Introduction

Day trading involves buying and selling financial instruments within the same trading day. All positions are closed out before the end of the day's trading session. Day traders seek to profit from short-term price movements and volatility that occur over periods ranging from a few minutes to several hours.

In order to capture these smaller intraday trends, day traders use technical analysis and trading platforms to monitor real-time market data. By using their analytical skills and quick reactions, day traders aim to take advantage of small gains that can accumulate into significant profits over time.

Day trading requires excellent discipline, vigilance and risk management. Traders must be focused and disciplined to take advantage of fleeting opportunities in fast-moving markets. They must follow news flow and price action closely and be prepared to enter and exit positions quickly. Strict risk controls are essential to mitigate losses on unprofitable trades.

Although risky, day trading is attractive because of the potential for quick returns. By closing out positions each day, traders do not have overnight exposure. The frequent buying and selling provides constant action for thrill-seekers who enjoy the daily challenge of beating the market. However, success in day trading requires extensive experience, sufficient capital, and the nerve to withstand the volatility.

What do you expect in this guide on Day trading?

This comprehensive guide introduces day trading and distinguishes it from other trading styles, as well as the tools, types of analysis, and strategies used. It outlines the steps to get started, including education, psychology, planning, and broker selection. Risk management is discussed through position sizing, stop losses, and emotional control. We explain the hard work and consistency required to become a successful day trader. Key skills such as chart reading, order types, and trading tools are reviewed. The guide concludes by setting expectations, highlighting key takeaways, and providing final tips. Throughout, the focus is on equipping the reader with the knowledge to evaluate day trading.

What is day trading and how does it differ from other trading styles?

Day trading is a fast-paced trading style that involves opening and closing trades within a single trading session. Unlike long-term investing, day trading does not involve overnight risk as positions are not held beyond the market close.

Day traders focus on short-term price movements and volatility. They use technical analysis to identify opportunities and execute trades quickly, often holding stocks from a few minutes to a few hours. Leverage allows day traders to maximize profits with less capital.

Swing trading captures trades over periods ranging from overnight to several days or weeks. Swing traders identify trending markets and seek to profit from the ups and downs within the broader directional move. They monitor 4-hour to daily charts, looking for trades with a higher reward-to-risk ratio. Swing trading requires less screen time, but overnight risk management is critical.

Position traders focus on larger market trends that play out over weeks, months, or years. They identify key support and resistance levels where major moves begin and end. Position trading offers the potential for huge profits, but requires the most patience. Trades can be held for weeks with only occasional monitoring. Risk management is still important given the large position sizes.

Day trading offers excitement for thrill-seekers who enjoy active trading and risk management. The non-stop action provides constant testing and the opportunity to profit in all market conditions. For disciplined traders, day trading can be a path to consistent profits and financial freedom.

What are the key characteristics of day trading?

- Short Timeframes - Day traders open and close all trades within the same trading day to avoid overnight exposure. Intraday timeframes range from a few minutes to take advantage of fleeting volatility to several hours for trends or swing moves.

- Frequent Trading - Day traders actively search for opportunities and may execute dozens of trades in a single session. They use short-term chart patterns, indicators and news events to develop trading ideas. Frequent trading results in high volume and liquidity requirements.

- Same Day Exits - All positions are closed out on the same trading day they are entered, usually around the market close. Day traders liquidate positions rather than carry exposure overnight due to the higher risk.

- Use of Leverage - Day traders use leverage through margin trading accounts to maximize profits from relatively small intraday moves. Leverage allows them to take larger position sizes than permitted in cash accounts.

- Risk Management - With frequent trading and the use of leverage comes a greater need for risk management. Day traders use tight stop losses, position sizing and disciplined exits to limit downside.

- Technical Analysis - Day trading is driven by technical analysis rather than fundamental analysis. Price action, indicators, trends, chart patterns, and volume are primary considerations for intraday decision making.

- Mathematical Edge - Profitable day trading requires finding and maintaining a mathematical edge. Traders seek consistent profits over time through statistical advantage.

The short timeframes, same-day exits, use of leverage, and active trading define day trading and distinguish it from other trading approaches. Risk management is critical to long-term success.

