Introduction

Owning best value stocks means having a stake in a business and understanding the types is crucial. Value stocks attract savvy investors because they consistently profit and offer dividends, even if undervalued. On the flip side, growth stocks appeal to those eyeing substantial returns with a focus on rapid sales and earnings growth. Income stocks ensure a steady income through regular dividends. Blue-chip stocks, from reputable companies, are seen as safer investments.

Small-cap stocks offer growth potential but come with higher risk, while big-cap stocks provide stability. Value stocks offer a safety net with reduced prices, consistent dividends, and the potential for substantial gains during market corrections.

Value stocks contribute to a well-rounded portfolio with safety, income, and growth potential.

What Are Value Stocks

Value stocks are considered undervalued in the stock market. Many investors think the market overreacts to news, inaccurately causing stock prices to reflect a company's fundamentals. So, stocks trading below their intrinsic value are called value stocks.

Investing in value stocks, or value investing, relies on believing that the market will eventually recognize their true potential. This recognition is expected to drive prices up, leading to good profits. In simple terms, value stocks are bargains waiting to be acknowledged for their actual worth, allowing investors to benefit from the market's eventual correction.

Definition of Value Stocks

VValue stocks are stocks of companies that are considered to be undervalued relative to their actual worth. This means that investors can purchase these stocks at a lower price than the stock's estimated fundamental value. A low price-to-earnings (P/E) ratio, a low price-to-book ratio, or other fundamental indicators are common financial metrics used to classify companies. The market has temporarily disconnected the stock price from the real worth of the underlying assets and profits, according to value stock investors, who feel that these businesses have reached their full potential.

However, investors seeking a blend of income and capital appreciation with an emphasis on long-term value find value stocks appealing since they are generally linked to companies with consistent profitability, strong fundamentals, and dividend payments. Finding these opportunities, predicting their eventual market correction, and profiting from the possible upward price adjustment comprise the value stock investing method.

Characteristics of Value Stocks

Value investors aim to make profits by purchasing stocks at discounted prices. Identifying if a stock is discounted involves calculating its intrinsic value, which includes assessing financial aspects like cash flows, revenues, profits, and fundamental factors such as brand, business model, and market structure. When selecting best value stocks, these considerations are vital.

- High Dividend Yield: A stock may qualify as a value stock if it offers a high dividend yield, exceeding industry or historical averages. This indicates a potential for a respectable income from the stock's price. A high dividend-yielding company attracts value-seeking investors, providing both income and dividends.

- Low Price-to-Book (P/B) Ratio: The P/B ratio, calculated by dividing a company's stock price by its book value per share, indicates potential cheapness. A low P/B ratio suggests that the market may be undervaluing the company's shares relative to its true net value, making it an effective tool for identifying value stocks.

- Low Price-to-Earnings (P/E) Ratio: A low P/E ratio (calculated by dividing a company's stock price by its earnings per share) suggests potential undervaluation by the market. This ratio aids investors in understanding whether the market is underestimating a company's future earnings potential, providing a signal for potential bargains.

- Established Companies: This characteristic involves examining a company's historical earnings and projected growth. An undervalued company may be considered a value stock if its current price is lower than its projected earnings growth. This presents an opportunity for investors seeking growth potential at a discounted price.

In essence, value investing involves recognizing discounted stocks' intrinsic value, and offering income and potential appreciation opportunities.

Value Stocks vs Growth Stocks

Growth stocks are those associated with companies deemed to have longer-term prospects than the market as a whole. Value stocks, on the other hand, are shares of businesses that are now selling below their true value and have the potential to yield a higher return.

Due to their potential in the future, growth stocks are expected to do better than the market. Value stocks, on the other hand, are seen to be cheap and are trading below their true value. Considering the investor's time horizon and risk, one must decide which approach is better: value or growth stocks.

Growth stocks are essentially about promise for the future, but value stocks provide a chance to profit from current undervaluation. The investor's comfort level with risk and the time they want to stay involved will determine the course of action to pursue.

Value vs Growth Stocks: Key Differences

Value and growth stocks are perceived differently by investors, based on their expectations and understanding of the market. Growth stocks are expected to provide major profits because of their resilient business development, which frequently results in what appear to be high price-to-earnings (P/E) ratios.

Value stocks, on the other hand, tend to get overlooked by the market and may even be undervalued. Even though there is no certainty of quick value appreciation, investors seek dividends from value stocks, which lowers price-to-earnings (P/E) ratios.

Here are some key differences between value stocks and growth stocks:

|

|

Value Stocks |

Growth Stocks |

|

Valuation |

Typical valuation metrics, such as dividend yield, PB, and PE ratios, help figure out-of-value stocks. They aim to reveal if a stock trades below its rivals in the same sector or below its fundamentals. |

The price-to-sales (P/S) ratio and the future PE ratio are two atypical metrics used to analyze growth stocks. These indicators project future growth as opposed to conventional measurements that rely on book value or current profitability. |

|

Expected returns |

Value stocks draw investors looking for high dividend yields because they frequently emphasize paying dividends. |

Growth stocks give more importance to reinvested earnings for corporate expansion than to dividend payments. |

|

Volatility |

Compared to growth investments, value stocks usually carry a smaller risk. |

Growth stocks are inclined towards volatility; they may do well in an expanding economy but may see losses in contracting. |

|

Investor goals |

The goal is to identify stocks that are cheap concerning their actual worth. Investors look for stocks that are trading below their true value. |

Stocks from companies with the potential for faster-than-average growth in sales, profitability, or market share are the main focus. |

|

Investment Horizon |

Value stocks frequently have a short investment horizon |

Growth stocks are often done over a long period. |

Growth vs Value Stocks: Which Is Better?

