- 通脹趨勢:在住房和汽油指數的推動下,CPI-U 上漲 0.4%,反映出持續的通脹壓力。

- 行業動態:能源、食品和服務行業的波動凸顯了不同的市場動態和消費者支出模式。

- 就業影響:醫療保健和建築行業的就業增長提振了消費者信心,影響了標準普爾 500 指數和納斯達克 100 指數等指數中的公司。

- 市場前景:儘管存在通脹擔憂,但標準普爾 500 指數仍維持支撐水平,預計到 2024 年第二季度目標價格為 5925 美元,儘管相對強弱指數 (RSI) 表明可能存在調整。

2024 年 3 月美國經濟數據,特別是消費者價格指數 (CPI) 和生產者價格指數 (PPI),揭示了有關通脹壓力和部門動態的重要見解。在住房和汽油指數的推動下,U CPI 上漲了 0.4%,通脹勢頭持續存在。不斷上漲的能源和食品成本,加上服務業的波動,凸顯了複雜的市場動態。不同行業的就業增長和流失會影響消費者支出模式,從而影響標普 500 指數和納斯達克 100 指數等公司。

美國經濟數據分析

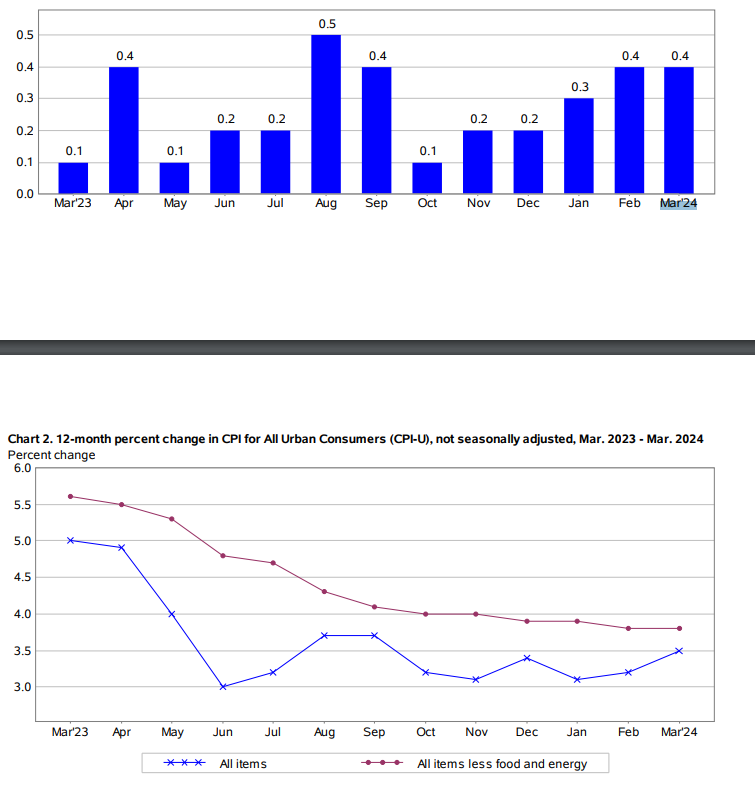

2024 年 3 月消費者價格指數 (CPI) 報告顯示,CPI-U 上漲 0.4%,與 2 月份觀察到的增長率一致。這種一致性表明消費者價格持續上漲,可能預示着通脹壓力。過去 12 個月,季節性調整前所有項目指數飆升 3.5%,凸顯通脹勢頭持續。

在U CPI中,住房和汽油指數的飆升在推動整體增長方面發揮了關鍵作用。這兩個組成部分合計貢獻了所有項目指數月度漲幅的一半以上。住房指數(包括租金和業主等效租金等住房相關費用)顯着上升,反映了全國住房成本上漲的總體趨勢。同樣,汽油指數大幅上漲,可能是受到地緣政治緊張局勢和影響全球石油市場的供應鏈中斷等外部因素的影響。

資料來源:bls.gov

能源指數:

