- US refinery operations indicate a minor drop in crude oil demand, while imports remain steady. Crude inventories are slightly below the five-year average, reflecting market stability.

- WTI crude oil prices have risen to $89.12 per barrel, showing a significant year-on-year increase, with gasoline and heating oil prices following mixed trends.

- Middle East tensions and US military operations in Gaza have caused market uncertainty, making future price movements hard to predict.

- Strong GDP growth and durable goods orders contrast with concerns about Q4, contributing to market volatility and cautious sentiment among investors.

Crude oil plays a pivotal role in the global economy, making it imperative to critically assess the fundamental factors affecting its valuation. The analysis explores key components, including refinery operations, imports/exports, inventories, demand, pricing, geopolitical influences, supply trends, economic data, market sentiment, and potential catalysts.

Refinery Operations

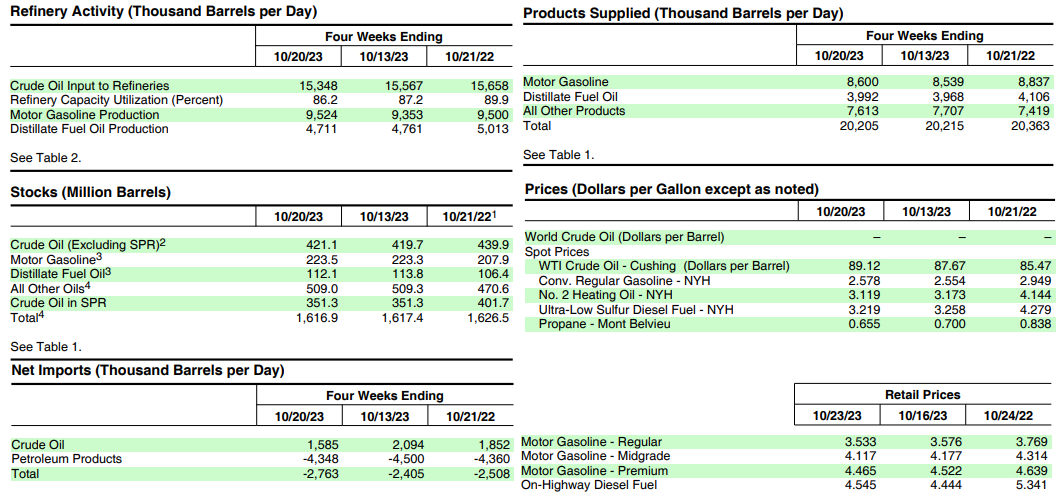

The health of refinery operations is a fundamental driver of crude oil valuations. As of the week ending October 20, 2023, US crude oil refinery inputs averaged 15.2 million barrels per day, indicating a decrease of 206 thousand barrels per day compared to the previous week. This reduction suggests a short-term decline in demand for crude oil. However, refineries operated at 85.6% of their capacity, highlighting ongoing activity in the sector.

Gasoline and distillate fuel production increased during the same week, averaging 9.8 million barrels per day and 4.7 million barrels per day, respectively. These production levels indicate sustained demand for petroleum products in the US market.

Crude Oil Imports/Exports

Crude oil imports are critical for assessing the demand-supply dynamics in the oil market. During the same period, US crude oil imports averaged 6.0 million barrels per day, showing a 71 thousand barrels per day increase from the previous week. Over the past four weeks, crude oil imports averaged about 6.1 million barrels per day, signifying a 1.7% year-on-year growth. This indicates a consistent need for imported crude oil in the US

Total motor gasoline imports (including finished gasoline and blending components) averaged 653 thousand barrels per day, while distillate fuel imports averaged 116 thousand barrels per day. These figures underscore the importance of imports in meeting US energy demands.

Source: Weekly Petroleum Status Report

Inventories

Crude oil inventories are closely monitored to gauge market stability. US commercial crude oil inventories (excluding the Strategic Petroleum Reserve) increased by 1.4 million barrels from the previous week, reaching a total of 421.1 million barrels. This level is approximately 5% below the five-year average for this time of the year.

Total motor gasoline inventories increased by 0.2 million barrels, slightly surpassing the five-year average by approximately 1%. Distillate fuel inventories decreased by 1.7 million barrels, positioning them about 12% below the five-year average. Propane/propylene inventories increased by 0.1 million barrels and are currently 18% above the five-year average.

Total commercial petroleum inventories, which include various oil-related products, decreased by 0.5 million barrels during the same week.

Demand

Assessing demand trends is crucial in determining future price movements. Total products supplied over the last four weeks averaged 20.2 million barrels per day, marking a 0.8% decline compared to the same period the previous year. Motor gasoline product supplied averaged 8.6 million barrels per day, showing a 2.7% year-on-year decrease. Distillate fuel product supplied averaged 4.0 million barrels per day, reflecting a 2.8% year-on-year decline. In contrast, jet fuel product supplied increased by 5.0% compared to the same four-week period the previous year.

