Introduction

The Federal Reserve's monetary policy objectives are price stability and full employment. The importance of maintaining price stability lies in the fact that either excessive inflation or excessive tightening can be detrimental to economic development and even social stability. Every time inflation data is released, there will be market turbulence because the Federal Reserve will refer to a lot of inflation-related data when formulating monetary policy. And inflation-related data can be said to be massive, this article combed through the Federal Reserve focus on inflation data and some forward-looking data, and provide access to query tools, and finally on the characteristics of this inflation, trend analysis, predict the direction of the Federal Reserve's monetary policy.

Federal Reserve Monetary Policy Objectives

The Federal Reserve's monetary policy objective is to maintain price stability and full employment. This reflects the dual mandate of the Federal Reserve System.

Price stability: Price stability means controlling inflation, usually with the goal of a low rate of inflation. A stable price environment makes it easier for consumers, businesses, and the government to make long-term decisions because they can better predict future price levels. Second, stable prices help maintain the purchasing power of money, which is eroded by inflation to the detriment of savers and those on fixed incomes. Price stability helps maintain the purchasing power of money. But moderate inflation encourages people to spend and invest, and promotes economic growth.

Full employment: Full employment means achieving the highest possible level of employment while keeping inflation within manageable limits. High employment helps reduce social instability and poverty and improves the quality of life. Full employment increases labor productivity and promotes economic growth. Increased employment opportunities contribute to higher household incomes, thereby boosting consumption, which is essential for economic growth.

The explicit inclusion of these two objectives as the ultimate goal of monetary policy is intended to ensure that monetary policy is conducive to achieving full employment while maintaining price stability. Because there may be trade-offs between these two objectives, the Federal Reserve must carefully balance the relationship between inflation and employment and adjust monetary policy to achieve both objectives in light of current economic conditions.

Background on the Fed's inflation objective

Price stability implies a reasonable rate of inflation, and the Fed has set its inflation objective at around 2 percent. A number of economic theories and policy considerations underlie the setting of this target.

Maintain predictability: Inflation expectations are market participants' views of future inflation rates, and they are important in decisions that drive consumer and business behavior. Inflation targeting can help to stabilize inflation expectations. Setting an inflation target at a well-defined level (e.g. 2%) helps market participants to better predict the future, which contributes to a more stable functioning of the economy.

Avoid deflation: Setting an inflation target close to 2% helps avoid the risk of deflation. Deflation can lead to a vicious cycle as consumers and businesses delay spending and investment in the expectation that prices will continue to fall, which can lead to more deflation. In the 1970s and 1980s, the Fed tightened too much, triggering a recession. In recent years, the Fed has focused more on managing inflation expectations and adopting forward-looking policies to reduce economic volatility.

Leave room for monetary policy: Setting an inflation target of 2% gives the central bank room for more aggressive monetary policy to stimulate economic growth and employment in an economic downturn. If the inflation target is set too low, it can limit policy space and prevent the central bank from responding to a recession.

While the 2% inflation target is theoretically justified, it is not set in stone. The Fed evaluates and adjusts its inflation objective based on economic conditions and policy needs. In special circumstances, such as a major economic crisis or exceptional inflationary pressures, the Fed may temporarily adjust its policy objective. Thus, while the 2% inflation objective is generally appropriate, it is not a rigid rule, and the central bank will be flexible in adjusting its policy objective as needed.

To achieve its goal, the Fed influences the supply and circulation of money by regulating the federal funds rate (the intermediate target of monetary policy) and by quantitative easing, among other things.

Inflation Data the Fed Focuses on

Consumer Price Index (CPI): The CPI is one of the most widely used measures of inflation in the United States. It measures changes in the prices of a basket of goods and services that represent consumer spending. The CPI is typically broken down into several sub-indices, including food, energy, health care, housing, etc., to provide a more complete picture of price trends in different sectors.

Core CPI: The core CPI excludes fluctuations in food and energy prices to better capture long-term trends in inflation. This helps to remove the impact of short-term fluctuations in supply-side changes, such as food and energy prices, on inflation data.

Producer Price Index (PPI): The PPI measures changes in the prices of raw materials and components purchased by manufacturers. It can be a predictor of future CPI changes because it reflects changes in production costs that may ultimately be passed on to consumers.

Personal Consumption Expenditures Price Index (PCEPI): The PCEPI is another inflation measure closely watched by the Federal Reserve. Unlike the CPI, the PCEPI takes into account a different weighting of products and services purchased by consumers and therefore may sometimes show a different rate of inflation.

Employment Cost Index (ECI): The ECI measures changes in the wages and benefits paid by employers to their employees. When labor costs rise, it can cause businesses to raise prices, which can affect inflation.

