I. Introduction

Introduction to gold trading and investing

Gold trading and investing is a popular financial activity that involves the buying and selling of Gold as a commodity or investment vehicle. While proponents highlight its historical value and potential as a hedge against economic uncertainty, a critical evaluation reveals several considerations:

● Gold's value is subjective and influenced by market dynamics, making it prone to price fluctuations.

● Gold does not generate cash flow or dividends, relying solely on price appreciation for returns.

● Its storage and security costs can erode profits.

● Gold's performance is not guaranteed, and alternative investment options may offer better risk-adjusted returns.

Therefore, a critical assessment of gold trading and investing is essential before committing capital to this asset class.

The importance of Gold in the finance industry

Gold holds significant importance in the finance industry for several reasons:

● It has served as a store of value throughout history, providing a hedge against inflation and currency devaluation.

● Central banks and governments hold substantial gold reserves to maintain stability and confidence in their respective economies.

● Gold is considered a safe asset during economic uncertainty, as investors seek its perceived stability and liquidity.

● Gold plays a vital role in international trade and settlements, as it is widely accepted as a form of payment.

II. Historical Significance of Gold

A brief history of Gold as a valued commodity

Over time, Gold evolved beyond its ornamental use and became a symbol of wealth and power. Civilizations such as the Egyptians, Greeks, and Romans used Gold as a medium of exchange and a store of value. Its scarcity and inherent worth made it a reliable means of trade across borders and cultures.

As economies developed, Gold began to play a pivotal role in the establishment of monetary systems. It served as the foundation of various currency standards, such as the gold standard, where the value of a currency was directly linked to a fixed quantity of Gold. This system provided stability and confidence in monetary transactions.

However, the shift towards fiat currencies and the abandonment of the gold standard during the 20th century reduced Gold's role in official monetary systems. Nevertheless, its enduring allure as a safe-haven asset and a hedge against economic uncertainties has sustained its value in the financial markets.

In recent decades, Gold has also emerged as an investment instrument. Investors diversify their portfolios by including Gold as a potential store of value during economic downturns or periods of market volatility.

Role of Gold in early currency systems

The role of Gold in early currency systems was significant, primarily due to its scarcity, durability, and intrinsic value. Gold emerged as a trusted medium of exchange, facilitating trade and commerce among ancient civilizations. The standardization of gold coins provided a universally accepted unit of value, enabling efficient transactions and promoting economic development.

Furthermore, the introduction of the gold standard solidified Gold's role as a foundation for currency systems. This system pegged the value of currencies to a fixed amount of Gold, instilling confidence and stability in monetary transactions. However, the rigidity of the gold standard and its limitations eventually led to its abandonment in favor of more flexible monetary frameworks.

Nonetheless, the historical importance of Gold in early currency systems remains undeniable, as it laid the groundwork for the evolution of money and the establishment of financial systems.

Reasons why Gold has been valued throughout history

Gold has been valued throughout history for several reasons, rooted in its unique characteristics and cultural significance. Firstly, Gold's scarcity and limited supply have contributed to its desirability. Its rarity gives it a sense of exclusivity and perceived value. Secondly, Gold's physical properties, such as its resistance to corrosion and malleability, have made it an ideal material for crafting intricate jewelry and decorative objects. Its aesthetic appeal and association with wealth and status have further enhanced its value.

Additionally, Gold's historical use as a medium of exchange and store of value has cemented its importance in financial systems. It has served as a reliable form of currency, offering stability and confidence in trade and transactions. Furthermore, Gold has been seen as a hedge against economic uncertainties and a safe-haven asset during times of instability. These reasons, combined with cultural and historical factors, have contributed to Gold's enduring value over the ages.

The significance of Gold in modern times

In modern times, the significance of Gold has evolved from its historical role. While it still holds value as a store of wealth, its importance has diminished in practical financial applications. Gold's limited industrial use, lack of cash flow generation, and absence of dividends make it less attractive compared to other investment options. Its price volatility, susceptible to speculative trading and market sentiment, adds risk for investors.

