I. Introduction

A. Overview of the AUD/USD currency pair

The AUD/USD currency pair represents the exchange rate between the Australian dollar (AUD) and the U.S. dollar (USD). It is one of the most actively traded currency pairs in the forex market, with significant liquidity and volatility. The exchange rate between these two currencies indicates the value of one currency in terms of the other. Traders and investors closely monitor this currency pair to identify potential trading opportunities and assess the economic health of both countries.

B. Importance of fundamental analysis

Fundamental analysis plays a crucial role in understanding and predicting the movements of the AUD/USD currency pair. It involves evaluating various economic indicators, central bank policies, political events, and market sentiment to determine the intrinsic value of a currency. By analyzing these factors, traders can make informed decisions about whether to buy or sell the currency pair.

C. A Brief explanation of the Australian dollar and U.S. dollar

Source: bwbx.io

The Australian dollar (AUD) is the official currency of Australia and is issued by the Reserve Bank of Australia. It is often referred to as a commodity currency due to Australia's significant exports of commodities such as iron ore, coal, and gold. The performance of the Australian economy, particularly in the commodity sector, has a significant impact on the value of the Australian dollar.

On the other hand, the U.S. dollar (USD) is the official currency of the United States and is issued by the Federal Reserve. The U.S. dollar is widely regarded as the world's reserve currency, and its value is influenced by factors such as economic data, monetary policy decisions, and geopolitical events. The U.S. dollar is considered a safe-haven currency, and its strength often increases during times of economic uncertainty.

Source: wallpaperaccess.com

II. Macroeconomic Overview: Australia

A. Economic Indicators Review

1. GDP and Unemployment Rate

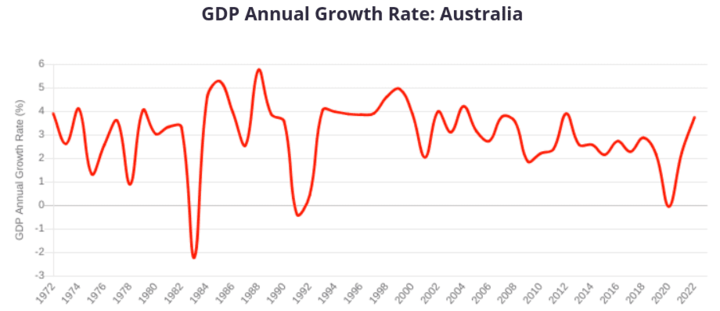

Gross Domestic Product (GDP) and the unemployment rate are two crucial economic indicators that provide insights into the overall health of an economy. In recent years, Australia has experienced mixed performance in these areas.

In 2022, Australia's real GDP grew by 3.8%, marking a significant rebound from the recession caused by the COVID-19 pandemic and impacted by macroeconomic adversities. This growth was primarily driven by strong domestic consumption, government spending, and a recovery in commodity exports. However, it is important to note that Australia's GDP growth has been volatile in the past, largely due to its reliance on commodity exports and fluctuations in global demand.

Source: worldeconomics.com

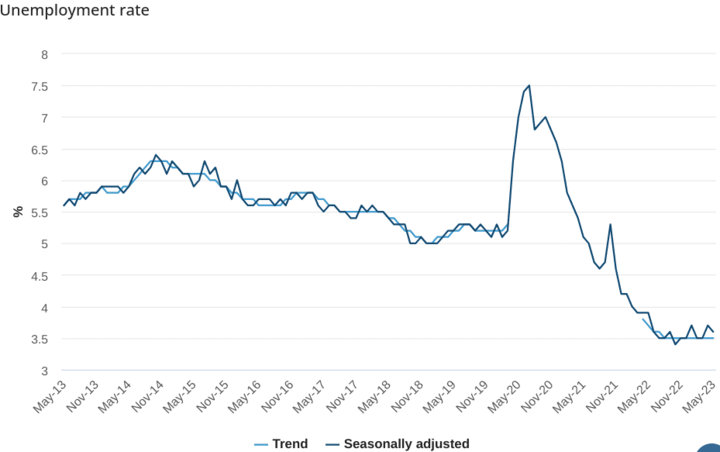

The unemployment rate in Australia has shown some improvement but remains a concern. As of May 2023, the unemployment rate stood at 3.6%, down from its peak during the pandemic but still higher than pre-pandemic levels. The labor market's recovery has been relatively slow, partly due to ongoing structural shifts in the economy and the impact of technological advancements.

