Mức ngừng giao dịch đề cập đến mức giá mà tại đó vị thế mở của nhà giao dịch sẽ bị nhà môi giới của mình thanh lý bắt buộc do lệnh gọi ký quỹ. Đó là mức ký quỹ tối thiểu mà tài khoản của nhà giao dịch phải duy trì để duy trì vị thế của họ. Khi vốn chủ sở hữu trong tài khoản của nhà giao dịch giảm xuống mức ngừng giao dịch, điều đó sẽ khiến nhà môi giới bắt đầu thanh lý các vị thế mở để khôi phục số dư ký quỹ. Mức ngừng giao dịch bảo vệ nhà môi giới khỏi những tổn thất có thể xảy ra nếu vốn chủ sở hữu của nhà giao dịch tiếp tục giảm. Chúng thường được đặt trong khoảng 10-30% số tiền ký quỹ, tùy thuộc vào nhà môi giới và loại tài khoản giao dịch. Hiểu cơ chế ngừng giao dịch là rất quan trọng để các nhà giao dịch quản lý rủi ro ký quỹ và tránh bị buộc phải thanh lý. Xem lại chính sách ngưng giao dịch của nhà môi giới trước khi mở tài khoản có thể giúp giảm thiểu rủi ro thanh lý khi giao dịch ký quỹ.

Mục đích chính của mức ngừng giao dịch là để bảo vệ cả nhà giao dịch và nhà môi giới khỏi bị tích lũy thêm tổn thất trong một giao dịch. Nếu ký quỹ của nhà giao dịch giảm quá thấp, vốn của nhà môi giới sẽ gặp rủi ro nếu thị trường tiếp tục đi ngược lại vị thế của nhà giao dịch. Lệnh Stop Out bắt đầu hoạt động để đóng giao dịch và xử lý các khoản lỗ trước khi chúng lớn hơn. Điều này ngăn số dư tài khoản âm và rủi ro quá mức cho nhà môi giới. Đối với nhà giao dịch, lệnh ngưng giao dịch cung cấp một hình thức quản lý rủi ro bắt buộc để hạn chế thua lỗ nếu họ không thể tự mình thoát khỏi các vị thế thua lỗ. Mặc dù việc ngưng giao dịch là điều không mong muốn nhưng cơ chế phòng ngừa nhằm mục đích hạn chế thua lỗ và tránh ảnh hưởng đến vốn của nhà môi giới, điều này trong những trường hợp cực đoan có thể dẫn đến tình trạng mất khả năng thanh toán của chính họ.

Cách mức ngừng giao dịch (Stop Out) hoạt động

Khái niệm ký quỹ và đòn bẩy trong forex

Giao dịch ngoại hối cung cấp cho các nhà giao dịch khả năng tiếp cận các thị trường tiền tệ lớn trên toàn cầu thông qua việc sử dụng đòn bẩy. Đòn bẩy cho phép nhà giao dịch mở các vị thế lớn hơn nhiều so với số dư tài khoản của họ thường cho phép. Ví dụ: tỷ lệ đòn bẩy 50:1 có nghĩa là họ có thể giao dịch với 50 USD cho mỗi 1 USD trong tài khoản của mình. Điều này cho phép tiếp cận thị trường nhiều hơn nhưng cũng làm tăng rủi ro.

Đòn bẩy đi kèm với yêu cầu ký quỹ. Ký quỹ đề cập đến vốn chủ sở hữu tối thiểu mà nhà giao dịch phải duy trì liên quan đến các vị thế mở của mình. Trên tài khoản có đòn bẩy 50:1, yêu cầu ký quỹ thường là 2%. Điều này có nghĩa là nếu nhà giao dịch có 1.000 USD trong tài khoản, họ có thể mở các vị thế trị giá 50.000 USD trong khi duy trì mức ký quỹ tối thiểu là 20 USD (2% của 50.000 USD).

Tuy nhiên, nếu giao dịch đi ngược lại với nhà giao dịch và bắt đầu thua lỗ, điều này sẽ nhanh chóng ăn vào số tiền ký quỹ của nhà giao dịch. Khi mức ký quỹ giảm xuống gần mức ngưng giao dịch của nhà môi giới, chẳng hạn như vốn chủ sở hữu 5%, nó sẽ kích hoạt lệnh gọi ký quỹ. Điều này yêu cầu nhà giao dịch phải gửi thêm tiền để đưa số tiền ký quỹ trở lại cao hơn yêu cầu của nhà môi giới.

