TLDR

- Headline CPI rose 3.2% y/y in July, slightly below forecasts. Core CPI rose 4.7% y/y, also slightly below estimates.

- Monthly gains for both measures moderated to 0.2%.

- Shelter costs drove the monthly increase, up 0.4% and 7.7% year-over-year.

- In inflation-adjusted terms, real wages rose 0.3% monthly and 1.1% annually.

- Despite easing from 40-year highs, inflation remains well above the Fed's 2% target.

July's CPI increased less than expected at 3.2%

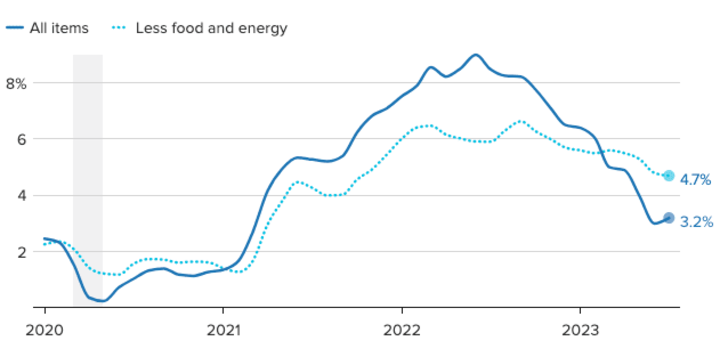

The latest Consumer Price Index (CPI) data from the Bureau of Labor Statistics shows that inflationary pressures continued to ease in July. The headline CPI, which includes volatile food and energy costs, rose 0.2% month-over-month and 3.2% year-over-year. These gains were slightly below economists' estimates of 0.3% and 3.3%, respectively.

Meanwhile, the core CPI, which excludes food and energy, rose 0.2% for the month and 4.7% from a year ago. This was slightly below forecasts of a 0.3% monthly increase and a 4.8% annual increase. The cooling of both headline and core inflation provides further evidence that last year's surge in prices is moderating.

U.S. consumer price index

Year-over-year percent change through July 2023

Note: Shaded area indicates recession.Chart: Gabriel Cortes / CNBCSource: U.S. Bureau of Labor Statistics

Data as of Aug. 10, 2023

Almost all of the monthly increase in the CPI was due to shelter costs, which rose 0.4% and are up 7.7% over the past 12 months. Rent indexes continued to rise, but at a slower rate, posting a monthly gain of 0.2%, down from 0.5% in June. Owner's equivalent rent was up 0.3% month over month, down from last month's 0.5% increase.

On the positive side, real average hourly earnings rose 0.3% in inflation-adjusted terms in July. On an annual basis, real wages have risen 1.1%, suggesting some early signs of consumer relief from high inflation.

While the July data suggest that disinflationary trends are taking hold, inflation remains well above the Federal Reserve's 2% target. But the cooling of both headline and underlying price pressures supports hopes that the Fed can continue to slow the pace of rate hikes in order to restore price stability over time.

Analysis of US July CPI Event

Lower but still far from Fed’s target

Although the year-on-year inflation rate was lower than expected, it actually rose from the 3% level in June. In other words, the pace of price increases has picked up on an annual basis, despite forecasts of a slowdown.

Overall, the latest batch of data shows that inflation remains well above the Federal Reserve's 2% target, even though it has come down significantly from the 40-year highs reached in mid-2002. Prices are still rising too fast for the Fed to feel comfortable easing interest rates anytime soon.

Source: Unsplash

Specifically, the Consumer Price Index rose 0.2% in July from the previous month, slightly below estimates. But the 12-month inflation rate ticked up to 3.2% from 3% in June, defying predictions of a slowdown. Core CPI also rose 4.7% over the past year, faster than expected.

While inflation may have peaked, the Fed is likely to continue its aggressive policy tightening in the near term with the goal of returning inflation decisively to 2%. Much more progress will be needed on this front.

High interest rates will continue for some time

However, lower inflation is at least taking some of the pressure off the Federal Reserve to continue to tighten policy aggressively. Indeed, almost all Fed members agree that higher rates are likely to be needed for some time, regardless of whether further increases are approved.

So far, high interest rates have not dampened economic growth: GDP grew 2% and 2.4% in the first two quarters of 2023, and the Atlanta Fed estimates growth of 4.1% in the third quarter. Wage growth has moderated somewhat but remains robust, and unemployment is near its lowest level since late 1969. Consumers have begun to feel the pinch and are increasingly turning to credit cards and savings to fund spending. Total credit card debt topped $1 trillion for the first time this year, according to the New York Fed.

Source: Unsplash

U.S. may avoid a recession despite the steep rate hikes

Still, a growing number of economists have begun to predict that the U.S. may avoid a recession despite the steep rate hikes. Bank of America, Goldman Sachs and JPMorgan have all recently raised their forecasts that the chances of an economic contraction are diminishing.

