Fitch downgrades U.S. debt rating, stock market shocks

Recently, Fitch Ratings, one of the world's three largest credit rating agencies, announced that it had downgraded the U.S. government's long-term debt rating from "AAA" to "AA+". S&P's long-term foreign currency debt issuer rating for the United States has remained at AA+ since the downgrade in 2011, leaving only Moody's to maintain the highest rating for the United States.

The move triggered short-term jitters in U.S. stocks, with the S&P 500 posting its biggest one-day drop since April and the tech-dominated Nasdaq Composite posting its biggest one-day drop since February.

The last time the U.S. government's long-term debt was downgraded was on August 5, 2011, when S&P downgraded the U.S. long-term debt rating from AAA to AA+. The downgrade came at a time of heightened concern over the U.S. debt ceiling and budget deficit. S&P expressed concern about the political gridlock and inability of the U.S. government to agree on a solution to the long-term debt and deficit issues, which led to the downgrade and triggered a spike in the price of gold, which rose to an all-time high of nearly $1,900 per ounce.

Fitch downgraded the U.S. debt rating for the same reason: Fitch commented that the debt ceiling issue has triggered an increase in public concern about the U.S. government's ability to manage its finances.

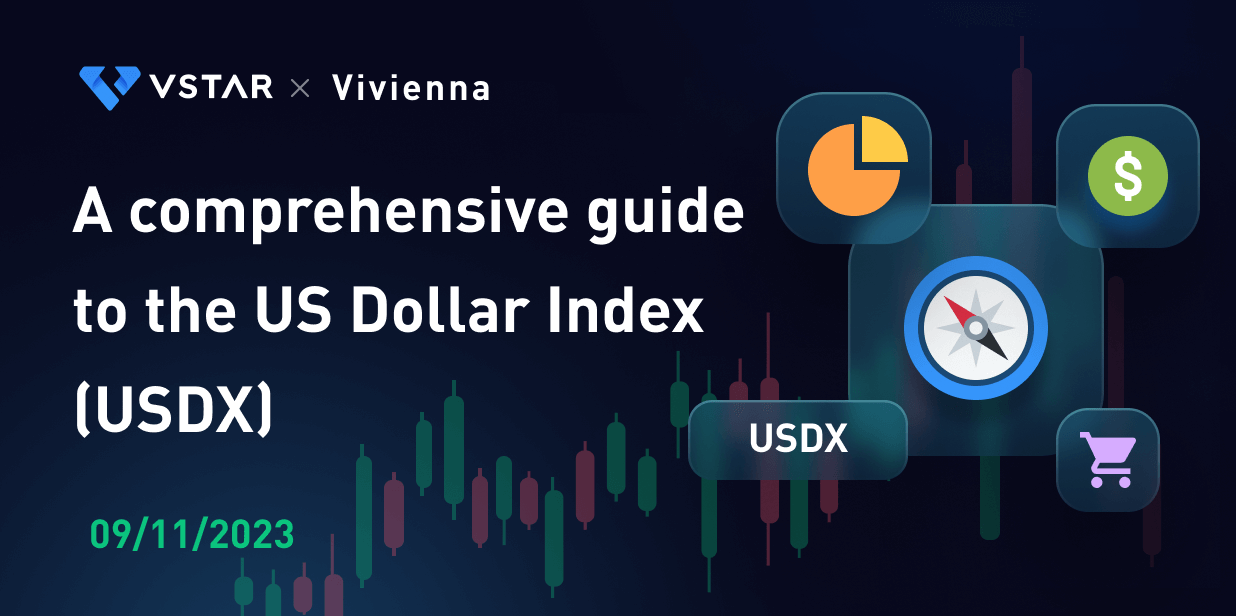

Chart: U.S. Treasury Debt Ceiling Raised Again, Issuance Reaches $32 Trillion

Source FRED

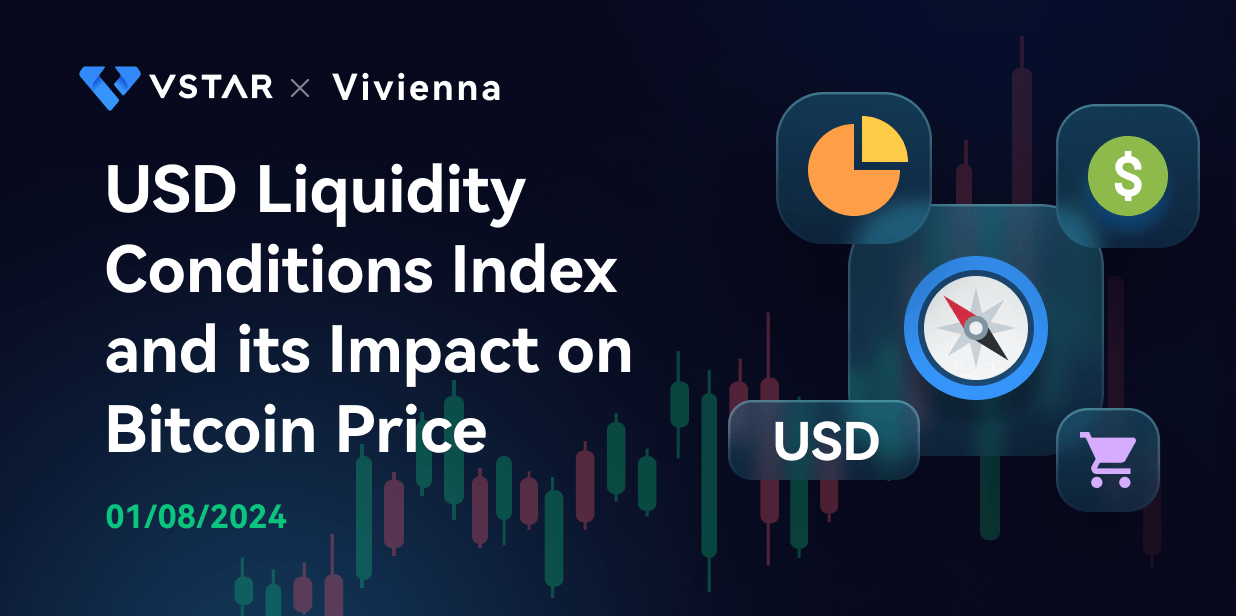

Meanwhile, government deficits continue to rise and the overall debt burden continues to increase. Fitch expects the U.S. general government deficit to rise from 3.7% of GDP in 2022 to 6.3% in 2023. The deficits are expected to rise to 6.6% and 6.9% of GDP in 2024 and 2025, respectively.

Chart: US general government deficit at 5.4% of GDP in 2022

Source: FRED

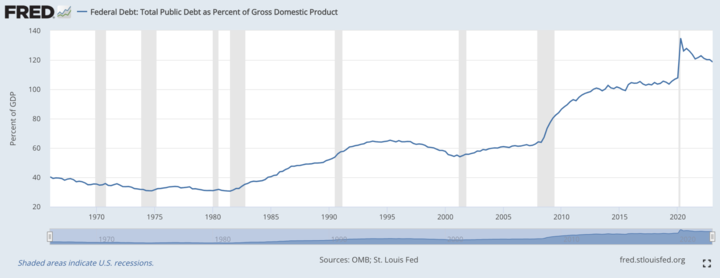

Fitch expects U.S. general government debt to continue to rise, reaching 118.4% of GDP in 2025, as interest rates are expected to remain high.

Chart: General government debt to GDP ratio reaches 118% in the first quarter of 2023

