Apple (NASDAQ: AAPL) is an American multinational company headquartered in California. The company was founded in 1976 by a group consisting of Steve Jobs and Steve Wozniak. Apple is currently led by CEO Tim Cook, CFO Luca Maestri, and Jeff Williams as chief operations officer.

The company is best-known as the maker of the hugely popular iPhone smartphone, though it started off making personal computers. With the iPhone, Apple transformed the way smartphones are designed and became the smartphone industry’s standard-bearer.

Apple has achieved many milestones in its history, including being the first company to attain $1 trillion and $2 trillion market cap. It remains the world’s most valuable company and one of the most valuable brands.

Investors apply various strategies to profit from Apple stock. While some buy and hold Apple shares for long-term gains, others trade Apple CFD for quick, short-term profit.

Apple’s Business Model and Main Products and Services

Apple is one company that has changed with the time without leaving its roots. In keeping its roots, Apple has primarily remained a hardware company. It runs a diversified hardware business, making personal computers under the Mac brand, tablets under the iPad brand, and smartphones under the iPhone brand.

The company’s other hardware products are smartwatches, media streaming devices, and HomePod smart speakers.

Aside from its hardware mainstay, Apple has built a thriving services business. Apple’s services division offers app distribution, digital payment, music streaming, video streaming, online games, and cloud storage among others.

Hardware sales contribute the bulk of Apple’s revenue at around 80% of the total. In the hardware division, the iPhone brings in the most revenue at about 65% of the hardware total. The Mac computer line and the iPad tablet lines are the second and third-largest hardware revenue sources for Apple.

Apple doesn’t break out its service revenue sources, but the App Store app distribution platform, Apple Music, and Apple Pay are the company’s largest service businesses. Although the services division only accounts for roughly 20% of Apple’s total revenue, it’s the company’s fastest-growing business.

Apple’s Financials

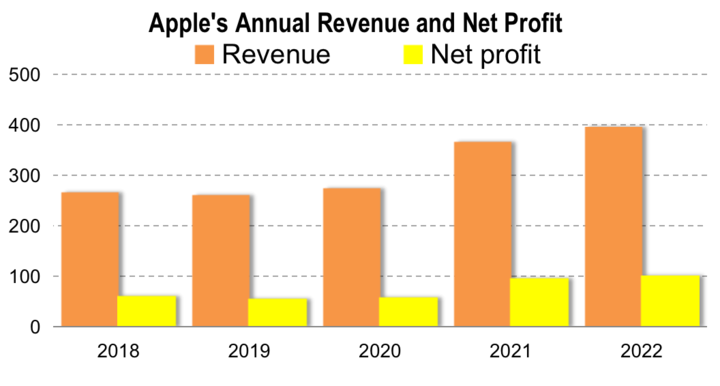

The company reported revenue of $394.3 billion in fiscal 2022, marking an increase of 8% from $365.8 billion in fiscal 2021. The company’s annual revenue has increased nearly 50% over the past 5 years, mostly powered by the services business. But the growth hasn’t been consistent every year as the chart below illustrates. Notably, Apple’s revenue dipped in the years during the height of the COVID-19 pandemic.

The company reported a profit of $99.8 billion in fiscal 2022, which increased from $94.7 billion in fiscal 2021. Apple has been consistently profitable for many decades. As with revenue, Apple’s profit has declined in some years as you can see in the chart above.

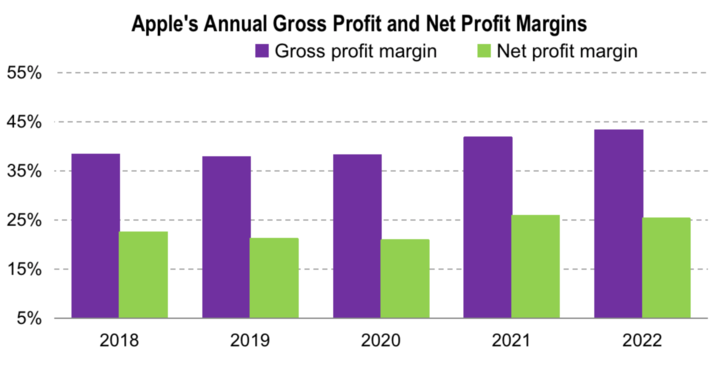

Apple’s profit is a function of revenue growth and prudent spending. The company achieved a gross profit margin of 43.3% in fiscal 2022. Apple has maintained its annual gross profit above 37% and net profit margin above 20% over the past 5 years as you can see in the illustration below.

