I. Company Positioning and Business Model: From Marketing Tool to "Marketing Operating System"

Zeta Global was founded in the era of data-driven marketing, and its core positioning is not that of a traditional marketing software vendor, but an attempt to build a unified, AI-driven marketing cloud platform. The company has long revolved around a core proposition: enterprise marketing systems are highly fragmented, and data is scattered across multiple systems, making it impossible to form a closed loop for customer identification, marketing execution, and results attribution. Zeta’s solution is to integrate identity resolution, data analytics, customer outreach, and marketing execution through a single platform, transforming dispersed marketing technology stacks into a unified decision system.

On the technical side, the company relies on proprietary AI models and massive data assets to build a data system covering trillions of consumer behavior signals and links over 245 million U.S. consumers through its identity graph. This identity resolution capability allows enterprises to convert anonymous traffic into identifiable users, thereby achieving precise marketing and remarketing, which is one of the core technical barriers of its platform. When customer identity resolution and marketing execution are in the same system, the match rate and conversion efficiency are significantly improved, directly enhancing the client's economic return.

From an industry perspective, Zeta is attempting to become the "Palantir of marketing." Palantir's core value lies in transforming complex data into a decision-making system, and Zeta is replicating this logic in the marketing domain, building a "Marketing Operating System" through a unified platform, driven by data and AI to optimize enterprise customer growth and efficiency.

II. Business Enters Acceleration Phase: Revenue Growth and Profitability Quality Improve Simultaneously

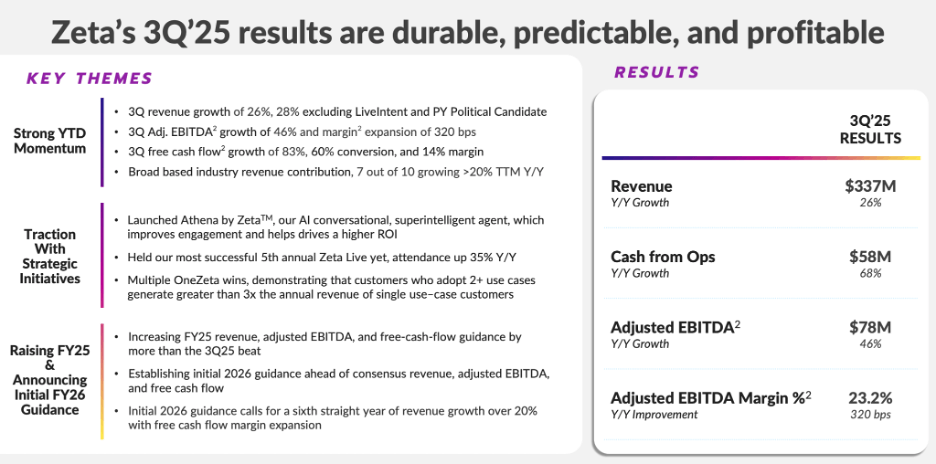

Zeta’s business model is transitioning from a pure growth stage to a "profitable growth" stage, which is typically the starting point for software company valuation repricing. The company's third-quarter performance provided key validation.

