Introduction

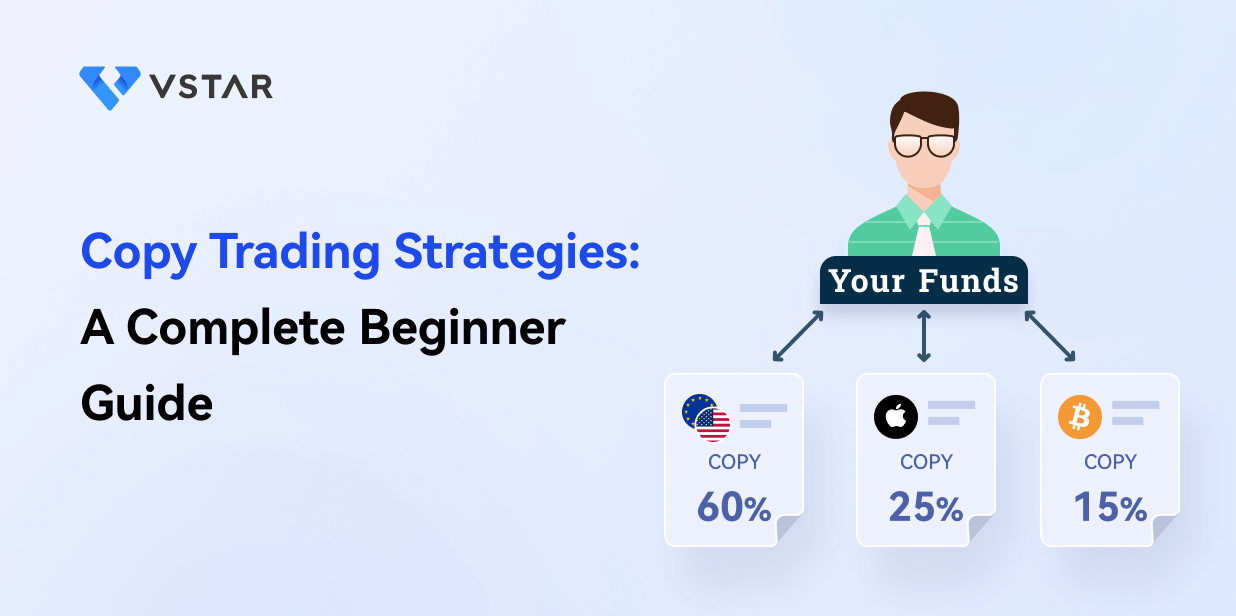

Copy trading allows traders to automatically follow the strategies of successful master traders. This innovative approach transforms trading into being accessible to those with limited market knowledge. The key advantage of copy trading is its simplicity, offering an easy way for traders to benefit from the expertise of experienced professionals.

As you dive into the world of copy trading, you'll find its potential to improve your portfolio without needing active management. By imitating the actions of seasoned traders, you will get various investment strategies and market insights. This strategy is especially useful for individuals lacking the time or expertise to navigate complex financial markets independently.

Whether you're a beginner or an experienced trader, incorporating copy trading into your trading technique may diversify your portfolio, reduce risks, and potentially increase returns. This modern trading technique is placed with user-friendly financial tools, making it a captivating option for anyone trying to optimize their trading strategy.

Choosing a Copy Trading Platform

Source: Unsplash

When selecting a copy trading platform, focus on crucial features like social trading, where you can connect and learn from a community of traders. Ensure the platform offers robust risk management tools to protect your funds effectively. Transparent fee structures are vital for understanding costs. Look for a platform that excels in these key aspects so that your copy trading experience becomes user-friendly and successful.

Speaking of selecting a solid platform in terms of copy trading, VSTAR stands out as an excellent choice and fits very smoothly with the essential aspects designed to enhance their users' trading experience in terms of copytrading strategies. Also, it’s an innovative but simple method that makes copying the strategies easy. Whether you're a seasoned trader or a beginner, VSTAR's user-friendly interface and step-by-step guidance make the process fast and simple.

Social trading is a core feature of VSTAR, which lets you connect with a lively community of traders and there you may collaborate to share strategies and insights. Besides, VSTAR's commitment to robust risk management tools, as explained in the "Copy Trading Mode and Setup" section, will empower you to protect your funds completely. The platform's easy-to-use interface ensures a smooth experience, and clear fee structures enhance trust and understanding. They also offer a step-by-step guide for setup in their section of "Introduction to Copy Trading."

