- Micron's revenue soars, bolstering its leadership in memory and storage technologies.

- A return to profitability points to operational strength and cash flow resilience.

- Cutting-edge nodes and investments drive product enhancement and innovation.

- Strategic moves into AI-driven markets fortify Micron's foothold in data centers and edge computing.

This article delves into Micron's recent performance and ascent through its strategies for market lead while scrutinizing the downsides it faces in capturing prolonged valuation growth amidst the turbulent currents of supply limitations.

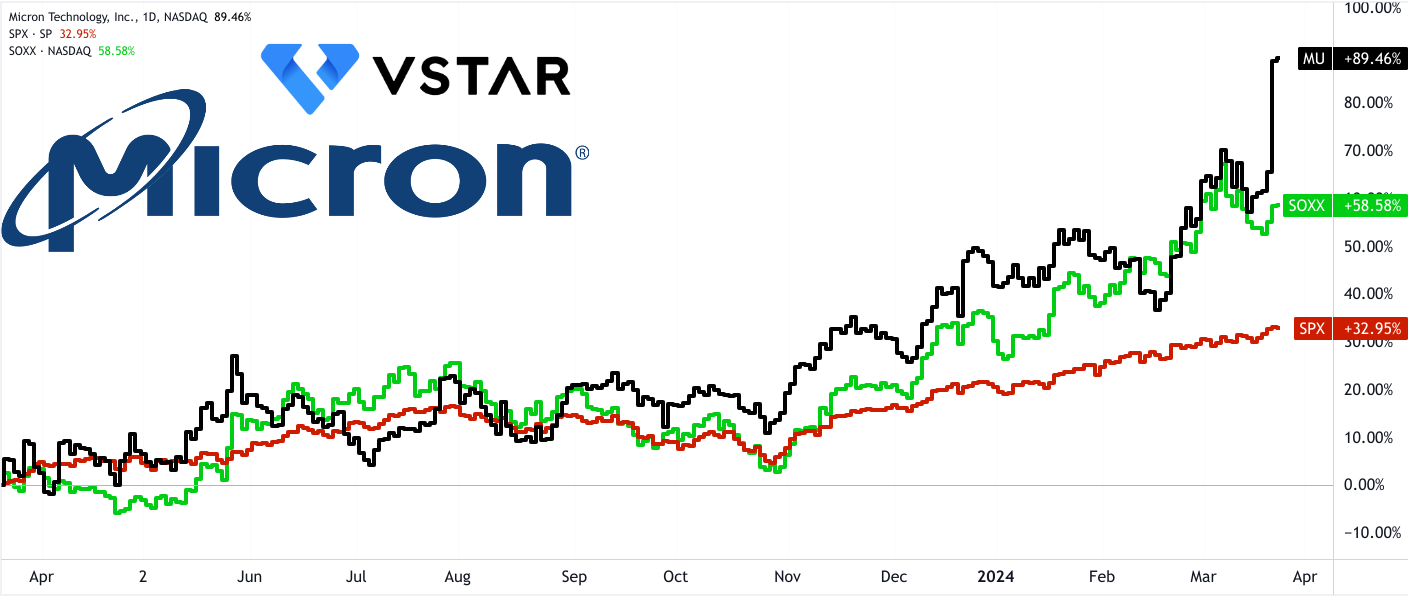

MU Stock Price Performance

The stock has outperformed the broader US market, with a decisive difference in terms of price return. The stock has yielded +160% pierce return against S&P 500’s (SPX) +85% over the last 5 Years. However, the stock has underperformed its specific benchmark, the iShares Semiconductor ETF (SOXX), yielding +250% over the same period. Over the short-term (1Y), the stock has outperformed both the market and the benchmark with a 90% price return. In short, the company has the potential to deliver aggressive returns in upcoming years based on solid fundamentals and progressive performance.

