- Texas Instruments Q4 revenue showcases operational scale.

- Gross profit margin at 60% reflects robust profitability amid challenges.

- Operating profit suggests adaptability in a shifting market.

- Strong cash flow, strategic investments, and shareholder-friendly practices fortify Texas Instruments’ position for sustained value growth.

In the semiconductor industry, Texas Instruments (NASDAQ: TXN) holds resilience and strategic adaptability. The company's recently disclosed Q4 2023 results reveal a compelling narrative beyond mere financial figures. This article delves into vital aspects of the company's financial standing. Beyond the numbers, it explores how Texas Instruments navigates industry complexities, invests strategically, and maintains a market-value-friendly approach.

Revenue and Gross Profitability

Texas Instruments (NASDAQ: TXN) reported impressive fourth-quarter revenue of $4.1 billion, signifying the company's substantial presence and influence in the semiconductor industry. The scale of operations indicated by this figure reflects not only the company's market share but also its ability to generate revenue on a significant scale. The gross profit of $2.4 billion, representing 60% of revenue, suggests the company's profitability, a crucial metric for sustained growth.

Source: investor.ti.com

The gross profit margin, albeit slightly reduced by 650 basis points from the previous year, still stands at a commendable 60%. This decrease can be attributed to several factors, including lower revenue, higher manufacturing costs linked to planned capacity expansions, and reduced factory loadings.

Operating Expenses and Profit

Examining the operating expenses for the quarter provides additional insights into Texas Instruments' financial health. Operating expenses, totaling $898 million, increased by 4% from the previous year but remained consistent with expectations. This controlled rise in operating expenses indicates that the company is managing its costs effectively, aligning them with revenue growth and market conditions.

Despite the challenges posed by increased operating expenses, Texas Instruments still achieved an operating profit of $1.5 billion in the quarter, constituting 38% of revenue. While this represents a 30% decrease from the year-ago quarter, it's essential to consider the broader economic context and industry trends. Many companies faced headwinds during this period, making Texas Instruments' ability to maintain a substantial operating profit a testament to its adaptability and strategic decision-making.

Cash Flow and Capital Management

Texas Instruments' cash flow from operations in the fourth quarter reached an impressive $1.9 billion, reflecting the company's robust cash generation capabilities. The ability to generate substantial cash flow is a key indicator of financial health, providing the company with the flexibility to invest in growth opportunities, return value to shareholders, and manage debt obligations.

Capital expenditures, totaling $1.1 billion in the quarter, highlight the company's focus on ongoing investments in its business. Strategic capital allocation is crucial for sustaining and enhancing operational capabilities, ensuring long-term competitiveness. Texas Instruments' willingness to invest in the face of market challenges demonstrates a forward-looking approach and confidence in its future prospects.

A noteworthy aspect of Texas Instruments' capital management is the return of value to shareholders. In the fourth quarter alone, the company paid $1.2 billion in dividends and repurchased $65 million of its stock. Additionally, the decision to increase the dividend per share by 5% in the fourth quarter marks an impressive streak of 20 consecutive years of dividend increases. This consistent and shareholder-friendly approach enhances the company's attractiveness to investors seeking stable returns.

Balance Sheet Strength

The balance sheet is a critical indicator of a company's financial health, and Texas Instruments' balance sheet remains robust. With $8.6 billion in cash and short-term investments at the end of the fourth quarter, the company has a solid liquidity position. This liquidity provides a cushion against unforeseen challenges, supports ongoing operations, and positions the company to seize strategic opportunities.

Total debt outstanding, standing at $11.3 billion with a weighted average coupon of 3.5%, indicates a prudent approach to debt management. While maintaining a balance between debt and equity, Texas Instruments ensures that it can leverage financial instruments effectively without compromising its long-term stability.

Inventory, standing at $4 billion at the end of the quarter, reflects the company's operational efficiency in managing its supply chain. The increase of $91 million from the prior quarter and a sequential rise of 14 days in inventory days demonstrate the company's ability to navigate supply chain complexities while ensuring readiness for future demand.

Free Cash Flow and Business Model

In 2023, Texas Instruments exhibited robust cash flow from operations, totaling $6.4 billion. This substantial cash generation is a testament to the strength of the company's business model. Despite facing challenges in the market, the company's ability to generate significant cash flow reflects the resilience and adaptability embedded in its operations.

Capital expenditures for 2023 amounted to $5.1 billion, resulting in a free cash flow of $1.3 billion, equivalent to 8% of revenue. This ratio highlights the efficiency of Texas Instruments' business model, emphasizing strategic decisions to invest in 300-millimeter manufacturing assets and inventory to maximize long-term free cash flow per share. The focus on optimizing free cash flow as the primary driver of long-term value positions the company for sustained growth.

Outlook and Competitive Advantages

The outlook provided by Texas Instruments for the first quarter includes revenue expectations ranging from $3.45 billion to $3.75 billion, with earnings per share projected to be between $0.96 and $1.16. While acknowledging the challenges posed by the current market environment, the company remains focused on its competitive advantages.

