Rivian is one of the hottest stocks in the electric vehicle space right now. Investing in Rivian can be profitable, as the company has the potential to disrupt the automotive industry with its electric adventure vehicles. Our must-read article provides an introduction to investing in Rivian stock or trading CFDs, including its financials and stock performance. Discover the pros and cons, along with insider tips and investing know-how on the best ways to maximize profits and minimize risk.

Introduction

Who makes the Rivian? Rivian Automotive is an electric vehicle (EV) startup company founded in 2009 by Robert "RJ" Scaringe. The company has received significant investments from Amazon and Ford to ramp up production.

Investing in Rivian stock is a great opportunity to invest in the future of electric vehicles and sustainable transportation. In addition, Rivian's unique focus on adventure vehicles and the outdoors gives the company a unique market position and potential for growth in niche markets. There are three primary ways to invest in Rivian stock: buying the underlying stock, buying options on the stock, and trading CFDs.

Boost your portfolio: The Case for a Long-Term Investment in Rivian Stock

A. Reasons to Invest in Rivian Stock for the Long Term: Is rivian a good stock to buy?

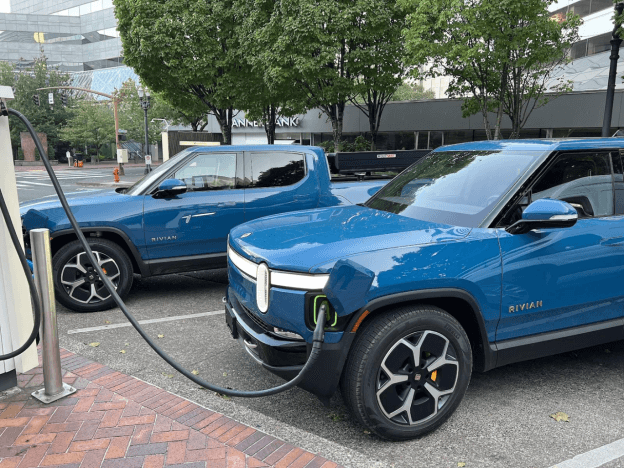

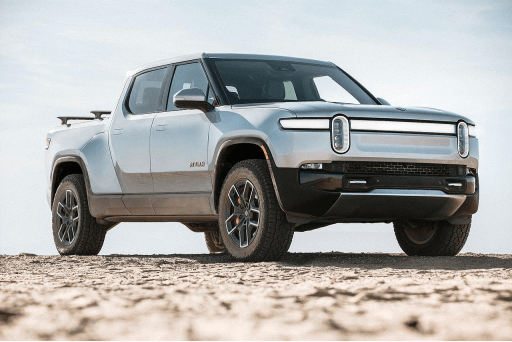

A key reason to consider a long-term investment in Rivian stock is the company's consistency and leadership position in the high-growth EV pickup/SUV market. While Tesla has been the dominant player in the broader EV market for several years, Rivian Inc. is more specific and has made a name for itself as the best outdoor EV manufacturer. Rivian is one of the few companies that focuses exclusively on producing adventure-oriented EVs. Rivian is making waves in the automotive industry with its innovative electric vehicles, including the Rivian Truck and Rivian SUV.

Additionally, another reason to consider investing in Rivian stock is the funding and support the company has received from major players in the automotive and tech industries. In 2019, the company raised $1.3 billion in funding from a group of investors that included Ford, Amazon, and Cox Automotive. This is a testament to the company's high-end growth potential, the weight it can pull, and the confidence it has from other powerful companies. In addition to its strong financial backing, Rivian has also made significant investments in manufacturing capacity, including the construction of a state-of-the-art EV factory in Normal, Illinois.

In recent Rivian news, Rivian has been making headlines with its highly anticipated Rivian electric vehicles, specifically the Rivian Truck. Rivian has several exciting models coming to market in the coming years, including the R1T pickup truck and R1S SUV. These models are expected to gain massive traction and generate profits for the EV startup. These vehicles have been designed from the ground up to meet the needs of outdoor enthusiasts, with features such as all-wheel drive, advanced battery technology, and ample storage space. The Rivian Truck price has garnered attention as it aims to offer competitive pricing while delivering impressive features and performance.

