- With record-breaking revenue and substantial growth across key segments like Data Center and Gaming, Nvidia's operational strength is evident, driven by increased demand and strategic collaborations.

- Nvidia's leadership in AI, data centers, and autonomous vehicles positions it for significant expansion, supported by technological innovations and strategic initiatives.

- Technical analysis suggests a bullish trend for Nvidia stock, with a projected average price target of $1,400 by the end of 2024, supported by positive fundamental analysis and market sentiment.

- Despite its promising outlook, Nvidia faces competition, regulatory hurdles, and supply chain disruptions, which could impact its global operations and financial performance.

I. Nvidia Q1 2024 Performance Analysis

A. Nvidia Key Segments Performance

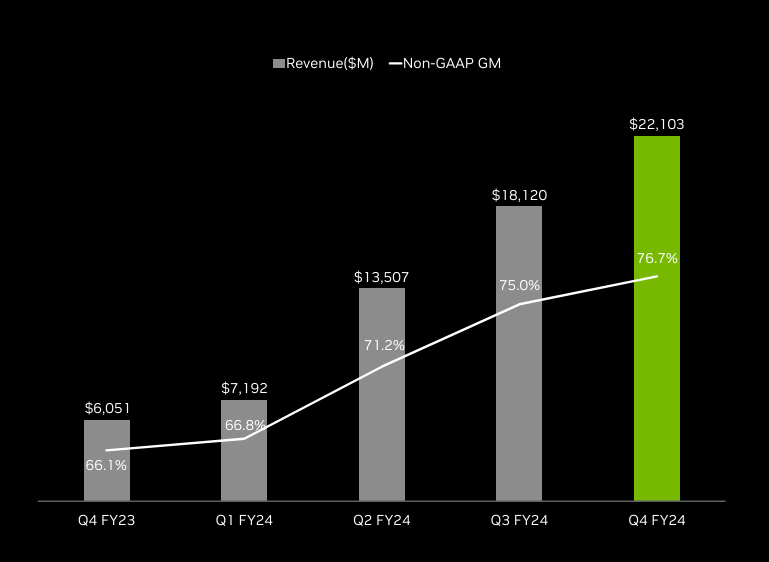

Financially, NVIDIA (NASDAQ:NVDA) reported record quarterly revenue of $22.1 billion, marking a 22% increase from the previous quarter and an astounding 265% surge from the same period last year. The company's net income and earnings per share also experienced substantial growth (+486% YoY), reflecting its strong operational performance.

Source: Q4 2024 Presentation

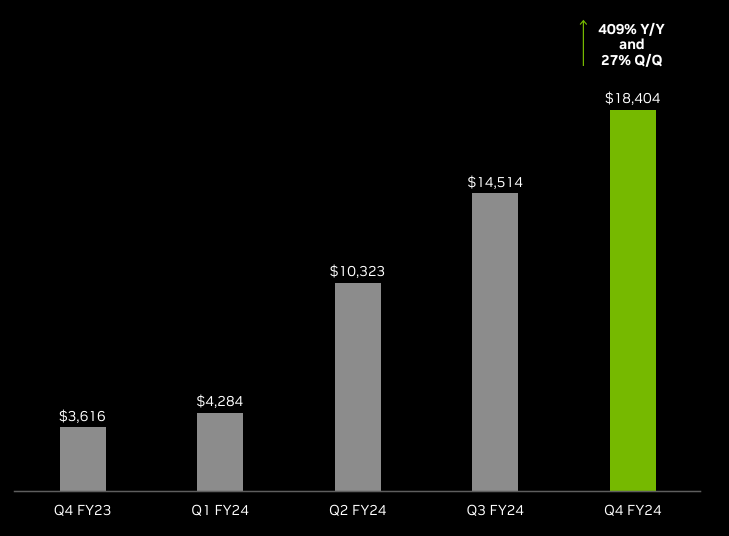

In terms of key segments, the Data Center division emerged as the primary revenue driver, achieving record quarterly revenue of $18.4 billion, up 27% from the previous quarter and an impressive 409% increase from a year ago. This growth was fueled by increased demand for data processing, training, and inference across various industries, including cloud-service providers, enterprise software companies, and consumer internet firms. NVIDIA's collaborations with industry giants like Google and Amazon Web Services further solidified its position in the data center market.