Texas Instruments identifies key strengths, including manufacturing and technology prowess, a diverse product portfolio, extensive reach through channels, and maintaining diverse and long-lived positions in the market. These competitive advantages serve as the foundation for the company's resilience and ability to navigate through industry fluctuations.

Long-Term Value and Capital Allocation

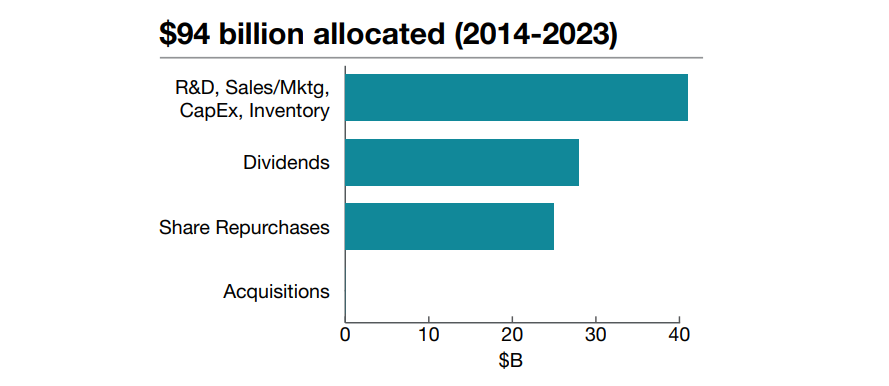

Despite the challenges presented by negative year-over-year comps for the sixth consecutive quarter, Texas Instruments maintains a strategic and disciplined approach to capital allocation. The company emphasizes returning all free cash flow to shareholders through dividends and repurchases. This commitment is suggested by the track record of returning $4.9 billion to owners in the past 12 months.

The Investment Tax Credit (ITC) and grants reflect the company's proactive approach to leveraging financial incentives to support its operations. The expected $1.4 billion from the ITC, accruing over the past year and a half, will contribute to the company's cash flow down the road. Additionally, the grants for which the company has submitted applications represent a potential source of financial support, pending approval from the Department of Commerce.

Texas Instruments' ability to balance dividends, share repurchases, and strategic investments exemplifies its focus on creating long-term value for shareholders.

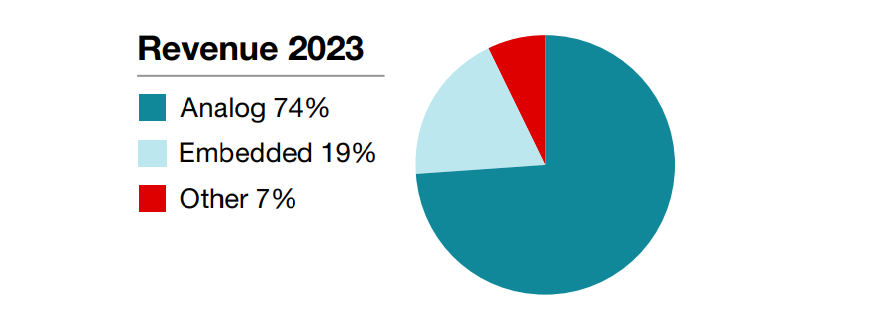

Source: investor.ti.com

Specific Downsides and Risks

The outlook for Q1 2024 sets the tone for TXN's immediate future. A revenue range of $3.45 billion to $3.75 billion, accompanied by an expected effective tax rate of about 13%, reflects the company's expectations for business conditions. The midpoint of the revenue guidance represents a 12% decrease from the previous quarter. This decline suggests challenging market conditions or weaker-than-expected demand.

Also, expansion in manufacturing capacity indicates confidence in future demand, but if that demand doesn't materialize as expected, the fixed costs associated with capacity expansion can weigh on profitability.

