The cryptocurrency industry is ever-increasing, and ATOM, the native token of Cosmos, has gained significant attention. The Cosmos ecosystem is usually described as the “internet of blockchain.” It was created to revolutionize blockchain interactions and collaborations. Previously, blockchains worked in isolation, but Cosmos offers a new level of scalability through seamless interoperability among various blockchains.

ATOM provides a unique opportunity for traders and investors to earn lots of money. However, investors and short-term traders must understand the price history. Volatility is a phenomenon that cannot be eliminated from crypto assets. Therefore, it is critical to understand past price trends as they can help you predict future trends.

This guide will examine the various significant prices of ATOM and its potential for growth.

ATOM Price history and performance

ATOM has displayed an intriguing price history since its launch in 2019. The token displayed volatility that has captured the attention of investors- initial price surges, corrections, and subsequent stabilization. Therefore, this section will highlight ATOM’s price history and previous performance.

a. Early Surge

ATOM launched in March 2019, and the market value was about $0.10. However, after four months, the price skyrocketed to about $8.28. This price may seem low, but the coin experienced a staggering increase of 8,180%, which played a role in capturing the interest of traders and investors.

After this exponential increase in the price of ATOM, there was a significant price correction. Despite the price correction, the value of the token has since stabilized within the range of $3 to $8. This stabilization shows the resilience of ATOM, even in the face of volatility, which suggests a support level. As a result, the stabilization is an indication of the potential of the token.

b. Yearly gains

ATOM is a highly volatile token, which makes it an excellent choice for traders with short-term plans. On average, ATOM has returned over 200-500% yearly gains since launch. While this may be impressive, traders and investors must bear in mind that such gains often come with volatility. Therefore, they must be alert and prepared for significant price changes.

The Price of ATOM is susceptible to extreme pumps and dumps, often driven by market sentiment rather than fundamentals. Therefore, if you are considering putting your money in ATOM, you must monitor market trends and sentiments. The rate of adoption, advancement in technology, and social media hype can influence the public’s sentiment regarding the token.

c. All-time high value

About five months after the launch of ATOM, it reached an all-time high of $8.28 in July 2019. However, the token has struggled to maintain or reclaim the level ever since. Currently trading at a steep discount, this suggests a potential increase in the market value of ATOM.

Fundamental factors like collaboration and partnership, staking reward, technological upgrades within the Cosmos ecosystem, and news could trigger renewed interest in ATOM. As a result, more traders start buying the token, which drives demand leading to a significant increase in ATOM’s value. Therefore, fundamental analysis is critical before investing and trading ATOM, irrespective of its potential.

Fundamental strength and valuation

Another significant concept in predicting ATOM’s future potential is fundamental strength and valuation. Fundamental analysis involves examining the factors that can affect the price of ATOM. This data can provide insight into the market condition of ATOM-if it is oversold or overbought, which can influence the market value.

Therefore, this section will examine fundamental factors like utility, market capitalization, and the integrity of the team behind the Cosmos network

i. ATOM aims to connect, secure and govern an ecosystem of sovereign blockchains

ATOM is central to the Cosmos ecosystem, created for Inter-Blockchain Communication (IBC). IBC is a technology that optimizes the scalability and efficiency of inter-blockchain communication. The success of this technology can lead to increasing adoption, which can drive up the price of ATOM.

ATOM was designed to connect and promote communication between various blockchains. The goal is to create an interconnected network of sovereign blockchains. Achieving this goal at full scale suggests substantial room for growth, which is not yet reflected in valuation or price.

Therefore, ATOM aims to connect, secure, and govern an ecosystem of sovereign blockchains. The potential benefit includes optimized efficiency and accessibility for developers and users.

ii. Functional Utility

ATOM offers staking rewards and governance rights, giving it functional utility, though currently limited. Holders of ATOM have governance rights, which means their voice matters when making critical decisions regarding the future of the ecosystem. Active participation can shape the direction of the Cosmos ecosystem, which helps community holders feel more connected to it. As a result, it can boost investor confidence and trigger positive market sentiments.

Staking ATOM yields about 9% annually, which is bigger than what most investments offer. This is an excellent way of earning passive income, which makes ATOM an appealing investment for those with long-term goals.

