NZD/CAD currency pair overview

The exchange rate between the New Zealand dollar (NZD) and the Canadian dollar (CAD) is represented by the NZD/CAD currency pair. It displays the conversion rate between Canadian and New Zealand dollars. The value of NZD/CAD fluctuates depending on several variables, including economic indicators, geopolitical developments, and market sentiment, just like with any other currency pair.

Fundamental analysis is essential when assessing the NZD/CAD currency pair and making trading decisions. It entails researching the political, economic, and financial issues that affect the value of currencies. Trading professionals can learn more about the underlying strengths and weaknesses of the Canadian and New Zealand economies by examining these fundamentals, which can aid in forecasting future currency fluctuations.

Indicators, including interest rates, inflation rates, GDP growth, employment statistics, trade balances, and monetary policy, are the main emphasis of fundamental research. By looking at these elements, traders may gauge the relative strength and performance of the economies of New Zealand and Canada, laying the groundwork for predicting the movement of the NZD/CAD exchange rate.

New Zealand dollar

The official money of New Zealand is the New Zealand dollar (NZD). Because of the bird that is pictured on the one-dollar coin, it is frequently referred to as the "kiwi.” The tourism industry, agriculture, and exports of goods like dairy, beef, and wool make up New Zealand's economy. New Zealand is renowned for its stable political climate and responsible economic policies.

Canadian dollar

The official currency of Canada is the Canadian dollar, or "Loonie" (CAD). The economy of Canada is highly developed and diverse, relying on a range of sectors, including industry, services, and natural resources. The nation exports many goods like oil, natural gas, minerals, and wood. Commodity prices, trade agreements, and monetary policy decisions made by the Bank of Canada all impact the value of the CAD.

Given that both economies depend on the export of commodities, the NZD and CAD are regarded as commodity currencies. Furthermore, the relative value of these currencies in the NZD/CAD currency pair is affected by variables like interest rate differences, economic indicators, geopolitical events, and market sentiment.

Macroeconomic Overview - New Zealand

Economic Indicators

Gross Domestic Product (GDP) and unemployment rate are critical economic statistics that shed light on the state and performance of the New Zealand economy.

GDP calculates the total dollar worth of goods and services a nation generates during a given time. New Zealand's diverse economy, healthy agriculture sector, and robust tourism industry have all contributed to the country's stable GDP growth in recent years. However, paying close attention to GDP data is crucial to spot any changes in the economy's pace or potential problems.

The unemployment rate represents the percentage of the labor force actively looking for work but cannot do so. Compared to many other wealthy nations, New Zealand has maintained unusually low unemployment rates, indicative of its robust labor market. A low unemployment rate indicates a strong job market and favorable economic conditions.

With rising costs for goods and services, a currency's purchasing power is being eroded at an increasing rate, measured by inflation rates. To ensure price stability and encourage sustainable economic growth, the Reserve Bank of New Zealand (RBNZ) closely monitors inflation and adjusts monetary policy as necessary. Excessive inflation can erode buying power and undermine economic stability; moderate inflation promotes consumer spending and guarantees a stable corporate climate. The RBNZ uses various methods, such as interest rate changes and regulatory actions, to control inflation rates and preserve economic equilibrium.

Business and consumer confidence indicators measure how enterprises and households feel and anticipate the state of the economy as a whole. These indices capture opinions on current economic conditions, prospects for the future, and investment intentions.

Positive corporate and consumer confidence can spur economic growth because it shows a willingness to spend money, take risks, and invest. On the other hand, low levels of trust can result in cautious corporate plans, lessened consumer spending, and possible economic slowdowns.

Monitoring consumer and corporate confidence in New Zealand offers essential insights into market sentiment and expectations for future economic activity. These metrics are crucial for evaluating the state of the economy and any potential effects on the New Zealand dollar.

Monetary Policy

The Reserve Bank of New Zealand (RBNZ) is the central bank in charge of creating and carrying out the country's monetary policy. Maintaining price stability, which the RBNZ defines as keeping inflation within a target range of 1 to 3 percent over the medium term, is its principal goal.

Monetary Policies

The RBNZ employs several monetary policy measures to meet its inflation target. The Official Cash Rate (OCR), the interest rate at which commercial banks lend and borrow money overnight, is one of the essential tools. The RBNZ intends to affect borrowing rates and, as a result, spending and investment choices in the economy by altering the OCR.

In addition to the OCR, the RBNZ may use unconventional monetary policy tools like quantitative easing to stimulate economic growth and maintain market stability under unusual conditions. These policies entail the central bank buying financial assets like government bonds to infuse liquidity into the economy and boost economic growth.

Interest rate expectations significantly shape market dynamics and currency prices. Changes in interest rates affect borrowing costs, investment choices, and a currency's allure to yield-seeking investors.

