一、简介

A.AUD/CAD货币对概述

AUD/CAD货币对代表澳大利亚元(AUD)和加拿大元(CAD)之间的汇率。基本面分析在理解和预测该货币对的走势方面发挥着关键作用。通过检查经济指标、利率和地缘政治因素,交易者可以做出明智的决策,以利用市场趋势。

澳元,通常表示为AUD,是澳大利亚的官方货币。它与该国的出口导向型经济密切相关,特别是其丰富的矿产和农业资源。加元,符号为CAD,是加拿大的官方货币,受到其广泛的自然资源出口(包括石油和木材)的影响。

B.基本面分析的重要性

基本面分析对于理解AUD/CAD货币对的行为至关重要。考虑利率的影响。与加拿大相比,澳大利亚的利率较高可能会导致对澳元的需求增加,因为投资者寻求更高的回报。如果澳大利亚储备银行(RBA)因经济强劲而提高利率,这可能会吸引外国资本并导致澳元兑加元升值。

经济指标也产生重大影响。如果澳大利亚的GDP增长率超过加拿大,则可能表明澳大利亚经济更加强劲,从而可能导致澳元兑加元升值。同样,贸易平衡也可以发挥作用。如果澳大利亚对中国的出口增加,由于中国与澳大利亚的重要经济联系,可能会推高澳元。

C.澳元和加元简介

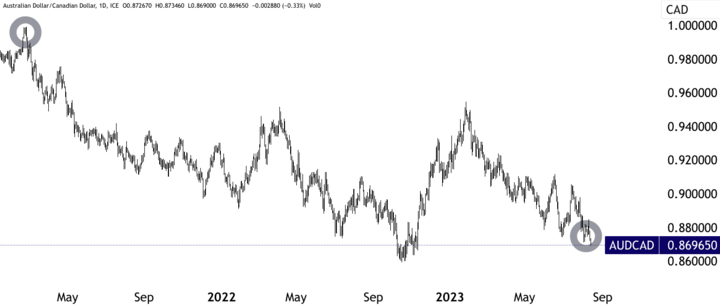

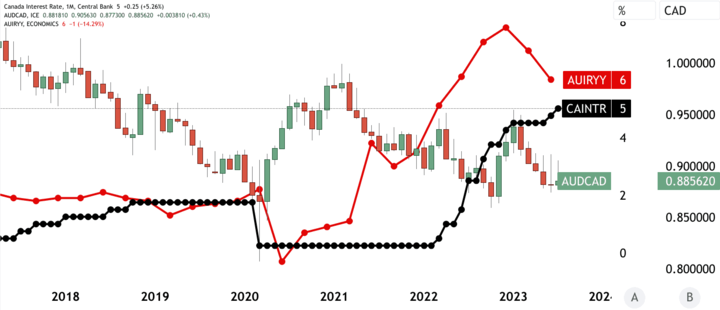

2021年2月,AUD/CAD汇率约为0.995270。随后,到2023年6月,它已降至0.881810。造成这一走势的一个因素是货币政策的分歧。澳大利亚央行表示对经济前景更加谨慎,而加拿大央行则采取了与美联储一致的鹰派态度。这种差异导致对澳元的需求减少,从而推高了汇率。