Source: tradingview.com

Micron Stock Fundamental Strengths

Revenue Growth and Market Positioning

Revenue Growth Trajectory:

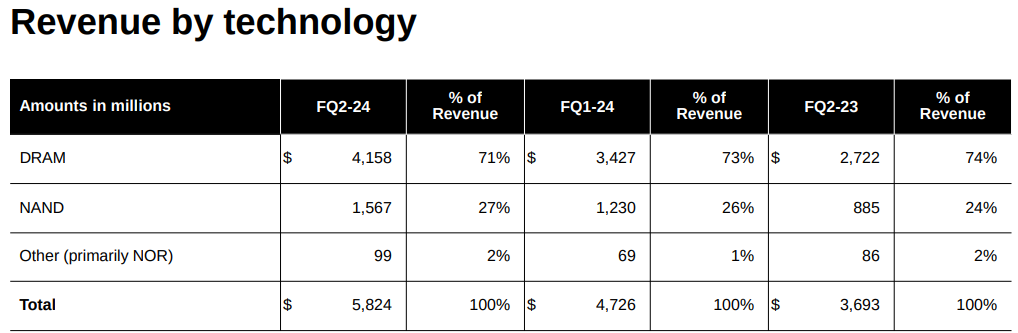

Micron's revenue growth trajectory is a key indicator of its rapid growth potential. In Q2 2024, Micron reported revenue of $5.82 billion, representing a substantial increase from $4.73 billion in the prior quarter and $3.69 billion for the same period last year. This sequential and year-over-year growth highlights the company's ability to capture market demand and capitalize on emerging opportunities.

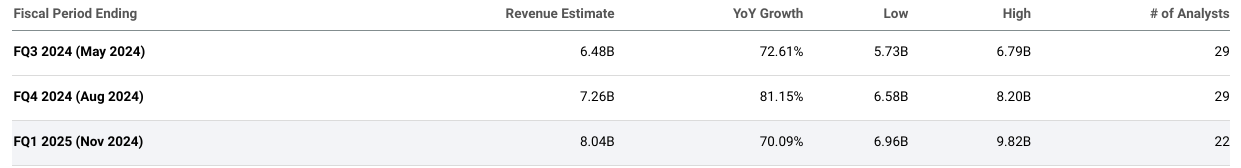

Looking forward, in the upcoming quarter, analysts are projecting over 70% YoY growth. Considering these topline projections, the stock may continue to hit higher highs at least till FQ1 2025 (November 2024).

Source: seekingalpha.com

Market Leadership in Memory and Storage Technologies:

Micron's strong revenue performance is underpinned by its leadership in memory and storage technologies. With a diverse product portfolio catering to various end markets, including data centers, PCs, smartphones, and automotive sectors, Micron maintains a dominant position in the semiconductor industry. The company's revenue growth reflects its successful penetration into high-growth segments such as AI-driven applications, where memory and storage solutions are in high demand.

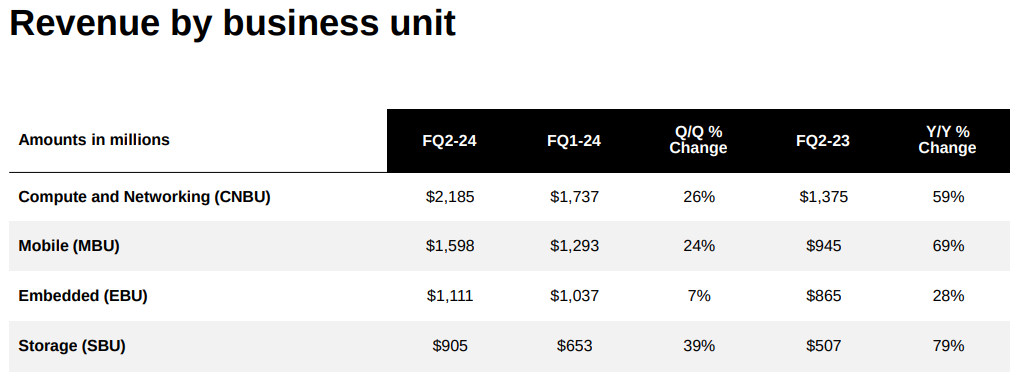

Source: investors.micron.com

In Q2 2024, based on the solid demand, Micron has delivered solid YoY and sequential uplift in all of its business units.