Source: abs.gov.au

2. Inflation Rates

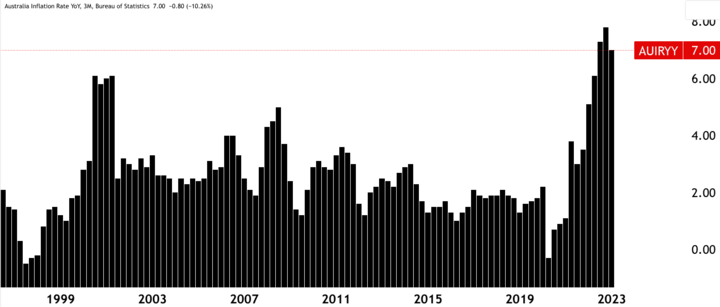

Inflation is another crucial economic indicator that impacts currency values. In recent years, Australia has witnessed relatively low inflation levels.

In May 2023, Australia's inflation rate was 7.0%, remaining within the Reserve Bank of Australia's (RBA) target range of 2–3%. The subdued inflation can be attributed to factors such as weak wage growth, intense retail competition, and technological advancements driving down prices in some sectors. However, there have been concerns about rising inflationary pressures globally, driven by factors such as supply chain disruptions and increased government spending.

Source: tradingview.com

3. Business and Consumer Confidence

Business and consumer confidence levels provide insights into the sentiment and expectations of market participants.

Business confidence in Australia has been gradually improving, supported by a strong economic recovery and improved trading conditions. This optimism is driven by factors such as robust commodity prices, increased investment in infrastructure projects, and a rebound in global demand. However, uncertainties surrounding global trade tensions and geopolitical risks can impact business sentiment.

Consumer confidence in Australia has also shown signs of improvement, although it remains influenced by factors such as employment prospects, household income, and housing market conditions. Rising consumer confidence generally translates into increased consumer spending, which stimulates economic growth.

4. Commodity Prices

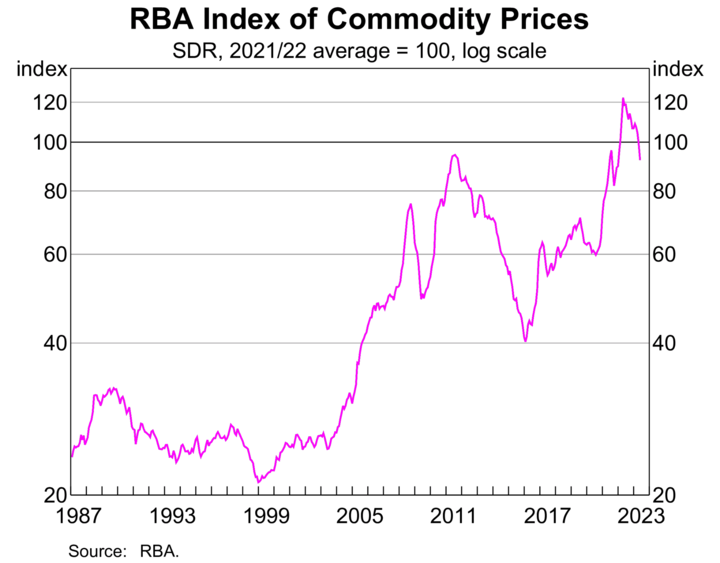

Australia is a major exporter of commodities such as iron ore, coal, and gold. Therefore, commodity prices play a crucial role in Australia's economic performance and its currency value.

In recent years, Australia has experienced significant fluctuations in commodity prices. For instance, commodity prices eased a bit in 2023 from record highs in 2022 caused by strong demand from China, which boosted Australia's export revenues. However, a slowdown in Chinese demand and increased global supply could lead to price declines, impacting Australia's export earnings and currency value.

