I. Hiệu suất cổ phiếu Tilray gần đây

Tilray Brands (NASDAQ: TLRY) đã trải qua những biến động đáng kể về giá cổ phiếu trong giai đoạn gần đây. Cổ phiếu có phạm vi biến động trong 52 tuần là $1,50-$3,40.

Trong ngắn hạn, động lượng của Tilray dường như đang có quỹ đạo đi xuống. Trong ba tháng qua, cổ phiếu đã ghi nhận hiệu suất giá âm -13,50%, cho thấy sự sụt giảm đáng chú ý về giá trị. Xu hướng này tiếp tục trong khoảng thời gian sáu tháng, với hiệu suất giá giảm 9,42%. Động lượng âm vẫn tồn tại trong khoảng thời gian 9 tháng, mặc dù ở mức độ thấp hơn, với mức giảm 2,26%. Những số liệu này cho thấy cổ phiếu Tilray đã phải đối mặt với những thách thức và khó khăn trong việc tạo ra lợi nhuận dương cho các nhà đầu tư trước mắt.

Việc xem xét khung thời gian một năm sẽ mang lại cái nhìn rộng hơn về hiệu suất của Tilray, cho thấy giá cổ phiếu của công ty này đang giảm đáng kể. Với hiệu suất giá trong một năm là -28,22%, Tilray đã trải qua sự sụt giảm giá trị đáng kể trong năm qua.

Nguồn: cnn.com

Các yếu tố ảnh hưởng

Tilray Brands hoạt động trong một bối cảnh năng động được định hình bởi vô số yếu tố.

Môi trường pháp lý: Những thay đổi về quy định tác động đáng kể đến hoạt động của Tilray. Ví dụ, ở Canada, cơ cấu thuế tiêu thụ đặc biệt ảnh hưởng trực tiếp đến lợi nhuận. Tilray dự đoán khoản tiết kiệm hàng năm là 80 triệu USD nếu thuế tính theo gam hiện tại được thay thế bằng Thuế giá trị quảng cáo 10%. Ngoài ra, cải cách quy định, chẳng hạn như thay đổi các quy tắc tiếp thị và các quy định về hiệu lực của THC, có thể mở ra những cơ hội thị trường mới.

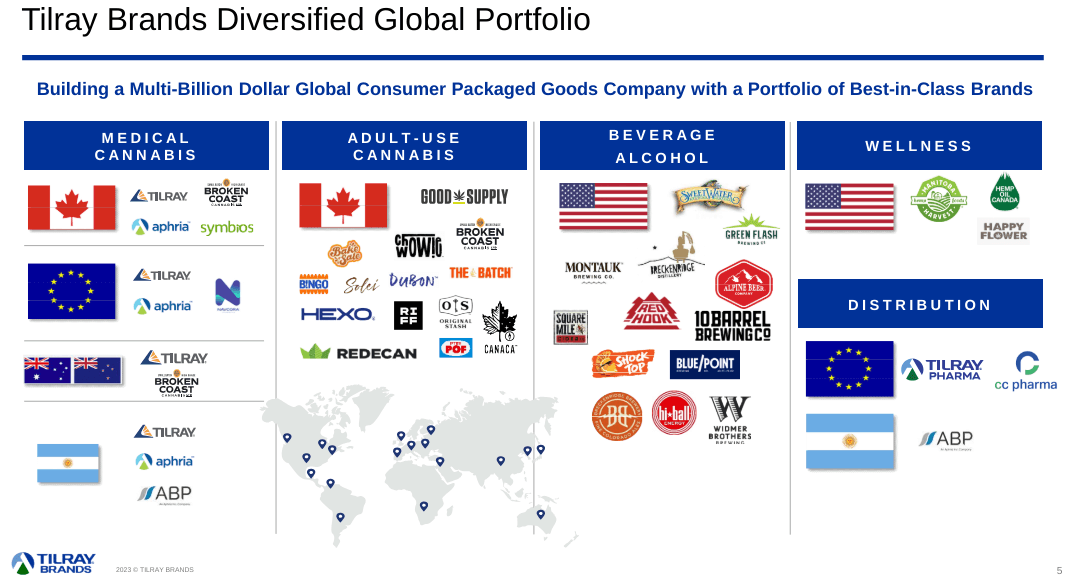

Định vị thị trường: Sự thống trị thị trường của Tilray ở các khu vực trọng điểm như Canada và Đức mang lại lợi thế cạnh tranh. Với thị phần lớn nhất ở Canada và thị phần doanh thu hàng đầu ở Đức, Tilray có vị trí chiến lược để tận dụng sự tăng trưởng của thị trường. Hơn nữa, danh mục đa dạng của họ bao gồm cả cần sa dành cho người lớn và cần sa y tế giúp tăng cường khả năng phục hồi thị trường của họ.

Mở rộng quốc tế: Chiến lược mở rộng toàn cầu của Tilray tận dụng các thị trường mới nổi như Đức và Châu Âu. Thị trường cần sa y tế trị giá 3 tỷ USD ở Đức và thị trường Châu Âu tiềm năng trị giá 45 tỷ USD mang lại triển vọng tăng trưởng đáng kể. Những thay đổi về quy định, chẳng hạn như việc loại bỏ cần sa y tế khỏi các hành vi ma tuý, mang đến cơ hội cho Tilray mở rộng cung cấp sản phẩm của mình và tăng khả năng thâm nhập thị trường.

Mua lại và Đa dạng hóa: Chiến lược mua lại của Tilray, được minh họa bằng việc mua lại HEXO và Truss, nhằm mục đích thúc đẩy sự phối hợp và mở rộng phạm vi tiếp cận thị trường. Các sáng kiến tiết kiệm chi phí, như hợp lý hóa SKU và hợp nhất cơ sở, nâng cao hiệu quả hoạt động. Đa dạng hóa sang các thị trường lân cận, chẳng hạn như đồ uống và sản phẩm chăm sóc sức khỏe, giảm thiểu rủi ro và thúc đẩy tăng trưởng doanh thu.

Đổi mới và xây dựng thương hiệu: Sự tập trung của Tilray vào đổi mới và xây dựng thương hiệu đã củng cố vị thế dẫn đầu thị trường của họ. Đầu tư vào đổi mới sản phẩm, như đồ uống có chứa THC và các dẫn xuất từ cây gai dầu, nhằm đáp ứng nhu cầu ngày càng tăng của người tiêu dùng. Các nỗ lực xây dựng thương hiệu mang tính chiến lược, chẳng hạn như việc hồi sinh Shock Top và mở rộng sang lĩnh vực hàng không cồn, nhằm mục đích nắm bắt các phân khúc và dịp tiêu dùng mới.

Nguồn: Investor Presentation

Hiệu suất tài chính: Hiệu suất tài chính của Tilray phản ánh quỹ đạo tăng trưởng và hiệu quả hoạt động của họ. Bất chấp những thách thức như tăng thuế tiêu thụ đặc biệt và nén giá, Tilray vẫn đạt được mức tăng trưởng doanh thu đáng kể là 30% trong Quý 3. Dòng tiền tự do được điều chỉnh dương và các sáng kiến giảm nợ giúp nâng cao sự ổn định và linh hoạt về tài chính, củng cố niềm tin của nhà đầu tư.

