I. Introduction

The performance of Nvidia Corporation's (NVDA) stock in recent times has been remarkable. Nvidia is a prominent player in the technology and semiconductor industry, known for its innovative products and solutions.

Recent Nvidia Stock Performance

As of the most recent data available, Nvidia stock had a 52-week range between $127.08 and $502.66, indicating significant price fluctuations. This wide range signifies both volatility and growth potential in the stock. Nvidia's forward EPS stands at 10.89, which indicates the company's expected earnings per share in the near future. A high EPS can be a positive signal for investors.

Source: Investor Relation Nvidia

The forward P/E ratio of 40.10 suggests that investors are willing to pay a premium for Nvidia's expected earnings. This may be attributed to high growth expectations. Nvidia offers a small dividend of $0.16 with a yield of 0.04%, reflecting the company's focus on growth rather than income generation.

With a market cap of $1.08 trillion, Nvidia is one of the largest companies in the technology sector. Over various timeframes, Nvidia stock has shown impressive returns, outperforming the S&P 500 by a significant margin. In the past year, the stock exhibited an extraordinary 231.61% price return.

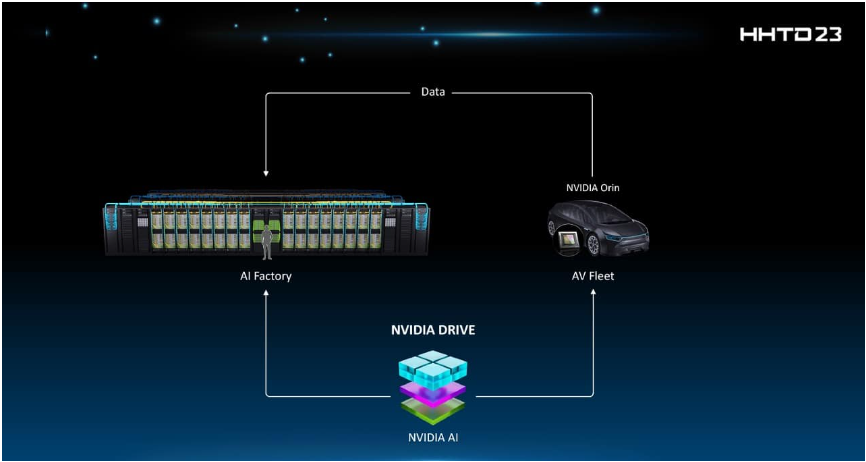

One of the main drivers of Nvidia's recent success is its data center segment. The company reported a record revenue of $10.32 billion in Q2 2023, with remarkable sequential and year-on-year growth. The strong demand from cloud service providers and consumer Internet companies for Nvidia's AI and GPU products has been a significant contributor to the company's growth.

At its core, Nvidia's data center growth was particularly strong in the United States, where capital investments are increasingly directed toward AI and accelerated computing. Moreover, despite concerns about potential export regulations to China, Nvidia does not anticipate immediate material impacts on its financial results.

Expert Insights on NVDA Stock Forecast 2023, 2025, 2030 and Beyond

Looking forward, there is a positive trajectory for NVDA stock. In 2023, it's anticipated to reach $550, reflecting strong growth potential. By 2025, NVDA is expected to be at $775, driven by continued advancements in AI and data centers. Looking further ahead to 2030, projections point to $1,850, underlining sustained expansion. Beyond 2030, the stock could potentially surpass $3,000, as NVDA's influence in AI, cloud services, and generative AI technologies continues to grow, making it a promising long-term investment. However, investors should remain vigilant of regulatory changes and market dynamics that might affect the stock's trajectory.

II. Nvidia Stock Forecast 2023

The short-term target (2023) for the NVDA stock prediction based on Fibonacci extension is at $580. Fibonacci extensions are commonly used to identify potential price targets. A target of $580 suggests a bullish perspective, indicating the potential for an uptrend continuation. The RSI is currently at 41. RSI measures the momentum of a stock's price movements. A value of 41 suggests that the stock is not currently overbought or oversold, indicating a neutral position.

Source: tradingview.com

The presence of a Head and Shoulder pattern near $475 is significant. This pattern typically signifies a reversal of the current trend, in this case, a potential change from an uptrend to a downtrend.