VSTAR is the right mix of social trading, risk management, and transparent fees to come together for a user-friendly and empowering experience. The platform meets the specified requirements and exceeds expectations, making itself a trustworthy partner in your trading journey.

Understanding the Differences between Copy Trading and Other Trading Approaches

Source: Unsplash

Knowing the differences between copy trading and other approaches is vital to making informed decisions. Unlike traditional methods, copy trading lets you imitate successful traders' trades. This varies from social trading, which focuses on community interaction, and mirror trading, replicating entire strategies.

Each method has its pros and cons, that suit various preferences and risk levels. Understanding these differences may give you the insight to pick the approach that matches your trading goals.

A. Copy Trading vs. Social Trading

Copytrading and social trading represent different methods in finance designed to suit different traders' preferences and levels. Copy trading means automatically imitating specific trades of experienced traders. Though it brings diversification, it also might limit your control over individual decisions and will rely on your chosen trader's performance.

Conversely, social trading focuses on community interaction, allowing traders to share insights and strategies. Despite offering a comprehensive market view and learning opportunities, the huge amount of information may lead to noise and conflicting advice, making it more time-consuming.

Copy trading's advantages include automation for a laid-back experience, diversification through replicated trades, and efficiency, especially for those with limited time. However, the drawbacks are that you’ll have limited control and have to rely on the performance of your selected trader.

On the other hand, social trading offers community interaction, learning opportunities, and a comprehensive market view. It allows you for collaboration and shared insights but may include information overload and the time-consuming nature of active participation.

B. Copy Trading vs. Mirror Trading

Let's get some thoughts about another trading approach called Mirror trading that automatically copies the complete trading strategies of successful traders, often called signal providers. Traders link their accounts to a platform that mirrors the real-time trades and decisions of the chosen signal provider. This method favors traders by letting them gain from accomplished traders' expertise without actively managing their funds.

However, choosing between CopyTrading and Mirror Trading means considering their advantages and disadvantages. Understanding these two approaches' differences is essential when making smart trading choices.

Copytrading means copying specific trades from a chosen trader, letting you imitate their moves in real time. On the flip side, mirror trading takes it a step further by copying entire trading strategies, comprehensively replicating a trader's or signal provider’s approach.

Copy trading's strengths lie in simplicity and flexibility. You can choose which specific trades to copy, customizing your portfolio based on your risk tolerance and preferences. However, mirror trading provides a hands-off approach, allowing you to adopt an entire investment strategy without constant monitoring.

While copytrading gives you selectivity, it may have the risk of focusing too much on specific assets. On the other hand, mirror trading might lack the detail needed for refined portfolio management. Having a balance between these methods can be crucial for optimizing your strategy. Explore the features of both approaches, considering factors like risk tolerance and time commitment, to find the right fit for your investment journey.

Selecting Traders to Copy

Source: Unsplash

If you decide to start copy trading, then choose wisely. Platforms like VSTAR provide a comprehensive guide to help you make informed decisions.

A. Analyzing trader statistics like ROI, Sharpe ratio, drawdowns

You should look into trader stats like Return on Investment (ROI), Sharpe ratio, and drawdowns. ROI tells you how profitable a trader is. The Sharpe ratio assesses traders’ risk-adjusted performance. And drawdowns show the potential extent of losses.

This analytical approach will help you to accurately calculate the performance and risk profile of potential copy traders.

B. Assessing trading history consistency and risk metrics

Checking a trader's past performance is vital to understanding their consistency and risk management method. Hence, you can spot patterns and evaluate risk metrics by checking their previous trades. It will give you confidence in a trader's ability to handle different market conditions.

This step will also ensure that your trading goals are aligned with copy traders who consistently and wisely manage risks over time.VSTAR emphasizes the importance of analyzing trading history for patterns and reliability. This ensures that traders you pick have shown stability and skill over time, reducing potential risks.

C. Following top performers and traditionally successful traders

Always pay attention to following top performers and traders with a successful history. By doing this, you can learn from the knowledge of experienced traders who have proven success. This aligns with social trading, where you may gain from the knowledge and strategies of accomplished traders in the community.

Throughout this process, VSTAR's user-friendly interface and detailed analytics may empower you to make data-driven decisions. With VSTAR as your guide, the platform provides Copy Trading Mode and Setup options, streamlining the entire process. Choosing VSTAR, you're not just copying trades; you're strategically choosing traders, supported by thorough analysis and historical performance, to enhance your trading journey.