Profitability and Operating Efficiency

Return to Profitability:

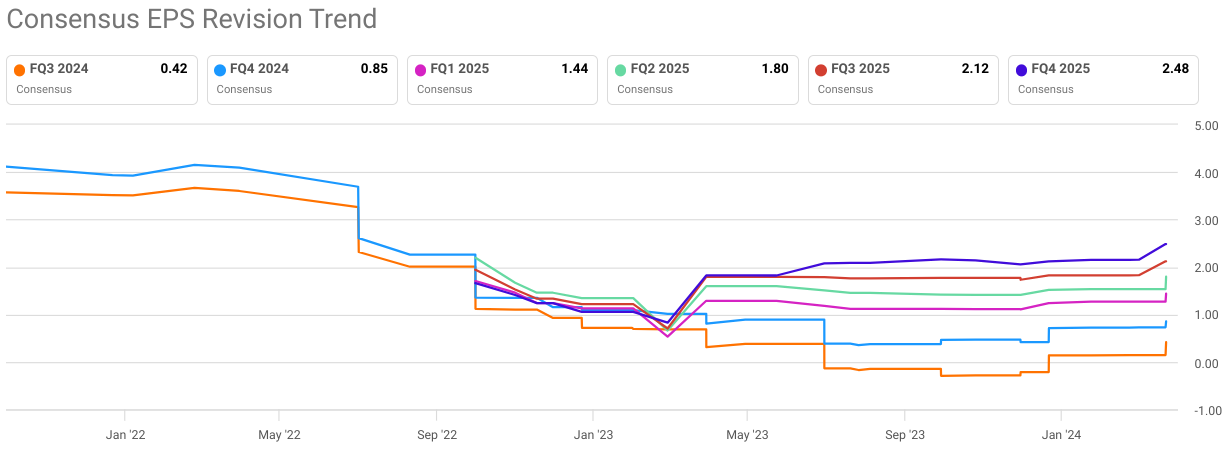

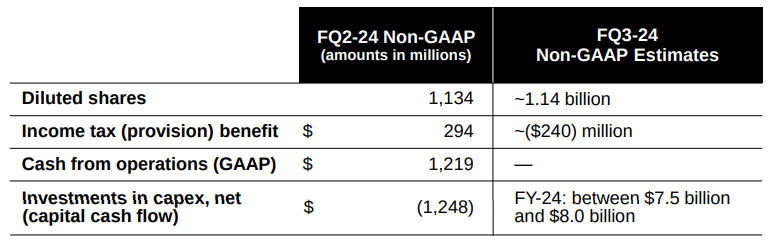

Micron's return to profitability is evident from its Q2 2024 financial results. The company reported a GAAP net income of $793 million, marking a significant improvement compared to previous quarters. Additionally, Micron achieved a non-GAAP net income of $476 million, indicating strong financial performance driven by revenue growth and operational efficiency measures. Looking forward, the market is optimistic about the bottomline of Micron, as can be observed in revisions to the consensus EPS estimates.