Source: rba.gov.au

B. Monetary Policy

1. The Reserve Bank of Australia's Monetary Policy

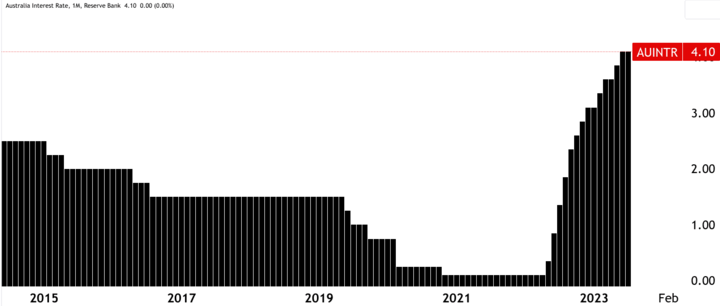

The Reserve Bank of Australia (RBA) is responsible for formulating and implementing monetary policy in the country. The RBA's primary objective is to maintain price stability while also considering employment and economic growth.

In recent years, the RBA has maintained an accommodative monetary policy stance to support economic recovery. It has kept the official cash rate at historically low levels to stimulate borrowing, investment, and spending. Additionally, the RBA has implemented quantitative easing measures, such as purchasing government bonds, to provide additional liquidity to financial markets.

2. Interest Rate Expectations

Expectations regarding future interest rate movements have a significant impact on currency values. Market participants closely monitor the RBA's communication and economic data to gauge the likelihood of interest rate changes.

As of the current period, the market consensus suggests that the RBA may gradually normalize its monetary policy by increasing interest rates. This is in response to improving economic conditions, concerns about rising inflationary pressures, and the need to prevent potential asset bubbles. However, the timing and pace of interest rate hikes remain uncertain and dependent on economic developments.

Source: tradingview.com

C. Political Climate

1. Economic policies of the government

The economic policies pursued by the Australian government can have a significant impact on the country's economic performance and currency value.

The Australian government has implemented various policies to support economic recovery and stimulate growth. This includes significant infrastructure spending, tax cuts, and regulatory reforms aimed at enhancing productivity and competitiveness. These policies are intended to drive investment, create jobs, and boost economic activity.

2. Current Australian and international trade policies

Trade policies, both at the domestic and international levels, can influence the Australian economy and its currency value.

Australia has been actively involved in international trade negotiations and agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements aim to facilitate trade and investment, reduce barriers, and increase market access for Australian businesses. The outcome of these negotiations and any changes in trade policies can impact Australia's export volumes, terms of trade, and currency value.

At the domestic level, the government's approach to trade policies can influence industries such as agriculture, manufacturing, and services. Protectionist measures or changes in trade regulations can have implications for the competitiveness of Australian businesses and the overall economy.

