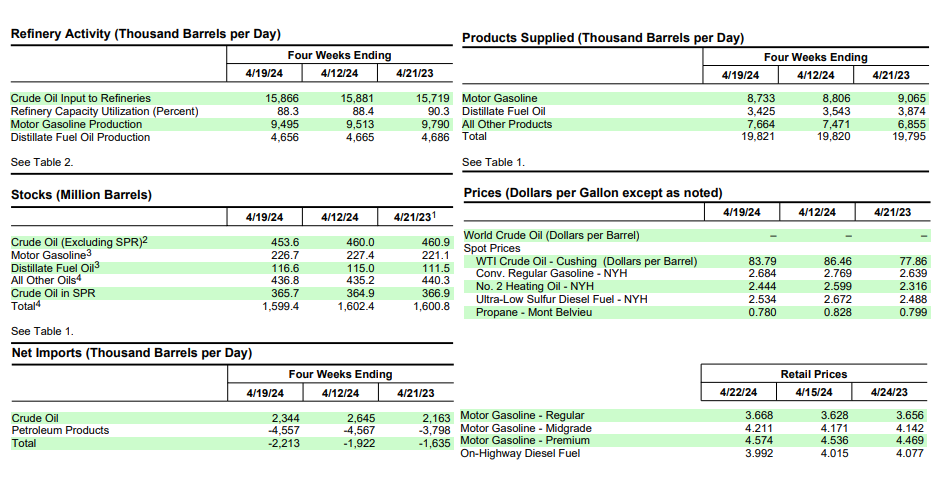

- US crude oil refinery inputs averaged 15.9 million barrels per day, down slightly by 42 thousand barrels per day from the previous week.

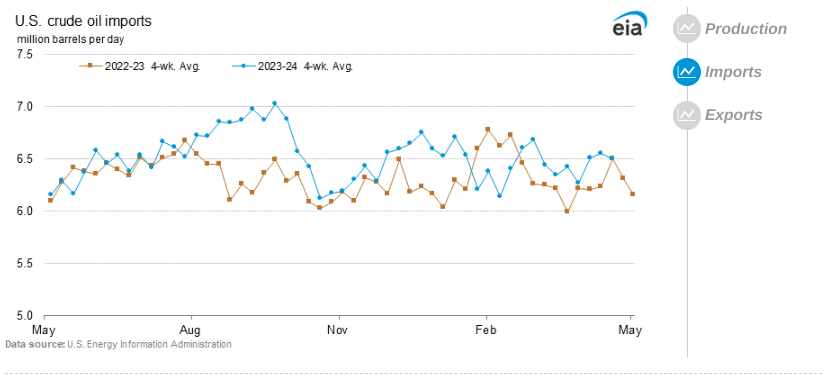

- Crude oil imports stood at 6.5 million barrels per day, showing a marginal increase of 36 thousand barrels per day.

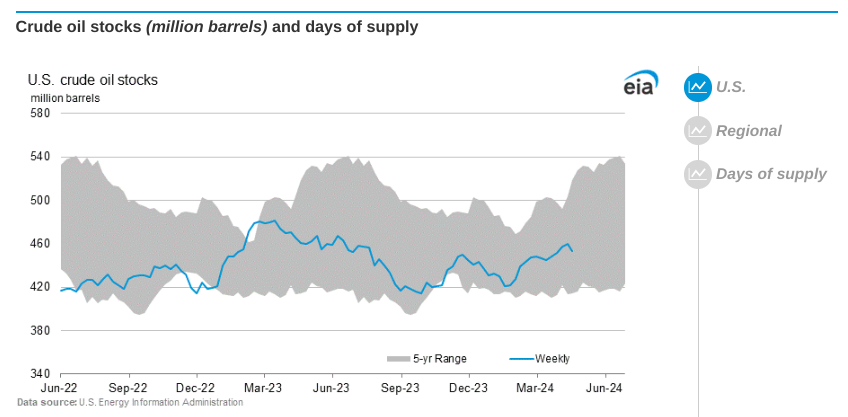

- Commercial crude oil inventories decreased by 6.4 million barrels, now standing at 453.6 million barrels, about 3% below the five-year average.