Source: seekingalpha.com

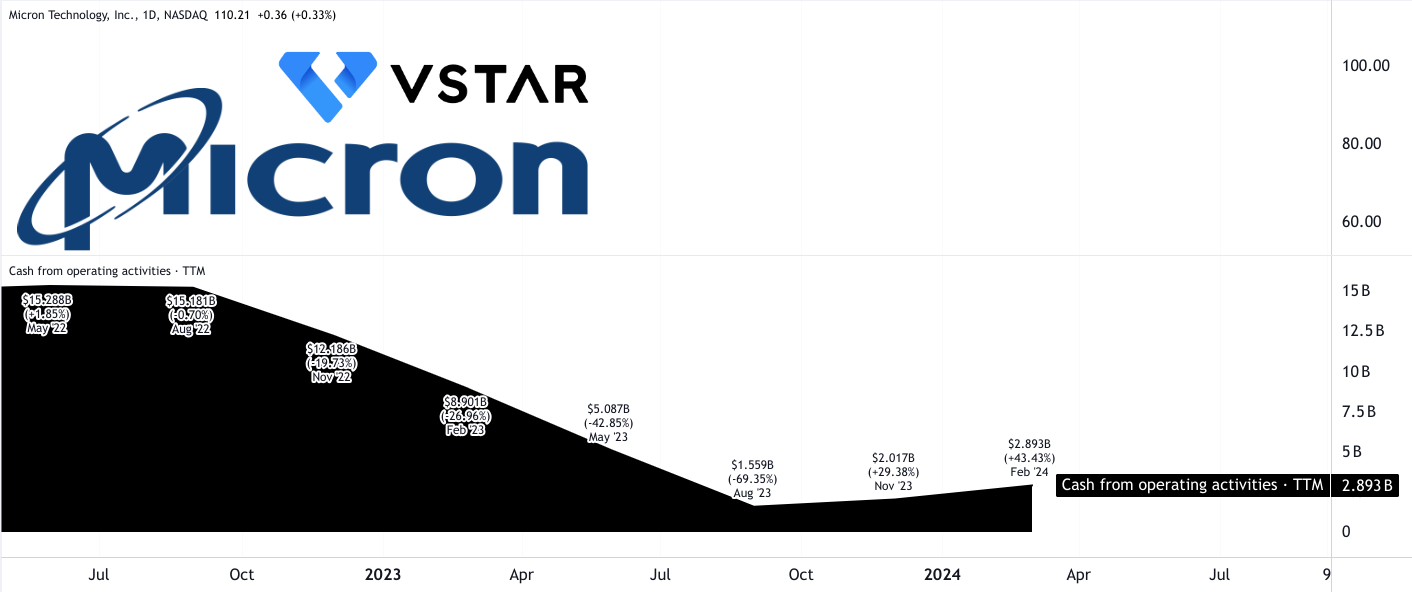

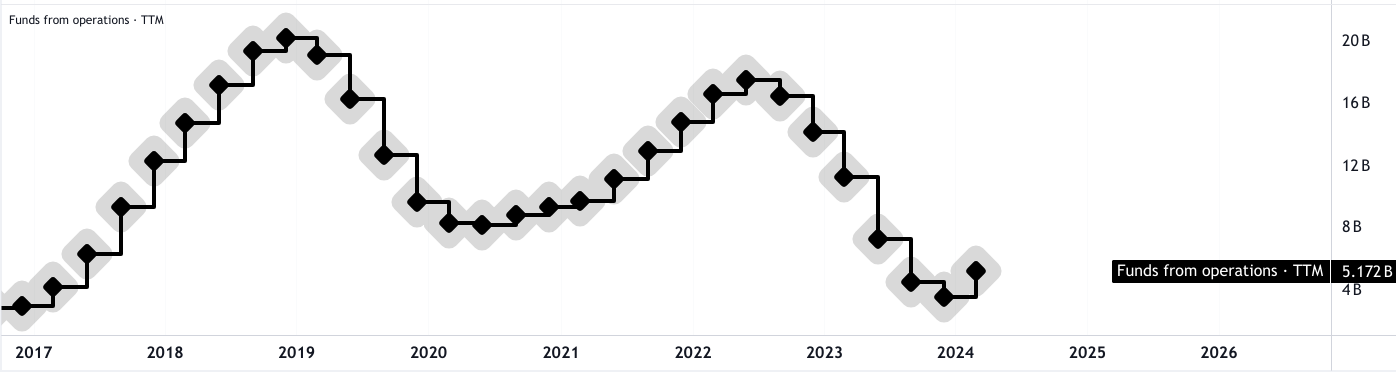

Strong Operating Cash Flow:

Despite a slight decrease from the prior quarter, Micron maintained a robust operating cash flow of $1.22 billion in Q2 2024. This demonstrates the company's ability to generate substantial cash from its operations, which is essential for funding growth initiatives, investing in research and development, and supporting shareholder returns. Micron's strong operating cash flow reflects its efficient operational management and ability to optimize resources effectively.

However, on a trailing twelve-month basis, an emerging uptrend in operating cash flow can be observed. This is a positive development for Micron's market valuations.

Source: tradingview.com

Technological Advancements

Advanced Technology Nodes:

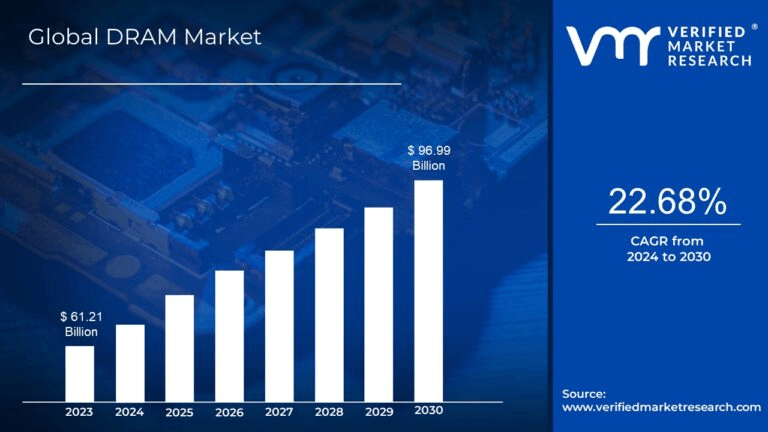

DRAM and NAND are the primary drivers for the company’s top-line growth. Micron's commitment to technological advancements is reflected in its adoption of leading-edge technology nodes in DRAM and NAND production. Over three-quarters of Micron's DRAM bits are on leading-edge 1-alpha and 1-beta nodes, while over 90% of its NAND bits are on advanced 176-layer and 232-layer nodes. This emphasis on advanced technology nodes enables Micron to enhance product performance, reduce manufacturing costs, and maintain competitiveness in the market.