III. Macroeconomic Overview: United States

A. Economic Indicators Review

1. GDP and Unemployment Rate

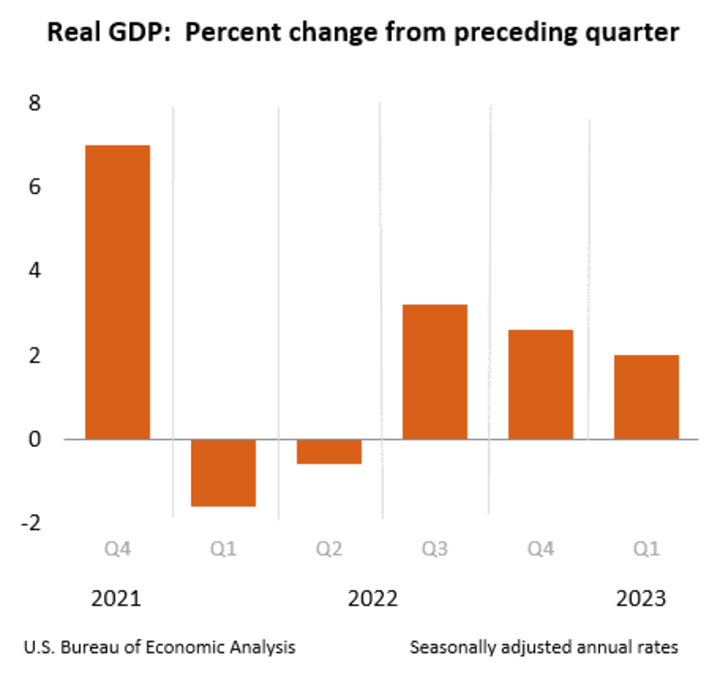

The United States has the largest economy globally, and its GDP and unemployment rate are key indicators of its economic performance.

In terms of GDP, the United States has experienced strong growth in recent years. In Q1 2023, the U.S. GDP expanded by 2.0%, driven by robust consumer spending, increased business investment, and government stimulus measures. However, it is important to note that the pace of economic growth can vary from year to year due to various factors, including fiscal and monetary policies, global economic conditions, and geopolitical events.

Source: bea.gov

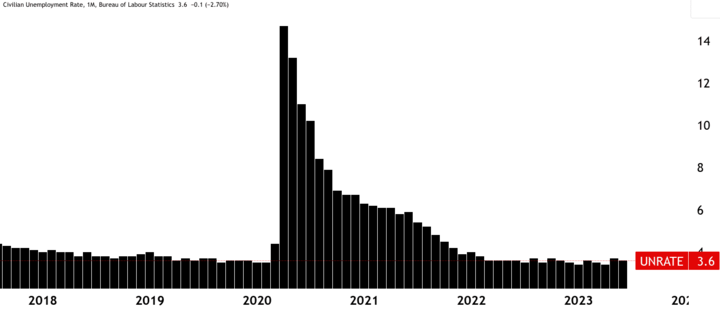

Regarding the unemployment rate, the U.S. experienced significant disruptions due to the COVID-19 pandemic. However, as of June 2023, the unemployment rate stood at 3.6%, representing a significant improvement from the peak of the pandemic. The strong recovery in the labor market can be attributed to factors such as increased vaccination rates, the easing of restrictions, and a rebound in economic activity.

Source: tradingview.com

2. Inflation Rates

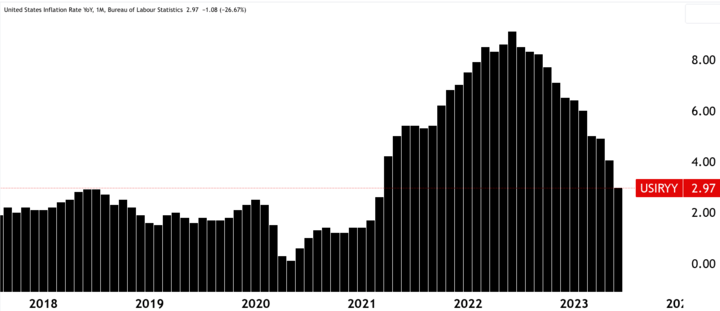

Inflation is a critical economic indicator that can impact currency values and monetary policy decisions. The United States has recently witnessed rising inflation levels.

In June 2023, the U.S. inflation rate reached 2.97%, marking a significant decrease compared to the historical highs of 2022. Factors contributing to inflationary pressure in 2022 include supply chain disruptions, rising energy, and commodity prices, increased government spending, and a surge in consumer demand as the economy reopens. Higher inflation rates can have implications for the purchasing power of consumers and may lead to adjustments in monetary policy.

Source: tradingview.com

3. Business and Consumer Confidence

Business and consumer confidence levels provide insights into the sentiment and expectations of market participants, impacting economic activity.

Business confidence in the United States has been relatively high, driven by factors such as favorable economic conditions, strong corporate profits, and business-friendly policies. This confidence can lead to increased investment, hiring, and expansion, contributing to economic growth.

Consumer confidence in the United States has also shown signs of improvement. As the economy recovers, consumer sentiment has been positively influenced by factors such as job growth, wage increases, and the availability of credit. Higher consumer confidence typically translates into increased consumer spending, which is a significant driver of economic growth.