Cooling inflation, coupled with resilient growth and healthy labor markets, provides some cautious optimism. However, the Fed will want to see a sustained downward trend in inflation back toward its 2% target before declaring victory. Rate hikes could continue or, at the very least, elevated rates are likely to remain in place for some time until clear disinflationary trends emerge.

Possible Impact on Bonds, Stock and Forex Markets

Yields on government bonds declined on reduced inflation worries

Government bond yields fell as concerns about high inflation eased. The drop in bond yields came after the latest Consumer Price Index (CPI) data showed that inflationary pressures continued to cool in July. Both the headline and core CPI rose less than expected on an annual basis. The moderation in price increases has led investors to scale back expectations for how aggressively the Federal Reserve will need to raise interest rates going forward. With inflation perhaps peaking, the prospects for an extended period of ultra-high interest rates have diminished. This improved outlook for inflation and Fed policy led to a decline in Treasury yields as investors became less concerned about rising prices eroding the value of long-term government bonds. The declining yields reflect greater confidence that inflation is on a sustained downward trajectory toward the Fed's 2% target.

Source: Unsplash

Equity markets rallied strongly on increased optimism and this part

Major stock indexes clung to modest gains in midday trading following the release of the latest CPI data, although they were off earlier session highs. The Dow Jones Industrial Average was up 0.18%, holding on to a modest advance after paring earlier gains. Similarly, the broader S&P 500 was up 0.23%, while the tech-heavy Nasdaq Composite was up 0.16% on the day. Despite the higher-than-expected inflation numbers, equities managed to maintain their upward momentum as investors focused on signs that price pressures were bottoming out. However, equity markets cooled off from the initial highs as the data still suggested that entrenched inflation would keep the Fed on its aggressive policy tightening path.

USD Weakens as Markets Reduce Fed Hike Expectations

The U.S. dollar weakened against other major currencies as financial markets scaled back expectations for further interest rate hikes by the Federal Reserve. The Dollar Index, which measures the greenback against a basket of currencies, fell 0.7%. This came after the latest U.S. inflation data showed that price pressures continued to ease in July. With inflation appearing to have peaked, investors became less certain that the Fed will maintain its ultra-hawkish stance. Markets now see US interest rates peaking below 4% rather than above as previously thought. The unwinding of rate hike bets reduced demand for the dollar, causing it to depreciate against rivals including the euro and Japanese yen.

Source: Unsplash

Conclusion

July's inflation data beat expectations and came in lower than forecast. This supports the narrative that price pressures are steadily cooling from the 40-year highs reached in early 2022. While still elevated at 8.5%, the moderating monthly increases suggest that inflation may have peaked. If this downward trajectory continues, it will allow the Federal Reserve to be less aggressive in tightening monetary policy going forward.

While high by historical standards, the inflation rate has fallen by more than half from its June peak of 9.1%. The steady moderation in price increases over the past three months is a positive sign that the worst inflationary spasm in generations is abating. This will provide some relief to the Fed and allow it to slow the pace of rate hikes.

However, risks remain that supply shocks or demand spikes could reignite inflationary pressures. Commodity prices and geopolitical tensions continue to add uncertainty to the outlook. But the overall trajectory is in the right direction, with inflation expected to gradually return to healthier levels.

While inflation remains a challenge, July's data provide some optimism that the Fed's policy actions are taking hold. With price increases moderating, the central bank may be able to ease its aggressive stance and achieve a soft landing for the economy. The path forward remains precarious, but hopes are growing that the inflation storm may be beginning to clear.

Source: Unsplash

Read More: U.S. inflation rate history

The U.S. inflation rate has fallen substantially from its 40-year high of 9.1% in June 2022, declining over 5 percentage points to 3.2% as of July 2023. However, it remains elevated versus the Federal Reserve's 2% target. Monthly inflation peaked at 1% in June 2022 before slowing each month through February 2023. Price increases picked up slightly to 0.5% in March and 0.2% in July after a brief decline to 0.1% in April and May. Despite moderating, persistent inflation above the Fed’s goal will likely warrant further interest rate hikes to rein in rising prices.

Here's a snapshot of the U.S. inflation rate by month since May 2022:

- May 2022: 8.6%

- June 2022: 9.1%

- July 2022: 8.5%

- Aug 2022: 8.3%

- Sept 2022: 8.2%

- Oct 2022: 7.7%

- Nov 2022: 7.1%

- Dec 2022: 6.5%

- Jan 2023: 6.4%

- Feb 2023: 6.0%

- Mar 2023: 5.0&

- Apr 2023: 4.9%

- May 2023: 4.0%

- June 2023: 3.0%

- July 2023: 3.2%