Market participants carefully examine economic data, central bank announcements, and other factors to predict future interest rate moves. The pricing of interest rate derivatives, such as interest rate futures or forward rate agreements, frequently reflects these predictions.

Interest Rate Expectations

Interest rate expectations are particularly significant in the context of the New Zealand currency, given the RBNZ's emphasis on preserving price stability. The value of the New Zealand dollar in foreign exchange markets can be strongly impacted by anticipated changes in the OCR or signs of potential alterations in the RBNZ's monetary policy stance.

As was previously mentioned, the Reserve Bank of New Zealand (RBNZ) is in charge of monetary policy. The government establishes the RBNZ's policy framework, outlining the goals and providing direction on the expected results. Cooperation between the government and the central bank is essential for monetary policy to align with more general economic objectives.

To increase global competitiveness and advance trade liberalization, the New Zealand government actively participates in developing trade policies. With its participation in bilateral and international trade agreements, New Zealand has adopted an open and free trade strategy. These regulations seek to increase market access for New Zealand exports, draw global capital, and promote economic expansion.

The government develops rules and structures to ensure fair competition, defend consumer rights, and foster financial stability. Restrictions include various topics, including banking, financial markets, labor markets, environmental protection, and conditions specific to particular industries. The government aims to promote economic growth while protecting public interests by ensuring a favorable regulatory environment.

Due to its reliance on commodity exports, the New Zealand economy is significantly impacted by changes in commodity prices. Dairy, beef, wool, and horticulture products are among the primary agricultural exports from New Zealand. In addition, it exports raw materials, including lumber and minerals.

Terms of trade, or the proportion of export prices to import prices in New Zealand, are directly impacted by changes in commodity prices. New Zealand's terms of trade improve as commodity prices rise, enabling the nation to buy more imports for a given amount of exports. This may have a favorable effect on investment, economic growth, and living standards.

Changes in commodity prices directly impact the revenue from exports of New Zealand. More commodity prices result in more export revenues, which help the mining and agriculture industries. Export earnings help New Zealand's economy grow, create jobs, and invest.

Changes in commodity prices can impact the value of the New Zealand dollar. Due to the strength of the nation's commodity exports, demand for the New Zealand dollar may climb when commodity prices rise. This may lead to currency appreciation, which could reduce the relative cost of imports and thus reduce export competitiveness.

The economy of New Zealand is vulnerable to fluctuations in commodity prices, which could be dangerous. Sudden drops in commodity prices can affect export revenues, present producers with financial difficulties, and impact rural communities. The government and corporations control these risks through diversity, innovation, and risk management techniques.

The New Zealand government's fiscal, monetary, trade, and regulatory policies ultimately support stable and sustainable growth. The New Zealand economy is heavily influenced by commodity prices, which affect export earnings, trade conditions, currency exchange rates, and overall economic performance—controlling the erratic nature of commodity prices and seizing opportunities.

Macroeconomic Overview – Canada

Gross Domestic Product (GDP) is a metric used to determine the value of all products and services generated inside a nation's borders. It offers information about the general economic expansion and activities. GDP data are closely watched in Canada to judge the state and performance of the economy. High unemployment rates signify economic turmoil, while low unemployment rates suggest a healthy labor market and economic stability.

The rate at which the average level of pricing for goods and services is rising is measured by inflation rates. The Bank of Canada closely analyzes inflation and implements monetary policy to ensure price stability. A steady economic environment and consumer spending are supported by moderate inflation, while high inflation erodes purchasing power.

Consumer and business confidence indicators show how businesses and people feel about the economy and what they anticipate. Positive corporate and consumer confidence can spur economic growth because it offers a willingness to spend money, take risks, and invest. On the other hand, low confidence levels might result in cautious company tactics, decreased consumer spending, and possible economic slowdowns.

Financial Policy

The monetary policy of the Bank of Canada is set and carried out by this institution, which serves as Canada's central bank. The BoC's primary goals are to uphold price stability and advance Canadians' economic and financial security. The BoC modifies the overnight rate, its primary policy interest rate, to affect borrowing costs and regulate inflation.

The market's future interest rate adjustment projections are called interest rate expectations. Interest rate changes that are anticipated can significantly affect the Canadian dollar's value, borrowing costs, investment choices, and the state of the economy as a whole. Traders, investors, and market analysts examine economic data, central bank announcements, and other factors to predict future interest rate movements.

Government economic policies: The Canadian government develops and puts into effect economic policies to promote economic expansion, uphold stability, and meet social requirements. These regulations cover trade policy, monetary policy cooperation with the Bank of Canada, fiscal policy, and monetary policy in general. The government establishes fiscal policies relating to taxation, spending, and public debt management to achieve economic goals.