B. Monetary Policy

1. The Federal Reserve's Monetary Policy

The Federal Reserve, commonly referred to as the Fed is responsible for formulating and implementing monetary policy in the United States. The Fed's primary mandate is to promote maximum employment, stable prices, and moderate long-term interest rates.

In recent years, the Fed has pursued an accommodative monetary policy to support economic recovery. It has maintained historically low-interest rates and implemented quantitative easing measures, including purchasing government bonds and mortgage-backed securities. These measures aim to stimulate borrowing, investment, and spending to support economic growth.

2. Interest Rate Expectations

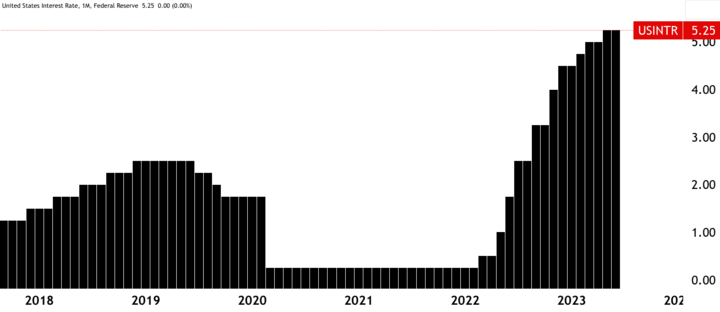

Expectations regarding future interest rate movements by the Federal Reserve have a significant impact on currency values and financial markets.

As of the current period, there are expectations that the Fed may gradually tighten its monetary policy by raising interest rates. Rising inflationary pressures and concerns about potential asset bubbles have prompted discussions about normalizing interest rates. However, the timing and pace of interest rate hikes will depend on various economic factors, including inflation trends, employment levels, and overall economic conditions.

Source: tradingview.com

C. Political Climate

1. Economic policies of the government

The economic policies pursued by the U.S. government can have substantial implications for the country's economic performance and currency value.

The U.S. government has implemented various policies to support economic growth and address socio-economic challenges. This includes measures such as tax cuts, infrastructure spending, and regulatory reforms aimed at stimulating investment, job creation, and innovation. The effectiveness of these policies can influence economic performance and market sentiment.

2. Current U.S. and international trade policies

Trade policies, both domestic and international, can significantly impact the U.S. economy and its currency value.

The U.S. has witnessed shifts in trade policies in recent years, including changes in tariffs, renegotiation of trade agreements, and a focus on addressing trade imbalances. These policies aim to protect domestic industries, promote fair trade practices, and strengthen the U.S. manufacturing base. The outcome of these policies can impact industries, international trade flows, and global market dynamics, potentially affecting the value of the U.S. dollar.

IV. Analysis of the AUD/USD Currency Pair

A. Relevant Economic Indicators

1. Correlation between the Australian and U.S. economies

The Australian and U.S. economies are closely interconnected, and their performance can significantly impact the AUD/USD currency pair. Understanding the correlation between these economies is crucial for analyzing the currency pair.

Historically, there has been a positive correlation between the Australian and U.S. economies. This means that when the U.S. economy strengthens, it often leads to increased demand for Australian goods and commodities, benefiting the Australian economy and potentially strengthening the Australian dollar. Conversely, if the U.S. economy weakens, it can negatively impact Australia's export-oriented economy and potentially weaken the Australian dollar.

2. Impact of GDP growth, inflation rates, interest rates, and commodity prices on the currency pair

Several key economic indicators have a significant impact on the AUD/USD currency pair.

GDP growth: Strong GDP growth in Australia, driven by factors such as increased consumer spending, business investment, and robust commodity exports, can support the Australian dollar. Similarly, strong economic growth in the United States can lead to a stronger U.S. dollar.