繼 2 月份上漲 2.3% 後,能源指數在 2024 年 3 月顯着上漲 1.1%。這一上升軌跡主要是由汽油指數上漲 1.7% 推動的,反映了燃料成本上漲的更廣泛趨勢。雖然汽油價格飆升可能歸因於地緣政治緊張局勢和供應鏈中斷等多種因素,但它凸顯了能源市場容易受到外部衝擊的影響。此外,天然氣和燃油等成分的波動凸顯了能源行業內供需動態的複雜相互作用,對消費者和生產者都產生影響。

食品指數:

儘管 2024 年 3 月食品指數小幅上漲 0.1%,但該類別中的特定成分表現出顯着的波動。雖然某些雜貨店食品類別指數出現下降,但其他食品類別,如肉類、家禽、魚類和雞蛋的價格卻出現上漲。特別重要的是雞蛋指數飆升 4.6%,表明潛在的供應鏈中斷或消費者偏好的變化會影響該細分市場的定價動態。此外,外出就餐指數上漲0.3%,表明外出就餐支出增加,這可能反映出消費者信心和可自由支配支出模式的改善。

所有項目減去食物和能源:

2024 年 3 月,扣除食品和能源後的所有商品指數飆升 0.4%,與過去兩個月觀察到的趨勢一致。在這一類別中,受租金和業主等值租金上漲的推動,住房指數成為整體上漲的重要貢獻者。機動車保險、服裝和醫療保健等領域也出現了顯着增長,而二手車和卡車、娛樂和新車等某些領域則出現了下降。這種微妙的價格變動模式凸顯了消費者支出模式的多樣性以及影響不同經濟部門定價動態的潛在因素。

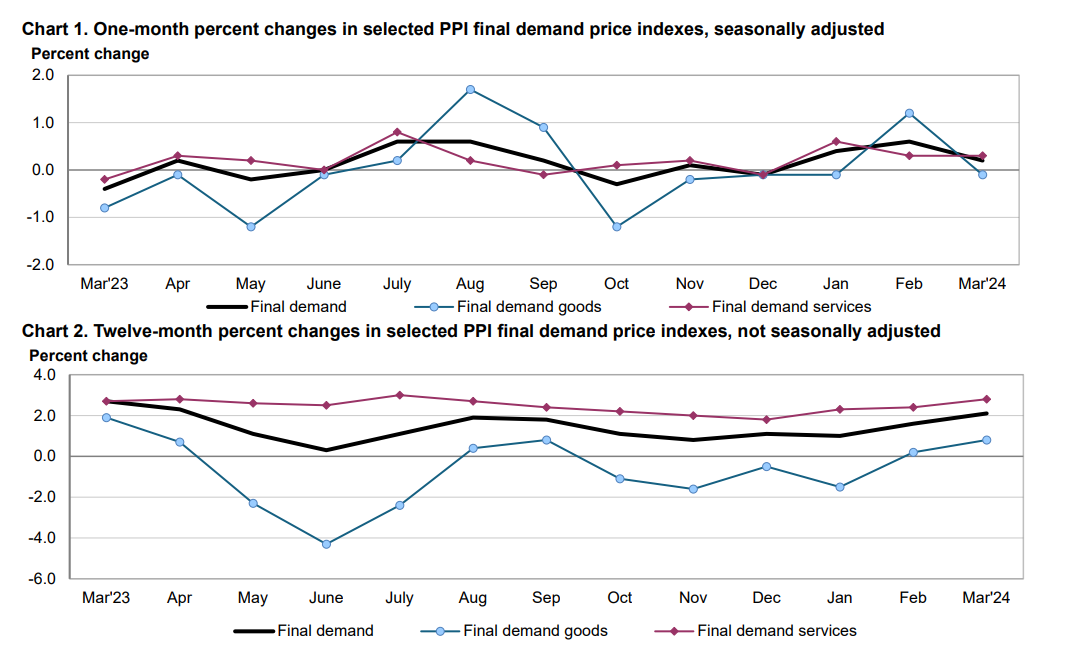

生產者價格指數(PPI)