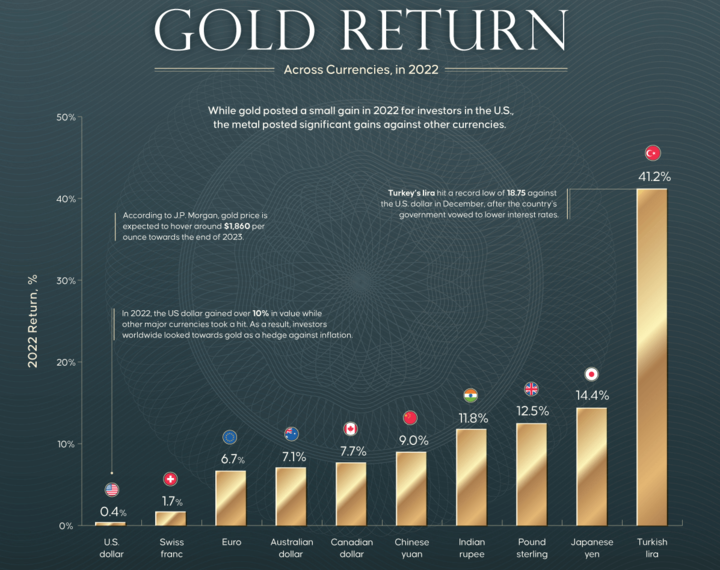

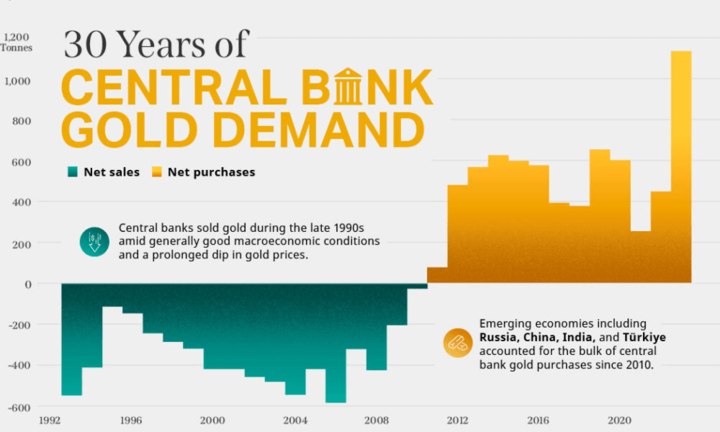

Source: visualcapitalist.com

Moreover, the shift away from the gold standard and the rise of fiat currencies has reduced its influence in official monetary systems. Despite these factors, Gold maintains a symbolic allure and serves as a safe haven during economic uncertainty. Its perceived stability and hedging properties appeal to investors seeking portfolio diversification. However, a critical evaluation of Gold's role in modern times requires considering its limitations as an investment and recognizing alternative assets that may offer better risk-adjusted returns.

III. Factors That Affect the Price of Gold

Current market trends that influence gold prices

Gold prices are influenced by a range of market trends that can be critical for investors to understand. Firstly, macroeconomic factors play a significant role. Changes in interest rates, inflation expectations, and the monetary policies of central banks can impact the demand for Gold as an inflation hedge or safe-haven asset. Geopolitical tensions and economic uncertainties also drive investors toward Gold as a perceived store of value. Secondly, currency movements affect gold prices. As Gold is priced in US dollars, value fluctuations in the strength or weakness of major currencies relative to the dollar can impact its price in international markets.

Source: visualcapitalist.com

Additionally, investor sentiment and market speculation contribute to short-term price volatility. Supply and demand dynamics, including mining production, central bank purchases or sales, and investor demand for physical Gold or gold-backed financial instruments, further influence prices. Understanding these current market trends is essential for critically evaluating Gold as an investment and making informed decisions.

Economic and political factors that affect gold prices

Gold prices are significantly influenced by a range of economic and political factors that require critical evaluation. Economically, interest rates play a crucial role. When rates are low, the opportunity cost of holding non-yielding assets like Gold diminishes, making it more attractive for investors. Inflation is another important factor, as Gold is often seen as a hedge against rising prices. Changes in monetary policies, especially those related to quantitative easing or tightening, can impact the value of currencies and subsequently influence gold prices.

Additionally, economic indicators like GDP growth, employment rates, and consumer sentiment can affect investor confidence and demand for Gold. On the political front, geopolitical tensions, trade disputes, and global economic uncertainties can drive investors toward Gold as a safe-haven asset. Policies related to taxation, import/export regulations, and government stability can also impact gold prices.

Supply and demand effects on gold prices

The prices of Gold are significantly influenced by the dynamics of supply and demand in the market. Understanding these effects is critical for evaluating the factors that drive gold prices. On the supply side, gold mining production plays a key role. Changes in production levels, such as increased mining output or decreased exploration activities, can impact the overall supply of Gold available for trading, potentially affecting prices.

