Giới thiệu

Cặp tiền tệ CHF/JPY thể hiện tỷ giá hối đoái giữa đồng franc Thụy Sĩ (CHF) và đồng yên Nhật (JPY). Nó phản ánh giá trị của một loại tiền tệ này so với loại tiền tệ kia và được giao dịch rộng rãi trên thị trường ngoại hối toàn cầu. Các nhà giao dịch và nhà đầu tư thường theo dõi chặt chẽ cặp tiền này do tính thanh khoản và biến động của nó.

Nếu bạn quan tâm đến giao dịch CHF/JPY thì việc hiểu được phân tích cơ bản của các cặp tiền tệ này là rất quan trọng để đưa ra quyết định sáng suốt. Phân tích cơ bản đóng một vai trò quan trọng trong việc hiểu rõ về động lực của cặp tiền tệ CHF/JPY. Nó đánh giá các yếu tố kinh tế, tài chính và địa chính trị ảnh hưởng đến đồng franc Thụy Sĩ và đồng yên Nhật, từ đó tác động đến tỷ giá hối đoái của chúng. Phân tích cơ bản cung cấp cái nhìn chuyên sâu về xu hướng tiềm năng của cặp tiền tệ.

Tổng quan kinh tế vĩ mô - Thụy Sĩ

Nguồn hình ảnh: Unsplash

Khi tiến hành phân tích cơ bản về cặp tiền tệ CHF/JPY, việc kiểm tra các yếu tố kinh tế vĩ mô ảnh hưởng đến hoạt động của đồng franc Thụy Sĩ là điều cần thiết. Thụy Sĩ, được biết đến với nền kinh tế và lĩnh vực tài chính ổn định, đóng một vai trò quan trọng trong thị trường tiền tệ toàn cầu.

A. Đánh giá các chỉ số kinh tế

Tăng trưởng GDP của Thụy Sĩ đã chứng kiến sự phục hồi trong những năm gần đây. Năm 2020, quốc gia này đã trải qua sự sụt giảm GDP 2,9% do tác động của đại dịch COVID-19. Tuy nhiên, sang năm 2021, nền kinh tế đã phục hồi mạnh mẽ, với tốc độ tăng trưởng 4,9%. Theo dữ liệu mới nhất vào năm 2022 và 2023, nền kinh tế Thụy Sĩ tiếp tục ổn định nhờ nhu cầu nội địa mạnh mẽ và các lĩnh vực định hướng xuất khẩu. Tỷ lệ thất nghiệp ở Thụy Sĩ vẫn tương đối thấp, dao động quanh mức 3% trong những năm gần đây, cho thấy một thị trường lao động lành mạnh.

Về lạm phát, Thụy Sĩ đã duy trì tỷ lệ thấp và ổn định. Năm 2020, đất nước này trải qua tình trạng giảm phát do suy thoái kinh tế vì đại dịch. Tuy nhiên, vào năm 2021 và những năm tiếp theo, lạm phát dần trở lại mức dương. Ngân hàng Quốc gia Thụy Sĩ (SNB) giám sát chặt chẽ lạm phát để đảm bảo ổn định giá cả và điều chỉnh chính sách tiền tệ cho phù hợp.

Niềm tin của doanh nghiệp và người tiêu dùng đóng một vai trò quan trọng trong triển vọng kinh tế tổng thể. Tâm lý các doanh nghiệp của Thụy Sĩ đã cho thấy sự phục hồi, với nhiều công ty thể hiện sự lạc quan về triển vọng tăng trưởng trong tương lai. Niềm tin của người tiêu dùng cũng được cải thiện khi nền kinh tế phục hồi sau suy thoái do đại dịch gây ra. Các tâm lý tích cực này góp phần tạo nên một môi trường thuận lợi cho việc mở rộng kinh tế và đầu tư.