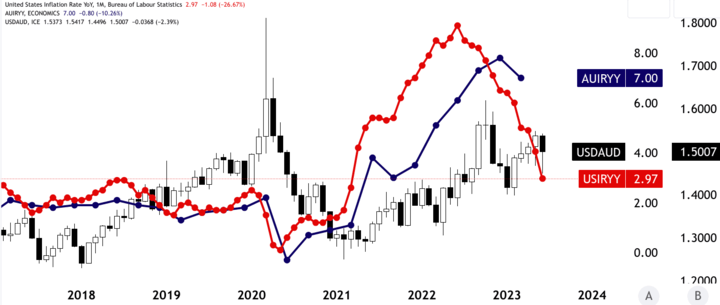

Inflation rates: Inflation has a direct influence on interest rates, which in turn affect currency values. Higher inflation rates can lead to central banks raising interest rates to combat inflation, making the respective currency more attractive to investors. Therefore, higher inflation in Australia relative to the United States can potentially strengthen the Australian dollar against the U.S. dollar.

Source: tradingview.com

Interest rates: Interest rate differentials between Australia and the United States impact the attractiveness of each currency. If the Reserve Bank of Australia raises interest rates while the U.S. Federal Reserve keeps rates unchanged, it can increase the yield advantage of holding Australian dollars and potentially strengthen the currency.

Commodity prices: Australia is a major exporter of commodities, and changes in commodity prices can significantly impact the Australian dollar. For example, if iron ore prices, one of Australia's key exports, rise due to increased demand, it can support the Australian dollar. Conversely, a decline in commodity prices can weaken the Australian dollar.

B. Factors Supporting a Bullish or Bearish Stance

1. Impact of the Reserve Bank of Australia's monetary policy on the currency pair

The Reserve Bank of Australia (RBA) plays a crucial role in shaping the Australian dollar's value through its monetary policy decisions. If the RBA adopts a hawkish stance by raising interest rates or signaling tighter monetary policy, it can strengthen the Australian dollar. Conversely, a dovish stance with lower interest rates or accommodative policies can weaken the currency.

2. Impact of the Federal Reserve's monetary policy on the currency pair

Similarly, the monetary policy decisions of the U.S. Federal Reserve have a significant impact on the U.S. dollar. If the Federal Reserve adopts a hawkish stance by raising interest rates or signaling tighter monetary policy, it can strengthen the U.S. dollar. Conversely, a dovish stance with lower interest rates or accommodative policies can weaken the currency.

3. Impact of Australian and international trade policies on the currency pair

Changes in trade policies can have implications for the AUD/USD currency pair. Protectionist measures or shifts in trade agreements can impact Australia's export-oriented economy and potentially weaken the Australian dollar. Additionally, trade tensions between the United States and its trading partners, such as China, can influence market sentiment and currency values.

C. Potential Risks to the Currency Pair

1. Sudden changes in global economic growth

A significant risk to the AUD/USD currency pair is a sudden slowdown in global economic growth. As Australia is heavily reliant on global demand for its commodities, a downturn in the global economy can negatively impact Australia's export revenues and weaken the Australian dollar.

2. Unpredicted changes in Australian or U.S. monetary policies

Unexpected shifts in the monetary policies of either the RBA or the Federal Reserve can lead to volatility in the AUD/USD currency pair. Sudden interest rate changes or changes in forward guidance can impact market expectations and result in rapid currency movements.

3. Geopolitical risks, such as trade tensions or political instability

Geopolitical risks, including trade tensions between major economies or political instability, can create uncertainties in the currency markets. For instance, escalating trade disputes between the United States and China can impact global market sentiment and potentially weaken the Australian dollar against the U.S. dollar.

V. Trading Strategies for AUD/USD

A. Technical Analysis

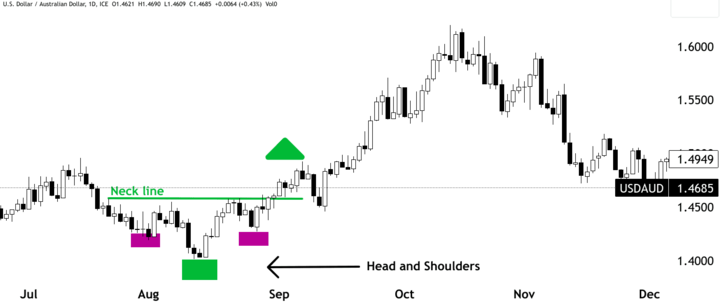

1. Identifying trends and patterns

Technical analysis involves studying historical price data to identify trends and patterns that can help predict future price movements. Traders analyzing the AUD/USD currency pair can use tools such as trendlines, chart patterns (e.g., head and shoulders, double tops and bottoms), and candlestick formations to identify potential trading opportunities. For example, if an uptrend is identified, traders may consider entering long positions or buying the Australian dollar against the U.S. dollar.

