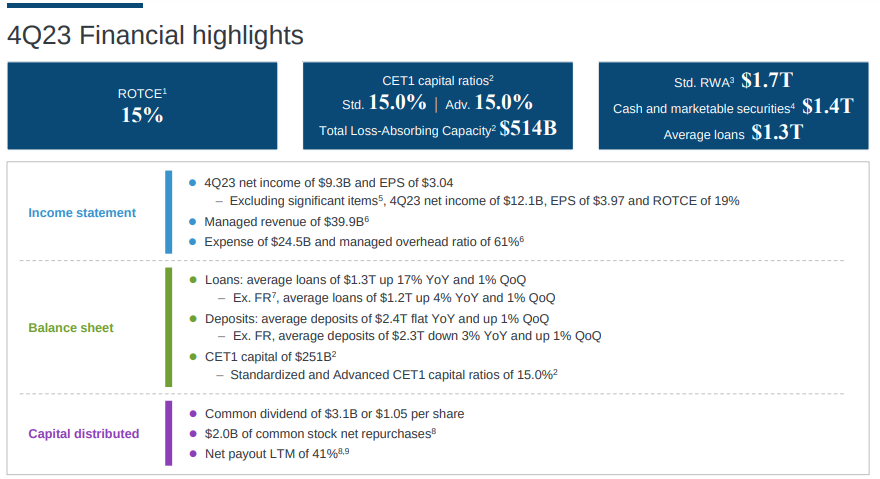

- Thu nhập ròng và EPS: Thu nhập ròng được báo cáo của JPMorgan là 9,3 tỷ USD và EPS là 3,04 USD nhấn mạnh khả năng sinh lời và hiệu quả hoạt động của công ty.

- Tạo ra doanh thu: Doanh thu đáng kể 39,9 tỷ USD của ngân hàng làm nổi bật các ngành nghề kinh doanh đa dạng và mạnh mẽ của ngân hàng.

- ROTCE: Lợi nhuận trên vốn chủ sở hữu chung hữu hình (ROTCE) là 15% phản ánh trọng tâm chiến lược, củng cố sự tăng trưởng bền vững.

- Hiệu suất của Phân khúc Kinh doanh: Điểm mạnh trong lĩnh vực Ngân hàng Tiêu dùng & Cộng đồng, Quản lý Ngân hàng & Tài sản cũng như Ngân hàng Doanh nghiệp & Đầu tư góp phần tạo nên vị thế vững chắc của JPMorgan.

Khám phá các phân khúc kinh doanh khác nhau, từ Ngân hàng Tiêu dùng & Cộng đồng đến Ngân hàng Doanh nghiệp & Đầu tư, bài viết khám phá hiệu quả hoạt động nhiều mặt của JPMorgan trong Quý 4 năm 2023. Tuy nhiên, giống như bất kỳ gã khổng lồ tài chính nào đang điều hướng sự phức tạp của thị trường, luôn có những cân nhắc về rủi ro tiềm ẩn. Bài viết này tập trung vào đánh giá cân bằng, trình bày khách quan các số liệu chính, hiệu quả hoạt động của phân khúc và dự đoán cho năm 2024, đồng thời thừa nhận những điều không chắc chắn có thể định hình hành trình của JPMorgan vào năm 2024.

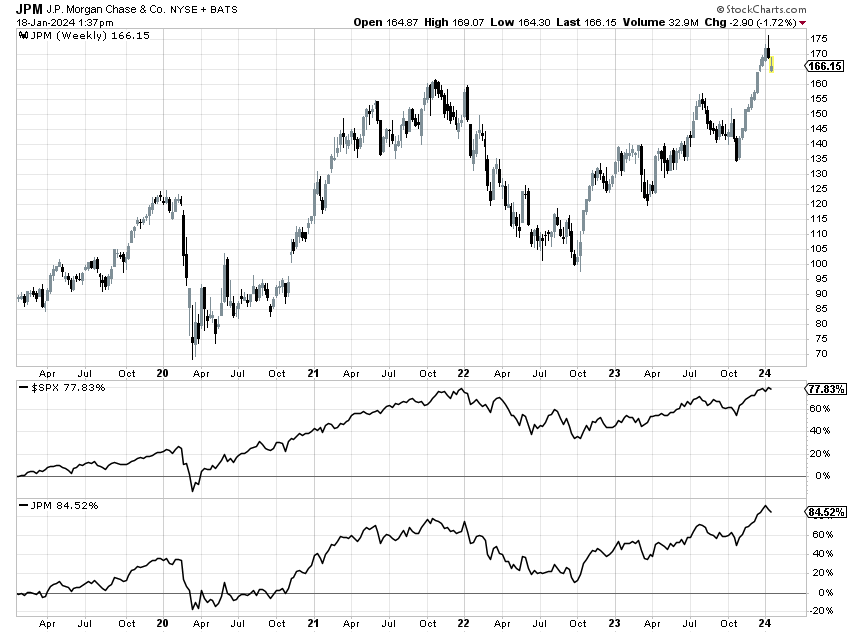

Nguồn: stockcharts.com (Price Performance)