Before starting Day Trading You need to know:

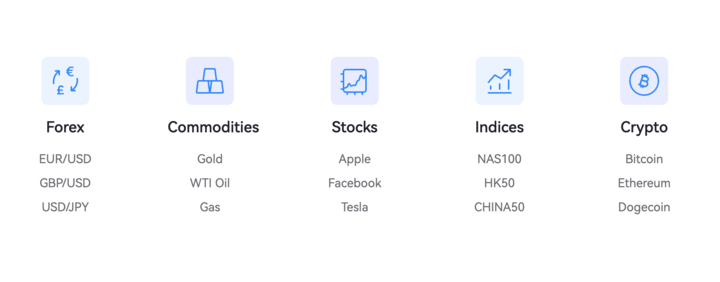

Markets and instruments (stocks, futures, forex, options)

Stocks

Stocks represent shares in publicly traded companies. They are a popular instrument for day trading because of their liquidity and volatility. Day traders seek to capitalize on the minute-to-minute price fluctuations of stocks by going long or short. Major stock exchanges include the NYSE and Nasdaq.

Futures

Futures contracts allow traders to buy or sell an underlying asset at a specified future date and price. They are commonly used to speculate on commodities, indices and currencies. The high leverage of futures attracts day traders who seek substantial profits from relatively small market movements. Popular futures for day trading include S&P 500 contracts and crude oil.

Foreign Exchange

The Forex or foreign exchange market facilitates the buying and selling of global currencies. Currency pairs such as EUR/USD or GBP/JPY see high daily trading volumes and offer opportunities for day traders. Forex operates 24 hours a day, allowing trading during Asian, European and American sessions. The macro nature of currencies leads many day traders to incorporate economic data.

Options Trading

Options contracts provide the right, but not the obligation, to buy or sell an asset at a specified price on or before the expiration of the contract. Day traders use options to speculate on the direction of or hedge positions in the underlying security. Volatile options with tight bid-ask spreads on highly liquid underlyings are best suited for intraday trading. Common instruments include S&P 500 options and options on popular stocks.

Analysis types (technical, fundamental)

Technical Analysis

Technical analysis is the study of price charts and market data to identify trends and inform trading decisions. Day traders rely heavily on technical analysis to time their entries and exits. Common technical indicators used include moving averages, RSI, MACD, Bollinger Bands, and candlesticks. Chart patterns such as head and shoulders, triangles, flags, and channels also provide trading signals. Technical analysis allows for quick reactions to price movements during the trading session.

Fundamental Analysis

Fundamental analysis focuses on the underlying economic and financial factors that determine an asset's intrinsic value. It involves evaluating economic reports, corporate earnings, industry trends, geopolitical events, monetary policy, and other factors that affect supply and demand. Fundamental analysis can identify macro themes to inform directional bias. While not as important for intraday trading, integrating fundamentals provides an edge in anticipating potential catalysts and volatility. The "trading the news" strategy is an example of the use of fundamentals in day trading.

Trading strategies (breakouts, reversals, range-bound)

Breakout Strategies

Breakout strategies aim to capitalize on strong directional moves when the price breaks out of a consolidation, resistance, or support level. The breakout signals emerging order flow that could propel price higher or lower. Common breakout approaches include trading breakouts from overnight range, breakouts after earnings gaps, and breakouts from chart patterns like rectangles.

Reversal Strategies

Reversal trading involves trading against the prevailing trend. This counter-trend approach seeks to profit when the momentum stalls and price changes direction. Traders identify overextended moves signaling a potential snapback or reversal using indicators like RSI. Reversal strategies can be applied on various time frames from 5-minutes to hourly.

Range Trading Strategies

Range trading aims to sell near the top of a range when price nears resistance and buy near the bottom of the range at support. Range bound markets exhibit less trended price action. Technical tools like Bollinger Bands help gauge range extremes. Range trading thrives on markets oscillating between support and resistance zones versus exhibiting a strong directional bias.

How to Start Day Trading

Education (books, online courses, mentors)

Books - Read classics like "How to Day Trade for a Living" by Andrew Aziz and "The Complete Day Trader" by Jake Bernstein to understand the fundamentals. Books provide structured learning and market insight.

Online Courses - Take structured online courses to gain a solid foundation. Well-known providers such as Investopedia Academy and VStar Academy offer courses designed for beginning traders. They teach trading strategies, risk management and psychology.

Mentors - Learning from an experienced day trading mentor provides valuable real-world insights. Mentors provide one-on-one guidance to accelerate learning. Experienced mentors, like those at VSTAR, can guide new traders and instill best practices.

Demo Trading - Paper trading or using trading simulators allows you to practice strategies without risking capital. Refine skills and solidify the trading process by demo trading before going live. Many brokers and trading platforms offer virtual accounts for the practice.

Education is key to day trading success. Take advantage of multiple learning resources such as structured courses, books, mentors and chat rooms. Demo trading to hone skills before committing real capital. Ongoing market analysis, practice and education allow traders to achieve consistency.