Stock market investing is an individual journey influenced by variables such as time commitment, financial objectives, and risk tolerance. A plan that suits one investor may not suit another; there is no one-size-fits-all approach. Growth stocks with high earning potential appeal to younger investors with a lengthy time horizon who are ready to take on more risks.

However, many investors take a more balanced approach, combining value and growth equities. This versatile portfolio approach seeks fair returns while monitoring noteworthy opportunities for growth. The secret is to identify the ideal combination that supports each investor's objectives and enables them to ride out market ups and downs according to their personal circumstances and style.

How to Find Value Stocks

A value stock is usually priced lower because investors perceive the company negatively. It's often associated with mature companies having stable dividends and facing temporary challenges. Conversely, companies that recently issued stocks might have high-value potential, especially if many investors are unaware of them.

There are several ways to assess whether a stock is undervalued:

Dividend Yield

If a stock yields a large dividend, it is considered a value stock. A firm becomes enticing when its price is affordable and its dividend yield is strong, especially if it exceeds industry or historical averages. In essence, a high dividend yield indicates that, about the stock's price, investors may expect to receive a stable income. This is comparable to a steady return on investment through regular dividend payments.

Hence, a company with a high dividend yield is worth considering for investors seeking value, as it provides income and dividends.

P/E Ratio

The P/E ratio compares a company's stock price to earnings per share (EPS). In simpler terms, it tells you how much investors will pay for $1 of the company's profit.

A high P/E ratio indicates that investors might expect high future growth, but also suggests the stock might be overvalued. On the other hand, the lower P/E ratio could mean the stock is undervalued, but it might also reflect slow growth prospects.

P/B Ratio

Dividing a corporation's stock price by its book value per share yields the price-to-book ratio or P/B. The entire assets less any liabilities are represented as book value. A low price-to-book ratio (P/B) indicates that a stock may be cheap. When finding value stocks, this ratio becomes a useful tool. Put differently, it facilitates investors' comprehension of whether the market undervalues a company's shares relative to its true net value.

The P/B ratio is a helpful statistic in the quest for value investing since investors eager to identify cheap companies frequently view it as a significant signal.

Historical and Anticipated Earnings Growth

An undervalued company may be considered a value stock if its price is lower than its projected earnings growth. Stated differently, investors try to determine if the market believes the company's potential for future profits is lower than it is. This may be a good chance for stock investors looking for growth potential that is currently undervalued.

Investors seeking growth and value in their investments may be drawn to stocks with projected earnings growth that deviates from the current market price.

Industry Position & Market Environment

Value stocks are often associated with larger, more established corporations, which theoretically reflects lower risk and volatility. They could still provide capital growth even if they fall short of the anticipated target price.

Why Some Stocks Are Undervalued

There are several reasons why stocks may be undervalued, including temporary setbacks, being overlooked by investors, or industry pessimism. A stock's price may fall below its intrinsic worth due to temporary setbacks like a poor quarter or a lawsuit. Furthermore, investors may pass away possibilities if they are unaware of something or prefer to focus on other industries.

Industry pessimism, in which an unfavorable perception of a certain industry influences stock prices despite the success of individual companies, can also be a factor. These elements may cause an undervaluation, allowing keen investors to profit from potential future gains.

Top 4 Best Value Stocks

PayPal (PYPL)