B. Chính sách tiền tệ

Chính sách tiền tệ của Ngân hàng Quốc gia Thụy Sĩ (SNB): SNB đóng một vai trò quan trọng trong việc định hình chính sách tiền tệ của nước này. SNB có mục tiêu duy trì sự ổn định giá cả và hỗ trợ tăng trưởng kinh tế. Trong những năm gần đây, SNB đã theo đuổi các biện pháp tiền tệ mở rộng, bao gồm lãi suất âm và can thiệp ngoại hối, để ngăn chặn sự tăng giá quá cao của đồng franc Thụy Sĩ.

Kỳ vọng lãi suất: Kỳ vọng lãi suất thường ảnh hưởng đến giá trị tiền tệ và sự hấp dẫn của các khoản đầu tư. Lãi suất của SNB vẫn ở mức thấp trong lịch sử. Theo thông tin mới nhất, SNB dự kiến sẽ duy trì lập trường hỗ trợ trong thời gian tới dựa theo các điều kiện kinh tế toàn cầu và áp lực lạm phát.

C. Môi trường chính trị

Chính sách kinh tế của chính phủ Thụy Sĩ: Chính phủ Thụy Sĩ đã thực hiện các chính sách hỗ trợ ổn định kinh tế và tăng khả năng cạnh tranh. Đất nước này được biết đến với nguyên tắc tài khóa chặt chẽ, môi trường kinh doanh thuận lợi và nền kinh tế định hướng đổi mới. Việc chính phủ tập trung vào việc duy trì một ngành tài chính vững mạnh, thúc đẩy nghiên cứu và phát triển cũng như tăng cường thương mại quốc tế có tác động trực tiếp đến đồng franc Thụy Sĩ và bối cảnh kinh tế nói chung.

Ảnh hưởng của ngành tài chính: Tầm ảnh hưởng của ngành tài chính Thụy Sĩ, đặc biệt là lĩnh vực ngân hàng, đóng một vai trò quan trọng trong nền kinh tế. Sự ổn định và danh tiếng của các ngân hàng Thụy Sĩ khiến quốc gia này trở thành điểm đến hấp dẫn cho các nhà đầu tư toàn cầu. Tình hình hoạt động, quy định và sự phát triển của ngành tài chính có thể ảnh hưởng đến giá trị của đồng franc Thụy Sĩ so với đồng yên Nhật. Việc theo dõi lĩnh vực tài chính của Thụy Sĩ là rất quan trọng để có một phân tích cơ bản toàn diện về cặp tiền tệ CHF/JPY.

Tổng quan kinh tế vĩ mô - Nhật Bản

Nguồn hình ảnh: Unsplash

Một phân tích cơ bản toàn diện về cặp tiền tệ CHF/JPY yêu cầu đánh giá các chỉ số kinh tế vĩ mô của Nhật Bản. Việc luôn cập nhật các chính sách và diễn biến kinh tế mới nhất của Nhật Bản là rất quan trọng để đảm bảo các chiến lược giao dịch hiệu quả và quản lý rủi ro trong bối cảnh tài chính luôn thay đổi.

A. Đánh giá các chỉ số kinh tế

GDP và tỷ lệ thất nghiệp của Nhật Bản đã phải đối mặt với những thách thức trong những năm gần đây. Năm 2020, quốc gia này đã trải qua sự sụt giảm GDP 4,6% do tác động của đại dịch COVID-19. Tuy nhiên, vào năm 2021, nền kinh tế đã phục hồi trở lại với tốc độ tăng trưởng 2,8%. Theo dữ liệu mới nhất vào năm 2022 và 2023, tăng trưởng GDP của Nhật Bản vẫn ở mức vừa phải, được thúc đẩy bởi nhu cầu trong nước và xuất khẩu. Tỷ lệ thất nghiệp ở Nhật Bản cũng có biến động nhưng vẫn ở mức tương đối thấp, ở mức khoảng 2-3% trong những năm gần đây.