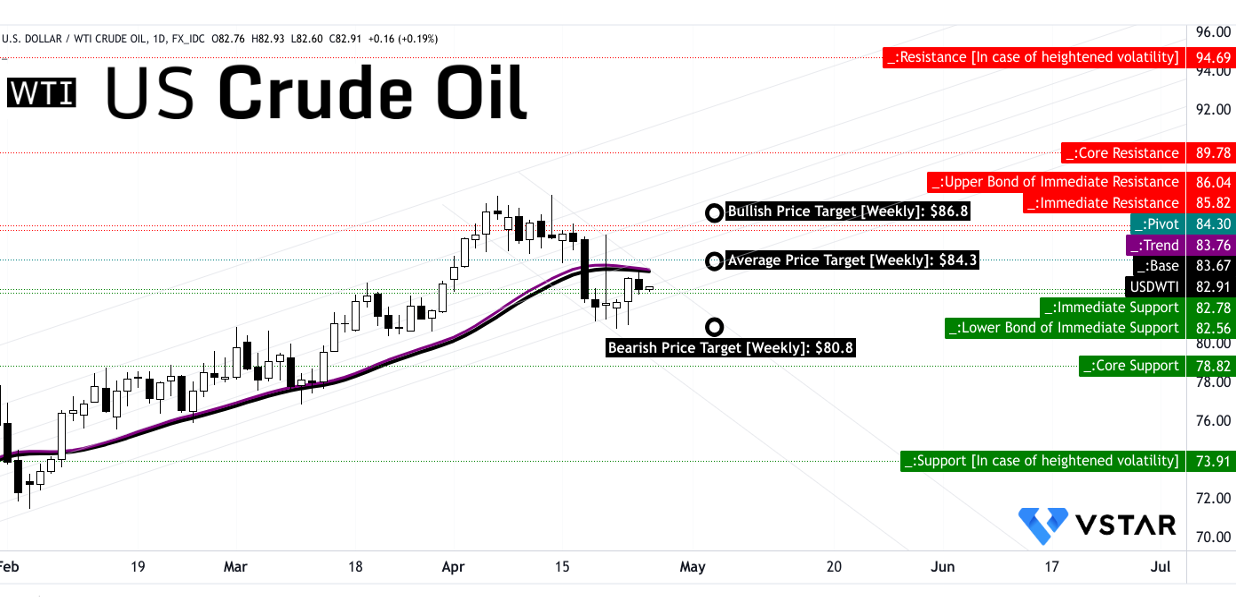

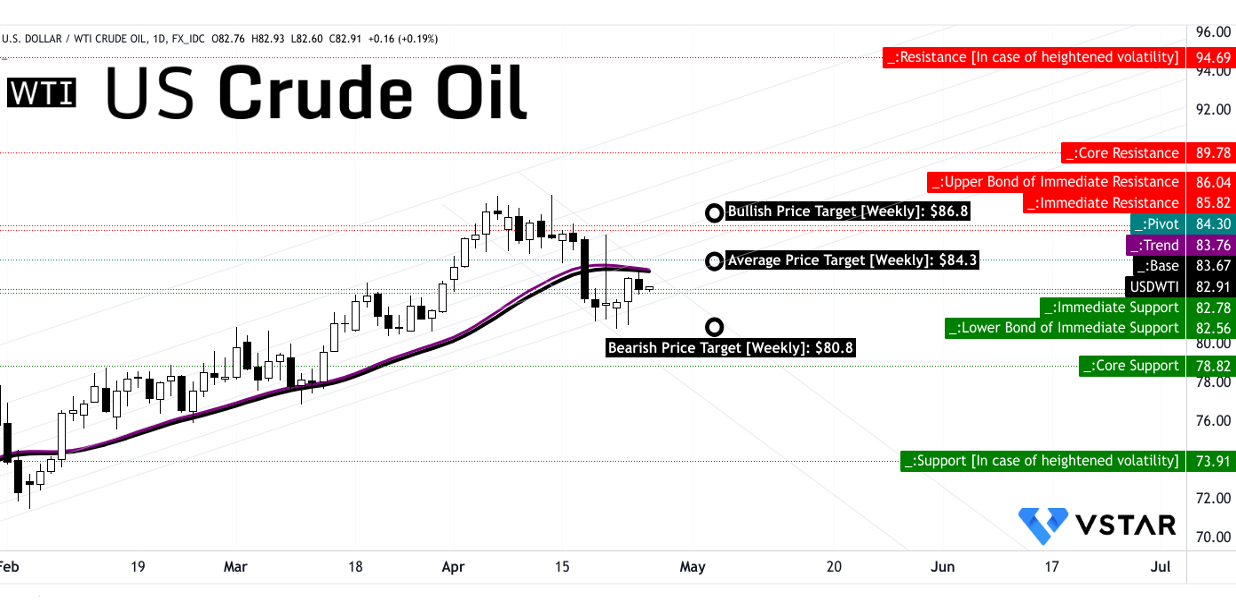

- WTI Crude Oil price at $82.91 shows a mild deviation from the trendline, indicating potential correction but maintaining an overall upward trend.

Following the EIA data points, each holding a key to deciphering market sentiments. As the lifeblood of modern economies, understanding the intricacies of crude oil dynamics becomes paramount. The article delves into the latest data for refinery inputs, import trends, inventory shifts, and technical analysis to mark the path forward for US crude oil CFDs.

Crude Oil Refinery Inputs and Production

Crude oil refinery inputs serve as a critical metric for understanding the demand for refining crude oil into petroleum products. In the context of the provided data, the average U.S. crude oil refinery inputs stood at 15.9 million barrels per day during the week ending April 19, 2024. This figure reflects a marginal decrease of 42 thousand barrels per day compared to the previous week's average.

Source: EIA.gov

The slight decline in refinery inputs suggests potential shifts in demand dynamics or operational adjustments within the refining sector. However, it's essential to note that despite this decrease, refineries operated at a robust 88.5% of their operable capacity, indicating overall efficiency in utilization.

Gasoline and distillate fuel production are key outcomes of the refining process and play crucial roles in meeting energy demands. Gasoline production decreased last week, averaging 9.1 million barrels per day. This decline could be attributed to factors such as seasonal demand patterns, changes in consumer behavior, or refining strategies aimed at optimizing product yields.

On the other hand, distillate fuel production increased last week, averaging 4.8 million barrels per day. This uptick may reflect shifts in demand for diesel and heating oil products, influenced by factors such as weather conditions, industrial activities, or transportation needs.

Crude Oil Imports and Inventories