However, the utility creates stable demand but also contributes to selling pressure, as some holders sell their staking rewards. The combination of staking rewards and utility positively influences the price of ATOM beyond mere speculation.

iii. Market capitalization and valuation

With a market capitalization of about $130 million, ATOM remains tiny relative to its ambitious goals. This suggests that there is room for significant growth in the Cosmos ecosystem. However, if the networks experience exponential growth and deliver value, the native token ATOM may be undervalued. Comparable utility token projects have exceeded $1 billion valuations. Therefore, there is a potential for the value of ATOM to increase as to increase the ecosystem thrives.

iv. World-class technical team

You can get a glimpse of the team behind the Cosmos Network- a world-class technical team. Any crypto asset developed by a team with industry expertise and experience will likely be a successful project.

The team’s expertise optimizes the likelihood of overcoming user experience and technical challenges. They are committed to continuous improvement, development, and success of the Cosmos ecosystem.

It is essential to read the whitepaper for ATOM tokens before you decide on your investment goals. The whitepaper provides a broad scope of ATOM‘s use cases, which can help you predict the degree of adoption. In addition, it highlights Cosmos’ unique features, which can influence investor sentiment.

The world-class technical team is responsible for developing Tendermint, the consensus algorithm which powers the ecosystem. However, it is essential to acknowledge that mainstream use and success are not guaranteed despite best efforts.

While ATOM has potential for growth, traders must also consider associated risks. The crypto market is highly volatile, so success cannot be 100% guaranteed. Some risks to consider include regulatory uncertainty, technological hurdles, and adoption challenges.

Regulatory restrictions could affect the development and adoption of ATOM. Also, barriers like technical complexities may hinder the expansion of Cosmos.

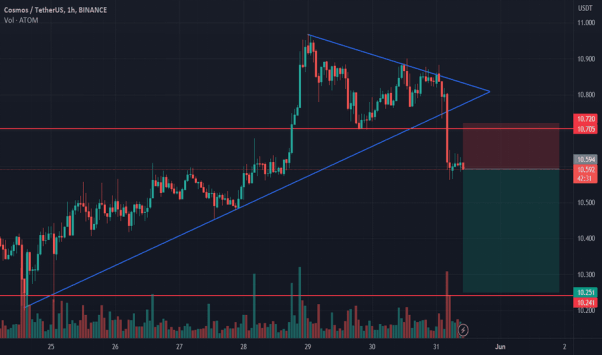

Technical analysis and Cosmos price prediction

Technical analysis is a critical aspect of price predictions. These tools provide insights into trend strength, trend speed, price directions, and more. Therefore, they are critical in helping traders analyze market conditions to make informed decisions. Charting tools, technical indicators and oscillators, and Fibonacci retracement indicators are essential for conducting technical analysis.

❖ Short-term (3-6 months):

Factors like market sentiment and the performance of major crypto assets can influence the price of ATOM within the short term (about three to six months). It may be challenging to provide an accurate short-term prediction for ATOM’s price. However, within three to six months, the price may return to the $6 to $8 range.

This rising price movement is most likely due to positive market sentiment, which shifts bullish and lifts major crypto assets like Bitcoin (BTC) and Ethereum (ETH). According to the herding effect, when big names like BTC are performing well, it promotes investor confidence even in other crypto assets.

However, the potential uptrend of ATOM’s price is limited without fundamental news. This news may include regulatory developments, upgrades, and adoption. So, any positive news or event can trigger an upward movement in ATOM’s price.

On the downside, a potential risk is the price dropping to $3 if the wider crypto market experiences a bearish trend. Negative news or events in the crypto industry can trigger negative sentiments, which can cause a price downtrend.

❖ Medium-term (6-12 months):

When considering medium-term ATOM price prediction, it is critical that you focus on developments within the network as well as market sentiments.

Breaking the $10 level seems feasible if the ecosystem secures new token listings, partnerships, or network effects. These factors can trigger an increase in price because they increase the likelihood of increasing demand. New token listings are crucial because it helps to increase ATOM’s visibility. Likewise, partnerships expose the unique functionality of the Cosmos ecosystem to a wider audience.

Partnership and listing on a reputable exchange increase positive sentiment and investor confidence, which may trigger a price uptrend.

In a bullish scenario (steady increase in asset price) with parabolic market movements and increasing buzz around interoperability, ATOM’s price could potentially reach the $20-$25 range. The concept of ease of communication between blockchains is a unique solution the cosmos ecosystem offers. Increased adoption of the interoperability solution could contribute to the medium-term price uptrend.

