I. Introduction

A. Recent Microsoft Stock Performance

Microsoft Corporation (MSFT) has exhibited a robust stock performance in recent times, marked by notable changes in key metrics and driven by a myriad of influential factors.

Notably, Microsoft's 52-week range spans from a low of $219.35 to a high of $366.78. The day range, as of the last available data, fluctuated between $347.33 and $354.39. Forward-looking metrics are also insightful; the estimated earnings per share (EPS) stands at $11.19, while the forward price-to-earnings ratio (PE) is approximately 31.53. The forward dividend rate is $3.00, with a yield of 0.85%. Microsoft's market capitalization is an impressive $2.62 trillion, highlighting its significant presence in the stock market.

Microsoft stock price performance over various timeframes demonstrates its resilience and growth potential compared to the broader market, symbolized by the S&P 500. Over the past year, Microsoft stock exhibited a remarkable 64.67% price return, while the S&P 500 delivered 17.16%. Over a five-year period, Microsoft stock return was a substantial 228.16%, compared to the S&P 500's 59.16%. This trend is even more pronounced over a ten-year period, where Microsoft stock outperformed the S&P 500 by a substantial margin, delivering a 893.10% return compared to the S&P 500's 147.40%.

Source: seekingalpha

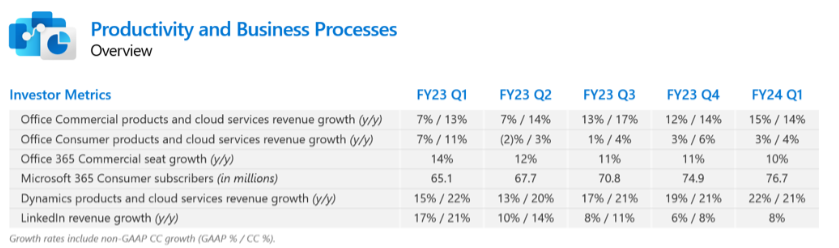

Microsoft's impressive stock performance is not coincidental but is rooted in various influential factors. The company's mission, focused on empowering individuals and organizations through technology, underscores its long-term vision and global relevance. Microsoft generates revenue through a diverse range of activities, including cloud-based solutions, content and services, software product licensing, online advertising, and the design and sale of hardware devices. Key highlights from the first quarter of fiscal year 2024 demonstrate the company's growth across multiple segments:

- Microsoft Cloud revenue increased by a remarkable 24% to reach $31.8 billion, highlighting the continued demand for cloud-based solutions.

- Office Commercial products and cloud services witnessed a 15% revenue growth, largely driven by the impressive 18% growth of Office 365 Commercial.

- Dynamics products and cloud services displayed a substantial 22% revenue increase, with Dynamics 365 growing by 28%.

- Azure and other cloud services contributed to a 29% growth in Server products and cloud services revenue.

- Windows revenue increased by 5%, including 4% growth in Windows OEM and 8% growth in Windows Commercial products and cloud services.

- Microsoft's Xbox content and services revenue increased by 13%, reflecting the strong performance of its gaming division.

- Search and news advertising revenue (excluding traffic acquisition costs) increased by 10%, indicating a growth in online advertising.

B. Expert Insights on MSFT Stock Forecast for 2023, 2025, 2030 and Beyond

Expert forecasts for Microsoft stock price offer valuable insights into its potential trajectory. Traders Union predicts that Microsoft stock may reach $492.29 USD by 2025, $791.04 USD by 2030, and $1156.06 USD by 2034. Coin Price Forecast analysts foresee prices ranging from $326 USD at the end of 2023 to $836 USD in 2035. Walletinvestor anticipates a stock price of $396.516 USD at the beginning of 2025 and $549.938 USD at the beginning of 2028. Long Forecast predicts a price of $461 USD at the start of 2025.

These forecasts, while varying in the exact figures, generally align in projecting a positive trajectory for Microsoft stock. Factors contributing to this optimism include the company's consistent financial performance, its leadership in cloud-based solutions, and its continued innovation in the tech industry.

II. Microsoft Stock Forecast for 2023

MSFT stock is poised to potentially reach $411.50 by the end of 2023. Currently, it faces weekly resistance at $352.80, and the Relative Strength Index (RSI) stands at 72, indicating an overbought condition. Support may be found at the pivot of $334.50 or the weekly support level of $316.50, while a critical support level lies at $295, backed by the 200-day EMA, reinforcing the uptrend.

Source: tradingview.com

Looking ahead, there's a possibility of reaching $375.10 in the coming weeks. After a minor dip within the $375-$335 range, with RSI around 50, the price is expected to resume its bullish momentum and target $411.50. The resistance at $375.10 is relatively weak, supporting this bullish outlook.

A. Other MSFT Stock Forecast for 2023 Insights

Recent analyst ratings and price forecasts for Microsoft Corporation (MSFT) offer valuable insights into the stock's performance and potential upsides. Here's a summary of the latest recommendations and MSFT target price adjustments:

On October 26, 2023, Citigroup revised its target for MSFT stock from "Buy" to "Buy" and raised the MSFT target price from $430.00 to $432.00, indicating a potential upside of approximately 31.70%. This adjustment underscores strong confidence in Microsoft stock's future prospects.