B. Strategies for Investing in Rivian Stock for the Long Term

When it comes to investing in Rivian stock for the long term, it's important to have a sound investment strategy. Here are some strategies that investors can consider:

Start building your position gradually: Rather than going "all in" at once, consider accumulating Rivian stock over time. Start with a small allocation and build your position gradually as you become more confident in the company's long-term prospects. Dollar-cost averaging is a useful technique for gradually building a position because it involves investing a fixed amount of money at regular intervals regardless of the stock's price. This can help reduce the risk of buying at the top of the market.

Look for technical support levels: Will Rivian stock go up? When should I buy Rivian? Determining the right time to buy Rivian is a complex task that requires careful consideration and analysis. Technical analysis can be useful in identifying potential buying opportunities. Look for technical support levels, which are price levels where the stock has historically found support and bounced back from.

Monitor analyst reports and news events: Analyst reports and news events can provide valuable insight into a company's long-term prospects. Follow reputable analysts who cover Rivian stock and provide Rivian CFD trading tips, paying attention to their recommendations and Rivian price target. For example, Rivian investors and enthusiasts eagerly await 2023 Rivian earnings reports to gain insight into the Rivian financials, including Rivian revenue. As a result, RIVN earnings and Rivian stock earnings have become important focal points. These reports shed light on key metrics such as revenue, net income and earnings per share, providing valuable information for evaluating Rivian's growth and profitability. In addition, investors closely monitor Rivian market cap, which represents the total value of its outstanding shares. RIVN earnings date is an important event for shareholders and analysts, as it sets the stage for potential market reactions and investment decisions. By staying informed about Rivian's earnings and market cap, investors can make more informed decisions regarding their investments in the company.

Managing Risks and Volatility

Trading any stock, including Rivian, involves inherent risks and uncertainties that investors must be aware of. When investing in Rivian stock for the long term, it's important to be prepared for a bumpy ride and to manage risk and volatility effectively. Here are some strategies for managing risk and volatility when investing in Rivian stock:

Diversify your portfolio: One of the most effective ways to manage risk is to diversify your portfolio. By investing in a number of different investments, you can reduce your exposure to any one stock or sector. In addition to Rivian Car Company, consider investing in other EV companies or related industries to mitigate the risks associated with investing in Rivian.

Set realistic expectations: Investing in stocks involves both ups and downs. While Rivian's long-term prospects may be strong, the stock may experience short-term volatility. Be prepared for fluctuations in the stock price and set realistic expectations for your returns.

Monitor potential risks: In addition to market risks, there are specific risks associated with investing in Rivian. Production challenges, increased competition, and potential stock dilution are just a few of the risks that could affect the company's performance. Stay informed about these risks and monitor the company's progress in addressing them.

Capture short-term profits: Trade Rivian CFDs with Expertise and Care

A. Why Trade Rivian with CFDs?

When trading Rivian CFDs, traders can go long or short based on whether they believe the price of the stock will rise or fall in the short term. When a trader goes long on Rivian CFDs, they are essentially buying the CFD with the expectation that the price of the underlying stock will rise. On the other hand, when a trader goes short on Rivian CFDs, they are selling the CFD in the expectation that the price of the underlying stock will fall.

Trading CFDs provides the opportunity to use leverage. This means that traders can take a larger position than they could with their own capital alone. For example, if a trader has $1,000 and wants to invest in Rivian stock, they may only be able to buy a small number of shares. However, by using CFDs with a leverage ratio of 10:1, the trader can achieve a position size of $10,000. CFDs offer several other advantages that make them ideal for short-term trading. Firstly, the low trading fees associated with CFDs make them attractive to short-term traders looking to profit from small price movements.

Another advantage of CFDs is that they have no expiration date, which means that traders can keep positions open for as long as they like. This makes them ideal for short-term trading around news events and technical levels, as traders can take advantage of price movements in real time.

