The rise of Bitcoin has been incredible, going from a worthless asset to over $60,000 in 2021. Early investors in Bitcoin who held their position became very wealthy when the meteoric rise began. With all the buzz and controversy surrounding Bitcoin, it is easy to forget that it launched in 2009.

Bitcoin is the mother of digital currencies, and while we cannot turn back the hands of time to buy it when it was in its infant stage, we can explore its evolution to guide us in making future investments.

However, Bitcoin’s value journey has been anything but smooth, with frequent pumps and dips over the years. This article will explore Bitcoin’s price history from the early years to future expectations of digital assets.

What is Bitcoin?

Bitcoin is a virtual or digital currency (virtual money) that operates on a decentralized network. Since it is money, you can use it to pay for goods or services. Decentralized technology means its operation is not subject to government or third party agency constraints.

You can store your Bitcoin in a digital wallet that can be accessed anytime from anywhere, provided you are connected to the internet. In addition, Bitcoin can be transferred between two digital wallets. A Bitcoin wallet contains a public and private key, which allows the account owner to sign in and perform transactions.

Bitcoin provides an alternative payment for people to get cash, goods, and services. The total wealth of a Bitcoin holder is the sum of the value of the price of each coin. Bitcoin works with blockchain technology, which records all transactions in a secure manner. Therefore, you cannot send Bitcoin that you do not have.

Early use cases of Bitcoin

The first transaction with Bitcoin was the pizza purchase on May 22, 2010- celebrated as Bitcoin pizza day. Laszlo Hanyecz offered 10,000 BTC to purchase two Papa John’s pizzas. The price of the two pizzas was about $25, but by 2021, their value exceeded $500 million. which shows the significant change in Bitcoin’s value over the years.

In the early days, the buzz around Bitcoin was its potential to challenge centralized financial institutions, offer maximum security, and serve as an alternative for online payments. Today, Bitcoin has become an acceptable means of payment for many businesses. Additionally, Bitcoin was used as a store of value due to its limited supply, indicating a potential for wealth protection.

Bitcoin's Early Years (2009-2013)

In October 2009, a Finnish computer science student, Sirius, sold 5050 Bitcoin for $5.02, giving each Bitcoin a monetary value of $0.0009. This exchange occurred on PayPal, as there were no crypto exchange platforms yet.

The first real-world Bitcoin transaction, which involved the purchase of two pizzas, placed the value of each BTC at $0.0041. Bitcoin did not experience a significant rise until 2011 when each BTC was valued at $30 in June. However, the volatile nature of Bitcoin became a reality as the price of each BTC crashed to $5. In October 2011, Bitcoin’s first competitor was launched- Litecoin. Following this event, the price of Bitcoin at the end of 2012 was about $13.

Another major event that led to the rise in the value of Bitcoin was dark web activities like Silk Road and Hansa- markets for illegal items. Bitcoin was adopted as payment on the dark web due to the anonymity associated with the blockchain network.

Some organizations like WikiLeaks accepted Bitcoin as a form of payment in 2011and by 2012, BitPay paid over 1000 merchants in Bitcoin. This increase in demand and adoption was significant in the history of Bitcoin.

In addition, blockchain technology provides more security and transparency than traditional payment methods. There were speculations about Bitcoin’s potential, leading to increased demand. As a result, the network grew, increasing Bitcoin’s value and attracting investors. However, Bitcoin’s decentralized nature and regulatory uncertainty brewed skepticism among investors and some policymakers.

Adoption of Bitcoin as an asset in financial markets and its impact on retail investors

Despite the volatile nature of Bitcoin, its adoption as an asset has increased significantly. First, this has made it more accessible to retail investors. Bitcoin provides investment opportunities to make profits in short-term trades. This profit is an alternative way of earning money instead of relying on traditional investments with low investment rates. However, the volatility associated with Bitcoin trading puts retail investors at risk for higher losses. The price of Bitcoin can go up within a short time, and retail investors can make a huge profit, but it can come crashing down so fast they have nothing left.

The First Significant Price Surge (2013-2014)

In 2013, Bitcoin experienced a significant surge in price, opening at $13; the value was over $1000 by November. Mt Gox was one of the notable exchanges that handled about 70% of all Bitcoin transactions.

Due to the drastic flop in the price of Bitcoin, Robert Shiller, the Nobel Prize winner called it a bubble. However, Bitcoin is different from other bubbles because, after each fall, the price increases again.

Although Bitcoin was making waves in 2013, China released new rules regarding crypto transactions at financial institutions to restrict it.

In addition, the strength of the economy also affects the price of Bitcoin. When the Federal Reserve was increasing interest rates to combat inflation, the price of Bitcoin plummeted.

Bear Market (2014-2016)

A bear market describes a situation when the price of Bitcoin (or other cryptocurrencies) falls below 20% or more of recent highs. The change in Bitcoin’s price between 2014 and 2016 was not significant. At the beginning of 2015, one bitcoin was valued at $315.21.

