Rocket Lab: Defense Space Inflection Point Confirmed, Space Systems Enters Realization Cycle

I. Investment Highlights

Rocket Lab is at a critical stage in its company development path. In early 2026, the company secured an $816 million prime contract from the U.S. Space Development Agency (SDA) for the Tranche 3 Tracking Layer program, the largest, most technically demanding, and strategically most significant order in the company's history.

We believe this contract is not solely driven by a single order but signals Rocket Lab's formal entry into the core supply chain of the U.S. national security space ecosystem, and the strategic value of its Space Systems business is beginning to be systematically validated.

It must be emphasized that Rocket Lab's long-term growth logic is no longer determined by rocket launches but by the scalability of its Space Systems business.

II. Industry Background: Defense Space Enters a Phase of Structural Expansion

In 2025–2026, the U.S. defense space strategy showed a marked change. The traditional model, relying on a small number of high-value, high-orbit satellites, is shifting toward a Low-Earth Orbit, large-scale, distributed constellation architecture. The core objectives of this transition are:

- Enhance the system's survivability in high-intensity conflicts

- Reduce the risk of single-point failure

- Achieve near-real-time, continuous intelligence sensing and transmission capabilities

Against this backdrop, the Proliferated Warfighter Space Architecture (PWSA), led by the SDA, has become the core engineering effort for U.S. military space. The Tracking Layer, as its most critical subsystem, undertakes core missions such as missile warning and hypersonic target tracking, with significantly higher technical thresholds and delivery requirements than traditional military satellite programs.

III. The Substantive Significance of the $816 Million SDA Contract

- Contract Level and Role Definition

In the Tranche 3 Tracking Layer program, Rocket Lab, as the Prime Contractor, is responsible for:

- Design of 18 missile warning/tracking satellites

- Satellite manufacturing and system integration

- Final delivery to the SDA system

This marks the first time the company has assumed full system responsibility in a core U.S. defense constellation program, meaning Rocket Lab is no longer just a "supplier" but is viewed as a defense space enterprise capable of system-level delivery.

- Impact on the Company's Business Structure

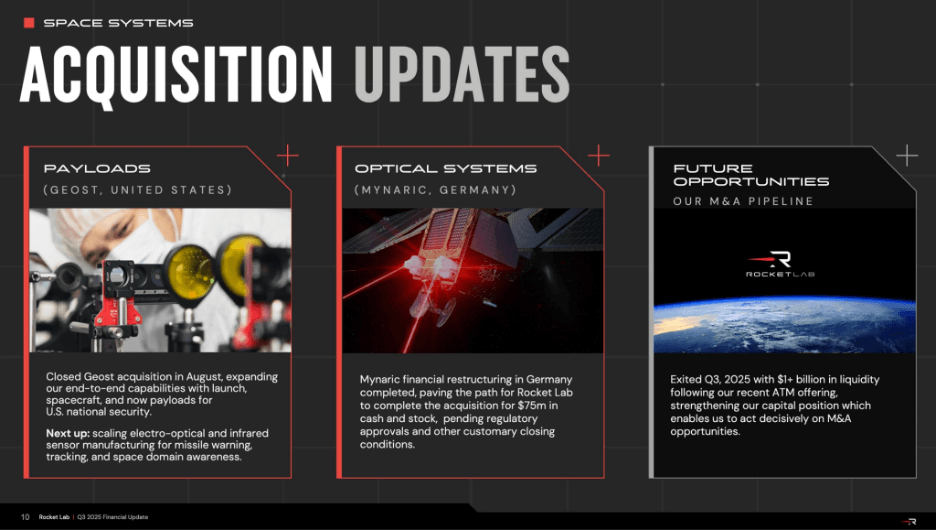

The contract explicitly adopts Rocket Lab's self-developed system, including:

- Lightning satellite platform

- Phoenix wide-field-of-view infrared payload

- StarLite protection sensor

This means the company is not merely supplying the satellite bus but directly controls the most critical and technically complex sensing and survivability modules within the project, significantly increasing the value per satellite and long-term bargaining power.

