What are Cryptocurrencies and CFDs?

Cryptocurrencies

Cryptocurrency, popularly called crypto, is a digital currency or token secured through cryptography and designed to work as a medium of exchange on a blockchain network. One unique feature of cryptocurrencies is that they’re generally decentralized (they exist outside the control of governments and central authorities).

Usually, cryptocurrencies are used to buy or sell through an online exchange. However, crypto owners hold it in a digital wallet.

Currently, thousands of cryptocurrencies exist and are traded on various platforms. Here are examples of some of the known cryptocurrencies include:

○ BTC – the first cryptocurrency and widely traded cryptocurrency.

○ ETH- it’s currently the second largest cryptocurrency with a market cap of about $231 billion as of July 2023.

○ LTC- It’s one of the oldest altcoins and saw the fairest launch ever. It’s considered the silver to Bitcoin’s gold.

○ XRP- Unlike most altcoins, XRP is pre-mined and has a total supply of 100 billion tokens. As of the time of writing it, was the 6 largest cryptocurrency with a market cap of approximately $25.5 billion.

○ USDT- It’s one of the most widely adopted and traded stablecoin. It’s pegged to the US dollar and boasts fully backed reserves.

○ DOGE- It’s a memecoin with unlimited supply and was created as an alternative to traditional cryptocurrencies like Bitcoin. It also hosts one of the largest community in the crypto space

○ BNB- It’s primarily used to pay transactions and trading fees on the Binance exchange.

○ ADA- It’s considered the most environment-friendly cryptocurrency and ranks as the 8 largest cryptocurrency with a market cap of $10.3 billion.

Crypto CFDs

CFD stands for Contract of Difference. It’s a type of financial derivative that acts as a contract between the trader and the brokerage. With CFDs, a trader only needs exposure to the price movement of an asset; therefore, owning the actual asset is unnecessary. It’s right to say that crypto CFDs allow traders to speculate on the price movement of cryptocurrencies without owning the actual coin or token.

It’s also worth noting that trading crypto CFDs entails all other features of a typical/traditional CFD. They include:

○ Ability to use leverage

○ Net profit or loss is calculated based on the difference between the opening and closing position.

○ Positions don’t have an expiry date

○ Open long and short positions

Examples of common crypto CFDs include BTC/USD, ETH/USD, BTC/EUR, XRP/USD etc.

Why Traders Use CFDs for Cryptocurrency Trading

Certain benefits make crypto CFD trading attractive to most traders. Here are five of them:

Margin trading- crypto CFDs are leveraged products; thus, traders have greater exposure in the market even with a small amount of capital in their accounts. For instance, with a 10:1 leverage, you only need $100 to open a $1000 position.

Ability to profit in all market directions- With crypto CFDs, you can open long (buys) or short (sells) positions depending on your market analysis. That means you can make a profit in a falling and rising market.

Quick trade execution-traders can quickly react to price movements in the market and benefit from it. Trades can be executed within seconds.

High liquidity- crypto CFD market offers better liquidity than the crypto spot market. Therefore, getting in and out of trades is much easier, and technical analysis increases accuracy. Also, transactions are much faster due to the direct cash-out systems offered by brokers.

Market volatility- thevolatile nature of the crypto CFDs makes traders like this particular market because of how quickly they can make profits.

Risks and Opportunities of Crypto CFDs?

1. Volatility and leverage

Leverage is one of the biggest attractions to CFDs. While increased leverage amplifies your potential profits, it also magnifies your losses when your analysis is wrong: leverage is a double-edged sword. It involves a high level of risk that could result in loss of capital. Therefore, it is essential to know how to use it appropriately, especially for beginners.

Additionally, crypto prices sometimes tend to be inherently volatile, posing some risks in CFD trading. For instance, extreme volatility tends to widen market spreads. Also, it could lead to gapping in the market, which may lead to significant losses if the market moves against you.

However, with proper risk management, traders can minimize risks associated with volatility and leverage in crypto CFD trading. First, it’s also advisable for traders to choose the leverage that is right for them. Other ways to control or manage risk exposure include:

○ Use of guaranteed stop-loss orders

○ Monitor your open positions

○ Do proper position (don’t expose all your capital in a single trade)

○ Diversify your portfolio

○ Create a reasonable trading plan and follow it

○ Cut your losses early and let your profits run

2. The speculative nature of cryptocurrencies

Currently, most cryptocurrencies (except for certain stablecoins) lack intrinsic value or fundamental metrics to fall back on. To start with, cryptocurrencies are known for their wild and unpredictable price swings. These significant price fluctuations sometimes occur within a short period and are driven by sentiments (not backed by assets or cash flow). In brief, the current value of most cryptocurrencies is based on speculations about their future value.