However, traders must be aware of the potential risks associated with CFD trading. The use of leverage can lead to significant losses and traders must carefully manage their risk exposure to avoid margin calls. In addition, short-term trading can be highly volatile and traders should use risk management tools such as stop loss orders to minimize their exposure.

B. How CFDs Compare to Options, Spread Betting and Direct Stock Trading

CFDs are not the only financial instruments traders can use to gain exposure to Rivian's stock price movements. Other popular options include options, spread betting, and direct stock trading. In this section, we will compare CFDs to these other options.

CFDs and options are similar in that they both provide traders with leverage, allowing them to open larger positions than they could with their own capital alone. However, options have expiration dates and higher fees than CFDs, limiting their usefulness for very short-term trading. In addition, options are more complex financial instruments that require more knowledge and experience to use effectively.

Spread betting is another popular way to speculate on the movement of financial assets. However, it is not available in some regions, unlike CFDs, which are widely available. Spread betting also has different tax implications than CFDs and traders need to be aware of these differences.

Finally, direct stock trading involves buying and owning the actual shares of Rivian. This method is less leveraged than CFDs and options, and traders must have the full amount of capital required to purchase the shares upfront. Direct stock trading also involves higher fees and commissions than CFD trading.

How to Trade Rivian Stock CFDs with VSTAR

VSTAR is a well-known and trusted trading platform that allows traders to trade stock CFDs. Trading with VSTAR is relatively simple and you can do so by:

- Open a trading account with VSTAR.

- Then funding the account with the required amount.

- Search for stocks on the platform, e.g. Rivian stock.

- Enter the amount you wish to trade.

- You should then set your Stop Loss and Take Profit levels.

- Finally, place the trade.

Why Choose VSTAR For Rivian Stock CFD Trading

Here are three potential reasons why an investor might choose VSTAR to trade Rivian stock:

Expert Analysis: VSTAR gives traders access to expert analysis and insight into the EV industry, which can be valuable in making informed decisions about Rivian and other EV stocks.

Innovative Trading Tools: VSTAR offers innovative trading tools, such as automated trading algorithms and customizable dashboards, that could enhance an investor's ability to trade Rivian stock and other securities.

User-Friendly Platform: VSTAR's platform is user-friendly and easy to navigate, making it a good option for both novice and experienced investors. In addition, VSTAR provides responsive customer support to address any questions or concerns that may arise during the trading process.

How to Become a Successful Rivian Trader

A. Follow the technicals and fundamentals guiding the stock's movements

Monitor Key Support and Resistance Levels

Here are some key points to follow when monitoring support and resistance levels for the Rivian stock price:

- Look at the chart of Rivian's stock price over time to identify areas of support and resistance. These are price levels from which the stock has previously bounced or been rejected.

- Support levels are typically found in areas where the stock has previously found buyers and bounced off, creating a floor of support. Resistance levels are found where the price has previously been found and rejected by sellers, creating a ceiling of resistance.

- Draw horizontal lines on the chart to mark these levels. You can also use technical indicators such as moving averages or trend lines to identify potential support or resistance levels.

- Observe how the stock behaves around these levels. A stock price that bounces off a support level may indicate a good buying opportunity, while a stock price that breaks through a resistance level may indicate a good selling opportunity.

However, it's important to remember that support and resistance levels are not set in stone and can change over time as the stock price moves. New highs and lows can be made, making previous levels less relevant. Therefore, it's important to keep up with the latest news and market trends that may affect the stock's price and adjust your trading strategy accordingly.

Some additional tips to keep in mind include:

- Pay attention to the volume: High trading volume around a certain level can indicate its significance as a support or resistance level.

- Look at the bigger picture: Consider the long-term trend of Rivian's stock price, and identify key support and resistance levels in that context. This can help you avoid getting caught up in short-term fluctuations that may not be as significant. For example, when it comes to Rivian stock forecast and Rivian stock price prediction 2025, there is significant interest and speculation surrounding the potential growth of Rivian (Rivn) stock. Most analysts estimate that Rivian's fair value is between $30 and $50 per share. The current price is above this range. While accurate RIVN stock forecast are difficult, analysts and investors are closely monitoring Rivian's development, product launches and market response. With increasing consumer demand for electric vehicles and the company's ambitious plans, many believe that Rivian stock has potential for growth in the coming years. Rivian stock price projection 2025 range from $60 on the low end to $140 on the high end.