The Neckline near $410 acts as a crucial support level. If this level is breached, it could indicate a substantial bearish trend. The Pivot level at $410 is another vital point of interest. Pivot levels often serve as support or resistance, depending on the stock's current direction. In this case, it aligns with the Neckline of the Head and Shoulder pattern.

The 200-day EMA is at $365 while the 50-day EMA is at $440. EMAs are used to gauge the stock's overall trend. The 200-Day EMA reflects the longer-term trend, while the 50-Day EMA represents the shorter-term trend. The EMA 50-Days being above the current price of $418 and EMA 200-days is a positive sign, indicating that the stock has experienced recent bullish momentum and stabilizing. The EMA 200-Days being at $365 suggests that the long-term trend has also been positive.

Overall, the Head and Shoulder pattern, if confirmed, could signal a bearish trend if the Neckline support at $410 is breached. This is a potential point of concern for investors, as it may lead to a significant price decline. However, the Fibonacci extension target of $580 suggests a bullish outlook in the short term. This could imply that the stock may experience an uptrend continuation. Likewise, the RSI at 41 indicates a neutral position, implying that the stock is not currently overbought or oversold. This can provide some stability to the stock's price movements. Also, the EMAs offer a somewhat strong short-term positive perspective.

Other NVDA stock prediction insights from Big institutions

Goldman Sachs' decision to add Nvidia to its Americas conviction list for October is a notable development. It indicates a high level of confidence in the stock's performance in the coming months. Goldman Sachs rates Nvidia as a "buy," aligning with the consensus of other analysts. This consensus reflects a positive sentiment in the market, underlining Nvidia's strong position in the tech industry.

The investment bank's confidence is rooted in Nvidia's competitive moat in the graphics processing unit (GPU) industry. The company is expected to maintain its status as the industry standard for accelerated computing, which is crucial in the AI and data center sectors. Goldman acknowledges Nvidia's impressive performance in customer development and the deployment of complex artificial intelligence models. This growth in AI applications is a strong driver of Nvidia's future success.

Notably, Nvidia's continued dominance in the data center industry is vital, given the increasing demand for data processing and AI capabilities. There is optimism that the chip supply constraints that affected the industry are starting to ease. This is a positive sign for Nvidia, as it relies on semiconductor components for its products. NVDA stock has gained approximately 186% since the start of the year. This is a remarkable performance and underscores the stock's attractiveness to investors.

While Goldman Sachs' endorsement of Nvidia with a price target of $605 is undoubtedly positive, it's important to remember that price targets are essentially predictions, and the actual stock performance can vary. Achieving and surpassing the target depends on several factors, including market dynamics, company performance, and broader economic conditions.

Rosenblatt's Buy recommendation on September 20, 2023, adds to the positive sentiment surrounding Nvidia. Analysts often reiterating Buy recommendations suggests ongoing confidence in the stock's prospects. This reaffirmation by a respected institution can boost investor confidence. The average one-year price target for Nvidia stock as of August 31, 2023, is $632.95. This forecast represents a significant upside potential of +40%.

Analyst Price Targets and Ratings

The analyst ratings and actions regarding Nvidia (NVDA) stock, along with their associated price targets and upside potential, offer a valuable insight into the market sentiment and expectations surrounding this technology company.

John Vinh, Keybanc:

Rating: Buy

Action: Maintains

NVDA Price Target: Revised from $750 to $650

Upside: +55.58%

John Vinh's maintained Buy rating on NVDA stock indicates his continued confidence in the company. However, it's noteworthy that he revised the price target from $750 to $650. While the stock is still expected to have a significant upside of over 55%, the reduction in the price target might signal a more conservative outlook. This could be influenced by factors such as market conditions or changes in Nvidia's performance prospects.

Joseph Moore, Morgan Stanley:

Rating: Buy

Action: Maintains

Nvidia Stock Price Target: Revised from $630 to $600

Upside: +43.61%

Joseph Moore's Buy rating on NVDA stock, along with a maintained status, shows his positive view of the company's future. However, like John Vinh, he also revised the NVDA target price downward, from $630 to $600. The reduced target, while still indicating a substantial upside, implies that there may be some cautiousness or uncertainty in the near term.