2024 年 3 月,生產者價格指數 (PPI) 最終需求增長 0.2%,主要是由於最終需求服務價格上漲 0.3%。這種上升軌跡表明經濟內部存在潛在的通脹壓力,對生產者和消費者都有影響。

資料來源:bls.gov

服務業影響:

在最終需求服務類別中,證券經紀、交易、投資諮詢及相關服務出現顯着增長,凸顯了對金融服務和投資產品的需求不斷增長。相反,旅行者住宿服務出現下降,這可能反映出酒店行業因旅行限制和消費者偏好變化等因素而面臨的持續挑戰。

中間需求

2024 年 3 月,加工產品價格下降了 0.5%,主要受到加工能源產品價格下降的影響。這種下降軌跡表明製造業內部存在潛在挑戰,對依賴能源密集型生產流程的生產商產生影響。然而,加工食品和飼料等某些細分市場的價格上漲,凸顯了該類別內定價動態的異質性。

未加工的貨物:

中間需求未加工商品指數繼 2 月份下降 0.7% 後,2024 年 3 月下降 1.9%。這種下降可歸因於未加工能源材料價格的大幅下跌,凸顯了商品市場固有的波動性。然而,未加工食品和飼料指數上漲,表明農業部門存在潛在的供應限制或需求動態變化。

服務:

2024 年 3 月,中間需求服務價格上漲 0.2%,主要是由於中間需求服務減去貿易、運輸和倉儲指數上漲 0.3%。這種上升軌跡表明服務業存在潛在的通脹壓力,對依賴服務投入的眾多行業產生影響。

對生產流程階段的影響

- 2024 年 3 月,第四階段中間需求的價格上漲了 0.2%,這主要是由於服務投入增加所致。這種上升軌跡表明生產者在生產最後階段的成本增加,可能預示着經濟內部更廣泛的通脹壓力。然而,投入成本上升的影響可能因行業而異,並對利潤率和定價策略產生影響。

- 繼 2 月份上漲 1.0% 後,第三階段中間需求價格在 2024 年 3 月保持不變。這種穩定性表明,生產中間階段的通脹壓力可能會趨於平穩。然而,現階段定價動態的影響可能會受到多種因素的影響,包括投入成本、供應鏈中斷和消費者需求的變化。

- 第二階段中間需求價格繼 2 月份上漲 0.8% 後,2024 年 3 月顯着下降 1.3%。這種下降軌跡表明製造業內部存在潛在挑戰,對依賴中間投入的生產商產生影響。但下降幅度可能會受到大宗商品價格、投入成本、產能利用率等因素的影響。

- 第一階段中間需求價格繼 2 月份上漲 1.0% 後,2024 年 3 月小幅下降 0.1%。這種小幅下降表明生產初期通脹壓力可能有所緩解。但現階段定價動態的影響可能會受到大宗商品價格、投入成本、產能利用率等因素的影響。

