The cryptocurrency market has experienced tremendous growth since the birth of Bitcoin in 2009. The volatility of the market can be a cause for jubilation or sorrow. Therefore, like snowboarding, traders need to have a firm grip on volatility. One of the ways to take advantage of this "volatility" is to diversify your trading portfolio.

This guide will explore Ripple and the secrets to successful XRP trading that every trader needs to know. Let's dive in!

What is Ripple and XRP?

Ripple, a global payment network launched in 2012, is a decentralized platform allowing fast and secure cross-border transactions. Ripple has gained significant attention in the industry because it is owned by a company instead of the usual "decentralized" system.

In addition, Ripple's mission is not to serve as an alternative to traditional currencies. Instead, the goal is to serve as a bridge for global trade between financial institutions and cryptocurrencies (including fiat currencies) using blockchain technology.

Ripple aims to work with banks and financial institutions to establish an efficient and reliable network. Therefore, we can classify Ripple as a major competitor to popular financial institutions like SWIFT.

Ripple works based on an algorithm called the RPCA (Ripple Protocol Census Algorithm), which ensures the speed and security of cross-border transactions on the platform. Therefore, transactions are completed within seconds, unlike traditional cross-border transactions, which may take days.

What is XRP: the native cryptocurrency of the Ripple network

XRP is the native asset of the Ripple network. The traditional use of XRP is to facilitate the transfer of funds across borders at low fees. Usually, transactions involving XRP take about seconds to be completed. Transaction speed is one advantage of XRP, making it more suitable than older names like Bitcoin, which require a longer time to confirm transactions.

XRP can be described as a bridge asset that provides a faster and more reliable avenue for financial institutions to exchange crypto and fiat assets. For example, suppose you want to send money internationally with Ripple. The money is first converted to XRP, transferred across borders, and the XRP token is converted to the destination country's currency.

In addition, XRP transactions come at low fees, which makes it an excellent choice if you are looking for cost-effective yet efficient cross-border payments.

Can You Trade XRP?

How to buy XRP? You can buy XRP as a long-term investment, trade, or pay for transactions on Ripple. The next part of this guide will examine why you should trade XRP tokens. Another significant fact about XRP is it is a premined token with a maximum supply of 100 billion. However, 80 billion of the token was allocated to the founding company, which locked 55 billion in an escrow account to ensure a stable supply. In addition, the team and co-founders got the rest of the 20 billion XRP tokens.

As a speculative investment, you can trade XRP on crypto exchanges like Binance, Coinbase, and Kraken. These exchanges allow account holders to buy or sell XRP coin against other cryptocurrencies. Therefore, if the market movement aligns with your speculation, you can make a profit.

In addition, some brokers offer the option of trading XRP CFDs (Contract for Difference). XRP CFD trading involves speculating the token's price movements without actually owning them. Contract for Difference is a financial instrument allowing traders to go long or short to profit from price volatility.

Trading XRP CFDs can be very rewarding, but it comes with risks. Therefore, traders must conduct research and choose a reputable broker. VSTAR is a reliable broker that provides institutional-level trading experience, including the lowest trading cost, which means tight spread and lightning-fast execution.

In addition, VSTAR is regulated by CySEC, which is essential when choosing a broker. Some crypto exchange platforms are often unregulated and have a high commission, which can negatively affect your profit. Furthermore, VSTAR offers a demo account for beginners to practice trading strategies to mitigate losses during actual trading.

Why Trade XRP?

According to Forbes, XRP is among the top 10 cryptocurrencies in 2023. XRP is different from traditional cryptocurrencies because it was designed for cross-border transactions involving financial institutions.

Therefore, trading XRP offers several opportunities. Here are some of the reasons why you should consider trading XRP.

a. Potential for high returns

XRP has experienced significant price gains in the past and has the potential for more in the future based on increased adoption. Increasing adoption is one factor that drives the price of crypto assets. Ripple is a network that offers global solutions to several problems associated with cross-border transactions. Therefore, with more adoption of XRP by financial institutions, the market value is expected to increase. Traders looking to capitalize on its potential for high returns can invest for the long term.

b. Volatility

One common feature in the crypto market is volatility - a measure of how much the price of an asset moves up or down over a period. Over the years, the price of XRP has had its dramatic moments. Therefore, XRP is attractive for traders who take advantage of short-term price fluctuations.

