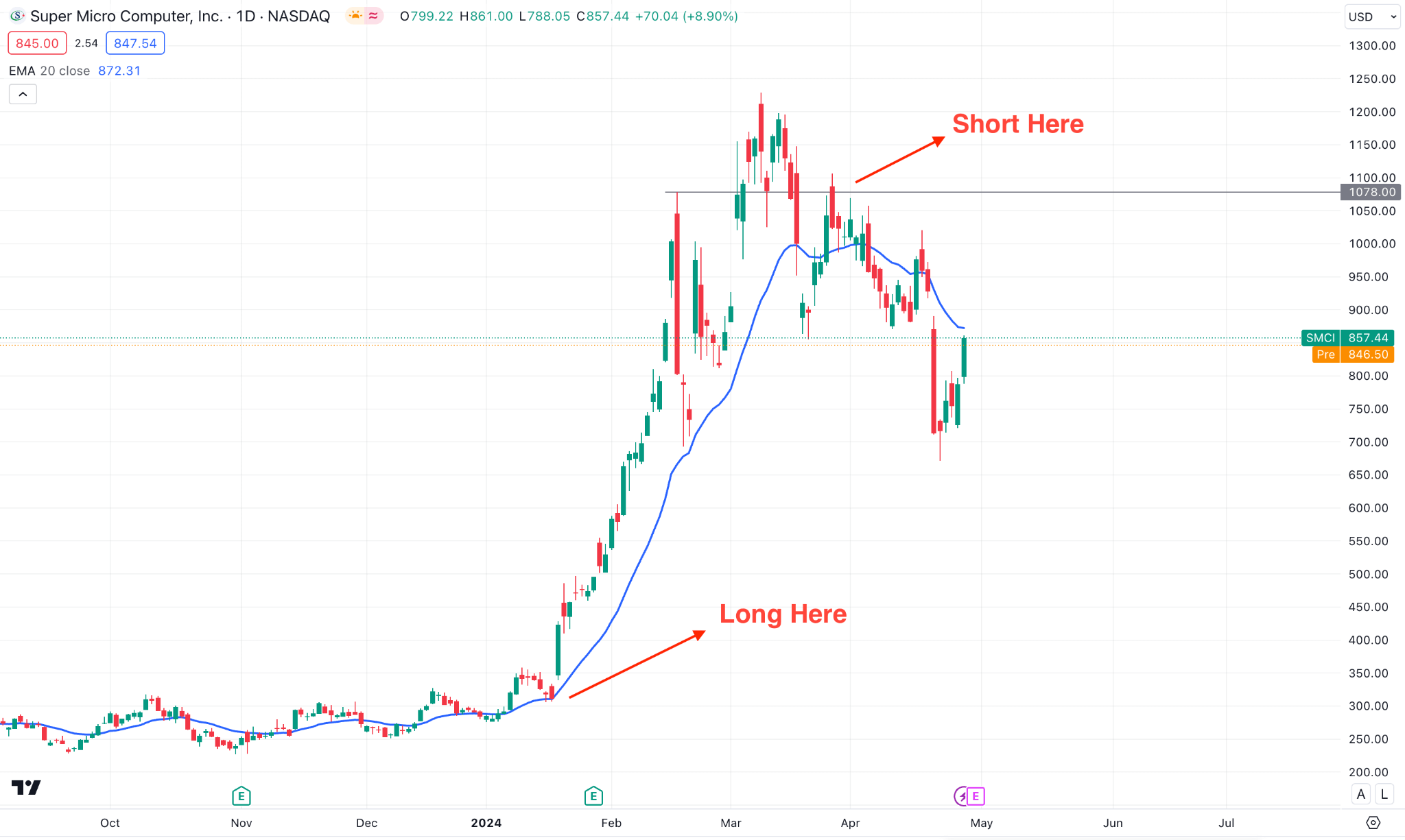

Super Micro stock reached an all-time high in March 2024 but dropped by over 30%.

It's trading above its 52-week low but significantly below its highs, indicating a downward trend in recent months.