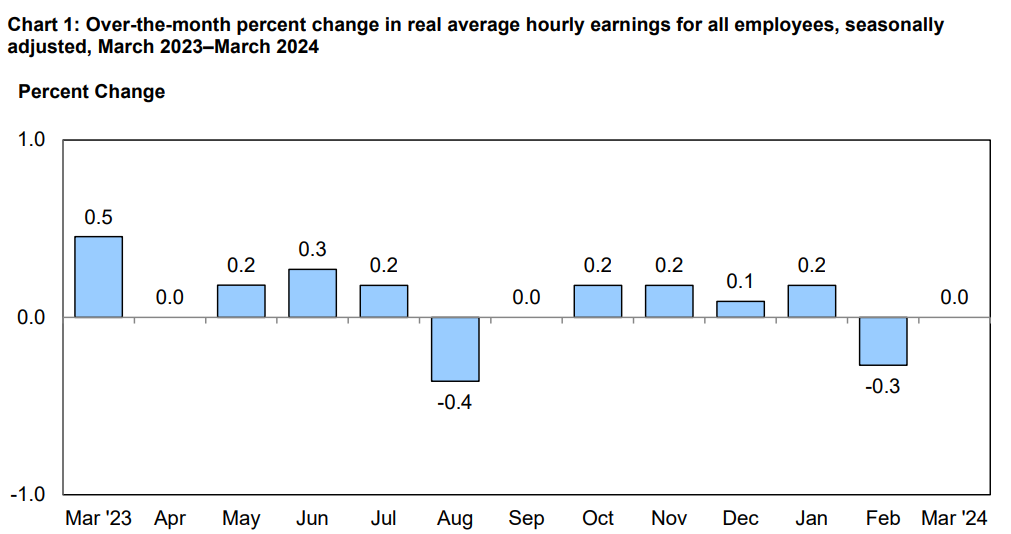

實際收入和就業情況

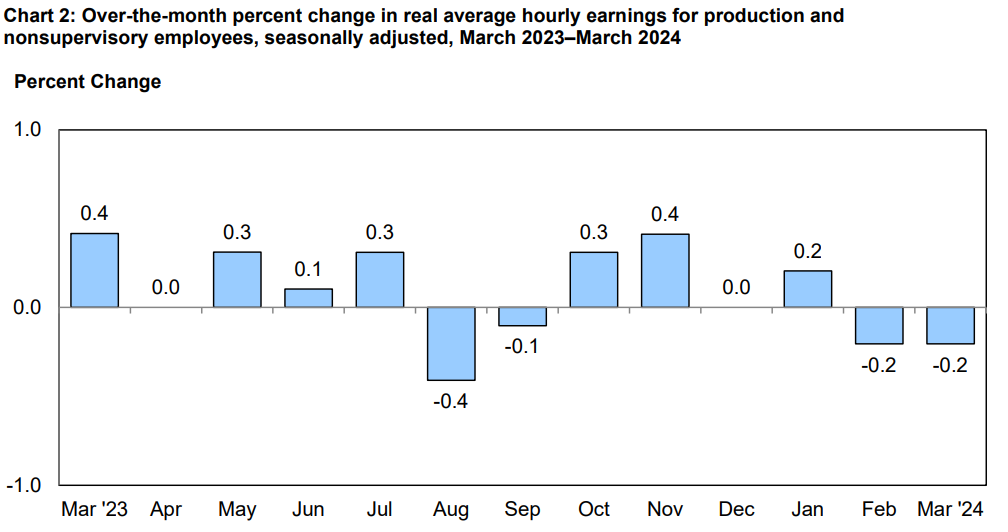

2 月至 3 月,所有員工的實際平均每小時收入保持不變,2023 年 3 月至 2024 年 3 月增長了 0.6%。這種穩定性表明實際工資增長可能趨於平穩,對消費者購買力和可自由支配支出模式產生影響。 2 月至 3 月,生產和非管理員工的實際平均每小時收入下降了 0.2%。這種下降可能反映出某些經濟部門面臨的潛在挑戰,並對家庭金融穩定產生影響。