Source: FRED

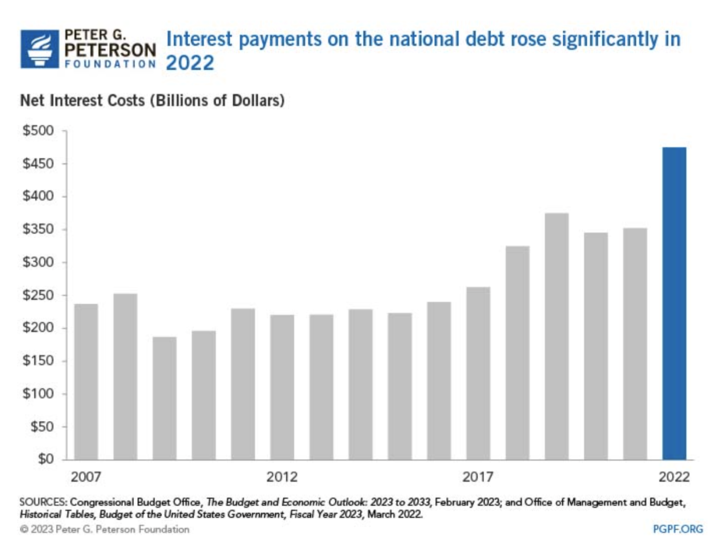

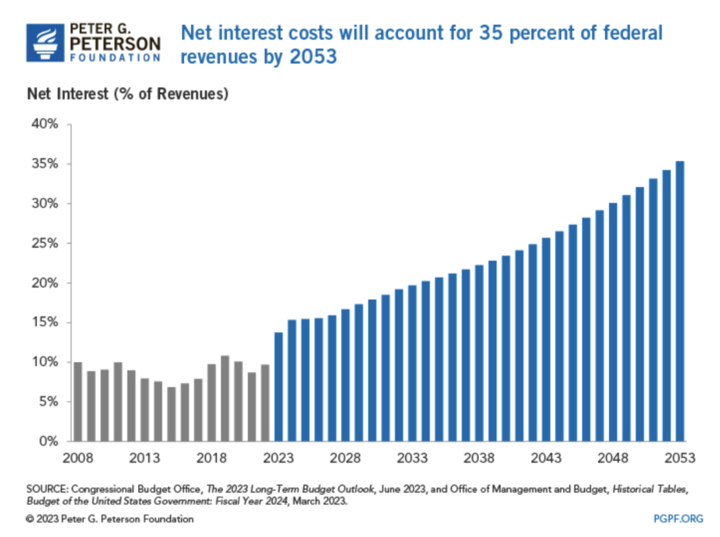

Fitch predicts that U.S. interest costs will double to 3.6% of GDP by 2033. The U.S. Congressional Budget Office also made a prediction on the U.S. debt interest in government revenue as a percentage of annual U.S. debt interest in 2022 amounted to $476 billion, and by 2035 the U.S. debt interest as a percentage of government revenue will reach 35%.

Chart: Annual U.S. debt interest reaches $476 billion in 2022

Source: Congressional Budget Office

Chart: Interest on U.S. debt projected to reach 35% of government revenues by 2035

Source: Congressional Budget Office

In addition, Fitch believes that continued high inflation, tighter financial conditions, weakening investment momentum, slowing consumption, and recessionary expectations will further undermine the U.S. government's fiscal position.

Although Treasury Secretary Yellen accused Fitch's report based on "seriously outdated", but undeniably, in the past year more than the background of high inflation, as well as a period of 16 months of violent interest rate hike cycle, U.S. bond yields have climbed to highs since 2008, and the yield curve for a long time seriously inverted.

Chart: 10-Year US Bond Yield Performance

Source: Yahoofinance

Chart: 3-month US short-term bond yield performance

Source: FRED

Gold's performance is mediocre

While the stock market has reacted strongly to the Fitch downgrade of US debt, gold is currently flat.

In a highly leveraged, high-interest-rate cycle, the key drivers of the short-term price of gold are the U.S. dollar and U.S. real interest rates.

As the international market gold traded with the dollar, so the dollar exchange rate on the price of gold has a direct impact: the dollar depreciation, gold for other currencies will be relatively cheap, more money into the international market to push up the price of gold. And the dollar appreciation, the theory is not conducive to the price of gold. U.S. dollar index in the market panic high point to appreciation.