Source: sc.com

Central banks also play a significant role, as they can choose to buy or sell gold reserves, affecting the supply in the market.

On the demand side, various factors come into play. Investment demand, including purchases of gold-backed exchange-traded funds (ETFs) or bars and coins, can significantly impact prices. Jewelry demand, particularly in emerging markets, also plays a significant role. Additionally, economic conditions, geopolitical uncertainties, and inflation expectations can influence the demand for Gold as a safe-haven asset and store of value.

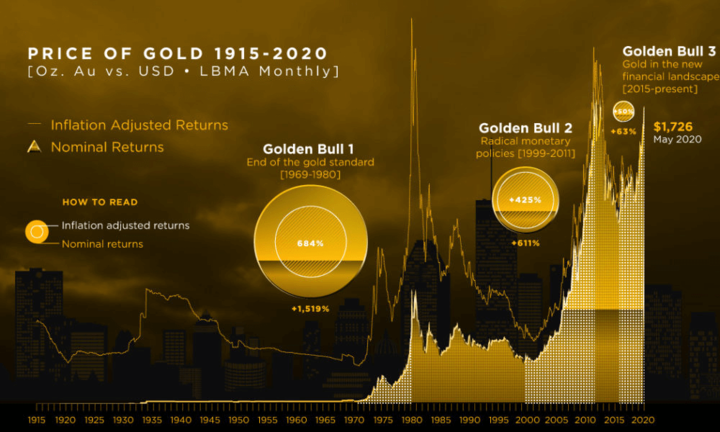

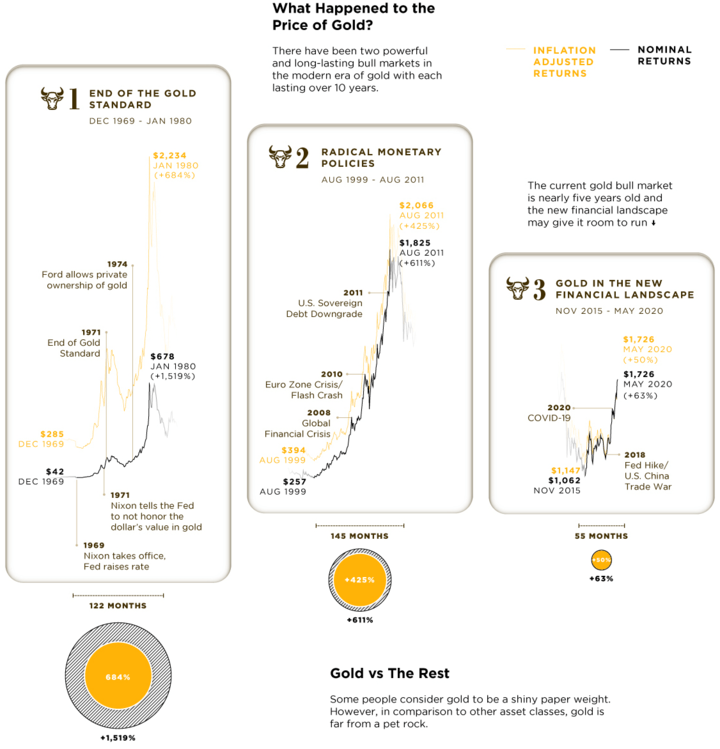

Gold price trends in the past and their impact on trading and investing strategies

Examining past gold price trends is crucial for understanding the impact they have on trading and investing strategies. Historical data reveals patterns that inform market behavior and aid in decision-making. Bullish periods, characterized by upward price trends, have enticed investors seeking capital appreciation. During such periods, trading strategies focused on buying Gold or gold-backed assets and holding them for potential gains. Conversely, bearish periods, marked by downward price trends, have prompted traders to adopt strategies aimed at short-selling or taking defensive positions.

One notable example is the global financial crisis of 2008. During this period, there was a severe economic downturn, with stock markets experiencing significant declines and widespread panic among investors. As a result, the demand for gold surged as investors sought a safe haven to protect their wealth.

Source: visualcapitalist.com

In the years leading up to the crisis, the price of gold had been relatively stable, hovering around $600 to $800 per ounce. However, as the financial crisis unfolded, the price of gold started to rise rapidly. From 2008 to 2011, the price of gold soared to unprecedented levels, reaching a peak of around $1,900 per ounce in September 2011.