In addition, the price of ATOM is unlikely to fall below $4 due to staking incentives offered by Cosmos network. The annual yield for staking ATOM is higher than the general percentage offered by other projects. Therefore, investors will be motivated to HODL their ATOM tokens as a form of passive income. When this happens, the selling pressure is minimized, thereby preventing a drastic price downtrend.

❖ Long-term (1-5 years):

When predicting ATOM’s price over a period of 1-5 years, it is essential to consider the potential for expansion of the Cosmos ecosystem, technological advancements, and competition.

If the Cosmos ecosystem experiences rapid growth and achieves its goal of optimizing scalability, usability, and interoperability, the price of ATOM could significantly increase within the next 5 years. Therefore, achieving a price of about $50 or more is reasonable. This projection is based on the theory that the network achieves its goals, attracts investment, and demonstrates utility.

In addition, it is essential to consider technical limitations and competition when predicting ATOM’s price within 5 years. Competitions that could hinder the adoption of ATOM include Polkadot, Cardano, Plasma Bridge, and Lisk because they all focus on providing similar solutions.

The cryptocurrency market is highly volatility, so long-term price speculation is surrounded by high uncertainty. These may include regulatory issues and unexpected events that could significantly affect ATOM’s price.

ATOM is a project with great potential, so a more realistic price projection is the $10-$30 range, even without a mainstream breakthrough.

❖ Key levels to watch:

There are key levels to watch out for when conducting technical analysis. Support and resistance levels are indicators of a trend reversal, breakout, or price correction. The $3 level is the major support level. When the price drops below $3 for a long time, it could indicate risk for much deeper corrections. A support level is when traders expect a reversal of a downtrend, usually due to increasing demand.

On the other hand, the resistance level is where an uptrend is expected to reverse due to an increasing desire to sell. Watch out for when the price of ATOM breaks at $10, $15, and $25 will confirm bullish uptrends with the potential for exponential upside if momentum gathers.

Future Potential of ATOM

Despite the volatile nature of crypto assets, ATOM has a promising future for several reasons.

i. Increasing need for blockchain interoperability

Cosmos offers a unique solution- blockchain interoperability. Blockchains usually operate in isolation, but interoperability allows them to communicate with each other. As a result, these blockchains can share data while eliminating the need for intermediaries.

Different blockchains have unique mechanisms, making it difficult for dApps and services to communicate. However, Cosmos offers an interoperable, easy-to-use, and scalable network of blockchains.

Therefore, as the need for interoperability solution rises, so will the adoption of the network. As a result, the price of ATOM has a promising potential to rise due to increasing demand.

ii. Partnership and Collaboration

Partnerships and collaborations are critical in predicting the future of crypto assets. Cosmos is collaborating with brands like Binance, KIRA Network, IOV, Loom Network, U SPORTS, Under Armour, and more. This strategic partnership optimizes the visibility and positive market sentiments of the Cosmos ecosystem. More reputable brands partnering with Cosmos opens the door for even more collaboration. As a result, the utility and value of ATOM increase over time as it becomes an appealing investment option for those who want to be part of this fast-growing ecosystem.

iii. Continuous Upgrades

The Cosmos team consists of highly skilled professionals committed to improving various areas of the network’s functionality, including scalability and infrastructure. Cosmos has scheduled regular upgrades on the network to ensure optimal functionality. Examples of upgrades on the Cosmos network include the Rho upgrade, Stargate upgrade, and Inter-Blockchain Communication protocol implementation.

Conclusion

ATOM is the native token of the Cosmos ecosystem, which focuses on an interoperable, easy-to-use, and scalable network of blockchains. The crypto market is highly volatile, so making an accurate prediction may be challenging. However, this guide has provided useful insights into short-term, medium-term, and long-term ATOM price prediction.

Various factors can influence these predictions. Therefore investors should research and develop an investment plan, including risk management strategies for optimal experience.

Another way to make money from the Cosmos ecosystem is to trade ATOM CFDs. Vstar is a reliable broker that provides institutional-level trading experience, including the lowest trading cost, which means tight spread and lightning-fast execution.

Finally, we are regulated by CySEC- unregulated brokers often have a high commission, which can erode your profit. Do not miss out on the opportunity to partake in the Cosmos ecosystem!