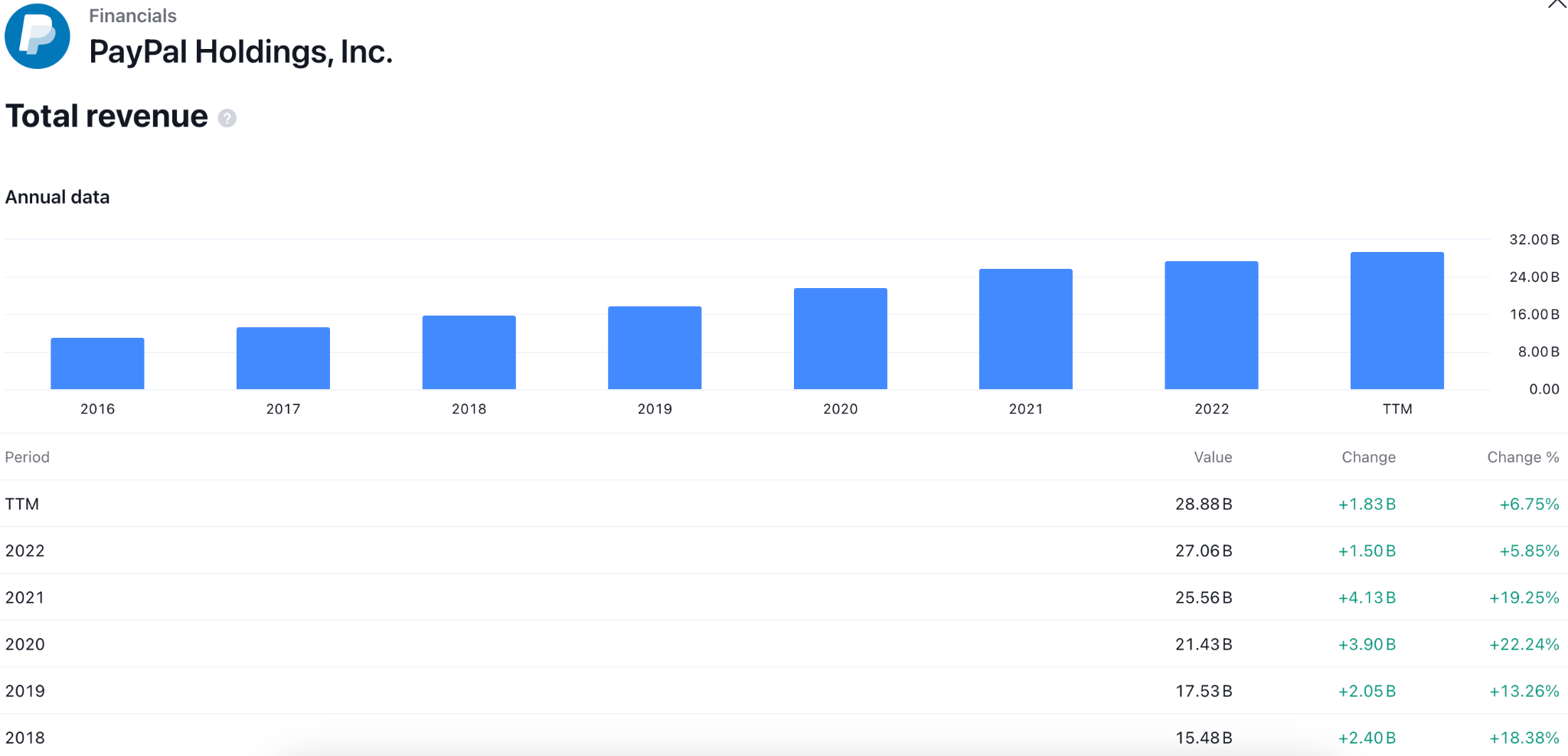

PayPal (PYPL), with a current price of $63.80, is unique in the information technology industry. Persistence is demonstrated by its consistency within a daily range of $62.07 to $64.50, with a small daily movement of 0.1% at $0.04. PayPal has a market value of $69 billion, generates $27.06 billion in revenue, and has a strong gross margin of 39.69%. Its earnings per share is $3.36. Situated in the IT services industry, it provides investors with stability and growth possibilities.