This surge in gold prices had a profound impact on trading and investing strategies. Many investors who had diversified their portfolios by including gold or gold-related investments benefited greatly. They were able to offset the losses incurred in other asset classes, such as stocks or real estate, by the substantial appreciation in gold prices.

IV. Why Gold is Popular with Traders and Investors

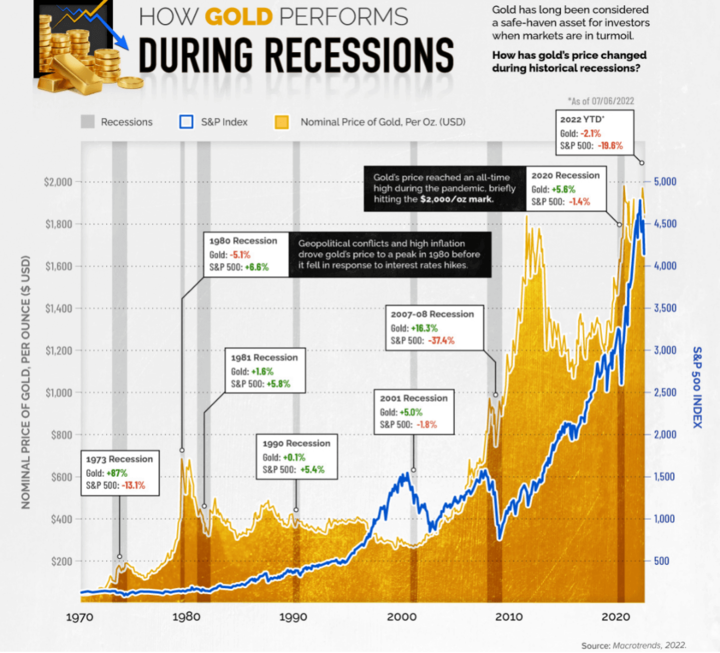

Gold's reputation as a safe haven asset during crises

Gold's perceived safety stems from its historical store of value, scarcity, and lack of reliance on any particular government or financial system. During periods of economic uncertainty, investors often seek the stability and potential liquidity Gold offers. However, it is vital to recognize that Gold's performance as a safe asset can vary. Its value is influenced by a multitude of factors, including market sentiment, supply and demand dynamics, and global economic conditions.

Source: visualcapitalist.com

Additionally, Gold's effectiveness as a safe-haven asset may be challenged during severe crises, such as deep economic recessions or systemic financial meltdowns, where investor behavior and liquidity constraints can cause significant price volatility. Therefore, while Gold can provide a measure of protection in certain situations, investors should critically assess its role within a diversified portfolio and consider other risk management strategies.

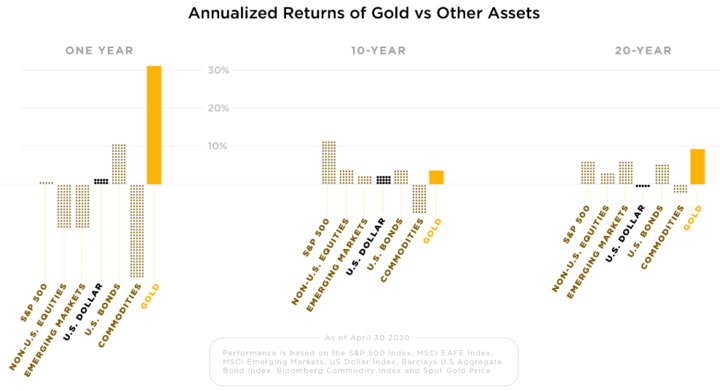

Diversification Benefits of Gold in Portfolios

Gold's low correlation with traditional financial assets, such as stocks and bonds, is often cited as a key reason for its inclusion. During periods of market turmoil, Gold has historically exhibited a tendency to move independently, acting as a potential hedge against equity market downturns. This characteristic offers the potential for reduced portfolio volatility and enhanced risk-adjusted returns.

However, it is crucial to recognize that Gold's diversification benefits may not be consistent across all market environments. Its performance can be influenced by a range of factors, including economic conditions, investor sentiment, and central bank policies. Moreover, Gold's lack of cash flow and reliance on price appreciation for returns can limit its long-term performance compared to income-generating assets.