Thông tin chuyên sâu của chuyên gia về dự báo cổ phiếu Tilray Brands cho năm 2024, 2025, 2030 và xa hơn

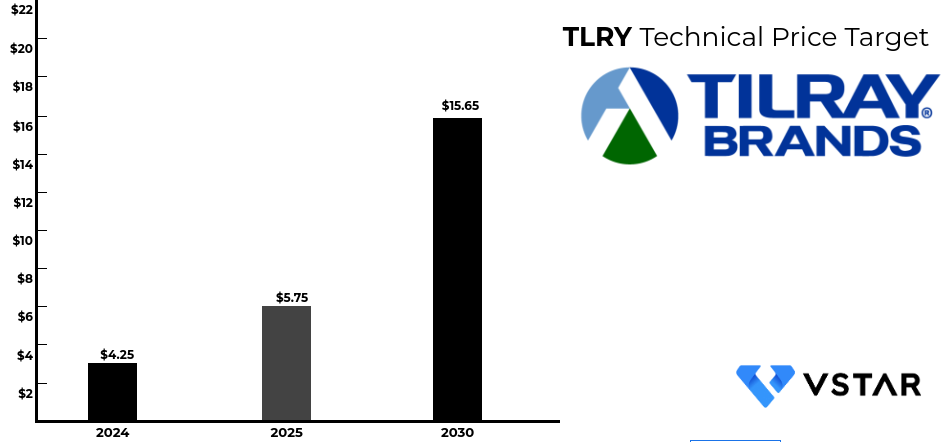

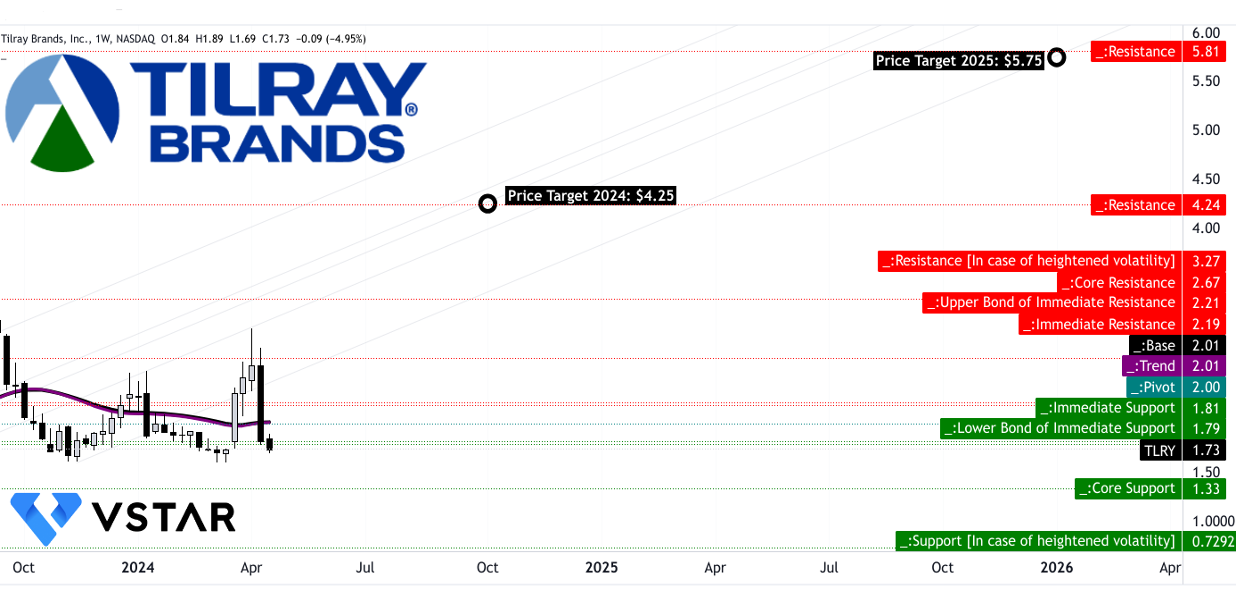

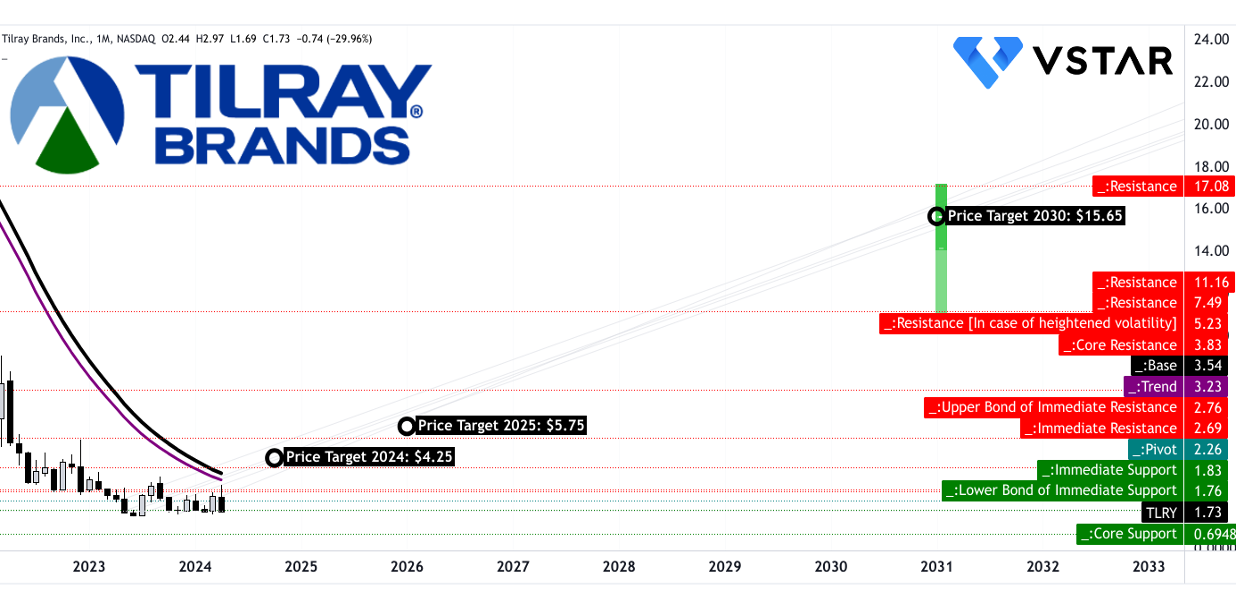

Cổ phiếu của Tilray Brands đặt mục tiêu giá 4,25 USD vào năm 2024, phản ánh sự lạc quan thận trọng trong bối cảnh không chắc chắn về quy định. Đến năm 2025, dự đoán sẽ có mức tăng vừa phải lên 5,75 USD khi nỗ lực hợp pháp hóa đạt được sức hút, mặc dù độ bão hòa thị trường vẫn là một mối lo ngại. Nhìn đến năm 2030, mức tăng tiềm năng sẽ lên tới 15,65 USD hoặc cao hơn nếu quá trình hợp pháp hóa toàn cầu tăng tốc.

Nguồn: Analyst's compilation

II. Dự báo cổ phiếu Tilray năm 2024

Mục tiêu giá TLRY vào cuối năm 2024 được đặt ở mức 4,25 USD. Dự báo này dựa trên đà thay đổi phân cực trong thời gian ngắn và nó được dự đoán trên các mức Fibonacci retracement/extension. Điều này cho thấy kỳ vọng về sự gia tăng đáng kể của giá cổ phiếu trong những năm tới, được thúc đẩy bởi những thay đổi đã được xác định trong tâm lý thị trường và phân tích kỹ thuật về biến động giá trong lịch sử.