Chart: Gold price vs. US dollar index, largely negatively correlated

Source: Yahoofinance

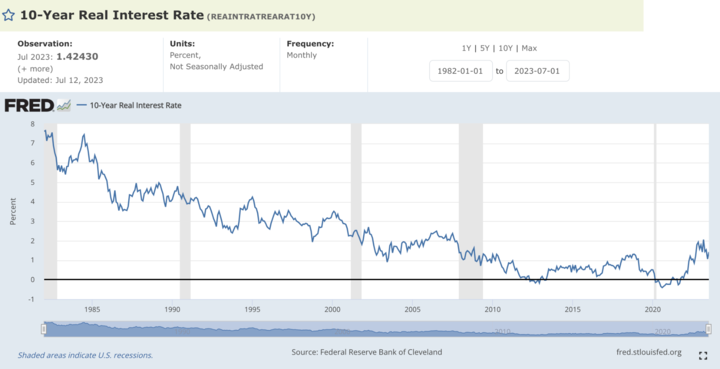

There is typically an inverse relationship between US real interest rates and the price of gold. When U.S. real interest rates are low or negative, i.e. inflation exceeds nominal interest rates, the opportunity cost of holding defensive assets such as gold falls. In this case, investors may be more inclined to invest in gold as a hedge against potential currency depreciation and to preserve purchasing power. On the other hand, when real interest rates are higher, the opportunity cost of holding gold increases, as investors can earn relatively higher returns on interest-bearing assets such as bonds or deposits. As a result, demand for gold may decline and its price may come under pressure. With the current rise in the Federal Funds rate to 5.5% and inflation (CPI) down to around 4%, real interest rates are at a low level of around 1.4%.

Chart: US real interest rates

Source: FRED

U.S. Treasury yields represent the interest rate on government debt. When U.S. Treasury yields rise, investors may find the returns on these safer assets more attractive than holding non-yielding assets such as gold. As a result, they may shift their investments from gold to Treasuries, causing the price of gold to fall.

Chart: U.S. 10-year bond yield and gold price performance

Source: Yahoofinance

Seasonal studies show that the fourth quarter often sees a rise in the 10-year US bond yield. Pershing Square Capital hedge fund manager Bill Ackman said on social media that he was "massively" short the 30-year US Treasury bond and that he expected longer-term US bond rates to continue to rise.

So with the dollar and US bond yields rising again, and uncertainty about real interest rates due to inflation, gold is in a bit of a tactical short-term panic and may not bounce back quickly.

Safe haven or anti-inflationary asset

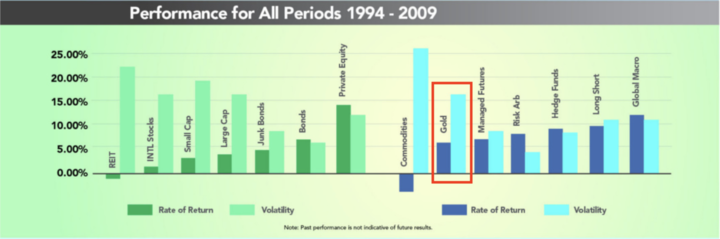

Gold has long been recognized as an asset that can provide returns in times of uncertainty. And historically, gold has delivered positive long-term returns during both growth and crisis periods. However, gold's 10-year and 20-year compound annualized returns are no better than any other asset (behind U.S. equities), and its volatility over the 1994-2009 period is no worse (behind commodities).

Chart: Historical Gold Returns and Volatility 1994-2009

Source: visualcapitalist

Gold and Risky Markets

From an asset allocation perspective, safe-haven currencies tend to be characterized by investors choosing this safe asset in large quantities when they are risk-averse. In the event of a sharp rise in global risk price indicators (e.g. the VIX index) and a significant change in asset prices and the associated capital and credit flows, global funds tend to focus on safe haven assets in individual currencies such as U.S. Treasuries, the U.S. dollar, the Japanese yen and the Swiss franc, as well as physical assets such as gold and commodities. The supply of gold is relatively stable and, unlike currency, can be printed at will. As a result, the supply of gold grows more slowly, which helps maintain its scarcity and value. In times of economic instability, investors may seek safe havens to protect their wealth, so gold is often seen as a safe haven option because it performs well during financial crises or geopolitical tensions.