資料來源:bls.gov

資料來源:bls.gov

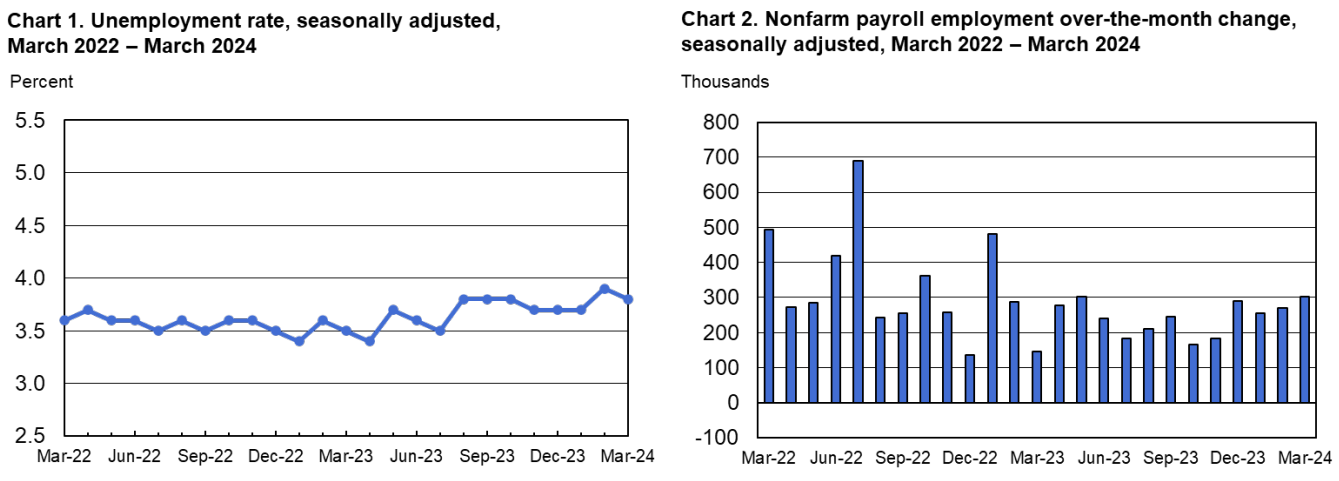

3月份非農就業人數增加30.3萬人,失業率維持在3.8%。這種強勁的就業增長表明勞動力市場具有彈性,對消費者信心和整體經濟活動產生影響。醫療保健、政府和建築行業的就業機會顯着增加,凸顯了經濟內就業機會的多樣性。然而,休閒和酒店等某些行業繼續面臨勞動力短缺和消費者偏好變化等因素帶來的挑戰。

資料來源:bls.gov

超級核心消費者物價指數和美聯儲的擔憂

超級核心消費者物價指數(CPI)不包括與住房相關的組成部分,可以進一步洞察通脹動態,突顯非住房部門持續存在的通脹壓力。 2024 年 3 月 CPI 報告顯示,超級核心 CPI 同比大幅上漲 4.8%,這主要是由交通服務推動的。這表明通脹壓力超出了住房相關成本,給美聯儲的通脹目標框架帶來了挑戰。

包括汽車保險費在內的運輸服務價格顯着上漲,突顯了重要經濟部門對通脹壓力的抵禦能力。儘管通過貨幣政策措施努力遏制通脹,但供應鏈中斷、投入成本上升和消費者偏好變化等因素繼續對價格施加上行壓力,導致通脹水平上升。

美聯儲對核心服務通脹的擔憂,特別是交通運輸和其他非住房部門的通脹,反映出在經濟結構性轉變中實現價格穩定面臨的更廣泛挑戰。在勞動力短缺、供應鏈瓶頸和被壓抑的需求等因素的推動下,核心服務通脹持續上升,凸顯了採取積極主動的通脹管理方法的必要性。

雖然貨幣政策工具可以影響短期通脹動態,但解決結構性失衡和供給側限制需要財政、貨幣和監管政策領域的協調努力。

對美聯儲政策的影響

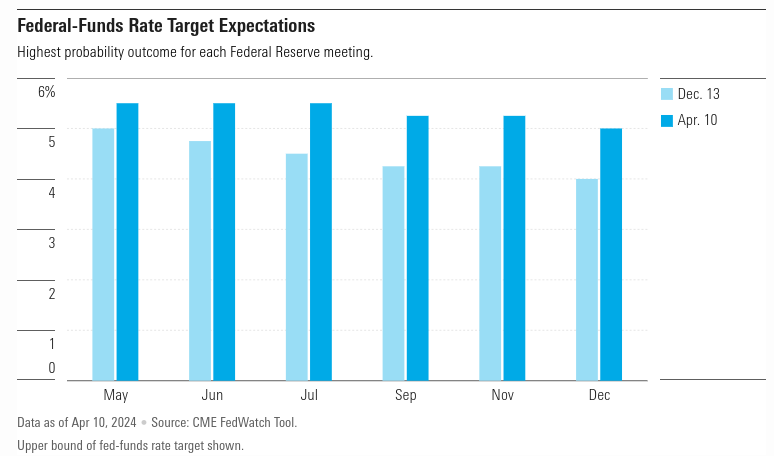

CPI報告中強調的持續通脹壓力對美聯儲的政策決策具有重大影響,塑造對未來利率調整和貨幣政策立場的預期。市場對降息的預期與美聯儲的謹慎態度之間的分歧凸顯了在支持經濟增長的同時實現物價穩定的挑戰。