Rosenblatt Securities also increased their target on the same day, maintaining a "Buy" rating and setting a new MSFT price target of $375.00, reflecting a potential gain of 13.01%. This adjustment suggests continued bullish sentiment.

HSBC, on October 26, 2023, upgraded its rating from "Hold" to "Buy" and concurrently raised the MSFT target price from $347.00 to $413.00. This upgrade implies an upside potential of 21.23%, indicating a favorable outlook for MSFT stock.

On October 25, 2023, Royal Bank of Canada reiterated its "Outperform" rating and maintained a MSFT price target of $390.00, reflecting a potential increase of 14.86%. This reaffirmation signifies the continued belief in the stock's outperformance.

Barclays, also on October 25, 2023, retained its "Overweight" rating but slightly adjusted the Microsoft target price from $425.00 to $421.00, suggesting a potential gain of 23.26%. This adjustment, while lower, still indicates confidence in the stock's upward movement.

The Goldman Sachs Group boosted its target on October 25, 2023, maintaining a "Buy" rating and setting a new MSFT price target of $450.00. This adjustment implies a substantial potential upside of 31.81%, emphasizing a bullish outlook for MSFT stock.

These recent analyst actions and forecasts collectively illustrate a positive sentiment surrounding MSFT stock, with multiple brokerages expressing their faith in the stock's growth potential.

B. Key Factors to Watch for Microsoft Stock Forecast 2023

Microsoft's recent financial performance, strategic developments, and analyst outlook for 2023 offer valuable insights into the tech giant's strengths and growth prospects.

Microsoft's recent financial results and strategic developments paint a positive outlook for the company in 2023. Its strong performance in the cloud, ongoing innovation in AI, and acquisitions like Activision demonstrate its commitment to staying at the forefront of the technology industry. The company's diverse product offerings, including cloud services, developer tools, business applications, and consumer-focused solutions, position it well for continued growth and innovation.

Microsoft Q1 2024 Financial Highlights

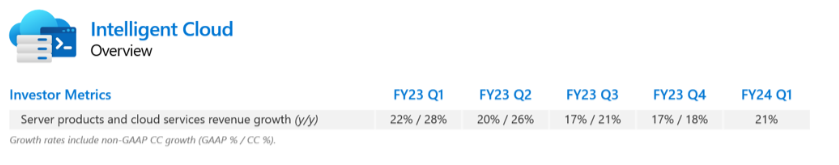

Microsoft reported strong fiscal year performance, attributing its success to the continued strength in its cloud segment. The company's cloud revenue represents a remarkable 24% increase. This substantial growth underscores the ongoing importance of Microsoft's cloud services in the tech industry.

Azure, Microsoft's cloud computing platform, gained market share as more organizations migrated their workloads to the cloud. With over 60 data center regions worldwide and strong AI infrastructure, Azure is at the forefront of the cloud industry. The general availability of the next-generation H100 virtual machines is another testament to Microsoft's commitment to innovation.

Source: Earnings Presentation

Azure AI's ability to provide access to top-notch AI models from OpenAI, Meta, and Hugging Face empowers organizations to create their own AI applications, fostering a broader customer base for Azure's services.

Additionally, Microsoft's Azure Arc facilitates cloud migrations by enabling organizations to run applications across on-premises, edge, and multi-cloud environments. This flexibility has attracted 21,000 Azure Arc customers, up 140% year-over-year.

Moreover, Microsoft's collaboration with Oracle in providing database services simplifies the transition of on-premises Oracle databases to Microsoft's cloud, adding a competitive advantage to its cloud offerings.

GitHub Copilot and Power Platform

Microsoft's GitHub Copilot boosts developer productivity by up to 55%, facilitating more efficient and enjoyable coding. With over one million paid users and significant adoption among organizations like Maersk and PwC, GitHub Copilot is driving substantial growth in developer usage.

The integration of Copilot into the Power Platform enables natural language-driven app creation, virtual agent building, and data analysis. Over 126,000 organizations have employed Copilot in Power Platform, reinforcing its impact.

Furthermore, Microsoft has expanded Copilot capabilities, empowering users to create data-driven websites and websites with just a few simple commands or clicks. Power Apps, Microsoft's low-code no-code development platform, now boasts 20 million monthly active users, up 40% year-over-year.

Business Applications and Dynamics 365

Dynamics 365, Microsoft's business application suite, has consistently taken market share over ten consecutive quarters. It's evolving into a Copilot-led transformation layer for existing CRM systems, such as Salesforce, enhancing customer interactions and productivity. Its broad implementation spans numerous organizations.

Source: Earnings Presentation

Healthcare, Security, and LinkedIn

In the healthcare sector, Microsoft is pioneering innovative solutions, such as Dragon Ambient eXperience and DAX Copilot, which automate patient interaction documentation, reduce physician burnout, and unify health data securely.

Microsoft's security division introduced Security Copilot, the industry's advanced generative AI product, integrated with Microsoft 365 Defender. Early users such as Bridgewater and Fidelity National Financial have provided positive feedback, and the company plans to expand the program.

Microsoft continues to drive innovation in the professional social network space through AI-driven features that enhance user experiences and interactions on LinkedIn.