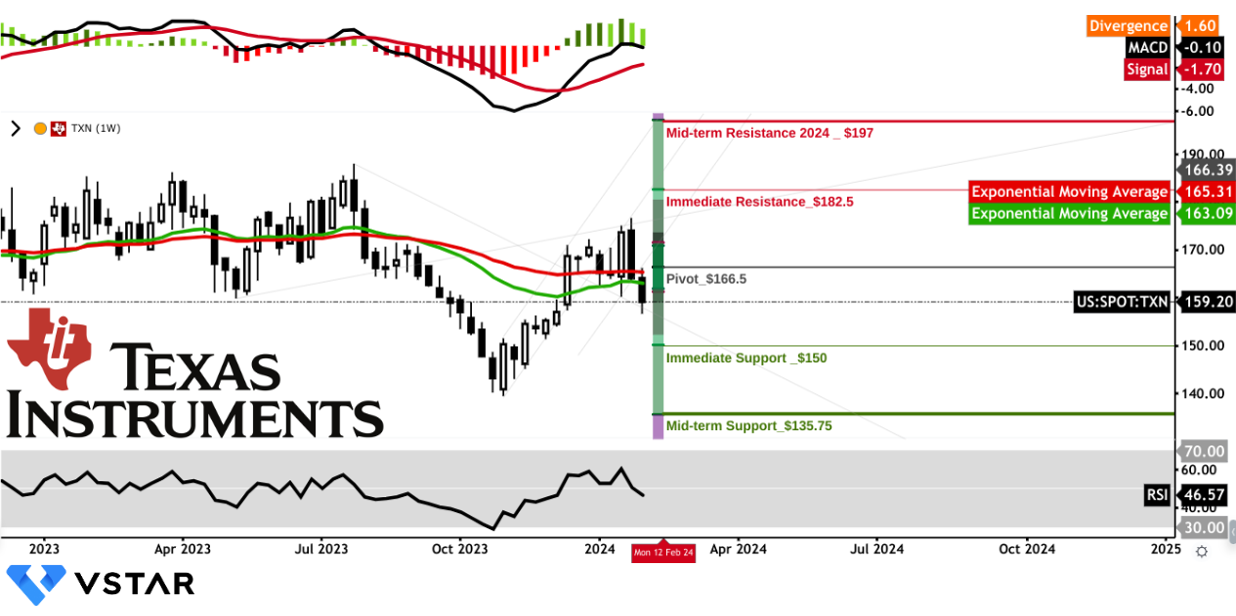

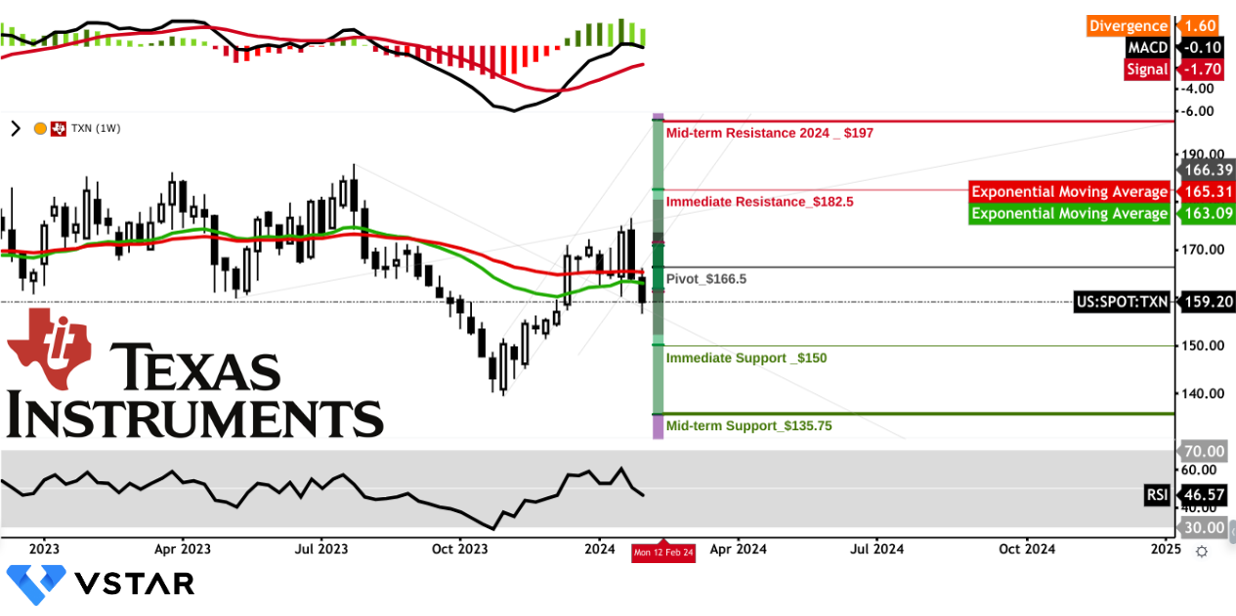

TXN Stock Technical Take

Considering the relative strength index (RSI) at 46, the Texas Instruments stock price is in a consolidation mode with a gradual upside trajectory since October 2023.

The moving average divergence convergence (MACD) indicator suggests positive momentum, although it is getting weaker. However, the stock price is expected to be in gradual upward motion. On the upside, the TXN stock price may hit $197 by the end of 2024 while facing strong resistance at $182.50 on the way.

Conversely, the alignment of exponential moving averages (EMAs, slow-red and fast-green) suggests an ongoing downtrend. A pivot at $166.5 may serve as a critical indicator of upward continuation after a proper weekly close above this level. On the downside, $150 and $135.75 serve as immediate and mid-term support, which may be hit with an equal possibility.

Source: gocharting.com

In conclusion, Texas Instruments' fiscal strength, driven by $4.1 billion in Q4 revenue and adept cost management, instills confidence. Yet, Q1 2024's projected 12% revenue dip demands scrutiny. Investors navigating the stock, which is currently consolidating with a positive RSI of 46, must watch resistance at $182.50 and support at $150. MACD signals waning momentum, emphasizing vigilance. While a potential $197 year-end target looms, a critical pivot at $166.5 shapes the trajectory.