Source: tradingview.com

2. Use of indicators such as moving averages and Fibonacci retracements

Technical indicators can provide additional insights into market trends and potential reversal levels. Moving averages, such as the 50-day and 200-day moving averages, can help identify support and resistance levels or signal potential trend changes. Fibonacci retracements are used to identify potential levels of price correction within a trend. Traders can use these indicators in conjunction with other technical analysis tools to make informed trading decisions.

B. Risk Management

1. Setting Stop-Loss and Take-Profit levels

Risk management is a crucial aspect of trading any currency pair. Traders should establish appropriate stop-loss and take-profit levels to limit potential losses and secure profits. Stop-loss orders are placed below the entry price to automatically exit a trade if the market moves against the expected direction. Take-profit orders, on the other hand, are placed above the entry price to automatically close the trade and lock in profits when the price reaches a predetermined level. These levels should be determined based on the trader's risk tolerance, an analysis of market conditions, and consideration of potential price volatility.

Source: tradingview.com

2. Determining position size based on risk tolerance

Determining the appropriate position size is essential for managing risk. Traders should calculate their position size based on their risk tolerance and the distance between their entry price and the stop-loss level. This calculation considers the potential loss about the trading account's capital and the desired risk-to-reward ratio. By properly managing position size, traders can control the amount of risk exposure per trade and avoid excessive losses that could significantly impact their trading capital.

Let's consider an example of a trading strategy for the AUD/USD currency pair using technical analysis and risk management principles:

Technical analysis: The trader identifies an uptrend in the AUD/USD pair based on the higher highs and higher lows observed on the price chart. They also notice that the price has recently retraced to the 50-day moving average, which has historically acted as a support level. It suggests a potential buying opportunity.

Risk management: The trader determines that their maximum acceptable risk for this trade is 2% of their trading account balance. Based on their analysis, they set a stop-loss order at a level just below the recent swing low, ensuring that the potential loss is limited within their risk tolerance. They calculate the distance between the entry price and stop-loss level to determine their position size, ensuring that the maximum loss does not exceed 2% of their account balance.

By combining technical analysis to identify the trend and potential entry-level and risk management principles to set an appropriate stop-loss and position size, the trader aims to maximize their chances of success while managing potential losses.

C. News Trading

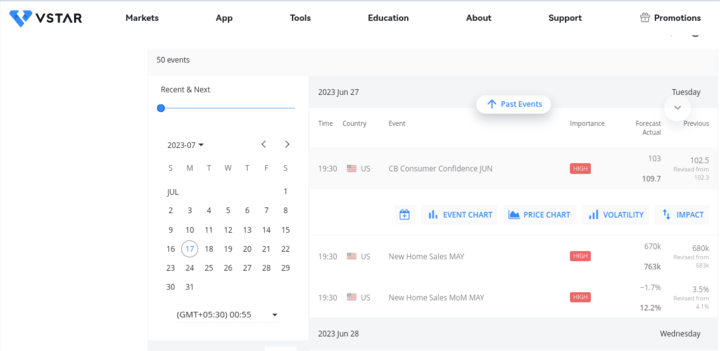

1. Following economic events and data releases

News trading involves taking positions based on the market's reaction to economic events and data releases. Traders closely monitor economic calendars to identify key events that can impact the AUD/USD currency pair. This includes releases of economic indicators such as GDP growth, employment data, inflation rates, and central bank announcements. By staying informed about these events, traders can anticipate market reactions and adjust their trading strategies accordingly.