The long-term investment Potential of Gold

Gold's historical track record as a store of value and hedge against inflation suggests potential benefits for long-term investors. It has sustained its purchasing power over time and served as a reliable diversification tool during periods of economic uncertainty.

Source: visualcapitalist.com

However, it is vital to consider the factors that influence Gold's long-term performance. Gold's price is affected by supply and demand dynamics, macroeconomic conditions, investor sentiment, and geopolitical events. These factors can introduce volatility and unpredictability into its price trajectory.

Additionally, Gold lacks cash flow and relies solely on price appreciation for returns, which can limit its potential for long-term growth compared to income-generating assets. The absence of dividends or interest payments further challenges its value proposition for income-oriented investors.

Moreover, as economies evolve and financial markets offer a wide array of investment options, the long-term outlook for Gold may be influenced by changing investor preferences and economic dynamics.

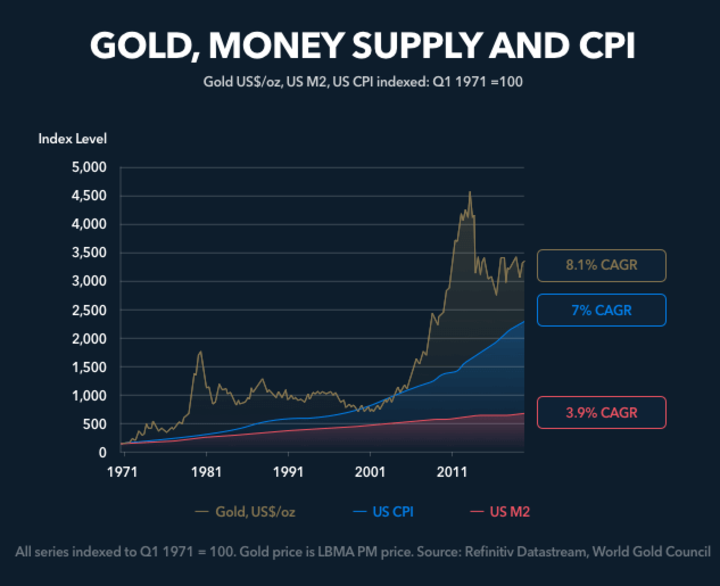

Inflation-hedging Benefits of Gold

Gold is often touted as an effective hedge against inflation, but a critical evaluation is necessary to understand its benefits in this regard. Gold's reputation as an inflation hedge stems from its historical track record of maintaining value during periods of rising prices. Its scarcity, limited supply, and universal acceptance as a store of wealth contribute to this perception.

Source: kinesis

However, the interactions between Gold and inflation are complex. Gold's price is influenced by various factors beyond inflation, including investor sentiment, monetary policies, and market dynamics. In some instances, Gold may not keep pace with inflation or experience significant volatility, leading to uncertain outcomes for investors.

Gold's appeal to traders is due to its daily price fluctuations

A critical evaluation is necessary to understand the factors driving this volatility and its implications for trading strategies. The Gold price is influenced by a myriad of factors, including macroeconomic indicators, geopolitical events, investor sentiment, and market speculation. These factors can create significant daily price swings, offering traders opportunities for short-term gains.

However, it is crucial to recognize that Gold's volatility can be challenging to navigate, as it is subject to sudden shifts in market sentiment and unpredictable events. The high liquidity and global trading volume in the gold market contributes to its price sensitivity. Traders need to employ robust risk management strategies, thorough analysis, and a deep understanding of market dynamics to successfully navigate Gold's daily price fluctuations. Pursuing short-term gains through trading gold requires a critical assessment of risk-reward trade-offs and adherence to disciplined trading strategies.

V. Investment Options for Gold

Physical Gold vs. Gold Stocks vs. Gold ETFs

Comparing physical Gold, gold stocks, and gold ETFs requires a critical evaluation of their respective characteristics, advantages, and limitations. Physical Gold, in bars or coins, offers direct ownership and actual possession. It serves as a store of value and a potential safe asset, but it lacks income generation and requires storage and security considerations.

Gold stocks represent ownership in companies involved in gold mining and exploration. They offer exposure to the potential profitability of gold mining operations but are subject to company-specific risks, such as operational challenges, management decisions, and regulatory issues.

Source: ZFunds

Gold ETFs are financial instruments that track the performance of gold prices. They provide diversification, liquidity, and convenience, allowing investors to gain exposure to Gold without physical ownership. However, they involve counterparty risk and management fees.