IV. Space Systems Business: Core Growth Engine, Not Auxiliary Business

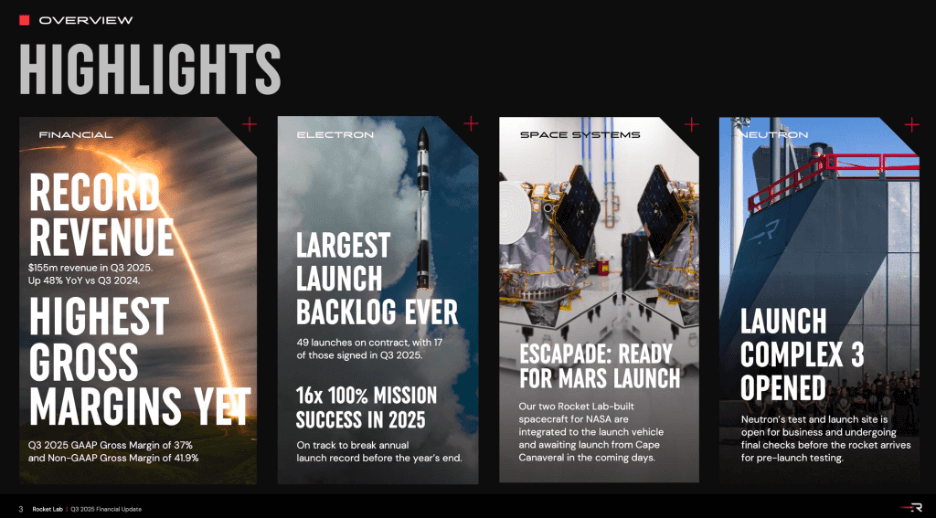

Market discussion around Rocket Lab's valuation has long focused more on Electron launch and Neutron project progress, but from the perspective of revenue structure and profitability path, Space Systems is the core segment determining the company's mid-to-long-term returns.

- Technical Value of the Phoenix Infrared Payload

Phoenix is a new-generation infrared detection system specifically designed for the SDA Tracking Layer, with the core goal of solving the hypersonic target detection challenge:

- Hypersonic targets fly at low altitudes and are highly maneuverable

- Infrared signatures are weak and change complexly

- Traditional ballistic missile warning systems struggle with continuous tracking

Phoenix achieves continuous tracking of targets, rather than instantaneous detection, through high-sensitivity detectors, wide-field-of-view coverage, and extremely high revisit rates. This capability is highly scarce in the current military satellite system.

From a commercial perspective, the complete in-house development and production of Phoenix gives Rocket Lab a clear advantage in cost, performance iteration, and delivery cadence, which is beneficial for long-term gross margin improvement.

- Strategic Significance of the StarLite Protection System

With the development of anti-satellite technology, on-orbit survivability has become a key focus for the military. StarLite is primarily used for:

- Real-time identification of laser and directed energy attacks

- Triggering attitude adjustments and protection mechanisms

- Enhancing overall constellation availability

Notably, StarLite has begun to be adopted by other Tranche 3 prime contractors, indicating that Rocket Lab is gradually expanding its industrial role from a full satellite manufacturer to a supplier of key defense subsystems.

V. Order Extendibility and Mid-to-Long-Term Revenue Visibility

In addition to the $816 million Tracking Layer contract, Rocket Lab had previously secured approximately $515 million in SDA Transport Layer orders. Totaling both orders, the company has secured over $1.3 billion in contracts within the SDA system.

Considering:

- Tranche 3 projects are typically executed over multiple years

- Rocket Lab also has the capacity to provide subsystems to other Primes

The company's actual order capture scale throughout the entire Tranche 3 cycle is expected to expand further, providing high certainty for revenue growth beyond 2026.

VI.Valuation and Financial Status Analysis

As of now, Rocket Lab's market capitalization is about $44 billion, and its enterprise value is about $43.9 billion. The valuation level is clearly skewed toward growth-style pricing:

- EV / Sales (TTM): approximately 79x

- P / Sales: approximately 77x

- Significantly higher than traditional aerospace and defense sectors

From the balance sheet perspective, the company holds about $1 billion in cash and total debt of about $517 million, providing a financial base for continuous R&D and capacity expansion.