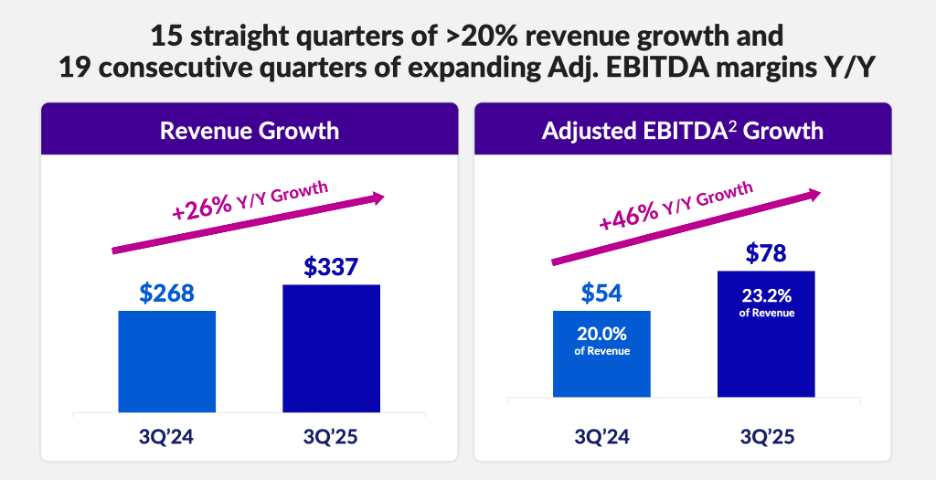

The company achieved third-quarter revenue of $337 million, a year-over-year increase of 25.68%, marking the 15th consecutive quarter of revenue growth exceeding 20% year-over-year. In the software industry, few companies can sustain this rate of growth over a multi-year cycle, indicating that Zeta's platform is still in the expansion phase of penetration, not the maturity phase.

In terms of profitability quality, the company’s Adjusted EBITDA reached $78 million, a 44.44% year-over-year increase, with the EBITDA margin improving to 23.2%, expanding for the 19th consecutive quarter. Simultaneously, Free Cash Flow reached $52.4 million, a 77.63% year-over-year increase, and the Free Cash Flow margin rose to 15.54%, improving for the sixth consecutive quarter. This set of data indicates that the company has entered an early profitability stage, where its growth no longer relies on high-intensity capital consumption but begins to unleash operating leverage through economies of scale.

Notably, the company’s operating cash flow increased by 68.3% to $57.9 million year-over-year, meaning the improvement in profitability is not an accounting change but a genuine increase in cash generation capability. For software companies, sustained improvement in free cash flow is often a prerequisite for long-term valuation appreciation.

III. Customer Structure Change: Core of Growth Comes from "Customer Quality"

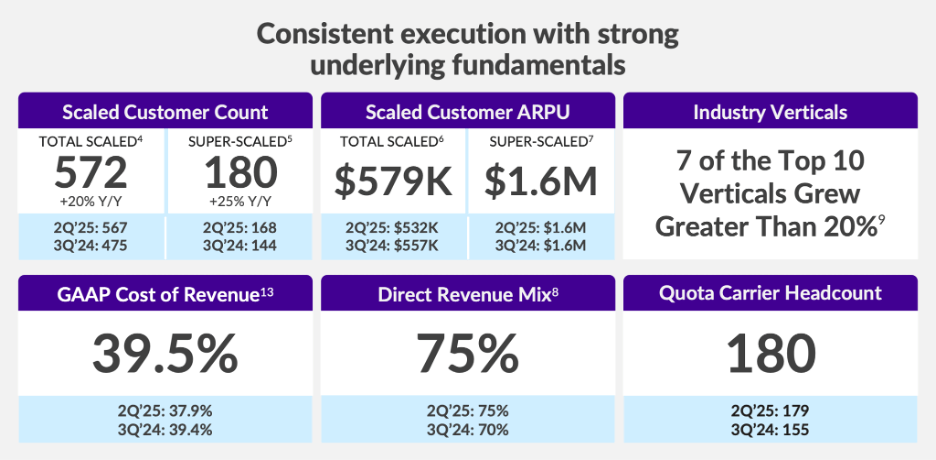

Zeta's growth is not solely dependent on expanding customer quantity but is driven by increasing customer value. The total number of customers in the third quarter reached 572, a 20% year-over-year increase. Of these, the number of large customers with annual revenue exceeding $1 million reached 180, a 25% year-over-year increase, indicating that enterprise-level customer penetration is rising.