Super Micro Computer (NASDAQ:SMCI) is a leader in data center storage and server solutions specifically designed for AI applications. As AI gained significant momentum and investment in 2024, investors recognized SMCI as a key player that would benefit from this growth.

Super Micro Computer's financial results seem to have contributed. Reports indicate impressive SMCI earnings growth, exceeding analyst expectations. This strong performance solidified investor confidence in the company's ability to capitalize on the AI boom.

C. SMCI Stock Forecast: Is SMCI a Buy?

SMCI stock is trading within a bullish pressure- driven by the ongoing surge in Artificial Intelligence. As a result, Supermicro Computer stock peaked in 2024 and found a ceiling at a new all-time high.

However, considerable downside pressure has come from the March 2024 high, which signals a decent profit taking. In the most recent price, bears found a bottom at the 50% Fibonacci Retracement level from where a bullish reversal has come. The dynamic 20-week EMA works as a confluence bullish factor for this stock.

Based on the forecast for SMCI share price, the next resistance level is at the 1026.28 level, which could be a crucial barrier. A successful breakout above this line could open the room for reaching the 1700.00 psychological level.

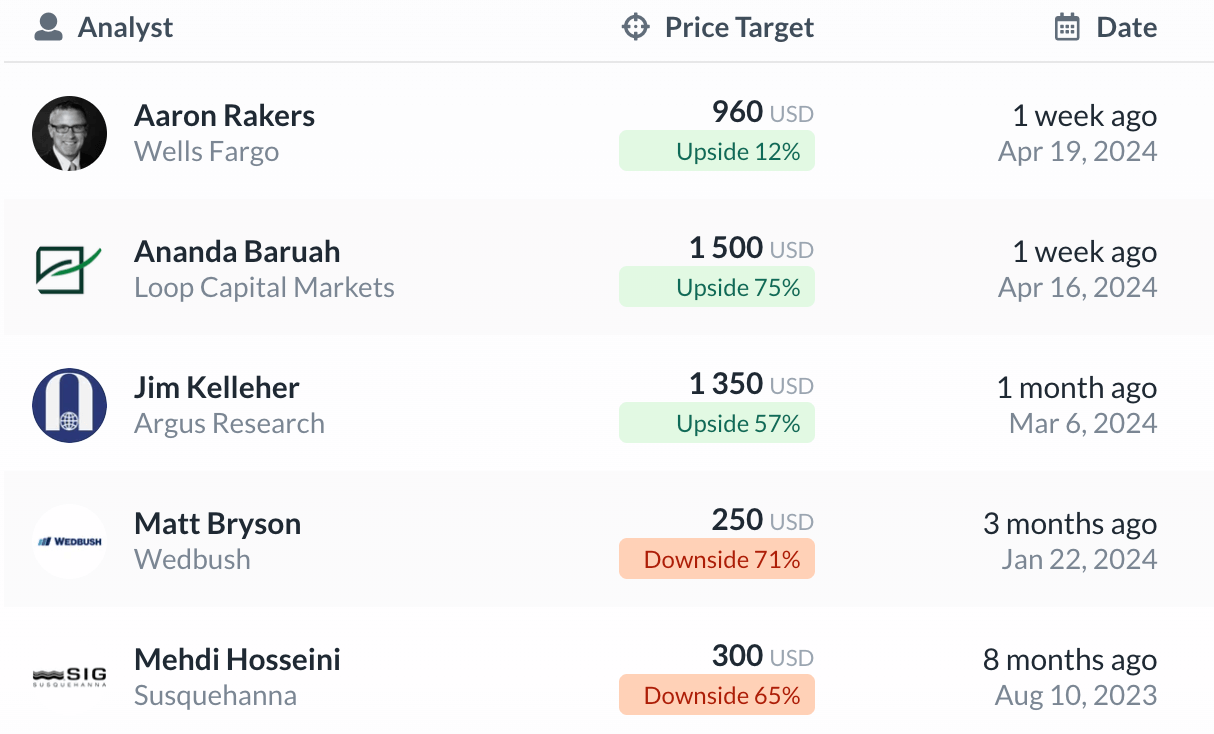

Let's see analysts opinion about SMCI stock:

According to some Wall Street analysts, the average 1-year SMCI stock price target is $1003.25 level. However, SMCI price can fluctuate between $252.50 to $1575.00.