Pros and cons of each investment option

When comparing physical Gold, gold stocks, and gold ETFs, a critical evaluation of the pros and cons of each investment option is necessary. Physical Gold offers tangible ownership and serves as a hedge against inflation and economic uncertainty. It has intrinsic value and can be held directly, providing a sense of security. However, physical Gold requires storage and insurance, and it does not generate income.

Gold stocks provide exposure to the potential profitability of gold mining companies. They offer the opportunity for capital appreciation and dividends. However, they are subject to operational risks, such as mine production challenges, regulatory issues, and geopolitical factors. Individual company performance can significantly impact investment returns.

Gold ETFs offer convenience and liquidity. They track the price of Gold and allow investors to gain exposure to Gold without physical ownership. ETFs provide diversification across multiple gold holdings and are generally more cost-effective than physical Gold. However, they carry counterparty risk as they depend on the financial stability of the issuing institution. ETF prices can also deviate from the actual spot price of Gold due to tracking errors or market dynamics.

How to choose the right investment option based on personal goals and risk tolerance

Choosing the right investment option among physical Gold, Gold stocks, and Gold ETFs requires a critical evaluation of personal goals and risk tolerance. Firstly, understanding investment goals is crucial. If the objective is to preserve wealth and has direct ownership, physical Gold may be preferred. It serves as a tangible store of value during economic uncertainties. However, if the goal is capital appreciation and income generation, gold stocks may be suitable. They offer exposure to the potential profitability of gold mining companies and the possibility of dividends.

Secondly, assessing risk tolerance is essential. Physical Gold provides stability but lacks liquidity and income. Gold stocks are subject to operational and market risks, making them more volatile. Gold ETFs offer diversification and liquidity but carry counterparty risk.

Consideration should also be given to practical factors such as storage, transaction costs, and ease of buying or selling. Additionally, understanding the broader investment portfolio is critical. The allocation to Gold should be balanced and aligned with other asset classes to achieve diversification.

VI. Trading Gold with CFDs

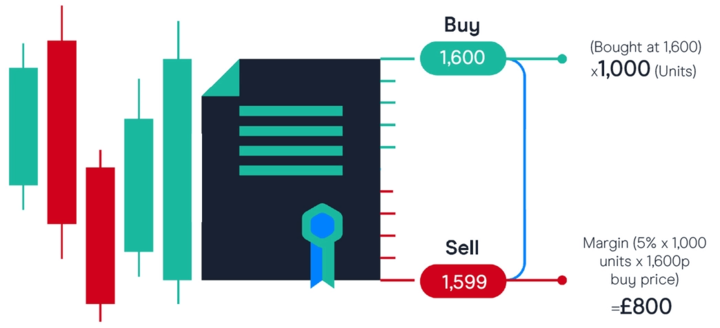

Definition of a CFD (Contract for Difference)

A CFD allows traders to speculate on the price movements of various underlying assets without owning them. In a CFD, the trader agrees with a broker or provider to exchange the difference in the underlying asset's price between the initiation and closing of the contract. CFDs offer flexibility in trading a wide range of assets, including stocks, commodities, currencies, and indices. They provide the opportunity for both long and short positions, potentially allowing traders to profit from both rising and falling markets.

Source: cmcmarkets

However, CFD trading involves leverage, which amplifies both potential gains and losses. Traders should critically evaluate the risks and benefits, understand the underlying asset, and have a solid risk management strategy before engaging in CFD trading.

Advantages and risks of trading gold CFDs

Trading gold CFDs offers several advantages, but a critical evaluation of the associated risks is essential. Benefits include the ability to speculate on gold price movements without owning physical Gold, access to leverage that amplifies potential returns, and flexibility to trade both long and short positions. CFDs also provide liquidity, allowing for easy entry and exit from trades.

However, trading gold CFDs carries risks. Leverage magnifies losses as well, making it essential to manage risk effectively. Market volatility can lead to rapid price fluctuations, increasing the potential for significant gains or losses.

Furthermore, CFDs are subject to counterparty risk, as traders rely on the financial stability of the CFD provider. Traders must conduct thorough research, employ risk management strategies, and have a clear understanding of the intricacies of trading gold CFDs before engaging in such transactions.

