SHIB is an Ethereum-based altcoin featuring the Shiba Inu hunting dogs. Ryoshi launched this Meme coin in August 2020, and it is often described as “the Dogecoin killer.” This is because SHIB is considered an alternative to Dogecoin.

SHIB is hosted on the Ethereum blockchain because it is an Ethereum-based ERC-20 token. The creators developed this meme-coin as an experiment in decentralized spontaneous community building.

This guide contains everything you need to know about trading SHIB, including trading tools and how to optimize its highly volatile nature to make profits.

Trade the SHIB volatility

The market capitalization of Shiba Inu at the beginning of 2023 is about $6 billion. Although the crypto market is associated with volatility, SHIB is one of the most volatile assets in 2023.

Why SHIB volatility attracts traders

As a meme coin with little utility, SHIB is primarily driven by hype, social media mentions and retail speculation. This results in frequent price spikes and crashes that short-term traders aim to capitalize on. Therefore, traders must keep an eye on social media hype to anticipate SHIB’s price movements.

Traders are attracted to SHIB because the low price and high volatility can result in significant gains. However, you can make huge losses if a trade goes against you. A rapid downtrend often accompanies the exponential spike in SHIBA’s price because it is based on hype. Therefore, tight risk management is essential when trading SHIB. Since price movement can happen so fast, traders must have an excellent plan to execute trades quickly and make a profit.

In addition, volume spikes with price, so high volatility also means greater liquidity, which suits short-term trading. It is easier to get in and out of positions without substantial slippage. The highly volatile nature means profits can disappear as quickly as they appear, so traders must learn to take profits and not be greedy. Therefore, SHIB is an excellent option for traders with short-term investment goals in cryptocurrency. Alternatively, consider trading SHIBA CFDs to make a profit within a short time frame.

The past performance of SHIBA, especially in 2021, is a driving factor that increased the community. In addition, developments within the Shiba Inu ecosystem affect the volatility. For example, following the launch of its metaverse and “layer-2 solution,” it experienced a bear trend. Moreso, crypto regulations can affect the volatility of the meme coin.

With little fundamental backing, SHIB has no real support or resistance areas. So when it moves, the moves tend to be dramatic. Therefore, traders follow the prevailing short-term trend, making it easier to profit from short-term price changes.

Tools for Analyzing SHIB Volatility

As a meme-coin, SHIB is highly volatile, which can be an opportunity to make a profit on a short-term basis or make losses. Regardless, trading SHIB requires careful analysis of market performance and trends to make the best trading decisions. Here are some tools that traders can use to analyze SHIB volatility.

Price charts

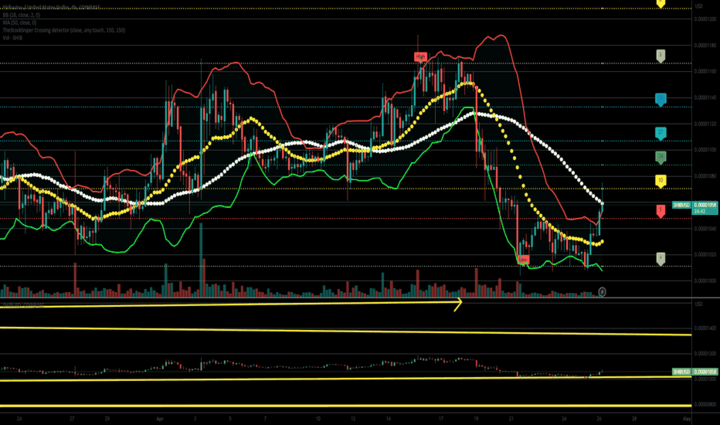

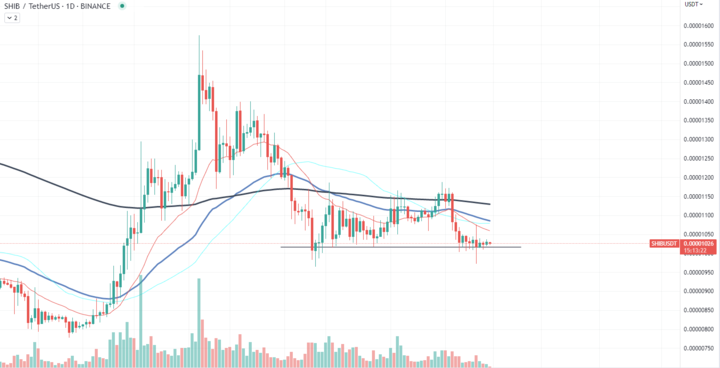

Traders can predict price movement by studying price charts. In addition, price charts reveal trends, patterns and possible movement of a crypto asset. Reading price charts can help traders identify support and resistance levels, influencing their decision to enter or exit a trade. Trading SHIB, like any other crypto asset, involves making predictions, and price charts play significant roles in this action.