Nếu nhà giao dịch không nạp tiền và số tiền ký quỹ tiếp tục giảm, tài khoản của nhà giao dịch sẽ đạt đến mức ngưng giao dịch. Đây là mức ký quỹ tối thiểu mà một nhà môi giới sẽ cho phép trước khi buộc đóng các vị thế mở để ngăn ngừa tổn thất thêm. Ở mức ngưng giao dịch 5% với đòn bẩy 50:1, các giao dịch đang mở sẽ bị đóng khi vốn chủ sở hữu tài khoản giảm xuống 250 USD trên quy mô vị thế 50.000 USD.

Đòn bẩy cao trong giao dịch Forex có nghĩa là giá tiền tệ biến động có thể nhanh chóng làm cạn kiệt tiền ký quỹ và dẫn đến tình trạng ngưng giao dịch bất ngờ. Nhà giao dịch phải theo dõi chặt chẽ mức ký quỹ và chủ động quản lý rủi ro để tránh bị thanh lý đột ngột.

Ngưng giao dịch được kích hoạt khi mức ký quỹ giảm xuống dưới yêu cầu của nhà môi giới

Khi sự biến động của thị trường gây ra thua lỗ trong các giao dịch mở, mức ký quỹ của nhà giao dịch sẽ giảm. Với đòn bẩy, những biến động giá bất lợi nhỏ sẽ nhanh chóng làm cạn kiệt lợi nhuận. Khi mức ký quỹ giảm xuống gần mức gọi ký quỹ của nhà môi giới, chẳng hạn như 15%, nhà môi giới sẽ đưa ra thông báo gửi thêm tiền. Nếu nhà giao dịch không thể nạp tiền, khoản lỗ ngày càng tăng sẽ tiếp tục làm xói mòn số tiền ký quỹ. Khi đạt đến mức ngưng giao dịch thấp hơn, chẳng hạn như 5%, nhà môi giới không có lựa chọn nào khác ngoài việc bắt đầu đóng các vị thế trước khi tổn thất leo thang hơn nữa. Việc thanh lý bắt buộc cho phép nhà môi giới bảo vệ vốn và đưa tài khoản trở lại mức yêu cầu ký quỹ tối thiểu. Các nhà giao dịch phải theo dõi tỷ lệ ký quỹ chặt chẽ nếu không sẽ có nguy cơ buộc phải đóng các vị thế khi nó giảm xuống dưới hai ngưỡng quan trọng.

Vị thế đóng ở mức ngưng giao dịch để bảo vệ nhà giao dịch và nhà môi giới

Khi mức ký quỹ trong tài khoản giao dịch có đòn bẩy giảm xuống mức ngưng giao dịch do nhà môi giới xác định, nó sẽ khiến công ty bắt đầu đóng các vị thế mở. Việc buộc phải thanh lý các giao dịch này được thực hiện để bảo vệ lợi ích tài chính của cả nhà giao dịch và nhà môi giới. Đối với nhà giao dịch, nó ngăn tài khoản của họ tích lũy những khoản lỗ thậm chí còn lớn hơn nếu thị trường tiếp tục đi ngược lại vị thế của họ. Đối với nhà môi giới, việc đóng vị thế trước khi tiền ký quỹ cạn kiệt hoàn toàn sẽ bảo vệ vốn của họ khỏi những tổn thất có thể xảy ra. Mặc dù các nhà giao dịch không thích thanh lý bắt buộc nhưng lệnh ngưng giao dịch là một cơ chế cần thiết trong giao dịch có đòn bẩy để hạn chế thua lỗ. Bằng cách đóng các vị thế ở mức ký quỹ tối thiểu được xác định trước, hệ thống ngưng giao dịch sẽ bảo vệ khả năng thanh toán của cả nhà giao dịch và nhà môi giới trong các thị trường biến động.