XRP tends to be very volatile, allowing traders to buy and sell on price fluctuations for a profit. The token recorded its highest value in 2018 at $3.75, but the current value is about $0.445 in May 2023. Volatility comes with risks as the change in price direction can be very sudden, occurring in minutes, leading to loss. Therefore, it is essential to implement risk management strategies to minimize loss and protect profit.

c. Get exposure to a top cryptocurrency

As of May 2023, XRP ranks no 6 in the list of cryptocurrencies. Therefore, XRP is a leading digital asset in terms of popularity and market capitalization. Trading XRP gets you exposure and allows you to diversify your portfolio. Diversification is critical in crypto trading because it helps to spread risks across various cryptocurrencies. As a result, your capital is spread among these crypto assets, which protects you from the poor performance of any single asset.

d. Trade on margin (XRP CFDs)

Another reason to consider trading XRP is you can trade on margin. Some brokers offer XRP CFDs that allow you to trade XRP on margin, enabling higher potential returns through leverage. Trading XRP CFDs allows you to control a big trading position with a small capital. Leverage can amplify potential profit or magnify loss. Therefore, it is critical to trade leverage cautiously because the potential benefit can be exciting, but the loss can be unimaginable.

e. 24/7/365 market

Finally, the XRP market is open continuously, allowing you to trade day and night throughout the year. This is another solution to the fixed trading hours of traditional financial institutions for processing cross-border transactions. In addition, individuals in different time zones can monitor their transactions even after regular trading hours.

How to Trade XRP

There are several factors to consider when trading XRP. You need a good trading plan and management strategies like any other crypto asset. Either as a short-term or long-term investment, here are some points that can help you trade XRP effectively:

i. Open an exchange account

Where to buy XRP

The first step to XRP spot trading is opening an exchange platform account. XRP is available on 127 crypto exchanges; therefore, it is critical that you choose a reputable exchange like Binance or Coinbase. These platforms are user-friendly, reliable, and offer XRP trading pairs. There are about 398 XRP trading pairs, including XRP/USDT, XRP/BTC, XRP/BUSD, XRP/ETH, and more.

After deciding on an exchange, you create an account, which involves providing your name, email, and country of residence to register it. The next step is account verification, which involves submitting "identification documents," residential address, and other required details to verify the account.

Once the account is verified, you can fund the account via debit card, credit card, bank transfer, or a crypto asset like Bitcoin. You can go to the dashboard to view the available trading pairs and select which is best for your investment needs.

ii. Open a CFD broker account (optional)

If you prefer trading XRPUSD CFDs, choose a broker like VSTAR and open an account. You can trade XRP CFDs by opening an account with the broker. This process involves providing your name and email and submitting identification documents. Once the account has been approved, you can fund it with USD or EUR.

In addition, it is critical to determine the amount of XRP CFDs you want to trade. Your appetite for risk and investment goals may influence this. Before diving into trading XRP CFDs, make a trading plan and risk management plans.

VSTAR offers the opportunity to practice with a demo account. Therefore, you can test your trading plan and risk management strategies to determine their efficiency. Also, our customer support is available 24/7 to help with your trading needs.

iii. Analyze the XRP market

Another critical factor in trading XRP crypto is conducting market analysis. You need to familiarize yourself with factors that may influence the price movement of the token.

Ripple news and announcement can affect market sentiment, which affects price volatility. Therefore, traders must stay updated on all XRP Ripple news to take advantage of small price changes.

XRP Partnerships are another factor that you must watch out for. When Ripple announces a new partnership, it sparks excitement and hype, which may trigger an uptrend in XRP price.

Another significant tool in market analysis is technical analysis. Technical analysis provides insight into trend strength, trend speed, and price direction to determine buy or sell signals.