Nhật Bản đã phải vật lộn với tình hình giảm phát trong một thời gian dài, một hiện tượng được gọi là "tư duy giảm phát của Nhật Bản". Năm 2020, đất nước này tiếp tục trải qua tình trạng giảm phát do tác động kinh tế của đại dịch. Trong năm 2021 và những năm tiếp theo, Nhật Bản đã phải vật lộn để đạt được mục tiêu lạm phát 2%. Ngân hàng Trung ương Nhật Bản (BOJ) luôn theo dõi chặt chẽ mức độ lạm phát và thực hiện các chính sách kích thích tăng trưởng giá cả.

Tâm lý của doanh nghiệp và người tiêu dùng là những chỉ báo thiết yếu về sức khỏe nền kinh tế. Trong những năm gần đây, niềm tin kinh doanh ở Nhật Bản đã cho thấy khả năng phục hồi do được hỗ trợ bởi việc cải thiện thương mại và đầu tư toàn cầu. Niềm tin của người tiêu dùng cũng phải đối mặt với một số biến động do tác động của đại dịch, nhưng nó đã dần được cải thiện khi nền kinh tế phục hồi. Tâm lý tích cực của các doanh nghiệp và người tiêu dùng đang góp phần vào tăng trưởng kinh tế của Nhật Bản.

B. Chính sách tiền tệ

Chính sách tiền tệ của Ngân hàng Trung ương Nhật Bản (BOJ): BOJ đóng vai trò quan trọng trong việc định hình chính sách tiền tệ của Nhật Bản. BOJ có mục tiêu đạt được sự ổn định về giá cả và hỗ trợ tăng trưởng kinh tế. Trong những năm gần đây, BOJ đã duy trì quan điểm nới lỏng với lãi suất cực thấp và các chương trình mua tài sản. Theo dõi các quyết định chính sách của BOJ và tác động của chúng đối với đồng yên Nhật là điều cần thiết để hiểu được động lực của cặp tiền tệ CHF/JPY.

Kỳ vọng về lãi suất: Kỳ vọng lãi suất đóng vai trò quan trọng trong định giá tiền tệ và quyết định đầu tư. BOJ đã giữ chính sách lãi suất gần bằng 0 trong một thời gian dài. Theo thông tin mới nhất, BOJ dự kiến sẽ duy trì lập trường nới lỏng để hỗ trợ phục hồi kinh tế và chống lại tình hình lạm phát thấp. Bất kỳ thay đổi nào về kỳ vọng lãi suất đều có thể tác động đáng kể đến cặp tiền tệ CHF/JPY.

C. Môi trường chính trị

Chính sách kinh tế của chính phủ Nhật Bản: Chính phủ Nhật Bản đã thực hiện các chính sách thúc đẩy tăng trưởng kinh tế, tăng năng suất và giải quyết các thách thức về cơ cấu. Các sáng kiến như Abenomics và chương trình cải cách kinh tế đang diễn ra nhằm mục đích kích thích đầu tư, nâng cao khả năng cạnh tranh và khuyến khích đổi mới. Việc theo dõi các chính sách kinh tế của chính phủ cung cấp thông tin chi tiết về các yếu tố ảnh hưởng đến nền kinh tế Nhật Bản và đồng yên.

Tác động của nhân khẩu học đối với nền kinh tế Nhật Bản: Dân số già và tỷ lệ sinh giảm của Nhật Bản đặt ra những thách thức cho nền kinh tế nước này. Lực lượng lao động bị thu hẹp và chi phí chăm sóc sức khỏe gia tăng ảnh hưởng đến tình hình tài chính của chính phủ và tiềm năng tăng trưởng kinh tế. Những nỗ lực giải quyết các thách thức về nhân khẩu học này, chẳng hạn như cải cách thị trường lao động và chính sách nhập cư, có thể có tác động lâu dài đến nền kinh tế Nhật Bản và đồng tiền của nước này.

Phân tích cặp tiền tệ CHF/JPY

Phân tích các yếu tố hỗ trợ xu hướng tăng giá hoặc giảm giá, bao gồm các chính sách tiền tệ của Ngân hàng Quốc gia Thụy Sĩ và Ngân hàng Trung ương Nhật Bản, cũng như trạng thái trú ẩn an toàn của đồng franc Thụy Sĩ, là rất quan trọng. Ngoài ra, nhận thức được các rủi ro tiềm ẩn là điều cần thiết để hiểu được động lực của cặp tiền tệ CHF/JPY.