Các yếu tố ảnh hưởng đến mức ngừng giao dịch

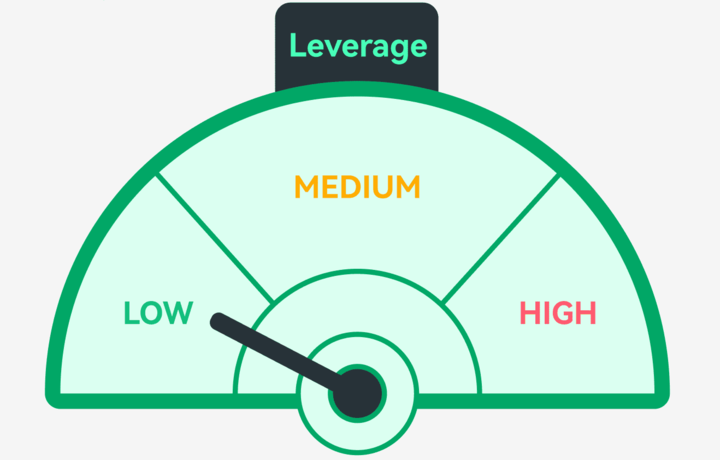

Đòn bẩy - đòn bẩy cao hơn làm tăng nguy cơ ngừng giao dịch

Đòn bẩy là một yếu tố quan trọng ảnh hưởng đến rủi ro ngưng giao dịch. Đòn bẩy cho phép nhà giao dịch kiểm soát các vị thế lớn hơn với ít vốn hơn. Tuy nhiên, đòn bẩy cao hơn có nghĩa là bất kỳ biến động giá bất lợi nào cũng sẽ có tác động lớn hơn đến biên lợi nhuận. Ví dụ: với tỷ lệ đòn bẩy là 50:1, biến động 2% trên thị trường sẽ xóa sạch toàn bộ số tiền ký quỹ của bạn. Tỷ lệ đòn bẩy thấp hơn, chẳng hạn như 10:1 hoặc 5:1, cho phép giá dao động lớn hơn trước khi tiền ký quỹ bị xóa. Do đó, các tài khoản có đòn bẩy quá mức dễ bị buộc phải thanh lý nhất do biến động thường xuyên của thị trường. Các nhà giao dịch muốn giảm thiểu rủi ro ngưng giao dịch nên sử dụng đòn bẩy một cách thận trọng phù hợp với quy mô tài khoản và khả năng chấp nhận rủi ro của họ. Việc giữ đòn bẩy ở mức thấp sẽ tạo ra một lớp đệm chống lại những biến động không ổn định có thể gây ra tình trạng thanh lý sớm.

Biến động và thanh khoản trong các công cụ giao dịch

Sự biến động và tính thanh khoản của các công cụ được giao dịch cũng ảnh hưởng đến khả năng ngưng giao dịch. Biến động cao hơn có nghĩa là giá biến động nhanh hơn, dẫn đến xói mòn lợi nhuận nhanh hơn. Ngay cả với mức đòn bẩy vừa phải, những biến động nhanh chóng có thể làm xói mòn biên lợi nhuận và dẫn đến việc buộc phải thanh lý. Thị trường có tính thanh khoản thấp cũng có độ trượt lớn hơn khi vào và thoát. Sự trượt giá này càng làm xói mòn vốn chủ sở hữu tài khoản và phần đệm ký quỹ. Các nhà giao dịch tài sản có truyền thống dễ biến động hoặc kém thanh khoản phải đặc biệt cẩn thận với quy mô vị thế và đòn bẩy để tránh bị ngưng giao dịch sớm. Mặt khác, các công cụ có độ biến động thực tế thấp hơn và tính thanh khoản sâu hơn có ít rủi ro thanh lý cố hữu hơn, cho phép sử dụng đòn bẩy cao hơn một cách thận trọng. Việc đánh giá mức độ biến động và tính thanh khoản của tài sản sẽ đưa ra mức đòn bẩy phù hợp.