Inflation Expectations: The Fed also pays attention to market and economists' inflation expectations, which reflect market participants' views of the future level of inflation and are important in formulating monetary policy.

Wage and employment data: Wage growth and employment data are also closely watched because they can provide early signs of inflationary pressures. If wages rise too fast, this can have an impact on inflation.

The Federal Reserve uses the Phillips curve to assess the relationship between inflation and unemployment. The Phillips curve is an economic model that describes the relationship between inflation and unemployment. According to this curve, there is a trade-off point between inflation and unemployment, often referred to as the natural rate of unemployment.

The Phillips curve is divided into two parts: the short run and the long run. In the short run, there is a negative correlation between inflation and unemployment, which means that when unemployment falls, inflation is likely to rise and vice versa. This is because, in the short run, macroeconomic policies (such as monetary policy) can affect both unemployment and inflation.

In the long run, the Phillips curve assumes that the unemployment rate will return to the natural rate of unemployment and that inflation will stabilize at the long-run target level. This implies that the relationship between unemployment and inflation is relatively weak in the long run and that inflation is largely determined by monetary policy, inflation expectations and structural factors.

The Phillips curve is only a theoretical model, and the relationship between inflation and unemployment in the real economy may be affected by other factors, such as supply and demand factors, output gaps, and international factors. Therefore, the Federal Reserve will consider a range of economic indicators and factors, not just inflation and unemployment, in formulating its monetary policy.

The Federal Reserve considers these data and other macroeconomic indicators together in formulating monetary policy to maintain inflation at the target level to promote price stability and full employment.

Factors affecting inflation

Inflation is a situation in which the general level of prices continues to rise, and its main factors include the following, each of which has a number of subdivisions that are observed as forward-looking data on inflation:

Demand-pulling factors

Consumer spending: When consumers increase their demand for goods and services, it can lead to higher prices. Higher spending is usually associated with inflation. U.S. consumer spending data is published by the Bureau of Economic Analysis (BEA). The monthly Personal Income and Expenditures report includes data on consumer spending. These data are usually released in the last few days of the month or at the beginning of a new month, and the BEA's data are generally reliable and widely used by economic analysts, policymakers, and researchers.

Individual consumption data from the BEA can be accessed at https://www.bea.gov/data/consumer-spending.

Business Investment: Increased business investment can also create demand and raise prices. For example, large infrastructure projects can lead to higher prices for construction materials and labor. Information on business investment and economic data can be found on the BEA's website, and its data retrieval tools can be used to access specific data series and reports. For example, fixed capital investment (FCI), which includes nonresidential and residential investment, is data that reflects business investment in structures, equipment, and technology.

BEA fixed investment data are available at https://www.bea.gov/data/investment-fixed-assets.

Government Spending: Increased government spending, especially in the context of rising budget deficits, can lead to inflation.

Data on U.S. government spending can be found on the official websites of government agencies such as the U.S. Department of the Treasury and the U.S. Bureau of Economic Analysis (BEA).

U.S. Department of the Treasury: The U.S. Department of the Treasury is responsible for overseeing and managing the financial activities of the federal government, including government spending. Official Web site: https://home.treasury.gov/

U.S. Bureau of National Statistics (BEA): The BEA provides data on gross domestic product (GDP) and related economic indicators, including government spending. Government spending is an important component of GDP. Official BEA Web site: https://www.bea.gov/

Federal Budget: The U.S. federal government produces an annual budget that includes detailed plans for government spending. U.S. Federal Budget: https://www.usa.gov/budget

Congressional Budget Office (CBO): The CBO provides non-political analysis and data on federal spending and budgeting. Its reports and data are important for policymaking and analysis. Official CBO website: https://www.cbo.gov/

Federal Reserve System: The Federal Reserve also provides information on the federal government's financial data, including the national debt and government spending. Official website of the Federal Reserve: https://www.federalreserve.gov/

Cost Drivers

Labor costs: Rising wages can lead to an increase in production costs, which in turn can cause companies to raise prices to maintain profit levels.

Raw material prices: Rising commodity prices (e.g., oil, metals, etc.) can increase the cost of manufacturing goods, which can be passed on to the price of the final product.

The BEA provides data on business profitability and costs, including a variety of business economic indicators such as gross profit margins, labor costs, taxes, etc. BEA Corporate Profits page: https://www.bea.gov/data/gdp/corporate-profits

BEA also publishes data on labor productivity and unit labor costs, which reflect the productivity of businesses. BEA Productivity page: https://www.bea.gov/data/gdp/labor-productivity

Money Supply Factors

Money supply growth: When the central bank increases the money supply through monetary policy (e.g., printing money or increasing bank reserves), this usually leads to inflation. Too much money circulating in the economy can lead to inflation because the same amount of money demands more goods and services. However, the Federal Reserve no longer bases its decisions on the money supply.