Hiệu suất tài chính của JP Morgan

Thu nhập ròng và thu nhập trên mỗi cổ phiếu (EPS):

Hiệu quả tài chính mạnh mẽ của JPMorgan là sức mạnh cơ bản chính hỗ trợ tiềm năng tăng trưởng nhanh chóng của nó. Thu nhập ròng được báo cáo là 9,3 tỷ USD và EPS là 3,04 USD nhấn mạnh khả năng sinh lời của ngân hàng. Thu nhập ròng cung cấp cái nhìn toàn diện về tổng thu nhập do ngân hàng tạo ra, trong khi EPS đo lường thu nhập được quy cho mỗi cổ phiếu đang lưu hành, đóng vai trò là thước đo chính cho các nhà đầu tư. Khả năng JPMorgan liên tục mang lại thu nhập ròng và EPS cao phản ánh hiệu quả hoạt động và quản lý nguồn lực hiệu quả.

Tạo ra doanh thu:

Tổng doanh thu được báo cáo là 39,9 tỷ USD càng làm nổi bật thêm khả năng tạo doanh thu mạnh mẽ của JPMorgan. Doanh thu là thước đo quan trọng đối với các tổ chức tài chính, cho biết tổng thu nhập được tạo ra từ các hoạt động kinh doanh khác nhau. Doanh thu đáng kể của JPMorgan nhấn mạnh ngành nghề kinh doanh đa dạng và mạnh mẽ của công ty, góp phần vào sức mạnh tài chính tổng thể của công ty. Khả năng tạo ra doanh thu đáng kể là thế mạnh cơ bản hỗ trợ tiềm năng tăng trưởng của ngân hàng.

Lợi nhuận trên vốn chủ sở hữu chung hữu hình (ROTCE):

Tỷ suất lợi nhuận trên vốn chủ sở hữu chung hữu hình (ROTCE) là 15% được JPMorgan báo cáo là một chỉ số quan trọng về hiệu quả của ngân hàng trong việc sử dụng vốn chủ sở hữu chung hữu hình của mình để tạo ra lợi nhuận. ROTCE là thước đo quan trọng để đánh giá khả năng sinh lời và tạo ra giá trị của tổ chức tài chính cho các cổ đông. ROTCE 15% của JPMorgan phản ánh trọng tâm chiến lược của công ty là tối ưu hóa lợi nhuận và cho thấy nền tảng vững chắc cho tăng trưởng bền vững.

Nguồn: Earnings Presentation

Hiệu suất phân khúc kinh doanh của JPMorgan

Khách hàng & Ngân Hàng Cộng Đồng (CCB):

Chi tiêu bằng thẻ ghi nợ và thẻ tín dụng:

Trong phân khúc Ngân hàng Tiêu dùng & Cộng đồng (CCB), tổng chi tiêu bằng thẻ ghi nợ và thẻ tín dụng được báo cáo tăng 7% so với cùng kỳ năm trước cho thấy sức mạnh của ngân hàng trong lĩnh vực ngân hàng tiêu dùng. Sự tăng trưởng trong chi tiêu thẻ là một chỉ số tích cực, phản ánh tốc độ tăng trưởng tài khoản mạnh mẽ và mô hình chi tiêu tiêu dùng ổn định. Sức mạnh cơ bản này giúp JPMorgan có vị thế tốt trong lĩnh vực ngân hàng bán lẻ.

Ngân hàng & Quản lý tài sản:

Doanh thu trong lĩnh vực Quản lý Tài sản & Ngân hàng tăng 6% so với cùng kỳ năm trước cho thấy khả năng điều hướng lãi suất cao hơn của ngân hàng. Thu nhập lãi ròng (NII) cao hơn do lãi suất tăng, cùng với sự tăng trưởng về tài sản đầu tư của khách hàng, thể hiện các chiến lược quản lý tài sản hiệu quả. Một năm kỷ lục về lượng tiền mới ròng bán lẻ càng củng cố thêm vị thế của JPMorgan trong lĩnh vực quản lý tài sản.