Apple is a strong cash machine. The company generated $122 billion in cash flow from operations in fiscal 2022, which increased from $104 billion in the previous year.

Apple Stock Dividend History

The company paid an annual dividend of $0.92 per share in fiscal 2022, marking an increase from $0.88 per share it paid in fiscal 2021. The company is on track to pay an annual dividend of $0.96 per share in fiscal 2023. Apple has paid an increasing annual dividend for the past 13 consecutive years.

Although it offers a modest dividend yield of less than 1%, Apple ranks among the best stocks for dividend reliability. The company has been paying dividends since 1987. Apple is prudent with its dividend program, only spending about 15% of its profit on dividends and retaining much of the cash to invest in growing its business.

Apple Stock Split History

Apple went public in December 1980, offering its stock at $22 per share. The company has split its stock multiple times since the IPO to make it more affordable to retail investors.

The first Apple stock split was a 2-for-1 split in 1987. The stock underwent additional 2-for-1 splits in 2000 and 2005. Apple implemented a 7-for-1 stock split in 2014 and a 4-for-1 split in 2020.

As a result of the 5 stock splits, an original position of 1,000 shares in Apple has increased to 224,000 shares. Apple’s split-adjusted IPO price is now about $0.10.

Apple Stock Price Performance

Apple stock has paid off well for long-term investors and short-term traders. At the current price of about $175, Apple has returned a whopping 174,900% for long-term on its split-adjusted IPO price. The stock has gained about 15% over the past year and 270% over the past 5 years.

The stock’s long-term gains have come alongside multiple price fluctuations, providing profit opportunities for Apple CFD traders in both rising and falling markets. The stock has soared whenever Apple reports strong earnings and dipped whenever investors see signs of struggle in Apple’s flagship iPhone business.

Apple Stock Forecast

Apple stock price prediction suggests modest upside potential. Analysts have an average 12-month price target of $183 on Apple stock, implying upside potential of about 6%. The peak price target of $205 implies 18% upside, while the bottom price target of $120 suggests 30% downside.

AAPL stock is trading at forward PE of 29%, higher than 28% for Microsoft (MSFT) and 20% for Alphabet (GOOGL). For investors seeking a long-term position in a stock, a lower PE ratio is preferable.

Apple’s Growth Opportunities and Strategies

Apple is looking for new growth opportunities. In the pursuit of future growth, the company is expanding in emerging markets and introducing new products. These are some of the ways Apple is trying to grow its revenue:

Expanding in India

Apple has made India a major focus in its aggressive expansion into emerging markets. India is the second-largest smartphone market after China. With a population of 1.4 billion people and just over 46% smartphone penetration, the growth opportunity in India is still enormous for smartphone companies.

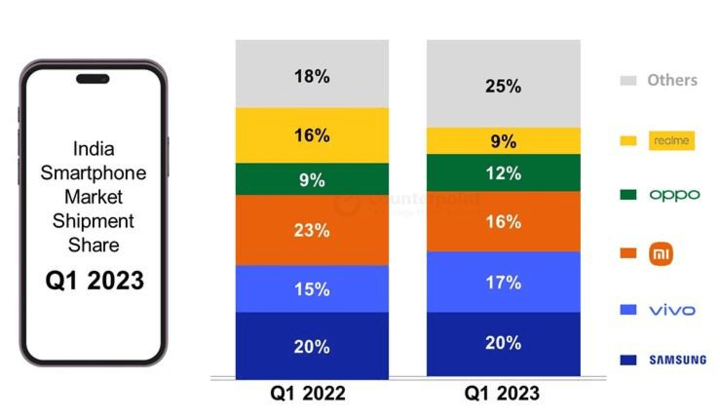

While Samsung, Vivo, and Xiaomi have long dominated India’s smartphone market, Apple has started gunning heavily for market share in this lucrative market.