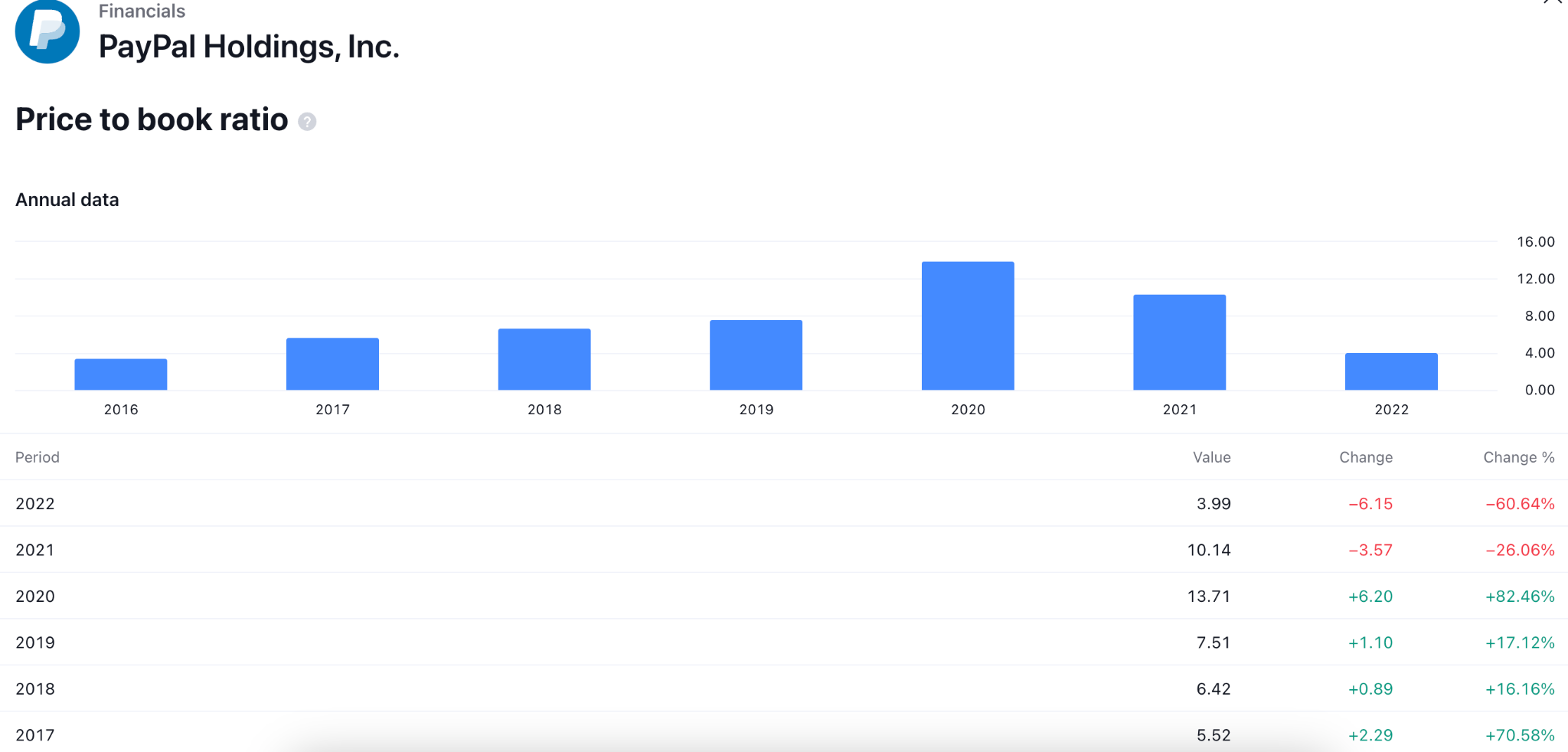

Moreover, examining PayPal's (PYPL) value metrics yields some interesting numbers. Given that the Price to Book ratio declined by 34.9% and the Price to Earnings ratio plummeted by 60.2% Year Over Year (YOY), the market may have undervalued it.

Although there were warning indicators such as a notable drop in Price to Sales and Enterprise Value to EBITDA, the Return on Equity showed a solid performance, rising by 73.4% year over year. PayPal's potential is further demonstrated by its Free Cash Flow Yield, which is more than 4%.

PayPal Stock (PYPL) Outlook 2024 And Beyond

The stock price has decreased for over two years, with net profits dropping significantly since 2021. This decline is partially attributed to post-pandemic normalization and stiff competition from players like Apple Pay.

Among recent developments, the new CEO appointment is a crucial event for PayPal stock (PYPL). The company appointed Alex Chriss as its new CEO in December 2023 and investors eagerly await his strategy to address the declining stock price. Chriss's background suggests a potential shift towards strengthening PayPal's position in the SMB sector. Integrating various financial tools within the PayPal app is another factor that could attract and retain users.

Investors should closely monitor upcoming earnings reports to gauge Chriss' recovery plan. Maintaining a strong foothold in physical stores would be a supportive feature of the company despite competition from Apple's tap-to-pay solutions, which is a key challenge.

Leveraging Venmo and Honey would be another growth potential as both platforms aim to maximize PayPal's value. Also, PayPal's healthy cash reserves could fuel strategic acquisitions to bolster its offerings.

PayPal Stock Forecast

Paypal Stock (PYPL) remained sideways after the 2022 market crash. However, the recent consolidation in 2023 suggests a possible buyers accumulation, which needs confirmation from the near-term price action.

A falling wedge breakout is present in the weekly chart, where a valid weekly price above the 76.17 level would be the first signal of a bull run. Moreover, a stable market above the 103.30 resistance could open the room to reach the 250.00 area.

FedEx (FDX)

FedEx (FDX) is a well-known business providing various commercial and transportation services worldwide since 1971. FedEx is based in Memphis, Tennessee, and offers specialized transportation and supply chain management solutions and express ground, and freight transportation services. FedEx appeals to investors looking for value and diversity because of its wide business.