Crude oil imports represent a significant component of domestic supply, particularly for countries like the United States, which rely heavily on imported crude to meet demand. In the provided data, U.S. crude oil imports averaged 6.5 million barrels per day last week, showing a slight increase of 36 thousand barrels per day from the previous week.

The stability in crude oil import levels, as indicated by the four-week average matching the previous year's level, suggests consistency in import patterns. However, even minor fluctuations in import volumes can influence market sentiment, especially in the context of global supply dynamics and geopolitical developments.

Commercial crude oil inventories serve as a key indicator of supply-demand balance within the market. The data indicates a significant decrease of 6.4 million barrels in U.S. commercial crude oil inventories from the previous week. With inventories now standing at 453.6 million barrels, approximately 3% below the five-year average for this time of year, there are implications for market participants.

Source: EIA.gov

A decrease in crude oil inventories can signal tightening supply conditions, potentially leading to upward pressure on prices. Traders interpret inventory data alongside other factors such as production levels, geopolitical tensions, and economic indicators to anticipate future price movements and adjust their trading strategies accordingly.

Petroleum Product Supply

Petroleum product supply metrics offer insights into consumption patterns and economic activity levels. Total products supplied over the last four-week period averaged 19.8 million barrels per day, showing a slight increase of 0.1% from the same period last year.

However, examining specific product categories reveals divergent trends. Motor gasoline product supplied decreased by 3.7% compared to the same period last year, while distillate fuel product supplied experienced a more substantial decline of 11.6%. These trends raise questions about underlying demand drivers and economic conditions impacting fuel consumption.

