I. Introduction

The GBPNZD currency pair consists of the British pound and the New Zealand dollar. The British pound is among the world's most expensive currencies, while the New Zealand dollar is often perceived as a proxy for Chinese growth. GBPNZD is also referred to as the Pound Kiwi in the forex market.

Fundamental analysis is a method of evaluating the intrinsic value of a currency pair based on the economic, political, and social factors that affect the supply and demand of the currencies involved. Fundamental analysis can help traders to identify long-term trends and potential opportunities in the forex market.

II. Macroeconomic Overview - UK

A. Economic Indicators Review

1. GDP and Unemployment Rate

The UK's gross domestic product (GDP) measures the total value of goods and services produced in the country. It is an indicator of economic activity and growth. A higher GDP indicates a stronger economy and a higher demand for the British pound.

The UK's unemployment rate measures the percentage of people in the labor force who are actively looking for work but cannot find one. It is an indicator of labor market conditions and consumer confidence. A lower unemployment rate indicates a tighter labor market and higher consumer spending.

According to the latest data from the Office for National Statistics (ONS), the UK's unemployment rate was 4.8% in January-March 2023, down from 4.9% in December-February 2023. The unemployment rate was 0.8 percentage points higher than a year earlier. The number of unemployed people decreased by 121,000 to 1.63 million in January-March 2023.

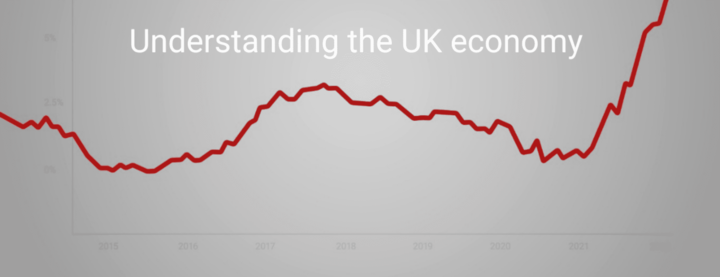

2. Inflation Rates

The UK's inflation rate measures the percentage change in the average prices of goods and services purchased by consumers over a certain period. It is an indicator of price stability and purchasing power. A higher inflation rate indicates a lower value of the British pound and a higher cost of living.

The UK's PPI output inflation rate was 4.6% in May 2023, up from 3.9% in April 2023. The PPI output inflation rate was at its highest level since February 2017. The main contributors to inflation were rising prices for crude oil, metals, chemicals, food products, and transportation equipment.

3. Business and Consumer Confidence

The UK's business confidence measures the degree of optimism or pessimism among business owners and managers regarding their current and future business conditions. It is an indicator of business activity and investment. Higher business confidence indicates a stronger economy and a higher demand for the British pound.

According to the latest data from GfK, the UK's consumer confidence index was -9 in June 2023, up from -10 in May 2023. The consumer confidence index was at its highest level since March 2020. The improvement in consumer confidence was mainly due to the easing of lockdown restrictions and the progress of the vaccination program.

B. Monetary Policy

1. Bank of England's Monetary Policy

The Bank of England (BoE) is the central bank of the UK. Its main objectives are to maintain price stability and to support economic growth and employment. The BoE sets its monetary policy by adjusting its policy interest rate, also known as the bank rate, and by conducting quantitative easing (QE), which involves buying government bonds and other assets to increase the money supply and lower long-term interest rates.

The BoE's current monetary policy stance is accommodative, meaning that it aims to stimulate economic activity and inflation by keeping interest rates low and the money supply high. The BoE has kept its base rate at 0.1% since March 2020, when it cut it twice from 0.75% in response to the coronavirus pandemic. The BoE has also increased its QE program from £435 billion in March 2020 to £895 billion in November 2020, consisting of £875 billion of government bonds and £20 billion of corporate bonds.