Oil prices significantly impact the Canadian economy because of the country's significant oil export and production activities. Oil price swings can affect government revenue, employment in the energy industry, investment choices, and the health of the economy as a whole. Oil price changes can impact the Canadian dollar's exchange rate and trade balances.

Analysis of the NZD/CAD Currency Pair

Pertinent economic indicators

Relationship between the economies of Canada and New Zealand: Both countries' economies are dependent on commodities exports and enjoy stable political systems. They do, however, also have unique qualities. When examining the NZD/CAD currency pair, it is essential to comprehend the relationship between these two economies. Commodity prices, interest rates, and economic performance can influence the relationship between these variables and the exchange rate.

GDP expansion, inflation, and interest rates effects on the currency pair: Growth in the gross domestic product (GDP) indicates a nation's overall economic activity. In general, higher GDP growth results in higher demand for local currency. Interest rates and inflation rates are also quite important. A stricter monetary policy might be implemented in response to higher inflation, strengthening the currency. Lower interest rates cause capital to leave, devaluing the currency.

What Supports a Bullish or Bearish Position?

The NZD/CAD currency pair may be significantly impacted by choices made by the Reserve Bank of New Zealand regarding its monetary policy, particularly if the Official Cash Rate changes. In general, hawkish measures that tighten financial conditions, such as raising interest rates, are positive for the New Zealand dollar. A dovish policy might be bearish if it lowers interest rates or adopts a more accommodating approach.

The Bank of Canada's monetary policy actions significantly impacts the currency pair, just like other currencies. Hawkish policies typically support a bullish prognosis for the Canadian dollar, whereas dovish policies might influence a bearish perspective. Market players actively monitor changes in interest rates and the central bank's forward guidance when analyzing the NZD/CAD currency pair.

Global commodities prices' effects on the two economies Prices of primary export commodities, such as dairy, beef, oil, and natural gas, significantly impact the economies of New Zealand and Canada. Changes in commodity prices may affect export earnings, trade terms, and economic performance, which may then affect the currencies involved. Lower commodity prices might be gloomy, whereas higher prices promote a positive outlook.

Possible dangers to the currency pair

Changes in the sudden global economic growth rate can significantly affect the NZD/CAD currency pair. Risk aversion might rise during global economic weakness or a downturn, weakening both currencies. On the other hand, robust global growth might encourage a bullish outlook for both currencies.

Unexpected shifts in the monetary policies of Canada or New Zealand

Volatility in the NZD/CAD currency pair may result from unanticipated changes in the Reserve Bank of New Zealand's or the Bank of Canada's monetary policy. Significant currency swings may be caused by unexpected interest rate decisions, adjustments to the forecast for monetary policy, or differing paths taken by the two central banks.

Risks posed by geopolitics, such as trade disputes between the United States and China: The NZD/CAD currency pair may be impacted by geopolitical events, such as trade disputes between large economies like the U.S. and China. Geopolitical unrest or intensified trade conflicts could cause risk aversion, lowering both currencies. On the other hand, a more upbeat view may be supported by a resolution or lessening of tensions.

Finally, when examining the NZD/CAD currency pair, it is essential to consider pertinent economic data such as GDP growth, inflation, and interest rates. It is necessary to comprehend the effects of the monetary policies of the Reserve Bank of New Zealand and the Bank of Canada. Additionally, the prognosis for the currency pair is significantly influenced by global commodity prices and geopolitical threats. Considering these aspects supports traders.

Trading Strategies for NZD/CAD

Technical Analysis

Finding trends and patterns: Technical analysis aims to find trends and practices that predict future price movements by looking at previous price and volume data. For trading decisions, traders examine charts and employ tools like trendlines, support, and resistance levels, and patterns like triangles, head and shoulders, and double tops/bottoms.

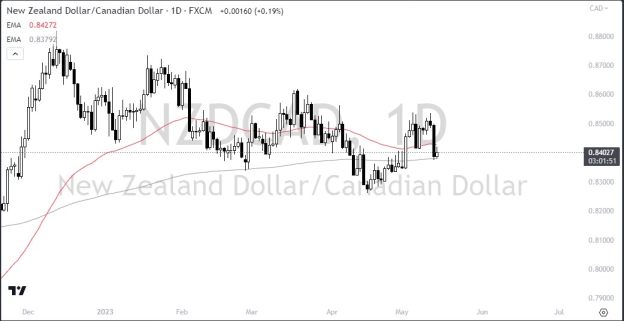

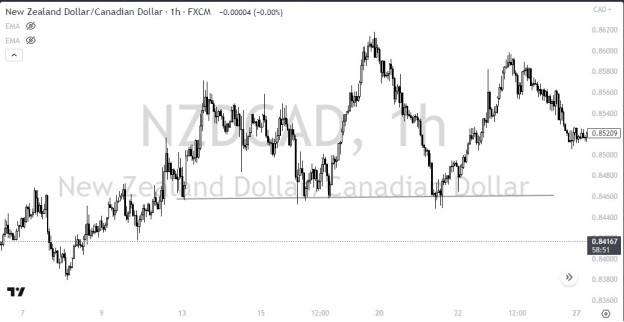

Strong support in the NZD/CAD pair.