The official website of the U.S. Federal Reserve System provides data and reports on the money supply, the monetary base, monetary policy, and other data and reports related to currency issuance. Official Fed website: https://www.federalreserve.gov/

The Federal Reserve Economic Data (FRED) database is a resource that provides a variety of macroeconomic and financial data. You can find information on the money supply and other money-related data in the FRED database. FRED database: https://fred.stlouisfed.org/

Expectation Factors

Inflation expectations: People's expectations about future inflation can affect their behavior. If people expect inflation to rise, they may buy goods in advance, which can actually increase inflation.

Interest rates and yields in the bond market provide clues to inflation expectations. In particular, the real interest rate (the interest rate excluding inflation) on U.S. Treasuries and the interest rate on Treasury Inflation-Protected Securities (TIPS) can be used to gauge the market's expectation of inflation.

The official website of the U.S. Department of the Treasury provides a wealth of data and tools on Treasury securities, including yields and real interest rates on various types of Treasury securities. Real rates and other data on Treasuries can be found here. Official U.S. Treasury website: https://home.treasury.gov/

External factors

Exchange rate movements: Fluctuations in exchange rates can affect import and export prices, which can affect inflation. For the U.S., changes in the US dollar index are closely related to inflation data. When the US dollar index rises, the purchasing power of the U.S. dollar becomes stronger and the price of imported goods is relatively low, which helps to reduce pressure on the price of imported goods.

Inflation is a complex phenomenon that usually results from the interaction of several factors. In the real economy, these factors are usually interrelated, leading to changes in the inflation rate.

Characteristics of this inflation

Since April 2021, the U.S. economy has continued to face inflationary pressures. Inflation has been on the rise, rising from 7.9% for all of 2021 to 8.2% in October 2022, a 40-year high. The high inflation rate has seriously plagued the U.S. economy and has become the most important issue of the day. The causes of this inflation are mainly due to the effects of excessive stimulus from macro-fiscal and monetary policies, economic restructuring, global supply chain crisis, and global trade wars.

Massive water release

Faced with the impact of the new crown epidemic, the Federal Reserve has implemented an unprecedented ultra-loose monetary policy: in March 2020, the Federal Reserve will cut interest rates twice on an emergency basis, reducing the federal benchmark interest rate to near zero in the range of 0-0.25%, and launch an unlimited bond purchase program. From February 2020 to March 2022, the Fed's balance sheet expanded rapidly, increasing in total from $4.2 trillion to nearly $9 trillion, more than doubling in less than two years. The massive monetary stimulus has provided the liquidity base for the current high level of US inflation.

Fiscal Stimulus

In conjunction with the Federal Reserve's ultra-loose monetary policy, the U.S. government has also implemented a massive fiscal stimulus. During the New Crown epidemic, the U.S. federal government launched seven rounds of fiscal bailout programs totaling $6.7 trillion.The U.S. budget deficit jumped from $984 billion in 2019 to $3.1 trillion in 2020, and its share of GDP rose from 4.6% to 15.2%. The huge fiscal stimulus has led to an overexpansion of aggregate demand, exacerbating the economy's supply-demand imbalance and setting the stage for the current high inflation.

Imbalance between domestic supply and demand

The United States is the world's largest economy and consumer, but its domestic supply capacity is seriously inadequate. The U.S. has long shifted its labor-intensive manufacturing chain overseas, reducing the share of domestic manufacturing to about 11% of GDP. Consumption, on the other hand, is high at over 80% of GDP. This structural imbalance between supply and demand is the root cause of US inflation. The mega fiscal and monetary stimulus implemented in the US during the epidemic has further widened this gap, pushing demand growth well beyond supply capacity and leading to a further build-up of inflationary pressures.

Impact of the trade war

The Trump administration has imposed high tariffs on a wide range of Chinese goods, but has not reduced imports from China. The cost of these additional tariffs has been passed on to U.S. businesses and consumers, pushing up the price of goods. The Biden administration's continued policy of imposing tariffs on China, as well as its push to "de-Chinaize" the supply chain, continues to push up U.S. inflation. Ending tariffs on China would be a direct and effective way to reduce U.S. inflationary pressures.

Supply chain crisis

U.S. supply chains have been hit hard in the aftermath of the New Crown epidemic, with shortages of key components and disruptions in the transportation system leading to severe supply shortages. Starting in the second half of 2020, the chip shortage led to an oversupply in the auto market, pushing up the price of used cars and becoming a major contributor to the rise in the CPI. Meanwhile, a significant decline in transportation efficiency at U.S. ports and the inability to ship imported goods in a timely manner also pushed up consumer prices. Serious disruptions in the supply chain have impaired the efficiency of economic operations and are the direct cause of the current high inflation in the United States.