Trading psychology (discipline, risk management)

Successful day trading requires discipline and effective risk management. Traders must follow rules, stick to strategies, limit emotions and accept losses. Using stop losses and following position sizing rules helps limit downside risk. Adhering to profit-taking strategies locks in profits. Discipline in closing all positions before the market closes limits overnight risk. Ongoing practice and analysis promotes consistency. Controlling fear and greed separates the winners from the losers. Mastering trading psychology through experience and study allows profits to compound over time.

Developing a trading plan

-Define Your Trading Strategy - Choose a strategy that fits your personality and risk tolerance. Trend trading, momentum, reversal and chart patterns are common day trading strategies.

- Set Risk Parameters - Determine your maximum loss per trade and your acceptable risk/reward ratio. Use stop losses and position size limits to control risk.

- Set entry/exit tactics - Define precise rules for entering and exiting trades to remove emotion. Set entry points, profit targets and stop loss levels.

- Choose markets - Focus on a specific asset class such as stocks, futures, forex or options. Trade markets that you understand and that fit your strategy.

- Establish routines - Outline your typical trading procedures from preparation to analysis to execution. Follow a consistent daily routine.

- Set profit goals - Set monetary goals such as daily or monthly profit targets. Define what constitutes a successful trading day or week.

- Limit Losses - If you lose your maximum daily loss, stop trading for the day. Losing discipline leads to revenge trading.

- Review performance - Track detailed statistics on all trades to measure what's working. Adjust your plan over time.

- Keep perspective - Remember that trading success requires patience, discipline and experience. Stick to the process for the long haul.

Follow the rules of your plan and adjust it as you gain experience. A trading plan helps build consistency by outlining the specific steps to trading success.

Managing Risk in Day Trading

Limiting Position Sizes

- Percentage at Risk - Risk only a small percentage of your account, typically 1-2%, on any single trade. For example, with a $10,000 account, risk no more than $100-$200 per trade.

- Position Size Calculator - Use an online position size calculator to determine the number of shares or contracts to buy or sell based on the stop loss distance and percentage at risk.

- Maximum Position Size - Set a maximum number of shares or contracts per trade, such as 50 shares of a stock. This limits your exposure.

- Volatility-based - For volatile assets, reduce the position size. For quieter assets, use a potentially larger size.

- Consider volatility - Adjust position sizes based on the average true range or volatility of the security. More volatile assets warrant smaller positions.

- Reduce orders - Take partial positions at smaller sizes rather than making one large trade at a time. Scale in to build larger positions.

- Spread Orders - Spread larger orders across multiple smaller lots using dollar cost averaging tactics. This will smooth out entry prices.

By using prudent position sizing tailored to each trade's parameters, day traders can improve results and consistently limit downside risk on individual trades and overall portfolios.

Using Stop Losses

- Use stop market orders to limit potential losses on each trade. Set stop levels below support or at technical price points.

- Trailing stops allow profits to run while moving the stop up as the price rises. This protects open profits.

- Use volatility tools such as ATR to determine appropriate stop distances from entry points.

Account Size Considerations

- Trade position sizes that are less than 5% of your total account size. This prevents overexposure.

- Only risk 1-2% of your account per trade. Losses won't have a significant impact on your account.

- Have at least 25 times the trading capital for your expected average loss per trade. This will ensure sufficient capital.

Avoid emotional trading

- Follow the rules of the trading plan for entering and exiting trades. Don't override the plan based on emotions.

- Avoid revenge trading after losses. Accept losses as part of the trading process.

- Don't chase trades or overtrade when bored. Be patient with quality setups.

- Take breaks after wins/losses to mentally reset and regain composure. Disconnect from results.

- Have reasonable daily profit goals. Overtrading for big profits increases risk.

Becoming a Successful Day Trader

Realistic profit expectations

- Aim for consistent daily gains, not huge windfalls. Compounding small gains leads to long-term growth.

- Expect losses and losing streaks. Trading success comes from controlling losses, not avoiding them.

- Set a reasonable dollar amount or percentage gain to achieve each day. Don't get discouraged by normal fluctuations.

- Understand that even experienced traders only win 50-60% of the time. Focus on executing high probability setups.

Hard work and consistent screen time

- Spend 4-6 hours a day analyzing charts, researching setups and monitoring positions. Screen time builds skills.

- Arrive early to assess overnight price action and plan for the day ahead. Pre-market preparation sets the tone.

- Review detailed performance statistics frequently to improve. Analysis reveals strengths and weaknesses.

- Continue to expand your market knowledge through books, courses and screen time. Trading mastery takes time.

- Stay mentally focused while looking at charts for long periods of time. Staying engaged is challenging.

Review trades for improvement

- Maintain a trading journal to record details of each trade - entries, exits, profits, losses, and reasons.

- Analyze losing trades to identify mistakes. Assess whether losses were due to poor planning, emotion, or execution.