资料来源:tradingview.com

此外,在此期间,中国经济低迷影响了对澳大利亚大宗商品的需求,对澳大利亚的出口前景产生了负面影响,并可能导致澳元兑加元走软。

二、宏观经济概况:澳大利亚

A.经济指标回顾

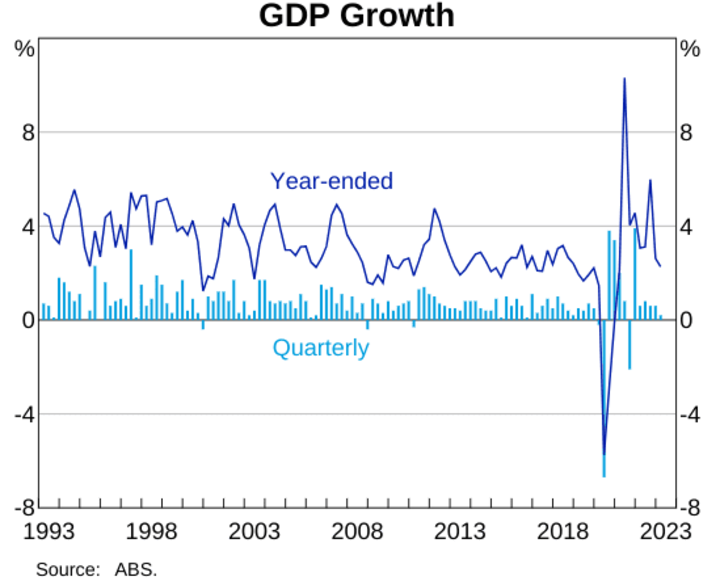

1.GDP和失业率

澳大利亚的GDP增长率是其货币强势的关键决定因素。2021年至2023年,澳大利亚GDP呈现稳定增长,平均在4%左右。这一增长是由强劲的商品出口和富有弹性的服务业推动的。相比之下,加拿大的GDP增长率略低,平均在3%左右。澳大利亚失业率徘徊在3.5%左右,劳动力市场相对稳定,加拿大失业率也呈现类似趋势。这种经济差异可能会影响AUD/CAD汇率,经济表现走强通常会导致货币升值。

资料来源:rba.gov.au

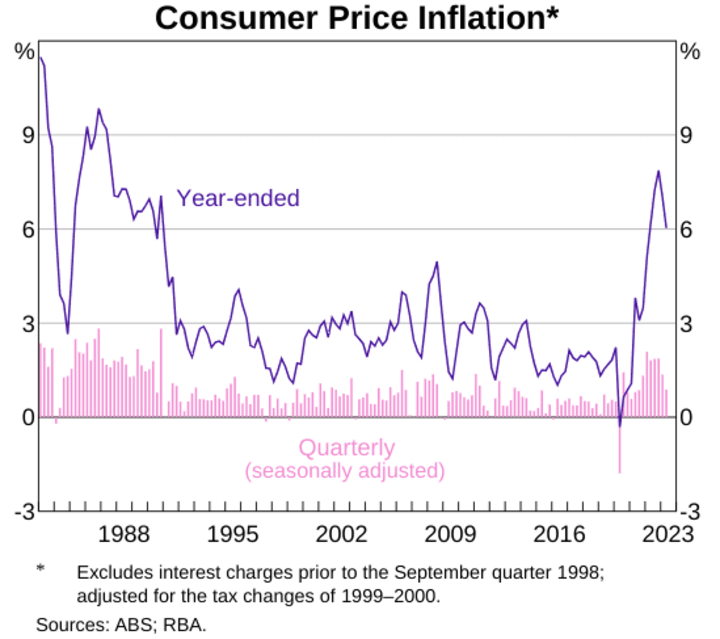

2.通货膨胀率

两国在此期间都经历了高通膨,澳大利亚目前(截至2023年8月)的通膨率约为6%,加拿大约为2.8%。通货膨胀是一个至关重要的指标,因为央行经常调整利率以应对通货膨胀压力。例如,澳大利亚通膨上升可能会促使澳大利亚储备银行(RBA)考虑收紧货币政策,但落后于加拿大央行的鹰派立场,可能导致澳元兑加元贬值。

资料来源:rba.gov.au

3.企业和消费者信心

商业和消费者信心是经济健康状况的重要预测指标。在澳大利亚,商业信心仍然相对较高,反映出积极的前景。消费者信心也表现出韧性,表明内需稳定。在加拿大,虽然商业信心良好,但由于大流行相关的不确定性,消费者信心出现了一些波动。这些情绪可能会影响投资流并相应影响AUD/CAD汇率。

