- Google's revenue surged from $100 billion to over $300 billion in six years, showcasing impressive growth across Search, YouTube, and Cloud segments.

- Leadership in AI research and infrastructure, exemplified by TPUs and Google DeepMind, positions Google at the forefront of AI innovation.

- Google's diverse product portfolio, spanning 2 billion users globally, drives extensive market penetration and monetization opportunities.

- Challenges include dependency on Search revenue, slowing growth in network advertising, and ongoing losses in the Other Bets segment, potentially hindering rapid growth.

As of Q1 2024, Google or Alphabet (NASDAQ:GOOG) charts its course in the tech market, its fundamentals unfolding with a blend of promise and scrutiny. Explore the essence of Google's prowess and pitfalls, from revenue surge to AI dominance, entwined with technical foresight guiding its market voyage.

Google Fundamental Strengths

Google (NASDAQ: GOOG) has exhibited remarkable growth over the years, driven by its strong performance in various segments such as Search, YouTube, and Cloud.

Google Revenue Growth Trajectory:

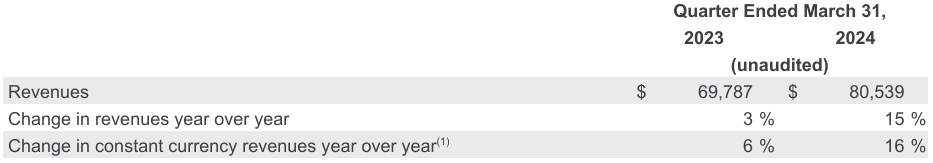

Google has experienced substantial revenue growth, exemplified by its trajectory from $100 billion to over $300 billion in annual revenue within six years. Such rapid expansion showcases the company's ability to scale its operations and capitalize on market opportunities efficiently. The consistent growth, especially in Search, YouTube, and Cloud, underpins Google's robust business model and diversified revenue streams. Google's ability to triple its annual revenue within six years signifies its adeptness in capitalizing on market demand and leveraging its core competencies across different business segments.

Source: Q1 2024 Earnings

AI Research and Infrastructure Leadership:

Google's commitment to AI innovation is evident through its research leadership, infrastructure advancements, and investment in cutting-edge technologies like TPUs (Tensor Processing Units). The consolidation of AI model-building teams under Google DeepMind and the development of groundbreaking models like Gemini highlight Google's dedication to staying at the forefront of AI innovation. Google's leadership in AI research and infrastructure equips it with a competitive edge in developing advanced AI models and algorithms. The deployment of TPUs, now in their fifth generation, underscores Google's focus on enhancing efficiency and driving innovation in AI-driven projects. This technological prowess positions Google to capitalize on the growing demand for AI-powered solutions across various industries.

Diversified Product Portfolio and Global Reach:

Google boasts a diversified product portfolio with over 2 billion monthly users across six products and operations spanning 100-plus countries. The widespread adoption of Google's products and services, including Android devices, provides Google with extensive opportunities to deliver AI-driven features and enhance user experiences globally. Google's expansive product footprint and global reach enable it to reach a vast audience and cater to diverse market needs. By leveraging AI capabilities across products like Pixel, Chrome, and Workspace, Google can enhance user engagement and drive monetization opportunities.

Google Fundamental Weakness

Google has experienced remarkable growth over the past years, particularly in revenue generation and innovation in AI and cloud services. However, several fundamental weaknesses exist that may impede the company's potential for rapid growth.

Challenges in Other Bets Segment:

Google's Other Bets segment, which includes experimental projects and businesses outside of Google's core operations, continues to incur significant losses. In the first quarter of 2024, the segment reported an operating loss of $1 billion. While Google has made investments in areas such as Waymo's autonomous vehicles and healthcare technology, these ventures have yet to demonstrate significant commercial success. The ongoing losses in the Other Bets segment indicate the challenges Google faces in translating its innovative ideas into profitable businesses.

Source: Q1 2024 Earnings

Dependency on Search Revenue:

While Google has diversified its revenue streams with products like YouTube and Cloud, it heavily relies on Search for its revenue generation. In the first quarter of 2024, Google Search and other advertising revenues amounted to $46.2 billion, contributing significantly to the company's overall revenue. This heavy dependence on Search makes Google vulnerable to fluctuations in the digital advertising market, changes in consumer behavior, and regulatory challenges. Any decline in Search revenue could disproportionately impact Google's financial performance and growth potential.

Slowing Growth in Network Advertising:

Despite the overall growth in advertising revenue, Google experienced a 1% decline in network advertising revenues in the first quarter of 2024. This indicates a weakness in Google's network advertising business, which includes ads displayed on third-party websites and apps. The decline suggests challenges in monetizing network traffic or potential competition from other advertising platforms.

Google Stock Forecast 2024

Google stock exhibits a bullish trend. The current Google stock price stands at $173.69, above both the modified exponential moving average trendline ($144.90) and the baseline ($144.15), indicating an upward trajectory. The average Google price target by the end of 2024 is $196.80, based on momentum changes projected over Fibonacci retracement/extension levels. An optimistic GOOG price target of $215.50 is derived from the current swing's momentum over mid- to short-term, also projected over Fibonacci levels.

Moreover, primary support is at $168.23, while the pivot of the current horizontal price channel is $155.00. Core resistance aligns with the average Google price target of $196.80. Further support lies at $141.75, with core support at $113.18.

Source: tradingview.com

Furthermore, the Relative Strength Index (RSI) value is 72.79, indicating a bullish sentiment. This value surpasses both the regular bullish level of 45.96 and the regular bearish level of 69.32, suggesting a strong bullish trend. No bullish or bearish divergences are observed. The RSI line trend is upward, signaling continued bullish momentum. On the other hand, the Moving Average Convergence/Divergence (MACD) indicator portrays a bullish trend, with the MACD line at 6.5, surpassing the signal line of 4.73. The MACD histogram at 1.77 supports this bullish trend, indicating increasing strength.

Source: tradingview.com

Conclusion

Google's robust fundamentals, marked by revenue growth, AI leadership, and product diversification, signal resilience amid challenges. However, dependencies on Search revenue and issues in other bets pose risks. Technical analysis forecasts a bullish trend, with support at $168.23 and resistance at $196.80, shaping perceptions of Google's market trajectory.