Dịch vụ thẻ & ô tô:

Doanh thu trong lĩnh vực Dịch vụ thẻ và ô tô tăng 8% so với cùng kỳ năm ngoái, nhờ Thu nhập lãi ròng (NII) của dịch vụ thẻ cao hơn và hoạt động mua lại tài khoản mạnh mẽ, cho thấy sự thành công của ngân hàng trong lĩnh vực thẻ tín dụng và tài trợ ô tô. Với mức tăng dư nợ thẻ 14% và số lượng ô tô ban đầu tăng 32%, JPMorgan chứng tỏ mức tăng thị phần và khả năng sinh lời của mình trong các phân khúc này.

Ngân hàng Doanh nghiệp & Đầu tư (CIB):

Doanh thu từ ngân hàng đầu tư:

Thu nhập ròng được báo cáo của phân khúc CIB là 2,5 tỷ USD trên doanh thu 11 tỷ USD phản ánh sức mạnh của ngân hàng trong lĩnh vực ngân hàng đầu tư. Doanh thu ngân hàng đầu tư tăng 13% so với cùng kỳ năm trước, cùng với mức tăng trưởng đáng chú ý về phí bảo lãnh nợ và vốn cổ phần, giúp JPMorgan trở thành công ty dẫn đầu trong hoạt động thị trường vốn. Xếp hạng số một của ngân hàng với thị phần ví là 8,8% nhấn mạnh vị thế vững chắc của ngân hàng trong bối cảnh ngân hàng đầu tư.

Doanh thu thị trường:

Trong Thị trường, tổng doanh thu 5,8 tỷ USD, tăng 2% so với cùng kỳ năm trước, cho thấy khả năng phục hồi của JPMorgan trong việc điều hướng các biến động của thị trường. Thu nhập cố định đạt kỷ lục trong quý 4, tăng 8%, cho thấy sức mạnh của hoạt động kinh doanh sản phẩm chứng khoán hóa. Mặc dù doanh thu từ thị trường chứng khoán giảm 8% nhưng hiệu quả hoạt động chung của ngân hàng trong Thị trường phản ánh khả năng đa dạng của ngân hàng.

Ngân hàng thương mại:

Doanh thu và hiệu suất tín dụng:

Thu nhập ròng được báo cáo của Ngân hàng Thương mại là 1,5 tỷ USD trên doanh thu 3,7 tỷ USD chứng tỏ sức mạnh của ngân hàng trong việc phục vụ khách hàng thương mại. Doanh thu tăng 7% so với cùng kỳ năm trước nhờ NII và doanh thu thanh toán cao hơn, làm nổi bật khả năng điều hướng những thay đổi về lãi suất của JPMorgan. Bất chấp những thách thức về chi phí tín dụng, với mức dự trữ ròng lên tới 142 triệu USD nhờ triển vọng định giá bất động sản thương mại, hiệu quả hoạt động của phân khúc này cho thấy khả năng phục hồi.

Quản lý tài sản (AWM):

Thu nhập ròng và tăng trưởng AUM:

Asset & Wealth Management báo cáo thu nhập ròng là 925 triệu USD với tỷ suất lợi nhuận trước thuế là 28%. Doanh thu tăng 2% so với cùng kỳ năm trước nhờ phí quản lý cao hơn và dòng vốn vào ròng mạnh mẽ, phản ánh sự thành công của ngân hàng trong việc quản lý tài sản. Dòng vốn vào tài sản khách hàng kỷ lục là 489 tỷ USD trong năm góp phần vào sự tăng trưởng mạnh mẽ của phân khúc này. Với AUM là 3,4 nghìn tỷ USD và tài sản khách hàng là 5 nghìn tỷ USD, phân khúc AWM của JPMorgan thể hiện khả năng thu hút và giữ chân khách hàng.

Corporate:

Động thái thu nhập và chi phí:

Báo cáo của Corporate lỗ ròng là 689 triệu USD và doanh thu 1,8 tỷ USD làm nổi bật tác động của đánh giá đặc biệt của FDIC và lỗ ròng chứng khoán đầu tư. NII là 2,5 tỷ USD, tăng 1,2 tỷ USD so với cùng kỳ năm ngoái, nhấn mạnh khả năng phục hồi của phân khúc này trong việc điều hướng lãi suất cao hơn và bảng cân đối kế toán hỗn hợp. Bất chấp khoản lỗ ròng về NIR, động lực của phân khúc này, bao gồm cả các chi phí do đánh giá đặc biệt của FDIC, góp phần vào sự hiểu biết chung về bối cảnh tài chính của JPMorgan.