Factors to consider when trading gold CFDs, such as leverage and stop-loss orders

When trading gold Contracts for Difference (CFDs), several factors need to be carefully considered to make informed decisions and manage risks effectively. Two key factors are leverage and stop-loss orders.

Leverage allows traders to control a larger position in the market with a smaller amount of capital. It amplifies both potential profits and losses. While leverage can enhance returns, it also increases risk and requires caution.

For example, suppose a trader has $5,000 in their trading account and decides to use a leverage ratio of 1:5. This means they can control a position size of $25,000 ($5,000 x 5) in gold CFDs. If the price of gold moves in their favor by 1%, they would make a profit of $250 ($25,000 x 1%). However, if the price moves against them by 1%, they would incur a loss of $250.

High leverage can lead to significant gains, but it also exposes traders to substantial losses if the market moves against them.

A stop-loss order is an instruction given to the broker to automatically close a trade when the price reaches a specific predetermined level. It helps limit potential losses by exiting a trade before the losses become excessive.

For instance, suppose a trader buys gold CFDs at $1,800 per ounce and sets a stop-loss order at $1,750. If the price of gold declines and reaches $1,750, the stop-loss order will trigger, automatically closing the trade and limiting the loss.

Stop-loss orders are crucial risk management tools that protect traders from significant losses if the market moves against their position. By defining a maximum acceptable loss in advance, traders can protect their capital and prevent emotions from influencing their decisions during volatile market conditions.

VII. Risks Associated with Investing in Gold

Market risks involved with trading Gold

Trading gold involves various market risks that require critical consideration. Firstly, gold prices are influenced by macroeconomic factors, such as interest rates, inflation, and geopolitical events, which can create price volatility and uncertainty. Market sentiment and investor behavior can further exacerbate price fluctuations. Additionally, Gold is a globally traded commodity, making it susceptible to currency exchange rate fluctuations. Liquidity risks may arise, especially during periods of market stress or when trading in less actively traded markets.

Counterparty risk is present when trading gold derivatives, as traders rely on the financial stability of their brokers or counterparties. It is crucial for traders to thoroughly understand and manage these market risks through robust risk management strategies, staying informed about market developments, and conducting thorough analyses to make informed trading decisions.

Counterparty and credit risks associated with Gold activities

Counterparty risk refers to the possibility of the other party in a transaction defaulting to match their obligations, such as a gold supplier failing to deliver the agreed-upon Gold. This risk can lead to financial losses and disruptions in business operations.

Credit risk involves the potential for financial institutions or counterparties involved in gold transactions to become insolvent or fail to fulfill their financial commitments.

To mitigate these risks, thorough due diligence on counterparties, robust contractual agreements, and the use of trusted intermediaries or reputable financial institutions are essential. Regular monitoring of counterparties' financial health and implementing risk management strategies are crucial to safeguarding against counterparty and credit risks in gold activities.

Fraud and investment scams in the gold market

Fraud and investment scams pose significant risks in the gold market and require critical vigilance. Unscrupulous individuals and entities may engage in various fraudulent practices, such as selling counterfeit Gold, misleading investors with false promises of high returns, or operating Ponzi schemes. These scams often exploit investors' desire for safe-haven assets or attractive investment opportunities.

To protect against fraud, investors must exercise caution and conduct thorough due diligence on sellers, brokers, and investment opportunities. Verifying the authenticity of Gold, researching the reputation and regulatory compliance of involved parties, and seeking independent advice are crucial steps. Staying informed about typical fraud schemes, being skeptical of unrealistic claims, and reporting any suspicious activities are essential for maintaining integrity and safeguarding investments in the gold market.

VIII. Best Practices for Trading and Investing in Gold

The importance of due diligence in gold trading and investing

Due diligence plays a crucial role in gold trading and investing, and its importance cannot be overstated. Conducting thorough due diligence enables investors to make informed decisions, assess risks, and safeguard their investments. It involves researching and verifying the credibility and reputation of sellers, brokers, and investment opportunities. Evaluating factors such as licensing, regulatory compliance, financial stability, and track record helps identify responsible parties.

Additionally, due diligence helps verify the authenticity and quality of Gold, ensuring investors are not exposed to counterfeit or substandard products. By performing comprehensive due diligence, investors can mitigate the risks of fraud, scams, and financial losses. It provides a solid foundation for logical decision-making, enabling investors to navigate the gold market with confidence and enhancing the likelihood of successful trading and investment outcomes.