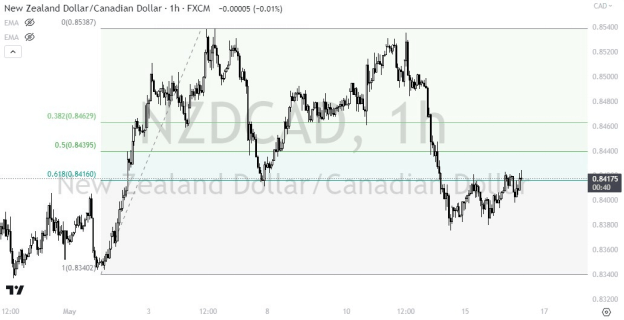

They use technical indicators, such as moving averages and Fibonacci retracements, to generate trading signals. Technical indicators are mathematical computations applied to market data. Moving averages, which assist in determining trend direction and potential support or resistance levels, and Fibonacci retracements, which pinpoint likely price retracement levels based on the Fibonacci sequence, are common indicators used in NZD/CAD trading.

61.8% Fibonacci level continues to show support and resistance

Risk Management

Setting stop-loss and take-profit levels is essential for risk management and profitable trading. By establishing specified price levels at which they will quit a trade if the market goes against them, traders employ stop-loss orders to limit prospective losses. By designating price levels at which traders will exit their positions if the market advances in their favor, take-profit orders are created to secure profits.

Position sizing calculates the right amount of capital to allocate to each trade, depending on an individual's risk tolerance level and the trading account size. Traders decide the position size after considering the proximity to the stop-loss level, the possible reward-to-risk ratio, and overall risk tolerance.

News Trading

Monitoring data releases and economic events that affect currency pairs significantly is part of news trading. Indicators, including GDP growth, employment statistics, inflation rates, and central bank pronouncements, are closely watched by traders. These occurrences may lead to volatility and offer trading chances.

The market frequently reacts with higher volatility after a large economic event or data release. By placing trades that align with the market sentiment created by the news, traders can profit from these price changes. Having a clear trading strategy and considering how recent news may affect the NZD/CAD currency pair.

Numerous techniques may be used when trading the NZD/CAD currency pair. Identification of trends, patterns, and potential entry and departure points are all aided by technical analysis. Effective risk management is essential for managing risk. This includes establishing stop-loss and take-profit levels and deciding on position size. Keeping up with economic developments and news releases also enables traders to profit from market responses to news, which can present trading chances in the NZD/CAD currency pair.

Trade NZD/CAD at VSTAR

Trading the NZD/CAD offers many opportunities when approached with strategy and professionalism. It would be best to deal with a trusted broker to continue benefiting from this pair. VSTAR offers regulation and licensing in the EU, falling under the protection of CySEC. By offering vast liquidity and balance protection, traders can feel secure in their investments in this pair and all markets we offer.

Conclusion

Fundamental analysis is essential to appraise the NZD/CAD currency pair and make wise trading decisions. Traders can learn about the relative strengths and weaknesses of New Zealand and Canada's economies by looking at economic indicators, monetary policies, and other influencing variables. Variables, including GDP growth, inflation rates, interest rates, and commodity prices, significantly affect the value of the NZD/CAD exchange rate.

The New Zealand dollar (NZD) and the Canadian dollar (CAD) are commodities. Therefore fluctuations in commodity prices have a significant impact on both currencies. The Reserve Bank of New Zealand and the Bank of Canada's monetary policy choices can also significantly impact the NZD/CAD currency pair.

When trading the NZD/CAD currency pair, it is crucial to consider the risks related to unforeseen changes in monetary policies, geopolitical situations, and overall economic conditions. In addition to employing efficient risk management procedures, traders can use technical analysis tools to spot trends, patterns, and potential entry and exit points.

Trading the NZD/CAD currency pair requires selecting a trustworthy broker, like VSTAR. VSTAR provides regulation, liquidity, and balance protection for a safe trading environment.

Overall, traders may confidently trade the NZD/CAD currency pair and take advantage of opportunities in the dynamic foreign exchange market by carefully examining fundamental factors, applying technical analysis, and successfully managing risks.