Giá hiện tại của Tilray Brands là 1,73 USD, thấp hơn đường xu hướng và đường cơ sở là 2,01 USD, dựa trên đường trung bình động lũy thừa đã được sửa đổi. Điều này cho thấy xu hướng giảm vì giá hiện tại thấp hơn đường xu hướng, cho thấy động lượng giảm. Hướng của giá cổ phiếu được mô tả là đi ngang, ngụ ý thiếu sự chuyển động lên hoặc xuống rõ ràng trong thời gian trước mắt. Tuy nhiên, khi xem xét mức giá hiện tại đang nằm dưới cả đường xu hướng và đường cơ sở, có dấu hiệu cho thấy tâm lý giảm giá.

- Hỗ trợ chính: 1,79 USD

- Điểm Pivot của kênh giá ngang hiện tại: $2,00

- Các mức kháng cự: 3,27 USD (trong trường hợp biến động tăng cao), 2,67 USD (mức kháng cự cốt lõi), 2,21 USD

- Hỗ trợ cốt lõi: 1,33 USD

Các mức này cung cấp những điểm quan trọng để các nhà đầu tư theo dõi. Mức hỗ trợ chính và điểm pivot của kênh giá ngang hiện tại cho thấy các khu vực tiềm năng mà lực mua có thể tăng lên. Các mức kháng cự biểu thị các điểm mà áp lực bán có thể tăng lên. Hỗ trợ cốt lõi ở mức 1,33 USD đặc biệt quan trọng vì nó thể hiện mức độ quan tâm mua tiềm năng mạnh mẽ.

Nguồn: tradingview.com

Mặt khác, giá trị chỉ số sức mạnh tương đối (RSI) hiện ở mức 41,8, cho thấy quan điểm trung lập. Không có tín hiệu rõ ràng về mức tăng hoặc giảm thường xuyên, cũng như không có bất kỳ dấu hiệu nào về phân kỳ tăng hoặc giảm. Tuy nhiên, xu hướng đường RSI đang giảm, cho thấy động lượng tăng đang suy yếu. Điều này ngụ ý rằng mặc dù chỉ số RSI không nằm trong vùng cực đoan, nhưng xu hướng giảm có thể cho thấy khả năng giá giảm thêm.

Đường trung bình động hội tụ phân kỳ (MACD) hiện ở mức -0,442, dưới đường tín hiệu -0,0531, cho thấy xu hướng giảm. Mặc dù xu hướng đang tăng nhưng cường độ của xu hướng này đang giảm dần, được biểu thị bằng giá trị biểu đồ giảm dần là 0,0089. Điều này cho thấy rằng mặc dù xu hướng chung là tăng nhưng đằng sau nó có động lực suy yếu, có khả năng báo hiệu sự đảo chiều trong tương lai gần.

Nguồn: tradingview.com

Theo tipranks.com, bảy nhà phân tích Phố Wall đều đồng thuận cho thấy mục tiêu giá trung bình là 2,62 USD cho cổ phiếu Tilray trong 12 tháng tới. Dự báo này cho thấy mức tăng đáng kể 51,45% so với mức giá hiện tại là 1,73 USD. Trong khi mức dự báo cao là 4,10 USD thể hiện sự lạc quan thì mức dự báo thấp là 2,00 USD cho thấy khả năng biến động tiềm ẩn.

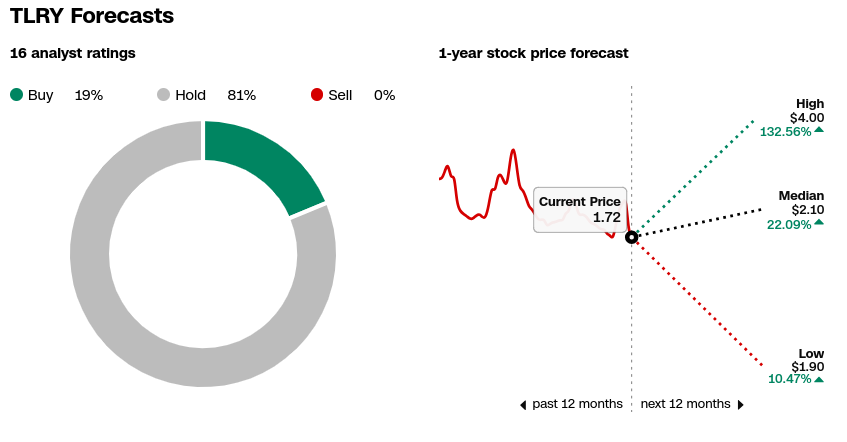

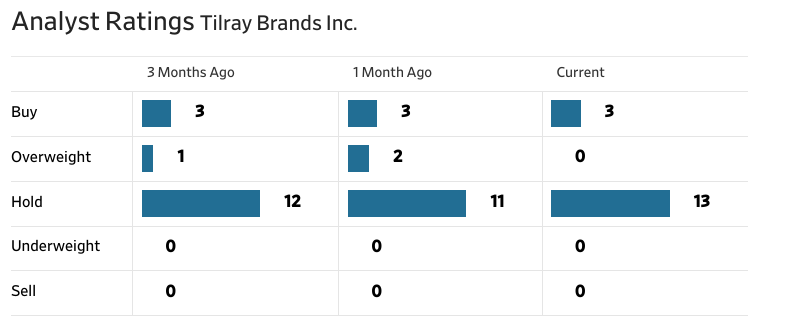

Ngược lại, dữ liệu của cnn.com lại cho thấy một quan điểm dè dặt hơn. Trong số 16 xếp hạng của nhà phân tích, chỉ 19% ủng hộ việc mua vào, trong khi 81% khuyên nên nắm giữ cổ phiếu Tilray. Dự báo dao động từ mức cao nhất là 4,00 USD đến mức thấp nhất là 1,90 USD, với mức dự báo trung bình là 2,10 USD. Sự đồng thuận như vậy chủ yếu nghiêng về sự lạc quan thận trọng, thừa nhận tiềm năng của cổ phiếu đồng thời kêu gọi kiềm chế.

Nguồn: cnn.com

Coinpriceforecast.com đưa ra quan điểm dài hạn, ước tính giá cổ phiếu Tilray sẽ đạt 2 USD vào cuối năm 2024, với dự báo tạm thời là 1,83 USD vào giữa năm nay. Dự báo này cho thấy mức tăng vừa phải là 19% trong suốt cả năm.

A. Thông tin chuyên sâu khác về dự báo cổ phiếu TLRY năm 2024

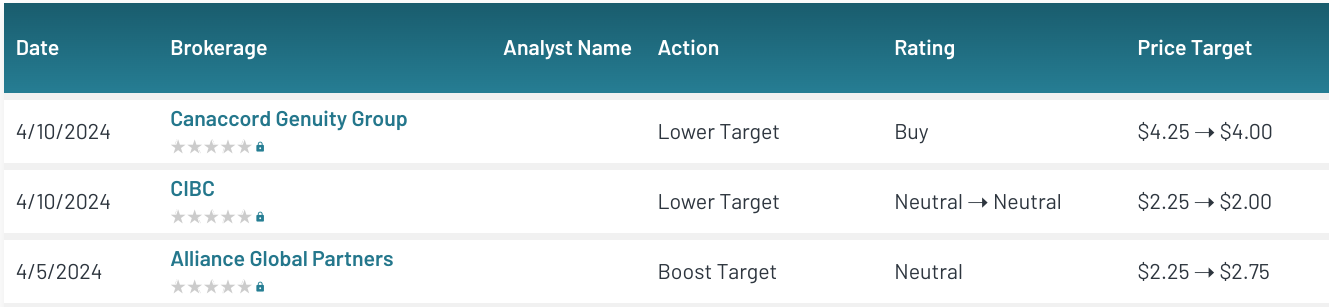

Tilray Brands phải chịu những quan điểm khác nhau từ các tổ chức tài chính và nhà phân tích, bằng chứng là những dự báo và điều chỉnh xếp hạng gần đây. Vào ngày 10 tháng 4 năm 2024, Canaccord Genuity Group đã hạ mục tiêu giá cổ phiếu TLRY từ 4,25 USD xuống 4,00 USD trong khi vẫn duy trì xếp hạng "Mua". Tương tự, CIBC đã điều chỉnh mục tiêu của mình từ 2,25 USD xuống 2,00 USD trong khi vẫn giữ mức xếp hạng ở mức "Trung lập".