近期的CPI數據表明通脹壓力持續存在,導致市場預期重新評估,債券交易員目前預計9月份將首次降息。這一轉變反映出人們對美聯儲在持續的物價壓力下實現通脹目標的能力的擔憂,因此需要重新調整貨幣政策工具以應對新出現的挑戰。

資料來源:morningstar.com

此外,對 2024 年降息次數的預期降低表明美聯儲在應對通脹動態方面將採取更加謹慎的態度。

美聯儲對通脹動態的反應及其對經濟前景的影響在塑造市場預期和投資者情緒方面發揮着至關重要的作用。美聯儲主席鮑威爾關於通脹率“崎嶇不平”地邁向2%的言論反映了持續通脹壓力和經濟前景不確定性帶來的挑戰。

對標準普爾 500 指數和納斯達克 100 指數的影響

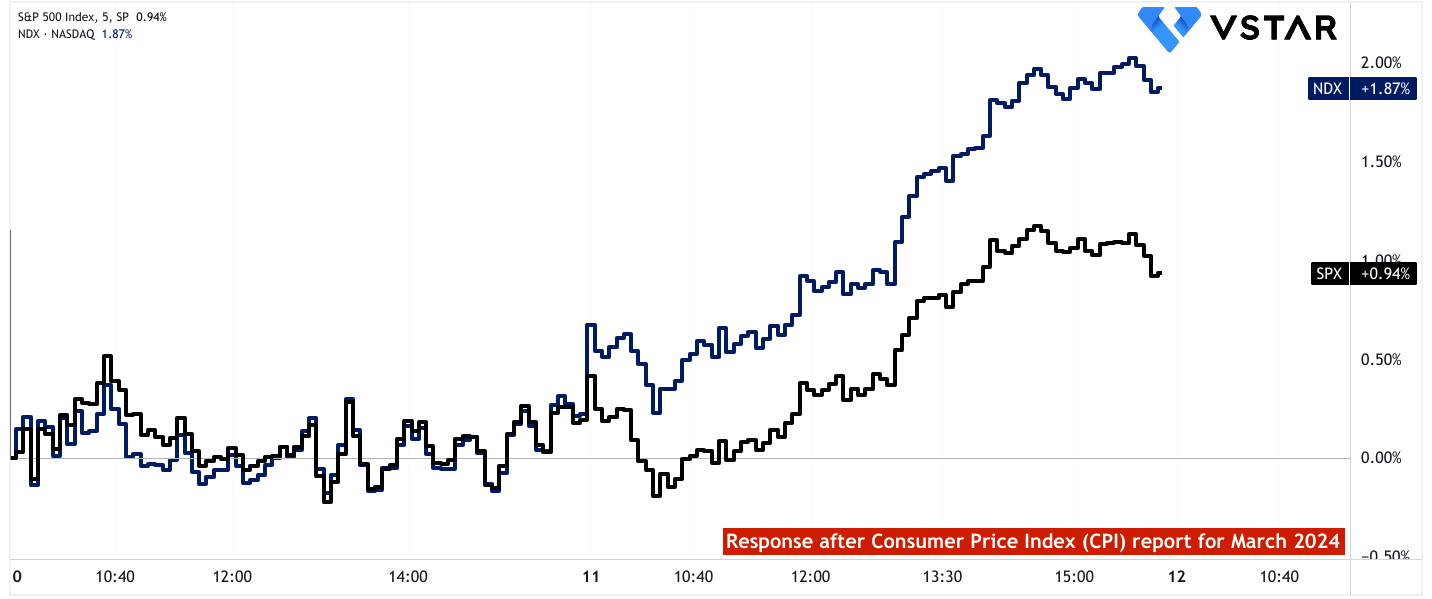

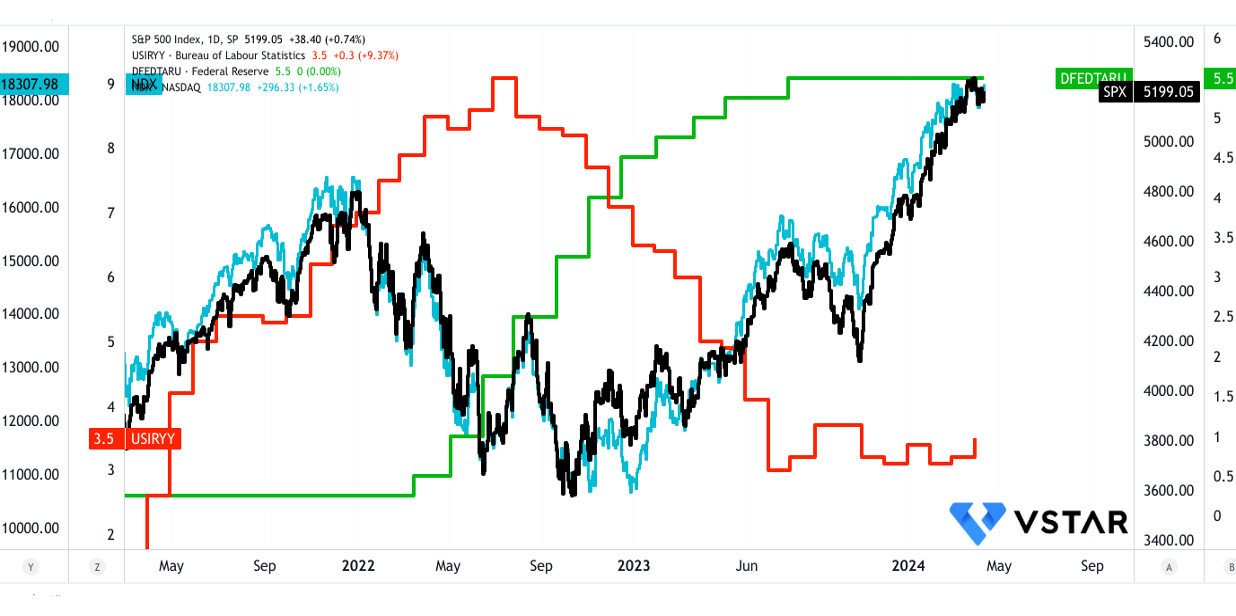

這兩個指數都對利率變化和通脹預期敏感。對美聯儲實現通脹目標能力的擔憂以及未來降息和貨幣政策決定的不確定性可能導致股市波動加劇。然而,市場反應積極,兩個指數在 4 月 10 日至 11 日期間均實現了正回報。