Atif Malik, Citigroup:

Rating: Strong Buy

Action: Maintains

NVDA Stock Price Target: Revised from $630 to $575

Upside: +37.63%

Atif Malik's Strong Buy rating underscores a high level of optimism regarding NVDA stock. However, the revised Nvidia target price of $575, down from $630, suggests a slightly more conservative stance compared to the earlier target. This adjustment, while still indicating a significant potential for growth, might be attributed to market dynamics and economic factors.

Toshiya Hari, Goldman Sachs:

Rating: Strong Buy

Action: Maintains

Toshiya Hari's Strong Buy rating, without a specific price target or upside provided, indicates a strong positive sentiment toward NVDA stock. The absence of a price target suggests a high level of confidence in Nvidia's performance without quantifying it.

These analyst ratings and actions collectively highlight a positive outlook for Nvidia stock. The fact that most analysts maintain Buy or Strong Buy ratings is indicative of a consensus regarding the company's potential for growth. However, the revisions in price targets, with some targets being lowered, could be attributed to various factors, including market volatility, supply chain issues, or macroeconomic conditions.

Key Factors to Watch for NVDA Stock Forecast 2023

Nvidia Forecast Bullish Factors

One of the key bullish factors for Nvidia (NVDA) stock is its impressive Q2 fiscal 2024 revenue of $13.51 billion, which demonstrated strong growth. This represented an 88% sequential increase and a remarkable 101% year-on-year growth, surpassing expectations of $11 billion. The robust performance in Q2 reflects Nvidia's ability to capitalize on its strengths in the semiconductor industry.

Within the Data Center segment, Nvidia reported record revenue of $10.32 billion, showcasing a 141% sequential surge and an impressive 171% year-on-year growth. The substantial growth in Data Center compute revenue, almost tripling year-on-year, can be attributed to the high demand from cloud service providers and major internet companies. Companies like AWS, Google Cloud, Meta, Microsoft Azure, and Oracle Cloud, among others, are deploying HGX systems based on Nvidia's Hopper and Ampere architecture Tensor Core GPUs. This strong demand underscores Nvidia's dominant position in the data center industry.

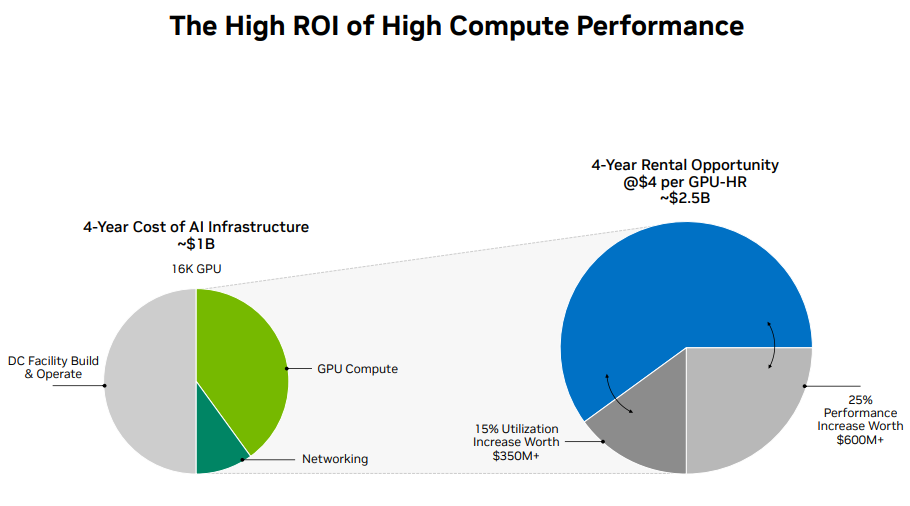

Source: Investor Presentation

Nvidia's exceptional supply chain and the ability to ramp up capacity to meet the growing demand are also positive indicators. The company has built a robust data center supply chain, and supply partners have been instrumental in expanding capacity to support their needs. As a result, they anticipate a gradual increase in supply over the coming quarters.

The growth in the U.S. data center sector was particularly noteworthy, as companies directed capital investments towards AI and accelerated computing. While there were reports of potential export regulations, Nvidia believed these would not have an immediate material impact on their financial results, emphasizing the sustained demand for their products.