Những điều chỉnh này có thể phản ánh những thay đổi trong tâm lý thị trường hoặc những thay đổi trong triển vọng cơ bản của công ty. Đối với Canaccord Genuity, việc giảm mục tiêu giá có thể gợi lên mối lo ngại về triển vọng tăng trưởng hoặc hiệu suất hoạt động của Tilray, dẫn đến việc định giá thận trọng hơn. Ngược lại, quyết định duy trì xếp hạng "Trung lập" của CIBC cùng với mục tiêu bị hạ thấp có thể cho thấy quan điểm thận trọng hơn về tiềm năng của cổ phiếu, có thể do xu hướng chung của ngành hoặc sự phát triển cụ thể của công ty.

Ngược lại, Alliance Global Partners đã tăng mục tiêu cho Tilray từ 2,25 USD lên 2,75 USD vào ngày 5 tháng 4 năm 2024, trong khi vẫn duy trì xếp hạng "Trung lập". Sự điều chỉnh lạc quan này có thể xuất phát từ những diễn biến tích cực trong hoạt động kinh doanh của Tilray, chẳng hạn như kết quả tài chính đầy hứa hẹn hoặc các sáng kiến chiến lược được cho là sẽ nâng cao triển vọng dài hạn của công ty.

Nguồn: marketbeat.com

B. Các yếu tố chính cần theo dõi cho dự đoán cổ phiếu TLRY năm 2024

Khi phân tích dự đoán về cổ phiếu Tilray cho năm 2024, một số yếu tố chính xuất hiện từ cả tình hình tài chính và diễn biến gần đây:

Dự báo cổ phiếu TLRY năm 2024 - Các yếu tố tăng giá

- Dẫn đầu thị trường: Tilray nắm giữ thị phần đáng kể ở Canada, Đức và các thị trường quốc tế khác, định vị tốt để tận dụng các cơ hội tăng trưởng.

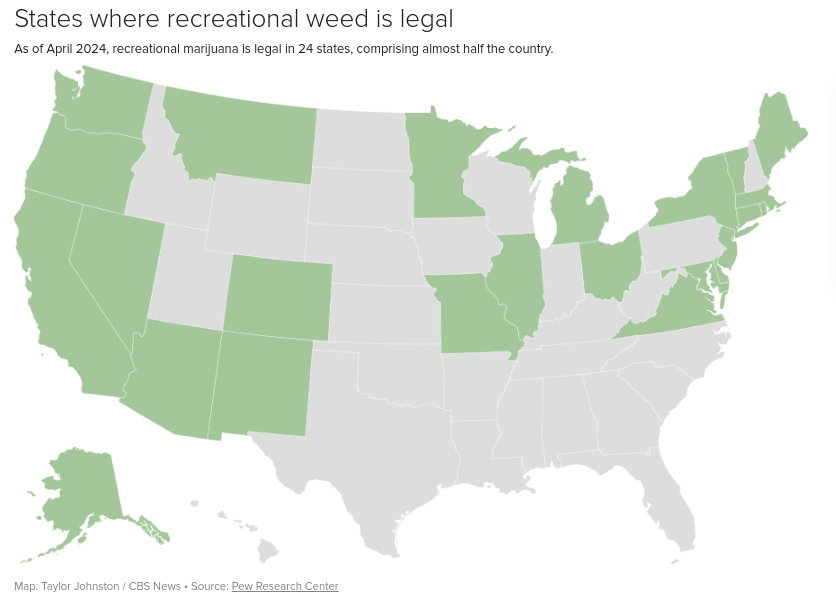

Tăng trưởng doanh thu: Ước tính doanh thu đồng thuận cho thấy sự tăng trưởng trong các quý sắp tới, tập trung vào tăng trưởng tự thân và mua lại chiến lược. - Hợp pháp hóa cần sa toàn cầu: Tilray được hưởng lợi từ việc hợp pháp hóa cần sa tiềm năng ở Hoa Kỳ, tận dụng chuyên môn và mạng lưới phân phối toàn cầu của mình để thâm nhập thị trường ngay lập tức.

- Đa dạng hóa: Việc Tilray mở rộng ngoài cần sa sang các thị trường lân cận như đồ uống có cồn và các sản phẩm chăm sóc sức khỏe sẽ đa dạng hóa nguồn doanh thu của mình, giảm sự phụ thuộc vào bất kỳ phân khúc nào.

- Sáng kiến giảm chi phí: Những nỗ lực nhằm hợp lý hóa hoạt động và tối ưu hóa cơ cấu chi phí, đặc biệt thông qua kế hoạch tích hợp HEXO, đã cho thấy sự tiến bộ, có khả năng cải thiện lợi nhuận.

- Cải cách quy định: Những thay đổi quy định dự kiến, chẳng hạn như điều chỉnh cơ cấu thuế tiêu thụ đặc biệt ở Canada, có thể tác động tích cực đáng kể đến lợi nhuận của Tilray.

Dự báo cổ phiếu Tilray năm 2024 - Các yếu tố giảm giá

- Tác động của thuế tiêu thụ đặc biệt: Thuế tiêu thụ đặc biệt cao ở Canada tiếp tục đè nặng lên biên lợi nhuận gộp của Tilray, ảnh hưởng đến lợi nhuận chung của công ty.

- Cạnh tranh và nén giá: Tại thị trường Canada, sự cạnh tranh từ lĩnh vực dành cho người lớn và việc nén giá trong phân khúc cần sa y tế đặt ra những thách thức đối với tăng trưởng doanh thu.

- Sự không chắc chắn về quy định: Mặc dù có tiềm năng thay đổi quy định thuận lợi, nhưng vẫn còn sự không chắc chắn về thời gian và mức độ hợp pháp hóa cần sa tại các thị trường trọng điểm như Hoa Kỳ, điều này có thể trì hoãn các kế hoạch mở rộng của Tilray.

- Doanh thu từ cần sa bán buôn: Mặc dù các thỏa thuận bán buôn có thể giúp tối ưu hóa mức tồn kho nhưng chúng lại tác động tiêu cực đến lợi nhuận gộp và EBITDA, làm nổi bật sự biến động tiềm ẩn trong dòng doanh thu.

- Sự phụ thuộc vào cải cách quy định: Triển vọng lạc quan của Tilray chủ yếu dựa vào những cải cách quy định được dự đoán trước, chẳng hạn như giảm thuế tiêu thụ đặc biệt và sử dụng cần sa y tế rộng rãi hơn ở Đức. Sự chậm trễ hoặc thất bại trong những cải cách này có thể cản trở triển vọng tăng trưởng.

- Những thách thức về hội nhập: Mặc dù đã đạt được tiến bộ trong việc tích hợp các thương vụ mua lại như HEXO, nhưng những thách thức trong việc hiện thực hóa sự phối hợp và tối ưu hóa cơ cấu chi phí có thể vẫn tồn tại, ảnh hưởng đến lợi nhuận trong ngắn hạn.