Price charts are fundamental tools for analyzing SHIB volatility. When you study price charts, you can identify spikes up or down, long wicks indicating a rejection of a price level and reversals in short-term trends. In addition, you can monitor increases in trading volume, which usually accompanies higher volatility.

Traders can view price charts on trading platforms or third-party websites specializing in cryptocurrency analysis. Charting platforms include TradingView, Coingy, Altrady, Cryptoview, and more.

Technical indicators

Technical indicators are graphs and formulas that can predict the price movement of SHIB tokens. These indicators use previous trends and patterns to give a future direction. However, since the SHIB token is highly volatile, there is no 100% guarantee that the price will follow the predicted direction.

Technical indicators can be classified into two broad groups- leading and lagging indicators. Leading indicators use past data to predict the future price movement of SHIB. As a result, traders can identify the best entry positions. On the other hand, lagging indicators show price movements after they have occurred. As a result, traders can be confident about entering a position. However, these indicators lack key levels, so that traders may miss the best entry points.

Indicators like the Average True Range (ATR) measure the average true range to determine volatility levels. The higher the ATR, the bigger the price swings, which indicates a greater opportunity for volatility trades. Other valuable indicators include the RSI, Stochastics RSI and Moving Average Convergence Divergence (MACD).

The relative strength indicator is a momentum indicator that analyses SHIB’s price movements to help traders determine the best point to sell or buy the asset. This indicator highlights the “overbought or oversold” condition of SHIB, which may reverse the current trend.

The RSI goes from 0 to 100- when it is below 30, the asset is considered oversold, which is a signal to buy. However, when the indicator is above 70, it shows an “overbought” market situation, a signal to sell the asset.

The moving average convergence divergence indicator is another momentum indicator that shows the change in momentum, direction, strength and trend in SHIB’s price. Traders can identify how strong the current is by using the MACD. When the indicator is below, it is a good time to buy assets. However, if it is below 0, the price may soon experience a downtrend, so traders should sell quickly to make profits.

News Feeds

News, social media hype, and market sentiments influence SHIB’s volatility. Positive news can increase the value of SHIB, while negative media representation can reduce investor confidence and demand.

Therefore, it is critical that traders monitor crypto news sources and social media for announcements, hype, fear, uncertainty or doubt that could suddenly increase SHIB volatility. Celebrity or influencer announcements mentioning SHIB can also play significant roles in the volatility of the Shiba Inu token.

Some Twitter pages worth following include SHIB Informer@ShibaInformer (34.4K followers), Shib(@Shibtoken (3.7M followers), Shiba @ BitShibaToken (77.4K followers) and Shib Dream @theshibadream (36K followers)

Volatility Stats

Volatility is the degree to which the price of a crypto asset changes. Professional traders exploit the highly-volatile nature of the Shiba Inu system to make a profit. Many trading platforms and crypto data sources also provide historical volatility numbers, so you can see if SHIB's current volatility levels are high relative to its past price activity.

Higher volatility usually means more chances of big swings emerging. Although volatility can be an opportunity for great profit, it could also result in monumental losses. Therefore, traders can use volatility stats to adjust their trading strategy to maximize profit and minimize loss.

Leverage Tools

Leverage trading is a form of crypto trading that allows you to open a position using borrowed funds. Leverage aims to optimize your trading power to make more profit without owning the crypto asset. Depending on the trading platform, various leverage ratios may include 5X, 20X, 30X and 100X. For example, suppose you choose a leverage of 5X, which means 1:5. You can enter a trade worth $200 with only $40. The $40 is the amount in your crypto account to fund that position. However, your profit or loss will be multiplied by 5.

Therefore, volatility is best traded using margin products like options, futures, CFDs, and spread bets. These products allow you to amplify your exposure to take maximum advantage of volatile moves in SHIB price. However, losses are amplified, so traders should implement risk-management strategies and closely monitor trade.

SHIB Volatility Trading Strategies

The crypto market is well known for its volatility, and Shiba Inu is an especially volatile asset. With the performance of SHIB, many investors consider it an opportunity for a quick profit. Therefore, traders must explore various trading strategies to make the most of the volatile nature of SHIB. Here are some SHIB volatility trading strategies:

Trend following

The aim of trend following is to ride the wave by going long or short based on the prevailing short-term trend. In the cryptocurrency market, prices can either steadily go up or down. Trend following is not about predicting price movement. Instead, it involves taking advantage of the current volatility. For example, if the price of SHIB is rising, you can go long, hoping that the price will keep increasing and you can make a good profit. However, it would be best for traders to implement tight stops. This is to protect profit and minimize losses if the trend reverses.