Source: investors.micron.com

Investment in Next-Generation Technologies:

Micron's investment in next-generation technologies such as extreme ultraviolet lithography (EUV) for DRAM production and the development of next-generation NAND nodes underscores its commitment to innovation. These investments aim to drive technological leadership, improve product capabilities, and meet the evolving needs of customers. By staying at the forefront of technological innovation, Micron ensures its relevance in the dynamic semiconductor landscape.

As per verifiedmarketresearch.com, DRAM market size may hit $96.99 Billion by 2030, based on a CAGR of 22.68% during 2024–2030. This suggests a prolonged demand for the company's core technology. This will continue to uplift the company's topline for this decade.

Source: verifiedmarketresearch.com

Market Expansion and Diversification

Expansion in AI-Driven Markets:

Micron's expansion into AI-driven markets positions it strategically to capitalize on emerging opportunities. With AI driving demand for memory and storage solutions across data centers and edge devices, Micron's product portfolio aligns with the evolving needs of the market. The company's focus on developing solutions tailored to AI workloads enables it to penetrate high-growth segments and diversify its revenue streams.

Strong Positioning in Data Center and Edge Computing:

Micron's strong positioning in the data center market, particularly with products like high-bandwidth memory (HBM), DDR5, and data center SSDs, enhances its competitiveness in AI-driven applications. Additionally, Micron's efforts to develop solutions for edge devices such as PCs and smartphones further expand its market reach and contribute to revenue diversification.

Supply Chain Management and Operational Resilience

Supply-Demand Balance Management:

Micron effectively manages the supply-demand balance in the semiconductor industry, leveraging factors such as AI server demand and supply reductions to drive pricing improvements. The company's ability to navigate these dynamics ensures supply continuity, enhances customer satisfaction, and supports revenue growth. Micron's proactive approach to supply chain management strengthens its operational resilience and mitigates risks associated with market volatility.