- Use multiple time frames: Identify key support and resistance levels on both shorter and longer timeframes to get a more complete picture of the market. The average analyst 12-month Rivian price target is around $45. The high target is $70 and the low is $24.

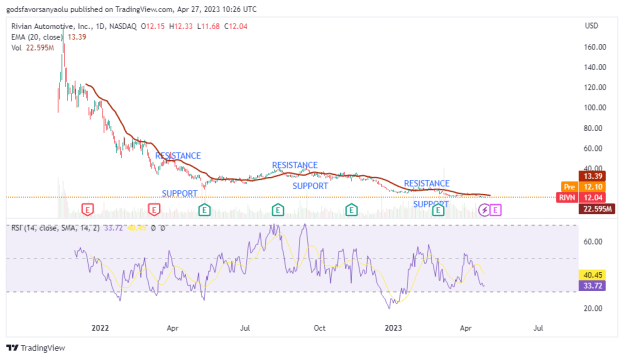

Here is an example chart of Rivian's stock price with key support and resistance levels indicated:

Looking at the chart for Rivian Automotive, we can see the key support and resistance levels to watch.

Support levels are areas where buyers have historically entered the market and pushed the price higher, while resistance levels are areas where sellers have historically entered the market and pushed the price lower.

- The chart shows potential support and resistance levels for Rivian's stock price, with support at approximately $40 and resistance at approximately $26.

- As a trader, you can use these levels to guide your entry and exit points for trades. For example, you may want to buy near the support level and sell near the resistance level.

- Trading strategies that can be used around these levels include breakouts (when the price breaks through the resistance or support level), reversals (when the price bounces off the resistance or support level), and channel plays (when the price moves in a range between the resistance and support levels).

- You should be aware of false breakouts, where the price briefly breaks through a support or resistance level before quickly reversing, which can lead to losses.

Knowing the Catalysts That Drive Momentum

To be a successful Rivian trader, it's important to know the catalysts that will drive momentum in the stock. Some key events to watch include:

- Earnings reports and guidance: Positive or negative earnings surprises can have a significant impact on the stock price.

- New vehicle reveals/launches: Any announcement of new vehicle models or plans can generate excitement and positive sentiment.

- Factory progress updates: Any news about Rivian's manufacturing progress can affect market sentiment.

- Analyst rating changes: Analyst upgrades or downgrades can also affect the stock price.

- Changes in the macro environment, such as policy incentives: Any change in government policy related to electric vehicles or sustainable transportation can affect the stock.

You should anticipate these events in advance and be prepared to act quickly using strategies such as straddles (buying both a call and put option at the same strike price), strangles (buying both a call and put option at different strike prices), and swing trades (taking advantage of short-term price fluctuations). You could predict the movement by paying attention to any important news, which is classified under fundamental analysis. Your technical analysis could also help you anticipate the events.

B. Start Small, Use Stop Losses and Don't Get Emotional

Starting small and using stop losses can help manage risk and prevent significant losses. Emotions can cloud judgment and lead to impulsive trading decisions, so it's important to stay disciplined and avoid getting emotionally attached to positions.

C. Stick to your trading plan

Having a well-defined trading plan that includes strategies for managing risk, monitoring key levels, and identifying potential catalysts can help traders stay focused and avoid making impulsive decisions. Sticking to the plan, while remaining flexible to adapt to changing market conditions, is critical to long-term success when trading Rivian or any other security.

Conclusion

This article has highlighted the potential of Rivian as a long-term investment due to the growing popularity of electric vehicles and the company's strong financial position. It has also discussed the use of CFDs for short-term trading around news events and technical levels, with lower fees, leverage, and no expiration dates. It is important to understand the risks involved in investing and trading and to have a solid plan in place before entering the market.