A. Các chỉ báo kinh tế liên quan

Nguồn hình ảnh: Unsplash

Nền kinh tế Thụy Sĩ và Nhật Bản có những điểm tương đồng và khác biệt ảnh hưởng đến cặp tiền tệ CHF/JPY. Cả hai quốc gia đều được biết đến với các ngành công nghiệp định hướng xuất khẩu mạnh mẽ và lĩnh vực tài chính phát triển vượt bậc. Tuy nhiên, Thụy Sĩ nổi tiếng là một trung tâm tài chính toàn cầu, trong khi Nhật Bản được công nhận về năng lực sản xuất. Mối tương quan giữa các nền kinh tế sẽ ảnh hưởng đến cặp tiền tệ, vì sự phát triển kinh tế ở một quốc gia có thể tác động đến quốc gia kia.

Tăng trưởng GDP, lạm phát và lãi suất là những chỉ số quan trọng ảnh hưởng đến cặp tiền tệ CHF/JPY. Tăng trưởng GDP cao hơn ở một trong hai quốc gia có thể thu hút đầu tư và củng cố đồng tiền tương ứng. Tỷ lệ lạm phát và lãi suất cũng đóng một vai trò quan trọng. Ví dụ, lạm phát cao hơn hoặc lãi suất tăng ở Thụy Sĩ có thể củng cố vị thế của đồng franc Thụy Sĩ so với đồng yên, trong khi điều ngược lại có thể làm suy yếu nó.

B. Các yếu tố hỗ trợ xu hướng tăng giá và giảm giá

Nguồn hình ảnh: Unsplash

Ngân hàng Quốc gia Thụy Sĩ (SNB) đóng một vai trò quan trọng trong việc tác động đến đồng franc Thụy Sĩ. Các quyết định chính sách tiền tệ của SNB, chẳng hạn như thay đổi lãi suất và can thiệp vào thị trường ngoại hối, có thể tác động đáng kể đến cặp tiền tệ CHF/JPY. Những thay đổi chính sách của SNB có thể tạo ra các điều kiện tăng giá hoặc giảm giá, ảnh hưởng đến động lực tỷ giá hối đoái.

Tương tự như SNB, Ngân hàng Trung ương Nhật Bản (BOJ) đóng một vai trò quan trọng trong việc định hình giá trị của đồng yên Nhật. Các quyết định về chính sách tiền tệ của BOJ, bao gồm thay đổi lãi suất và các chương trình mua tài sản, ảnh hưởng đến cặp tiền tệ CHF/JPY. Những thay đổi trong lập trường chính sách của BOJ có thể thúc đẩy tâm lý tăng giá hoặc giảm giá, ảnh hưởng đến tỷ giá hối đoái.

Đồng franc Thụy Sĩ theo truyền thống được coi là một loại tiền tệ trú ẩn an toàn, được các nhà đầu tư tìm kiếm trong thời kỳ kinh tế bất ổn. Ngược lại, đồng yên Nhật cũng được coi là tài sản trú ẩn an toàn. Tuy nhiên, trạng thái trú ẩn an toàn của đồng franc Thụy Sĩ có sự ảnh hưởng khác biệt đến cặp tiền tệ CHF/JPY trong thời kỳ bất ổn kinh tế toàn cầu.

C. Rủi ro tiềm tàng đối với cặp tiền tệ

Tăng trưởng kinh tế toàn cầu rất quan trọng đối với các cặp tiền tệ, bao gồm CHF/JPY. Những thay đổi bất ngờ trong điều kiện kinh tế toàn cầu, chẳng hạn như suy thoái hoặc tăng trưởng mạnh mẽ, có thể ảnh hưởng đáng kể đến sức mạnh tương đối của đồng franc Thụy Sĩ và đồng yên Nhật. Theo dõi các chỉ số kinh tế và diễn biến địa chính trị trên toàn thế giới là rất quan trọng để xác định các rủi ro và cơ hội tiềm ẩn đối với cặp tiền tệ.