The current valuation reflects the market's high expectation for the company's long-term high growth and scalable profitability, but it also means the requirement for execution is extremely high.

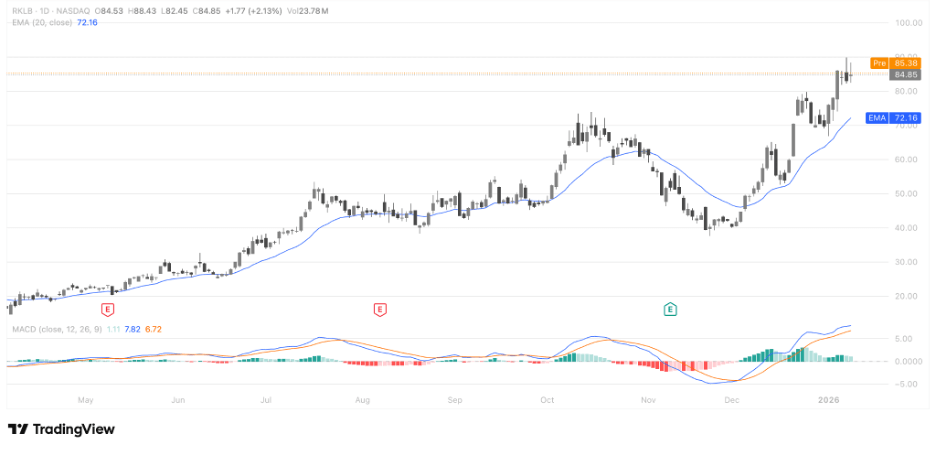

VII. Technical Analysis

From the daily chart structure, Rocket Lab's stock price has maintained a clear upward trend since 2025, and is currently in a high-level consolidation phase after a trend acceleration. The price is generally trading above the 20-day Exponential Moving Average (EMA20), which as of the latest trading day is around $72, providing effective dynamic support for the stock price, indicating the medium-term trend remains intact.

In terms of movement structure, RKLB completed a relatively deep correction in November 2025, established a short-term low near $40, and then began a rapid recovery, entering a trending upward channel. Recently, the stock price has broken through the previous high and stabilized above $80, with the current trading range mainly revolving around $83–$85, entering a short-term high-level consolidation phase to digest the gains. From a pattern perspective, this is a normal consolidation within a trend continuation, rather than a top reversal structure.

Key technical levels:

- Short-term support: Near $72 (EMA20, also the previous breakout platform)

- Secondary support: The $65–$68 range (previous consolidation dense area)

Overall, RKLB's current technical pattern and fundamentals show a strong resonance: the trend direction is upward, the structure is not damaged, but it is at a high level in the short term, requiring time or a slight pullback to digest the gains. Until the trend falls below the EMA20, the stock price remains in a medium-term bullish phase.

VIII. Major Risk Factors

- High valuation sensitivity: Any order delays, lower-than-expected deliveries, or slowdown in profitability cadence could trigger significant pullbacks

- Execution complexity of defense projects: Uncertainties exist in system integration, testing, and certification cycles

- Neutron project risk: The medium-lift launch vehicle remains a crucial component of the long-term growth narrative

- Profitability inflection point is not fully confirmed yet

IX.Conclusion

In summary, Rocket Lab has completed a substantive leap from a commercial space company to a critical participant in the national security space ecosystem. The SDA Tranche 3 contract not only brings substantial orders to the company but, more importantly, validates its technical capabilities and system delivery level in the high-end defense space domain.

In the short term, the stock price is at a high level, and volatility risk cannot be ignored; however, from a mid-to-long-term perspective, the sustained volume growth of the Space Systems business will be the core factor determining Rocket Lab's ultimate valuation center.

We believe Rocket Lab has entered a phase where it needs to be re-evaluated as a "core defense space asset" rather than a "launch services company," warranting continuous tracking and prudent allocation by long-term funds.