Nvidia is at the forefront of generative AI and AI platforms, which are experiencing strong demand across industries. Their partnership with Snowflake and initiatives to develop large language models (LLMs) for AI services offer promising growth opportunities. The applications of generative AI extend across various sectors, from boosting the productivity of office workers to creating multi-billion dollar market opportunities in legal services, sales, customer support, and education.

Collaborations with companies like WPP, Shutterstock, ServiceNow, and Accenture further strengthen Nvidia's position in the AI and generative AI markets. The partnerships aim to create AI-driven solutions that cater to diverse industries, reflecting the widespread applicability of generative AI.

In gaming, Nvidia's revenue growth of $2.49 billion in Q2, up 11% sequentially and 22% year-on-year, indicates sustained demand, with the global end demand showing signs of returning to growth. The introduction of the GeForce RTX 40 Series GPUs for laptops and desktops, as well as the expansion of RTX and DLSS games, are driving gaming revenue. The data suggests a significant upgrade opportunity for Nvidia.

NVDA Forecast Bearish Factors

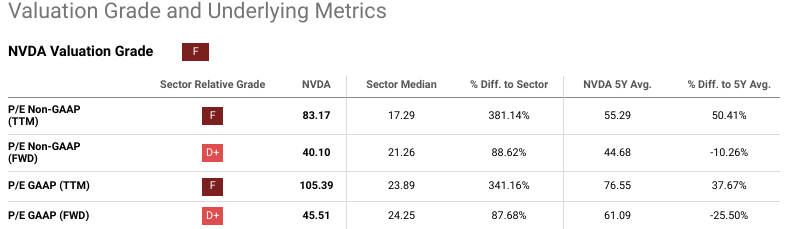

While the overall outlook for Nvidia appears bullish, there are several considerations to keep in mind. Nvidia's valuation metrics, such as Price/Earnings (P/E) and Price/Sales (P/S), are significantly higher than the sector median and its own five-year average. This could suggest that the stock is already priced at a premium, and there is a risk of overvaluation.

For instance, the P/E non-GAAP (forward) for Nvidia is 40.10, which is 88.62% higher than the sector median of 21.26 and higher than its own five-year average of 44.68. Similarly, the Price/Sales (forward) for Nvidia is 19.95, which is 733.51% higher than the sector median of 2.39 and higher than its own five-year average of 16.30. Such high valuation metrics may be seen as a bearish factor, as they imply that the stock may be overpriced relative to its fundamentals.

Source: seekingalpha

The high expectations for Nvidia's future performance are built into the stock's valuation, making it more vulnerable to disappointment if the company fails to meet these elevated expectations. Additionally, Nvidia operates in a highly competitive and rapidly evolving industry, and any disruptions or adverse market conditions could impact its growth prospects. Therefore, while the current outlook appears positive, investors should be cautious and consider these valuation metrics and potential risks when making investment decisions regarding Nvidia stock.

III. Nvidia Stock Forecast 2025

The mid-term target (2025) for NVDA stock is based on Fibonacci extensions and is estimated to be at $760. Fibonacci extensions are often used by traders to identify potential price targets beyond previous highs. This suggests that, should NVDA break through the $485 resistance, there may be a strong bullish trend with a potential price target of $760.

Source: tradingview.com

A significant pattern to note is the "triple top" pattern near the $485 price level. This pattern suggests that NVDA stock has made multiple unsuccessful attempts to break above $485, leading to price consolidation since July 2023. The triple top pattern is considered a bearish reversal pattern, indicating that there is strong resistance at this level. However, if the resistance at $485 were to break, it could signal a bullish trend reversal.

Interestingly, two critical support levels are identified at $315 and $208. These levels represent areas where the stock has historically found buying interest and reversed its downtrend. If the stock experiences a significant pullback, these levels may act as support and could prevent further decline. Apart from the $485 resistance level, another notable resistance level is at $590. These resistance levels represent barriers where the stock has previously struggled to move higher. If the price surpasses these levels, it would signal increased bullish momentum.

Further, the pivot level for NVDA stock is noted at $400. Pivot points are used in technical analysis to identify potential turning points in the price action. A pivot point at $400 suggests it is a crucial price level to watch for potential reversals or breakouts.

Notably, the Relative Strength Index (RSI) is currently at 53. An RSI value of 53 indicates a balanced level of buying and selling pressure. It is neither overbought (above 70) nor oversold (below 30). This suggests that NVDA is in a neutral position, and there is no extreme bullish or bearish sentiment at this time.