Apple is opening retail stores in India and recruiting channel partners to help it grow its presence in the country. Since Apple currently has low penetration in India, it sees huge growth potential in the country as it takes market share from its rivals.

In addition to India, Apple is making an aggressive push into other emerging markets such as Brazil, Mexico, Turkey, Malaysia, and Saudi Arabia.

Pursuing Fintech Opportunities

Apple is aggressively building its financial technology (fintech) business. After introducing Apple Pay, Apple has gone on to launch several other financial solutions. These include the Apple Card and Apple Pay Later short-term credit service. Moreover, the company has launched a high-yield savings account in partnership with Wall Street bank Goldman Sachs.

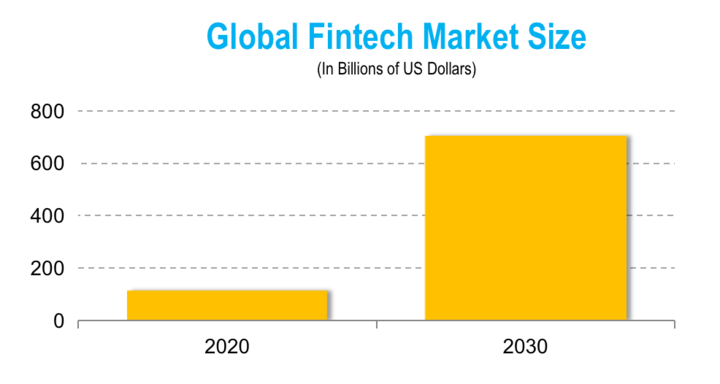

Fintech is one of the most promising segments of the technology sector in terms of growth opportunity. The global fintech market is on track to grow to nearly $700 billion by 2030, from $110 billion in 2020. That presents a huge market opportunity for Apple’s expanding fintech services portfolio.

Pursuing Digital Health Opportunities

Apple is making a big push into the digital health market. The company is particularly packing more health features into its Apple Watch device. For example, Apple is interested in high-demand digital health features such as blood pressure monitoring and glucose level tracking.

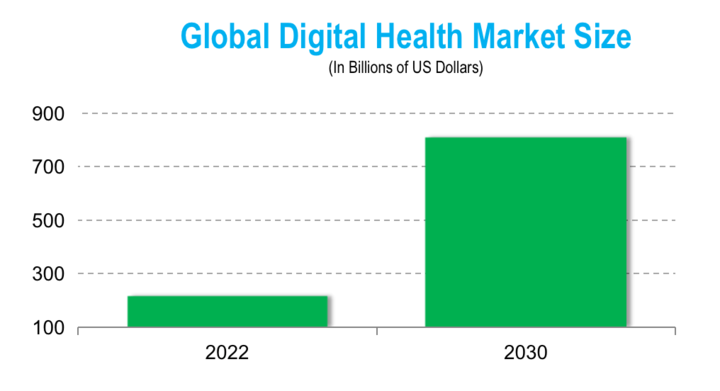

The global digital health market is on track to reach $809 billion by 2030, from $211 billion in 2022. That presents a huge revenue opportunity for Apple in both its hardware and services divisions as products like Apple Watch get health features.

Exploring New Product Categories

Apple is exploring new product categories beyond the iPhone, Mac, and iPad. For example, the company has entered the smart speaker market with HomePod. The company is also interested in the virtual reality (VR) and augmented reality (AR) market.

VR and AR headsets are used as gateways into the metaverse, so this presents a huge growth opportunity for Apple.

Additionally, Apple is interested in the automotive business. The company is thought to be developing an electric self-driving car that could debut as early as 2024. Apple could use the car to offer ride-hailing services like Alphabet’s Waymo or sell it to drivers like Tesla. Although Apple hasn’t confirmed its car plans, the auto market presents a huge growth opportunity for the company amid the transition to electric vehicles.

Enhancing Existing Products With AI Technology

Apple believes that artificial intelligence (AI) has great potential in how it can enhance customer experience. As a result, AI is a major focus for the company. The company has continued to bring AI-powered features into its various products, including the iPhone, Apple Watch, and Siri voice assistant.