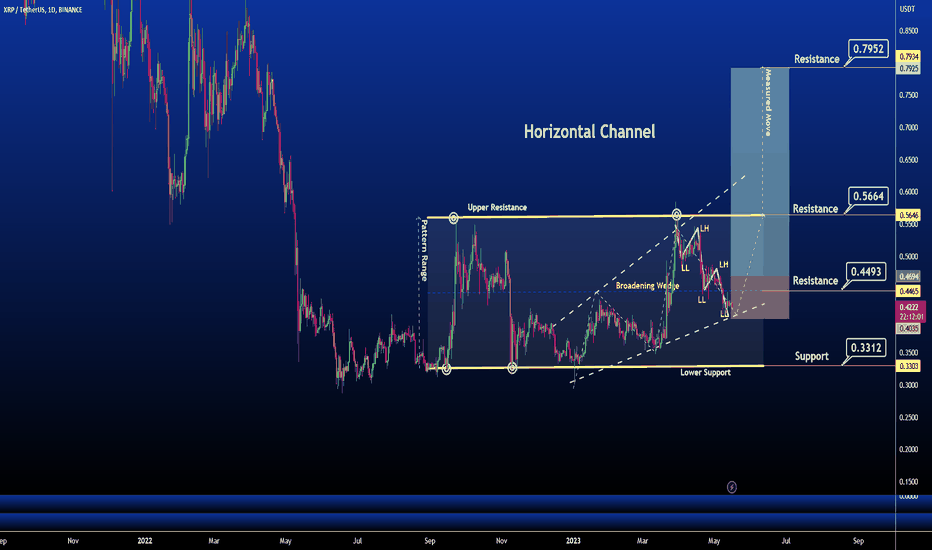

Charting platforms like Tradingview, Coinigy, and Glassnode offer comprehensive XRP price charts. They help you understand the previous trend and identify potential entry and exit positions.

Technical indicators like Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands can be critical for technical analysis. These indicators can provide XRP trading signals to minimize risks.

iv. Develop a trading plan

Before putting your capital into any trade, develop a trading plan. A trading plan is critical because it clearly defines your strategy for entering or exiting a position. In addition, a good trading plan considers your investment goals, risk tolerance, and trading experience. Therefore, it protects you from "emotional trading". Although crypto trading is a general prediction, it is based on data, not guesswork.

An indispensable part of the trading plan is risk management strategies. These strategies can protect your capital and profit and minimize loss due to XRP's volatility. Suppose you are considering using leverage, be cautious about it. Carefully select the leverage ratio suitable for your investment plans and risk appetite.