Gold and Inflation

Inflation-resistant assets are those that maintain or increase their value during periods of inflation. These assets tend to outperform during inflation because their appreciation can exceed the rate of inflation, helping investors maintain their purchasing power. However, gold does not seem to perform well on an inflation-resistant basis.

The inflation-adjusted price of gold provides a broader and longer-term perspective that helps us understand how the real value of gold has changed over time. When the inflation-adjusted price of gold rises, it means that gold has become more valuable in terms of its real purchasing power. In other words, we can buy more goods and services in terms of the purchasing power of gold. In terms of gold price movements, if gold has an inflation-protecting function, then the price excluding inflation should at least be non-depreciating. The chart below shows the (inflation-adjusted) price history of real gold since 1970, and it can be seen that while gold experienced two rounds of major appreciation in 1972-1980 and 2006-2012, it has mostly depreciated at other times and does not have a value-preserving function. So, strictly speaking, gold is not a hedge against cash-based assets.

Chart: Inflation Adjusted Gold Price Updated August 2, 2023

Source: gurufocus

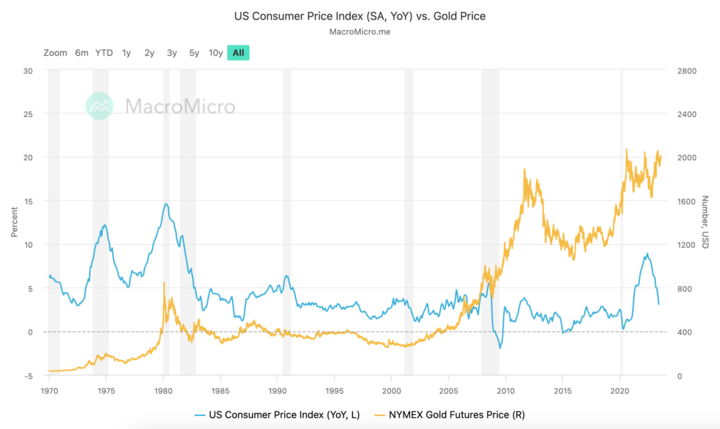

Some analysts would simplify the relationship between rising inflation and rising demand for gold, but the correlation between the two may or may not be simple. Increased demand can push gold prices up to a certain extent, but there are many other factors that influence gold prices: the international political situation, supply factors in the futures market, trading trends and investment sentiment can all have an impact on gold prices.

Chart: Gold Price vs. US CPI

Source: Marcomicro

Looking back to the 1970s, the last period of high inflation in the U.S., the historical experience of gold as an investment hedge may provide some insight.

Between 1974 and 2008, there were eight years when U.S. inflation was considered high. During this period, gold prices rose an average of 14.9% year-over-year. From 1973 to 1979, oil price shocks and energy shortages led to a high average annual inflation rate of about 8.8% in the United States. During this six-year period, gold returned an astounding 35% annually, making it a top inflation hedge and winning the favor of many investors.

However, between 1980 and 1984, when annual inflation averaged 6.5%, the price of gold fell by an average of 10% per year. Not only did gold underperform inflation, it also underperformed the S&P 500, real estate and commodities. Also, between 1988 and 1991, annual inflation averaged about 4.6%, but the price of gold fell an average of about 7.6% per year.

During the current inflationary cycle, gold is trending higher again. From November 2022 to February 2023, the price of gold rose 14%. However, this rise followed relatively weak performance in 2021 and 2022, and came at a time of heightened risk aversion during the heat of the Russia-Ukraine war. The U.S. CPI rose 4.2% year-over-year in April 2021, the first time it has risen more than 4% on an annual basis since 2008, with the U.S. CPI rising at an average annual rate of about 6.8% that year, while the gold price rose at an average annual rate of just 1% over the same period. Gold's recent underperformance has exposed its shortcomings as an inflation hedge.

Therefore, gold can be an effective inflation hedge, but only over a very long time horizon of a century.

Is Bitcoin a Risk and Inflation Resistant Asset?

