Introduction

Swing trading is a trading strategy that aims to profit from price movements in financial markets such as stocks, forex, or commodities over a few days to several weeks. The goal is to identify and capitalize on market trends and price swings, taking advantage of the market's natural ebb and flow.

Swing trading has a number of advantages, and therefore is a very popular way to trade markets. Some of these benefits include that it can be done part-time, allowing those with full time jobs to take advantage of the financial markets. The profit potential is sometimes thought of as being more consistent, as the day-to-day noise doesn’t have as much influence. Most importantly, swing trading is much less stressful than trading short-term charts.

Swing trading typically requires a strong grasp on technical analysis, as well as a basic fundamental analysis ability. A trading plan is crucial, just as it is again in any type of trading. The swing trader will also need sufficient trading capital in order to be able to take advantage of the bigger moves. Stop losses can be bigger in swing trading, so tiny accounts aren’t necessarily suited for it.

Understanding Swing Trading in CFD Markets

Swing trading is a trading strategy that entails holding positions for a short to medium period of time, typically a few days to a few weeks. It seeks to profit from market price fluctuations or "swings," which are typically caused by market fluctuations or changes in investor sentiment.

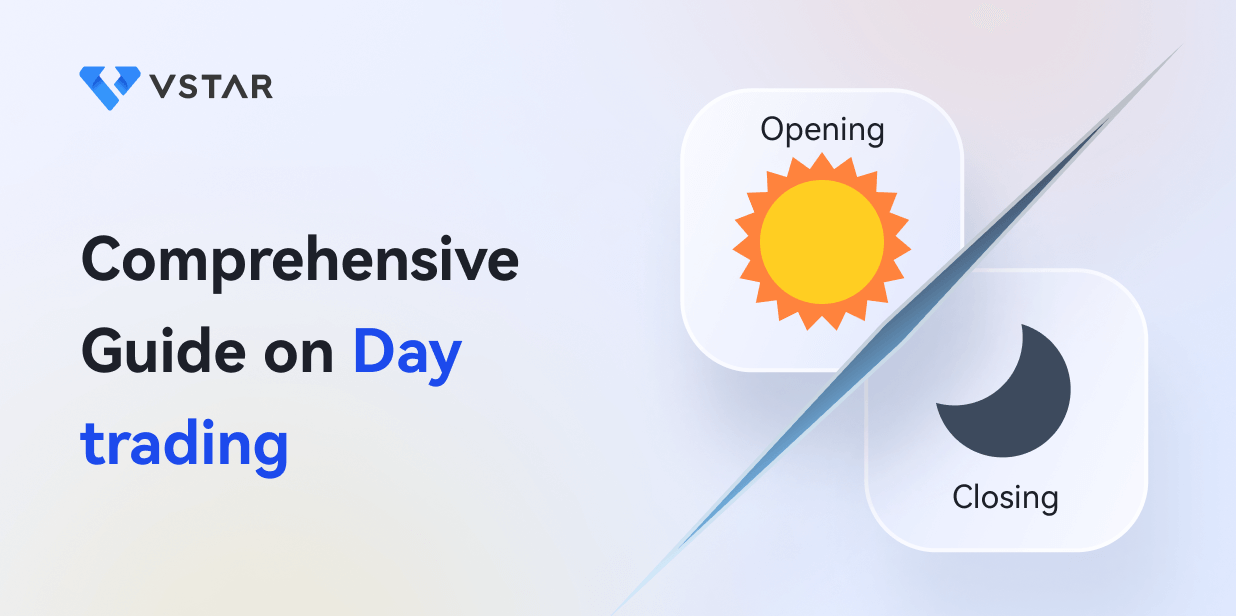

A chart showing swing highs and lows. Traders will enter in either direction, buying (green) or selling (red).

Swing traders, as opposed to day traders, who close out their positions at the end of each trading day, may hold their positions overnight or for several days, but rarely for more than a few weeks. This strategy enables them to profit from larger price movements while minimizing the risks associated with long-term investments. However, they are not like long-term traders, as they are not simply “buy and hold.”

A swing trader must have the following characteristics:

Short to medium term focus: Swing traders typically hold positions for a few days to a few weeks, and rarely for more than a few months. They intend to profit from market price fluctuations in the short term.

Technical analysis: Swing traders rely heavily on technical analysis to identify market trends, patterns, and support and resistance levels. To make informed trading decisions, they employ charting tools, indicators, and other technical analysis techniques.

