Amidst escalating inputs, nuanced production shifts, import variations, and inventory puzzles, the U.S. crude oil landscape is rife with intricacies. Delve into the recent EIA data, decoding the complexities that underpin this volatile market. Unravel the intricate tapestry influencing CFDs on crude oil, as we explore the intriguing dynamics shaping its trajectory.

- U.S. crude oil refinery inputs rose by 518,000 barrels/day, hitting 16.0 million barrels/day.

- Decrease in gasoline production (9.3 million barrels/day) but an increase in distillate fuel production (5.0 million barrels/day).

- Crude oil imports dropped by 696,000 barrels/day, averaging 5.8 million barrels/day.

- Inventories showed an increase in crude oil and distillate fuel but a deficit in gasoline, impacting market sentiments.

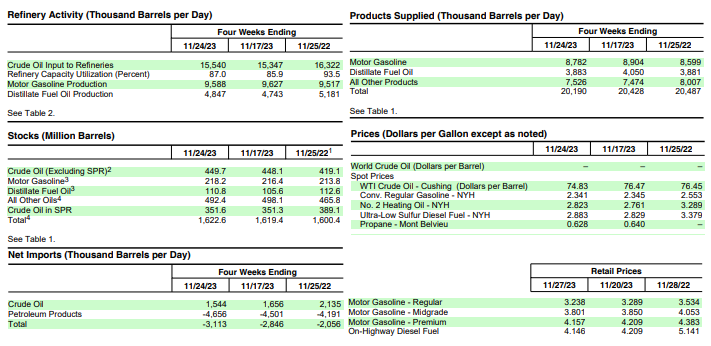

U.S. Energy Information Administration Weekly Data

Refinery Inputs & Capacity

The U.S. witnessed a notable increase in crude oil refinery inputs during the week ending November 24, 2023, averaging 16.0 million barrels per day, up by 518 thousand barrels per day compared to the previous week. Refineries operated at 89.8% of their operable capacity, signifying a robust demand for processing crude oil into various petroleum products. However, the decrease in gasoline production to 9.3 million barrels per day raises questions about the underlying dynamics driving demand for refined gasoline products. Simultaneously, distillate fuel production increased to 5.0 million barrels per day, indicating a possible shift in demand for different refined products.

Source: eia.gov

Crude Oil Imports

The data indicated a decrease in U.S. crude oil imports by 696 thousand barrels per day, averaging 5.8 million barrels per day during the reported week. While this marks a decline in imports, the four-week average, standing at 6.3 million barrels per day, demonstrates stability compared to the same period last year. This suggests that despite the weekly fluctuations, overall crude oil imports have remained relatively consistent, signaling consistent demand for foreign crude oil sources.

Inventories

Commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.6 million barrels from the previous week, reaching 449.7 million barrels. This quantity slightly exceeds the five-year average for this time of year, indicating a surplus of crude oil in storage. Motor gasoline inventories rose by 1.8 million barrels, remaining approximately 2% below the five-year average. Conversely, distillate fuel inventories experienced a substantial increase of 5.2 million barrels, yet they stand around 11% below the five-year average. This discrepancy between gasoline and distillate fuel inventories might suggest differing demand patterns or supply chain disruptions in these refined products.

Products Supplied

Over the last four-week period, the total products supplied averaged 20.2 million barrels per day, indicating a 1.5% decline from the same period last year. However, motor gasoline product supplied increased by 2.1%, suggesting a sustained demand for gasoline. Similarly, distillate fuel product supplied remained slightly above the same period last year. Notably, jet fuel product supplied exhibited a substantial increase of 5.5% compared to the same four-week period last year, indicating a resurgence in demand for air travel and related jet fuel consumption.

Price Data

The West Texas Intermediate crude oil price stood at $74.83 per barrel on November 24, 2023, reflecting a decline of $1.64 from the previous week and $1.62 below the price recorded in the same period last year. Additionally, spot prices for conventional gasoline and No. 2 heating oil demonstrated varied trends. The national average retail price for regular gasoline dropped to $3.238 per gallon, marking a decrease of $0.245 compared to the price reported last year.

Possible Implications on Price of CFDs on Crude Oil

Refinery Operations & Production

The surge in refinery inputs and operational capacity signals an uptick in the demand for crude oil for refining purposes. However, the decline in gasoline production despite increased overall refining activity poses a potential concern for the crude oil market. It might suggest a shift in the production focus towards other refined products or a mismatch between refined product demands and available inventories, which could influence the crude oil price.

Imports & Inventories

The reduction in crude oil imports during the reported week may indicate a slight adjustment in the supply dynamics. Nevertheless, the modest increase in crude oil inventories could suggest an excess in supply or a potential lag in matching refined product demands. The discrepancy between gasoline and distillate fuel inventories, with gasoline remaining below the five-year average while distillate fuel inventories fell significantly, could affect market sentiment and potentially impact crude oil prices.