In terms of usage depth, large customers, on average, utilize 3.1 marketing channels, with average revenue per customer reaching $579,000, reflecting the platform's stickiness and customer expansion capability. The company currently serves 44% of the Fortune 100 companies, and approximately 90% of revenue comes from customers using the platform for over a year, demonstrating low customer churn and revenue stability.

The company's introduction of the Athena AI Agent system is becoming a new growth driver. This system can translate natural language directly into marketing execution processes, enabling enterprises to reduce data analysis time and enhance decision-making efficiency. At the Zeta Live event, approximately 35% of attending enterprises adopted Athena, indicating that the AI feature is being rapidly accepted by the market.

IV. Growth Trajectory: AI and M&A Build a Second Growth Curve

Zeta’s future growth primarily stems from two paths: the deepening of AI capabilities and the expansion of enterprise customers.

1) Partnership with OpenAI: AI Becomes a Core Competency

Zeta established a strategic partnership with OpenAI, which provides conversational intelligence and agent system capabilities for Athena. Athena's core goal is to build an enterprise-level marketing AI agent, enabling enterprises to drive marketing processes directly through natural language, without the need for manual operation of complex data systems.

The first two agent modules are:

- Insights: Automated data insights and marketing analytics

- Advisor: Marketing decision-making and execution recommendations

As OpenAI models continue to evolve, Zeta can continuously integrate the latest AI capabilities into its products, which will enhance customer retention and create a clear product differentiation. The value of AI in marketing is not only about efficiency improvement but more about transforming marketing into a predictable, optimizable, and systematic decision-making process.

2) Acquisition of Marigold: Upgrading to Enterprise-Level Customers

Zeta acquired Marigold for $325 million. The core significance of this transaction is not short-term revenue, but an upgrade in customer structure. Marigold possesses 100+ global enterprise customers, including 20 of the top 100 global advertisers and 40+ Fortune 500 companies. This provides Zeta with a foundation for expanding into the enterprise-level market.

The transaction is expected to bring:

- Revenue increase of $190 million

- Adjusted EBITDA increase of $31.4 million

- Free Cash Flow increase of $15 million

The acquisition not only enhances profitability but also creates cross-selling opportunities for the platform and strengthens the enterprise-level subscription revenue model. The company anticipates the acquisition will raise 2025 and 2026 financial guidance and have a sustained impact on long-term growth.

V. Growth Trajectory and Valuation: Market May Undervalue Its Cash Flow Capability

The company's guidance shows:

2026 (Excluding M&A)

- Revenue: $1.54 billion

- EBITDA: $354 million

- Free Cash Flow: $209 million

If the Marigold acquisition is included, revenue and cash flow are expected to increase further. The company projects revenue to reach $2.36 billion by 2028, EBITDA to reach $570 million, and Free Cash Flow to be approximately $364 million.

Based on the current market capitalization of approximately $5.35 billion:

- 2026 FCF valuation is about 24–25 times

- Forward P/E is about 15 times

Among software companies maintaining a 20%+ growth rate, this valuation is at a significant discount, while most software company valuations are in the 25–35 times range. If the company achieves sustained profitability expansion, there is room for its valuation to revert to the industry mean.

VI. Risks: Execution Capability and Industry Structure Determine the Ceiling

Despite the clear growth path, Zeta remains in a phase of high execution requirements. The Marigold acquisition is substantial, and if synergies are not realized, it could affect profit margins and growth quality. The marketing software industry is fiercely competitive; if major platforms like Meta, Alphabet, or Salesforce strengthen their marketing system integration, it could compress Zeta's market space.

Macro cycles also pose a risk. Advertising spending has a clear cyclical nature, and an economic slowdown will directly impact the company's revenue and profit. The company's share count has increased by approximately 18% over the past three years, and while the dilution rate is slowing, changes in the equity structure's impact on shareholder returns still require attention.

A deeper risk stems from the business model itself. Becoming the "Palantir of a certain field" is extremely difficult, and many AI companies attempt to replicate this model, but few succeed. The market has not yet fully confirmed whether Zeta can sustain profitability, which is also a major reason for its valuation discount.