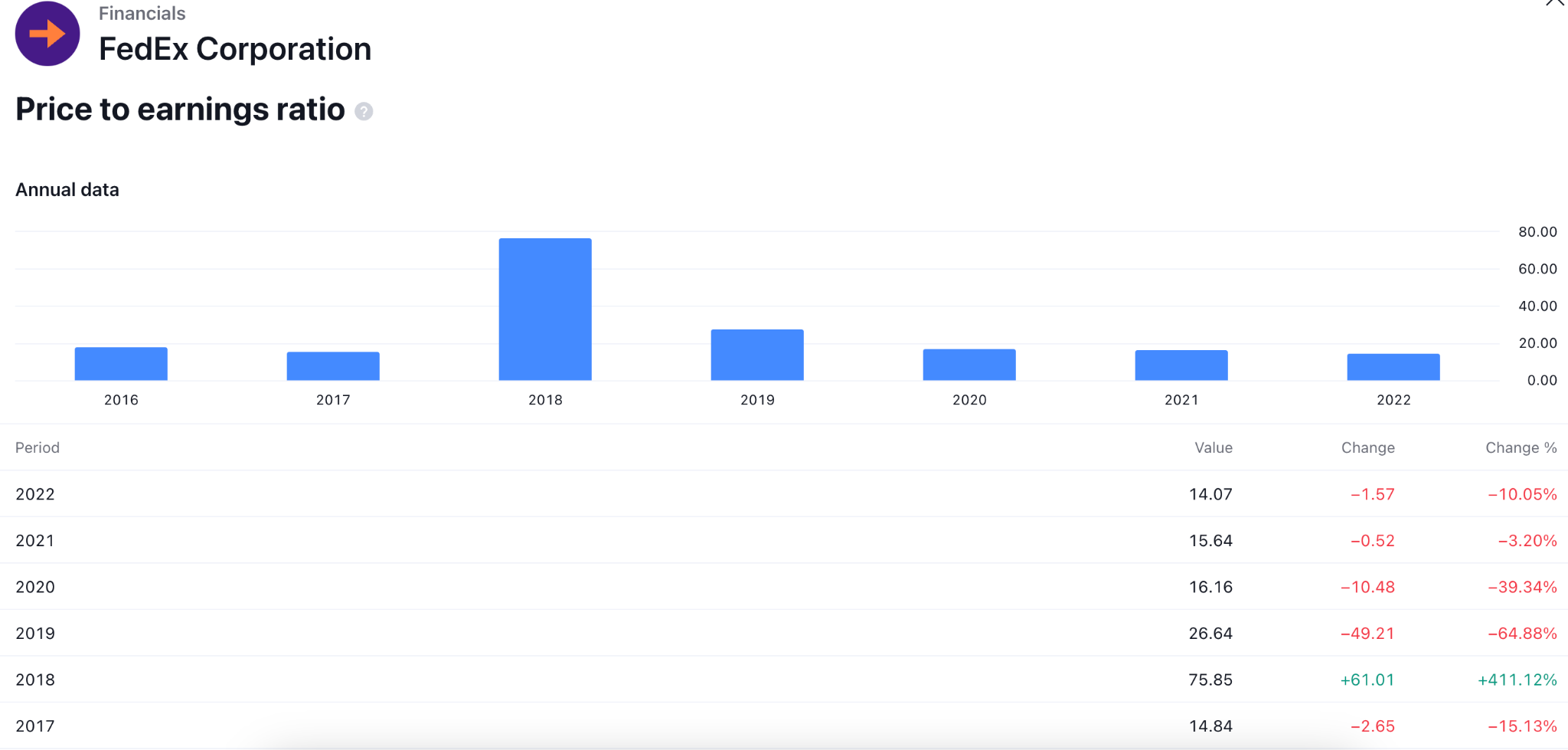

Based on value measures analysis, FedEx's trailing PE ratio of 14.39 and its forward PE of 13.02 suggest that the market is undervaluing the company. The PEG ratio of 1.08 indicates room for expansion.

Its attractiveness is further enhanced by a notable YoY dividend growth of 17.38% and a 2.07% dividend yield. A 5.46% shareholder yield and a 7.08% earnings yield make FedEx a compelling option for value investors.

FedEX Stock (FDX) Outlook 2024 And Beyond

FedEx showed an impressive development in recent days, which could influence investors to keep this stock in their portfolios. Some key factors are as follows:

- FDX has invested heavily in expanding its global network and automating operations to improve efficiency and capacity. Under this development, crucial actions like opening new hubs, acquiring robots for sorting, and deploying autonomous delivery vehicles are significant.

- The recent surge in online business benefited FDX as demand for parcel delivery surged but the rising fuel costs and labor shortages are factors to consider.

- FDX has invested in technologies like autonomous drones and artificial intelligence to optimize routes, predict demand, and enhance security.

Now move to future plans of the company, which could work as a strong bullish factor for the company:

- FDX management decided to improve its profit margins by optimizing costs and raising prices strategically, which could affect the stock price positively. Moreover, expanding higher-margin services like international shipping and healthcare logistics would work as a positive factor.

- As e-commerce growth is anticipated to continue, FDX is making necessary preparations for its network in order to accommodate the growing volume.

- In particular, FDX intends to expand its international service and network offerings in emerging markets.

- To bolster its capacities in domains such as logistics technology or last-mile delivery, FDX might contemplate the pursuit of strategic acquisitions.

FedEx Stock Forecast

In the weekly chart of FDX, the broader market direction is bullish, supported by the 10-week Simple Moving Average level. Moreover, a strong V-shape recovery is present from the 224.49 bottom.

Primarily, an immediate bullish rebound is possible as long as the price trades above the 224.49 level. Below this line, a considerable correction might happen towards the 180.00 to 165.00 zone before forming another long signal.

In both cases, the primary intention for the upward possibility is to test the 320.21 resistance level before making a new all-time high.

Lockheed Martin (LMT)

Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space are the four divisions in which Lockheed Martin Corporation focuses on cutting-edge technology, making it a global leader in aerospace and security. It contributes by investigating, creating, and manufacturing cutting-edge industrial and military applications technologies.