Gap di chuyển và dao động giá quá mức

Gap di chuyển đột ngột và sự dao động giá quá mức cũng thường gây ra ngưng giao dịch trong giao dịch có đòn bẩy. Gap xảy ra khi thị trường mở cửa cao hơn hoặc thấp hơn đáng kể so với giá đóng cửa của ngày hôm trước. Động thái bất lợi ngay lập tức này có thể ngay lập tức tiêu tốn số tiền ký quỹ sẵn có trước khi nhà giao dịch có thể phản ứng. Tương tự, sự biến động bất ngờ do sự kiện gây ra, chẳng hạn như thông báo tin tức hoặc công bố dữ liệu, có thể gây ra những đột biến mạnh mẽ làm mất đi lợi nhuận trong vài giây. Việc sử dụng lệnh cắt lỗ không thể bảo vệ bạn trước những động thái đột ngột, tốc độ cao này. Cách phòng thủ duy nhất là giảm trước đòn bẩy hoặc quy mô vị thế và duy trì mức đệm ký quỹ hào phóng. Với việc tiền ký quỹ bốc hơi nhanh hơn mức mà các nhà giao dịch có thể phản ứng, các gap lớn và dao động mạnh chắc chắn sẽ buộc những tay yếu hơn phải đứng ngoài cuộc thông qua việc thanh lý ngưng giao dịch. Quản lý rủi ro đòi hỏi phải dự đoán những điều kiện không ổn định này.

Kiểm tra mức ngưng của nhà môi giới

Mức ngưng giao dịch khác nhau giữa các nhà môi giới (điển hình là 10-30%)

Khi mở tài khoản giao dịch có đòn bẩy, điều quan trọng là phải xác nhận chính sách ngưng giao dịch cụ thể của nhà môi giới. Mức ngưng giao dịch có thể rất khác nhau giữa các nhà môi giới Forex và CFD khác nhau. Thông thường, các nhà môi giới đặt mức ngưng giao dịch trong khoảng 10-30% vốn chủ sở hữu ký quỹ.

Ví dụ: một nhà môi giới có thể phát hành lệnh gọi ký quỹ ở mức vốn chủ sở hữu 25% và thanh lý các vị thế ở mức vốn chủ sở hữu 15%. Một nhà môi giới khác có thể có mức ngưng giao dịch chặt chẽ hơn ở mức 15% lệnh gọi và mức thanh lý 10%. Vẫn còn những người khác có thể có chính sách 30%/20% lỏng lẻo hơn.

Sự khác biệt giữa mức ngưng giao dịch chặt chẽ 10% hoặc mức ngưng giao dịch 30% nhẹ nhàng hơn có thể ảnh hưởng đáng kể đến giao dịch. Mức ngưng giao dịch chặt chẽ hơn mang lại ít sai sót hơn trước những biến động không ổn định. Mức ngưng giao dịch rộng hơn cho phép có nhiều thời gian hơn. Do đó, nhà giao dịch nên kiểm tra xem chính sách của nhà môi giới có phù hợp với mức độ chấp nhận rủi ro và quy mô tài khoản của họ hay không.

Điều quan trọng là phải kiểm tra các điều khoản ngưng giao dịch chính thức trong thỏa thuận của nhà môi giới. Đừng dựa vào những giả định chung chung. Ngưỡng ngưng giao dịch thực tế có thể xác định liệu mức đòn bẩy hợp lý với một nhà môi giới cụ thể có còn mang lại rủi ro thanh lý bắt buộc quá mức hay không.

Mức ngưng giao dịch thấp hơn làm tăng rủi ro thanh lý

Các nhà môi giới có mức ngưng giao dịch được chỉ định thấp hơn vốn có nguy cơ thanh lý bắt buộc cao hơn. Một công ty có chính sách ngưng giao dịch nghiêm ngặt với biên độ vốn chủ sở hữu là 10% sẽ cung cấp rất ít khoảng đệm chống lại những biến động giá bất lợi làm tiêu tốn số tiền ký quỹ sẵn có. Ngay cả đòn bẩy vừa phải cũng có thể dễ bị thanh lý. Ngược lại, ngưỡng ngưng giao dịch 30% mang lại nhiều khoảng đệm hơn trước sự biến động trước khi kích hoạt việc đóng. Tỷ lệ ngưng giao dịch do nhà môi giới đặt ra càng cao thì khả năng ngưng giao dịch sớm càng thấp. Các nhà giao dịch đang tìm cách giảm thiểu việc thanh lý không tự nguyện nên ưu tiên các nhà môi giới có chính sách ngưng giao dịch ít tích cực hơn. Tất cả các yếu tố khác đều bằng nhau, tỷ lệ ký quỹ ngưng giao dịch cao hơn dẫn đến ít yêu cầu ký quỹ và buộc phải đóng vị thế hơn. Việc chọn một nhà môi giới có mức ngưng giao dịch cao hơn sẽ giảm thiểu rủi ro này.