Additionally, the cryptocurrency market is not regulated like traditional financial markets. As a result, traders view crypto assets as speculative, making crypto CFDs ideal for short-term trading.

Why would you want to speculate on crypto CFDs? It’s easy to make quick and massive profits: prices fluctuate rapidly. Also, you can speculate on the value of a cryptocurrency without taking ownership of the asset.

Uncertainty around cryptocurrencies’ long-term value

The crypto space is a growing market with a lot of dynamic forces. You’re probably wondering what the uncertainty around the long-term value of cryptocurrencies is. The lack of clear policies around the crypto market is the leading cause of uncertainty in this space, and it’s attributed to significantly impacting price volatility and crypto returns.

Is there a future beyond speculations? Cryptocurrencies are likely to gain more value when they are widely accepted as a medium of exchange, with better regulatory clarity.

3. Regulations of cryptocurrency exchanges and brokers

As highlighted above, regulation is one of the top concerns in the crypto market despite its existence for over a decade. Currently, governments around the world have taken different approaches concerning crypto regulations. As a result, there is no clear framework around the regulation of crypto assets.

For instance, about 75% of countries globally are making substantial changes in their regulatory framework to address cryptocurrency markets. Also, 64% of advanced economies already have regulations on taxation, consumer protection and licensing around crypto assets. Following the recent fall of FTX in 2022, crypto products and service providers, including crypto exchanges and CFD brokers, have come under more scrutiny. Regulatory agencies look forward to promoting responsible industry standards.

Less oversight, increased counterparty risk

One of the risks CFD traders face is counterparty risk. The risk even increases further when there is a lack of oversight. First, there is the risk that the CFD provider may fail to meet the agreed obligations to the traders who is their client. Second, the CFD providers may provide a client’s money to a third party in order to effect a transaction or provide a margin. Suppose an event like insolvency of the CFD provider occurs; the provider can only have unsecured claims against the third party on behalf of the trader. As a result, you may suffer significant losses.

Regulations that may potentially improve CFD trading

The crypto space recently saw the world’s first compressive regulatory framework from the EU parliament through MiCA. It aims to protect investors by increasing transparency and creating a comprehensive framework for issuers and service providers. Other regulatory changes that could improve crypto CFD trading include:

a. Having clearly defined criteria on how licensing, registration and authorization of CFD providers should be done.

b. Negative balance protection for crypto CFD traders. It ensures a trader cannot lose more than their initial investment.

c. Clear and thorough disclosure of risks related to CFD trading by CFD providers.

d. Establishment of robust global policies that guide regulations and supervision of cryptocurrencies and related activities.

4. Liquidity considerations

Liquidity in CFDs refers to the ease of buying and selling market assets. A cryptocurrency’s liquidity mainly relies on trade volume, i.e. the total amount of crypto (in terms of monetary value) traded over a certain period. Usually, lower volumes mean less liquidity and increased volume means higher liquidity. Generally, you could say the liquidity of a cryptocurrency is mainly influenced by the number of people trading, holding and investing in that coin or digital token. For this reason, liquidity tends to vary widely between cryptocurrencies.

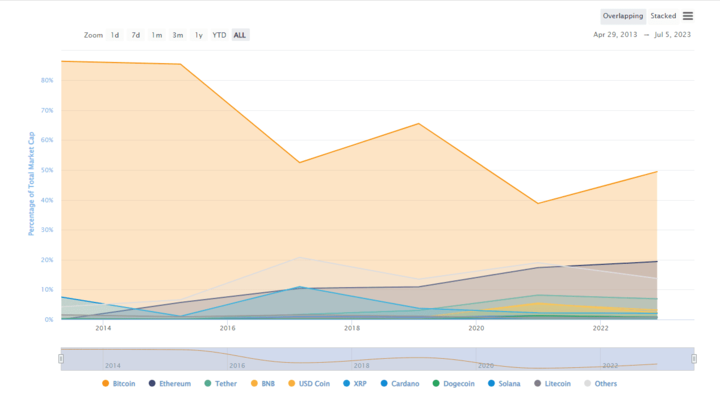

Some cryptocurrencies tend to be more liquid than others depending on the market conditions. For instance, on a typical day, cryptocurrencies like BTC, ETH, USDT, USDC, BNB and XRP tend to be more liquid than most cryptocurrencies. Why is that the case? These cryptocurrencies tend to have high and consistent trading volumes per day. Also, they often have a higher market cap (the number of outstanding assets multiplied by the price of each one of the assets than other cryptos in the market).

