AEP: Core Infrastructure Beneficiary in the AI Data Center Power Wave

I. Company Overview: The "Foundation Asset" in US Electric Transmission and Distribution

American Electric Power (AEP) is one of the largest regulated electric utilities in the United States, serving approximately 5.6 million customers across 11 states. The company owns and operates one of the largest transmission networks in the US, totaling approximately 40,000 miles of transmission lines, with the highest number of 765kV ultra-high voltage lines nationwide, constituting its most core and difficult-to-replicate infrastructure barrier.

Its generating capacity and contracted power scale total approximately 30GW. The generation mix is highly diversified, covering natural gas, coal, nuclear, hydro, wind, and solar power. As a typical regulated utility, AEP is known for stable cash flow + long-term returns. Its total return over the past 10 years was approximately 207%, a significant portion of which came from dividends and dividend growth.

II. Core Investment Thesis: AI Data Centers Reshaping the Power Demand Curve

The structure of US electricity demand is undergoing a fundamental change. AI data centers, cloud computing infrastructure, and manufacturing reshoring are becoming the primary sources of new load. Their characteristics include:

- Large single-site power consumption scale

- Extremely high requirements for power supply stability and voltage levels

- Long contract terms with high default costs

This is precisely where AEP's structural advantage lies.

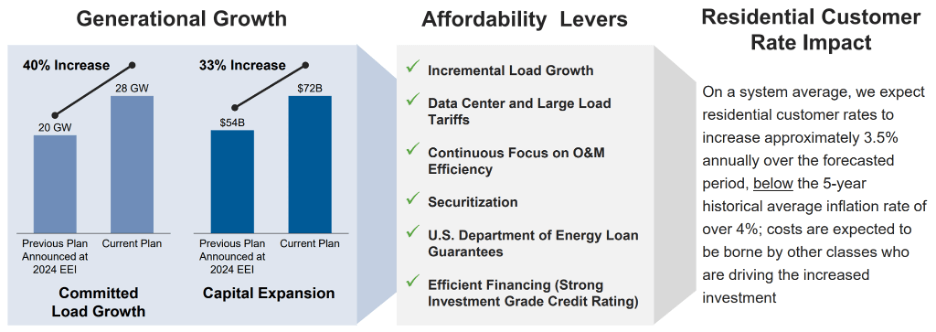

Company management projects that the system peak load will reach 65GW by 2030. Compared to the current system size of approximately 37GW, this represents an increase of 28GW in contracted load, all supported by "power service agreements or letters of intent (take-or-pay)," significantly reducing demand uncertainty. Compared to the 2024 plan, the committed load scale has been raised by approximately 40%, clearly reflecting the rapid realization of AI and industrial demand.

III. Competitive Moat: Transmission Network Determines Data Center “Landing Rights”

Unlike most utility companies, AEP's core competitive moat is not in a single generation technology but in its transmission capacity and grid structure.

- AEP owns the most 765kV ultra-high voltage lines in the US

- Capable of supporting ultra-large-scale, continuous-load data center clusters

- Possesses a natural geographic advantage in core areas of AI and manufacturing expansion such as Indiana, Ohio, Texas, and Oklahoma

In the process of selecting AI data center locations, "the ability to quickly connect to a high-grade power grid" has become a decisive factor, giving AEP an irreplaceable position in the competition for new load.

IV. Capital Expenditure and Growth Certainty: $72 Billion Plan Secures Long-Term Returns

To accommodate the aforementioned demand, AEP has formulated a 5-year, $72 billion capital expenditure plan, with over two-thirds allocated to upgrading and expanding transmission and generation infrastructure. Under the regulated model, this means:

- Invested capital can be entered into the Rate Base

- Leads to predictable, long-term earnings returns

The company projects a Rate Base CAGR of approximately 10% from 2024–2030 and, based on this, has raised its operational EPS compounded annual growth guidance to 7%–9% for 2026–2030.

For the first three quarters of 2025, AEP's operating EPS grew 9% year-over-year to $4.78, with a full-year EPS mid-point guidance increase of approximately 8%. This growth primarily stems from:

- Multi-state rate increases

- Execution of transmission investments

- Increased load from large customers

V. Valuation and Risks: Reasonable Premium for Long-Term Certainty

The current stock price has pulled back to around $117, corresponding to a forward P/E of approximately 19.9 times, which is higher than the historical average (approximately 15.8 times). However, considering:

- The upward shift in the demand curve driven by AI data centers

- The long-term EPS growth rate of 7%–9%

- A stable dividend yield of 3%+

This premium is justified, and the anticipated total return remains attractive.

Major risks include:

- Slowdown in the construction pace of data center clients

- Regulatory approval and rate uncertainty

- Risk of dilution of returns from massive capital expenditure in an inflationary environment

VI. Technical Analysis

From a daily structure perspective, American Electric Power entered a technical correction after an earlier steady upward trend. During the correction, the low points tend to converge, and no structural trend destruction signal has yet appeared. As long as the 114–115 area is not effectively broken, the overall long structure of "rise—pullback—re-rise" remains intact. The key focus for subsequent observation is whether it can re-stabilize and move away from the 20-day moving average. If it stabilizes and moves up, the medium-term trend is still expected to follow the original trajectory; if it breaks below this support, the market will extend into a longer period of sideways consolidation.

American Electric Power is not a high-elasticity growth stock but an indispensable provider of underlying infrastructure in the AI era. Under the long-term expansion trend of data center and industrial load, its transmission network advantage, contracted load scale, and regulated return mechanism provide high visibility for earnings growth.

Following the recent pullback, AEP offers a combination of medium-to-long-term growth certainty + defensive cash flow + stable dividends, making it suitable as a low-volatility core allocation asset in the AI theme. Based on a comprehensive assessment of fundamentals and valuation, we maintain a Buy rating.