The first cryptocurrency was created as an alternative to the traditional “central money network.” Therefore, blockchain technology revolutionized how we store or transact digital money while offering high levels of security and decentralization. However, one setback to blockchain technology was “cross-chain communication.”

Chainlink is fast becoming a significant component of many blockchain applications. This guide will explain Chainlink, analysis, trading strategies, risk management, and how to trade LINK tokens.

What is Chainlink and LINK Token?

Chainlink is a blockchain abstraction layer that enables universally connected smart contracts. It is a decentralized oracle network connecting non-blockchain platforms to blockchain technology. Chainlink is also a hybrid smart contract because it allows on-chain and off-chain communication.

In addition, Chainlink is an open-source project hosted on the Ethereum network. Therefore, it provides secure inputs and outputs for complex smart contracts on any blockchain.

The operation of Chainlink relies on a system of nodes that follow certain instructions. Node operators are required to lock a specific amount of their tokens, and they can set their fees based on the value of the off-chain service they are providing.

LINK is an ERC-20 token used on the Chainlink platform to pay node operators for data and service provision. LINK tokens are given as rewards to node operators who provide accurate data to the Chainlink network. However, LINK holders must stake the token to a smart contract to become a node operator that can supply data to the oracle.

Chainlink nodes are blockchain agnostic, allowing any blockchain to use its services to access data, web APIs, traditional bank APIs, and more. The agonistic nature of Chainlink implies it can be integrated with any blockchain network.

Traditional financial products such as asset equity, derivatives, and loan can be built using Chainlink, with increasing security and transparency. Another critical case use of Chainlink is smart contract-based gaming applications. In addition, blockchain technology can access traditional systems like enterprises or IoT networks with Chainlink.

Fundamental Analysis of LINK

Chainlink has established itself as a leader in the blockchain industry by providing Oracle solutions that serve as a bridge between off-chain data and on-chain data. In this segment, we shall analyze fundamental factors that affect LINK.

Partnership and integrations

A significant indicator of the success of a blockchain project is partnership and integration with leading blockchain and financial networks. Facilitating extensive integrations and partnerships is fundamental to Chainlinks’s role as a middleware standard. As a result, this is expected to fuel the adoption of Chainlink by big enterprises and small businesses.

In February 2023, the digital fashion brand PLAY! POP! GO! announced an integration with Chainlink's Verifiable Random Function (VRF). Also, TP ICAP, an industry leader in the electronic market infrastructure and information provision, announced it had joined the Chainlink Network to provide high-quality forex data for the expansion of the blockchain network.

Other notable partners include SWIFT (Interbank messaging system), StarkWare, Hedera, Hashgraph, and Google Big Query. This partnership results in more usage and adoption of Chainlink. Therefore, it could lead to an increase in the value of LINK in the long run as the project becomes increasingly useful.

Chainlink 2.0 upgrade

Chainlink 2.0 went live in 2022 as the next step in revolutionizing Oracle networks. The goal was to create new utility for new and existing applications in the ecosystem. In addition, this update will promote reliable, fast, and secure universal connection and off-chain algorithms for smart contracts.

This upgrade includes features like fair sequencing services, Layer 2 scaling solutions, CCIPs, Off-chain Reporting, decentralized identity services, trust minimization, abstracting away complexity, and more. These upgrades could significantly impact LINK’s value as it increases utility and adoption.

Operating cost and staking reward

Chainlink provides Oracle services through a decentralized network of nodes. The cost of operating nodes is another factor that can influence the growth of the ecosystem. Therefore, if the operating cost of Chainlink is less than the potential staking rewards, it attracts more operators. On the contrary, if the rewards are lesser, it may drive operators away and impact network effects. As a result, the operating cost and potential reward can determine the growth of the Chainlink ecosystem.

