- High equity multiples limit market potential despite economic growth.

- Concerns regarding the risk-reward profiles of mega-cap tech stocks amidst inflated expectations.

- Varied market prospects across the US, UK, Europe, Japan, and emerging markets.

- Investment strategies emphasize quality and growth amid uncertain economic conditions.

As the clock ticks into 2024, the S&P 500's forecasted trajectory becomes a focal point for investors. In a landscape shadowed by economic uncertainties and stretched valuations, Goldman Sachs' and JP Morgan's insights highlight challenges like tech dominance, varied regional prospects, valuation concerns, and potential investment opportunities.

Economic Indicators and Market Valuations

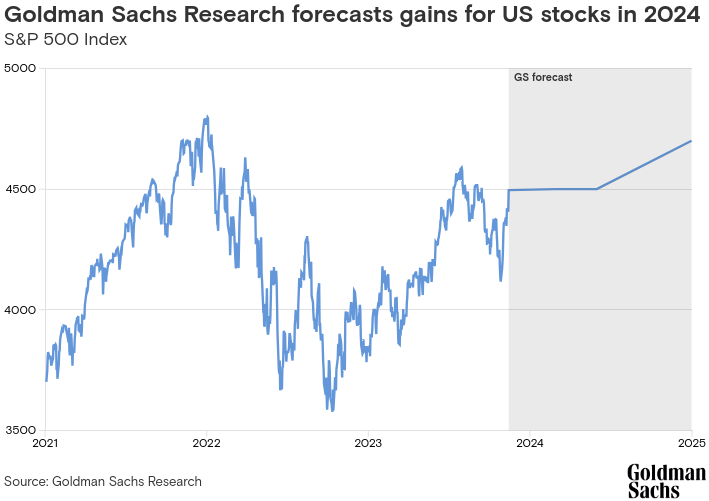

Goldman Sachs predicts a modest return for US stocks in 2024, attributing this to above-consensus economic growth somewhat offset by high equity valuations. The forecasted rise in the S&P 500 to 4700 by the end of 2024, coupled with a 6% total return (including dividends), reflects a restrained appreciation potential due to already high starting valuations.

The high price-to-earnings ratio of the S&P 500, trading in the 87th percentile since 1976, raises concerns about the limited potential for significant appreciation. The expectation of sustained economic growth at the beginning of the year driving a market adjustment in the latter half due to potential Federal Reserve cuts and the resolution of election uncertainty highlights a shift in market sentiment throughout 2024.

Source: goldmansachs.com

Mega-Cap Tech and Investment Opportunities

The dominance of mega-cap tech stocks in 2023 raised concerns about their sustainability in outperforming the broader market in 2024. Despite expectations of continued outperformance from these tech giants, Goldman Sachs highlights the risk-reward imbalance due to elevated expectations, high hedge fund ownership, and potential shifts in investor sentiment related to AI enthusiasm.

Goldman Sachs also identifies investment opportunities in "quality" stocks, emphasizing higher profitability, stronger balance sheets, and stable growth in sales and earnings. This indicates a potential shift in investment focus towards fundamentally sound companies amid concerns about an impending recession.

J.P. Morgan's Perspectives and Geopolitical Factors

J.P. Morgan's outlook echoes concerns about equity valuations, anticipating a downside bias for the S&P 500 with estimated earnings growth of 2–3% and a price target of 4,200. The expectation of slowing U.S. and global growth by the end of 2024, coupled with contracting liquidity from major central banks and geopolitical risks, adds complexity to the market landscape.

The elevated geopolitical risks, ongoing conflicts, and impending national elections in various countries, including the U.S., contribute to anticipated higher equity volatility in 2024. The uncertainties surrounding the timing and severity of a potential recession pose challenges for investors, as these risks might not be consistently factored into market pricing across different regions, styles, and sectors.