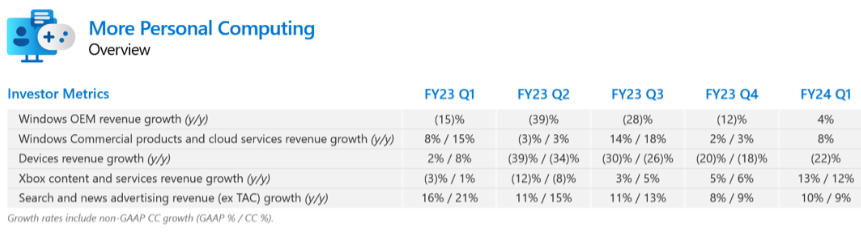

Windows and Consumer Business

Microsoft is continuously innovating its Windows operating system by adding AI-powered features. The recent Windows 11 update brought 150 new features, offering users an enhanced experience. The focus is on personalized assistance and improved user productivity.

Microsoft's consumer business, including Windows and Xbox, showed solid performance. The PC market is stabilizing, driven by strong demand and an increase in consumer channel inventory builds.

Source: Earnings Presentation

Outlook for 2023

For the fiscal year 2023, Microsoft has provided guidance for its different segments. It expects steady growth in Productivity and Business Processes, driven by Office 365 and LinkedIn. In Intelligent Cloud, Azure remains a growth driver, while Azure AI will continue to play a significant role. More Personal Computing anticipates robust growth with the completion of the Activision acquisition, driven by Xbox content and services.

In terms of financials, Microsoft anticipates stable operating margins despite the investment in the cloud and AI sectors. The company also expects no significant FX impact on revenue, COGS, or operating expenses, assuming stable currency rates.

Bullish Factors

- Strong Cloud Growth: Microsoft's cloud revenue exceeded $31.8 billion in a single quarter, reflecting the increasing demand for Azure and Microsoft 365.

- Azure's Competitive Edge: Azure continues to gain market share with its comprehensive cloud footprint, AI infrastructure, and AI services deployed in numerous regions.

- GitHub Copilot Adoption: Over 1 million paid Copilot users and more than 37,000 organizations subscribing to Copilot for business, indicating high developer adoption.

- Dynamics 365 Success: Dynamics 365 has taken market share for ten consecutive quarters, demonstrating its success.

- Healthcare and Security Solutions: Microsoft's solutions in healthcare and security, such as AI-driven clinical notes and AI-powered security, are making a positive impact.

Bearish Factors

- Cloud Competition: Intense competition in the cloud market from rivals like AWS and Google Cloud, making differentiation challenging.

- Economic Uncertainty: Economic downturns or reduced IT spending could impact Microsoft's revenue and growth.

- Regulatory Challenges: Regulatory concerns and privacy issues may result in legal changes, fines, and potential disruptions to Microsoft's operations.

- Hardware Revenue Decline: Declining revenue in non-premium hardware products due to competition in the hardware industry.

- Acquisition Risks: The integration of the Activision Blizzard King acquisition carries execution risks and uncertainties.

- These factors will collectively influence Microsoft's performance and trajectory in 2023.