Lastly, the 200-day Exponential Moving Average is at $220. This long-term moving average is below the current stock price of $418, indicating that the stock is trading above its long-term average. This is a positive sign for NVDA. The 50-day Exponential Moving Average is at $347. This shorter-term moving average is also below the current stock price. While the 50-day EMA is above the 200-day EMA, it suggests a bullish short-to-medium-term trend.

Overall, the RSI at 53 reflects a neutral sentiment in the market, and the EMAs indicate that the stock is trading above its long-term and short-term averages, which is generally a positive sign. Traders and investors should closely monitor the $485 resistance level, as a breakout above it could trigger a significant bullish move, while failure to break through may result in a prolonged consolidation or even a bearish reversal.

Other NVDA stock prediction 2025 insights from Big institutions

As per Reuters, analysts are highly optimistic about NVIDIA's future, with the company exceeding revenue forecasts and announcing a $25 billion stock buyback program. The strong demand for AI-driven technologies, primarily powered by NVIDIA's chips, has been a key driver of this optimism.

NVIDIA's revenue forecast has surpassed expectations by a significant margin, indicating a continued boom in generative AI technologies. It is recognized that demand for NVIDIA's AI chips is exceeding supply by at least 50%, a situation expected to persist for several quarters. This imbalance has driven the company's shares to an all-time high.

Notably, the entire AI systems, not just the chips, have been the primary contributors to the company's growth. While NVIDIA is renowned for its GPUs, it also produces complete AI machines, including memory chips from other suppliers. This diversification in AI offerings has been a significant growth driver.

The positive performance of NVIDIA has had a ripple effect on other Big Tech stocks and AI-related companies, boosting their share prices. The company's success is regarded as a pivotal moment in the tech industry in 2023, further underlining its strong position in harnessing the AI momentum.

Analysts anticipate that NVIDIA's data center segment will expand significantly in the coming years, driven by its edge in AI chips and related technologies. While competitors like AMD are expected to make inroads, NVIDIA's software, particularly CUDA, holds a substantial lead.

Furthermore, the demand for AI-related chips is expected to remain strong, outpacing other traditional server equipment. Despite weak performance in certain chip segments, the AI market represents a bright spot in the industry, with continued growth expected.

The Traders Union's forecasts $772.94 USD and Coin Price Forecast analysts predicting a $988 USD stock price for Nvidia in 2025, might be employing a more speculative approach.

Analyst Price Targets and Ratings

S&P Global Ratings has recently upgraded NVIDIA Corp. to 'A+' and provided a stable outlook. This upgrade is attributed to the company's expected strong growth due to the rapid investments in generative artificial intelligence (AI) by cloud providers and enterprises. This outlook is crucial as it implies that S&P Global believes NVIDIA is set to benefit significantly from the AI investment cycle. They have highlighted several factors contributing to this optimistic forecast.

Source: S&P Global

One bullish factor is the rapid adoption of generative AI, which enhances NVIDIA's business risk profile. This adoption is happening faster than anticipated, leading to substantial capital spending and revenue growth for NVIDIA. The potential of generative AI to enhance productivity across various sectors is a key driver of this growth.

Additionally, NVIDIA's full-stack solution across silicon, systems, and software is identified as a significant barrier to entry and a major competitive advantage. This comprehensive ecosystem of hardware and software is expected to enable the deployment of AI-related models, further reinforcing NVIDIA's dominant position in the market.

Moreover, S&P Global Ratings expects NVIDIA's data center segment to triple in scale over the next four years due to the prioritization of GPU spending by cloud providers for generative AI and large language models. This growth is predicted to come at the expense of traditional CPU-based servers, benefiting NVIDIA over competitors.

However, there are bearish factors to consider. NVIDIA faces the risk of competition in the generative AI space as customers and competitors invest in their own solutions. Hyperscalers with significant purchasing power, such as Amazon and Google, are developing their products, potentially reducing their dependence on NVIDIA. Additionally, AMD, a competitor with a smaller market share, is investing heavily in the GPU segment and could become a credible alternative supplier in the longer term.

S&P Global also highlights concerns about NVIDIA's reliance on Taiwan Semiconductor Manufacturing (TSM) as a foundry partner, given escalating geopolitical tensions and a lack of a credible secondary supplier. Any supply chain disruptions could impact NVIDIA's ability to meet the high demand for its products.