2. Interest Rate Expectations

The interest rate expectations reflect the market's anticipation of future changes in the BoE's monetary policy based on its economic outlook and inflation target. The interest rate expectations affect the value of the British pound, as a higher expected interest rate increases the demand for and the return on holding the currency.

According to the latest data from Bloomberg, as of July 12, 2023, the market expects that the BoE will start raising its bank rate from 0.1% to 0.25% in May 2024, followed by another hike to 0.5% in November 2024. The market also expects that the BoE will start tapering its QE program from August 2023, reducing its monthly purchases from 4.4 billion pounds to zero by February 2024.

Source: LSE

C. Political Climate

1. Economic policies of the government

The economic policies of the government refer to its fiscal policy, which involves adjusting its spending and taxation levels to influence economic activity and public finances; and its trade policy, which involves negotiating trade agreements with other countries or regions to facilitate trade flows and protect domestic industries.

The UK's current government is led by the Conservative Party, which has a majority in Parliament since December 2019. The government's main economic policies are:

● Fiscal policy: The government has implemented a series of fiscal stimulus measures to support the economy and mitigate the impact of the pandemic.

● Trade policy: The government completed its withdrawal from the European Union (EU) on December 31, 2020, after reaching a trade and cooperation agreement with the EU that preserves tariff-free and quota-free trade in goods.

2. Impact of Brexit on the UK economy

Brexit refers to the UK's exit from the EU, which was triggered by a referendum held in June 2016, where 52% of voters opted to leave the EU. Brexit has been one of the most significant and controversial political events in the UK's history, as it has implications for various aspects of its economy, such as trade, investment, immigration, regulation, and sovereignty.

The impact of Brexit on the UK economy is still uncertain and depends on several factors, such as the outcome of the negotiations with the EU and other trading partners; the adjustment costs and benefits for businesses and consumers, and the policy responses of the government and the BoE. However, some possible effects of Brexit are:

● Trade: Brexit creates trade barriers, affecting UK-EU and other preferential trade agreements. It could reduce trade by 15% to 37%, impacting economic growth, productivity, income, and employment in the UK and EU.

● Investment: Brexit is expected to decrease FDI inflows to the UK from EU and non-EU sources, as it diminishes the country's investment appeal due to loss of access to the EU's single market, increased uncertainty and risk, and lower growth prospects. A study suggests a potential 22% decline in FDI in the long term, impacting economic growth, productivity, innovation, and competitiveness in the UK.

● Immigration: Brexit is likely to reduce immigration flows into the UK from both EU and non-EU sources. This is because Brexit ends the free movement of people between the UK and the EU, imposes stricter immigration controls and criteria, and reduces the demand for and supply of labor in the UK.

III. Macroeconomic Overview - New Zealand

Source: Rabobank

A. Economic Indicators Review

1. GDP and Unemployment Rate

New Zealand's gross domestic product (GDP) measures the total value of goods and services produced in the country. It is an indicator of economic activity and growth. A higher GDP indicates a stronger economy and a higher demand for the New Zealand dollar.

According to the latest data from Statistics New Zealand, New Zealand's GDP grew by 1.6% in March 2023, following a 1% growth in December 2022. The GDP was 2.4% higher than its pre-pandemic level in December 2019. The main contributors to the GDP growth were the service, manufacturing, and construction sectors.

New Zealand's unemployment rate was 4.7% in March 2023, unchanged from December 2022. The unemployment rate was 0.6 percentage points higher than a year earlier. The number of unemployed people increased by 2,000 to 141,000 in March 2023.

2. Inflation Rates

New Zealand's inflation rate measures the percentage change in the average prices of goods and services purchased by consumers over some time. It is an indicator of price stability and purchasing power. A higher inflation rate indicates a lower value of the New Zealand dollar and a higher cost of living.

According to the latest data from Statistics New Zealand, New Zealand's CPI inflation rate was 1.5% in March 2023, up from 1.4% in December 2022. The CPI inflation rate was within the RBNZ's target range of 1% to 3%. The main drivers of inflation were rising prices for transport, housing, and food.