III. Microsoft Stock Forecast for 2025

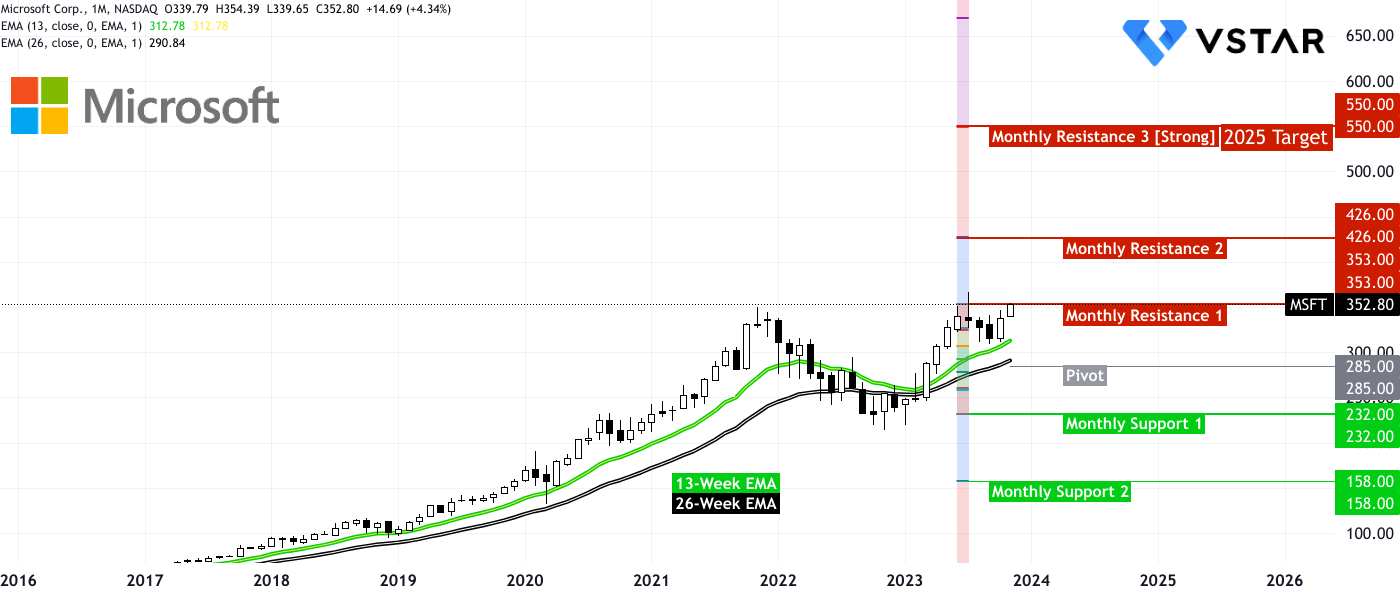

MSFT stock price is poised to reach $550, primarily driven by the enthusiasm surrounding artificial intelligence (AI). However, a minor correction might occur in 2024 if a mild recession emerges due to the Federal Reserve's "higher for longer" stance. In this scenario, $285 could act as a mid-term support level. Nevertheless, the potential for heightened volatility may lead to swift downward movements, followed by rapid recoveries, with $232 serving as a support level in such cases.

Source: tradingview.com

Looking ahead, with the current momentum, the price is expected to reach $426 in early or mid-2024 and could hit $550 by the end of 2025. Notably, investors should closely monitor the 13-week and 26-week Exponential Moving Averages (EMAs) to discern the prevailing trend. Based on these two EMAs, a consistent long-term uptrend appears to be in progress for the stock.

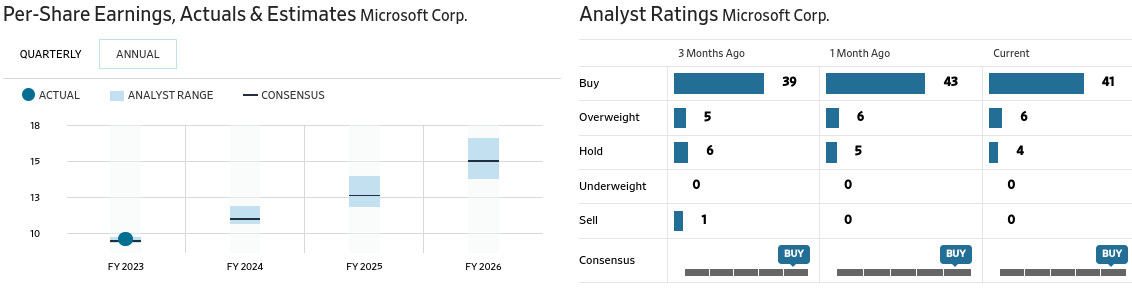

A. Other MSFT Stock Forecast for 2025 Insights

MarketWatch offers a 2025 price target of $487 for MSFT stock. In contrast, Coincodex predicts a price of $547 for 2025, using the stock's average growth over the past decade as a basis for their MSFT forecast. Meanwhile, Yahoo Finance and Wall Street Journal (WSJ) provides a 2025 Microsoft price target near $450 (based on P/E of 34 and EPS of $13).

Source: WSJ (Consensus EPS)

For the short to mid-term, prominent analysts mostly focus on Microsoft's products to project price targets.

Firstly, Keith Weiss from Morgan Stanley emphasized Microsoft's position as a platform where thousands of companies can spend tens of millions of dollars per year. This highlights the company's ability to attract substantial enterprise-level revenue. Microsoft's vast ecosystem of products and services, including cloud solutions, productivity tools, and infrastructure, makes it an attractive choice for businesses of all sizes. This diverse client base and revenue streams contribute to a positive outlook.

Kash Rangan of Goldman Sachs points out Microsoft's unique strength across all layers of the cloud stack, including application platforms and infrastructure. This comprehensive presence in the cloud sector positions Microsoft as a one-stop solution for various cloud needs. Its Azure cloud platform, in particular, is a significant revenue generator. The increasing demand for cloud services and Microsoft's strong position within this market are key factors supporting its future growth.

Brad Sills from Bank of America underlines Microsoft's potential for sustained low double-digit growth over the next 3-5 years. This growth is expected to be driven by the continued adoption of Azure, the cloud-based Office 365 suite, and the profitability of games and Game Pass revenue in the Xbox segment. Azure's growth in the cloud infrastructure sector, combined with Microsoft's established products, positions the company for steady and reliable growth.

In conclusion, the experts' opinions collectively emphasize Microsoft's diverse revenue streams, strong presence in the cloud sector, and the profitability of its existing products and services.

B. Key Factors to Watch for Microsoft Stock Forecast 2025

Microsoft stock forecast 2025 - Bullish Factors

Strong Earnings Growth: Microsoft's consensus EPS estimates indicate robust growth, with an expected YoY increase of 14.82% for fiscal year ending June 2025. This reflects the company's ability to generate substantial earnings, driven by its diversified product portfolio.

Positive Revenue Outlook: The consensus revenue estimates for Microsoft in 2025 are encouraging, with an anticipated YoY growth of 13.85%. This suggests that Microsoft's core businesses, including cloud computing, are poised for continued expansion.

Forward Price-to-Earnings (P/E) Ratio: The forward P/E ratio is projected to be around 27.46 in 2025, which is relatively reasonable considering Microsoft's growth prospects. A moderate PE ratio implies that investors are optimistic about the company's future earnings potential.

