在深入研究当前事态发展之前,了解石油和天然气价格之间关系的背景至关重要。传统上,由于以下几个因素,这两种商品之间存在很强的相关性:

- 能源替代效应:石油和天然气在各种应用中通常被认为是彼此的替代品,特别是在工业和运输领域。当石油价格大幅上涨时,用户可能会选择转向天然气,从而增加其需求,从而增加其价格。

- 大宗商品市场情绪:投资者和交易商通常将石油和天然气视为更广泛的能源综合体的一部分。石油价格的变化会影响整个能源行业的情绪,从而影响石油和天然气价格。

- 生产重叠:许多天然气储量与石油矿床一起被发现。因此,石油钻探活动的变化可能会间接影响天然气产量,从而对价格产生连锁反应。

- 全球能源需求:石油和天然气对于满足全球能源需求至关重要。因此,一种商品的需求变化也会影响另一种商品。

价格波动及其影响

中东冲突:中东持续的冲突,特别是对以色列的袭击,导致油价大幅波动。由于地缘政治紧张局势,原油价格从下跌轨迹飙升至 87 美元。油价的快速大幅上涨对天然气差价合约产生了直接影响。差价合约从 3 美元以下快速上涨至 3.50 美元以上。

2022 年,美国基准亨利中心的天然气现货价格平均为每百万英热单位 (MMBtu) 6.45 美元。然而,2023 年初出现了明显逆转,亨利中心价格在今年前 9 个月暴跌至平均 2.46 美元/MMBtu。与 2022 年平均水平相比,这标志着近 4.00 美元/MMBtu 的显着下降。

- 价格相关性:从历史上看,地缘政治事件和石油价格表现出很强的正相关性。由于地缘政治紧张局势导致石油价格飙升,天然气价格往往也会上涨。

- 直接影响:石油价格的迅速飙升可能会给能源市场带来不确定性和恐慌感,导致天然气价格上涨的本能反应。交易者应警惕地缘政治事件造成的短期波动。

- 潜在的长期影响:中东冲突的持续时间将是对石油价格以及随后对天然气差价合约的长期影响的关键决定因素。如果冲突持续或升级,可能会导致油价持续高企,从而导致天然气价格上涨。

- 地区供应中断:如果冲突蔓延到伊朗等主要产油区,可能会扰乱石油供应。这种情况可能会对天然气市场产生连锁反应,因为这两种商品在全球能源供应链中相互关联。

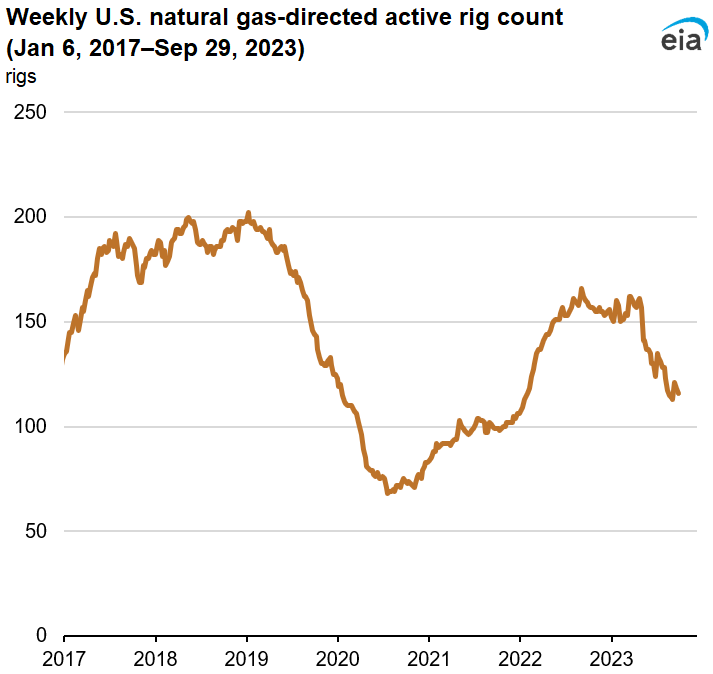

钻机数量和钻井活动

截至 2023 年 9 月 29 日,贝克休斯报告称,自年初以来,美国天然气钻机数量已大幅下降 26%。活跃的天然气钻机数量为 116 座,较 2023 年初减少了 40 座。据贝克休斯称,截至 2023 年 9 月 26 日,天然气钻机数量较一周前减少 2 座。同期,石油钻井平台数量也减少了 5 座,降至 502 座。包括杂项钻机在内的钻机总数为 623 台,比上年同期减少 142 台。

2023 年天然气价格下降促使生产商通过减少开发费用和缩减钻探活动(包括减少部署的活跃钻机数量)等策略来降低成本。二叠纪地区是美国天然气生产的重要地区。该地区的生产商在规划勘探和生产活动时通常会对原油价格的变化做出反应,这随后可能会影响天然气钻探。

到2022年,二叠纪地区的天然气产量约占美国天然气总产量的18%。然而,这种产量与该地区的原油产量密切相关。尽管原油价格波动,二叠纪地区的石油钻井平台数量从5月份的357座下降到2023年9月29日的308座,这表明二叠纪地区的生产商采取了谨慎的态度。