標準普爾 500 指數涵蓋各個行業,這意味着它受到行業表現趨勢的影響。例如,CPI 和 PPI 數據表明,住房相關成本和運輸服務的增加可能會影響指數內的非必需消費品(例如房屋建築商、汽車製造商)和運輸(例如航空公司、物流公司)等行業。同樣,休閒和酒店等行業的挑戰可能會影響非必需消費品行業的公司。

持續的通脹壓力和圍繞貨幣政策的不確定性可能會對標準普爾 500 指數中的公司產生不同的影響。通脹上升可能會導致公司的投入成本上升,從而可能擠壓利潤率。此外,對美聯儲未來利率調整的預期可能會對各個行業產生不同的影響。例如,公用事業和消費必需品等行業通常對利率變化不太敏感,但與金融和科技等行業相比,它們的表現可能會更好。

就業形勢,特別是特定行業的就業增加或減少,可能會影響消費者支出模式和整體經濟活動,從而影響標準普爾 500 指數成分股的公司。強勁的就業增長,尤其是醫療保健和建築等行業的就業增長,可能會導致消費者信心和可自由支配收入的增加支出,使指數內非必需消費品和醫療保健等行業的公司受益。

資料來源:tradingview.com

納斯達克 100 指數對科技行業的重視使其對該行業的趨勢特別敏感。交通服務的變化(例如,對電動汽車的需求影響特斯拉等公司)和通脹壓力(例如,半導體製造商的投入成本上升)等因素可能會直接影響指數內的科技公司。