New Zealand's PPI output inflation rate was 0.8% in March 2023, down from 1.3% in December 2022. The PPI output inflation rate was at its lowest level since June 2019. The main contributors to inflation were rising prices for dairy products, meat products, and electricity.

3. Business and Consumer Confidence

New Zealand's business confidence measures the degree of optimism or pessimism among business owners and managers regarding their current and future business conditions. It is an indicator of business activity and investment. Higher business confidence indicates a stronger economy and a higher demand for the New Zealand dollar.

According to the latest data from ANZ, New Zealand's business confidence index was -0.4 in June 2023, up from -2 in May 2023. The business confidence index was at its highest level since February 2020. The improvement in business confidence was mainly due to the easing of Covid-19 restrictions, the recovery of domestic demand, and the resilience of export sectors.

B. Monetary Policy

1. Reserve Bank of New Zealand's Monetary Policy

The Reserve Bank of New Zealand (RBNZ) is the central bank of New Zealand. Its main objectives are to maintain price stability and to support economic growth and employment. The RBNZ sets its monetary policy by adjusting its official cash rate (OCR), which is the interest rate paid by banks on overnight loans from the RBNZ; and by conducting large-scale asset purchases (LSAP), which involve buying government bonds and other assets to increase the money supply and lower long-term interest rates.

The RBNZ's current monetary policy stance is accommodative, meaning that it aims to stimulate economic activity and inflation by keeping interest rates low and money supply high. The RBNZ has maintained its OCR at 0.25% since March 2020, when it cut it from 1% in response to the coronavirus pandemic. The RBNZ has also increased its LSAP program from NZD 30 billion in March 2020 to NZD 100 billion in August 2020, consisting of NZD 60 billion of government bonds, NZD 28 billion of local government funding agency bonds, and NZD 12 billion of inflation-indexed bonds.

2. Interest Rate Expectations

The interest rate expectations reflect the market's anticipation of future changes in the RBNZ's monetary policy based on its economic outlook and inflation target. The interest rate expectations affect the value of the New Zealand dollar, as a higher expected interest rate increases the demand for and the return on holding the currency.

According to the latest data from Bloomberg, as of July 12, 2023, the market expects that the RBNZ will start raising its OCR from 0.25% to 0.5% in November 2023, followed by another hike to 0.75% in February 2024. The market also expects that the RBNZ will start tapering its LSAP program from August 2023, reducing its monthly purchases from NZD 2 billion to zero by February 2024.

C. Political Climate

1. Economic policies of the government

The economic policies of the government refer to its fiscal policy, which involves adjusting its spending and taxation levels to influence economic activity and public finances; and its trade policy, which involves negotiating trade agreements with other countries or regions to facilitate trade flows and protect domestic industries.

New Zealand's current government is led by Prime Minister Jacinda Ardern of the Labour Party, which has had the majority in Parliament since October 2020. The government's main economic policies are:

● Fiscal policy: The government has implemented a series of fiscal stimulus measures to support the economy and mitigate the impact of the pandemic, including a wage subsidy scheme that pays up to NZ$585 per week per employee, a business finance guarantee scheme that provides loans to small businesses, and various tax relief measures.

● Trade policy: The government has maintained its commitment to free trade and multilateralism, as it believes that trade is essential for New Zealand's economic prosperity and security.

2. Impact of commodity prices on the New Zealand economy

Commodity prices refer to the prices of raw materials or primary products that are traded in global markets, such as dairy products, meat products, wool products, wood products, metals, oil, and gas. Commodity prices are influenced by various factors, such as supply and demand conditions, weather patterns, geopolitical events, and exchange rates.

According to the latest data from ANZ, New Zealand's commodity price index was 9.8% higher in June 2023 than a year earlier, driven by strong demand and tight supply for dairy products, meat products, and wood products. The commodity price index was also 5.4% higher in New Zealand dollar terms, as the exchange rate depreciated against most major currencies.