The Gaming segment, although experiencing flat revenue sequentially, witnessed a significant 56% year-on-year growth, reaching $2.9 billion in revenue for the quarter. The launch of the GeForce RTX 40 SUPER Series GPUs and continued investments in AI-powered gaming technologies contributed to this positive performance.

Professional Visualization and Automotive segments also posted notable gains, with revenue increasing by 11% and 8% sequentially, respectively. The adoption of NVIDIA Omniverse in the automotive industry and the introduction of new AI-powered capabilities for visualization purposes underscored NVIDIA's commitment to innovation across diverse sectors.

Operationally, NVIDIA's focus on technological advancements and innovations was evident through product launches, research and development investments, and strategic collaborations. Initiatives like the NVIDIA NeMo Retriever and MONAI cloud APIs demonstrated the company's dedication to advancing AI-driven solutions across various domains, including healthcare and finance.

Looking ahead, NVIDIA's outlook for the first quarter of fiscal 2025 remains optimistic, with expected revenue of $24.0 billion, driven by continued growth in data center and professional visualization segments. The company's strong financial performance, coupled with its ongoing investments in emerging technologies, positions it well for sustained growth and market leadership in the coming quarters.

B. Nvidia Stock Price Performance

In Q1 2024, Nvidia (NVDA) significantly outperformed broader market indices. With an 84% price return and market cap of $2.26 trillion, NVDA surged, driven by strong demand for its products. This contrasted sharply with the S&P 500's 11% and Nasdaq 100's 10% gains. However, NVDA's wide price range, from $473.20 (Q1 low) to $974 (Q1 high), indicates considerable volatility against market fluctuations.

Source: tradingview.com

II. Nvidia Growth Opportunities

A. Segments with growth potential

Nvidia stands at the forefront of several burgeoning industries poised for exponential growth. Primarily, the areas of Artificial Intelligence (AI), Data Centers, and Autonomous Vehicles present substantial avenues for expansion.

AI: Nvidia's Data Center segment witnessed an exceptional 409% year-over-year growth, highlighting the surging demand for AI-related services and technologies. The advent of generative AI promises to revolutionize various sectors, as evidenced by Nvidia's successful deployment of AI models across diverse industries. The increasing adoption of AI-driven solutions across sectors like healthcare, finance, and automotive underscores the vast potential for growth in this domain.

Source: Q4 2024 Presentation

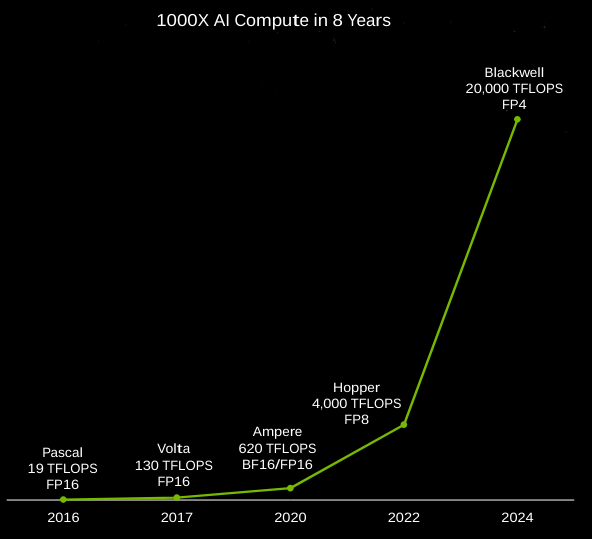

Data Center: Nvidia's dominance in the Data Center market is evident from its staggering revenue figures. The proliferation of AI applications, driven by Nvidia's advanced GPU computing platforms like Hopper, signifies sustained growth opportunities in this segment. Notably, Nvidia's strategic focus on addressing specific verticals such as automotive, healthcare, and financial services further bolsters its position as a leader in the Data Center space.

