Overview of MATIC

MATIC is the native token of Polygon (formerly MATIC Network), a platform for Ethereum scaling and infrastructure development. The polygon network is a “layer two” solution, which provides scalability and interoperability solutions for Ethereum, building a better blockchain ecosystem.

MATIC tokens are used to pay transaction fees on the polygon network. MATIC holders are also eligible for staking rewards and governance rights (meaning MATIC holders can vote on changes on the network).

The transaction fee is lower while the transaction time is fast, which makes it a better alternative to Ethereum. The supply of MATIC token is limited -only 10 billion can exist in the market. However, about $7.4 billion MATIC tokens are currently in circulation. In addition, the current market capitalization of MATIC is $9.2 billion

MATIC is an ERC-20 token on the Ethereum blockchain. It is currently among the top 20 cryptocurrencies by market capitalization. Since its inception in 2019, MATIC has experienced significant growth. The increasing adoption of MATIC by big names like Disney can be attributed to the “layer 2” technology.

MATIC has a promising potential to perform well. However, like any other crypto investment, it comes with risks. Therefore, this guide will cover what you need to know about trading MATIC, trading strategies, and factors that influence its price.

MATIC Spot Trading

MATIC can be traded on major cryptocurrency exchanges like Binance, OKEx, Coinbase Pro, and Huobi Global. Once you set up an account on these platforms, you can find MATIC tokens and buy them. In addition, you can store MATIC tokens in a polygon wallet.

As an ERC-20 token, MATIC can be traded against ETH and stablecoins like USDT or USDC. It can also be traded against major fiat currencies. One of the advantages of MATIC tokens is optimized efficiency while increasing security. In addition, the polygon network is highly scalable- it can perform about 7,200 transactions per second.

For example, the MATIC token was $0.01 in early 2021. However, the market value increased to $2.42 by May of the same year. Therefore, you would have made significant profits if you had made substantial investments. Nevertheless, the price went down again, which could spell considerable loss if you did not withdraw in May.

MATIC has a reputation for high volatility, so risk management strategies are essential for traders. Stop loss and take profits orders are critical to protecting your investment. The high volatility associated with MATIC may constitute a discouraging factor to new traders.

MATIC tends to trade in cyclical boom and bust cycles. The change in the price of MATIC is primarily driven by demand and supply. However, you can take advantage of these price fluctuations to make a quick profit. For example, the price may vary across various exchanges, and this does not hinder your possibility of making profits.

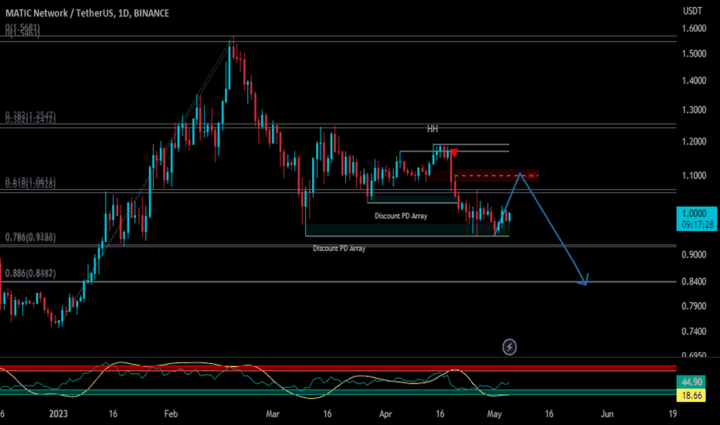

Look for reversals at support and resistance levels using technical analysis. Analyzing support and resistance levels can help traders identify points on a chart where they could be an increase or reversal of a trend.

Support levels predict a downtrend pause due to an increase in demand. On the other hand, resistance levels indicate a pause in an upward trend due to increasing supply.

Trading MATIC requires you to keep an eye on Polygon's roadmap and development updates as the price often rises, leading to new features or product releases.

You must get familiar with a “trading pair” if you are trading MATIC. In simple terms, it describes assets are being exchanged. You can exchange MATIC with a fiat currency like the US dollar (MATIC/USD) or another cryptocurrency (MATIC/ETH).

Beginner traders may want to opt for a “crypto-fiat” pair because it is less complicated. However, expert traders who can simultaneously speculate the price of two crypto assets can choose the “crypto-crypto” pair.

When making plans for trading MATIC, you must determine if you want to adopt short-term or long-term trading. Long-term trading involves buying and holding MATIC for several months or years until you are ready to withdraw the profit.

