About VSTAR

VSTAR is part of VS Group, the Internet retail brand of the global multi-asset fintech group, founded by professionals with extensive industry experience and a deep understanding of traders' needs. VSTAR provides users with an institutional-grade trading experience, competitive trading costs, and a product team that strives for excellence to expand core products into new and existing markets, support advanced tools, and deepen engagement with clients to meet user needs.

One platform. 1000+ popular global markets

VSTAR, the emerging technology-leading trading platform, is trusted by users in 100+ regions worldwide. The advantages of trading financial markets through the VSTAR platform include the following:

Enjoy the world's best-class CFD trading experience with diverse trading products, including stocks, indices, currency pairs, commodities, and cryptocurrencies.

Best-in-class market depth, efficient order execution, and flexible leverage options, VSTAR's convenient and easy-to-use trading App helps you seize every market opportunity.

Transparent fees and extremely low transaction costs.

Powerful technical infrastructure ensures the stability and security of trading, making your investment more secure and trading more smoothly.

VSTAR strictly complies with regulations to provide you with a transparent and fair trading environment, making your transactions more secure.

Multilingual customer service team to support you 24/7.

Comprehensive Trading Tools, Chart Analyzers, Technical Indicators, News, Education, podcast and Tutorial.

VSTAR offers Experience Enhanced Mobile Trading. A trading app designed for traders of all types.

Powerful infrastructure to ensure hassle-free trading

- Best-in-class order matching engine for efficient trade fulfillment

- World-class distributed system design that easily handles large, concurrent transactions

- Industry-leading trading system architecture for the high-speed execution of trades, ensuring the fairness of transactions and the liquidity of the market.

- A robust security protection system to fully resist all kinds of failures and attacks, ensuring the reliability and stability of transactions.

- Comprehensive user security measures to protect both the asset and transaction data of users.

Trading Fees

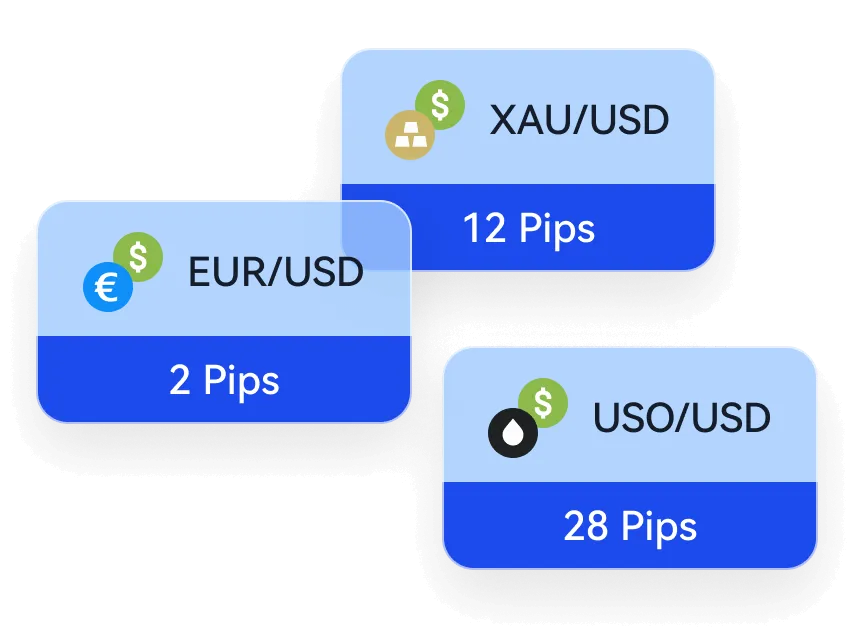

On a 0 commission basis, VSTAR offers some of the lowest spreads in the industry.

Spreads on major instruments such as XAUUSD as low as 12, USOUSD as low as 28, EURUSD as low as 2.0 pips.

VSTAR is compensated for its services by charging a bid/ask spread. Therefore, when you open a position, you are essentially "paying" the spread included in VSTAR's quotes. In certain circumstances, when a position is held for a period of time ("overnight fee time"), an overnight fee will be charged to or deducted from your account, depending on the exchange on which the order is executed and the type of asset held.

Investor Education

- VSTAR provides third-party real-time trading signals, comprehensive and classic trading learning articles, risk management strategies, online courses for VIP users, seminars, and market interpretation services to help users improve trading skills and minimize trading risks.

Powerful infrastructure to ensure hassle-free trading

VSTAR is the retail Internet trading brand of VS Group, which has obtained licenses in many countries around the world: -Vstar& Soho Markets Ltd (Cyprus) -VSTAR Finance Pty Ltd (Australia) -Vstar Limited (Mauritius) -VSTAR Global LLC(St. Vincent and the Grenadines)

CySEC

Vstar & Soho Markets Global Ltd. is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) under licence number #409/22. Cyprus is a member of the European Union which enables all CySEC Forex brokers to expand their services throughout the European countries; therefore, they must adhere to European MiFID financial guidelines. Under CySEC laws, traders’ funds must be kept in segregated accounts, completely separate from Broker’s funds, at top-tier European banks for extra protection. Moreover, Cyprus brokers are a member of ICF (Investor Compensation Fund) which ensures clients’ funds up to 20,000 Euro

MiFiD

The purpose of Financial Instruments (MiFID) is to regulate financial markets and the provision of investment services and activities within the European Economic Area (EEA). Its primary goal is to promote efficiency, financial transparency, competition, and consumer protection in investment services across the EEA. Investment firms can provide their services within other member states or third countries if their services are covered by their authorization under the MiFID. Companies authorized under the MiFID must comply with transparency and good conduct standards across Europe and are thus permitted to provide cross-border services.

Investor Compensation Fund (ICF)

VSTAR is a member of the Investor Compensation Fund (ICF). The Investor Compensation Fund is an investor compensation fund for CIF clients established under Article 59(1) and (2) of Law 144(Ι)/2007, and its functions are regulated by the Cyprus Securities and Exchange Commission's Directive DI87-07. The objective of the Fund is to ensure that insured clients indemnify the members of the Investor Compensation Fund against claims made by them by paying compensation for any claims arising from the failure of the members of the Fund to fulfill their obligations.

FSC

The Financial Services Commission (FSC) is an integrated regulatory body in Mauritius in charge of regulating and licensing all the financial institutions, forex brokerage companies, and any other entities registered under its laws and regulations. The FSC licenses, regulates, monitors and supervises the conduct of business activities in the financial services sector other than banking. Additionally, all the registered members of FSC are to meet the compliance requirements as specified by the organization.

Become a Partner

Engage with a trusted regulated trading platform and succeed together! Your dedicated affiliate manager will be at your side.