- Review winning trades as well. Determine if successes are repeatable or just luck.

- Compare trading records with your plan. See if deviations led to poor performance.

- Tweak your trading plan over time to improve results. Review the process frequently.

Join a trader community

- Join online trading forums or social media groups to share ideas. Experienced traders offer guidance.

- Find a mentor or join a chat room. Gain real-time insights from experienced traders.

- Attend meetups to network with local traders, share strategies and find new opportunities.

- Follow active traders on platforms such as Twitter. Observation can speed up the learning curve.

- Don't rely on paid gurus. Many make their money selling, not actually trading. Find free resources.

[Most Important] Key Skills and Tools for Day Trading

Chart reading and technical analysis

- Learn to read candlestick charts to gauge market sentiment, support/resistance. Candlestick patterns reveal entry/exit signals.

- Master common indicators such as moving averages, RSI, MACD to identify momentum, overbought/oversold conditions, trend strength.

- Apply Fibonacci retracements to predict support/resistance levels based on market movements.

- Use volume indicators to assess buying/selling pressure and validate other signals. Volume confirms price action.

- Become familiar with chart patterns such as head-and-shoulders, wedges, and channels to identify potential breakouts or reversals.

- Study chart trends and use trend lines to determine the overall market bias and direction. Trading in the direction of the trend improves your odds.

- Combine basic and advanced charting techniques to identify high probability setups. Develop a trading strategy around them.

- Use charting platforms such as TradingView to analyze charts, draw tools, and save layouts. The right software makes analysis easier.

Mastering technical chart analysis provides a framework for interpreting market behavior and identifying favorable day trading opportunities in various asset classes. It is an essential skill.

Order types (market, limit)

Market Orders

- Market orders are executed immediately at the current market price. Use them to get into positions quickly.

- Can cause slippage in volatile assets. Limit orders help control the entry price.

Limit Orders

- Limit orders specify a price at which to enter or exit positions. Trades are executed only at that limit price.

- Allows control over entries and exits. Won't fill unless price threshold is reached.

- Can miss fast moves if limit isn't reached. Monitor and adjust as needed.

Stop Orders

- Stop orders become market orders to exit positions when a trigger price is reached.

- Protect against excessive losses by placing stop orders below support.

- Use stop-limit orders to control the exit price in fast moving markets.

Bracket Orders

- Bracket orders combine a limit order to enter with a stop-loss and profit target order to exit.

- Allows you to set the trade parameters for both entry and exit in advance.

Smart order placement is critical for day traders to achieve favorable entries and exits. Using the right type of order for specific trading plans and market conditions is an essential skill.

Trading platforms and tools

Trading Platforms

- Interactive Brokers, TD Ameritrade and VSTAR - Prestigious brokerages with advanced trading platforms and tools, direct market access.

- Thinkorswim, TradeStation - Sophisticated platforms with charting, screening and automation capabilities.

Charting Platforms

- TradingView - Robust free charting with extensive technical analysis tools, ideal for chart study.

- TC2000, TrendSpider - Feature-rich charting and scanning designed for the day trader.

News & Research Tools

- Benzinga Pro, Seeking Alpha - News feeds, catalyst calendars, SEC filings, earnings data.

- StockTwits - Social platform to see what stocks traders are watching and discussing.

Scanning & Screening Tools

- Trade-Ideas, Finviz - Scan for technical patterns, customize filters to find potential trades.

- FlowAlgo - Analyze unusual options flows and dark pool activity.

Other tools

- Level 2, Time & Sales - View market depth, order flow, spot price patterns.

- Paper Trading Accounts - Simulate live trading without financial risk.

With the right mix of platforms and tools, day traders can efficiently screen, analyze and execute trades at favorable conditions. Traders should use tools that match their strategy, experience level and needs.

Day Trading as a Career vs. Supplemental Income

- Day trading as a full-time job requires immense dedication, skill development and financial reserves. It's very demanding.

- For most, it may be better to start day trading part-time or as a supplement to other sources of income.

- Trade small position sizes while working another job until profits consistently exceed your current income.

- Be prepared to trade unprofitable for 1-2 years as you learn before earning a consistent income.

Key Takeaways

- Set reasonable expectations. Small daily profits add up to growth over time.

- Screen time, study and review are critical to improving skills. Trading mastery takes significant work.

- Take full advantage of technology. The right trading tools and platforms enable success.

- Start with simulations or trade small amounts. Monitor performance closely before increasing position sizes.

- Join a community to share ideas and accelerate learning. Find a good mentor.

Final advice

Treat day trading as a serious profession that requires significant commitment. Stay disciplined, manage risk, and improve through practice and analysis. Success is achievable with a dedication to mastering the necessary skills over time.