Analyst Consensus: The fact that a substantial number of analysts have contributed to these estimates (35 for EPS and 48 for revenue) indicates a strong consensus within the investment community. This consensus often reflects confidence in the company's future performance.

Growth in Cloud Services: Microsoft's Azure cloud platform is a major driver of growth. The increasing adoption of cloud services, especially in a post-pandemic world where remote work and digital transformation are prevalent, is likely to benefit Microsoft significantly.

Microsoft stock forecast 2025 - Bearish Factors

Economic Uncertainty: Economic conditions can impact Microsoft's performance. If there is a significant economic downturn, it may affect the company's revenue and earnings growth, as businesses could cut back on IT spending.

Competition: Microsoft faces competition from other tech giants like Amazon, Google, and Apple, especially in the cloud computing and software sectors. Increased competition may lead to margin pressure or reduced market share.

Regulatory Risks: The tech industry faces increasing scrutiny from regulators worldwide. Regulatory changes or antitrust actions could have adverse effects on Microsoft's business operations and Microsoft valuation.

IV. Microsoft Stock Forecast for 2030 and Beyond

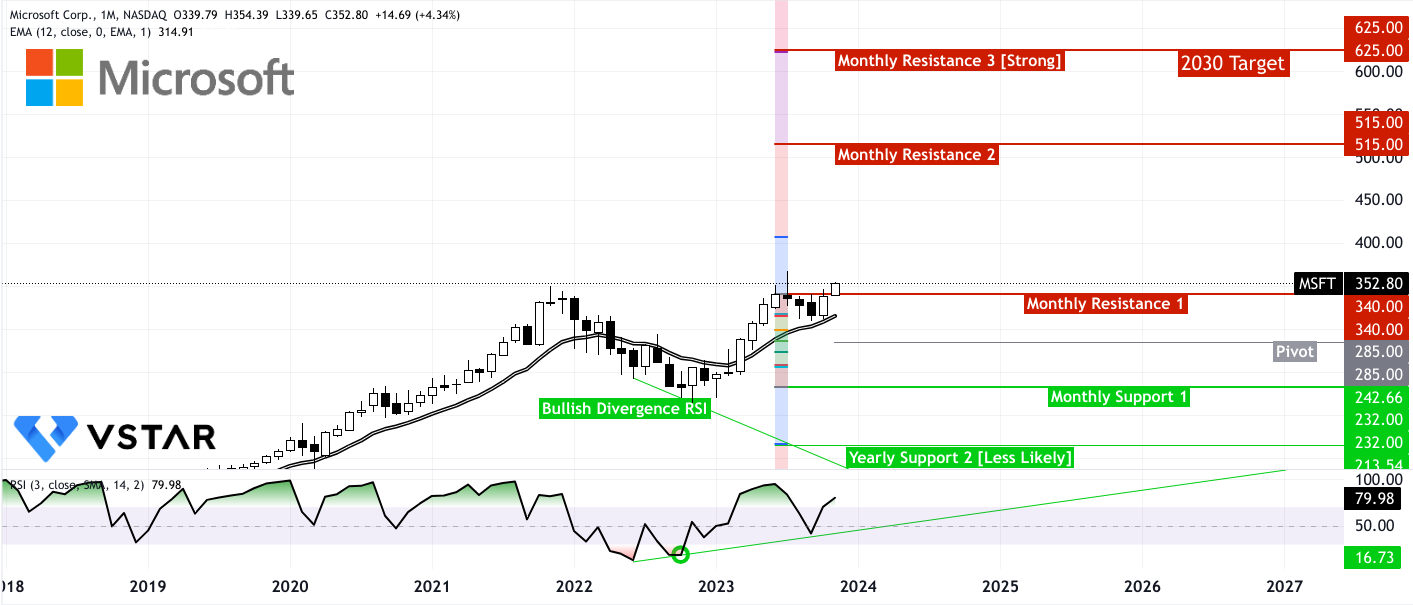

The stock exhibits a promising outlook, with the potential to reach $625 by the end of 2030, supported by its 12-month Exponential Moving Average (EMA). A notable bullish indicator is the Relative Strength Index (RSI) showing a bullish divergence in 2022, leading to a robust upward trend.

However, the downside presents some risks. The stock could revisit the pivot level at $285. In a more adverse economic scenario, it might even drop to a support level of $232, with the worst-case scenario seeing it reach $165.

Source: tradingview.com

On the optimistic side, the stock will likely encounter resistance around $515, with a formidable barrier at $625, which acts as the target for 2030. Over the coming months, expect strong upward movements as the stock has already breached the current monthly resistance at $340.

The 12-month EMA is crucial as it provides dynamic support during the ongoing uptrend, helping sustain the positive momentum. This outlook is based on various technical indicators and should be considered alongside broader market conditions and potential macroeconomic factors.

A. Other MSFT Stock Predictions 2030 and Beyond Insights

Microsoft's stock performance and future outlook hold several key factors that investors should consider. Coincodex predicts that Microsoft stock price could reach $1,626.41 by the end of 2030, a growth of 359.26% from its current price, which is an exciting prospect. This prediction is based on the company's current 10-year average growth rate, and it is rooted in several fundamental factors.