The company thinks AI technology can enhance every product and service it offers. Microsoft, Google, and Amazon (AMZN) are making a strong push into the AI space. But Apple is taking calculated steps into the AI race. Although AI technology has interesting potential, Apple wants to be cautious in how it approaches the technology.

Apple’s Challenges in the Growth Pursuits

As Apple works to unlock new growth opportunities and diversify its business, the company needs to overcome several challenges. These are some of the challenges facing Apple:

Affordability in Emerging Markets

Apple primarily sells high-end products, such as 5G iPhones that command premium prices. In its push into the emerging markets, the company could face affordability challenges. In places like India, budget smartphones are the most popular. Apple can overcome the affordability problem by offering financing and selling refurbished products to customers in emerging markets.

Increasing Competition

Apple faces tough competition in the smartphone business. Rivals like Samsung, Google, and Xiaomi are introducing smartphones with features that nearly match those of the iPhone. The iPhone is Apple’s primary revenue source. The tightening competition in the smartphone business could cause Apple to lose market share. Alternatively, the company may be forced to lower its prices and sacrifice profit margins to defend its market. All these are tough choices for the company to make.

Supply Chain Hiccups

Apple relies on a network of suppliers and contract manufacturers to produce its hardware products. As a result, troubles with a critical supplier or manufacturer can cause product shortages or delay product launches schedules and lead to revenue loss.

The company is bringing more partners on board in an effort to diversify its supply chain to reduce its risks. But working with multiple supply chain partners can make it difficult for the company to safeguard its business secrets, which can lead to the loss of an important competitive edge.

Investing in Apple Stock and Trading Apple CFD

You can get exposure to Apple stock in a variety of ways. The common ways to make money with Apple are holding Apple shares, trading Apple stock options, and trading Apple CFD.

Buying and holding shares is the traditional investing method. Those applying this strategy seek fundamentally strong companies to invest in for the long-term. Apple’s strong fundamentals make it an ideal stock for buying and holding.

Options trading is about getting the rights to buy or sell Apple stock in the future. You’ll buy a Call option when you’re bullish on AAPL stock, and buy a Put option when you’re bearish on the stock. The idea is that a Call option allows you to buy the stock at a discount at a future date while a Put option allows you to sell the stock at a premium in the future. An option contract involves a package of 100 shares.

CFD trading offers a simpler way to get exposure to Apple stock than buying and holding Apple shares or trading Apple stock options. Trading Apple CFD involves betting on the direction of the Apple stock price.

If you think AAPL stock is going to rise, you’d purchase the Apple CFD contract that pays you when the stock price goes up. Likewise, if you expect the stock to fall, you’d purchase the Apple CFD contract that pays you when the stock price declines.

Unlike buying and holding shares where you have to wait a long time to see returns, CFD trading allows you to capture profit over short periods such as an hour, day, or week. Additionally, CFD trading is more flexible because it requires less capital than buying and holding shares or trading options.

The biggest advantage of CFD trading is that it allows you to profit from both rising and falling markets.

Why Trade Apple Stock CFD with VSTAR

If you’re ready to start trading Apple CFD, try VSTAR CFD trading platform. VSTAR offers tight Buy-Sell spread, low trading fees, and fast trade execution. The platform also allows you to start trading with as little as $50.

Moreover, VSTAR provides stop and limit order features to help traders lock in profit or minimize their losses.

Additionally, the platform offers resources to help you improve their trading strategies. VSTAR also offers leverage to stretch your capital. For those new to CFD trading and want to practice before they start investing real money, VSTAR offers a demo account with up to $100,000 in virtual money.

You can trade CFDs confidently with VSTAR because the platform is regulated by the CySEC.

Final Thoughts

Apple stock provides long-term and short-term profit opportunities. If Apple’s expansion and diversification efforts succeed, the stock could soar and deliver solid returns to long-term investors. But the stock could fall if Apple’s growth efforts flop. Trading Apple CFD allows you to profit from both the rise and fall of Apple stock price.