Oil Pricing

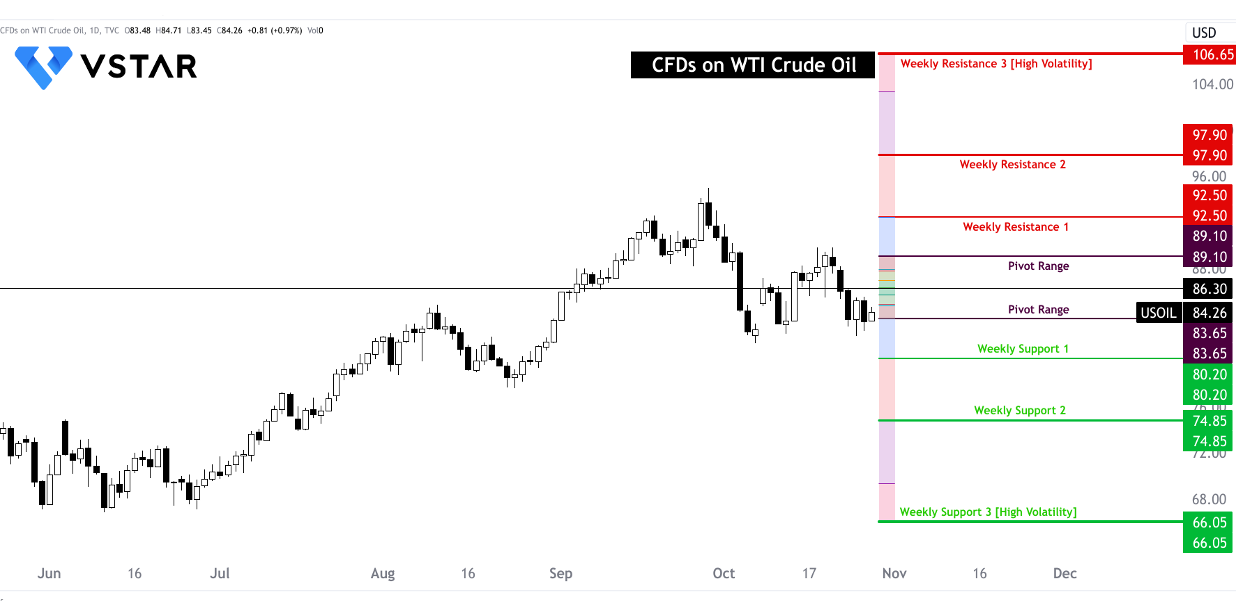

Oil pricing is a key factor influencing investment decisions. On October 20, 2023, the price for West Texas Intermediate (WTI) crude oil stood at $89.12 per barrel. This marked an increase of $1.45 from the previous week and a notable $3.65 surge compared to the same period the previous year.

The New York Harbor spot price for conventional gasoline increased by $0.024 to $2.578 per gallon, which is $0.371 less than the price at the same time the previous year. The spot price for No. 2 heating oil at New York Harbor dropped by $0.054 to $3.119 per gallon, representing a decrease of $1.025 from the year-ago price.

The national average retail price for regular gasoline was $3.533 per gallon on October 23, 2023. This was $0.043 less than the previous week and $0.236 less than the price a year ago. Conversely, the national average retail price for diesel fuel rose by $0.101 to $4.545 per gallon, marking a $0.796 decrease compared to the previous year at the same time.

Geopolitical Influences

Geopolitical factors have historically had a substantial impact on oil prices. As of the analysis date, there were tensions in the Middle East, which traditionally have the potential to disrupt oil markets. However, it was noted that there appeared to be a growing belief that the US might avert a full-scale military operation in Gaza, temporarily allaying fears of further escalation. This shift in sentiment makes it difficult to predict future movements from a technical standpoint, underscoring the volatile nature of geopolitical influences on oil prices.

Supply Trends

Supply trends play a vital role in crude oil valuations. Data showed that US waterborne imports of crude oil from OPEC+ members steadily declined over the past year. Total US crude imports for October 2023 were set to average 2.47 million barrels per day, down from 2.92 million barrels a day in September. A part of this decline was attributed to the end of the summer period in the US, which typically sees decreased demand. However, another concerning factor was identified—the drop in barrels from Saudi Arabia, which suggested the Kingdom's intention to influence oil prices. This trend coincided with the US Strategic Petroleum Reserve (SPR) reaching multi-decade lows, prompting the US to announce its intention to replenish the reserves by the end of 2023.

In addition to import trends, US exports of crude oil to Europe showed a slowdown, falling to 1.86 million barrels a day in September from 2.01 million barrels a day in July. This reduction was not attributed to the US-Venezuela deal, as a significant supply increase from Venezuela has yet to materialize. This aligns with previous assessments that Venezuela requires substantial investment in its oil infrastructure before making a meaningful supply return to the markets.

Economic Data

Economic data, including GDP growth and durable goods orders, have a considerable impact on oil demand. On the analysis date, US GDP data and durable goods orders were released, indicating a robust economy. However, there were concerns about the fourth quarter of the year, which could add to the uncertainty and lack of commitment from market participants.

Market Sentiment and Volatility

Market sentiment can significantly influence oil prices. Uncertainty in the Middle East, coupled with economic concerns, was noted as factors contributing to choppy price action in the days ahead. The upcoming US Federal Open Market Committee (FOMC) meeting and other high-impact data events were expected to stoke volatility. Analysts emphasized that the market was on edge and that one headline could trigger a significant rally.

In conclusion, the analysis of CFDs on WTI Crude Oil valuations as of October 20, 2023, underscores a complex and dynamic environment. While some indicators suggest steady demand and supply trends, external factors such as geopolitical tensions and economic uncertainties introduce a sense of unpredictability. Market participants are cautious, and upcoming events, including the Federal Reserve meeting and OPEC+ decisions, will be pivotal in shaping the oil market's future movements.

Source: tradingview.com