The Background of Bitcoin

Bitcoin was born in 2009, in the wake of a global financial crisis triggered by the credit crunch, and has been dubbed "digital gold" by cryptocurrency enthusiasts, mainly due to the deflationary properties of a fixed and unchanging total amount of cryptocurrencies, which are very similar to those of gold. A slight difference is that the supply of bitcoin is only related to its block rules and is not limited by external natural conditions such as mining tools and geological environments, so even if the total amount of global computing power changes, its supply will always remain stable, so the supply of bitcoin is absolutely open, transparent and predictable. The mission of Bitcoin is to protect private property from "invasion", not only by centralized institutions with direct control over private property, but also by the increasing frequency and severity of crises due to the fragility of traditional finance. Individuals are unable to withstand the effects of these crises on their property, including the reduction of real purchasing power due to inflation or the devaluation of assets due to deflation.

Bitcoin as Currency

Satoshi Nakamoto's core value proposition for Bitcoin is "a peer-to-peer electronic cash system," a position that reveals three of Bitcoin's core values: peer-to-peer payments, electronic cash, and a system. Bitcoin currently has the general characteristics of a currency:

- A generalized medium of exchange: It can be accepted by buyers and sellers without the need for barter - for example, merchants such as Tesla accept Bitcoin payments.

- A store of value: It can be used to store value over a long period of time, and holding the currency maintains a certain amount of purchasing power - countries such as El Salvador or certain publicly traded companies include bitcoin as an asset on their balance sheets, reflecting bitcoin's value-storing function as an asset.

- Unit of value: Used to measure and compare the value of different goods and services - Bitcoin serves as a benchmark of value in the digital currency market and also anchors the energy behind the arithmetic, a unit of measurement of the value of energy.

In fact, bitcoin's advantages as a secure and convenient, low-cost, divisible global payment medium are unmatched by gold, which is no longer used as a payment medium in modern times. However, bitcoin also has significant limitations compared to fiat currencies backed by traditional government credit:

- Availability: The supply of money should be able to adapt to the needs of the economy, and should not be over-supplied, leading to inflation, nor under-supplied, leading to deflation - whether a lack of supply will have a deflationary effect on the Bitcoin ecosystem is a major concern, and modern monetary economics suggests that appropriate inflation is normal and allowed. allowed, the risk of deflation is much more dangerous. In this regard, it is important to note that Bitcoin is divisible: the smallest unit of Bitcoin is the Satoshi, with 1 Bitcoin (BTC) = 100,000,000 Satoshi, and the total amount of Bitcoin, while constant, can be divided almost indefinitely, which is more than enough to act as a currency within the range of the total value of human society.

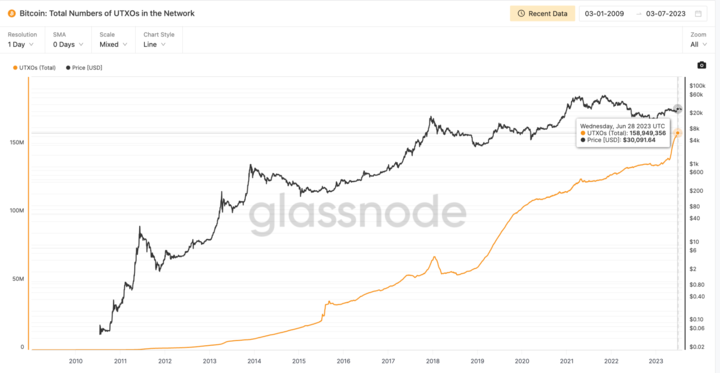

- Widespread acceptance: The currency must be widely accepted by society at large, both domestically and internationally. People must trust it and be willing to accept it as a medium of exchange. This is a test that any attempt at a super-sovereign currency must face, but the fact that Bitcoin's unique address count has reached 158 million, a rapid growth rate that exceeds the population of most countries on the planet (there are only 14 countries in the world with populations in the hundreds of millions), signals that acceptance has become increasingly widespread.