By 2030, Microsoft could reach a valuation of $5 trillion, presenting a compelling investment opportunity with a potential 140% return for investors. The key drivers behind this bullish outlook are Microsoft's diversification and focus on high-growth sectors, particularly artificial intelligence.

Microsoft's evolution from a consumer software company into a technology powerhouse positions it for significant growth. While its flagship products, like the Windows operating system and Office 365, have a massive user base, the company has ventured beyond these to tap into areas with high growth potential. Initiatives such as its hardware businesses, including Surface and Xbox, have expanded its footprint. Moreover, Azure, Microsoft's cloud services platform, has become a leading global player, and it is expected to operate in a market potentially worth $1.5 trillion annually by 2030, driven by digital transformation demands.

One area of particular interest is Bing, Microsoft's search engine, which is poised to challenge Alphabet's Google Search. Microsoft's substantial investment in OpenAI and its ChatGPT chatbot, powered by AI, have the potential to revolutionize the way people search for information. This technology enables tailored responses to complex queries, offering a faster alternative to traditional internet searches. Microsoft's integration of OpenAI into its Azure platform provides customers with AI tools that can transform their businesses.

According to Ark Investment Management's forecast, generative AI software like ChatGPT could generate $14 trillion in revenue by the end of the decade. Bing has already seen significant adoption, with the Bing mobile app's downloads surging after the ChatGPT integration. This could be a turning point for Bing, currently holding just a 3% global market share in search compared to Google's dominant 93%. Gaining even a small percentage of market share could translate to significant revenue growth. Microsoft estimates that each percentage point of market share gained in the search industry equates to $2 billion in annual revenue. If Bing achieves a 25% market share by 2030, its contribution to Microsoft's revenue could potentially be $38.4 billion higher than its current figures.

From a valuation perspective, Microsoft's price-to-sales (P/S) ratio has remained within a consistent range between 8 and 12 over the past three years. Given Microsoft's growth rate, if the company continues growing its annual revenue at a compound annual rate of 11.3%, it could reach revenue of over $420 billion in fiscal 2030. This would result in a market capitalization of $4.41 trillion based on a P/S ratio of 10.5. Incorporating the additional revenue from ChatGPT-powered Bing, the valuation could increase to $4.81 trillion.

The potential growth in the AI industry, along with OpenAI's integrations with Azure, positions Microsoft as a go-to choice for businesses seeking advanced AI tools. This trend could ultimately propel Microsoft's valuation above the coveted $5 trillion mark.

B. Key Factors to Watch for Microsoft Stock Forecast 2030 and Beyond

Microsoft stock forecast for 2030 and beyond - Bullish Factors

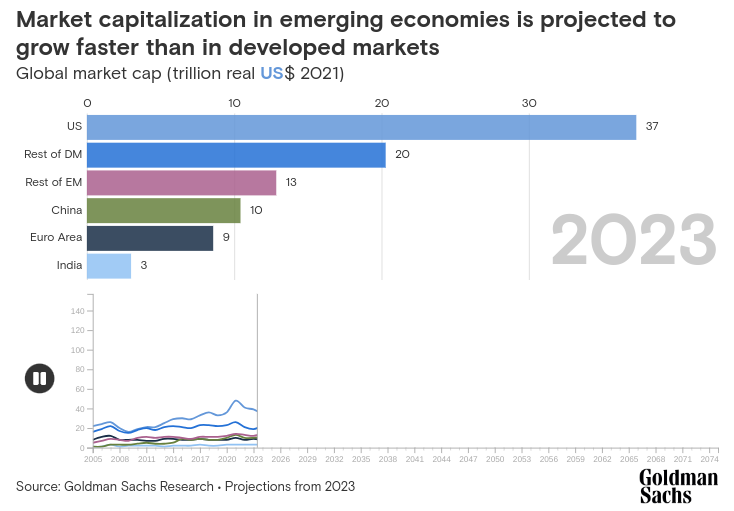

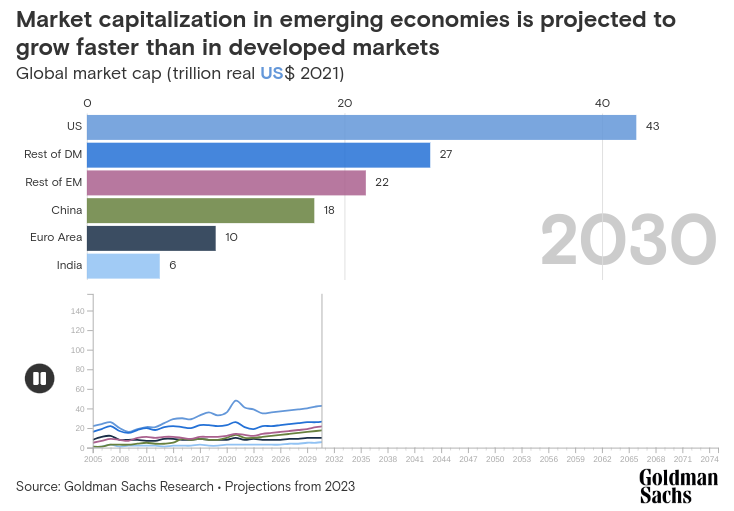

Emerging Market Growth: The rise of emerging markets (EMs) presents a bullish factor for Microsoft and global corporations. As EMs gain a larger share of global equity market capitalization, it implies expanded business opportunities for companies like Microsoft.