A screenshot displaying 10 largest (by market cap) and most liquid crypto assets. (Source: Binance)

Why does liquidity matter in crypto CFD trading?

To start with, low liquidity often translates to more volatility in the market. In such instances, it’s hard to predict price swings, thus making it hard for you to place or exit trades.

Also, low liquidity can negatively impact spreads (the difference between the selling and purchasing prices in the order book). In brief, when crypto CFD has low liquidity, you’re more likely to see wider spreads which ultimately increases your cost of trading. Lastly, low liquidity tends to increase slippage (the difference between the expected price of a trade and the price at which the trade is executed). With higher slippage, your market orders aren’t executed at your requested price, and you risk a significant loss.

On the other hand, more liquidity means stable crypto CFD prices and less volatility. It is also hard to manipulate prices. Therefore, the ability to be more accurate in technical analysis is much higher.

5. Opportunities from volatility

Often, high volatility of prices in a crypto CFD market means a high risk to traders. However, it’s not always bad; volatility can also mean opportunity. Here is how you can use volatility to your advantage in CFD trading:

Identify strategic entry and exit points- volatility can help traders identify key potential points to exit or enter a trade, such as breakouts and reversal points.

Identify more opportunities to profit in a short time- volatility increases trading opportunities, especially in short time frames which means quicker profits. Aggressive traders (scalpers) tend to profit more in such market conditions.

How can you trade volatile market conditions effectively?

For novice traders, trading a volatile market can be daunting, but with certain trading strategies, you can be profitable. However, you must have a disciplined approach and sound risk management strategy. Here are tips for trading to help you capitalize on volatile crypto CFD movements:

Develop a trading strategy that suits you

Traders are different, and each has their preferred trading style. Among the key aspects to consider while developing a trading strategy for volatile market conditions include the following:

○ Time frames

○ Chart patterns

○ Defined entry and exit points

○ Market structure

○ Risk tolerance

Use technical indicators

Technical indicators can be used to identify trading opportunities in a volatile market. Some of the common indicators in this kind of market condition include Exponential Moving Average (EMA), Relative Strength Index (RSI), Bollinger Bands and Moving Average Convergence Divergence (MACD) indicators.

Backtest your strategy

Backtesting helps you determine if your strategy works in the market. It also builds your confidence in executing your trading strategy.

Use limit orders to get the best pricing

Limit orders can be significant when you want to enter a trade at a predetermined price. Suppose your preferred price level isn’t reached; your trade isn’t triggered. As a result, you’ll have avoided panic attacks, and you’re more likely to stick to your strategy.

Manage risk using stop-loss orders

Setting stop-loss orders is significant in risk management; they automatically close positions if the price moves against you and hits a certain predetermined level. Therefore, you limit potential losses.

Challenges of Fundamental Analysis

Fundamental analysis entails studying economic data, industry trends and other non-quantifiable factors to determine the value of a crypto asset. From a cryptocurrency perspective, fundamental analysis is more based on factors such as:

○ The technological innovation of a project

○ Tokenomics

○ Developers behind the project and their capability

○ Social media engagement of the community

○ Supply and demand of a cryptocurrency

○ On-chain metrics

○ Financial metrics (Market cap, trading volume and liquidity)

Difficult of valuing cryptocurrencies using traditional metrics

As you can tell from the above-outlined factors, it’s difficult to determine the value of cryptocurrencies based on traditional metrics such as interest rates, economic growth, business cycles and geopolitics.

You’re probably wondering why fundamental analysis in cryptocurrency somewhat takes a different approach from typical markets like the forex and stocks. Most crypto assets lack the historical data required to use traditional metrics. Therefore, fundamental analysis has to be based on available information of a crypto asset, as highlighted above.