Key Factors to Watch for NVDA Stock Forecast 2025

Nvidia Stock Prediction 2025 - Bullish Factors

One of the most significant bullish factors for NVIDIA is the rapid adoption of generative AI. This adoption rate exceeded expectations, contributing to strong earnings and revenue projections. As generative AI enhances productivity across various industries, NVIDIA is poised to benefit from a massive market opportunity.

NVIDIA's full-stack solution, encompassing silicon, systems, and software, serves as a substantial competitive advantage. This comprehensive ecosystem facilitates the deployment of AI models, reinforcing the company's leading position.

The anticipated tripling in scale of NVIDIA's data center segment over the next four years is a strong bullish factor. This growth is driven by cloud providers prioritizing GPU spending to enable generative AI and large language models. As data centers continue to deploy generative AI capabilities, NVIDIA is expected to experience increased profitability and revenue stability due to higher-margin data center business.

NVDA Stock Prediction 2025 - Bearish Factors

Despite the optimism, there are bearish factors to consider for NVIDIA stock forecast. One of the key risks is increased competition. Customers and competitors are investing in their own generative AI solutions, potentially reducing their reliance on NVIDIA. Hyperscalers, such as Amazon and Google, are developing their AI products, posing a challenge to NVIDIA.

Additionally, NVIDIA faces risks related to its reliance on Taiwan Semiconductor Manufacturing Corp. (TSMC) as a foundry partner. Geopolitical tensions and the lack of a credible secondary supplier for chip production could impact the company's ability to meet the demand for its products.

Another risk is the potential inconsistency in hyperscalers' spending patterns over time. If customers realize they ordered too many chips or are ahead of demand, there could be a "digestion phase" leading to suppressed GPU demand for multiple quarters.

IV. Nvidia Stock Forecast 2030 and Beyond

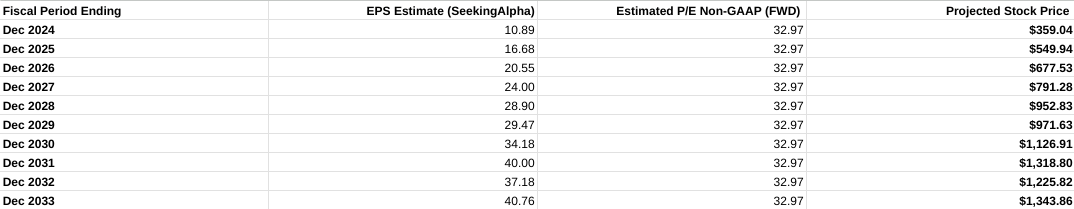

Based on the forecast, Nvidia stock may surpass $1100 by 2030 and may hit $1350 by 2033.

Source: Analyst’s compilation

In this context, based on utilizing the concept of mean reversion and drawing insights from Seeking Alpha's EPS forecast data, we can derive a projection for NVDA price well into 2030. Employing a cautious methodology, we posit that the stock will sustain a forward Price-to-Earnings (PE) ratio. This forward PE is a composite of the average forward PE for the sector, which stands at 21.26, and Nvidia's own 5-year historical mean forward PE, which sits at 44.68. This approach extends into the long-term.

Under this projection, it implies a substantial upside potential of 170% by 2030, excluding dividend yield. This forecast is rooted in the assumption that Nvidia's stock will experience a reversion to the estimated mean of its forward PE, which may lead to substantial gains for investors by 2030.

Other NVDA Forecast insights

Prominent institutions offer divergent price forecasts for Nvidia (NVDA) in the long term. For instance, Traders Union's projection suggests that by 2030, the stock could potentially surge to $1852, indicating significant growth. In contrast, Coin Price Forecast analysts are even more bullish, envisioning a stock price forecast of $1926 for 2030.

Key Factors to Watch for NVDA Stock Forecast 2030

Nvidia (NVDA) exhibits several key factors influencing its stock forecast for 2030, with both bullish and bearish aspects to consider.

Nvidia Stock Prediction - Bullish Factors

Electric Vehicle Innovation: Nvidia's partnership with Foxconn to develop intelligent electric vehicle (EV) platforms reflects the company's foray into the burgeoning EV market. Nvidia provides advanced AI car computers for automakers, including highly automated and autonomous vehicles. Foxconn's role as a contract manufacturer of AI-rich EVs featuring Nvidia's technology signifies growth prospects in the EV sector.