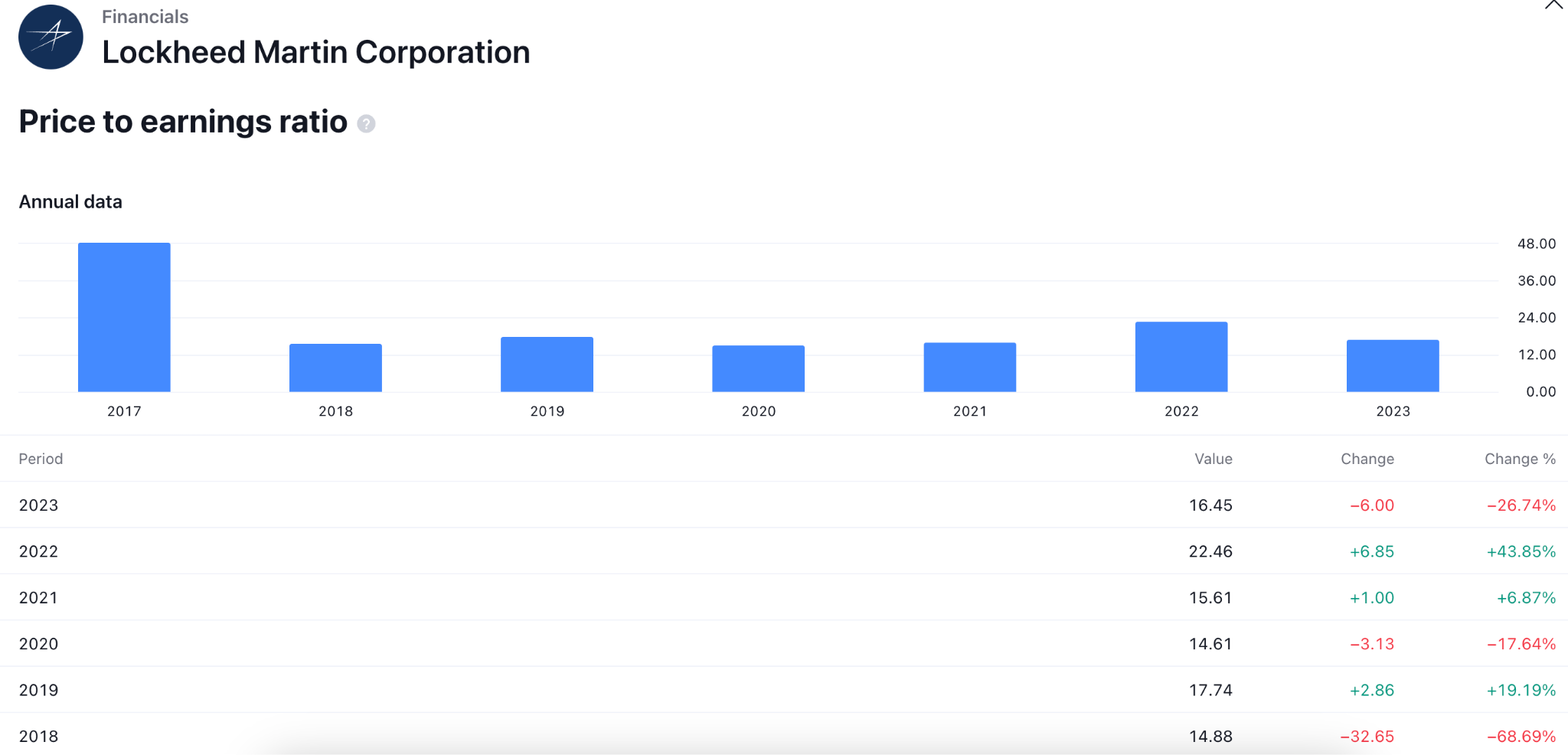

With a trailing P/E ratio of 15.54 and a prospective P/E ratio of 16.50, the market appears to value it appropriately. However, a PEG ratio of 4.23 makes one wonder about potential future growth.

The company has a forecast annual dividend yield of 2.94% with a payout ratio of 44.10%. Analyzing the industrial environment and its place in the market is essential. With a market worth of $103.43 billion, Lockheed Martin is an important player in the military and aerospace sector.

Lockheed Martin Stock (LMT) Outlook 2024 And Beyond

Let's look at recent developments of LMT that can grab massive investors attention:

- LMT once again delivered a robust quarter in the third quarter of 2023, surpassing analysts' anticipated revenue and earnings growth. The company attributes this to the continued demand for its fundamental defense products and programs.

- Positioned for future commercial opportunities and conflicts, LMT is making substantial investments in artificial intelligence, hypersonic weapons, and space technologies.

- For its F-35 fighter jets, LMT is actively pursuing international sales, having secured contracts in India, Poland, and the Czech Republic.

There are several plans by the LMT management, which can work as a strong bullish factor:

- LMT anticipates delivering the Artemis lunar lander and the Next Generation Interceptor (NGI) missile defense system, among other significant projects.

- There is a plan to expand its digital services division, which provides customers with maintenance, data analytics, and additional technology-driven solutions.