納斯達克 100 指數以關注創新和成長型公司而聞名。因此,影響創新和增長的宏觀經濟因素,例如消費者偏好的變化(例如,對技術產品和服務的需求增加)和供應鏈的中斷(例如,影響科技硬件公司的半導體短缺),可能會對創新和增長產生重大影響。指數。

由於該指數內成長型股票高度集中,納斯達克 100 指數通常對利率和貨幣政策的變化敏感。受通脹壓力和經濟數據影響,對美聯儲未來利率調整的預期可能會影響投資者對成長股的情緒。美聯儲採取更強硬的立場可能會導致納斯達克 100 指數中高估值股票面臨拋售壓力。

簡而言之,通脹上升可能會推動任何可能的降息,並可能迫使美聯儲進一步加息。市場預期的波動對這些指數的影響最大。

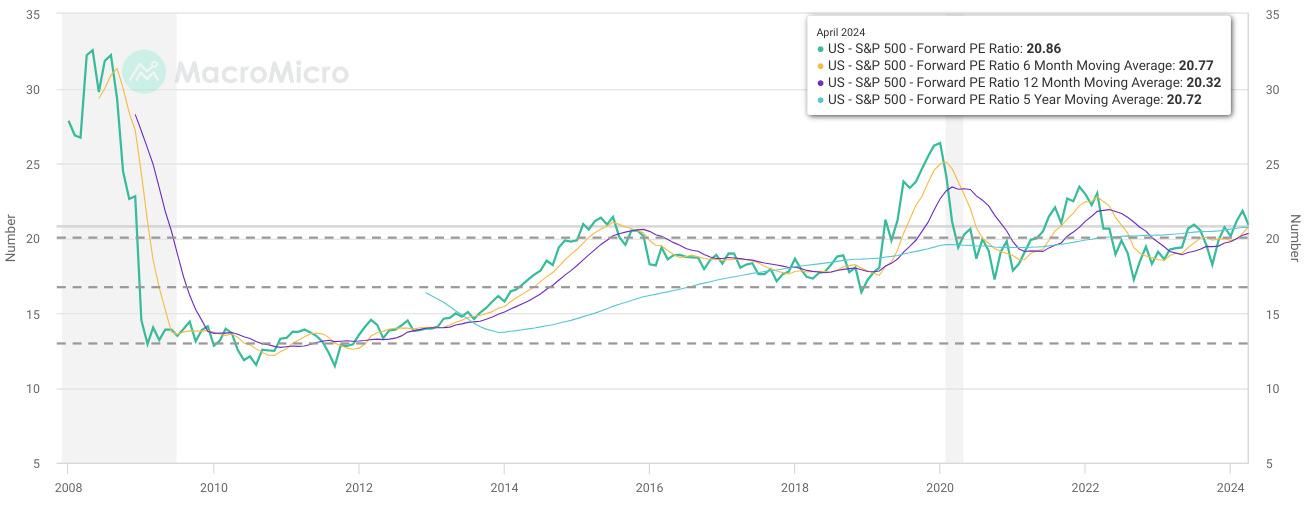

有趣的是,目前標準普爾 500 指數的價格圍繞其短期到長期遠期市盈率。從技術上講,5,071.10 美元至 5,020.85 美元是關鍵支撐區域。因此,從當前水平的任何下跌都是建立股票多頭頭寸的機會。進一步下跌(可能性較小)為對基於標準普爾 500 指數的股票執行美元成本平均法提供了理想的條件。遵循當前的價格波動並預測斐波那契回撤和延伸的勢頭,到 2024 年第二季度末的價格目標為 5925 美元。

然而,從 78 的相對強弱指數 (RSI) 來看,價格可能會出現調整,隨後價格會出現橫盤走勢。綜上所述,標普500指數觸及目標價的可能性很大。

來源:macromicro.me

資料來源:tradingview.com

總之,在關鍵技術水平和市場動力的支持下,標準普爾 500 指數當前的價格動態表明了戰略投資的機會。儘管存在通脹壓力和不確定性,但前景樂觀,有可能在 2024 年第二季度實現預計價格目標。