Source: Nvidia

Generative AI Expansion: Nvidia's expansion into generative AI models and cloud-native APIs for edge AI and robotics strengthens its position in a rapidly evolving AI landscape. This expansion enables various industries, including robotics and logistics, to benefit from generative AI capabilities, simplifying AI application development and deployment.

AI Reference Workflows: The introduction of AI reference workflows based on Metropolis and Isaac frameworks streamlines AI application development and saves developers time and cost. These reference workflows address various use cases, such as network video recording, autonomous mobile robots, and optical inspection, enhancing Nvidia's offerings in AI at the edge.

Nvidia's Research Breakthrough: Nvidia's groundbreaking work in reinforcement learning, through the Eureka AI agent, is advancing robot learning significantly. This AI agent autonomously writes reward algorithms for training robots, resulting in robots accomplishing complex tasks with high proficiency. The application of AI in this domain showcases Nvidia's capabilities to innovate and lead in AI research.

Nvidia Stock Prediction - Bearish Factors

Competition and Market Dynamics: Despite its strong position, Nvidia faces competition in various segments, particularly in the AI and semiconductor industries. Competitors may challenge Nvidia's market share and margins, creating potential headwinds. Market dynamics can quickly shift, affecting Nvidia's performance.

Supply Chain Challenges: As Nvidia expands its AI applications, particularly in the EV sector, supply chain challenges may arise. Securing adequate supply and navigating supply chain hurdles can impact the company's ability to meet growing demand. Issues related to geopolitical tensions and lack of alternative suppliers pose supply risks.

Complex AI Development: Nvidia's focus on generative AI and robotics, while promising, may require complex development and longer development cycles. This complexity could deter some developers, potentially slowing adoption and increasing costs.

V. Nvidia Stock Price History Performance

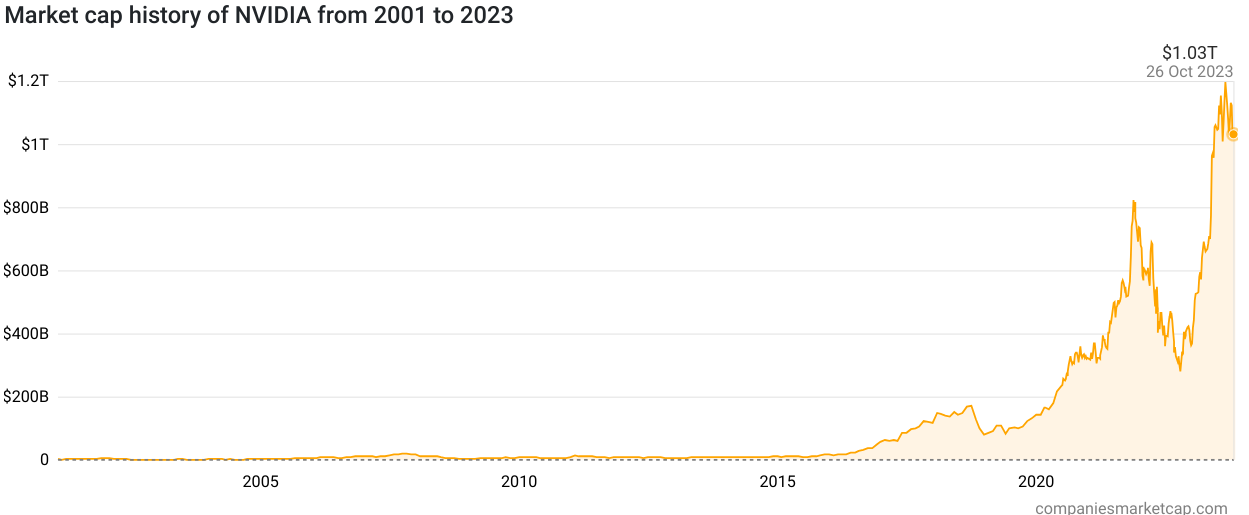

2001 - 2008: The early 2000s marked a period of volatility for Nvidia stock. It went from a market cap of $6.44 billion in 2001 to $4.33 billion in 2008. Factors such as the bursting of the dot-com bubble and the global financial crisis negatively impacted the stock. Nvidia's exposure to the gaming and PC markets made it susceptible to economic downturns.