B.货币政策

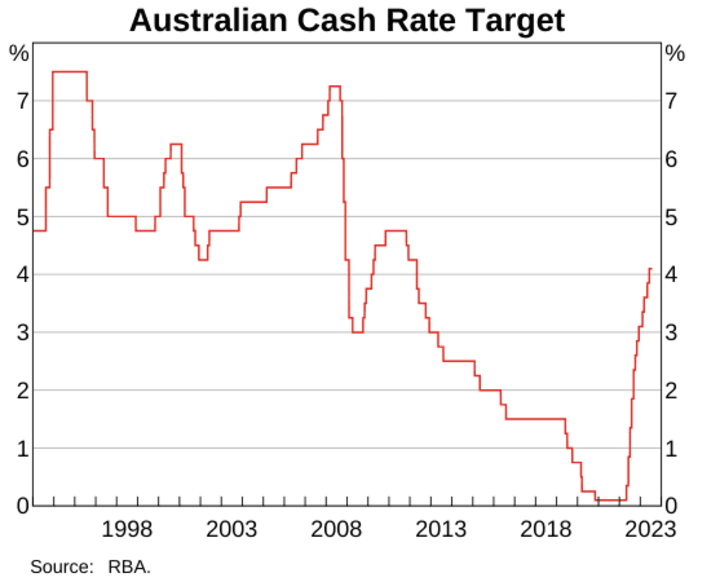

1.澳大利亚储备银行的货币政策

澳洲联储的货币政策决定对澳元有重大影响。2022年以来,澳联储一直保持鹰派立场,截至2023年8月,将现金利率维持在4.1%左右的历史低位。澳联储的量化紧缩措施旨在抑制通膨。相比之下,加拿大央行(BoC)采取了更为强硬的态度,逐步将政策利率提高至5%以应对通膨状况。货币政策的分歧造成了影响AUD/CAD汇率的利率差异。

资料来源:rba.gov.au

2.利率预期

市场参与者密切关注利率预期。利率的预期变化可以推动资本流动并影响汇率。如果澳大利亚央行表示由于经济状况改善而可能加息,则可能会吸引寻求更高回报的外国投资者,从而可能推高澳元兑加元的价值。

C.政治气候

1.政府经济政策

政府政策在塑造一个国家的经济格局中发挥着至关重要的作用。在澳大利亚,支持资源出口、基础设施发展和创新的政策促进了经济增长。在加拿大,旨在大流行后复苏的财政刺激措施引人注目。这些政策可以影响经济表现,从而影响AUD/CAD汇率。

2.中国对澳大利亚经济的影响

中国作为主要贸易伙伴的角色极大地影响了澳大利亚的经济。中国对澳大利亚铁矿石、煤炭、农产品等大宗商品的需求极大地影响了澳大利亚的出口收入。中国经济活动的增加可能会导致对澳大利亚商品的需求增加,从而可能使澳元走强。然而,这种依赖也使澳大利亚经济面临来自中国经济政策转变或地缘政治紧张局势的潜在风险。

三、宏观经济概况:加拿大

AUD/CAD货币对代表澳元(AUD)和加元(CAD)之间的汇率,受到众多宏观经济决定因素的影响。全面审查这些因素,包括经济指标、货币政策和加拿大的政治气候,对于全面了解该货币对的动态并做出明智的交易决策至关重要。

A.经济指标回顾

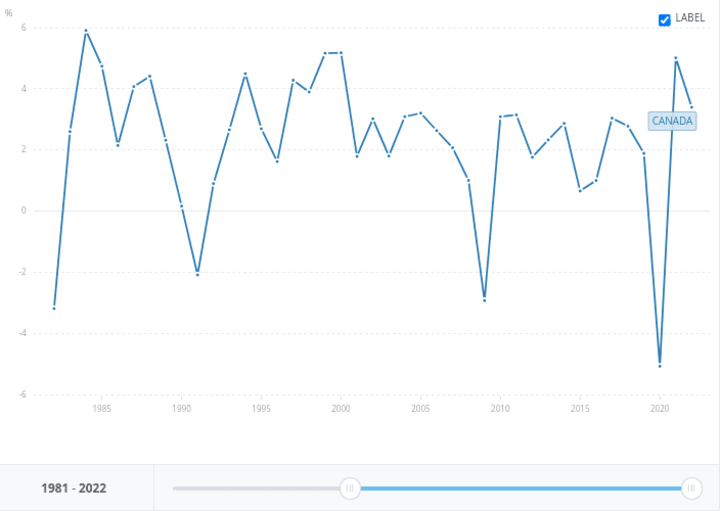

1.GDP和失业率

GDP增长率和失业率是衡量一个国家经济健康状况的重要指标。就加拿大而言,其GDP呈现温和增长,截至2022年约为3.4%。失业率保持相对稳定,截至2023年7月徘徊在5.5%左右。这一表现反映了加拿大经济多元化,包括自然资源、制造业等行业和服务。相比之下,澳大利亚的GDP增长率略高,失业率则较低。这些差异可能会影响AUD/CAD汇率,经济表现走强往往会导致货币升值。