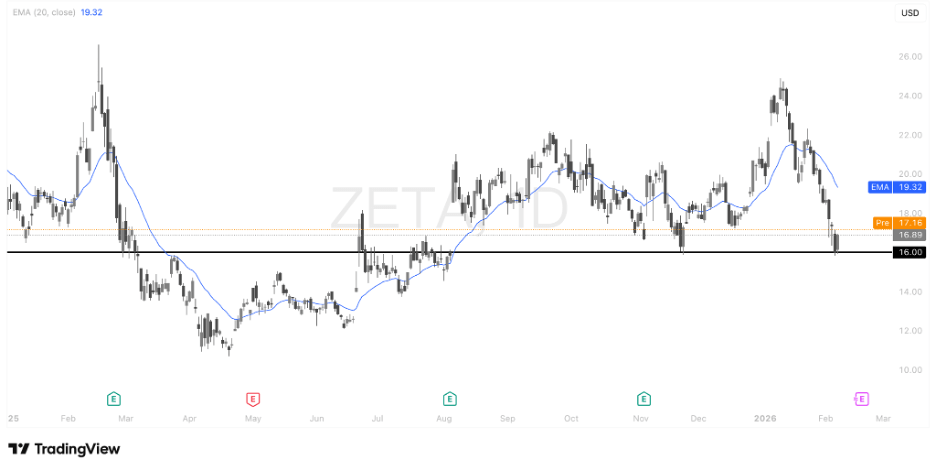

VII. Technical Structure: Mid-Term Structure Retraces to Key Support Zone, Directional Choice Approaching

From a price structure perspective, Zeta's stock price has retraced about 40% from its historical high, and the market has priced in some execution risk and profitability uncertainty. The current stock price is in a mid-term consolidation and bottoming phase, and a clear trend reversal has not yet formed.

The current price is re-testing the mid-term key support range. The current stock price is trading below the 20-day moving average, the short-term trend has weakened, momentum has slowed significantly, and the market is entering a directional choice phase.

The price is currently near the $16 key structural support level. This area is both a dense trading zone from the previous platform and a technical position where the price has stopped falling and rebounded multiple times in the past, giving it strong reference significance. From a trend perspective, this area belongs to a pullback confirmation zone within the mid-term upward structure, rather than the initial stage of trend breakdown.

The short-term focus is on the effectiveness of this support:

- If the price stabilizes near $16 and shows a volume-driven rebound, it suggests that capital is still defending the key structural level, and the mid-term upward trend is likely to be sustained, potentially re-testing the $19–$21 resistance range later.

- If the price effectively breaks below $16 and loses the structural support, it signifies a weakening of the mid-term trend, and the market may enter a deeper round of valuation repair, with potential support shifting downward to the previous low area.

Overall, ZETA is currently in the trend validation phase at a critical support zone. Against the backdrop of sustained growth in fundamentals and improving profitability, this area is closer to a mid-term favorable risk-reward position, but still requires waiting for confirmation of price stabilization signals.

(ZETA Daily Chart)

VIII. Investment Judgment: The Intersection of Growth and Profitability

Zeta is at the most critical stage for a software company—the transition from high-speed growth to profitable growth. Its AI strategy is beginning to commercialize, its enterprise customer structure continues to optimize, and its free cash flow is rapidly expanding, while its valuation remains at a discount.

If the company maintains 20%+ revenue growth and continues to expand its profit margin, the market may reprice its stock. From a risk-reward structure, this stock possesses typical growth stock characteristics: high execution requirements, but significant potential for valuation appreciation upon success.

On the operational level, it is more suitable to adopt a phased deployment strategy, while paying attention to the realization of profits and the progress of acquisition integration. For investors with medium-to-high risk tolerance who are optimistic about the AI application layer and enterprise software sectors, this stock has long-term allocation value.