On the other hand, a short-term strategy involves entering trades for some minutes, hours, or days and exiting when you can take profit. Trade MATIC CFDs for leveraged exposure without owning the underlying asset. This short-term trading strategy is highly speculative but suitable for short-term trading.

Trading MATIC CFDs

Trading MATIC CFDs is the use of financial instruments to predict the price fluctuations of MATIC without actually owning it. In other words, you are speculating on the price trend and entering a position. However, this speculation is not “guesswork” but involves using analytical tools and indicators to make good choices.

Trade MATIC CFDs on platforms like VSTAR, which is reputable and regulated by CySEC. Some platforms are often unregulated and have a high commission, which can negatively affect your profit. Vstar is unique because we offer institutional-level trading experience, including the lowest trading cost, which means tight spread and lightning-fast execution.

Another advantage of trading MATIC CFDs is that they offer “leverage” up to 100x, amplifying gains and losses. Therefore, it is critical to choose a regulated platform to minimize the risk from unregulated platforms.

Short-term CFD trading allows you to enter a position with only a fraction of its worth. For example, suppose you have $500 in your trading account. In that case, you can apply the leverage of 1:10. As a result, your total investment becomes $5000. Therefore any profit or loss will be multiplied by 10. Consequently, it is easy to make a lot of money or lose it quickly.

After creating an account on a reputable plate, fund your account with fiat or cryptocurrencies. The next step is to choose your desired leverage. However, traders must bear in mind that higher leverage means higher risk. Leverage can have two outcomes- magnify profit or amplify loss. Therefore, traders must implement adequate risk management strategies when using “leverage.”

Once your trading account is funded, you can go long or short on MATIC CFDs, depending on the current market situation and analysis. When traders anticipate a price increase, they can go long. On the other hand, you can go short when you think the MATIC price will fall. Traders do not need to own the underlying MATIC.

Traders can place certain orders like “Stop Loss” or “Take Profit” to protect profit and minimize risk in the highly volatile market. A stop-loss order automatically closes the trade when the price of MATIC falls to the pre-set level. Take profit order also automatically exits your market position when your profit has reached a certain level. These two orders aim to protect your profit and minimize losses. “Stop-loss” and “Take profit” orders can be adjusted depending on the market outlook. Therefore, it is necessary to monitor your MATIC CFD trades carefully.

You can take profit at resistance levels for long positions or support levels for short positions. The supply level on the chart indicates a possible increase in price due to increasing demand. Resistance levels foretell a possible downturn of market value triggered by a decrease in demand. Alternatively, you can aim for a risk-to-reward ratio of 1:2 or more.

Since MATIC is highly volatile, you can use short timeframes, like 15-30 minutes, to capture price swings. On the other hand, traders can use 1-2 hour charts for trend trading.

Traders can identify new trends by watching for consolidation periods or rangebound market breakouts. This breakout may signal the emergence of a new trend.

It is critical for traders to consider fundamentals like Polygon announcements as well as technical analysis for timing entries and exits of market positions. In addition, proper risk management is crucial to trading MATIC CFDs. We recommend not risking more than 2-5% of your account balance on any trade. The aim is to manage losses such that you have enough funds to continue trading.

Factors influencing MATIC price

Here are some factors that affect the market value of MATIC token:

Scalability of Polygon

One of the most significant influencing factors is the progress of Polygon in achieving scalability and adoption of its products. Polygon was created as a solution for Ethereum to provide cheaper and faster transactions. Therefore, the scalability of Polygon plays a significant role in the development of DeFi platforms and decentralized apps.

Innovation

The price of MATIC is affected by on-chain activity and innovation on the network. In addition, the cross-chain migration project also influenced the price of MATIC. The recent “Green Manifesto” reveals that MATIC has gone carbon negative. Therefore criticism about the environmental impact of crypto has been silenced on the network. As a result, there is a possibility for a bullish MATIC market due to increasing adoption.

Growth of the network

Another factor that affects the price of MATIC is the growth in DeFi platforms and Dapps launching on or migrating to the polygon network. An increase in DeFi projects and dApps means higher demand. This increase in demand can trigger an uptrend in the price of MATIC.

Price of Ethereum

The price of Ethereum also has a significant impact on MATIC’s price. Since the polygon network is a scaling solution for Ethereum, both cryptos are quite related. Therefore, if the price of Ethereum goes up, it usually predicts an increase in the price of MATIC. The success of Ethereum has positively affected the polygon network.