Why fundamental analysis is not enough in crypto trading

While fundamental analysis gives an overall picture of what is likely to happen in the market, you cannot base your strategy all on it. Often, most crypto CFD traders tend to rely more on technical and sentimental factors to identify the potential of cryptocurrencies. Here is why sentiment and technical analysis dominate in crypto trading:

a. It’s easy to identify short-term trading opportunities

b. It’s easier to determine entries and exits in the market

c. It enables you to make decisions based on current data

d. It gives you more detailed ideas

e. Sentiment analysis often has a significant impact on the price of a cryptocurrency.

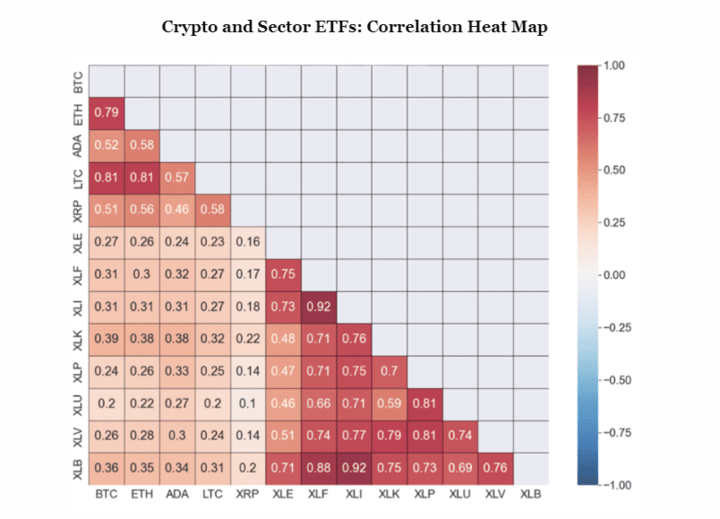

Correlations with Traditional Assets

Understanding the correlation of different asset classes is fundamental in the current world, especially when diversifying your investment portfolio. Understanding the relationship between assets is essential in reducing risk and maximizing returns.

What’s the cryptocurrency correlation with traditional asset classes like stocks and bonds? Overall, the correlation between cryptocurrencies is usually positive (moving in a similar direction). However, cryptocurrencies often depict a negative correlation (they move in opposite directions) with most traditional assets. As a result, cryptocurrencies such as Bitcoin could be used to hedge against economic events where stocks and bonds are often affected negatively.

Source: CFA Institute

It is also worth noting that there are instances when the correlation between cryptocurrencies and traditional assets may temporarily increase. For example, in 2020, the effect of COVID-19 contributed to an increase in correlation between these two assets. Also, a similar pattern was experienced in 2022 amid an increased crypto adoption whereby crypto prices moved in sync with stocks.

Trade Crypto CFDs with VSTAR

Now that you understand nearly all the fundamentals of crypto CFDs, you need a platform to trade various CFDs. The crucial thing is choosing a reliable CFD broker to start your trading journey.VSTAR is your go-to online platform for crypto CFD trading. It features a user-friendly interface accessible on VSTAR’s mobile app and website. Why trade with VSTAR?

a. It’s a licensed and multi-regulated CFD broker offering services globally in over 100 countries.

b. Access over 40 crypto CFDs with super tight spreads.

c. Transparent and low trading costs and zero commissions on trades

d. Trade crypto CFDs with up to 100:1 leverage.

e. It offers negative balance protection to its clients

f. Client funds are kept separately and safely in reputable tier-1 banks (your funds are protected)

g. Practice and test your trading strategy on a free demo account.

Final Thought

Unlike most asset classes, crypto CFDs are speculative, making them attractive for short-term trading. The best part is that you can go long or short in the market, allowing you to profit from either direction of the market. Leverage and volatility can help you boost profits if used correctly. With leverage, you can take bigger positions with small capital in your account, and volatility creates numerous trading opportunities. However, these could also lead to significant losses if not applied correctly. For this reason, having a good risk management strategy is crucial.

Aspects such as liquidity and market analysis are vital in CFD trading. You need to understand that liquidity varies among cryptocurrencies and consider trading CFDs with high liquidity. On the other hand, low liquidity impacts your trading negatively by increasing spreads and slippage in the market. Also, unlike most traditional markets where fundamental analysis is often used, CFD traders rely more on technical and sentiment analysis.

Lastly, you need a reputable and reliable broker to trade crypto CFDs. With crypto regulations being a concern, you must ensure the broker is regulated by reputable licensing and regulatory bodies. Above all, you need a broker who offers transparent and low trading costs.