Mt Gox, a trading platform was forced to shut down in a security breach where hackers made away with about $60 million worth of Bitcoin. The media was all over this unfortunate incident, and it caused the value of Bitcoin to plummet to about $300 at the end of 2014. In addition, the FBI was able to crack down and shut down the silk road in 2014, which promoted the image that Bitcoin is money for criminals. As a result, market sentiment was unfavorable.

In 2016, the Japanese Yen became Bitcoin’s biggest partner. In Argentina, Uber announced the adoption of Bitcoin. In addition, Swiss Railways upgraded their ATMs to accept Bitcoin. Furthermore, by the end of the year, there were over 700 Bitcoin ATMs worldwide.

The sharp decline in the price of Bitcoin in 2014 was the beginning of the bear period. During this period, the price of Bitcoin was relatively stable at a low point- between $200-$500. However, other cryptocurrencies like Ethereum and Ripple performed better, staying ahead of Bitcoin.

Some of the problems faced by Bitcoin in this period are regulatory issues as some countries implemented restrictive policies while others outrightly banned the use of Bitcoin. Due to the good performance of other cryptocurrencies, blockchain technology has become more popular. However, the legal issues surrounding the use of cryptocurrency fuelled skepticism.

Second Wave of Mainstream Attention (2017)

Bitcoin experienced a second wave of mainstream attention in 2017. By May, the value of one BTC was over $2000, and in a few weeks, it hit $3000. The value of Bitcoin kept increasing until it exceeded $5000 in September and $19783 in December.

Some factors that affected this soar were mistrust in the government and a way to protect against financial crises like that of 2008. Also, many individuals who do not trust the banking system found Bitcoin as a convenient store of value.

Bitcoin's remarkable journey through 2017 made governments, economists, and whale investors interested. However, China banned crypto ICOs in an attempt to further restrict crypto transactions. Regardless other countries like Japan were adopting Bitcoin, which boosted investor confidence.

The Second Cryptocurrency Bear Market (2018-2020)

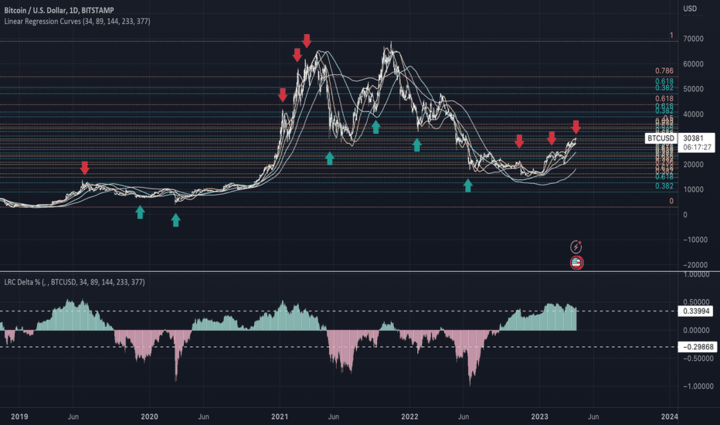

During the second cryptocurrency bear market, the value of Bitcoin came crashing from over $19,000 to about $3185 in December 2018. However, the fall was far from over, as the price of Bitcoin was progressively going down. This period is often referred to as “the crypto-winter.” By the end of 2019, the price of BTC once again rose to $12,000.

The 2020 COVID-19 pandemic caused global inflation and economic recession. Bitcoin began the year at over $6965 but crashed to less than $4000 around May. This caused an upward trend in the price of Bitcoin as the public lost faith in the government. By the end of the year, Bitcoin experienced a 416% increase to reach about $29,000 in December.

Another factor that caused the upward trend of BTC was the trade war between China and the United States of America under President Trump. In early 2018, the data scandal emerged, leading to concerns about data privacy and security, which negatively impacted the price of Bitcoin. Consequently, social media exposure of negativity surrounding cryptocurrency led to a decline in BTC’s price.

Unprecedented Cryptocurrency Bull Market (2021)

As early as January 7, the value of Bitcoin was $40,000 and it experienced an upward trend of over $60,000 in April. This price increase can be attributed to increased adoption by institutional investors. Big companies like Tesla, Square, and MicroStrategy adopted Bitcoin and made significant investments.

However, the price was slashed by half by July, with Bitcoin value under $30,000. The limited supply of Bitcoin (21 million) contributes to increasing demand, leading to the bull market.

Another Bitcoin bull run began in September when the price jumped to over $52,000, but the price fell to about $40,000. The rising sentiment from equity markets also contributed to the Bitcoin bull market. Many investors choose Bitcoin as a hedge against inflation. Once again, in November, Bitcoin reached an all-time high of over $65,000. However, the price started fluctuating due to rising sentiment demand from equity markets. At the end of 2021, the value of Bitcoin fell to about $46,164.

Long-term and Short-term Implications

The 2021 Bitcoin bull market implies that as more investors enter the market, the more likely the value of Bitcoin will increase. However, the potential of a market crash should not be ignored.