Source: vstar.com (Economic Calendar)

2. Trading based on market reactions to news

When important economic news is released, it can lead to increased volatility in the AUD/USD currency pair. Traders may adopt different strategies depending on the news and market sentiment. For instance, positive economic data from Australia, such as better-than-expected GDP growth, can lead to an increase in demand for the Australian dollar and result in a bullish reaction. Conversely, negative news, such as a slowdown in the U.S. economy, can weaken the U.S. dollar and lead to a bearish reaction. Traders can take advantage of these market reactions by entering trades in the direction of the trend.

Trade AUD/USD on VSTAR

VSTAR offers competitive leverage of up to 1:200, allowing traders to participate in more trading opportunities with less capital. This can be advantageous for traders looking to trade the AUD/USD currency pair, as it offers increased flexibility and the potential for higher returns.

The platform boasts top-tier liquidity, enabling traders to quickly enter and exit trades at any time. This liquidity ensures that traders can execute their orders efficiently and at the best market prices. Additionally, VSTAR offers spreads starting at 0 pips, providing traders with competitive pricing on major products, including the AUD/USD pair.

VSTAR emphasizes best execution, ensuring that orders are filled at the best available prices and executed within milliseconds. This commitment to fast and accurate order execution can be critical for traders, as it allows them to take advantage of market opportunities and potentially maximize profits.

Choosing VSTAR also comes with several benefits, such as zero platform fees and zero commission charges. This can help traders reduce their trading costs and retain a larger portion of their profits. Furthermore, the platform offers 24/7 real human customer support, ensuring that traders can receive assistance and resolve any issues they may encounter.

The security of investments and personal data is a priority for VSTAR. The platform is licensed and regulated, adhering to strict global regulatory requirements. Traders can have peace of mind knowing that they are trading on a reputable and trustworthy platform.

In terms of fund protection, VSTAR keeps client funds separated from the company's funds and securely deposits them in reputable tier-1 banks. Additionally, clients' funds are protected by the Investor Compensation Fund (ICF), which offers compensation of up to 20,000 euros in the event of the company's insolvency. This provides an added layer of security for traders' funds.

VI. Conclusion

A. Recap of the fundamental analysis of the AUD/USD currency pair

In the fundamental analysis of the AUD/USD currency pair, several key economic indicators and factors were examined. The economic indicators included GDP growth, the unemployment rate, inflation rates, business and consumer confidence, and commodity prices. Additionally, the monetary policies of the Reserve Bank of Australia and the Federal Reserve, as well as the impact of trade policies, were considered.

B. Overview of bullish or bearish stance based on analysis

Based on the analysis, the AUD/USD currency pair's stance can be influenced by various factors. Positive economic indicators, such as strong GDP growth, low unemployment, and increased consumer and business confidence, can support a bullish stance for the Australian dollar against the U.S. dollar. Additionally, a hawkish monetary policy by the Reserve Bank of Australia and a favorable trade policy environment can further strengthen the Australian dollar.

On the other hand, negative economic indicators, higher inflation rates, and a dovish monetary policy by the Reserve Bank of Australia can support a bearish stance for the Australian dollar. Changes in trade policies and geopolitical risks can also introduce uncertainty and potentially weaken the Australian dollar against the U.S. dollar.

C. Final thoughts on trading the AUD/USD currency pair based on fundamental analysis and trading strategies

Trading the AUD/USD currency pair requires a comprehensive understanding of fundamental analysis and the application of appropriate trading strategies. Fundamental analysis provides insights into the economic conditions and policy decisions that can influence the currency pair. Traders should consider factors such as economic indicators, monetary policies, trade policies, and geopolitical risks when making trading decisions.

Furthermore, incorporating technical analysis tools and risk management strategies can enhance trading approaches. Technical analysis helps identify trends, patterns, and potential entry and exit points, while risk management techniques such as setting stop-loss and take-profit levels and determining position size are crucial for managing risk and preserving capital.

It is important for traders to continuously monitor and evaluate fundamental factors and adjust their strategies accordingly. The currency markets are dynamic and influenced by various factors, and traders should stay informed about economic news and events that can impact the AUD/USD currency pair.