Source: goldmansachs.com

With EMs' increasing share of global GDP, Microsoft can anticipate higher demand for its products and services in these growing economies.

Source: goldmansachs.com

AI's Economic Impact: Artificial intelligence (AI) has the potential to revolutionize productivity and GDP. Microsoft's strategic investments in AI, including initiatives like ChatGPT, can significantly enhance the company's performance and offerings. AI-driven product enhancements can stimulate consumer demand, benefiting Microsoft by providing an avenue for innovation and personalization. This offers a bullish outlook for the company's future growth.

Outperformance of Emerging Market Equities: While the relationship between equity market capitalization growth and equity performance is not linear, EM equities are expected to outperform DM (developed market) stocks in the long run. Microsoft, as a global tech giant, can benefit from the stronger long-term earnings growth and valuation expansion in EMs. As risk premia decrease, these markets can offer more attractive investment opportunities for Microsoft.

Future Economic Landscape: Projections by Goldman Sachs Research indicate that the world's three largest economies in 2075 will be China, India, and the U.S. Microsoft, with its global reach and presence in these markets, can capitalize on this economic shift. India's substantial increase in market cap share is particularly noteworthy, offering opportunities for Microsoft to expand its business.

MSFT stock forecast for 2030 and beyond Bearish Factors

Rising Protectionism: A significant bearish factor for Microsoft's global outlook is the risk of rising protectionism, stemming from populist nationalism. Increased protectionism and a reversal of globalization could disrupt the development of open capital markets. Microsoft, as an international corporation, may face hurdles in navigating protectionist policies, potentially impacting its global operations.

AI-Related Risks: While AI promises significant benefits, it also poses potential risks. Generative artificial intelligence could lead to a divergence in AI's effects on developed and emerging economies. This could be a downside risk to the projected increase in EMs' share of global equity market capitalization. The challenges of managing AI's impact, privacy concerns, and ethical considerations are also potential bearish factors for AI-related investments.

Long-term Economic Uncertainties: The long-term economic projections and economic landscape come with uncertainties. Economic trends are subject to various external factors, and deviations from projections can affect market dynamics. Factors such as climate change, geopolitical shifts, and changes in political leadership can introduce uncertainties into economic forecasts.

V. Microsoft Stock Price History Performance

Microsoft Stock History Performance

Short-term Gains: In the past week, Microsoft stock price has returned 6.97%, outperforming the S&P 500's 5.85%. This could be influenced by recent positive news or earnings reports.

Strong Monthly Growth: Over the last month, Microsoft stock has seen a 12.58% price return, indicating sustained investor interest.

Robust Half-Year Performance: MSFT stock price returned 15.90% over the past six months, surpassing the S&P 500's 6.54%. Factors like strong financial results and cloud growth likely contributed to this performance.

Year-to-Date Rally: Microsoft's year-to-date price return of 47.11% reflects consistent growth, aligning with the technology sector's resilience.

Impressive One-Year Gain: Over the past year, Microsoft stock has gained 64.67%, driven by its role in the technology and cloud computing sectors, which experienced heightened demand during the pandemic.

Long-term Growth: Over three years, Microsoft stock has demonstrated a price return of 70.91%, reflecting its ability to maintain momentum.

Exceptional 5-Year Performance: MSFT stock's 5-year return of 232.33% significantly outperformed the S&P 500's 60.05%, driven by cloud expansion, acquisitions, and strong financials.

A Decade of Growth: Over the last decade, Microsoft stock price exhibited remarkable growth, returning 893.10%, significantly exceeding the S&P 500's 147.40%. This long-term performance is attributed to diversification and strategic initiatives.