Risk management: Swing traders are risk-averse and frequently use stop-loss orders to limit their potential losses. They also employ position sizing and risk-reward ratios to ensure that potential profits exceed potential losses.

Patience: Swing traders must be patient while waiting for the right trading opportunities to present themselves. They rarely make rash trades based on short-term market fluctuations.

Flexibility: Swing traders are adaptable to changing market conditions. They might change their trading strategies in response to new information or market developments.

Discipline: Successful swing traders are disciplined and stick to their trading plans. They do not make trading decisions based on emotions or market hype.

Identifying CFD Assets for Swing Trading

CFD stands for Contract for Difference. It is a financial derivative product that allows traders to speculate on the price movements of various underlying assets, such as stocks, indices, commodities, and currencies, without owning the underlying asset itself.

In a CFD, the buyer and seller agree to exchange the difference in the price of the underlying asset from the time the contract is opened to the time it is closed. If the price of the underlying asset increases, the buyer makes a profit, and if it decreases, the seller makes a profit.

CFDs allow traders to trade on margin, which means they can open a position with a fraction of the total value of the underlying asset and leverage their positions to potentially generate higher returns. However, trading on margin also carries a higher risk, as losses can exceed the initial investment.

Identifying the assets to swing trade will come down to risk profile. This is because some markets are more volatile than others, so much of what a trader will be looking for is a market that matches their risk tolerance more than anything else. Also, the bigger markets such as currencies tend to be attractive to swing traders.

Building a Swing Trading Plan

Developing a CFD trading plan is an essential part of becoming a successful trader. Here are some steps you can take to develop a CFD trading plan:

Define your goals and risk tolerance: Before you start trading, you need to determine what you want to achieve and how much risk you are willing to take. Your goals should be realistic, achievable, and aligned with your overall financial objectives.

Choose your trading strategy: You need to decide on a trading strategy that suits your goals, risk tolerance, and trading style. There are various trading strategies, such as swing trading, day trading, and position trading, and each has its own strengths and weaknesses.

Set your entry and exit rules: Your entry and exit rules should be based on your trading strategy and should be clearly defined. You should have a plan for when to enter a trade, what indicators to use, and when to exit a trade, either to take profits or cut losses.

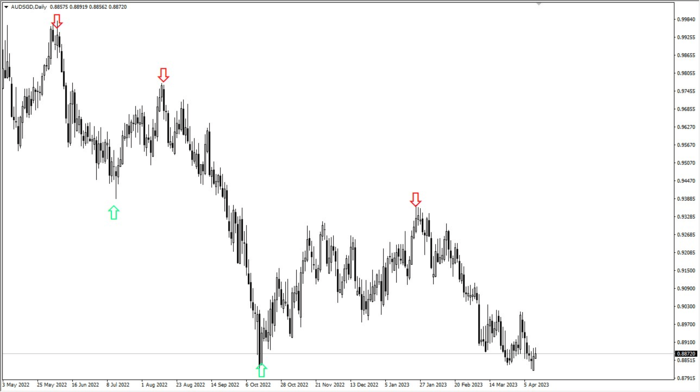

A chart showing a moving average crossover system. One of the most common is using 50-day EMA with the 200-day EMA. As they cross, a trade is triggered.

Manage your risk: Risk management is crucial in CFD trading. You need to have a plan for managing your risk, such as setting stop-loss orders to limit your losses and position sizing to manage your exposure.

Monitor your performance: It is essential to monitor your trading performance regularly and make adjustments to your trading plan as necessary. You should keep a trading journal to record your trades and analyze your performance.

Keep learning: The financial markets are constantly changing, and it is essential to keep learning and improving your trading skills. You can attend trading courses, read books, or follow market experts to stay up to date with market trends and news.

Remember that developing a CFD trading plan takes time and effort, but it is essential for success in the markets. A well-designed trading plan will help you stay focused, disciplined, and consistent in your trading activities. One of the most important things to do as a professional trader is to always monitor results. Furthermore, you must understand how to analyze technical and fundamental indicators to recognize trading opportunities.

Implementation of Swing Trading in CFD Markets

Entering a swing trade involves identifying an opportunity and executing a trade with the goal of profiting from a short to medium-term price movement. Here are some steps to follow when entering a swing trade:

Identify potential trade setups: Using technical analysis, such as trend reversals, breakouts, or pullbacks. Look for patterns and signals that point to a possible price movement. Remember, you are trying to join the next leg higher or lower.