III. Dự báo cổ phiếu Tilray năm 2025

Mục tiêu giá cho TLRY vào cuối năm 2025 được dự đoán là 5,75 USD. Dự báo này dựa trên đà thay đổi phân cực trong trung và ngắn hạn, kết hợp với các mức Fibonacci retracement/extension. Nó ngụ ý tiềm năng tăng giá đáng kể so với mức giá hiện tại là 1,73 USD. Tuy nhiên, để đạt được mục tiêu này sẽ đòi hỏi phải có sự thay đổi đáng kể trong tâm lý thị trường và những yếu tố xúc tác tích cực đáng kể cho cổ phiếu.

Hơn nữa, giá hiện tại của Tilray Brands là 1,73 USD, thấp hơn đường xu hướng và đường cơ sở đều được đặt ở mức 2,01 USD, có nguồn gốc từ đường trung bình động lũy thừa đã được sửa đổi. Điều này cho thấy độ lệch giảm so với xu hướng dự kiến. Đường trung bình động lũy thừa đã sửa đổi cho thấy mức kháng cự mạnh tiềm năng ở mức 2,01 USD, phản ánh thách thức để TLRY vượt qua.

Hướng của giá cổ phiếu được mô tả là "đi ngang", cho thấy thiếu động lượng tăng hoặc giảm rõ ràng. Tuy nhiên, mức giá hiện tại nằm dưới cả đường xu hướng và đường cơ sở cho thấy tâm lý giảm giá trong ngắn hạn.

Mức hỗ trợ chính ở mức 1,79 USD cho thấy mức quan trọng mà áp lực mua có thể tăng lên, hỗ trợ giá cổ phiếu không giảm thêm. Tuy nhiên, việc thiếu các mức hỗ trợ cụ thể trong thời gian biến động tăng cao cho thấy sự không chắc chắn gia tăng và tiềm năng biến động giá mạnh hơn.

Điểm pivot của kênh giá ngang hiện tại ở mức 2,00 USD đóng vai trò là điểm uốn quan trọng trong đó hướng chuyển động giá của TLRY có thể thay đổi. Việc vượt lên trên mức này có thể báo hiệu sự tiếp tục xu hướng tăng, trong khi việc giảm xuống dưới có thể cho thấy áp lực giảm giá tiếp theo.

Các mức kháng cự cốt lõi ở mức 3,27 USD, 2,67 USD và 2,21 USD thể hiện những rào cản đáng kể mà TLRY cần phải vượt qua để tiếp tục quỹ đạo đi lên. Các mức này có khả năng thu hút lãi bán, có khả năng hạn chế đà tăng trừ khi bị phá vỡ một cách thuyết phục.

Nguồn: tradingview.com

Nhìn vào chỉ báo Supertrend, giá cổ phiếu hiện đang ở trạng thái xu hướng tăng trung hạn. Sự hỗ trợ này có thể đẩy giá theo quỹ đạo tăng trong trung hạn (năm 2025).

Nguồn: tradingview.com

Hiệu suất dự báo của cổ phiếu Tilray cho năm 2025 cho thấy sự chênh lệch giữa các dự đoán từ các nguồn khác nhau. Coincodex.com dự đoán một triển vọng hơi bi quan, dự báo mức giá khoảng 1,72 USD, cho thấy mức giảm nhẹ -0,39% so với mức hiện tại. Ngược lại, coinpriceforecast.com đưa ra một viễn cảnh lạc quan hơn, dự đoán mức giá là 3 USD vào cuối năm 2025, cho thấy mức tăng đáng kể 87% so với mức giá dự đoán vào giữa năm là 2,68 USD.

A. Thông tin chuyên sâu khác về dự báo cổ phiếu TLRY năm 2025

Theo Wall Street Journal, có ba xếp hạng "Mua", cho thấy tâm lý tích cực của một số nhà phân tích đối với TLRY. Tuy nhiên, số lượng xếp hạng "Tăng tỉ trọng" đã giảm từ 2 xuống 0 trong tháng qua. Mặt khác, xếp hạng “Giữ” vẫn tương đối ổn định, cho thấy quan điểm thận trọng của đa số nhà phân tích.

Việc kiểm tra các mục tiêu giá cung cấp thêm thông tin chi tiết về kỳ vọng của nhà phân tích. Mục tiêu cao là 4,00 USD, điều này cho thấy triển vọng lạc quan về hiệu suất trong tương lai của TLRY. Tuy nhiên, mục tiêu trung là 2,10 USD, phản ánh kỳ vọng vừa phải hơn. Mục tiêu thấp là 1,90 USD nhấn mạnh khả năng xảy ra rủi ro giảm giá, trong khi mục tiêu trung bình là 2,37 USD đóng vai trò là điểm giữa trong số các dự đoán của các nhà phân tích.

So sánh các mục tiêu này với mức giá hiện tại là 1,72 USD, có sự khác biệt về kỳ vọng. Mục tiêu cao ngụ ý tiềm năng tăng giá đáng kể, trong khi mục tiêu thấp cho thấy mức tăng giá hạn chế. Các mục tiêu trung và trung bình nằm giữa các thái cực này, cho thấy nhiều kết quả tiềm năng.

Nguồn:WSJ.com

Source:WSJ.com

B. Các yếu tố chính cần theo dõi cho dự báo cổ phiếu Tilray năm 2025

Dự báo cổ phiếu TLRY năm 2025 - Các yếu tố tăng giá

- Dẫn đầu và mở rộng thị trường: Vị trí thống trị của Tilray trong thị trường cần sa dành cho người lớn ở Canada và thị phần hàng đầu của họ ở Đức mang lại nền tảng vững chắc cho sự phát triển. Với việc tập trung vào đổi mới và mua lại chiến lược, Tilray đặt mục tiêu mở rộng sự hiện diện trên thị trường trên toàn cầu.

- Cải cách quy định: Những thay đổi quy định dự kiến, chẳng hạn như khả năng thay thế chế độ thuế tiêu thụ đặc biệt ở Canada bằng Thuế giá trị quảng cáo 10%, có thể giúp tiết kiệm đáng kể chi phí cho Tilray, ước tính khoảng 80 triệu USD hàng năm. Hơn nữa, những cải cách pháp lý về hiệu lực THC và tiếp thị có thể mang lại lợi ích hơn nữa cho công ty.

- Cơ hội quốc tế: Sự hiện diện của Tilray tại nhiều thị trường quốc tế, đặc biệt là ở Châu Âu, giúp công ty tận dụng thị trường cần sa y tế đang phát triển. Những thay đổi về mặt lập pháp, chẳng hạn như việc loại bỏ cần sa y tế khỏi đạo luật ma túy ở Đức, có thể mở rộng đáng kể cơ hội thị trường của Tilray.

- Danh mục đa dạng: Danh mục thương hiệu đa dạng của Tilray, bao gồm cần sa, đồ uống có cồn và các sản phẩm chăm sóc sức khỏe, cho phép công ty tiếp cận nhiều phân khúc người tiêu dùng và xu hướng thị trường khác nhau. Việc mua lại chiến lược và đổi mới sản phẩm góp phần tăng trưởng doanh thu trên các phân khúc kinh doanh khác nhau.

Dự báo cổ phiếu Tilray năm 2025 - Các yếu tố giảm giá

- Sự không chắc chắn về quy định: Trong khi các cải cách về quy định mang lại cơ hội thì sự không chắc chắn về quy định, đặc biệt là ở Hoa Kỳ, vẫn là một yếu tố rủi ro. Việc Tilray không thể tham gia vào các hoạt động cần sa ở Hoa Kỳ do các quy định của liên bang đã hạn chế tiềm năng tăng trưởng của họ trên thị trường cần sa lớn nhất thế giới.