Learning Various Copy Trading Strategies

Source: Unsplash

There are various copytrading strategies that you can consider. Remember that these strategies' effectiveness can vary, and it's important to do thorough research and consider your risk tolerance before engaging in copy trading.

VSTAR's copy trading options range from following experienced traders to copying friends and thematic investors. The flexible platform lets you tailor your approach for a personalized and effective trading journey. Embrace these strategies and start your copytrading adventure confidently, taking advantage of the diverse offerings in the VSTAR ecosystem. Here are some common copy trading strategies:

A. Following experienced/successful traders

One way is to watch and copy seasoned copy traders who consistently do well. By copying their moves, you can benefit from their knowledge and experience, which might improve your own trading.

B. Copying friends/social network

If you prefer a more personal touch, copying friends and trusted people from your social circle can be smart. This method is all about trust and connections, fitting with VSTAR's goal of creating a community-focused trading space.

C. Copying thematic investors

Another strategy involves thematic investing, where you copy portfolios based on specific themes, sectors, or strategies. Whether it's biotech stocks, crypto traders, or dividend investors, this lets you focus on areas that match your interests.

D. Using copy trading signals

Copy trading signals give you real-time advice on market trends and potential trading chances. You can use these signals to make smart decisions, aligning with VSTAR's focus on data-driven and strategic trading.

E. Following top-performing portfolios

Alternatively, you can copy portfolios with a track record of high returns. By looking at past performance, you can find and copy portfolios that consistently beat the market, in line with VSTAR's commitment to helping users succeed.

F. Selecting an Appropriate Copy Mode

Choosing the right copy mode is key for successful copy trading. VSTAR offers three unique modes that give traders flexibility in managing their investment strategies. Smart Copy optimizes allocation based on traders' performance for a dynamic approach.

Fixed Ratio Copy keeps a consistent risk-reward ratio, adapting to different market conditions. Meanwhile, Fixed Amount Copy controls the invested amount per trade.

- Smart Copy: Designed for those who want a flexible strategy, Smart Copy optimizes allocation based on the selected copy traders' performance. This mode adjusts to market changes, offering adaptability and responsiveness.

- Fixed Ratio Copy: Perfect for keeping a steady risk-reward ratio, Fixed Ratio Copy trade ensures funds are allocated proportionally based on the trader's strategy. It adapts to different market situations while maintaining a predetermined balance.

- Fixed Amount Copy: With Fixed Amount Copy trade, users have exact control over investment amounts per trade, allowing them to set specific monetary values for each copied trade. This mode is ideal for those who prefer precise control over their investment sizes.

Mistakes to Avoid in Copy Trading

Source: Unsplash

Before diving into copy trading, you must be aware of some mistakes that are crucial to avoid aiming for lasting success. Recognizing and avoiding these errors may significantly improve your copy trading experience.

A. Over diversification resulting in high fees

One common mistake is over-diversification, leading to high fees and reduced returns. Diversifying your portfolio is smart, but too much diversification can dilute the impact of successful trades and increase transaction costs. Finding a balance is recommended, ensuring a diversified portfolio without sacrificing cost-effectiveness.

B. Copying undisciplined traders with heavy losses

Copying traders who take big risks and face heavy losses is a risky mistake. It's essential to assess a trader's risk management practices and historical performance. Prioritize disciplined copy traders with a track record of managing risk effectively to avoid mirroring erratic trading behavior that may result in substantial losses.

C. Lack of exit control on copied trades

A crucial but often overlooked aspect is having no exit control on copied trades. You should set clear parameters for profit-taking and stop-loss levels to minimize potential losses. VSTAR empowers users with the ability to customize their exit strategies, providing a crucial tool to maintain control and protect their investments.

D. Blindly copying traders without research

Another fundamental mistake of blindly copying traders without research is crucial to avoid. It's significant to do your research, carefully examining a trader's historical performance, risk metrics, and overall trading strategy before replicating their trades. This proactive approach ensures that you align your investment goals with the strategies of well-informed and successful traders.

Conclusion

Successful copy trading relies on three essential factors: effective risk management, thorough research, and a diverse copy trading portfolio. These strategies are crucial for a secure and rewarding investment journey. Adopting strong risk management practices, conducting comprehensive research, and diversifying your copy trading portfolio on VSTAR create a safer and more rewarding investment journey.

As you start your copy trade journey, consider VSTAR your reliable partner, offering the tools and platform to confidently begin copy trading. Today, utilize VSTAR's user-friendly interface and powerful features to navigate the financial markets effortlessly.