The rise in commodity prices is expected to have a positive impact on New Zealand's economy, as it boosts its export earnings, terms of trade, income levels, and inflation rates. However, it could also have some negative effects, such as increasing the cost of production and consumption for some sectors and households and creating volatility and uncertainty for exporters and importers.

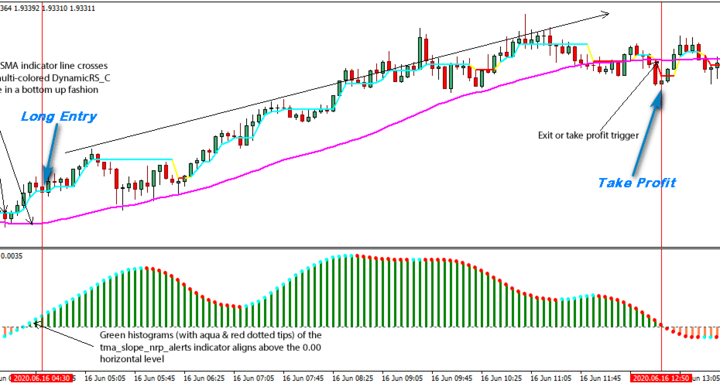

Source: admiralmarkets

IV. Analysis of the GBPNZD Currency Pair

A. Relevant Economic Indicators

1. Correlation between the UK and New Zealand economies

The correlation between the UK and New Zealand economies measures the degree of similarity or difference in their economic performance and outlook. It is an indicator of how the GBPNZD currency pair moves in response to changes in economic conditions in both countries. A positive correlation indicates that the GBPNZD currency pair tends to move in the same direction as the UK and New Zealand economies, while a negative correlation indicates that it tends to move in the opposite direction.

A study has shown that the correlation between the UK and New Zealand economies was 0.32 in 2019, based on their GDP growth rates. This means that there was a moderate positive correlation between the UK and New Zealand economies, implying that the GBP NZD currency pair tended to move in the same direction as their economic growth rates.

2. Impact of GDP growth, inflation rates, and interest rates on the currency pair

The impact of GDP growth, inflation rates, and interest rates on the currency pair reflects how the GBP NZD currency pair responds to changes in these economic indicators in both countries. It is an indicator of how the relative strength or weakness of each currency affects the exchange rate between them. A higher GDP growth, inflation rate, or interest rate in one country relative to another country tends to increase the value of its currency relative to the other currency.

Growth, inflation rates, and interest rates have different effects on different currency pairs, depending on their characteristics and market conditions. However, some general patterns are:

● GDP growth: A higher GDP growth in one country relative to another country tends to increase the value of its currency relative to the other currency, as it indicates a stronger economy and a higher demand for its currency.

● Inflation rates: A higher inflation rate in one country relative to another country tends to decrease the value of its currency relative to the other currency, as it indicates a lower purchasing power and a higher cost of living.

● Interest rates: A higher interest rate in one country relative to another country tends to increase the value of its currency relative to the other currency, as it indicates a higher return and attractiveness of holding its currency.

Based on these patterns, we can expect that the GBPNZD currency pair will be influenced by the relative differences in GDP growth, inflation rates, and interest rates between the UK and New Zealand.

B. Factors Supporting a Bullish or Bearish Stance

1. Impact of the Bank of England's monetary policy on the currency pair

The impact of the Bank of England's monetary policy on the currency pair reflects how the GBP/NZD currency pair reacts to changes in the BoE's monetary policy stance and actions. It is an indicator of how the BoE's monetary policy affects the supply and demand of the British pound in relation to the New Zealand dollar. A more hawkish monetary policy stance, which involves raising interest rates or reducing QE, tends to increase the value of the British pound relative to the New Zealand dollar, while a more dovish monetary policy stance, which involves lowering interest rates or increasing QE, tends to decrease it.