In the long term, Bitcoin has the potential for a significant boom. As more big companies adopt the use of Bitcoin, it has the potential to become a mainstream investment. However, regulatory frameworks are still a concern, with countries taking different approaches to cryptocurrencies.

The Ongoing Cryptocurrency Downturn (2022-Present)

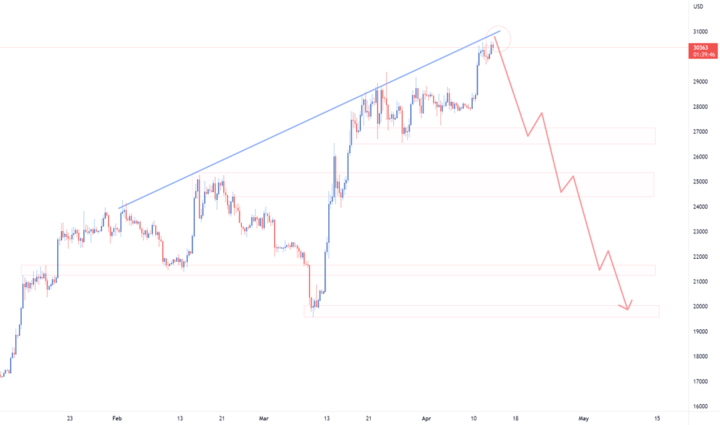

The price of Bitcoin experienced a downtrend between January and May of 2022. By the end of March, the value was above $47,000. However, it quickly crashed to less than $30,000. However, at the end of 2022, Bitcoin's value was below $20,000.

The dip in the value of Bitcoin was most likely precipitated by the crash of TerraUSD, which promoted skepticism for cryptocurrency investments. January of 2023 saw Bitcoin with a value of less than $17,000. As of April 2023, the price of Bitcoin was $28516. However, it is projected to be over $29,000 at the end of the month.

Several factors contributed to the on-going Bitcoin downtrend. First, many investors are concerned about global inflation. As a result, their focus is on buying assets- such as gold or real estate that offer better protection against inflation.

Regulatory interventions have also stirred volatility and uncertainty within the cryptocurrency market. Finally, many environmentally conscious individuals are paying attention to Bitcoin's significant environmental impact and energy consumption.

Potential Effects of These Factors

These factors causing a progressive downtrend in the price of Bitcoin have a significant impact on the cryptocurrency market. The decline in Bitcoin’s price has reduced investor confidence, making them sell off their holdings and further driving down its price.

In addition, regulatory interventions fuel uncertainty around Bitcoin's future, which can further drive down its price. With the growing concern about the greenhouse effect of Bitcoin, many people passionate about preserving the earth's integrity may boycott BTC investment.

The overall market sentiment around Bitcoin is ambiguous. Many investors are concerned about the on-going downtrend and the potential for a further price decline. However, some investors are optimistic about the future because Bitcoin always finds a way to rebound after crashing.

Future Expectations for Bitcoin

The future of Bitcoin is largely uncertain because it is a volatile asset. Several factors will play a significant role in the future of Bitcoin. One primary driving factor will be the adoption of Bitcoin by institutional investors. In addition, acceptance by various world governments could boost investor confidence and public adoption.

On the other hand, growing concerns about energy consumption and the impact of Bitcoin mining on the environment could negatively affect public sentiment.

Ultimately, the future of Bitcoin depends on various factors, and it may be difficult to predict its long-term performance. It is, however, important to remember that Bitcoin can experience a gradual uptrend or sudden crash.

Is Bitcoin a worthy investment?

Investing in Bitcoin comes with its potential risks and rewards. However, good trading strategies and technical analysis indicators can help minimize risk and increase profit. In addition, choosing a reliable trading platform like Vstar plays a key role in your Bitcoin investment. Suppose you want an institutional-level trading experience. Then, Vstar is the perfect platform for you as it includes the lowest trading cost, which means tight spread and lightning-fast execution. Another factor that sets Vstar apart from the competition is the platform is regulated by CYCEC (NO.409/22) as some platforms are often unregulated.

Buying and holding BTC spots may be risky because of the volatile nature of the market. On the other hand, trading Bitcoin through Contracts for Difference (CFD) involves speculating the price movement of Bitcoin using derivatives without actually owning the coin. Although trading Bitcoin through CFD may be less risky, it can potentially limit profits.

Like any investment, it is essential to research to get in-depth knowledge before investing in Bitcoin. Therefore, whether Bitcoin is worth investing in depends on risk tolerance and tools.

Conclusion

The history of Bitcoin’s price has been a rollercoaster ride since its inception in 2009. Extreme volatility, sudden crashes, and rapid price increase characterize Bitcoin. Despite the ups and down associated with Bitcoin, it has captured the attention of mainstream media and big investors. Undoubtedly, Bitcoin represents a revolutionary form of money and a potential store of value. Although the future of Bitcoin remains highly unpredictable, it will continue to be a topic of interest in the financial sector.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.