Impact of the Russia-Ukraine War

The Russian-Ukrainian conflict has led to the blockage of global resource supply, and the prices of commodities such as crude oil, natural gas, minerals and food have risen sharply. Europe and the United States are trying to get rid of Russian energy dependence, resulting in the global energy supply contraction, oil prices and natural gas prices soared, the United States is currently facing the most serious energy crisis in 50 years. The Russian-Ukrainian conflict and the resulting global resource supply shock are important external factors driving current inflation.

Inflation trend and forecast under current monetary policy

Beginning in March 2022, the Federal Reserve embarked on a new cycle of rapid rate hikes, raising rates 11 times to date for a cumulative rate hike of 525 basis points. This is the fastest pace of Fed rate hikes since the 1980s.

The current round of rate hikes, unlike previous ones, involves both managing expectations of an overheating economy and reflecting ongoing concerns about inflation. Inflation began the hiking cycle at 7.9% and peaked at 9.1% in June 2022. Inflation then moderates, falling to 3% for a time after May 2023, but then begins to rise again.

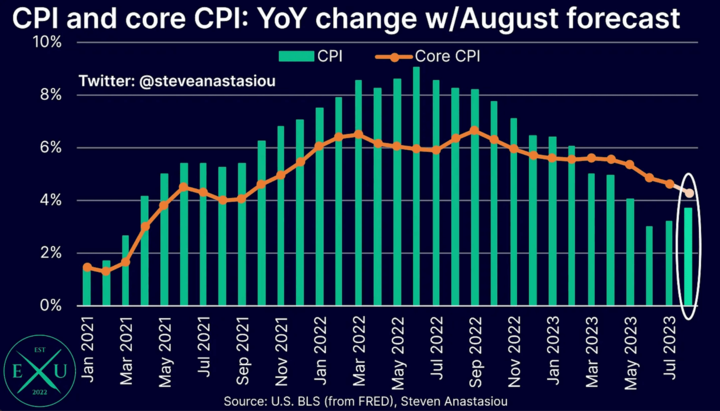

In July 2023, the U.S. headline CPI rose from 3.2% to 3.7% in August, the second consecutive month of higher year-over-year inflation. However, the core CPI (excluding food/energy) fell to 4.4% y/y, the lowest core inflation rate since September 2021.

Chart: CPI and Core CPI Trend

Source: twitter@stevenanastasiou

Some analysts expect annual CPI growth to rise sharply in August, but core CPI growth is expected to slow further. On an annual basis, headline CPI growth is expected to rise sharply from 3.2% in July to 3.7% in August. This is slightly above the consensus estimate of 3.6%. Meanwhile, core CPI is expected to slow for the fifth consecutive year, falling to 4.3% in August from 4.7% in July. This figure is still above the Fed's inflation target.

Given that the Fed focuses more on the core CPI than the headline CPI, the continued deceleration in the core CPI should be enough to offset the spike in the headline CPI in August and support current market expectations for an unchanged federal funds rate through September 2023.1 The Fed's inflation target for August is 4.3%, which is the fifth consecutive year of deceleration.

Expectations about the future direction of monetary policy

In the 1970s, the United States also appeared serious stagflation problem, CPI once rose close to double digits. The main reason is the huge fiscal spending brought about by the Vietnam War, excessive money supply led to inflation out of control. The Federal Reserve was forced to raise interest rates sharply to curb inflation, and finally in the early 80s to keep inflation down.

This historical event is an important reference for today's monetary policy:

- Emphasis on managing inflation expectations to prevent psychological expectations of inflation from translating into behavior;

- Monetary policy must respond to inflationary pressures in a timely manner and not lag too far behind;

- The magnitude of interest rate adjustments should be moderate, both to ensure the tightening effect and to take into account the impact on the real economy.

Since the beginning of this year, the Federal Reserve has begun to slow the pace of interest rate increases. After a long and aggressive interest rate hikes, the current inflation, although it has fallen sharply, but inflation expectations are at a relatively high level and have a tendency to rebound, what to curb the rebound in inflation expectations is very important. If firms and residents believe that inflation will persist for a long time, they will take countermeasures, leading to a continued upward price spiral.

While high interest rates have slowed economic growth and put pressure on the banking sector, the Fed has indicated that it still has plans for further rate hikes as inflation remains well above its 2% target. Controlling inflation will remain the Fed's policy focus, even if it comes at some cost to economic growth.

The Fed must continue to tighten policy and signal its determination to keep inflation in check. However, the tightening must be moderate, must not have too much of an impact on output, and must also take financial risks into account.

In the coming period, the Fed's monetary policy will strike a balance between preventing a recession and controlling inflation. Inflation data and the labor market will be important policy guidelines.