Kiểm tra mức và sự ổn định của nhà môi giới trước khi mở tài khoản

Khi đánh giá các nhà môi giới để giao dịch có đòn bẩy, các nhà giao dịch nên nghiên cứu kỹ lưỡng cả chính sách ngưng giao dịch được chỉ định của công ty và sự ổn định chung của họ.

Nhà môi giới của bạn sẽ không cho phép bạn đặt điểm ngưng giao dịch nhỏ hơn "Mức ngưng" của họ. Vì vậy, nếu mức ngưng của nhà môi giới của bạn là 20 pip, bạn không thể đặt điểm ngưng chặt hơn 20 pip. Điều này cản trở rất nhiều đến việc quản lý rủi ro của bạn, đặc biệt nếu bạn là người đầu cơ sử dụng các điểm ngưng siêu chặt.

Sự thiếu hiểu biết rộng rãi về mức ngưng là một bí mật mở mà các nhà môi giới không quảng cáo. Nhưng mức ngưng giao dịch cao có thể phá hủy chiến lược của bạn bằng cách ngăn chặn các điểm ngưng chặt chẽ. Nó giống như việc lái một chiếc ô tô bị hỏng phanh - bạn đang bị phụ thuộc vào động lượng.

Đừng để nhà môi giới quyết định số phận của bạn thông qua các mức ngưng hạn chế. Hãy nghiên cứu và tìm các nhà môi giới có mức ngưng giao dịch chặt chẽ nhất cho chiến lược của bạn. Sự khác biệt của một vài pip trên điểm ngưng giao dịch có thể tạo ra hoặc phá vỡ giao dịch của bạn.

VSTAR không chỉ đưa ra mức chênh lệch thấp mà còn có mức ngưng hợp lý. Ví dụ: mức ngưng trên các cặp tiền tệ chính như EURUSD, GBPUSD, NZDUSD, AUDUSD và USDCHF chỉ là 2,5 Pips. Bạn có thể tìm thêm thông tin chi tiết về mức ngưng này trong ứng dụng.

Mức ngưng chặt chẽ này mang lại cho bạn độ chính xác khi đặt điểm ngưng. Bạn có thể đặt chúng gần hơn với hành động giá hiện tại mà không sợ bị kích hoạt lệnh ngưng giao dịch sớm.

Đối với các nhà giao dịch ngắn hạn, mức ngưng giao dịch cực thấp của VSTAR có nghĩa là ít rủi ro hơn trên mỗi giao dịch. Bạn có thể giao dịch một cách tự tin khi biết rằng những biến động bình thường của thị trường sẽ không loại bạn ra khỏi cuộc chơi.

Các chiến lược để quản lý rủi ro ngưng giao dịch

Sử dụng đòn bẩy hợp lý phù hợp với quy mô tài khoản

Cách trực tiếp nhất để các nhà giao dịch giảm thiểu rủi ro ngưng giao dịch là sử dụng đòn bẩy phù hợp với quy mô tài khoản của họ. Các tài khoản nhỏ có ít tiền ký quỹ hơn để hấp thụ những biến động không ổn định. Với tài khoản 1.000 USD, đòn bẩy 50:1 dẫn đến rủi ro 2% đối với toàn bộ vốn sở hữu trong tài khoản dẫn đến việc thanh lý thường xuyên. Tuy nhiên, đòn bẩy 50:1 với rủi ro chỉ 2% đối với tài khoản 50.000 USD mang lại nhiều cơ hội hơn cho biến động giá. Tỷ lệ đòn bẩy giống nhau mang lại những rủi ro rất khác nhau đối với các quy mô tài khoản khác nhau. Nhà giao dịch phải đánh giá đòn bẩy thích hợp dựa trên mức ký quỹ thực tế mà vốn của họ cung cấp. Đòn bẩy phù hợp được điều chỉnh theo quy mô tài khoản, không phải số lượng lớn tùy ý, giúp quản lý các điểm ngưng giao dịch.