资料来源:data.worldbank.org

2.通货膨胀率

通货膨胀率在影响央行政策决策方面发挥着关键作用。在此期间,加拿大通膨温和,平均通膨率徘徊在1.5%左右。这促使加拿大央行(BoC)采取谨慎措施调整货币政策。如果通膨大幅上升,央行可能会考虑通过加息来收紧货币政策。这种调整可以通过利差影响AUD/CAD汇率。

3.企业和消费者信心

商业和消费者信心指数可以洞察一个国家的经济前景。在加拿大,企业和消费者信心仍然相对乐观,表明市场情绪良好。商业乐观反映了持续增长的预期,而消费者信心则表明需求环境稳定。这些情绪影响投资决策和消费者支出,进而影响AUD/CAD汇率。

B.货币政策

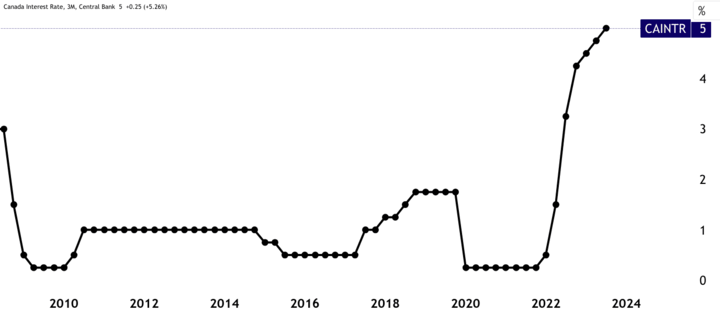

1.加拿大央行的货币政策

加拿大央行的货币政策决定对加元产生重大影响。在分析期间,加拿大央行采取谨慎态度,逐步将政策利率从0.25%提高至0.75%,以应对经济状况的改善。这种审慎的方法旨在平衡经济复苏与通膨管理。加拿大央行的行动导致了加拿大与包括澳大利亚在内的其他经济体之间的利差,从而影响了AUD/CAD的汇率。

2.利率预期

市场参与者在制定投资决策时密切关注利率预期。利率的预期变化可以推动资本流动,从而影响汇率。如果加拿大央行因经济指标改善而发出可能加息的信号,则可以吸引寻求更高回报的外国资本,从而可能导致加元兑澳元升值。

资料来源:tradingview.com

C.政治气候

1.政府经济政策

政府政策显著影响经济状况。在加拿大,旨在疫情后复苏、基础设施发展和支持重点行业的政策发挥了至关重要的作用。这些措施会影响经济增长率,从而影响AUD/CAD汇率。

2、全球贸易紧张局势对加拿大经济的影响

全球贸易紧张局势,尤其是美国和中国等主要贸易伙伴之间的紧张局势,可能会对加拿大的出口导向型经济产生重大影响。作为大宗商品和制成品的主要出口国,加拿大很容易受到国际贸易中断的影响。例如,贸易紧张局势可能导致对加拿大出口的需求减少,影响经济增长并可能削弱加元。

四、AUD/CAD货币对分析

AUD/CAD货币对反映了澳元(AUD)和加元(CAD)之间的汇率,受到经济指标、货币政策和地缘政治因素复杂相互作用的影响。对这些组成部分的批判性分析对于理解货币对的动态、确定潜在的市场方向和识别相关风险至关重要。

A. 相关经济指标

1.澳大利亚和加拿大经济的相关性

澳大利亚和加拿大都是资源丰富、经济出口导向型的国家。澳元和加元的表现与全球大宗商品价格密切相关。澳大利亚是矿产和农产品的重要出口国,而加拿大的出口包括石油、金属和木材。因此,大宗商品价格的变化可能会影响两国经济,进而影响AUD/CAD汇率。

2.GDP增长、通货膨胀率和利率对货币对的影响

GDP增长率、通货膨胀率和利率是影响货币对的基本指标。在强劲的大宗商品出口和富有弹性的服务业等因素的推动下,澳大利亚GDP的强劲增长可能会导致澳元升值。同样,加拿大的GDP增长在不同行业的支持下也会影响加元。通货膨胀率会影响央行政策,通膨上升可能导致利率上升,从而可能导致货币升值。澳大利亚储备银行(RBA)和加拿大银行(BoC)之间的利率差异可以推动资本流动,从而影响AUD/CAD汇率。