- LMT has set forth ambitious sustainability objectives, including the achievement of net-zero greenhouse gas emissions by the year 2040.

LMT Stock Forecast

In the weekly price of LMT, the overall market momentum is bullish, supported by the rising trendline. However, the weekly RSI moved below the 50.00 line, while the 20-week EMA is acting as a resistance.

Based on this outlook, a bullish recovery above the 479.27 resistance level could be a stable long opportunity in 2024. However, a downside pressure to the 380.00 area with a valid rebound could resume the upward trend in 2024 and onwards.

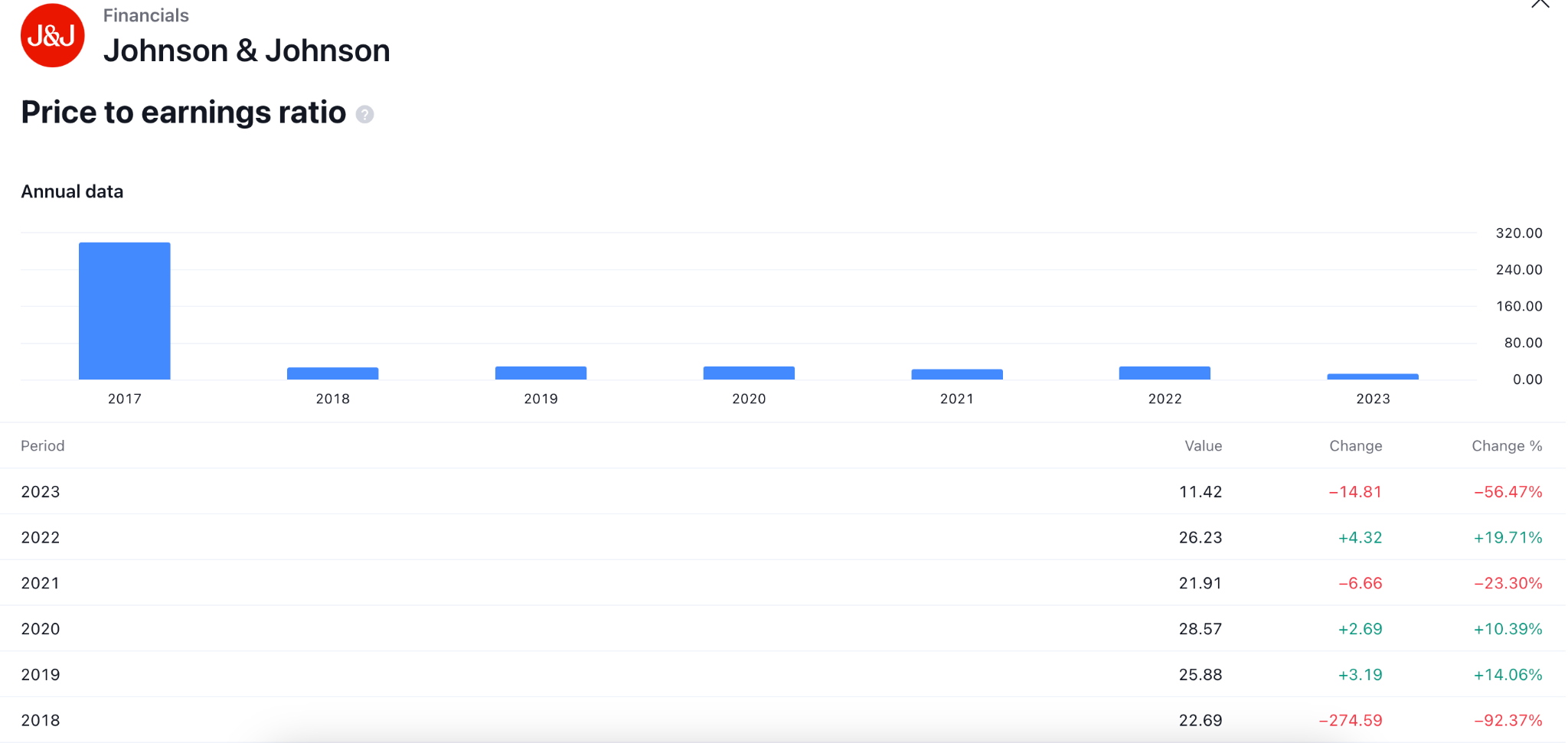

Johnson & Johnson (JNJ)

One prominent name in the healthcare sector is Johnson & Johnson. Its portfolio is diverse, with a core emphasis on research, development, and sales of healthcare products. JNJ is a multidisciplinary pharmaceutical and medical technology business that operates in the domains of immunology, infectious illnesses, and cancer. With operations in the US, Europe, and Asia, JNJ offers stability and potential for growth in a particular industry.

The company has a market capitalization of $383.62 billion and an estimated price-to-earnings ratio of 14.97.

With a trailing annual dividend yield of 2.95% and a payout ratio of 90.38%, JNJ offers investors stability and growth possibilities. Its extensive portfolio and strong market presence make it a desirable choice in healthcare.