New Chainlink data feeds and tools

Chainlink is continuously trying to improve the ecosystem with new data feeds and tools that offer unquestionable benefits. More functionality and data sources expand possibilities for developers and contracts, which can support LINK demand. Therefore, developers have a platform with wide functionality and data sources to integrate into smart contracts. In addition, enterprises can also benefit from the features and tools provided by Chainlink’s network. As a result, this plays a role in promoting the adoption and integration of LINK, which can increase demand and cause an uptrend in the market value.

Competitive threats and regulatory issues

While Chainlink has set the bar in the Oracle space, other companies like Corda and Kaleido can be an alternative for enterprise businesses. These competition networks offer Oracle/data services, which could undermine Chainlink adoption if they provide superior solutions for businesses and developers. Therefore, a fundamental analysis of the competitive landscape can help you evaluate the potential of LINK.

In addition, like any other crypto project, regulatory issues around blockchain could also hamper the progress of the Chainlink ecosystem. Therefore, it is best to stay abreast of regulatory changes and how they can affect the market value of LINK.

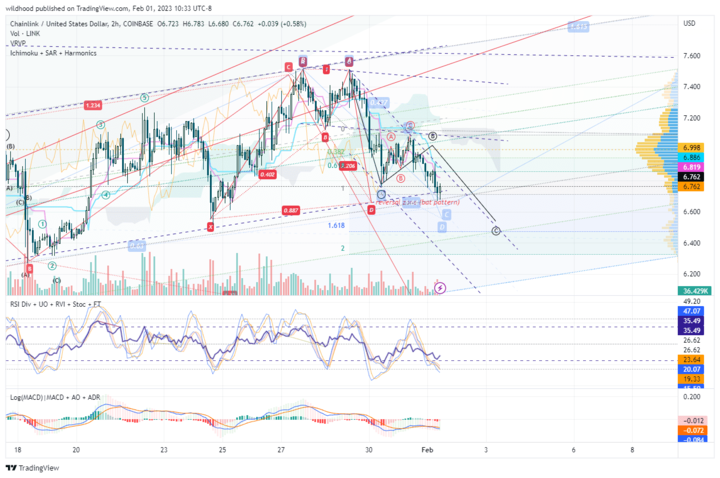

Technical Analysis of LINK’s Price

When it comes to trading LINK, it is critical to understand the importance of technical analysis. Technical analysis can help traders understand market trends and potential price movement by analyzing past trading activities and price variations. Analysis of support/resistance levels, moving averages, indicators, patterns, and trading volumes traders can understand the demand and supply of LINK and possible future predictions.

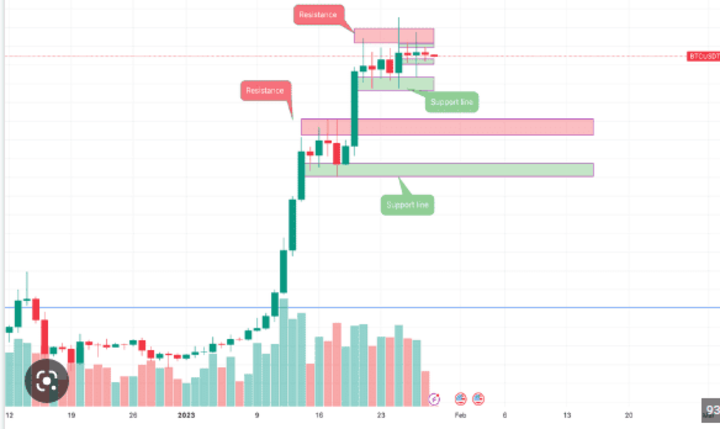

Support and resistance levels

Support and resistance levels are key concepts that every trader must understand to predict market movements. Support levels describe a potential increase in demand, which signifies that the ongoing decline in price will likely halt and reverse. On the other hand, resistance is associated with a reversal in an ongoing uptrend.

Therefore, analyzing LINK's key support/resistance levels, especially its all-time highs and lows, can help traders make informed decisions. In addition, trendline and Fib retracements also provide key reference points. They can show potential support and resistance levels that may determine price movements.

