Last Friday marked the third consecutive day of strength for the US dollar, with the USD Index (USDX) surpassing 106.00, a level not observed since early November.

Why did the US Dollar Index (USDX) pop up?

The dissemination of US inflation data further propelled the resurgence of favorable sentiment toward the dollar. According to the Consumer Price Index (CPI), headline prices surpassed expectations, whereas core prices, excluding energy and food, remained persistently elevated throughout March.

The economy's resilience is further bolstered by the unforeseen persistence of inflationary pressures, which implies that the Federal Reserve (Fed) might extend its ongoing monetary tightening campaign.

Is The Rate Cut Possible?

Consequently, the probability of the Federal Reserve commencing an easing cycle in June has substantially decreased, as indicated by the FedWatch Tool of the CME Group, which rates the decline from 60% to approximately 20%. At its September meeting, certain investors even predicted that the Federal Reserve would reduce interest rates by 25 basis points.

Sustained labor market strength lends credence to the concept of a robust economy, thereby promoting the possibility of incremental rate reductions occurring later than originally projected.

The dollar's strong performance was accompanied by an increase in US yields for various maturities, which reflected expectations of only one or two rate cuts for the remainder of the year.

Moreover, several Federal Reserve officials endorsed continuing the existing stringent monetary policy position over an extended duration. Minneapolis Fed President Neel Kashkari suggested that future rate decreases may be postponed if inflation remains low.

FOMC Members On Rate Decisions

President Austan Goolsbee of the Federal Reserve Bank of Chicago underscored the criticality of scrutinizing monetary policy determinations. FOMC Governor Michelle Bowman acknowledged the difficulties associated with containing inflation.

In contrast, John Williams, president of the New York Fed, emphasized the criticality of adhering to the existing policy despite recent price volatility. Boston Fed President Susan Collins proposed two interest rate cuts this year, citing the time required to bring inflation to target levels.

Chairman Jerome Powell's recent remarks, in which he calls for forbearance when contemplating interest rate adjustments, reinforce the current sentiment shift in favor of the dollar and postpone anticipations of rate cuts.

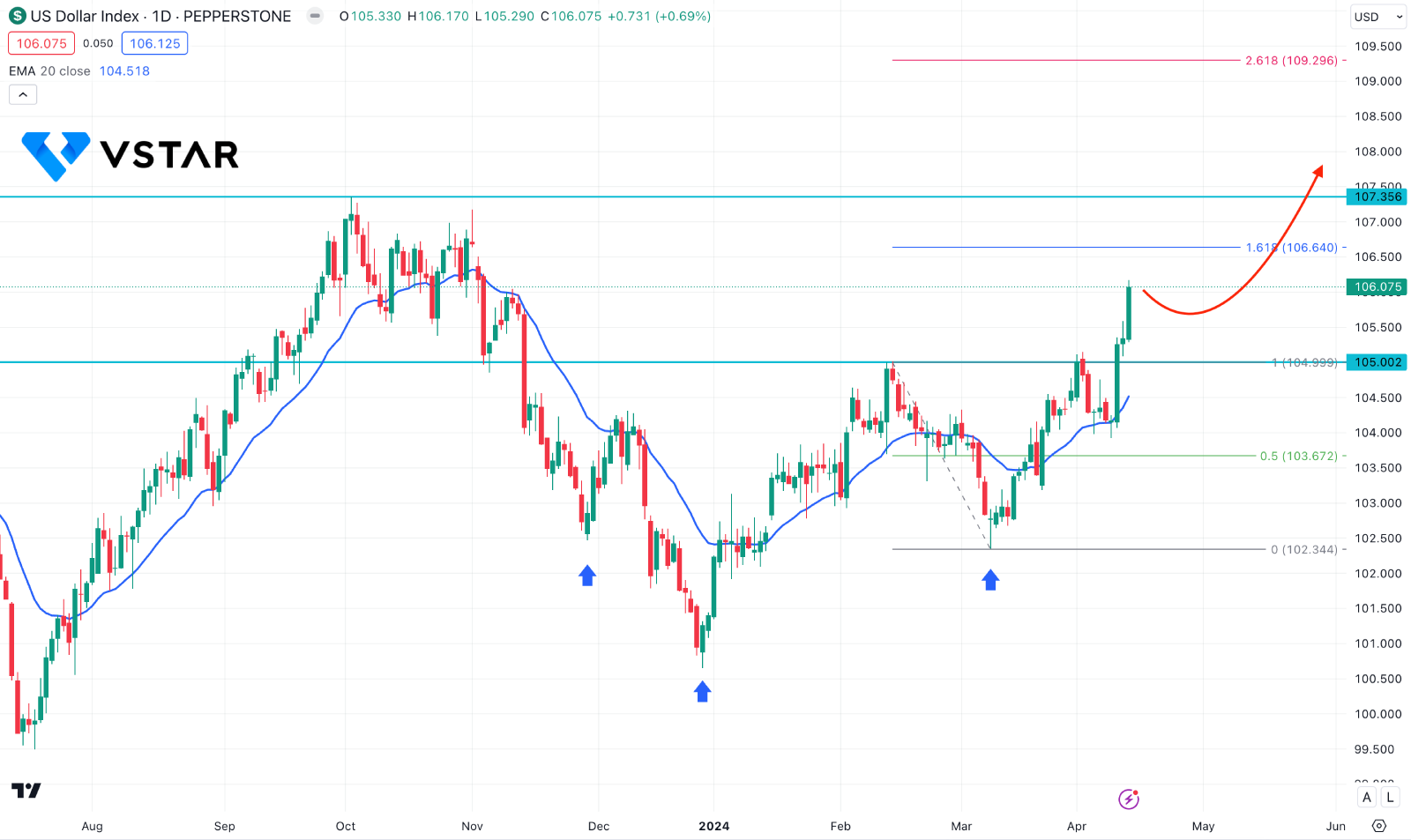

US Dollar Index (USDX) Technical Analysis

In the daily chart of DXY, the current price trades higher with a bullish impulsive wave, supported by the dynamic 20-day EMA line.

Moreover, the current price exceeds the 105.00 crucial line, which works as a confluence bullish factor. In the major context, the ongoing buying pressure is supported by the Inverse Head and Shoulders Breakout, where the 105.00 level is a crucial neckline. As the current price hovers above this crucial line, we may expect the buying pressure to extend in the coming days.

Based on the daily market outlook of DXY, a minor downside pressure and a bullish reversal from the dynamic level could be a potential long signal, targeting the 107.35 level.