Introduction

The EUR/AUD currency pair is a popular choice among forex traders due to its potential for volatility and profit. When analyzing currency pairs, fundamental analysis plays a crucial role in understanding the underlying economic factors that influence their movements. In this article, we will explore the EUR/AUD currency pair and delve into the fundamental analysis of the euro and the Australian dollar.

Macroeconomic Overview - Eurozone

Economic Indicators Review

To comprehend the current state of the euro, it is essential to review key economic indicators. GDP (Gross Domestic Product) and the unemployment rate provide insights into the overall economic health of the Eurozone. Examining inflation rates enables us to assess the purchasing power and stability of the euro. Additionally, business and consumer confidence indices gauge the sentiment and expectations within the Eurozone.

Monetary Policy

The European Central Bank plays a significant role in shaping the monetary policy of the Eurozone. We can better understand the potential impacts on the euro's value by analyzing the ECB's monetary policy decisions, such as interest rates and quantitative easing measures. Furthermore, keeping track of interest rate expectations allows traders to anticipate market reactions and adjust their strategies accordingly. Traders will be looking for signs of where the central bank is heading as far as interest rate decisions and the peripheral actions that they do.

Political Climate

The economic policies implemented by the Eurozone's governments have a substantial impact on the euro's performance. By examining these policies, we can gain insights into the potential influences on the currency pair. The repercussions of Brexit on the eurozone economy are worth considering, as they have had far-reaching consequences and may continue to impact the euro's value. However, as the last few years have gone by, the effect of Brexit seems to be much less than originally feared.

Macroeconomic Overview - Australia

Economic Indicators Review

Understanding the economic indicators of Australia provides valuable insights into the Australian dollar's strength and potential movements. Monitoring GDP and the unemployment rate allows us to gauge the country's economic performance and labor market conditions. Inflation rates help determine the stability of the Australian dollar, while business and consumer confidence indices shed light on economic sentiment within the country.

Monetary Policy

The Reserve Bank of Australia plays a crucial role in shaping the country’s monetary policy. By examining the RBA's decisions on interest rates and other policy tools, we can assess the potential impacts on the Australian dollar's value. Keeping an eye on interest rate expectations allows traders to anticipate market reactions and adjust their trading strategies accordingly.

Political Climate

The economic policies pursued by the Australian government can significantly influence the Australian dollar's performance. Analyzing these policies provides insights into factors that may affect the currency pair. Additionally, considering the impact of China on the Australian economy is crucial, as China has been a major trading partner and a key driver of economic growth in Australia.

By thoroughly examining the macroeconomic indicators, monetary policies, and political climates of both the Eurozone and Australia, traders can make informed decisions when trading the EUR/AUD currency pair. Fundamental analysis is a valuable tool for understanding the underlying factors driving currency movements and minimizing risks in the forex market.

Analysis of the EUR/AUD Currency Pair

Relevant Economic Indicators

Understanding the correlation between the eurozone and Australian economies is crucial when analyzing the EUR/AUD currency pair. Economic indicators such as GDP growth, inflation, and interest rates can significantly influence the currency pair's movements. By examining these indicators, traders can gain insights into the potential impacts on the EUR/AUD exchange rate.

Factors Supporting a Bullish or Bearish Stance

Several factors contribute to a bullish or bearish stance on the EUR/AUD currency pair. The monetary policy decisions of the European Central Bank play a pivotal role in shaping the euro's performance. Traders can assess the potential impacts on the currency pair by analyzing the ECB's policies, such as interest rates and quantitative easing measures. Similarly, monitoring the Reserve Bank of Australia's monetary policy decisions provides insights into the Australian dollar's strength and influence on the currency pair. Additionally, commodity prices, which significantly impact the Australian economy, can also influence the EUR/AUD exchange rate.

Potential Risks to the Currency Pair

Traders must know the potential risks impacting the EUR/AUD currency pair. Sudden changes in global economic growth can cause fluctuations in the exchange rate, affecting the overall market sentiment and risk appetite. Unexpected shifts in the Eurozone or Australian monetary policies can also significantly affect the currency pair. Traders need to monitor any policy announcements or changes that may occur closely. Geopolitical risks, such as trade tensions between China and the U.S., can create volatility in the forex market, potentially impacting the EUR/AUD exchange rate.

By considering the relevant economic indicators, evaluating factors supporting a bullish or bearish stance, and recognizing potential risks, traders can develop a comprehensive analysis of the EUR/AUD currency pair. This analysis allows for informed decision-making and the implementation of appropriate risk management strategies when trading this particular currency pair.