Moving averages

Moving averages are technical indicators that can help traders identify price levels. Traders can study moving averages like 200 and 50-day for dynamic support/resistance and trend changes. When the price crosses above or below the moving average, it may indicate a continuation or reversal of current trends.

Momentum indicators

Momentum indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) indicate overbought/oversold levels and momentum shifts, which may foretell trend reversals or breakouts. RSI and MACD are useful for identifying the changes in price momentum. However, it is critical to note that LINK can remain overbought during strong uptrends.

Chart patterns

Patterns such as double tops, head and shoulders, and triangles can help traders to anticipate key breakouts and reversals. Price movements determine these patterns and can predict future price trends. However, patterns often fail, so confirm signals with volumes, fundamental analysis, and technical indicators to get the best possible outcome.

Trading volumes

Analyzing trading volumes can help traders identify price movements. In addition, trading volumes highlight the strength of breakouts and reversals. Higher volumes cement trend changes while lower volumes warn of false signals.

Timeframes

Traders can analyze different timeframes to identify opportunities for day trading, position trading, or swing trading. Based on your strategy, check smaller timeframes for day trading signals or higher ones for position/swing trading. Smaller timeframes are suitable for short-term investments, while higher timeframes are for long-term trading.

LINK Trading Strategies

The crypto market is associated with volatility, and Chainlink is not exempted. Therefore, it is critical to implement trading strategies to maximize profit and minimize loss. Here are six effective trading strategies for LINK trading:

Trend following

Trend following is a popular crypto trading strategy where traders can ride the major trend up or down. To join the trend, LINK traders should look for continuation signals like pullbacks and volumes. These trends will determine if you will go long or short on a market position. However, it is critical to implement stop-loss orders to protect profit in case of a trend reversal.

Range trading

Range trading is a strategy where traders identify periods where LINK moves sideways between clear support and resistance. Therefore, traders buy toward support zones and sell toward the resistance zones with this strategy. You can place stops outside the range to minimize loss if the price breaks out of range. Chart indicators are crucial tools to help you identify LINK’s range.

Breakout trading

Breakout trading can be a profitable strategy if adequately implemented. Traders can go long or short when LINK breaks key levels like its all-time high low or stiff trendlines. This strategy aims to open a position when LINK’s price breaks out of range. However, it is critical to confirm signals based on high volumes indicating the emergence of a new trend. This is to manage the risk of false breakouts, which can quickly reverse and lead to huge losses. You can determine your position size based on risk appetite. In addition, Fibonacci levels are instrumental to quickly opening a position while minimizing risk.

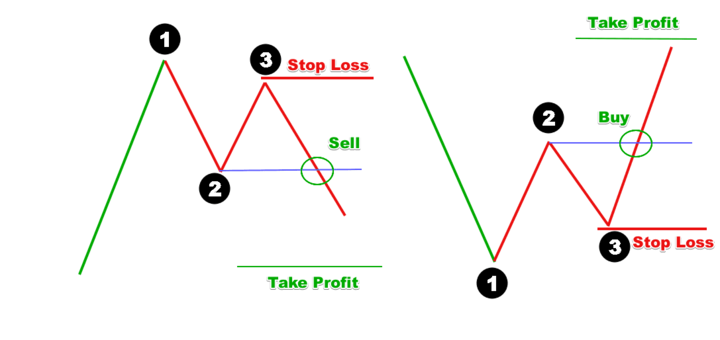

Reversal trading

The aim of reversal trading is to make profits from the reversal of the current LINK market trend. Although a high-risk strategy, it can be very lucrative for traders who catch trend reversal at the early stage. This strategy involves looking for reversal patterns, shifts in momentum indicators, and fundamental catalysts that may indicate a change in trend. However, it is critical for traders to implement tight stop losses because many reversals fail.