Market sentiment

Broader market sentiment influences the price of MATIC. The crypto market is associated with volatility- a sharp increase or decline in price. Every crypto asset undergoes a cycle of uptrend and downtrend. This cycle is influenced by demand and the number of coins in circulation. Many cryptocurrencies have a limited supply, which drives their prices. However, MATIC is a recent project with about 8 billion coins in circulation, which also influences the price.

During the bear market, the price of MATIC experiences a rapid decline due to decreasing investor interest and demand. On the other hand, a bullish market predicts an uptrend in MATIC’s price. In this situation, investing in MATIC is a potentially lucrative investment for traders.

MATIC staking

MATIC staking is another factor that influences its price. This works based on the “law of demand and supply.” When more investors stake MATIC, the circulating amount in the crypto market will reduce, which may drive up the price. On the other hand, if fewer investors stake in MATIC, the circulating number will be high, which can drive the price down.

Regulatory news

Lastly, regulatory news may significantly impact the price of MATIC. Regulatory responses to decentralized technologies like Polygon can also sway MATIC prices up or down. Positive regulations can increase adoption, which can lead to an increase in demand for MATIC. Alternatively, negative laws can cause the withdrawal of investors leading to a decrease in demand for MATIC.

MATIC Trading Strategies

The volatile nature of cryptocurrencies can be a quick blessing or a fast loss of wealth. MATIC, like other crypto assets, is subject to sharp price fluctuations. Therefore traders need to implement strategies that can help them maximize profit and minimize risk. Here are some common MATIC trading strategies.

HODL

This strategy involves buying and holding MATIC as a medium or long-term investment strategy. This is a form of passive trading strategy that involves buying MATIC and storing them in your wallet. HODLing is based on the premise that the asset's value will increase due to the polygon’s potential. In addition, this strategy requires patience to profit from the long-term increase in MATIC’s value.

Swing trading

Swing trading is a “short or medium-term” investment strategy. It involves speculating on cycles and volatility in the MATIC market to capture price movement. Swing traders often look for 20-30% price moves and hold for days or weeks. The volatile nature of the crypto market provides an avenue for swing traders to benefit from larger price swings.

Day trading

Day trading is suitable for short-term purposes. This strategy involves using short timeframe charts like hourly to capitalize on volatility and daily price ranges. In other words, day trading is when a trader enters and exits the market within the same trading day. Adopting day trading requires fast reaction times and constant monitoring to catch price hikes. In addition, traders may need technical indicators to identify the best entry and exit points for that trading day.

Margin/leverage trading

Margin/leverage trading is a strategy where traders open a margin account and borrow funds to increase their trading position. As a result, leverage trading can either amplify your profit or loss. This strategy is not recommended for beginners because the risk is high. You can adopt this strategy when you are confident of a breakout price movement and willing to take risks.

Dollar-cost averaging (DCA)

Dollar-cost averaging involves buying MATIC regularly to get an excellent overall entry price. This strategy reduces the risk of mistiming the market. One benefit of DCA is it does not require indicators, making it an excellent option for beginners and expert traders.

DCA involves investing a certain amount at regular intervals. As a result, you can accumulate a good percentage of MATIC over time. However, finding the “right” time to exit the market may be tricky. Therefore, traders can monitor overbought and oversold charts to make better decisions.

Contract for Difference

Trade MATIC CFDs to take advantage of both rising and falling MATIC prices. CFD allows traders to speculate on the price movement of MATIC without actually owning it. Look for breakout moves and reversals using short timeframes, like 15 minutes, to benefit from leverage. When implanting this strategy, it is critical to place “take-profit” and “stop-loss” orders due to the volatile nature of the asset.

Conclusion

Finally, MATIC has a promising future. It quickly gained popularity in the crypto market due to low transaction costs, fast execution time, and support for decentralized projects. MATIC’s success and adoption are primarily influenced by the potential of the polygon network and the price of Ethereum.

It is also critical to adopt trading strategies (such as buy and hold, margin trading, swing trading, day trading, margin trading, DCA, and MATIC CFD trading) based on investment goals. These strategies can protect your profit and minimize loss, which is necessary for the volatile market.

In addition, the importance of trading MATIC on a reputable and regulated platform like VSTAR cannot be over-emphasized. You can visit our website today for expert advice and practice with the demo account.