Trading Strategies for EUR/AUD

Technical Analysis

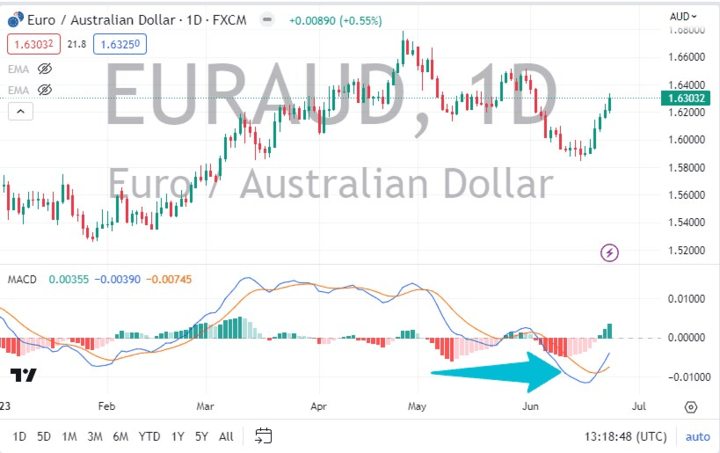

Technical analysis can be valuable when trading the EUR/AUD currency pair. By identifying trends and patterns in price charts, traders can gain insights into potential future price movements. Various indicators, such as moving averages and the MACD (Moving Average Convergence Divergence), can assist in identifying entry and exit points. These tools help traders make informed decisions based on historical price data and market trends.

The moving averages on the MACD indicator have crossed at a low, showing buyers coming back into the EUR/AUD pair. This is a sign to start buying.

Risk Management

Implementing effective risk management strategies is essential when trading the EUR/AUD currency pair. Setting Stop-Loss and Take-Profit levels helps traders limit potential losses and secure profits. By defining predetermined levels at which to exit a trade, traders can mitigate risks and protect their capital. Additionally, determining position size based on risk tolerance ensures that traders allocate an appropriate portion of their capital to each trade, considering their individual risk appetite.

News Trading

Keeping track of economic events and data releases is crucial when trading the EUR/AUD currency pair. News and economic indicators can significantly impact currency movements. By staying informed about upcoming events and monitoring market reactions to the news, traders can capitalize on potential price fluctuations. This strategy involves entering trades based on the market's response to the news, leveraging the volatility and opportunities presented by significant economic announcements.

By incorporating technical analysis, risk management techniques, and news trading strategies, traders can develop a well-rounded approach to trading the EUR/AUD currency pair. These strategies enable traders to make informed decisions based on price patterns, manage risks effectively, and capitalize on market opportunities driven by economic news. It is important to note that trading strategies should be personalized and adjusted according to individual trading styles, goals, and risk preferences.

Why Trade EUR/AUD with VSTAR

Trading the EUR/AUD market offers opportunities when approached with strategic professionalism. It would be best to deal with a trusted broker to continue benefiting from this pair. VSTAR offers regulation and licensing in the EU under the protection of CySEC and others. By offering vast liquidity and balance protection, traders can feel secure in their investments in this pair and all our markets.

Conclusion

Recap of Fundamental Analysis of the EUR/AUD Currency Pair

Throughout this analysis, we have delved into the fundamental factors that drive the EUR/AUD currency pair. By examining economic indicators, monetary policies, and political climates in both the Eurozone and Australia, we gained valuable insights into the underlying forces influencing the exchange rate.

Summary of Bullish or Bearish Stance Based on Analysis

Based on our analysis, a summary of the bullish or bearish stance on the EUR/AUD currency pair can be derived. Factors such as GDP growth, inflation, and interest rates in both regions contribute to this stance. Additionally, the impacts of monetary policies, commodity prices, and geopolitical risks should be considered when forming an outlook on the currency pair.

Final Thoughts on Trading the EUR/AUD Currency Pair Based on Fundamental Analysis and Trading Strategies

In conclusion, trading the EUR/AUD currency pair requires a comprehensive understanding of fundamental analysis and applying appropriate trading strategies. With effective trading strategies, traders can make informed decisions and manage risks by combining insights from fundamental analysis, such as economic indicators, monetary policies, and political climates.

It is essential to remember that trading involves inherent risks, and market conditions can change rapidly. Therefore, continuous monitoring of economic developments, adjusting strategies accordingly, and staying up to date with relevant news are crucial elements of successful trading.

A solid understanding of fundamental analysis, effective trading strategies, and disciplined risk management can ultimately enhance the prospects of achieving profitable trades when trading the EUR/AUD currency pair.