Source: GTC 2024

Autonomous Vehicles: Nvidia's DRIVE platform continues to be the preferred choice for leading automotive manufacturers venturing into autonomous driving technology. The adoption of Nvidia's AI car computers, including DRIVE Orin and the upcoming DRIVE Thor, by prominent EV makers like Li Auto and Great Wall Motor underscores the potential for growth in this segment. Moreover, Nvidia's collaboration with telecom giant Singtel to establish sovereign AI data centers in Southeast Asia signifies its commitment to expanding its footprint in the autonomous vehicles market.

B. Expansions and Strategic Initiatives

Nvidia's growth trajectory is further propelled by its strategic initiatives, including mergers and acquisitions, research and development investments, and partnerships.

Strategic Collaborations: Nvidia's collaboration with AWS to host DGX Cloud on AWS and introduce new Amazon EC2 instances underscores its commitment to advancing generative AI capabilities. Similarly, partnerships with healthcare companies like Recursion and Amgen demonstrate Nvidia's focus on leveraging AI for drug discovery and medical research.

Source: Q4 2024 Presentation

Product Innovations: The introduction of new GeForce RTX GPUs, coupled with advancements in AI-ready laptops and workstations, reflects Nvidia's commitment to delivering cutting-edge technologies across gaming, creative, and professional visualization sectors. Additionally, initiatives like Equinix Private AI highlight Nvidia's efforts to democratize AI infrastructure and accelerate the deployment of custom AI models for enterprises.

III. Nvidia Stock Forecast 2024

A. Nvidia Stock Forecast: Technical Analysis

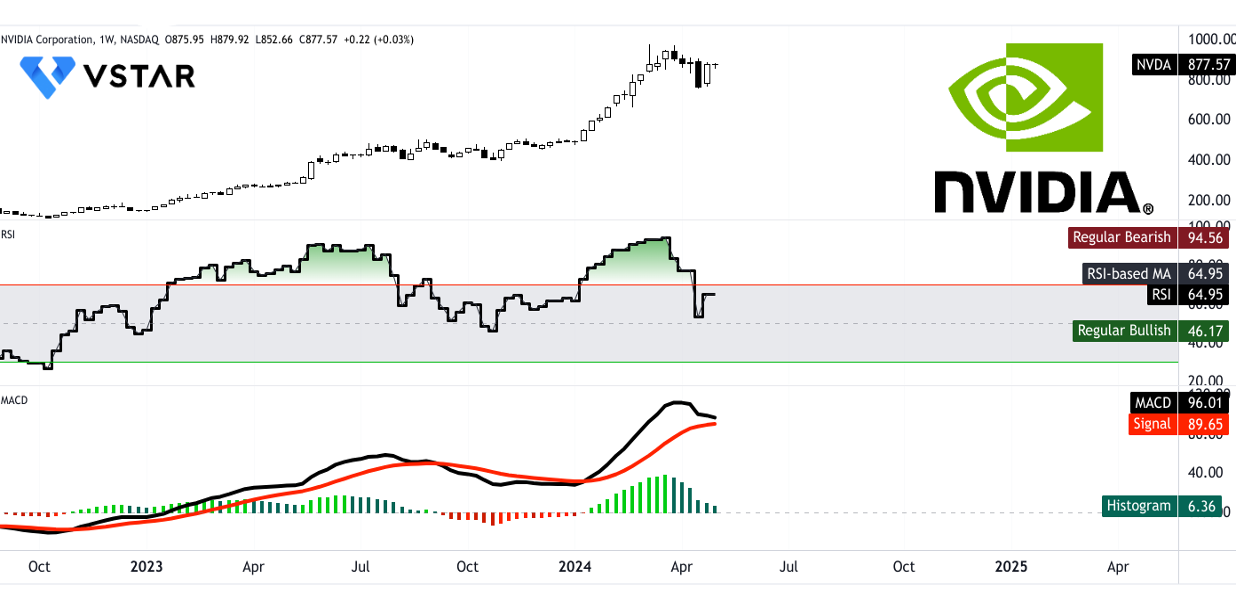

Source: tradingview.com

Nvidia (NVDA) has displayed a strong upward trend, supported by its modified exponential moving averages. The current NVDA stock price of $877.57 exceeds both the trendline ($731.37) and the baseline ($713.98), indicating bullish momentum. The Relative Strength Index (RSI) at 64.95 suggests the stock is neither overbought nor oversold but trending upwards. Additionally, the Moving Average Convergence/Divergence (MACD) indicator confirms a bullish trend, although with decreasing strength.