As per the Wells Fargo Research team, SMCI stock price could extend the upward pressure and reach the $960.00 level within one year. The more optimistic view came from Loop Capital Markets with a 75% upside possibility to $1500.00 level.

On the other hand, some analysts showed a bearish signal, where Wedbush downgraded the Super Micro Computer stock price towards the $250.00 level.

V. SMCI Challenges and Opportunities

Super Micro Computer (SMCI) operates in a dynamic and competitive environment. However, there are some other tech giants that show their presence in this industry, creating a competitive threat.

SMCI key competitors

- Hewlett Packard Enterprise (HPE)

- Dell Technologies (DELL)

- Lenovo Group

Let's see what threats might come from SMCI's competitors:

- HPE & Dell: These tech giants have vast resources and established customer bases, allowing them to undercut SMCI on price and offer bundled solutions.

- Inspur: Inspur is a Chinese multinational company specializing in cloud computing, big data, and AI technologies. It has been rapidly expanding its presence in the global server market and is a notable competitor to SMCI, particularly in the Asia-Pacific region.

- Lenovo: A major player in the server market, particularly in China, Lenovo presents a significant competitive threat, especially in price-sensitive markets.

Superior Micro's competitive edge:

- The company's sustained growth highlights its capacity to customize server solutions to fulfill distinct client needs, establishing a competitive advantage. Super Micro's modular approach allows for the smooth integration of pre-designed, compatible components, expediting the configuration process by utilizing state-of-the-art technology. Through its agility and solid alliances with prominent component manufacturers in Silicon Valley, Super Micro maintains a competitive edge over its rivals in the AI server industry.

- Furthermore, SMCI's dedication to sustainable expansion is apparent in its implementation of liquid cooling in its servers, which promotes ecologically conscious computing methodologies. The increased efficacy and decreased physical footprint of liquid-cooled servers result in client cost savings.

Other risks for SMCI

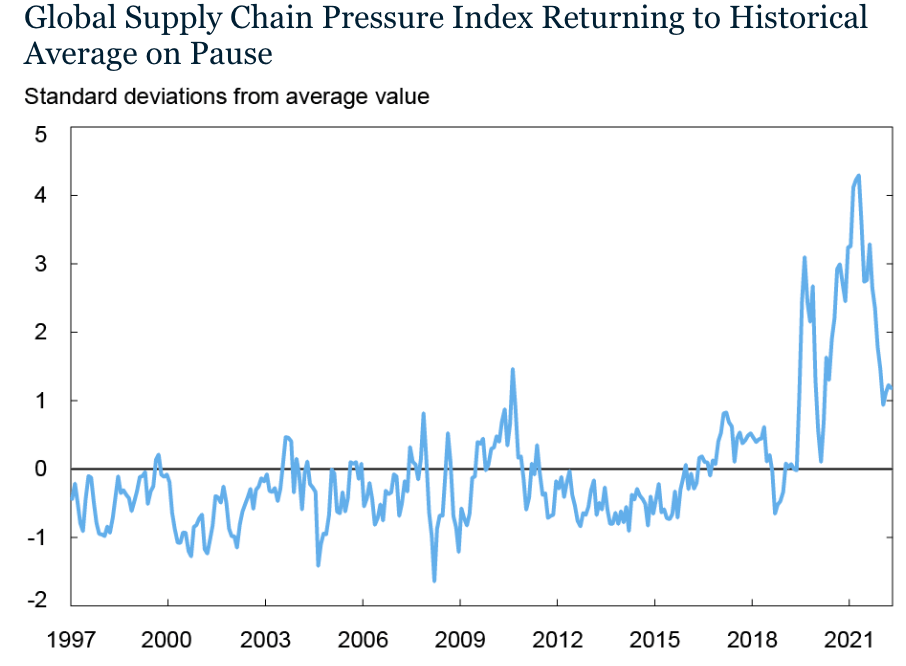

Global supply chain disruption will be a challenging factor for this stock as lower supply of goods could hamper regular business.