A potential swing set up. A daily hammer at a large figure - 95 - and an area where buyers came into the CAD/JPY pair. At the green arrow, swing traders would look at this as a potential signal.

Determine your entry point: Determine your entry point, which is the price at which you will enter the trade, based on your analysis. A variety of technical indicators and charting tools can assist you in determining your entry point.

Set your stop-loss order: To limit your potential losses if the trade goes against you, place a stop-loss order. The stop-loss order should be placed below the entry point, and the distance between the two should be determined by your risk management strategy.

Determine your position size: Decide how much of your trading capital you are willing to risk on the trade. Your position size should be determined by your risk management strategy and be appropriate for the size of your account and risk tolerance.

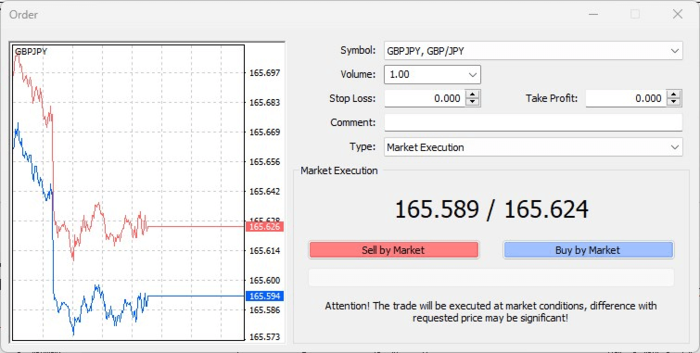

Execute the trade: Once you've decided on an entry point, a stop-loss order, and a position size, you can place the order through your broker's trading platform.

Managing a swing trade is typically where most traders make mistakes. Remember, you are trying to ride the market from one swing low to the next swing high, or vice versa. Unfortunately, not everyone can keep their cool while waiting for a trade to play out.

Be patient: Part of the major advantage of being a swing trader is that you are allowing the market to “breathe.” You simply must allow the trade to play out and understand that the market will have the occasional pullback against the original position, even with winning trades.

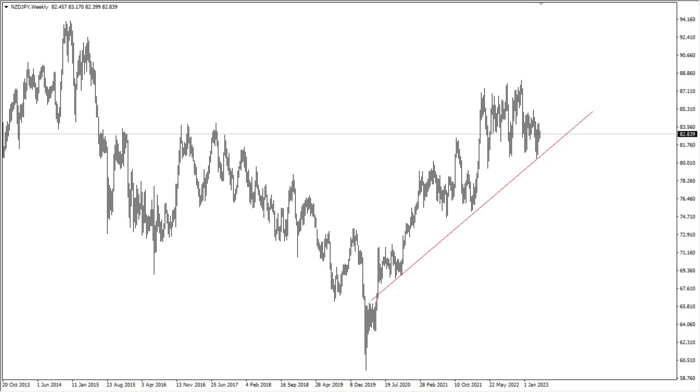

Be mindful of the long-term trend: One major influence on your trading should be the overall trend. The longer-term trend of a market doesn’t change very quickly, although there can be occasions when the market moves against it. However, this is natural, and doesn’t mean anything has changed.

A weekly NZD/JPY chart showing the longer-term uptrend, zoomed out. Make sure to be aware of this, no matter the length or duration of your trade.

Pay attention to market changes: The trickiest part is when you get an actual fundamental change in the overall market. These changes don’t happen often, but the reality is that they can. (An example might be an emergency rate cut by a central bank.) In these unexpected times, it can warrant a closing out of the position. Most of the time, these changes do not happen though.

The most important thing that traders must pay attention to is discipline. The #1 killer of trading accounts is a deviation of discipline. The most important thing you can do is stick to your plan.

Honor your stops: You put your stop loss order on the trade for a reason. You should never change your stop loss unless you are trying to lock in profits. By changing your stop loss to what could be a bigger loss in order to avoid being stopped out is dangerous.

Position sizing is paramount: There are only a handful of things that you control. Beyond entries, exits, stop loss orders, and profit orders, the only other thing is the position size. By allowing for losses, a smaller position size can keep you in the game for longer.