Sử dụng các lệnh quản lý rủi ro như cắt lỗ

Ngoài đòn bẩy thận trọng, việc sử dụng các lệnh quản lý rủi ro hiệu quả giúp nhà giao dịch tránh bị buộc phải ngưng giao dịch. Lệnh cắt lỗ tự động đóng các vị thế ở mức được xác định trước để hạn chế thua lỗ trước khi chúng tiêu tốn toàn bộ số dư ký quỹ. Việc cắt lỗ được đảm bảo vẫn có hiệu lực ngay cả khi gap di chuyển không ổn định. Trailing Stop theo dõi các chuyển động thuận lợi để chốt lợi nhuận. Lệnh mục tiêu lợi nhuận đóng các giao dịch thắng ở các mức được chỉ định. Việc sử dụng các lệnh này và các lệnh rủi ro khác đặt ra các kế hoạch rõ ràng để quản lý giao dịch trước khi hành động giá bất lợi đòi hỏi phải thanh lý không tự nguyện. Với các giao thức rủi ro thích hợp được áp dụng, các nhà giao dịch có thể thực hiện chiến lược của mình đồng thời bảo vệ vốn khỏi tình trạng rút vốn quá mức dẫn đến ngưng giao dịch.

Duy trì vốn chủ sở hữu tài khoản thích hợp thông qua quản lý

Một chiến lược quan trọng để tránh tình trạng ngưng giao dịch là chủ động quản lý vốn chủ sở hữu trong tài khoản. Nhà giao dịch nên thường xuyên rút lợi nhuận để duy trì mức đệm ký quỹ đầy đủ. Điều này ngăn cản các vị thế quá lớn dường như được tận dụng đòn bẩy thích hợp sớm trong chuỗi chiến thắng trở nên lớn một cách nguy hiểm khi tài khoản tăng lên. Tái cân bằng định kỳ quy mô vị thế và việc sử dụng đòn bẩy giúp duy trì mức độ rủi ro tỷ lệ thuận với tăng trưởng vốn chủ sở hữu. Việc bổ sung vốn mới từ bên ngoài tài khoản giao dịch cũng mang lại nhiều khoảng trống ký quỹ hơn. Tuy nhiên, để lợi nhuận tăng lên mà không quản lý vốn phù hợp sẽ khiến rủi ro tài khoản tăng lên một cách âm thầm và tạo tiền đề cho việc buộc phải thanh lý. Duy trì vốn chủ sở hữu hợp lý sẽ bù đắp rủi ro ngày càng tăng và giúp ngăn ngừa tình trạng ngưng giao dịch nghiêm trọng.

Phản hồi các sự kiện ngưng giao dịch

Đánh giá khách quan các điều kiện thị trường và hành động giá

Khi tình trạng ngưng giao dịch chắc chắn xảy ra, điều quan trọng là phải phản ứng thích hợp. Phản ứng tồi tệ nhất là để cho cảm xúc thúc đẩy những quyết định phi lý nhằm cố gắng bù đắp ngay sự mất mát. Thay vào đó, các nhà giao dịch nên phản hồi bằng một đánh giá khách quan. Phân tích các điều kiện thị trường và hành động giá dẫn đến việc thanh lý. Liệu một sự kiện gây sốc, chẳng hạn như thông báo của ngân hàng trung ương, có tạo ra biến động bất thường không? Hay tổn thất là do sai sót trong chiến lược hoặc quản lý rủi ro? Hiểu được nguyên nhân gốc rễ một cách khách quan, không tự trách mình hay hoảng sợ, sẽ mang lại những bài học quý giá. Đánh giá xem kế hoạch quản lý rủi ro có thất bại hay điều kiện đơn giản là không thuận lợi. Xác định mọi thay đổi cần thiết đối với quy tắc hệ thống hoặc việc sử dụng đòn bẩy. Việc xem xét một cách khách quan về các yếu tố xung quanh điểm ngưng giao dịch có thể cung cấp những hiểu biết quan trọng để cải thiện hoạt động giao dịch trong tương lai. Với quan điểm phân tích thay vì phản ứng tức thời, ngưng giao dịch sẽ trở thành những trải nghiệm học tập mang tính xây dựng.