Oil Prices Forecast - Price Analysis

Crude oil prices are influenced by a myriad of factors, including supply-demand dynamics, geopolitical tensions, economic indicators, and market sentiment. The price for West Texas Intermediate (WTI) crude oil stood at $83.79 per barrel on April 19, 2024, marking a decrease of $2.67 from the previous week but an increase of $5.93 compared to a year ago.

The volatility in crude oil prices reflects ongoing market uncertainties and fluctuations in global supply and demand fundamentals. Traders analyze price movements alongside inventory levels, production data, geopolitical developments, and macroeconomic trends to identify trading opportunities and manage risk effectively.

Oil Prices Forecast - Bullish Implications

Decrease in Crude Oil Inventories: The U.S. commercial crude oil inventories decreased by 6.4 million barrels from the previous week. This reduction suggests a tightening of supply, which could exert upward pressure on crude oil prices due to increased demand relative to supply. Additionally, at 453.6 million barrels, U.S. crude oil inventories are about 3% below the five-year average for this time of year, indicating a potential bullish sentiment.

Decline in Gasoline Inventories: Total motor gasoline inventories decreased by 0.6 million barrels from the previous week and are about 4% below the five-year average for this time of year. This reduction in gasoline inventories could lead to higher gasoline prices, which in turn could drive up the demand for crude oil as refineries seek to produce more gasoline, contributing to a bullish outlook for crude oil prices.

Increase in Distillate Fuel Demand: Distillate fuel product supplied averaged 3.4 million barrels a day over the past four weeks, down by 11.6% from the same period last year. However, distillate fuel inventories increased by 1.6 million barrels last week. Despite this increase in inventories, the demand for distillate fuel may rise in the future, particularly if economic activities accelerate, leading to upward pressure on crude oil prices.

Oil Prices Forecast - Bearish Implications

Decline in Gasoline Prices: The spot price for conventional gasoline decreased to $2.684 per gallon, which is $0.085 less than a week ago. This decline in gasoline prices may indicate weakening demand for gasoline, which could potentially dampen the demand for crude oil as a feedstock in gasoline production, leading to downward pressure on crude oil prices.

Decline in Total Motor Gasoline Product Supplied: Over the past four weeks, motor gasoline product supplied averaged 8.7 million barrels a day, down by 3.7% from the same period last year. This decline in gasoline demand suggests a potential decrease in the overall demand for crude oil, as gasoline is a major derivative product of crude oil. A sustained decrease in gasoline product supplied could signal a bearish sentiment for crude oil prices.

Increase in Crude Oil Imports: U.S. crude oil imports averaged 6.5 million barrels per day last week, slightly more than the same four-week period last year. Additionally, preliminary crude imports from various countries show mixed trends, with some countries experiencing increases in imports compared to the previous week. Higher imports could contribute to an oversupply situation, exerting downward pressure on crude oil prices.

Source: EIA.gov

Oil Prices Forecast: WTI Crude Oil Technical Take

Oil Prices Forecast - Price Trend Analysis

The current price of WTI Crude Oil stands at $82.91, slightly below the trendline of $83.76 and the baseline of $83.67, both calculated using modified exponential moving averages. This indicates a mild deviation from the trendline, suggesting a potential correction. However, the overall direction of the price is upward, supported by the fact that the current price is above the baseline. This upward trend may signal continued bullish sentiment in the market.

Oil Prices Forecast - Average Price Target by the End of Next Week

The average price target is $84.30, derived from the momentum of change-in-polarity over the short-term, projected over Fibonacci retracement/extension levels. This suggests a modest increase from the current price.

- Bullish target: $86.80, based on higher-high price momentum of the current swing, projected over Fibonacci retracement/extension levels.

- Bearish target: $80.80, based on lower-low price momentum of the current swing, projected over Fibonacci retracement/extension levels.

Oil Prices Forecast - Support and Resistance Levels

- Support Levels:

- Primary Support: $82.55

- Major Support: $78.80

- Resistance Levels:

- Primary Resistance: $86.05

- Major Resistance: $89.80

The pivot of the current horizontal price channel is at $84.30. These support and resistance levels provide key reference points for traders, indicating potential areas of price reversal or continuation.