Kết quả cả năm và vị thế vốn của JP Morgan Chase

Hiệu suất cả năm:

Kết quả cả năm của JPMorgan cho thấy thu nhập ròng là 50 tỷ USD, EPS là 16,23 USD và doanh thu là 162 tỷ USD. Việc đạt được ROTCE 21% trong cả năm nhấn mạnh khả năng sinh lời ổn định của ngân hàng. Khả năng mang lại kết quả mạnh mẽ như vậy trên các phân khúc kinh doanh đa dạng đã giúp JPMorgan trở thành công ty chủ chốt trong ngành tài chính.

Bảng cân đối kế toán và vị thế vốn:

Kết thúc quý với tỷ lệ Vốn chủ sở hữu chung Cấp 1 (CET1) là 15%, tăng 70 điểm cơ bản so với quý trước, phản ánh vị thế vốn vững chắc của JPMorgan. Các yếu tố góp phần vào mức tăng này bao gồm thu nhập ròng, lợi nhuận Thu nhập toàn diện tích lũy khác (AOCI) và Tài sản có trọng số rủi ro (RWA) thấp hơn. Bất chấp tốc độ phân bổ vốn liên tục, ngân hàng vẫn duy trì nguồn vốn dồi dào, phù hợp với các yêu cầu của Basel III Endgame.

Triển vọng JPMorgan Chase trong năm 2024

Nguồn: Earnings Presentation

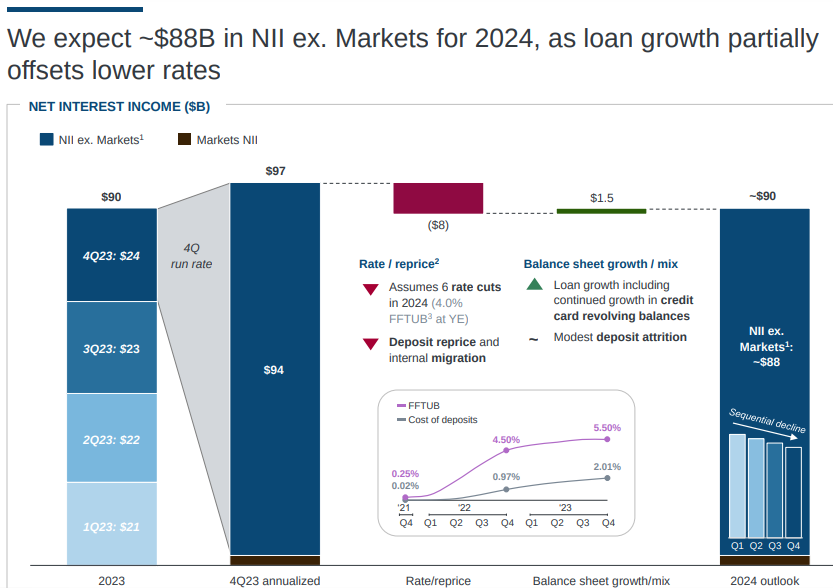

Thu nhập lãi ròng (NII) và chi phí:

Triển vọng của JPMorgan cho năm 2024 dự báo NII ex-Markets sẽ đạt khoảng 88 tỷ USD. Triển vọng xem xét tác động của việc cắt giảm lãi suất dự kiến và kỳ vọng về những thay đổi số dư khiêm tốn. Tăng trưởng cho vay mạnh mẽ trong Thẻ dự kiến sẽ bù đắp một số tác động của lãi suất thấp hơn, góp phần vào NII chung. Chi phí dự kiến khoảng 90 tỷ USD cho năm 2024 phản ánh các khoản đầu tư chiến lược của ngân hàng, bao gồm các sáng kiến tăng trưởng và mở rộng kinh doanh đang diễn ra.

Hiệu suất tín dụng:

Hướng dẫn về tỷ lệ xóa nợ ròng thẻ năm 2024 dưới 3,5% nhấn mạnh cam kết của JPMorgan trong việc quản lý rủi ro tín dụng một cách hiệu quả. Bất chấp những bất ổn về kinh tế và địa chính trị, ngân hàng vẫn duy trì cách tiếp cận thận trọng trong quản lý tín dụng, đảm bảo quỹ đạo tăng trưởng cân bằng và bền vững.