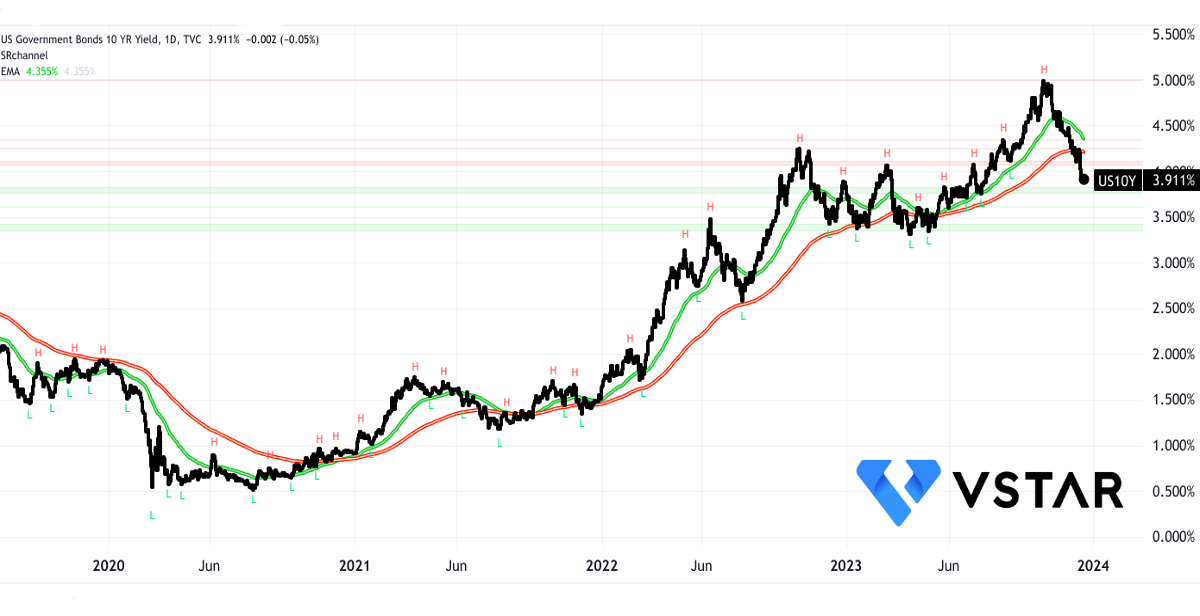

Cash as an Alternative and Ownership Trends

The attractiveness of cash as a competitive alternative to stocks, especially with a 4-5% long-term risk-free return, raises questions about investors' preferences amid market uncertainty. High ownership levels of US stocks across various investor categories, along with forecasts of net selling in 2024, signify a potential rebalancing of portfolios and a reduced appetite for equities.

The projected corporate buybacks and strength in mergers and acquisitions, amounting to $550 billion (net) of US stocks in 2024, might influence market dynamics but may not fully offset potential selling pressures from other investor categories.

Regional Perspectives and Emerging Markets

Regional outlooks, such as the optimism towards U.K. equities due to favorable valuations and sector compositions, highlight varied opportunities across different global markets. The contrasting expectations for European equities, potential growth in Japan, and the anticipated volatility in emerging markets, especially in the initial phase of 2024, underscore the importance of diversification and understanding regional nuances for investors.

S&P500 (SPX500) Technical Assessment

Against all pessimism, the technical analysis put the 2024 high for S&P 500 at 5700 (based on Fibonacci retracement and current momentum of higher highs) that may be attained in December 2024 or early. Short-term and mid-term exponential moving averages are signaling a solid bullish trajectory for the S&P 500. The pivot at $4420 may serve as a critical support level in 2024. Similarly, short-term support has also emerged at $4115, in line with the mid-term exponential moving average. Although a recession is not likely anymore, this level may serve as a cautionary measure for rapid price movements. To be sure, this estimation is not a close for 2024; the $5700 resistance can be considered a partial profit booking level.

Source: tradingview.com

In conclusion, the outlook for the S&P 500 in 2024, as presented by Goldman Sachs and J.P. Morgan Research, offers a cautious perspective underpinned by concerns about high valuations, economic uncertainties, and geopolitical risks. The dominance of mega-cap tech stocks, the potential of specific stock categories amidst challenging conditions, and the divergent regional market assessments are key points to consider. Investors are advised to remain vigilant, diversify their portfolios, and focus on quality and growth in a market environment characterized by elevated risks and uncertainties.