Source: tradingview.com

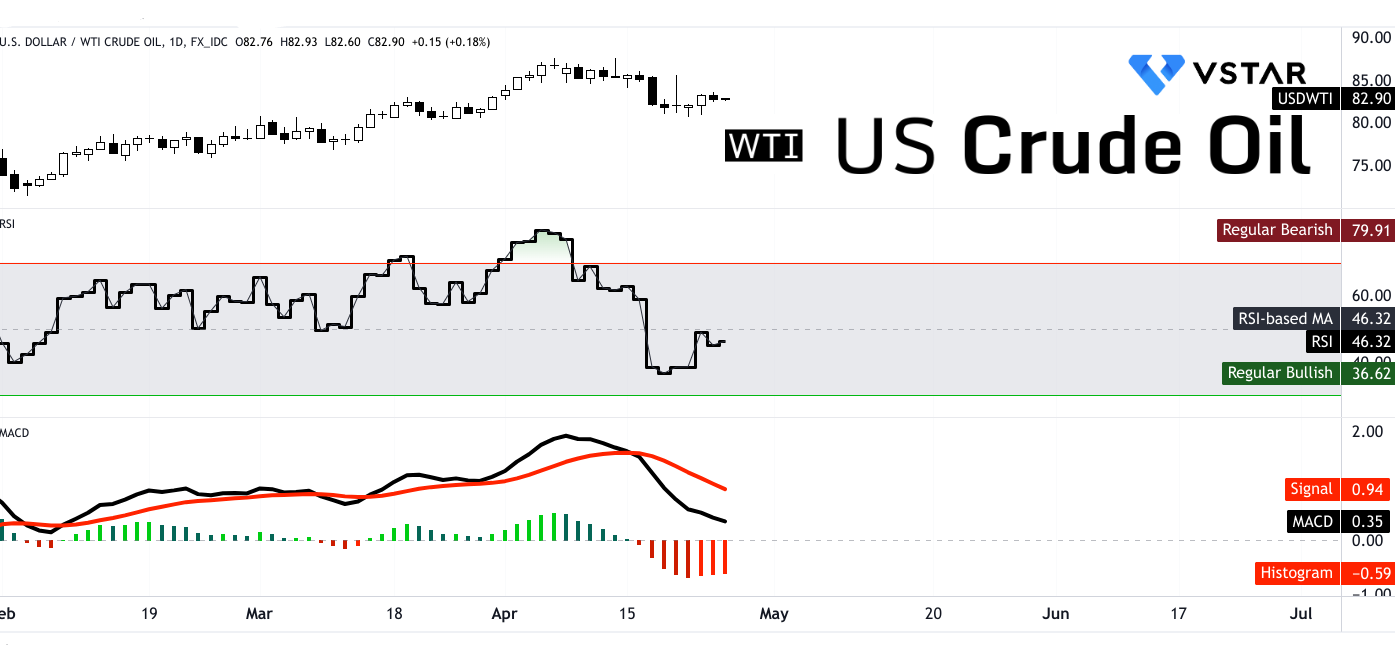

Oil Prices Forecast - Relative Strength Index (RSI) Analysis

The RSI value is 46.32, indicating a neutral position. The RSI trend is increasing, suggesting a strengthening momentum. However, it remains below the regular bullish level of 79.91, indicating a potential for further upside. There is no bullish or bearish divergence observed, implying alignment between price and momentum.

Oil Prices Forecast - Moving Average Convergence/Divergence (MACD) Analysis

The MACD line is at 0.35, below the signal line of 0.94, indicating a bearish trend. The MACD histogram is negative (-0.59), confirming the bearish sentiment. However, the strength of the trend is stabilized, suggesting a potential for a reversal or consolidation in this week.

Source: tradingview.com

Conclusion:

In conclusion, with refinery inputs stabilizing and inventories tightening, the fundamentals suggest a bullish sentiment in crude oil markets. However, amidst geopolitical uncertainties and fluctuating demand, price direction remains uncertain. While WTI Crude Oil prices exhibit a mild deviation from the trendline, indicating potential correction, the overall trajectory remains upward.