Defining a trend may be a bit complex because Trader A can see it as a reversion while Trader B is a trend. Trends are usually long-term and indicate the price of SHIB within certain values. Some may define a trend by the 200-day moving average of the closing position. If the price is below the average, it is a downtrend, but above the average indicates an up-trend.

There are various trend-following strategies, and they include:

Average True Range:

This volatility strategy is based on the 350-day moving average. Traders can open a long position if trades close above the average or a short position if the trades closed below the average.

Bollinger Channel Breakout Strategy:

You can opt for a long position if the previous day’s close is above the top of the channel. On the other hand, a short trade is best when the last day’s close is below the bottom of the channel.

Donchain Trend Strategy:

This strategy requires the 25-day moving average to be greater than the 350-day moving average to initiate a long position.

Breakout Trading

A breakout describes a price movement outside the resistance and support levels. It can indicate the emergence of a new trend ( bull or bear market). Breakout trading can be a profitable strategy. However, it is critical to wait for confirmation- when the price closes outside the trend, before opening a position.

Breakout trading involves identifying a new trend and entering the market at the right time. Traders can observe SHIB price to break out of periods of consolidation or ranges. Afterward, you can buy or sell at the breakout in anticipation of further volatile moves.

In addition, it is best to enter breakout trading with a small position. Technical indicators can help you identify volatility breakouts. Breakout trading is an excellent strategy for a highly volatile asset like SHIB.

Reversal Trading

Reversal trading is a high-risk strategy that involves identifying price movements that indicate a reversal of the current trend. The aim is to capture sharp reversals against the established short-term trend. Traders should look for spikes in volume and long wicks on price charts which often signal momentum reversals.

Reversal trading involves entering a market position against the current trend. Since it is a high-risk strategy, setting tight stops to minimize losses is critical. A reversal can occur in any direction- bullish ( downtrend reversal ) or bearish (uptrend reversal). You can use the Fibonacci retracement tool to enter a position while minimizing risk quickly.

Options Straddles

Option straddles is a neutral strategy where traders buy a “put option” and “call option” of SHIB. A straddle is one of the best strategies for a highly volatile asset like SHIBA. However, selecting the straddles is the complicated part of it.

The goal of option straddles is to limit the loss and maximize profit. Around potentially volatile events, some traders will place long straddle options positions that can profit from a move up or down. If SHIB remains rangebound, the strategy loses. However, the straddle strategy wins if it sees a price surge in either direction.

News Trading

News trading strategy is when traders make investment decisions based on news announcements and economic updates. The strategy is event-driven, so traders need to monitor financial and crypto news to act quickly.

The aim of news trading is to buy or sell immediately after announcements that are likely to increase SHIB volatility and generate price instability like exchange listings, influencer tweets, etc. Traders try to capture initial volatile moves but must exit fast if momentum fades.

Daily news and economic update provide an opportunity for defined entry and exit plans to make a profit and reduce risk. However, a trend can reverse overnight depending on the news, and traders must be able to differentiate authentic from fake news.

Scalping Strategy

Scalping is a short-term strategy that involves entering and exiting a position within a short time- a few minutes to hours. The concept of scalping is to open a market position and take small but frequent profit by leveraging the high volatility of SHIB.

Scalping requires dedication and intense monitoring of trades to identify price movements and capitalize on them to make a quick profit. This strategy is suitable for very short-term traders to make many small profits from continuous buying and selling during periods of higher SHIB volatility and price fluctuations.

Scalping is a fast and frantic trading strategy, but profits can increase if you make consistent profits. Therefore, this strategy requires wide stop losses though due to the high volatility of SHIB.

Conclusion

SHIB is a meme coin with an active and growing online community; hence, hype and news easily influence the price. Therefore, it is a highly-volatile crypto asset that provides an opportunity for profit.

SHIB investors need tools like price charts, technical indicators, news feeds, volatility stats, and leverage options to analyze SHIB’s volatility. In addition, trend following, breakout strategy, scalping, reversal trading and options straddling are strategies to maximize profit and minimize risks when trading SHIB.

Finally, the importance of choosing a reputable and regulated platform like VSTAR cannot be overemphasized. Visit our website today to take advantage of the highly volatile meme coin.