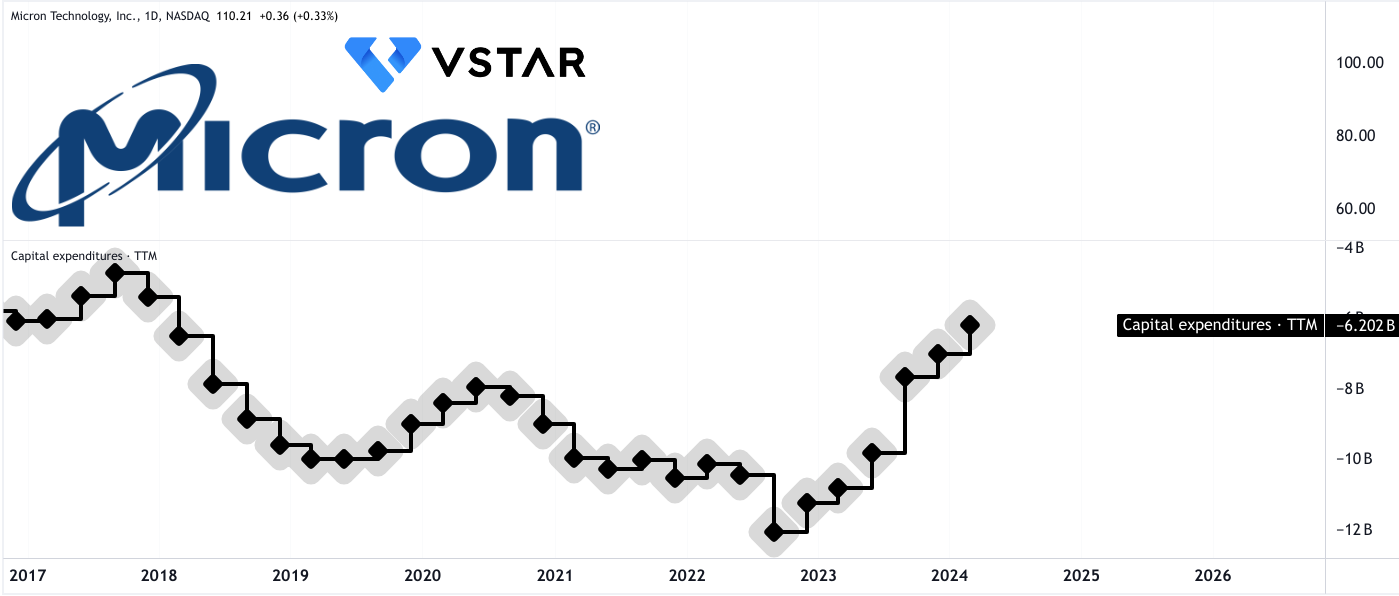

Capital Expenditure Efficiency:

Micron's capital-efficient approach, including the reuse of equipment from older nodes and disciplined CapEx planning, enhances operational efficiency and supports long-term growth. By optimizing capital expenditures and focusing on strategic investments, Micron maximizes returns on invested capital and maintains financial discipline. This approach underscores the company's commitment to operational edge and sustainable value growth.

The company may invest about $8 billion in the current fiscal year. Logically, such a massive CapEx may bring in a fundamental moat that may benefit the company's performance and competitive edge over the long-term.

Financial Stability and Future Outlook

Solid Financial Position:

Micron's solid financial position is reflected in its strong cash reserves, marketable investments, and liquidity. With $9.72 billion in cash, marketable investments, and restricted cash at the end of Q2 2024, Micron maintains a robust financial foundation to support its growth initiatives and withstand market uncertainties. The company's financial stability enhances investor confidence and supports its long-term growth objectives.

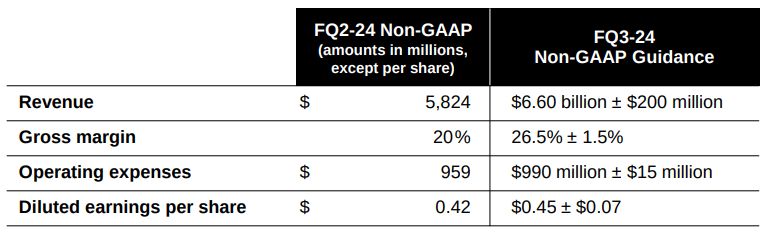

Positive Outlook and Guidance:

Micron's positive outlook and Q3 2024 guidance underscore its internal confidence in growth prospects. With expectations of further revenue growth and improved profitability in fiscal year 2025, Micron anticipates sustained momentum in its business operations. The company's optimistic outlook reflects its strategic initiatives, market positioning, and ability to capitalize on emerging demand.

To be specific, the Q3 2024 guidance reflects solid sequential boost in topline, gross margin, and EPS. This will provide fundamental support for the company's market valuations in the coming months.

Downsides and Risks

Revenue Growth vs. Supply Growth:

Micron's revenue growth, while impressive, reveals underlying challenges in supply growth alignment. Fiscal Q2 revenue surged to $5.8 billion, a 23% sequential increase and a 58% year-over-year increase. However, the growth in revenue is not fully mirrored by supply growth, particularly in DRAM and NAND, essential components for Micron's products. But shipments for DRAM increased only by a low single-digit percentage, while for NAND, they decreased by a low single-digit percentage. This discrepancy indicates that Micron's supply growth is not keeping pace with the burgeoning demand, potentially hindering the company's ability to fully exploit market opportunities.

Capital Expenditures (CapEx) and Supply Growth:

Micron's substantial investments in capital expenditures (CapEx) are crucial for expanding production capacity. However, despite a significant CapEx of $1.2 billion in fiscal Q2, the operating cash flow remained near breakeven. This suggests that the investments may not be translating into immediate supply capacity expansion. Furthermore, Micron's unchanged fiscal 2024 CapEx plan of $7.5 billion to $8.0 billion raises concerns about whether it is sufficient to bridge the supply-demand gap, especially amidst the growing demand for AI-related products driving industry growth.

Source: tradingview.com

Capacity Utilization and Structural Reduction:

Micron's strategy of capital-efficient operations includes a "material structural reduction" in DRAM and NAND wafer capacities, achieved by reusing equipment from older nodes to support conversions to leading-edge nodes. While this approach optimizes capital efficiency, it also indicates potential limitations in rapidly scaling up production capacity. Micron anticipates ending fiscal 2024 with low double-digit percentage less wafer capacity in both DRAM and NAND than peak levels in fiscal 2022, signaling constraints on supply expansion efforts.