尽管钻探活动有所下降,但 2023 年美国日均天然气产量仍高于 2022 年。2023 年前 7 个月,美国干天然气产量平均为 1,030 亿立方英尺/天 (Bcf/d),相当于比 2022 年平均 99.6 Bcf/d 增加 3%。二叠纪地区油井生产力的提高是生产效率提高的一个因素。

- 价格和钻机数量的关系:从历史上看,天然气价格和钻机数量之间存在反比关系。当价格下跌时,生产商往往会减少钻探活动以降低成本,从而减少天然气供应。供应的减少可能会推高价格。

- 滞后效应:值得注意的是,钻机数量的变化对天然气产量的影响并不是立竿见影的。生产商对价格变化的反应通常滞后四到六个月。因此,尽管钻机数量有所下降,但生产水平可能需要一段时间才能做出相应调整。

- 生产效率:尽管钻机数量下降,但由于油井生产率提高,美国天然气产量仍保持相对稳定。这种生产效率可以缓解因钻井活动减少而导致的传统价格上涨。

资料来源:eia.gov

液化天然气市场动态

液化天然气出口是天然气市场的重要组成部分,因为它们代表了剩余天然气的出口,可以影响整体市场动态。美国液化天然气出口码头的交货量环比增加 5.0%,表明液化天然气出口需求不断增长。某些液化天然气接收站(例如马里兰州的 Cove Point 液化天然气接收站)的维护活动可能会影响液化天然气的供应和价格。

- 对天然气价格的影响:液化天然气需求增加可能会给天然气价格带来上行压力。随着越来越多的天然气被转移到液化天然气出口市场,国内供应可能会收紧,这可能会提高消费者和投资者的天然气差价合约价格。

- 基础设施投资:请求批准自由港液化天然气出口设施全面商业运营,这表明人们对液化天然气出口的信心不断增强。对液化天然气基础设施的进一步投资可以维持液化天然气需求,从而影响天然气价格。

供需动态

美国天然气平均总供应量保持相对稳定,平均为 106.0 Bcf/d。这种稳定性反映了干天然气产量和来自加拿大的净进口量的小幅波动。天然气需求出现变化,美国总消费量下降0.9%。然而,各部门的消费模式各不相同,发电量下降,但工业和住宅/商业部门的消费呈现出混合趋势。

- 发电影响:发电用天然气消耗量的下降可能表明人们转向替代能源,从而可能影响天然气价格。交易者应密切关注能源发电趋势的变化。

- 工业和居民消费:虽然发电量有所下降,但工业和居民消费略有增长。这些趋势可以抵消部分天然气价格的下行压力。

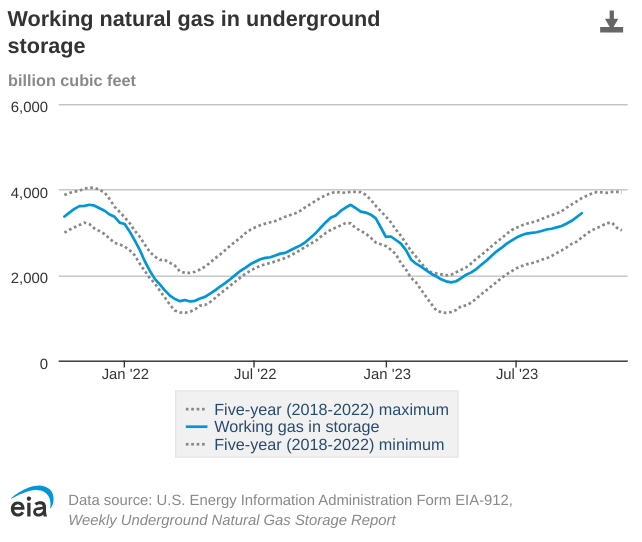

存储级别

截至 2023 年 9 月 29 日当周,净注入存储量总计 86 Bcf。这低于五年平均水平和去年同一周的净注入量。工作天然气库存总计 3,445 Bcf,比五年平均水平增加 5%,比上年同期增加 12%。

- 对价格的影响:更高的存储水平可以缓解需求增加或供应中断期间的价格波动。它提供了防止价格极端上涨的缓冲。

- 补充季节轨迹:补充季节期间注入存储的轨迹对于了解未来的定价至关重要。

- 较低的注入率:目前的平均注入率比五年平均水平低 7%。如果这种趋势持续下去,可能表明供应紧张,并导致价格上涨压力。

- 潜在的库存增加:如果库存注入量与补充季节剩余时间的五年平均水平一致,则总库存可能会超过历史平均水平。这种情况可能会稳定价格。

资料来源:eia.gov

总之,石油价格和天然气差价合约之间错综复杂的关系随着当前的发展而不断演变。地缘政治紧张局势、钻井数量下降、液化天然气需求增长以及供需动态变化导致的油价波动都是影响天然气价格的因素。

交易者和投资者必须保持警惕,因为这些因素动态相互作用,塑造天然气差价合约的未来。地缘政治事件,特别是影响石油价格的事件,可能对天然气价格产生直接和持久的影响。然而,美国天然气生产和储存水平的弹性提供了平衡,可以减轻价格波动。

天然气差价合约每周走势的技术角度可以理解如下:

资料来源:tradingview.com

*免责声明:本文内容仅供学习之用,不代表VSTAR官方立场,也不能作为投资建议。