Johnson & Johnson (JNJ) Outlook 2024 And Beyond

Johnson & Johnson (JNJ) Recent developments

- JNJ successfully concluded the spin-off of its Consumer Health division in August 2023 and became a novel publicly traded organization known as Kenvue.

- In recent quarters, JNJ has shown robust financial outcomes by surpassing analysts' expectations. Moreover, the diverse portfolio of products and continuous research and development initiatives are advantageous to the business.

- Joaquin Duato, the CEO of JNJ might steer the organization into the future and his strategic priorities.

JNJ growth possibilities

- Over the next five years, JNJ intends to achieve 5-7% annual sales growth in its Pharmaceutical and Medical Device segments. New product launches, geographic expansion, and sustained R&D spending will propel this.

- JNJ will prioritize research and development in the following critical therapeutic areas: oncology, immunology, infectious diseases, and medical devices for interventional procedures and surgery.

- JNJ plans to invest in digital health technologies to enhance patient care and improve outcomes. Wearable technology, data analytics, and artificial intelligence are all included.

JNJ Stock Forecast

In the weekly chart of JNJ, the broader market direction is corrective, where the RSI shows a corrective pressure at the neutral level.

A stable market is visible above the 20-week SMA, where a bullish rebound above the near-term resistance level of 163.62 could activate a long opportunity in 2024.

Value Investing Strategies

The goal of a value investing strategy is to target stocks that are undervalued by the market. These companies appear to be cheap relative to their actual sales and profitability. Value investors believe that the stock price will rise when the company's real value is realized. Value investors would be better off investing the larger the difference between the stock's current price and its intrinsic value. When a value stock's performance does not increase as anticipated, this "margin of safety" helps reduce losses.

Value investing was pioneered by Benjamin Graham, who introduced notions like intrinsic value and a margin of safety in his books "Security Analysis" (1934) and "The Intelligent Investor" (1949). Warren Buffett, who briefly worked at Graham's business and studied under him at Columbia University, was also influenced by him. Buffett, well-known for his value investing, changed his focus as CEO of Berkshire Hathaway from only looking for discounted assets to valuing excellent reasonably priced companies.

"It's better to purchase a fantastic company at a reasonable cost than a reasonable company at a fantastic cost" is his well-known statement, reflecting his development and influence by his partner Charlie Munger.

You may create a solid investing plan that endures throughout time by concentrating on timeless ideas rather than volatile market movements. Let's explore a few common value investing strategies:

- Purchase Companies Rather Than Stocks: Put long-term company opportunities ahead of short-term swings for steady development.

- Love the Business You Buy Into: Prior to investing, familiarize yourself with the company's main functions and financial standing, just like you would when selecting a life companion.

- Invest in the Companies you know better: If you want to reduce uncertainty brought on by complexity, stick with companies you understand.

- Find Companies with Good Management: To create long-term value, prioritize leaders who possess honesty, intellect, and enthusiasm.

- Preference for Quality Over Diversification: Concentrate your portfolio on inexpensive stocks to maximize gains.

- Make a watchlist: Always be on the lookout for better investing chances, and keep your hands up when the market turns down.

- Ignore Market Noise: Remain calm and let solid assets compound over time instead of responding hastily to market swings.

Tips for Successful Value Investing

Value investing means buying stocks below their real value, expecting prices to rise later. It's like getting a stock discount, aiming for long-term gains as their value increases. Achieving success in value investing requires a strategic approach. Here are key tips to enhance your value investing journey:

- Time horizon: Adopt a long-range perspective. Be patient and resist the urge to be influenced by temporary market swings since value investing pays off in the long run.

- Diversification: To lower risk, distribute your investments among various assets. Value investing frequently entails focusing on a few stocks, but to withstand market fluctuations, make sure your portfolio is well-diversified.

- Portfolio rebalancing: To keep your intended asset allocation, examine and modify your portfolio regularly. Rebalancing aids in risk management and helps you remain on course with your investing objectives.

- Thorough research: Dig deep into the company's foundations before investing. Comprehend the financials, competitive environment, and company strategy to pinpoint undervalued prospects precisely.

- Avoid value traps: It is crucial to identify them first, which depends on a critical component: a company's market share. A firm is probably a value trap if its market share constantly declines. A rising share price usually corresponds with an increasing market share, and vice versa.

Trade Best Value Stocks with VSTAR

Best Value Stocks are a reliable foundation for sustainable long-term gains. With VSTAR's all-inclusive trading solutions, you can trade with confidence, invest sensibly, and protect your financial future:

- Master 1000+ Markets: Trade major forex pairs, CFD indices, cryptocurrencies, CFD stocks, and commodities.

- Experience Institutional-Level Trading: Benefit from low trading fees, super tight spreads, and deep liquidity for reliable and fast order execution.

- VSTAR is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) and is a member of the Investor Compensation Fund.

- The VSTAR app is easy to use for both experienced and beginner traders. It features a minimum deposit of only $50, negative balance protection, and real-time market updates.

- Risk-Free Demo Account: Explore the platform and test your trading strategies with a $100,000 risk-free demo account.