Figure: Bitcoin standalone address count trend (yellow line address count, black line price)

Source: glassnode

Bitcoin as an asset

In addition, the world has been quite critical of bitcoin's price volatility as a currency, which has hindered its adoption, and in doing so has determined that bitcoin is not a currency. But that's probably not a criticism worth making. Bitcoin was designed to be both a payment and an asset, and although its price fluctuations are influenced by supply and demand, sentiment and expectations, and its price performance is more akin to that of a high-risk speculative asset, this does not detract from the fact that it realizes the value of the inviolability of private property for those willing to accept it.

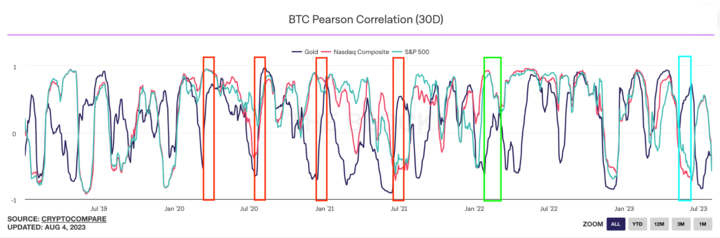

Even during periods of increased international political risk, such as the beginning of the Russia-Ukraine war (marked in green in the chart below), the resurgence of epidemics (marked in red) and the U.S. debt ceiling crisis (marked in blue), bitcoin's performance has decoupled from risky assets such as the stock market and converged with that of gold, reflecting a certain degree of anti-risk characteristics.

Chart: btc/gold/nasdaq/s&p 500 correlation

Source: theblock

Bitcoin's attributes as an inflation hedge have been tested for the first time in the past two years, during a period of significant inflationary increases. Bitcoin's price is down nearly 67% from its all-time high in November 2021, and it doesn't really qualify as an inflation hedge. But when discussing the inflationary performance of a currency, shouldn't we also pay attention to the fact that fiat currencies have lost real purchasing power in the course of their indiscriminate issuance?

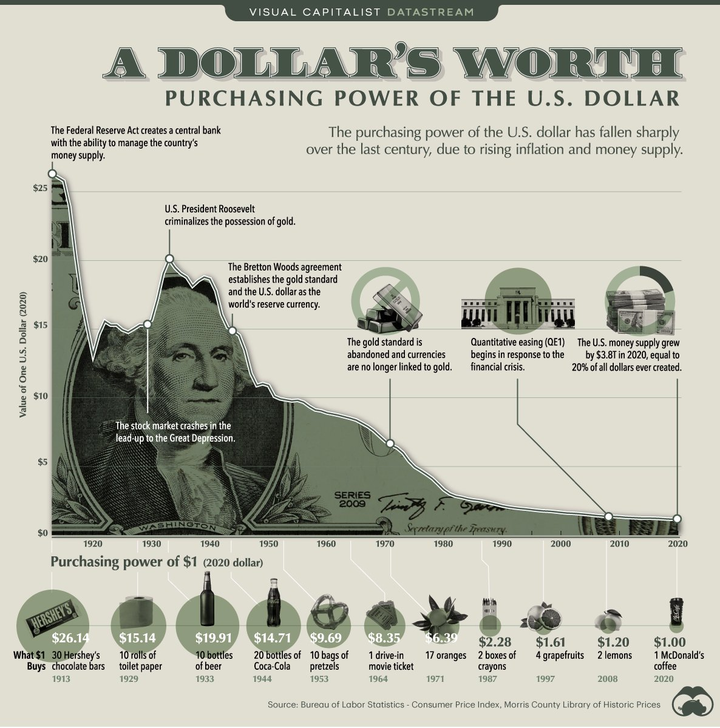

Figure: Historical Purchasing Power of $1

Source: Bureau of Labor Statistics

Conclusion

The answer to the question of Is gold or bitcoin the best anti-inflationary asset, may not have been in bitcoin's favor over the past two years, but with the halving every four years designed to combat the next round of loose monetary policy and the risk of increasingly frequent financial crises, and with the time cycle stretched out compared to gold's inflation-fighting performance over the course of a century, can we leave some room for hope for bitcoin as well?