Products Supplied

Despite the overall decline in total products supplied, the sustained increase in motor gasoline product supplied implies a consistent demand for gasoline, which might support crude oil prices if this demand continues. The resilience observed in jet fuel product supplied signifies a recovery in air travel demand, contributing positively to crude oil consumption and potentially stabilizing prices in this context.

Price Data Analysis

The decrease in crude oil prices despite the rise in inventories suggests that market factors beyond mere supply and demand dynamics are at play. Geopolitical tensions, global economic conditions, or shifts in production and consumption patterns could be influencing crude oil prices. Lower retail prices for gasoline and diesel compared to the previous year might positively affect the overall demand for crude oil, potentially exerting downward pressure on its price.

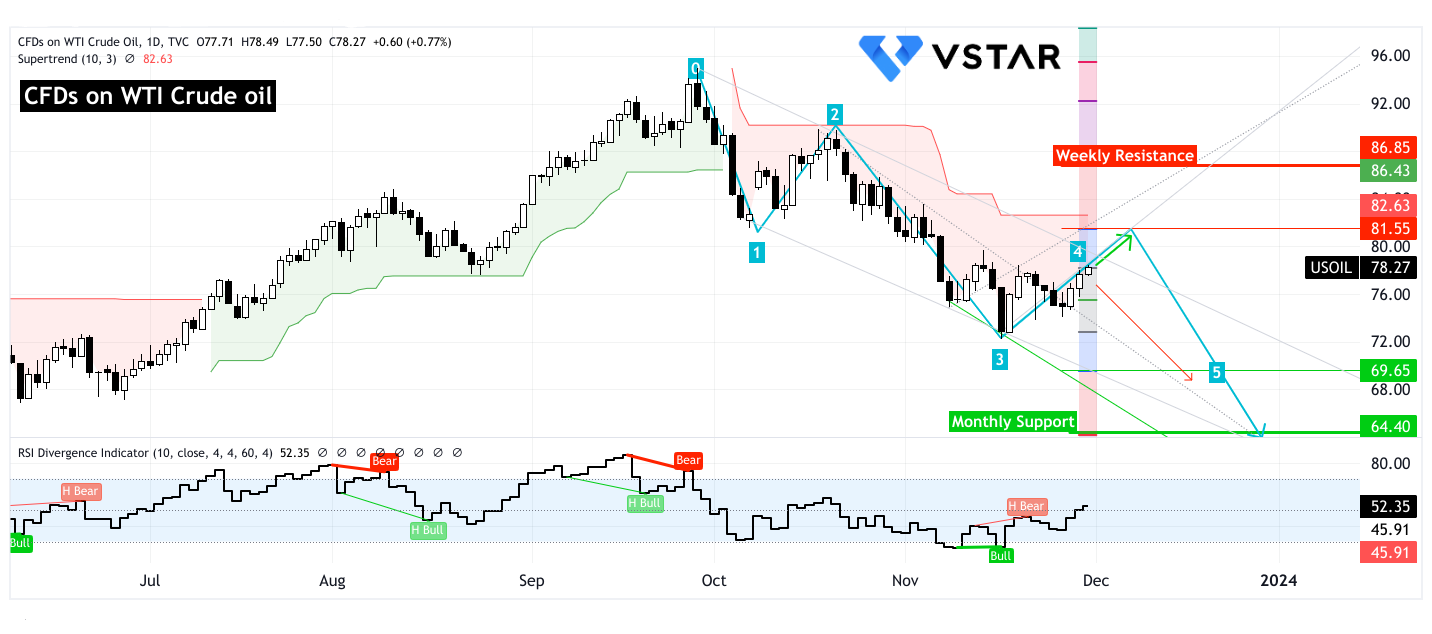

Technical Take On WTI Crude Oil CFD

Evolving from the previous coverage, the prices are in motion to form the last impulsive wave to test the support levels at $69.65 and $64.40. However, as the price is about to conclude the correction wave, this is a small upside toward $81.55 (as confirmed by Supertrend).

Looking at RSI, hidden bearish divergence suggests that upward momentum is getting weaker day by day. Coupled with Supertrend’s prevalence of a downward trend, the price may see a further downtrend (red arrow) in the upcoming days.

Source: tradingview.com

In conclusion, the data reflects a complex interplay of factors that could influence the price direction of CFDs on Crude Oil. While increased refinery inputs and reduced imports may signal increased demand, the discrepancy in inventory levels, particularly the shortage in gasoline inventory compared to the five-year average, presents a mixed scenario. Moreover, consumer retail prices dropping compared to the previous year could impact overall demand, potentially exerting downward pressure on crude oil prices.