Xem xét điều chỉnh mức đòn bẩy và tính toán quy mô vị thế

Điều chỉnh thực tế đầu tiên sau khi ngưng giao dịch phải là đòn bẩy và tính toán quy mô vị thế. Nếu đòn bẩy quá mạnh so với quy mô tài khoản gây ra việc thanh lý thì nên giảm mức đòn bẩy xuống mức hợp lý hơn. Các nhà giao dịch nên tính toán quy mô vị thế để tiêu thụ không quá 2-5% vốn có rủi ro cho mỗi giao dịch. Điều này giúp chống lại những biến động của thị trường đồng thời đa dạng hóa rủi ro. Các vị thế nhỏ hơn và đòn bẩy thận trọng hơn sẽ tạo ra nhiều khoảng trống hơn cho sự biến động. Điểm ngưng giao dịch thường chỉ ra rằng việc quản lý rủi ro hiện tại là không bền vững. Việc giảm đòn bẩy và quy mô vị thế sẽ mang lại sự bảo vệ ngay lập tức đồng thời xác định xem có cần điều chỉnh chiến lược hay không. Các thông số rủi ro thích hợp ngăn chặn sự tái diễn của rủi ro quá mức dẫn đến thanh lý sớm.

Cập nhật kế hoạch quản lý rủi ro để tránh tái diễn

Ngoài việc điều chỉnh đòn bẩy và quy mô, nhà giao dịch nên cập nhật kế hoạch quản lý rủi ro để ngăn chặn tình trạng ngưng giao dịch lặp lại. Xem xét tính hiệu quả của kế hoạch trong quá trình chuẩn bị và thực hiện thanh lý. Xác định xem mức cắt lỗ có được đặt sai hay không. Hoặc một gap đã di chuyển qua các điểm ngưng? Hãy xem xét các biện pháp bảo vệ bổ sung như điểm ngưng rộng hơn, điểm ngưng được đảm bảo hoặc chốt lãi sớm hơn. Đánh giá xem bản thân chiến lược giao dịch có quá rủi ro và cần phải sửa đổi hay không. Cập nhật kế hoạch rủi ro tổng thể dựa trên những bài học rút ra từ giao dịch thất bại sẽ bảo vệ tốt hơn các vị thế trong tương lai. Các giao thức rủi ro phù hợp, được điều chỉnh phù hợp với những điểm yếu được xác định cho phép ngưng giao dịch, làm giảm đáng kể khả năng tái diễn. Kế hoạch cập nhật biến thất bại thành phòng thủ được tăng cường.

Kết luận

Khả năng xảy ra các mức ngưng giao dịch nghiêm trọng nhấn mạnh tầm quan trọng của việc quản lý rủi ro thận trọng. Đầu tiên, các nhà giao dịch nên lựa chọn cẩn thận các nhà môi giới sau khi so sánh các quy định, giới hạn đòn bẩy và chính sách ngưng giao dịch. Đòn bẩy thấp hơn có nghĩa là mức ngưng giao dịch cao hơn, một sự đánh đổi có lợi cho hầu hết mọi người.

Trong khi giao dịch, hãy áp dụng các biện pháp phòng ngừa rủi ro hợp lý như rủi ro tối đa 2% cho mỗi giao dịch, cắt lỗ trên tất cả các vị thế và duy trì đòn bẩy tài khoản phù hợp. Khi xảy ra tình trạng ngưng giao dịch, hãy phản ứng một cách khách quan bằng cách giảm quy mô vị thế và đòn bẩy trong khi phân tích các yếu tố đằng sau sự thất bại.

Cập nhật kế hoạch quản lý rủi ro của bạn để ngăn chặn sự tái diễn. Với việc lựa chọn nhà môi giới thích hợp, các biện pháp phòng ngừa thận trọng và các điều chỉnh bình tĩnh sau khi thanh lý, các nhà giao dịch có thể giảm thiểu rủi ro ngưng giao dịch thay vì phải phó mặc cho nó.

Luôn cập nhật thông tin và thận trọng sẽ giúp chiến lược giao dịch của bạn tồn tại trong tình trạng hỗn loạn của thị trường. Con đường dẫn đến thành công đòi hỏi phải chủ động tránh mức ngưng giao dịch thông qua các chiến lược hợp lý và cải tiến thích ứng khi có thách thức.