Source: libertystreeteconomics.newyorkfed.org

CSGPI (Global Supply Chain Pressure Index) is a unique tool for measuring supply-chain pressure.

By the end of 2021, the GSCPI had risen 4.3 standard deviations above its historical mean, after which it experienced a substantial decline. It fell to 2.8 in March 2022 before momentarily increasing in April, primarily due to pandemic restrictions in China and the Russia-Ukraine conflict.

The most recent reading is near the neutral line, from where any upward traction could be a challenging factor for SMCI bulls.

Source: libertystreeteconomics.newyorkfed.org

Geopolitical uncertainty is another crucial factor to consider, as the recent conflict in the Middle East could divide the world in two. A further increase in business disruption could affect global business, leading to a bearish factor for SMCI.

SMCI growth opportunities

Source: statista.com

The key revenue generator for SMCI is the Server business, which could soar in the coming days. According to the current projection, online server revenue will grow at an average of 5.81% annually, which could take the market volume to $119.90 billion by 2028.

Source: statista.com

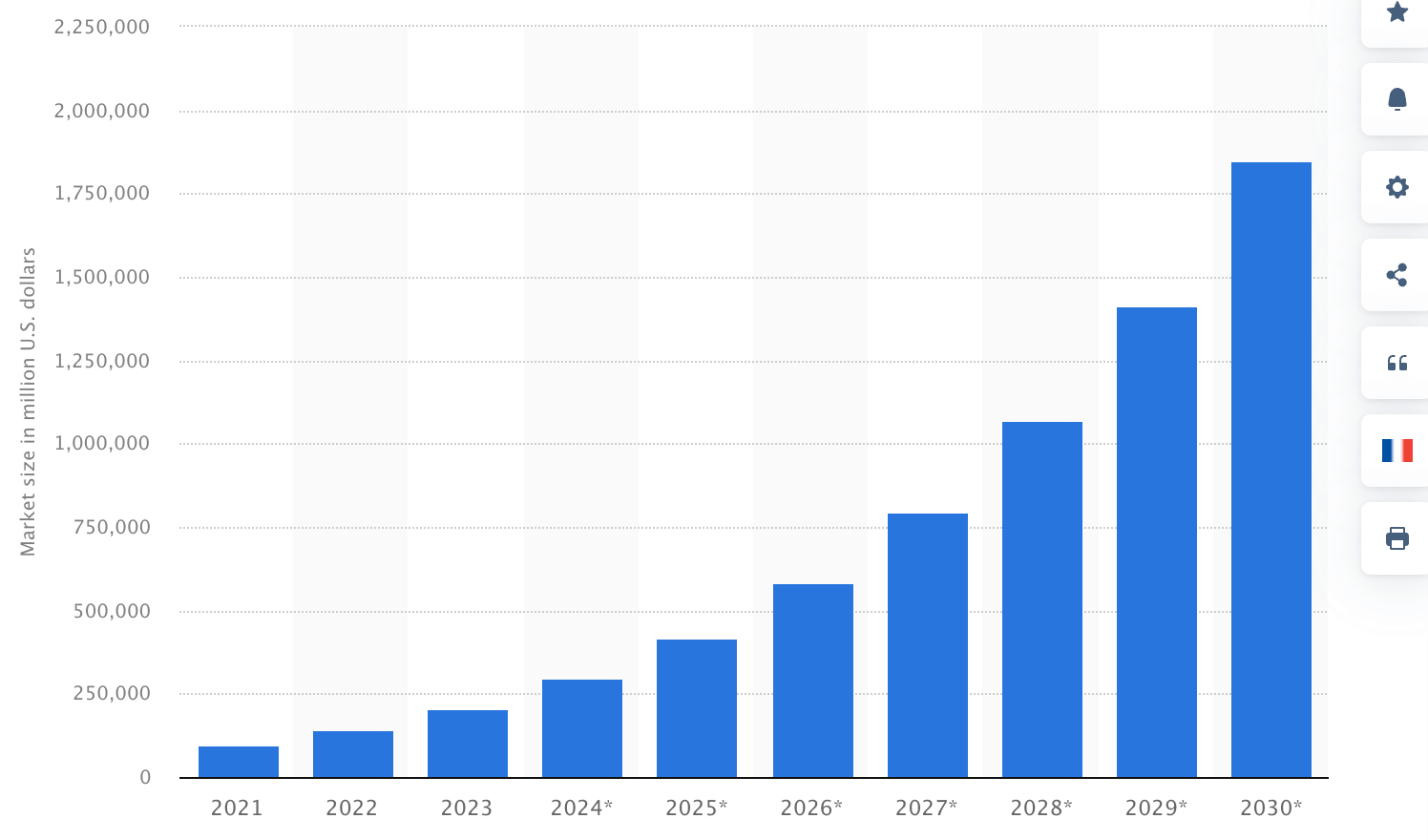

The implementation of artificial intelligence could be another factor to be considered when gauging SMCI's price projection. The recent surge in AI could increase the use of the online portal, creating an opportunity to extend the market in the global server market.

Following Move Over the next decade, Strategy Consulting anticipates the artificial intelligence (AI) market to expand at a rapid rate. At present, it is estimated at around $100 billion, and its valuation is expected to increase twentyfold by 2030, reaching nearly $2 trillion. The impact of AI is pervasive in numerous sectors, encompassing research, analysis, marketing, product development, and supply chains.

VI. SMCI Stock Trading Strategies

Investing in stock needs special attention as price appreciation depends on various factors, such as financial performance, debt structure, management reports, macroeconomic conditions, and geopolitical factors. Therefore, the best approach is to take the maximum outcome from the market when the situation is favorable.

SMCI Stock CFD Trading

CFD trading allows investors to generate more money by taking leverage when the market condition is favorable. Moreover, making money from rising and falling markets is another benefit of CFD trading.

For example, the SMCI stock formed a bullish breakout from the dynamic 20-day EMA support, creating a long opportunity. Moreover, the Super Micro Computer Inc stock price increased and formed a bearish Change of Character at an all-time high, creating a short opportunity.