2. Impact of Reserve Bank of New Zealand's monetary policy on the currency pair

The impact of the Reserve Bank of New Zealand's monetary policy on the currency pair reflects how the GBPNZD currency pair reacts to changes in the RBNZ's monetary policy stance and actions. It is an indicator of how the RBNZ's monetary policy affects the supply and demand of the New Zealand dollar in relation to the British pound. A more hawkish monetary policy stance, which involves raising interest rates or reducing LSAP, tends to increase the value of the New Zealand dollar relative to the British pound, while a more dovish monetary policy stance, which involves lowering interest rates or increasing LSAP, tends to decrease it.

3. Impact of Brexit on the UK economy

The impact of Brexit on the UK economy reflects how the GBPNZD currency pair responds to changes in the UK's economic performance and outlook as a result of its withdrawal from the EU. It is an indicator of how Brexit affects the supply and demand of the British pound in relation to the New Zealand dollar. A positive impact of Brexit on the UK economy, which involves higher growth, lower inflation, or better trade deals, tends to increase the value of the British pound relative to the New Zealand dollar, while a negative impact of Brexit on the UK economy, which involves lower growth, higher inflation, or worse trade deals, tends to decrease it.

C. Potential Risks to the Currency Pair

1. Sudden changes in global economic growth

Sudden changes in global economic growth refer to unexpected shocks or events that affect the global economy positively or negatively, such as natural disasters, pandemics, wars, or technological breakthroughs. Sudden changes in global economic growth affect the GBP/NZD currency pair by changing the relative economic performance and outlook of the UK and New Zealand, as well as their trade and financial linkages with other countries. Sudden changes in global economic growth can also affect the risk appetite and sentiment of investors and traders, which can influence their demand for and supply of different currencies.

2. Unpredicted changes in UK or New Zealand monetary policies

Unpredicted changes in UK or New Zealand monetary policies refer to unexpected decisions or actions by the BoE or the RBNZ that deviate from their previous guidance or market expectations, such as raising or lowering interest rates, increasing or decreasing QE or LSAP, or introducing new policy tools or measures. Unpredicted changes in UK or New Zealand monetary policies affect the GBP NZD currency pair by changing the relative interest rate differential and money supply between the British pound and the New Zealand dollar, as well as their attractiveness and return for investors and traders.

3. Geopolitical risks, such as trade tensions between the U.S. and China

Geopolitical risks refer to political or diplomatic conflicts or tensions between countries or regions that affect their economic and security interests, such as trade wars, sanctions, tariffs, or military actions. Geopolitical risks affect the GBPNZD currency pair by changing the global trade and financial environment, as well as the risk appetite and sentiment of investors and traders, which can influence their demand for and supply of different currencies.

V. Trading Strategies for GBPNZD

A. Technical Analysis

Technical analysis is a method of analyzing and forecasting the price movements and trends of a currency pair based on its historical price patterns and indicators, such as support and resistance levels, trend lines, moving averages, Fibonacci retracements, oscillators, and candlestick formations. Technical analysis can help traders to identify entry and exit points, as well as to determine the direction and strength of a trend.

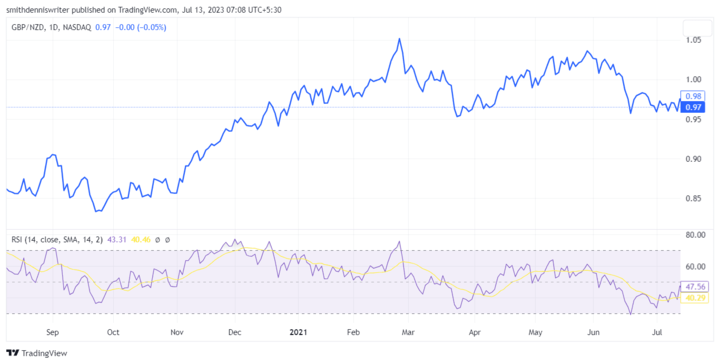

According to the latest data from TradingView, as of July 12, 2023, the GBPNZD currency pair was trading at 0.97, within a descending channel that has been forming since April 2020. The currency pair was below its 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. The currency pair was also below its 50% Fibonacci retracement level of 0.9568, which acted as a resistance level. The relative strength index (RSI) was at 40.29, indicating a neutral momentum.