Nguồn: CBSnews.com

- Thuế tiêu thụ đặc biệt và áp lực về giá: Cơ cấu thuế tiêu thụ đặc biệt hiện tại ở Canada, cùng với áp lực về giá từ cạnh tranh, đã dẫn đến thuế tiêu thụ đặc biệt tăng và biên lợi nhuận bị nén. Lợi nhuận của Tilray có thể bị ảnh hưởng tiêu cực nếu những thay đổi về quy định nhằm giải quyết những vấn đề này không được thực hiện như mong đợi.

- Những thách thức về tích hợp: Việc tích hợp các thương vụ mua lại gần đây, chẳng hạn như HEXO và Truss, đặt ra những thách thức, bao gồm hợp lý hóa hoạt động, tối ưu hóa chi phí và đạt được sự hiệp lực. Sự chậm trễ hoặc khó khăn trong quá trình tích hợp có thể cản trở khả năng của Tilray trong việc tiết kiệm chi phí và cải thiện biên lợi nhuận như mong đợi.

- Biến động và cạnh tranh của thị trường: Ngành công nghiệp cần sa được đặc trưng bởi sự biến động của thị trường và cạnh tranh gay gắt. Tilray phải đối mặt với sự cạnh tranh từ cả những công ty lâu đời và những người mới tham gia, điều này có thể gây áp lực lên thị phần và lợi nhuận của họ nếu không được giải quyết hiệu quả.

IV. Dự báo cổ phiếu Tilray năm 2030 và xa hơn

Mục tiêu giá của Tilray Brands vào cuối năm 2030 là 15,65 USD. Mục tiêu đầy tham vọng này dựa trên phân tích động lượng, đặc biệt xem xét những thay đổi về độ phân cực trong dài hạn, được dự kiến qua các mức Fibonacci retracement/extension. Dự báo như vậy giả định tâm lý tăng giá đáng kể và động lượng duy trì trong dài hạn.

Giá hiện tại của Tilray Brands ở mức 1,73 USD, thấp hơn đáng kể so với giá trị đường xu hướng và giá trị cơ bản lần lượt là 3,23 USD và 3,54 USD, cho thấy một xu hướng giảm. Đường trung bình động lũy thừa (EMA) đã sửa đổi gợi ý một quỹ đạo tiêu cực cho cổ phiếu. Tuy nhiên, điều đáng chú ý là xu hướng giá cổ phiếu được đánh giá là đi ngang dù có dấu hiệu rõ ràng về một xu hướng giảm. Điều này có thể ngụ ý sự ổn định hoặc củng cố tiềm năng trong thời gian tới.

Hỗ trợ chính được xác định ở mức 1,76 USD, cho thấy mức quan trọng mà áp lực mua có thể tăng lên. Điểm pivot của kênh giá ngang hiện tại cao hơn một chút ở mức 2,26 USD, cho thấy một khu vực khả thi mà hành động giá có thể xoay trục. Các mức kháng cự, đặc biệt là mức kháng cự cốt lõi ở mức 3,83 USD và mức kháng cự cao hơn ở mức 11,15 USD, tạo ra những rào cản đáng kể cho việc tăng giá. Hỗ trợ cốt lõi là 0,70 USD, cho thấy mức độ mạnh mẽ trong lịch sử mà sự quan tâm mua là đáng kể.

Nguồn: tradingview.com

Hơn nữa, giá trị RSI là 39,92 cho thấy cổ phiếu không bị bán quá mức hay mua quá mức, nằm trong vùng trung tính. Mặc dù không có dấu hiệu nào về mức tăng hoặc giảm thường xuyên, nhưng việc không có phân kỳ tăng hoặc giảm ngụ ý thiếu áp lực mua hoặc bán đáng kể vượt quá những gì đã được phản ánh trong giá. Xu hướng đi lên của đường RSI cho thấy động lượng mua có thể được củng cố.

Cuối cùng, đường MACD ở -2,39 nằm dưới đường tín hiệu ở -3,58, cho thấy tâm lý giảm giá trong ngắn hạn. Tuy nhiên, giá trị biểu đồ dương là 1,19 cho thấy xu hướng tăng có thể đang ổn định. Điều này cho thấy một bức tranh hỗn hợp về động lượng giá ngắn hạn, với tâm lý giảm giá chiếm ưu thế nhưng có dấu hiệu ổn định hoặc thậm chí đảo chiều.

Nguồn: tradingview.com

Theo coincodex.com, cổ phiếu của Tilray được dự đoán sẽ giảm dần trong giai đoạn dự báo, với giá cổ phiếu giảm từ 1,70 USD vào năm 2025 xuống còn 1,67 USD vào năm 2030. Dự báo này cho thấy triển vọng bi quan, cho thấy những thách thức tiềm ẩn hoặc sự trì trệ trong hiệu quả kinh doanh của Tilray . Các yếu tố góp phần vào xu hướng giảm này có thể bao gồm sự cạnh tranh gia tăng, các rào cản pháp lý hoặc hoạt động kém hiệu quả.

Ngược lại, coinpriceforecast.com lại đưa ra cái nhìn lạc quan hơn khi dự báo giá cổ phiếu Tilray sẽ tăng trưởng đáng kể so với cùng kỳ. Theo dự đoán của họ, cổ phiếu Tilray dự kiến sẽ tăng giá ổn định, đạt 5,65 USD vào cuối năm 2030. Dự báo này cho thấy niềm tin vào khả năng tận dụng các cơ hội thị trường, mở rộng thị phần hoặc đổi mới trong ngành của Tilray.

Nguồn: coinpriceforecast.com

A. Thông tin chuyên sâu khác về dự báo cổ phiếu TLRY năm 2030 và xa hơn

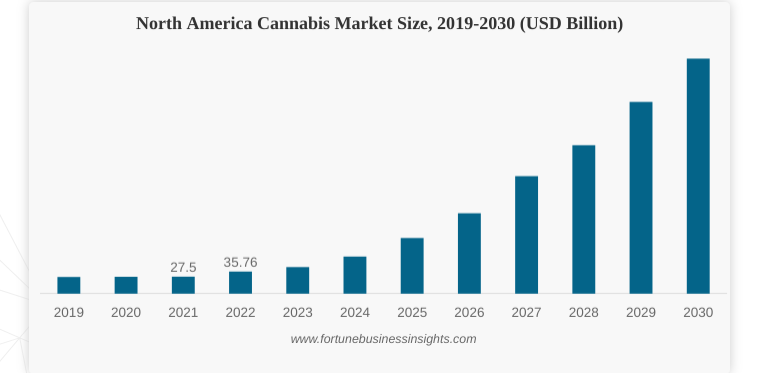

Tillay Brands đang định vị chính mình trong thị trường cần sa toàn cầu đang mở rộng nhanh chóng. Theo Fortune Business Insights, thị trường được dự báo sẽ đạt 444 tỷ USD vào năm 2030 (từ 57,18 tỷ USD vào năm 2023) với tỷ lệ CAGR là 34,03% (2023-2030). Sự tăng trưởng này chủ yếu là do việc hợp pháp hóa cần sa ngày càng tăng trên toàn thế giới, được thúc đẩy bởi lợi ích y học được nhận thấy và sự chấp nhận về mặt văn hóa của nó. Thông báo gần đây của công ty về dòng sản phẩm mở rộng mang thương hiệu CANACA phản ánh những nỗ lực chiến lược của công ty nhằm tận dụng việc mở rộng thị trường này.