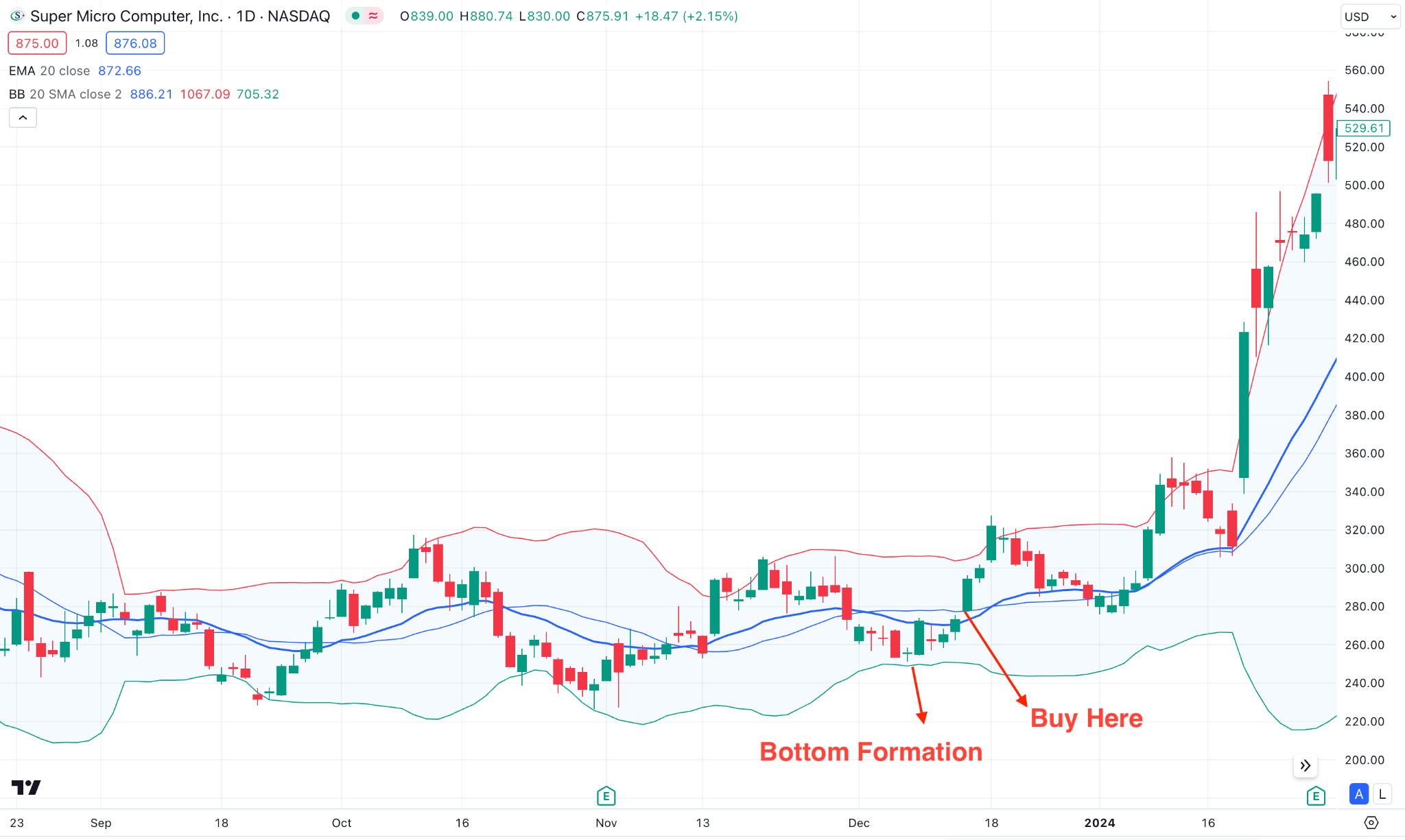

BBMA Trend Continuation Strategy

According to the BBMA bullish continuation signal, Super Computer stock price increased the downside pressure and formed a bottom from the lower Bollinger Bands level. We may expect the buying pressure to extend once the price rebounds and forms a bullish reversal candlestick above the dynamic SMA line.

In this strategy, the stop loss will be below the previous swing low, with the first take profit level at the upper Bollinger Bands.

VII. Conclusion

In summary, Super Micro Computer Inc.'s consistent performance, innovative approach, and strategic positioning underscore its potential for sustained success and value creation in the ever-changing technology sector.

As the demand for AI-driven technologies continues to surge, Super Micro is well-positioned to capitalize on market expansion opportunities, supported by its emphasis on research and development, AI expertise, and strategic alliances. Furthermore, the company's strong financial position, reflected in its robust cash reserves and manageable debt levels, underpins its ability to navigate dynamic market conditions effectively.

Investing in a prominent company like Super Micro Computer (SMCI) could be beyond the expectation through brokers like VSTAR. Investors can boost the gain by taking leverage, while CFDs allow making money from up and downside movements.

Let's see other key features offered by VSTAR:

- Handle all trading activities from the VSTAR mobile app

- Super fast trade execution

- Opportunity to trade from a Multi-regulated platform

- 24/7 customer support

- Opportunity to diversify the portfolio in forex, stocks, indices, cryptocurrencies, and commodities

Overall, with bullish sentiment surrounding SMCI stock fueled by AI-driven growth prospects, investors can anticipate continued momentum and potential upside in the foreseeable future.

FAQs

1. Is SMCI a good stock to buy?

Super Micro Computer, Inc.(SMCI) can be considered overvalued and its financial health and growth prospects indicate the potential to underperform the market.

2. What is the projection for SMCI stock?

The consensus analyst SMCI price target is $954.38, with a high estimate of $1,500.00 and a low estimate of $250.00.

3. What will SMCI be worth in 2025?

The average SMCI stock price target 2025 is $1,301.43.

4. What is the stock prediction for SMCI in 2030?

Long-term forecasts suggest that SMCI stock price target 2030 could reach as high as $2245 if the company continues on its current growth trajectory.