Các quyết định về chính sách tiền tệ ở Thụy Sĩ và Nhật Bản có thể tác động sâu sắc đến cặp tiền tệ CHF/JPY. Những thay đổi không lường trước về lãi suất, các biện pháp nới lỏng định lượng hoặc chính sách can thiệp của các ngân hàng trung ương có thể tạo ra sự biến động và ảnh hưởng đến tỷ giá hối đoái. Cập nhật thông tin về các tuyên bố chính sách và thông báo truyền thông của ngân hàng trung ương là điều cần thiết để hiểu được những rủi ro tiềm ẩn liên quan đến cặp tiền tệ.

Rủi ro địa chính trị, bao gồm căng thẳng thương mại giữa các nền kinh tế lớn, cũng có thể lan rộng ra trên thị trường tài chính toàn cầu, bao gồm cả các cặp tiền tệ. Chẳng hạn, tranh chấp giữa Hoa Kỳ và Trung Quốc có thể gây ra những quan ngại rủi ro và tác động đến cặp tiền tệ CHF/JPY.

Chiến lược giao dịch cho CHF/JPY

Nguồn hình ảnh: Unsplash

Việc thực hiện các chiến lược giao dịch hiệu quả có thể giúp bạn tự tin giao dịch cặp tiền tệ CHF/JPY và quản lý rủi ro.

A. Phân tích kỹ thuật

Một trong những chiến lược giao dịch cho cặp tiền tệ CHF/JPY là phân tích kỹ thuật. Cách tiếp cận này bao gồm việc nghiên cứu dữ liệu giá lịch sử để xác định xu hướng và mô hình. Bằng cách xác định các xu hướng và mô hình trong quá khứ, bạn có thể hiểu rõ hơn về các biến động giá tiềm năng.

Xác định xu hướng và mô hình

Nguồn hình ảnh: Tradingview

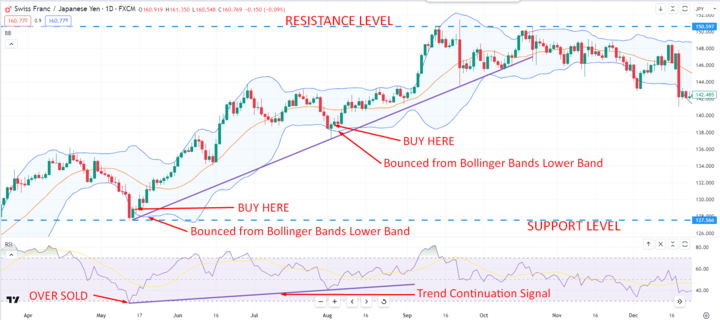

Tìm kiếm các xu hướng tăng hoặc giảm trong cặp tiền tệ CHF/JPY. Ngoài ra, hãy phân tích các mẫu biểu đồ như mức hỗ trợ và kháng cự, đường xu hướng và các dạng biểu đồ như cờ, tam giác hoặc mô hình đầu và vai.

Sử dụng các chỉ báo

Nguồn hình ảnh: Tradingview

Kết hợp các chỉ báo kỹ thuật như Bollinger Bands và Chỉ số sức mạnh tương đối (RSI) để nâng cao khả năng phân tích của bạn. Bollinger Bands giúp xác định các khoảng thời gian có mức độ biến động thấp hoặc cao, trong khi chỉ báo RSI cho biết tình trạng mua quá mức hoặc bán quá mức. Hãy thử nghiệm với các chỉ báo khác nhau để tìm ra những chỉ báo hỗ trợ cho chiến lược giao dịch của bạn.