Việc ra mắt Chiến dịch 'Let 'Er Rip' thể hiện sự tập trung của Tilray Brands vào sự đổi mới và chất lượng sản phẩm. Bằng cách giới thiệu các sản phẩm mới được thiết kế để nâng cao cường độ và mang lại trải nghiệm tiêu dùng đầy hương vị, công ty đặt mục tiêu tạo sự khác biệt trong bối cảnh cạnh tranh. Sáng kiến này phù hợp với sở thích ngày càng tăng của người tiêu dùng cần sa, những người tìm kiếm các sản phẩm chất lượng cao mang lại trải nghiệm độc đáo và hài lòng.

Thông qua việc tập trung vào đổi mới, Tilray Brands đặt mục tiêu vượt qua sự mong đợi của người tiêu dùng và củng cố vị thế của mình trên thị trường. Việc nhấn mạnh vào chất lượng sản phẩm và tường thuật thương hiệu phản ánh sự hiểu biết của công ty về tầm quan trọng của nhận thức và lòng trung thành của người tiêu dùng trong việc thúc đẩy thành công lâu dài. Bằng cách liên tục cải tiến các quy trình và dịch vụ của mình, Tilray Brands cố gắng duy trì lợi thế cạnh tranh và chiếm được thị phần đáng kể trong thị trường cần sa đang phát triển.

B. Các yếu tố chính cần theo dõi cho dự đoán giá cổ phiếu Tilray năm 2030 và xa hơn

Dự đoán giá TLRY năm 2030 và xa hơn - Các yếu tố tăng giá

- Ước tính doanh thu mở rộng: Ước tính doanh thu của Tilray cho thấy mức tăng trưởng nhất quán, đạt 1,51 tỷ USD vào tháng 5 năm 2030. Sự tăng trưởng này được hỗ trợ bởi sự gia tăng dự kiến của thị trường cần sa toàn cầu, dự kiến sẽ đạt 444 tỷ USD vào năm 2030. Định vị chiến lược của Tilray trong thị trường này cho thấy tiềm năng chiếm được một phần đáng kể trong sự tăng trưởng này.

Nguồn: fortunebusinessinsights.com

- Cải thiện EPS: Ước tính EPS đồng thuận cho thấy xu hướng tích cực, với thu nhập trên mỗi cổ phiếu dự kiến sẽ tăng đều đặn, đạt 0,24 USD vào tháng 5 năm 2033. Điều này cho thấy khả năng sinh lời được cải thiện trong giai đoạn dự báo, được thúc đẩy bởi hiệu quả hoạt động tiềm năng, mở rộng thị trường và đổi mới sản phẩm.

- Xu hướng tích cực của nhà phân tích: Bất chấp những biến động ngắn hạn, ước tính của các nhà phân tích về cả doanh thu và EPS đều có xu hướng tích cực dài hạn. Điều này cho thấy niềm tin ngày càng tăng vào khả năng của Tilray trong việc thực hiện các kế hoạch chiến lược và tận dụng các cơ hội thị trường trong thập kỷ tới.

- Cơ hội mở rộng thị trường: Khi thị trường cần sa toàn cầu mở rộng, Tilray có cơ hội tận dụng khả năng nhận diện thương hiệu, mạng lưới phân phối và danh mục sản phẩm của mình để thâm nhập các thị trường mới và chiếm thị phần. Quan hệ đối tác, mua lại và liên minh chiến lược có thể nâng cao hơn nữa sự hiện diện trên thị trường và dòng doanh thu của Tilray.

Dự đoán giá cổ phiếu TLRY năm 2030 và xa hơn - Các yếu tố giảm giá

- Biến động về thu nhập: Mặc dù doanh thu được dự đoán sẽ tăng ổn định nhưng ước tính EPS cho thấy sự biến động, đặc biệt là trong ngắn hạn và trung hạn. Ước tính EPS âm trong những năm đầu có thể báo hiệu những thách thức tiềm ẩn trong việc quản lý chi phí, rào cản pháp lý hoặc áp lực cạnh tranh ảnh hưởng đến lợi nhuận.

- Tốc độ tăng trưởng doanh thu giảm: Mặc dù doanh thu chung tăng trưởng, tốc độ tăng trưởng được dự đoán sẽ giảm từ 9,24% vào tháng 5 năm 2030 xuống 4,24% vào tháng 5 năm 2033. Sự giảm tốc này có thể là do bão hòa thị trường, cạnh tranh gia tăng, các hạn chế về quy định hoặc sự thay đổi trong sở thích của người tiêu dùng, đặt ra những thách thức để duy trì mức tăng trưởng cao.

- Cạnh tranh thị trường: Ngành công nghiệp cần sa đang ngày càng trở nên cạnh tranh, với những người mới tham gia và những người chơi lâu năm đang tranh giành thị phần. Tilray phải đối mặt với nguy cơ áp lực về giá, mất thị phần hoặc xói mòn lợi nhuận do cạnh tranh gay gắt, điều này có thể ảnh hưởng đến triển vọng tăng trưởng dài hạn của công ty.

- Sự không chắc chắn về quy định: Những thay đổi về quy định hoặc sự chậm trễ trong việc hợp pháp hóa cần sa trên các thị trường trọng điểm có thể cản trở kế hoạch mở rộng của Tilray và phá vỡ quỹ đạo tăng trưởng doanh thu của công ty. Những diễn biến bất lợi về quy định, chẳng hạn như các quy định chặt chẽ hơn hoặc chính sách thuế, có thể tác động tiêu cực đến hiệu quả tài chính và triển vọng giá cổ phiếu của Tilray.

V. Hiệu suất lịch sử giá cổ phiếu Tilray

A. Các cột mốc quan trọng về giá cổ phiếu TLRY

2014: Giá cổ phiếu của Tilray chỉ ở mức 0,45 triệu USD, phản ánh vị thế giai đoạn đầu của công ty trong ngành cần sa. Công ty vẫn đang thiết lập sự hiện diện và mô hình kinh doanh của mình trên thị trường cần sa hợp pháp còn non trẻ.

2015: Tilray có mức tăng trưởng bùng nổ, với giá trị vốn hóa thị trường tăng vọt lên 48,1 triệu USD, phản ánh mức tăng đáng kinh ngạc 10536,53%. Sự gia tăng này có thể là do sự chấp nhận ngày càng tăng của cần sa y tế và sự quan tâm ngày càng tăng của nhà đầu tư đối với ngành công nghiệp mới nổi.

2016: Tilray tiếp tục mở rộng nhanh chóng, với mức giá trị vốn hóa thị trường đạt 0,41 tỷ USD, đánh dấu một cột mốc quan trọng trong quỹ đạo tăng trưởng họ. Công ty có thể được hưởng lợi từ những diễn biến pháp lý thuận lợi và cơ hội thị trường đang mở rộng.

2017: Giá trị vốn hóa thị trường của Tilray tăng lên 2,24 tỷ USD, tăng đáng kể 433,79% so với năm trước. Sự đánh giá cao này được thúc đẩy bởi sự lạc quan xung quanh việc hợp pháp hóa cần sa ở nhiều khu vực pháp lý khác nhau và vị trí chiến lược của Tilray trên thị trường.

2018: Tilray có mức tăng trưởng chưa từng có, với giá trị vốn hóa thị trường tăng vọt lên 6,57 tỷ USD, phản ánh mức tăng 193,39%. Sự gia tăng này được thúc đẩy bởi sự quan tâm ngày càng cao của các nhà đầu tư, sự đầu cơ và sự mở rộng toàn cầu của ngành công nghiệp cần sa.

Nguồn: companiesmarketcap.com

Năm 2019: Tilray phải đối mặt với một đợt suy thoái đáng kể, với giá trị vốn hóa thị trường giảm mạnh xuống còn 1,47 tỷ USD, đánh dấu mức giảm mạnh 77,56%. Những thách thức về quy định, các vấn đề về chuỗi cung ứng và mối lo ngại về lợi nhuận đã góp phần khiến tâm lý nhà đầu tư đảo chiều.