资料来源:tradingview.com

B.支持看涨或看跌立场的因素

1.澳大利亚储备银行货币政策对货币对的影响

澳大利亚央行的货币政策决定可能会影响AUD/CAD货币对。澳大利亚央行利用历史低位利率和量化宽松措施来支持经济复苏。如果澳大利亚央行因经济强劲而发出转向收紧货币政策的信号,可能会吸引寻求更高回报的外国投资,从而可能导致澳元升值。

2.加拿大央行货币政策对货币对的影响

同样,加拿大央行的政策对加元也有显著影响。因经济改善而逐步加息可能会增强加元兑澳元的汇率。澳大利亚央行和加拿大央行之间货币政策的分歧可能会产生利率差异,从而影响汇率。

3.中国对澳大利亚经济的影响以及全球贸易紧张局势对加元的影响

由于中国对澳大利亚大宗商品的需求,对澳元的走强起著至关重要的作用。中国经济复苏可以提振澳大利亚的出口,从而推动澳元走强。另一方面,全球贸易紧张局势,尤其是中美之间的贸易紧张局势,可能会影响加拿大的出口,从而影响加元兑澳元的表现。

C.货币对的潜在风险

1.全球经济增长突变

全球经济变化可能会显著影响两个经济体的表现。全球经济增长意外放缓可能会减少对大宗商品的需求,从而影响澳大利亚和加拿大。这可能导致澳元和加元贬值,从而可能改变AUD/CAD汇率。

2.澳大利亚或加拿大货币政策的意外变化

中央银行的政策决定可能会受到不可预见事件的影响。由于经济或地缘政治发展而导致的意外加息或降息可能导致货币快速波动。此类变化可能会导致AUD/CAD汇率波动。

3.地缘政治风险,例如中美贸易紧张局势

地缘政治事件,尤其是主要经济体之间的贸易紧张局势,可能会给市场带来不确定性。例如,美国和中国之间的紧张局势可能会扰乱全球贸易流动,从而影响澳大利亚和加拿大。这种不确定性可能会导致风险规避,从而可能影响澳元和加元。

五、AUD/CAD交易策略

交易AUD/CAD货币对需要一种消息灵通的方法,结合技术分析、风险管理和对新闻驱动的市场动态的把握。通过采用这些策略,交易者可以增强决策过程并优化交易结果。

A.技术分析

1.识别趋势和模式

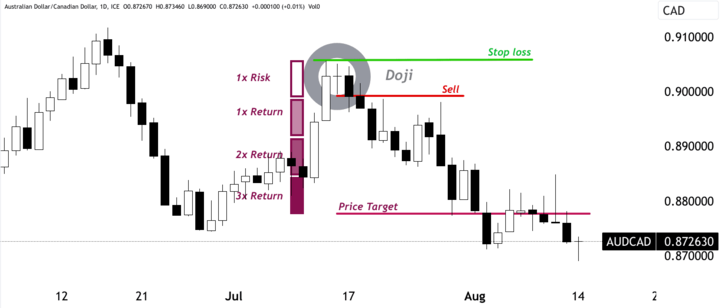

技术分析涉及研究历史价格数据以识别趋势和模式。交易者可以使用趋势线、支撑位和阻力位等工具以及头肩形或双顶双底等图表模式来发现潜在的趋势反转或持续模式。例如,2023年7月期间,AUD/CAD货币对一直呈上升趋势,然后出现十字烛台模式,导致大幅反转。

资料来源:tradingview.com

2.移动平均线和斐波那契回撤等指标的使用

移动平均线和斐波那契回撤等指标可以为潜在的进入和退出点提供有价值的见解。移动平均线可以帮助平滑价格波动,而斐波那契回撤则根据历史价格走势确定潜在的支撑和阻力水平。如果AUD/CAD货币对遇到关键的斐波那契水平,交易者可能会根据历史价格行为预测反转或延续。

B.风险管理

1.设置止损和止盈水平

管理风险对于外汇交易至关重要。交易者应设置适当的止损水平,以限制交易不利时的潜在损失。应根据潜在价格目标或关键支撑位和阻力位战略性地设置止盈水平。例如,如果交易者在AUD/CAD货币对上建立空头头寸(在观察十字星烛台图案后),并将基于风险回报率的水平确定为潜在的止盈和止损点,他们可以设置其止盈-相应的利润和止损订单。