Based on technical indicators, the average NVDA price target by the end of 2024 is $1,400. The optimistic Nvidia price target stands at $1,635. The primary support is at $806.62, with a pivot at $640.14. Core resistance is projected at $1,165.91, with support at $473.66.

Source: tradingview.com

B. NVDA Stock Forecast: Fundamental Analysis

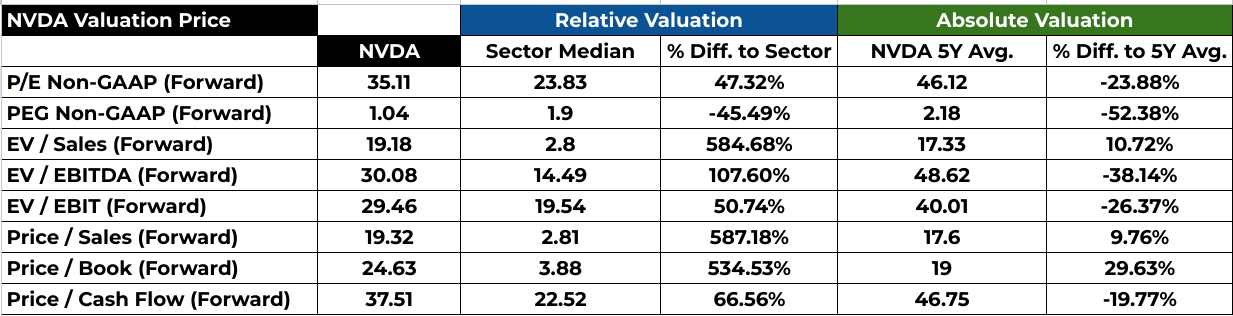

NVDA's fundamental analysis reveals a mixed picture. The P/E ratio of 35.11 is below the company's 5Y average of 46.12, indicating an undervaluation. However, the PEG ratio of 1.04 is below the sector median, suggesting potential undervaluation in terms of growth prospects. Other metrics like EV/Sales, EV/EBITDA, and Price/Sales are substantially higher than sector medians, indicating rich valuation multiples.