News trading

New trading involves opening positions after the Chainlink network releases key news announcements or partnerships. You can easily define entry and exit positions based on price movement. Due to the high volatility in the market, traders must be ready close positions fast, as reactions are often short-lived before fading. In addition, news trading involves understanding how certain news can affect LINK’s price movement.

HODL trading

HODL stands for “hold on for dear life” and is a long-term trading strategy that involves buying LINK tokens and holding them for several weeks, months, or years. HODL is only suitable when you have a positive outlook toward Chainlink’s future price movements.

You may consider LINK as a long-term hold given its potential to transform smart contract connectivity - but take profits at critical milestones and accumulate again on major dips. In addition, placing "take profit or stop loss orders" is critical to protect your profit and minimize risk.

Managing LINK Trading Risks

Risk management is a critical part of LINK trading. Good risk management strategies can protect profit and minimize loss. Here are some tips for managing LINK trading risks.

❖ Risk only 1-5% of capital on any single trade

LINK is very volatile, so it is essential to size positions appropriately before beginning a trade. One of the golden rules of trading is to risk only 1-5% of capital on any single trade. This ensures you can manage losses while having capital for other investments. In addition, it is recommended that traders diversify investments into comparable assets to manage risk associated with LINK’s price volatility.

❖ Stop loss and take profit orders

Leveraging is one of the many ways to amplify your gains or loss when trading LINK. However, you can manage this risk by setting a stop loss or taking a profit order. The stop loss order, when triggered, automatically closes your market position to ensure you do not suffer more losses. Similarly, the take profit order automatically closes your position to protect your profit. However, setting these orders with some buffer is good to avoid premature exit due to short-term volatility.

❖ Stay updated on news in the Oracle community

The value of LINK can drop significantly if competitors release superior Oracle solutions or if the industry encounters major issues. Therefore, traders should monitor the news regarding the Oracle community. It also helps to monitor rival progress and regulatory news as they may influence LINK’s volatility. Staying updated on news and events in the Oracle and blockchain community places you in a better position to anticipate possible future trends.

❖ Technical glitches on Chainlink Network

The Chainlink ecosystem has an excellent track record of security, reliability, and scalability. However, technical glitches or vulnerabilities on the Chainlink network could negatively affect investor confidence. As a result, the demand may drastically reduce, which will cause a possible downtrend in LINK’s price. Therefore, it is recommended that traders stay updated on any potential issues and Chainlink’s approach to solving them.

❖ Be wary of excessive leverage

While leverage can be a gold pot, it can also be a landmine. Therefore, traders must be wary of excessive leverage. Leverage allows you to enter a position with only a percentage of its original price which can amplify our gains. However, your losses can also be amplified if the market moves against you. We advise traders to start with moderate leverage of 5x or less until they gain experience. Therefore, with more experience, they can determine their risk appetite and choose a suitable leverage ratio.

❖ Trading pairs and liquidity

LINK currently has limited trading pairs- mainly BTC, ETH, and USDT. During periods of market turmoil, the limited range of trading pairs can affect liquidity, resulting in price volatility. Traders should watch out for new fiat trading pairs coming online on major exchanges. Increased liquidity can offer more stable trading conditions, especially during volatile market periods.

Trading LINK CFDs

Contract for difference (CFD) trading is becoming more popular in crypto trading. Trading LINK CFDs allows you to speculate on the price movements of LINK without actually owning the token. CFDs offer many benefits, making them an attractive option for investors.

One of the advantages of trading LINK CFDs is flexibility, which allows traders to take advantage of market opportunities to make a profit. However, it is essential to trade CFDs with regulated brokers like VSTAR.

When trading LINK CFDs, it is critical to choose a good broker. Low spreads, fees, and commissions on the platform can affect your overall profit. Therefore, traders should compare CFD brokers to identify competitive prices. Also, a platform with a demo account is an excellent choice as it allows traders to practice and test their trading strategies before going live.