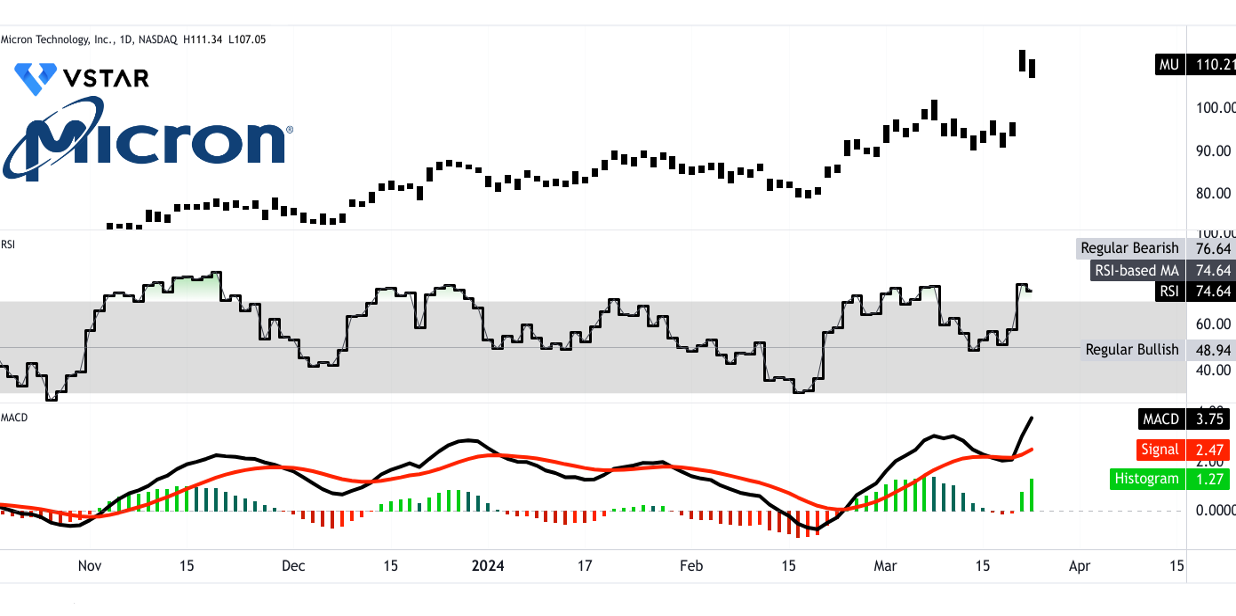

MU Stock Forecast Technical Take

The Micron stock price may hit $185 by the end of 2024. This is an optimistic price target based on the recent price momentum projected over Fibonacci levels. Considering the short-term higher momentum, the price may reach $137% by the end of the year. The MU stock price has breached the current horizontal price channel in a weekly time frame. It has provided a proper close above the immediate resistance zone of $105.73–$104.34. However, on the downside, $94.85 (pivot) may serve as critical support for the stock along with an immediate resistance zone this year. The purple trend line, a modified exponential moving average, may provide dynamic support for the stock. This is also in parity with the lower bond of the immediate support zone at $83.06–$82.17.

![]()

Source: tradingview.com

Looking at the relative strength index (RSI) and moving average convergence divergence (MACD), the trend is highly positive on the upside. Meanwhile, RSI suggests an overbought level at 75, there is no bearish divergence. RSI is still away from the regular bearish level at 77. This suggests the price may hover around these levels with upside potential. Similarly, MACD has resumed bullish momentum recently. Here, the histogram is positive, with the MACD line crossed above the signal line.

Interestingly, the gap created by the stock price after the Q2 earnings supports the possibility of a correction in the coming weeks. That may lead to testing the above-mentioned support levels, with RSI reaching near 60.

Source: tradingview.com

In conclusion, Micron's stock demonstrates robust performance amidst semiconductor market volatility. With a solid return over the past year, it outpaces the S&P 500 and its benchmark, SOXX. Revenue growth highlights market demand capture and strategic investments. A profitability resurgence indicates operational resilience. Technological advancements and market expansion fortify Micron's position. Despite challenges in aligning supply with demand and concerns over CapEx efficacy, optimistic guidance and technical analysis foresee a bullish trajectory, with a projected target of $185 by 2024-end. Micron's fundamentals suggest potential for consolidated and valuation growth in 2024.