B. Quản lý rủi ro

Quản lý rủi ro tối ưu là rất quan trọng để giao dịch thành công. Hãy xem xét các kỹ thuật quản lý rủi ro sau đây khi giao dịch cặp tiền tệ CHF/JPY:

Thiết lập mức cắt lỗ và chốt lời

Nguồn hình ảnh: Tradingview

Đặt ra các mức giá cụ thể mà bạn sẽ thoát giao dịch để hạn chế thua lỗ tiềm ẩn (dừng lỗ) hoặc đảm bảo lợi nhuận (chốt lãi). Điều này đảm bảo bạn nắm rõ các thông số rủi ro được xác định trước.

Xác định kích thước vị thế

Tính toán quy mô vị thế dựa trên mức độ chấp nhận rủi ro và khoảng cách giữa điểm vào lệnh và mức dừng lỗ. Điều này giúp quản lý số vốn bạn mà bạn sẵn sàng dành ra cho mỗi giao dịch.

C. Giao dịch theo tin tức

Giao dịch theo tin tức liên quan đến việc theo dõi các sự kiện kinh tế và công bố dữ liệu quan trọng, có tác động đến cặp tiền tệ CHF/JPY. Chiến lược này tận dụng phản ứng của thị trường đối với các sự kiện tin tức.

Theo dõi các sự kiện kinh tế và công bố dữ liệu

Nguồn hình ảnh: ForexFactory

Cập nhật thông tin về các sự kiện kinh tế quan trọng, chẳng hạn như thông báo của ngân hàng trung ương, công bố GDP và báo cáo việc làm. Những sự kiện này có thể ảnh hưởng đáng kể đến cặp tiền tệ CHF/JPY. Sử dụng lịch kinh tế và các trang web tin tức để cập nhật các sự kiện sắp tới.

Giao dịch dựa trên phản ứng của thị trường đối với tin tức

Nguồn hình ảnh: Tradingview

Theo dõi cách thị trường phản ứng với các tin tức mới. Những sự kiện bất ngờ mang tính tích cực hoặc tiêu cực đều có thể dẫn đến những biến động giá lớn. Hãy cân nhắc tham gia giao dịch dựa trên xu hướng và cường độ phản ứng của thị trường đối với tin tức.

Để thực hiện các chiến lược giao dịch này, bạn có thể giao dịch cặp tiền tệ CHF/JPY trên VSTAR, một nền tảng giao dịch đáng tin cậy. VSTAR cung cấp dữ liệu thị trường theo thời gian thực, giao diện giao dịch trực quan và cung cấp các công cụ quản lý rủi ro để tạo thuận lợi cho các quyết định của bạn.

Hãy nhớ rằng, giao dịch chứa rủi ro và việc tiến hành phân tích kỹ lưỡng cũng như thực hành quản lý rủi ro phù hợp là điều cần thiết. Luôn cập nhật những diễn biến thị trường mới nhất và liên tục điều chỉnh các chiến lược giao dịch cặp tiền tệ CHF/JPY cho phù hợp.

Kết luận

Phân tích cơ bản cung cấp thông tin chi tiết có giá trị về cặp tiền tệ CHF/JPY. Dựa trên phân tích này, xu hướng tăng hoặc giảm có thể được xác định. Khi giao dịch cặp CHF/JPY, điều quan trọng là phải áp dụng phân tích kỹ thuật, cũng như sử dụng các chiến lược quản lý rủi ro. Bằng cách theo dõi các sự kiện kinh tế và công bố dữ liệu, cũng như giao dịch dựa trên phản ứng của thị trường, giao dịch theo tin tức cũng có thể là một chiến lược sinh lợi tốt cho cặp tiền tệ CHF/JPY.

Hiểu biết toàn diện về phân tích cơ bản và các chiến lược giao dịch hiệu quả có thể nâng cao khả năng sinh lời từ cặp tiền tệ CHF/JPY. Luôn cập nhật thông tin mới nhất, điều chỉnh phân tích của bạn và tận dụng các nền tảng như VSTAR để thực hiện giao dịch hiệu quả.

* Tuyên bố miễn trừ trách nhiệm: Nội dung của bài viết này chỉ dành cho mục đích học tập và không thể hiện quan điểm chính thức của VSTAR, cũng như không thể được sử dụng như một lời khuyên đầu tư.