资料来源:tradingview.com

2.根据风险承受能力确定头寸规模

头寸规模由风险承受能力决定,可以使用交易资本的百分比或根据入场点与止损水平之间的距离来计算。如果交易者愿意在单笔交易中冒2%的资本风险,并且入场点和止损点之间的距离为50点,那么他们可以相应地计算其头寸规模。

C.新闻交易

1.关注经济事件和数据发布

经济指标、利率决策和地缘政治新闻都会对货币对产生重大影响。交易者需要随时了解即将发生的可能影响澳元和加元的经济事件和数据发布。例如,如果澳大利亚储备银行宣布利率决定,交易者应为AUD/CAD货币对的潜在波动做好准备。

2.根据市场对新闻的反应进行交易

新闻交易涉及根据市场对重大新闻事件的即时反应建立头寸。如果澳大利亚发布的就业数据好于预期,导致澳元飙升,交易者可能会考虑建立AUD/CAD货币对的多头头寸,预计澳元将持续走强。

在VSTAR交易AUD/CAD差价合约

使用VSTAR进行外汇交易具有几个关键优势,可以潜在地增强交易者在动态外汇市场中的体验和成果。该公司具有竞争力的杠杆、深厚的流动性、低点差以及对最佳执行的承诺增强了其吸引力。然而,必须严格评估这些功能才能做出明智的决策。

竞争优势:

VSTAR强调高达1:200的竞争杠杆,具体取决于工具。杠杆允许交易者以较少的资金控制较大的头寸,从而可能放大利润和损失。虽然较高的杠杆可以提供更多的交易机会,但它也会增加风险。交易者在使用高杠杆之前应谨慎行事并考虑其风险承受能力。

示例:如果交易者对1,000美元的交易账户使用1:100的杠杆,他们可以控制100,000美元的头寸规模。对他们有利的1%的价格变动可能会导致1,000美元的利润或损失,这是整个账户资本。

顶级深度流动性:

VSTAR强调由于顶级的深度流动性而快速执行交易。流动性是指在不引起重大价格变化的情况下购买或出售资产的难易程度。深厚的流动性可以促进更快的订单执行,从而有可能减少市场波动期间的滑点。然而,深度流动性也取决于市场状况,极端波动仍可能影响交易执行。

点差从0点开始:

低点差可以吸引交易者,因为它们降低了交易成本。点差是买入(卖出)价格和卖出(买入)价格之间的差额。更小的点差可以带来更具成本效益的交易,特别是对于高频交易者或从事倒卖策略的交易者而言。然而,交易者应该意识到,在流动性较低或市场波动加剧期间,点差可能会扩大。

有效执行:

VSTAR致力于提供有效的执行,确保订单以最佳市场价格执行并在几毫秒内执行。高效的执行对于捕捉所需的进入和退出点至关重要,尤其是对于短期交易者而言。最佳的执行可以最大限度地减少滑点并提高整体交易效率。

六、结论

A.AUD/CAD货币对基本面分析回顾

对AUD/CAD货币对的全面分析揭示了影响其行为的基本因素之间错综复杂的相互作用。经济指标、央行政策和地缘政治影响都会导致其波动和趋势。

经济指标审查强调了澳大利亚和加拿大经济之间的相关性,强调GDP增长、通膨率和利率对货币对的影响。澳大利亚储备银行的货币政策和加拿大央行的反应在影响该货币对走势方面发挥了关键作用。此外,中国对澳大利亚经济的影响以及影响加元的全球贸易紧张局势凸显了影响汇率的外部因素。

B.基于分析的看涨或看跌立场概述

看涨或看跌立场受到这些因素的影响。不同的货币政策导致利率差异,影响AUD/CAD汇率。此外,澳元对中国经济表现的敏感性以及加元对贸易紧张局势的敏感性导致了方向性偏差。

C.基于基本面分析和交易策略交易AUD/CAD货币对的最终想法

最终,AUD/CAD货币对的交易策略集中于技术分析、风险管理和新闻交易。识别趋势、利用指标、设定风险参数以及利用新闻驱动的波动性都是有效交易策略的关键组成部分。

总之,AUD/CAD货币对需要对宏观经济指标及其影响有细致的了解,以及明确的交易策略。成功交易该货币对需要基本面见解、技术工具和风险管理实践的和谐整合。交易者可以根据基本面分析和有效的交易策略不断完善自己的方法,从而应对该货币对的复杂性。

*免责声明:本文内容仅供学习,不代表VSTAR官方立场,也不能作为投资建议。