Năm 2020: Giá trị vốn hóa thị trường của Tilray vẫn tương đối ổn định ở mức 1,30 tỷ USD, phản ánh mức giảm khiêm tốn 11,38% so với năm trước. Công ty phải vật lộn với những thách thức đang diễn ra trên thị trường cần sa, bao gồm các rào cản pháp lý và áp lực về giá cả.

Năm 2021: Giá trị vốn hóa thị trường của Tilray tăng trở lại lên 3,33 tỷ USD, được thúc đẩy bởi sự lạc quan mới xung quanh những diễn biến hợp pháp hóa tiềm năng và quan hệ đối tác chiến lược. Công ty đã tận dụng sự chấp nhận ngày càng tăng của cần sa cho cả mục đích y tế và giải trí.

Năm 2022: Giá trị vốn hóa thị trường của Tilray giảm xuống còn 1,64 tỷ USD, phản ánh mức giảm 50,7% so với năm trước. Công ty phải đối mặt với những thách thức liên tục trong việc mở rộng quy mô hoạt động và đạt được lợi nhuận trong bối cảnh những bất ổn về quy định và cạnh tranh trên thị trường.

Năm 2023: Giá trị vốn hóa thị trường của Tilray phục hồi nhẹ, đạt 1,70 tỷ USD, tương ứng mức tăng 3,47%. Công ty có thể tập trung vào các sáng kiến chiến lược để giải quyết sự thiếu hiệu quả trong hoạt động và tận dụng các cơ hội thị trường mới nổi.

Năm 2024: Giá trị vốn hóa thị trường của Tilray tiếp tục giảm xuống còn 1,33 tỷ USD, phản ánh mức giảm 21,31% so với năm trước. Công ty tiếp tục vượt qua những trở ngại trong ngành, bao gồm các rào cản pháp lý, áp lực về giá và sở thích ngày càng phát triển của người tiêu dùng.

B. Lợi nhuận và tổng lợi nhuận giá cổ phiếu Tilray

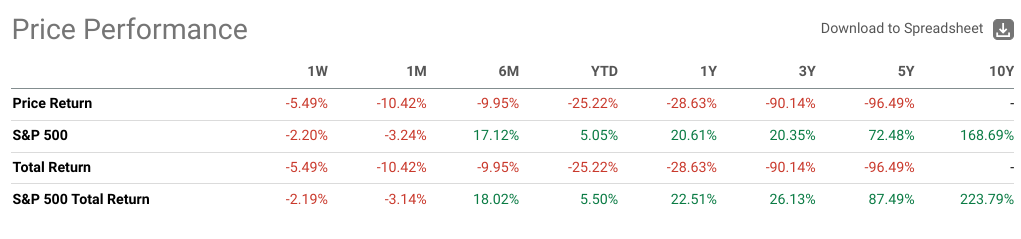

Tilray, một công ty cần sa nổi tiếng được niêm yết trên sàn giao dịch NASDAQ với mã chứng khoán TLRY, đã thể hiện các số liệu hiệu suất khác nhau liên quan đến chỉ số S&P 500 trong các khung thời gian khác nhau. Trong ngắn hạn, hiệu suất cổ phiếu Tilray có dấu hiệu suy yếu. Trong tuần qua, Tilray đã có mức lợi nhuận -5,49%, kém hơn một chút so với S&P 500, vốn có mức lợi nhuận -2,20%. Xu hướng này vẫn tồn tại trong khung thời gian một tháng, với việc Tilray ghi nhận mức lợi nhuận là -10,42%, so với -3,24% của S&P 500. Hiệu suất kém trong ngắn hạn như vậy cho thấy các nhà đầu tư của Tilray có thể phải gánh chịu tổn thất lớn hơn so với những nhà đầu tư trên thị trường rộng lớn hơn.

Nguồn: seekingalpha.com

Nhìn lại hiệu suất từ đầu năm đến nay, cổ phiếu Tilray tiếp tục tụt hậu so với S&P 500. Tính từ đầu năm đến nay, lợi nhuận theo giá của Tilray ở mức -25,22%, tệ hơn đáng kể so với lợi nhuận 5,05% của S&P 500. Điều này cho thấy Tilray có hiệu suất kém hơn trong một thời gian dài so với chỉ số thị trường rộng hơn, cho thấy những thách thức hoặc điểm yếu tiềm ẩn trong công ty hoặc toàn bộ ngành công nghiệp cần sa.

Hiệu suất kém của cổ phiếu Tilray càng trở nên rõ ràng hơn khi xem xét hiệu suất của họ trong khoảng thời gian một năm. Tilray ghi nhận mức lợi nhuận -28,63% trong năm qua, trong khi S&P 500 có mức lợi nhuận 20,61% trong cùng kỳ. Sự khác biệt đáng kể -48% này làm nổi bật cuộc đấu tranh không ngừng của Tilray để theo kịp chỉ số thị trường rộng lớn hơn trong thời gian dài.

Trong 5 năm qua, hiệu suất cổ phiếu của Tilray đã cho thấy sự sụt giảm đáng kể so với chỉ số S&P 500. lợi nhuận theo giá của Tilray trong khung thời gian này ở mức -97%, phản ánh xu hướng giảm đáng kể về giá trị cổ phiếu của công ty. Ngược lại, chỉ số S&P 500 có mức tăng giá 73% so với cùng kỳ, cho thấy sự khác biệt rõ rệt về hiệu suất giữa Tilray và thị trường rộng lớn hơn. Khi xem xét tổng lợi nhuận, bao gồm cổ tức và các khoản phân phối khác được tái đầu tư, hiệu suất của Tilray trong 5 năm qua tiếp tục tụt hậu đáng kể so với S&P 500.

VI. Kết luận

Tilray Brands đã chứng kiến sự biến động đáng kể về giá cổ phiếu của mình, phản ánh tính chất năng động của ngành cần sa và các yếu tố ảnh hưởng khác nhau. Mặc dù hiệu suất gần đây cho thấy những thách thức và khó khăn, nhưng những dự báo và dự đoán cho thấy những cơ hội tiềm năng cho các nhà đầu tư, mặc dù có mức độ lạc quan khác nhau.

Động lượng ngắn hạn cho Tilray có vẻ đi xuống, với sự sụt giảm giá gần đây cho thấy những thách thức trước mắt. Tuy nhiên, những thông tin chuyên sâu và dự báo của chuyên gia đưa ra một triển vọng lạc quan một cách thận trọng, dự đoán các mục tiêu giá tiềm năng là 4,25 USD vào năm 2024, 5,75 USD vào năm 2025 và thậm chí 15,65 USD hoặc cao hơn vào năm 2030 nếu xu hướng hợp pháp hóa toàn cầu tăng tốc. Những dự đoán này dựa trên các yếu tố như thay đổi quy định, chiếm ưu thế trên thị trường, mở rộng quốc tế, mua lại, đổi mới và hiệu quả tài chính.

Về giao dịch cổ phiếu Tilray thông qua hợp đồng chênh lệch (CFD) với VSTAR, một số lợi ích có thể thu hút các nhà đầu tư. VSTAR cung cấp tiền thưởng khi nạp tiền, tính năng sao chép giao dịch, tính năng giám sát thị trường và các tài nguyên giáo dục. Những tính năng này có thể nâng cao trải nghiệm giao dịch, giảm thiểu rủi ro và cung cấp những hiểu biết có giá trị để đưa ra quyết định đầu tư sáng suốt.