2009: The stock made a remarkable recovery in 2009, with a market cap of $10.36 billion, showing a 139.16% increase. This recovery was driven by a resurgence in the technology sector following the global financial crisis. Nvidia's graphics processing units (GPUs) gained popularity for applications in gaming and data centers.

2016: In 2016, Nvidia's market cap surged to $57.53 billion, marking a significant uptrend. This growth was attributed to the company's expanding presence in AI and deep learning. The use of Nvidia GPUs in AI applications, especially in autonomous vehicles, boosted investor confidence.

2017: The stock continued its ascent, with a 103.82% increase in market cap. Nvidia's GPUs found increased use in cryptocurrency mining, contributing to the company's growth. The demand for high-performance GPUs for mining purposes drove up the stock price.

2018: Although the market cap decreased by -30.55%, this drop was relatively modest given the sharp upward trajectory in previous years. Concerns about the sustainability of cryptocurrency-related demand affected Nvidia's stock performance.

2019 - 2020: The market cap rose by 76.83% in 2019 and 124.47% in 2020. Nvidia's dominance in the gaming and AI sectors remained strong. Its acquisition of Mellanox Technologies in 2020 signaled its expansion into data center and networking markets, which excited investors.

2021: The market cap skyrocketed to $735.27 billion in 2021, representing a 127.47% increase. Factors contributing to this surge included increased demand for GPUs in data centers, gaming, and AI, along with the broader tech sector's performance.

2022: Nvidia's market cap decreased by -50.47% in 2022. This decline was likely due to concerns about overvaluation, semiconductor supply chain challenges, and a broader market correction.

2023: The market cap soared to $1.031 trillion in 2023, marking an impressive 183.36% increase. Several factors may have contributed to this rise. The increasing adoption of AI and machine learning across various industries, coupled with Nvidia's focus on autonomous vehicles, contributed to this substantial market cap growth.

Source: companiesmarketcap.com

NVDA Stock Price Return Analysis

Over the past decade, Nvidia stock exhibited a phenomenal 10,865.62% price return, significantly outperforming the S&P 500's return of 137.91%. This outstanding performance reflects Nvidia's strong presence in high-growth sectors like AI, gaming, and data centers.

In recent years, Nvidia stock experienced remarkable returns, with a 704.06% price return over five years, indicating sustained investor confidence in the company's growth prospects.

Source: seekingalpha

NVDA Stock Total Return Analysis

The total return closely follows the price return trends, indicating that the majority of Nvidia's returns are from capital appreciation rather than dividends.

VI. Conclusion

Nvidia stock has seen remarkable growth over the years, with a bright outlook for 2023, 2025, and 2030. Price forecasts show optimistic projections, indicating potential for significant increases. For 2023, these forecasts point to a positive trajectory. In 2025, the estimates remain promising, reflecting sustained growth in Nvidia's core sectors, such as AI and autonomous vehicles. Looking to 2030, a more conservative projection suggests a 170% potential upside, considering sector and historical PE averages. Nvidia is a compelling investment option, particularly in the tech and semiconductor sectors. Diversification and risk management are vital. Trading Nvidia Stock CFDs with VSTAR offers leverage, lower costs, and access to global markets, all of which can be advantageous for investors. However, it's important to approach trading with a clear strategy and risk management.

FAQs

1. Is Nvidia a Buy, Sell or Hold?

Nvidia stock is currently rated Buy or Hold by most analysts. The average analyst consensus recommendation is Buy.

2. What is the prediction for NVDA stock?

The average price target over the next 12 months is around $560, which represents a potential upside of about 22% from current levels.

3. Is Nvidia stock expected to rise?

Nvidia stock is expected to continue growing in the coming years as a leader in AI, gaming, autonomous vehicles, and metaverse-related technologies.

4. What will Nvidia stock be worth in 2025?

By 2025, analyst price targets range from $650 on the low end to $900 on the high end, suggesting significant growth ahead.

5. What is the 5-year forecast for NVDA stock?

The 5-year forecast continues to be very positive for Nvidia stock, with analysts projecting strong double-digit revenue and earnings growth.