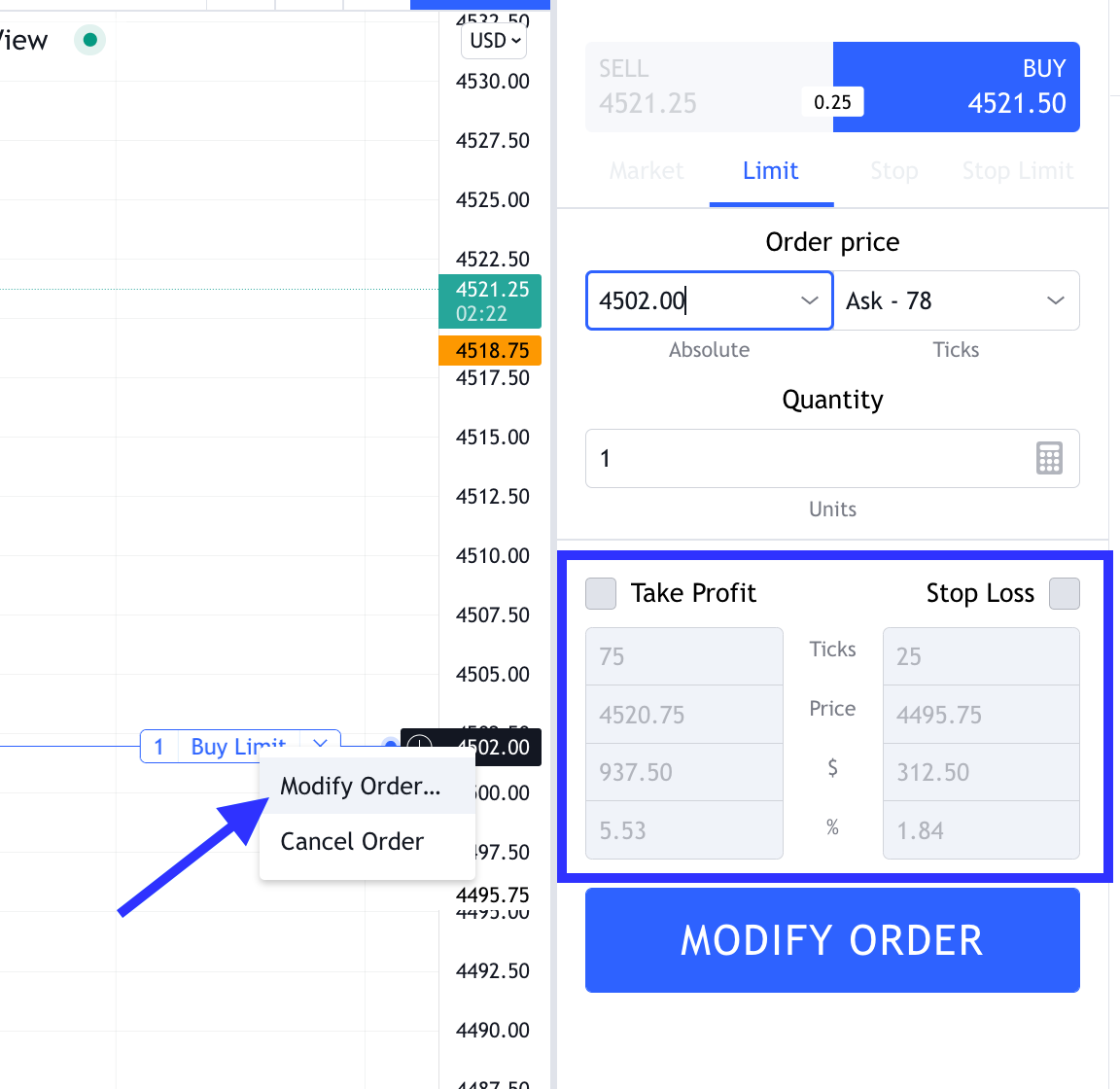

Take profit and stop loss orders are two risk management tools that can help you minimize loss. Take profit order works by automatically closing your trading position when your profit has reached a pre-set limit. On the other hand, a stop-loss order automatically exits a market position when the price of XRP has dropped to a pre-set level.

For example, you enter a position when the price of XRP is $0.3, you can set a Take Profit order at $0.36 and a Stop Loss order at $0.27. Therefore, the orders automatically close your market position when the price of XRP reaches the set value. As a result, you can get your profit while minimizing risk.

v. Place buy and sell orders

After market analysis and the development of the trading plan, the next step is to execute the trade by placing a sell or buy order. On an exchange or through your broker, place market or limit orders to buy (go long) and sell (go short) XRP depending on your market analysis and trading plan.

You can go long if you think the market value of XRP will increase in the coming days or weeks to make a profit. On the other hand, you can go short if you predict a downtrend in XRP market value to minimize losses.

vi. Monitor your positions

It is impossible to predict volatility; therefore, monitoring your positions becomes critical once you enter a trade. Monitor XRP price movements, general crypto market trends, and any relevant news that may affect your trading position.

Monitoring your positions is essential because it improves your trading experience and performance. For example, suppose the market is moving according to your prediction. In that case, you can adjust your stop loss and take profit levels as needed. On the other hand, if the market is moving against you, you may want to consider closing the position to prevent losses.

vii. Close your positions

To realize your profits or losses, place sell orders to close out your XRP positions. Then you can withdraw your funds or proceed to trade the markets again. Your trading position automatically closes when you set take profit or stop loss orders. When the price of XRP gets to the pre-set value, the system will close your trading position.

Another way to close your position is to create a market or limit order. A market order is a transaction executed at the best available price. Short-term investors can benefit from setting a market order.

On the other hand, a limit order allows you to set a price limit for selling XRP. The limit order may take longer to execute compared to the market order.

Summary

Ripple and its native token, XRP, have introduced a blockchain-based solution for cross-border payment. This revolutionary platform offers fast, secure, and reliable global transactions at very low costs. XRP has the potential for high returns, offers a unique opportunity for investors to diversify their portfolio, and its volatile nature makes it an appealing choice. However, trading XRP involves research, choosing the best exchange or broker, making a plan, monitoring, and risk management strategies.

You can also be a part of the ecosystem transforming financial transactions while making profits. Diversify your portfolio by trading XRP now!