Understand why you are in the trade: Unfortunately, a lot of traders don’t truly understand why they are taking a trade. There is a point where you decided to get involved, and you also have a couple of ideas where you need to get out. Remember these as the market moves either for or against you.

Monitoring and Adjusting Your Swing Trading Strategy

One of the more advanced concepts for the trader to consider is how to monitor and adjust your trading strategy. The ability to look back at the recent past and understand what has happened. The first thing you must do is to keep a trading journal. The ability to look back at the past trading and see where your profits and losses come from is important.

Volatility is a major factor in the markets, and one of the easiest ways to keep an eye on volatility is to measure the overall range on a daily basis in the markets that you are trading. One easy way is to use and indicator like Average True Range, which will tell you the size of the trading range over the last “N sessions.” By knowing how much a market can move in a hour, day, week, or whatever time frame you are trading, you can know if you need bigger or smaller stop losses.

Managing risks preventing losses is somewhat of a limited possibility for the average trader. Unless you go into the options market, or even with some kind of credit swap if you can, the best thing you can do is to simply set a reasonable stop loss, and a reasonable position size. That being said, one of the great things that markets offer swing traders is that the longer-term uptrend, as an example, typically returns so it allows adding to a position as the market moves along on each dip.

Risks and Potential Rewards in Swing Trading

Swing trading, like any other trading strategy, comes with risks that traders must be aware of. Here are some of the dangers of swing trading:

· Swing traders are exposed to market risk, which is the risk of losing money due to market fluctuations. The market can be volatile and unpredictable, with price movements that are abrupt and abrupt. Swing traders must be prepared to suffer significant losses.

· Swing traders may use leverage to boost their potential profits, but this also raises their risk. Margin trading magnifies both gains and losses, and traders can lose more than their initial investment.

· Swing traders must carefully manage their position sizes to ensure that their potential losses do not exceed their risk tolerance. The process of determining how much of your trading capital to risk on each trade is known as position sizing. A loss on a single trade can be significant if the position size is too large.

· Swing traders heavily rely on technical analysis to make trading decisions, but technical analysis is not always accurate. False signals from technical indicators and patterns can result in losses. Also, swing traders must be aware of news and events that may have an impact on the markets and their trades. Unexpected news or events can cause price fluctuations and significant losses.

Swing trading can be a profitable trading strategy for those who succeed. Here are some of the potential benefits of swing trading:

· Swing trading allows traders to profit from market price movements in the short to medium term, typically holding positions for a few days to a few weeks. This has the potential to result in faster gains than longer-term investments.

· Swing traders may use leverage to generate higher potential returns on their trades. Leverage enables traders to control larger positions with less capital, thereby increasing their potential returns.

· Swing traders can adapt their trading strategies to changing market conditions and profit from both bullish and bearish trends. This adaptability enables potentially higher profits in a broader range of market conditions.

· Swing traders are typically risk-averse, employing stop-loss orders and position sizing to limit potential losses. This protects their capital and lessens the impact of any losses.

· Swing trading allows traders to trade in a more relaxed manner than day trading, which requires traders to make quick decisions throughout the day. Swing traders have more time to analyze the market and make informed decisions, which reduces the emotional stress of trading.

Conclusion

When it comes to swing trading, there are a lot of advantages over other types of trading. The sheer possibility of those who are working full-time to take advantage of financial moves, as the trader doesn’t have to sit at their computer the entire time. It is a matter of placing a trade, and letting the market do what it will.

It is not without its risks. Furthermore, there remains the need to become adept at technical analysis, fundamental analysis, and position management. The swing trader tries to capture bigger moves over the course of a few days or even weeks. It is not a “buy and hold” strategy, rather it is trying to catch major swings in the market. It allows for greater profits, but it also means that you must be willing to let the trade run to its conclusion.

Discipline is without a doubt the main stumbling block for a lot of swing traders. By allowing the market to either hit the stop loss or take profit order, you are essentially placing an order and allowing your account to grow without a lot of interference. It is typically when traders “tinker” with a trade that they struggle as swing traders. (This assumes that a solid technical analysis understanding and a strategy that is workable are employed.)

Swing traders, overall, eliminate a lot of the potential issues that you may face. However, you need to determine whether this kind of trading is for you. You can test whether this is a style you want by opening a demo account with VSTAR. This will allow you to test your potential system while noting whether or not the timeframe of a swing trader suits you.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.