Trade LINK CFDs on VSTAR, which is reputable and regulated by CySEC. Some platforms are often unregulated and have a high commission, negatively affecting your profit. Vstar is unique because we offer institutional-level trading experience, including the lowest trading cost, which means tight spread and lightning-fast execution.

In addition, Vstar offers a demo account for beginners to practice their trading strategies to mitigate loss during actual trading. Beginners can also benefit from the various educational resources available on the platform.

Furthermore, Vstar is committed to ensuring client satisfaction and offers 24/7 customer support. Vstar can take your trading to the next level as the platform offers global assets, allowing traders to diversify their portfolios. Here are some tips for LINK CFD trading:

Begin with lower leverage

Since one of the highlights of trading LINK CFDs is leverage, it is easy to get carried away and make mistakes. Higher leverage means increased risk exposure, which can either amplify loss or profit. Therefore, traders can go long or short with up to 30x leverage for larger returns but also much higher risks. However, we advise novice traders to start with lower leverage, 5-10x, until they gain mastery of the process.

In addition, traders must be highly cautious of leverage due to the volatile nature of LINK. Sometimes, losses can spiral even with tight stop losses. Therefore, it is critical to monitor your trade, especially when you are using high leverage. In cases of extreme market volatility, sudden drastic price movements can lead to losses beyond your imagination. When trading on higher leverage, close losing positions fast to avoid the worst scenario.

Use stop-loss orders

Volatility is something that humans or any tool can predict. Therefore, traders should use guaranteed and trailing stop losses to limit risk on every trade. Guaranteed stop losses exit your trading position at the pre-set price regardless of price fluctuation. On the other hand, trailing stop loss allows more flexibility as it automatically adjusts the stop loss level as the market moves in your favor. However, effective risk management involves continuous trade monitoring to catch any sudden change in LINK’s price. Rapid price fluctuation can skip your stops, so you must be ready to close losing positions to protect profit and minimize risk manually.

Make trading decisions based on news, events, and updates

Look for trading opportunities around LINK news, events, and updates. News and events related to Chainlink can cause a stir that can positively or negatively affect market sentiments. Regardless of the authenticity of the news, it could drive LINK prices up or down within a short time. Therefore you need to make t profits quickly, as market reactions often don't last long.

Price chart analysis

Technical analysis tools play significant roles in helping traders decide when to enter or exit a trade. LINK charts can highlight reversal patterns and shift in momentum due to volatility. However, traders should consider broader trends and fundamental analysis to avoid weak and inaccurate signals.

Diversify your trading portfolio

Diversification is crucial in LINK CFD trading due to concerns regarding volatility. Therefore, traders may consider a diverse portfolio of digital assets and not just LINK. One of the advantages of doing this is to reduce the impact of market volatility on estimated profit. In addition, we recommend limiting total CFD exposure to no more than 5% of your trading capital to avoid amplified losses.

Funding costs for overnight positions

Funding costs may not be an issue of concern for inter-day trading. However, when you are holding LINK for several days, weeks, or months, funding costs may become applicable. Funding costs may significantly impact profits and losses based on the direction and duration of trades. However, when you compare broker overnight funding rates, you can make better cost management decisions to optimize LINK CFD trading.

Conclusion

Chainlink is a decentralized oracle ecosystem that provides secure and reliable communication between blockchain and real-world data. Chainlink will greatly influence the future of blockchain technology due to its increasing usage in various niches like travel, finance, accommodation, gaming, and more.

Trading the LINK token requires careful use of fundamental analysis and technical indicators to understand the market. Analysis of support levels, resistance levels, RSI and MACD, chart patterns, and trading volumes can help traders predict LINK’s price movement.

Trading LINK CFD is one of the ways of making profits in the Chainlink ecosystem. However, it would be best if you implemented effective risk management strategies to minimize risk and protect profit.

Visit VSTAR today to enjoy the competitive spread, fast execution time, and demo accounts to practice. Take advantage of this opportunity to ride the crypto market wave with a reliable and regulated broker!