Source: tradingview

Based on these technical indicators, we can expect that the GBPNZD currency pair will continue to trade within its descending channel in the near term, with a potential to break below its lower trend line at 0.9300, which could open the way for further downside towards its next support level at 0.9000. Alternatively, if the currency pair manages to break above its upper trend line at 0.9600, which could act as a resistance level, it could signal a reversal of the trend and open the way for further upside towards its next resistance level at 1.0500.

B. Risk Management

Risk management is a method of controlling and minimizing the potential losses and risks associated with trading a currency pair, such as market risk, liquidity risk, leverage risk, or operational risk. Risk management can help traders to protect their capital and achieve consistent returns.

Some of the common risk management techniques are:

● Setting stop-loss and take-profit levels: Stop-loss and take-profit levels are predefined price levels that automatically close a trade when it reaches a certain amount of loss or profit. Stop-loss and take-profit levels can help traders to lock in their profits and limit their losses, as well as to avoid emotional or impulsive trading decisions.

● Determining position size based on risk tolerance: Position size refers to the amount of money or units that a trader invests in a trade. Position size should be determined based on the trader's risk tolerance, which is the maximum amount of money or percentage of capital that a trader is willing to lose in a trade.

C. News Trading

News trading is a method of trading a currency pair based on its reaction to economic events and data releases that affect its supply and demand, such as GDP growth, inflation rates, interest rates, trade balance, employment reports, consumer confidence, business confidence, PMI, etc. News trading can help traders to capture short-term price movements and volatility.

Some of the common news trading techniques are:

● Following economic events and data releases: Economic events and data releases are scheduled announcements or publications of economic indicators or statistics that reflect the economic performance and outlook of a country or region.

● Trading based on market reactions to the news: Market reactions to news refer to how the price of a currency pair changes in response to an economic event or data release, compared to its previous level or market expectation.

VI. Trade GBPNZD with VSTAR

VSTAR is a leading online forex broker that offers competitive spreads, fast execution, and reliable customer service. VSTAR provides access to over 50 currency pairs, including the GBPNZD, as well as other financial instruments such as CFDs, etc. VSTAR also offers various trading platforms, tools, and resources to help traders of all levels and styles to succeed in the forex market.

Whether you are a beginner or an expert trader, VSTAR can help you to trade GBPNZD with confidence and convenience. Join VSTAR today and enjoy these benefits:

● Low spreads from 0.1 pips

● High leverage up to 1:200

● 24/7customer support

● Free demo account

● Mobile trading app

● Trading signals and indicators

● Economic calendar and news

● Trading education

VII. Conclusion

In this article, we have conducted a fundamental analysis of the GBPNZD currency pair by examining the macroeconomic factors that influence the British pound and the New Zealand dollar, such as GDP growth, inflation rates, interest rates, monetary policies, and political climates. We have also analyzed the relevant economic indicators and factors that support a bullish or bearish stance on the currency pair, as well as the potential risks that could affect its performance.

Based on our analysis, we can conclude that the GBP to NZD currency pair is likely to trade within a bearish trend in the near term, as the UK's economic recovery and inflation prospects are weaker than New Zealand's, and as the BoE's monetary policy stance is more dovish than the RBNZ's. However, some factors could support a bullish reversal of the trend in the medium to long term.

Therefore, traders who want to trade the GBPNZD currency pair should pay attention to the economic events and data releases in both countries, as well as the global trade and financial environment, and use appropriate technical indicators, risk management techniques, and news trading techniques to capture the price movements and volatility of the currency pair.