Source: Analyst's Compilation

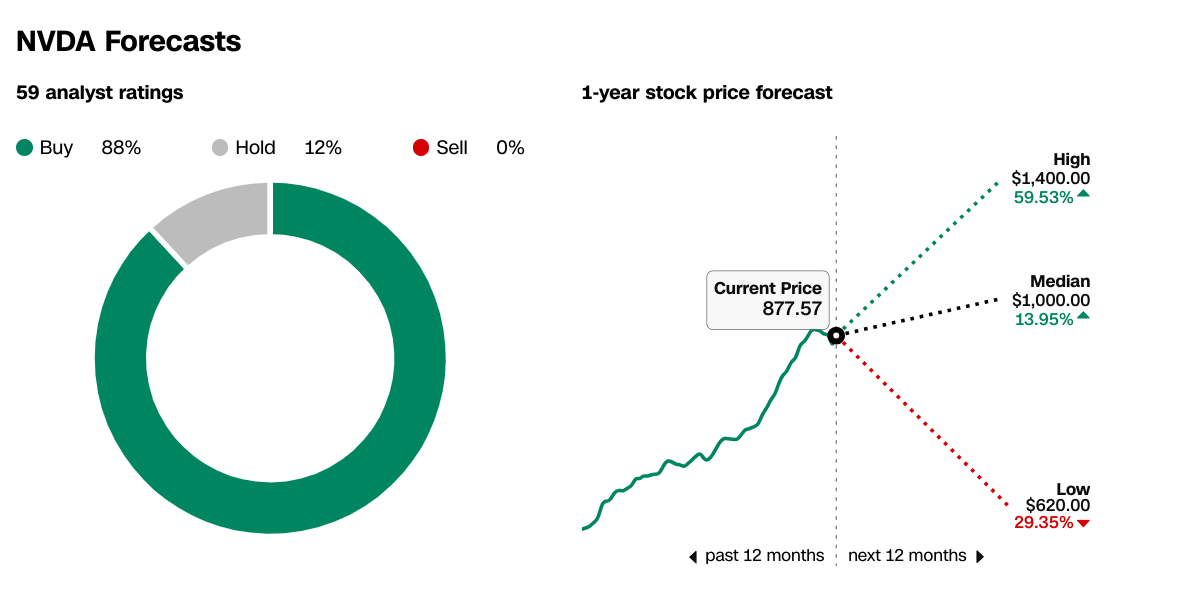

Analyst recommendations from both WSJ and CNN remain predominantly bullish, with no sell ratings. The consensus one-year price forecasts range from $620 to $1,400, with a median target of $1,000, reflecting confidence in future growth.

Source:CNN.com

Source: WSJ.com

C. NVDA Stock Prediction: Market Sentiment

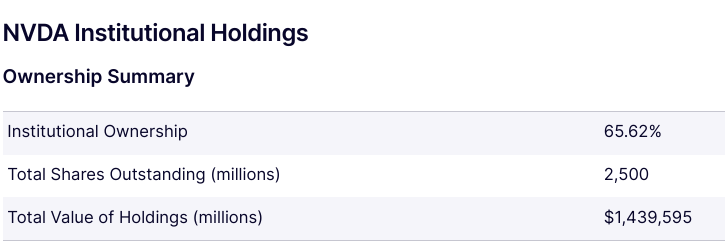

Market sentiment appears positive, with strong investor confidence reflected in institutional holdings of 65.62%. Short interest is relatively low, indicating minimal bearish sentiment. Institutional investors continue to maintain significant positions in NVDA, with a total value of holdings at $1.44 billion, affirming long-term bullish sentiment.

Source: Nasdaq.com

Source: Nasdaq.com

IV. Nvidia Risk Factors

Nvidia competitors analysis

Nvidia faces intense competition from various competitors in the GPU and AI computing processor markets. Key rivals include Advanced Micro Devices (AMD), Intel, and Huawei, as well as major cloud service providers such as Alibaba, Alphabet (Google), Amazon, Baidu, and Microsoft. Nvidia revenue is significantly impacted by international sales, accounting for 56% of total revenue in fiscal year 2024. Notably, sales to China decreased from 19% of total Data Center revenue in fiscal year 2023 to 14% in fiscal year 2024 due to USG licensing requirements.

Source: SEC 10-K

Regulatory challenges: Antitrust concerns, Trade policies

The regulatory landscape poses significant challenges for Nvidia, particularly in areas such as IP protection, taxes, export controls, and data privacy. Compliance with these regulations is costly and burdensome, impacting Nvidia's competitive position and financial performance. Additionally, increasing regulatory scrutiny, especially regarding AI technologies, may further hinder Nvidia's global operations.

Geopolitical risks, including economic and political instability, trade tensions, and regulatory changes, further complicate Nvidia's international operations. These risks impact Nvidia's ability to manufacture and distribute products globally, especially in key markets like China. For example, USG export controls have restricted Nvidia's ability to ship certain products to China, leading to decreased sales revenue in the region.

Supply chain disruptions: Semiconductor shortages, Logistics issues

Supply chain disruptions, including semiconductor shortages and logistics issues, exacerbate Nvidia's challenges. The company relies on third-party manufacturers, primarily located in Taiwan, for its products. Long manufacturing lead times and fluctuating demand forecasts contribute to mismatches between supply and demand, resulting in product shortages, excess inventory, and increased costs. Nvidia has experienced extended lead times of more than 12 months and has paid premiums and deposits to secure future supply and capacity.

Conclusion

Nvidia's stellar performance, marked by record-breaking revenue driven by Data Center and Gaming segments, alongside robust growth in AI, Data Centers, and Autonomous Vehicles. Despite regulatory challenges and supply chain disruptions, Nvidia's operational strength and market leadership are evident. The VSTAR trading app presents an opportunity to capitalize on Nvidia's bullish stock forecast, with technical indicators projecting an upward trend towards a $1,400 average price target by 2024-end. However, risk factors include competition, regulatory hurdles, and supply chain vulnerabilities.