Đánh giá kỹ thuật về cổ phiếu JPM

Nguồn: tradingview.com

Giá cổ phiếu JPM có thể đạt 195 USD vào những tháng cuối nửa đầu năm 2024 là kịch bản rất có thể xảy ra dựa trên mức thoái lui Fibonacci và đà tăng hiện tại (dự kiến trong tương lai). Động lực hiện tại là tăng, như có thể được quan sát thấy trong sự liên kết của các đường trung bình động hàm mũ (EMA) 50 tuần và 200 tuần.

Cổ phiếu JP Morgan đã được hỗ trợ tại EMA 200 tuần vào đầu năm 2024 và đang nhận được hỗ trợ tích cực tại EMA 50 tuần. Tuy nhiên, cổ phiếu hiện đang chạm tới mức kháng cự. Do đó, có thể dự kiến sẽ có một đợt điều chỉnh, trong đó giá cổ phiếu có thể kiểm tra mức pivot ở khoảng 154 USD.

Cụ thể, dự đoán này dựa trên chỉ số RSI (chỉ số sức mạnh tương đối), hiện ở mức 64 và có thể quay trở lại mức 50 trước khi quay trở lại tín hiệu quá mua trên 70. Đồng thời, cũng có nhiều khả năng tăng giá hơn có thể dẫn đến sự xuất hiện của phân kỳ giảm giá.

Mặt khác, với quan điểm lạc quan, giá có thể đạt 232 USD vào cuối năm 2024, nhưng chỉ khi giá có thể đóng cửa trên 195 USD vào nửa đầu năm 2024. Một lần nữa, có thể dự kiến sẽ có sự điều chỉnh nếu giá đóng cửa gặp phải ngưỡng kháng cự quan trọng gần $195.

Mặt khác, việc cắt giảm lãi suất nhanh chóng của Fed hoặc môi trường kinh tế suy thoái có thể khiến giá điều chỉnh lớn trở lại pivot. Trong trường hợp biến động tăng cao, giá có thể giảm xuống còn 113,50 USD, đóng vai trò hỗ trợ trung hạn. Nhưng điều này ít có khả năng xảy ra hơn.

Rủi ro và bất lợi cụ thể

Triển vọng Thu nhập lãi ròng (NII) của JPMorgan đóng vai trò then chốt trong việc tìm hiểu điểm yếu cơ bản có thể cản trở tiềm năng tăng trưởng nhanh chóng của công ty. Triển vọng đang cho thấy sự suy giảm khi đối mặt với việc cắt giảm lãi suất dự kiến. Khía cạnh này rất quan trọng vì NII chiếm một phần đáng kể trong doanh thu của ngân hàng và bị ảnh hưởng trực tiếp bởi môi trường lãi suất hiện hành.

Lãi suất có ảnh hưởng đáng kể đến lợi nhuận của ngân hàng, đặc biệt là về sự chênh lệch giữa lãi thu được từ tài sản và lãi phải trả trên nợ phải trả. Trong trường hợp của JPMorgan, triển vọng về NII cho thấy quan điểm thận trọng, với NII ước tính cho các Thị trường ngoài thị trường năm 2024 là khoảng 88 tỷ USD. Dự báo này thấp hơn đáng kể so với tỷ lệ chạy NII ngoài thị trường hàng quý được báo cáo là 94 tỷ USD. Giả định đằng sau triển vọng này bao gồm kỳ vọng về lãi suất theo đường cong kỳ hạn, bao gồm sáu lần cắt giảm trong suốt cả năm.

Độ nhạy của NII đối với sự thay đổi lãi suất là một yếu tố quan trọng cần xem xét. JPMorgan, vốn nhạy cảm với tài sản, phải đối mặt với những thách thức trong việc duy trì tỷ suất lợi nhuận tối ưu khi lãi suất giảm. Môi trường Fed ôn hòa hơn có thể làm giảm bớt một số áp lực định giá lại. Tuy nhiên, kỳ vọng tiền gửi tăng trưởng khiêm tốn và NII giảm do lãi suất thấp hơn là những lo ngại đáng kể.

Mặc dù sức mạnh tài chính và hiệu quả hoạt động của phân khúc của JPMorgan vẫn đáng khen ngợi nhưng triển vọng cho năm 2024 lại cho thấy sự thận trọng, đặc biệt là về Thu nhập lãi ròng (NII). Tác động tiềm tàng của việc cắt giảm lãi suất dự kiến đối với NII đóng vai trò là một yếu tố quan trọng cần cân nhắc, đặt ra câu hỏi về khả năng duy trì tỷ suất lợi nhuận tối ưu của ngân hàng trong môi trường kinh tế đang thay đổi.