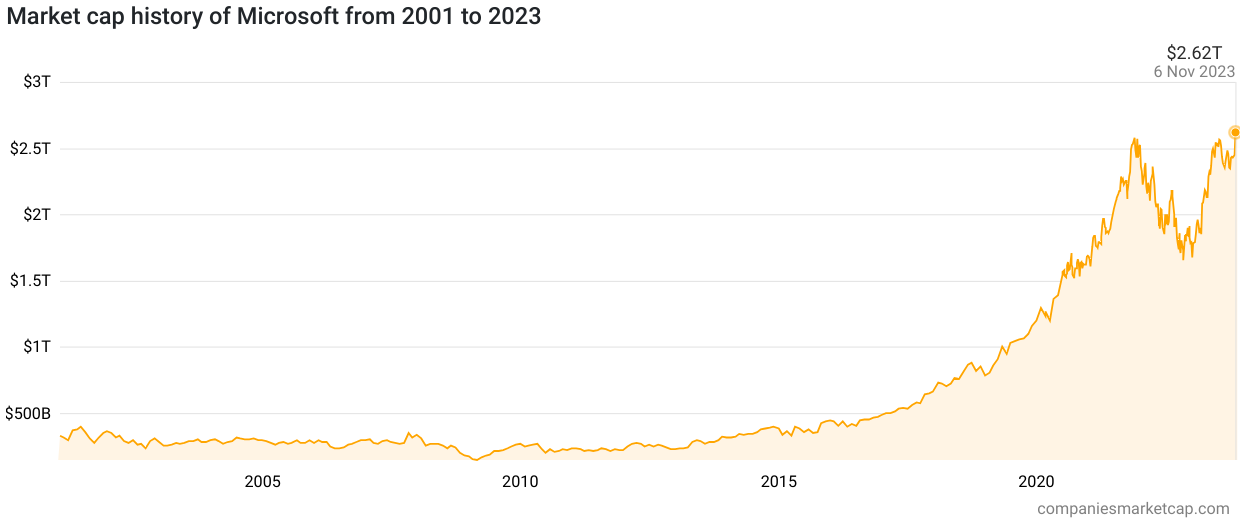

Microsoft Market Capitalization History

Microsoft's market capitalization history demonstrates its consistent growth:

Source: companiesmarketcap.com

Microsoft's stock price history has been a journey of resilience and adaptability. In the early 2000s, the burst of the dot-com bubble led to a decline in market capitalization, reflecting broader market challenges.

However, by 2007, Microsoft's market cap had grown as it expanded its product portfolio and diversified its revenue streams. Successful products like Windows Vista and the Xbox 360, along with strategic acquisitions, played key roles in this growth.

The global financial crisis in 2008 led to a significant drop in market cap, but by 2009, signs of recovery were evident as the economy improved. Throughout the 2010s, Microsoft's market cap remained relatively stable, with fluctuations influenced by competition from companies like Apple and Google, as well as uncertainties in the global economy.

In 2013, under the leadership of CEO Satya Nadella, Microsoft began focusing on cloud services and enterprise software. This strategic shift led to substantial market cap growth, as products like Office 365 and Azure gained prominence. The successful launch of Windows 10 and the expansion of Azure further contributed to market cap growth in subsequent years.

In 2017, the acquisition of LinkedIn and the continued success of Azure propelled Microsoft's market cap to new heights.

By 2019, it had reached a trillion-dollar market cap, reflecting its leadership in cloud computing. The COVID-19 pandemic in 2020 accelerated the adoption of digital solutions, boosting demand for Microsoft's productivity and cloud services and driving further market cap growth.

In 2022, market corrections and investor sentiment led to a decrease in market cap. However, by 2023, the company's consistent growth in cloud computing (Azure) and an expanding product portfolio, combined with improved macroeconomic conditions, contributed to a rebound in market cap.

VI. Conclusion

In conclusion, when evaluating Microsoft's stock price forecasts for 2023, 2025, and 2030, it's important to consider several key factors. In 2023, the stock is expected to hover around $410, with the potential for bullish momentum driven by the company's AI and cloud computing initiatives. By 2025, the price may reach $550, reflecting the positive long-term outlook, while the 2030 target of $625 underscores the impact of AI enthusiasm and emerging market dynamics. However, these forecasts come with certain caveats and uncertainties tied to economic conditions, competition, and regulatory risks.

For investors, Microsoft offers a compelling investment opportunity. With the company's emphasis on AI and cloud computing, coupled with its consistent growth in revenue and earnings, there is a strong foundation for potential returns. As always, diversification and a long-term perspective should guide investment decisions. It is advisable to consult with a financial advisor and conduct thorough research before making any investment in Microsoft or any other stock.

Additionally, for those interested in trading Microsoft Stock CFDs, VSTAR presents some distinct advantages. By using Stock CFDs, traders can leverage their positions with up to 1:200, enabling participation in a broader range of trading opportunities. Moreover, VSTAR offers a cost-effective trading experience with $0 commission and transparent trading costs, allowing traders to maximize their profits.

VSTAR provides access to global stock markets, including popular Asian, US, and international stocks. This broad market exposure can diversify trading portfolios and help traders take advantage of opportunities across the globe. Furthermore, VSTAR's focus on lightning-fast execution ensures that orders are filled at the best market prices and executed within milliseconds, enabling efficient and timely trading.

VSTAR's trading platform, with its leverage, low trading costs, global market access, and quick execution, can be a valuable resource for investors looking to capitalize on the potential of Microsoft stock in the coming years.

FAQs

1. What is the prediction for Microsoft stock?

Microsoft stock predictions are generally positive, with analysts forecasting further growth. The average analyst 12-month price target is around $378.

2. Is Microsoft stock expected to rise?

Yes, Microsoft stock is expected to continue rising in 2023 and beyond. Microsoft has solid cash flow to support dividends and share repurchases, and has a strong balance sheet and profitability compared to other large technology companies.

3. How high will Microsoft go?

Analyst price targets for Microsoft stock range from $320 on the low end up to $420 on the high end over the next year.

4. Will MSFT stock go up in 2023?

Most forecasts have Microsoft stock rising through 2023, probably into the $400+ range.

5. What is the prediction for Microsoft in 2023?

The consensus for Microsoft in 2023 seems to be continued revenue and earnings growth, with stock price appreciation forecast in the high single digits to low double digits.

6. What will MSFT be worth in 2025?

Analyst estimates for Microsoft stock in 2025 range from $450 on the conservative side to over $500 on the optimistic side.