Building a diversified portfolio that includes Gold

Building a diversified portfolio that includes gold is a strategy aimed at managing risk and maximizing returns. However, it requires careful consideration and critical analysis to ensure an effective allocation. Here, I will provide a critical explanation along with examples to illustrate the key considerations when building a diversified portfolio that includes gold.

Determining the appropriate allocation to gold within a portfolio is crucial. It depends on factors such as risk tolerance, investment objectives, and market outlook. While there is no one-size-fits-all approach, a general guideline is to allocate a small percentage, typically 5% to 10%, of the portfolio to gold.

For example, if an investor has a $100,000 portfolio, a 5% allocation to gold would mean investing $5,000. This allocation is designed to provide diversification without overly concentrating the portfolio in a single asset.

Understanding the risk and correlation of gold with other assets is critical. Gold has historically exhibited low to negative correlation with traditional asset classes such as stocks and bonds. This means that during periods of market volatility or economic downturns, gold may act as a hedge, potentially offsetting losses in other investments.

For instance, if a portfolio is heavily weighted in stocks, including gold can help mitigate the risk associated with a market downturn. During the 2008 financial crisis, when equities suffered significant declines, gold prices surged, providing a hedge for investors who had allocated to gold.

Diversification within the gold component of the portfolio is also important. There are multiple ways to invest in gold, including physical gold (such as coins or bars), gold exchange-traded funds (ETFs), gold mining stocks, or gold futures and options.

For example, an investor may allocate a portion of the gold allocation to physical gold as a long-term store of value and allocate another portion to gold ETFs or gold mining stocks for potential growth and exposure to the gold industry. This diversification within the gold segment helps reduce concentration risk and captures different aspects of gold investing.

Building a diversified portfolio is not a one-time exercise. Regular monitoring and rebalancing are essential to maintain the desired asset allocation. Market conditions and the relative performance of different assets can cause the portfolio to deviate from its intended allocation over time.

For instance, if the price of gold significantly outperforms other asset classes, the portfolio's gold allocation may become overweight. In such cases, rebalancing involves selling some gold investments to restore the original allocation.

Staying informed about market news and trends

Staying informed about market news and trends in gold trading is essential for traders. Accessing reliable and diverse information sources enables them to make informed decisions. Various sources provide valuable insights into the gold market:

Financial News Outlets: Publications, TV channels, and websites like Bloomberg, CNBC, and Financial Times offer real-time updates, market commentary, and expert opinions on gold prices.

Market Research Reports: Reports from financial institutions and research firms such as Goldman Sachs and World Gold Council provide comprehensive analysis on factors affecting gold prices, including supply and demand dynamics and global economic trends.

Economic Indicators: Government reports and economic indicators like inflation rates, GDP growth, and central bank decisions and gold related activities provide insights into the economic health and potential impact on gold prices.

Source: visualcapitalist.com

Industry Conferences: Attending conferences and events by organizations like the LBMA and the World Gold Forum offers traders the opportunity to learn from industry experts, discuss trends, and network with peers.

By utilizing these information sources, traders can stay updated on gold market trends, understand the factors driving price movements, and make more informed trading decisions. Critical evaluation of sources and considering multiple perspectives is crucial for a well-rounded understanding of the gold market.

Developing a long-term investment strategy that includes Gold as a hedge during economic downturns

Developing a long-term investment strategy that includes gold as a hedge during economic downturns has been a popular approach for many investors. Historical examples can shed light on the rationale behind this strategy and its effectiveness in providing a hedge during challenging economic times.

The Great Recession (2007-2009):

During the Great Recession, which was triggered by the collapse of the U.S. housing market and the subsequent global financial crisis, gold proved to be an effective hedge for investors. As the stock markets plummeted and the economy contracted, the demand for gold surged. From 2007 to 2009, the price of gold rose by around 26% per year, reaching a peak of over $1,000 per ounce.

Investors who had allocated a portion of their portfolios to gold as a hedge were able to offset the losses incurred in equities and other risky assets. The rise in gold prices helped to preserve their wealth and mitigate the negative impact of the economic downturn. This example highlights how gold can act as a safe haven asset during times of severe market stress.

COVID-19 Pandemic (2020):

The outbreak of the COVID-19 pandemic in 2020 led to widespread economic uncertainty and market volatility. As economies around the world entered lockdowns and businesses suffered, investors sought refuge in safe assets like gold. During this period, the price of gold reached all-time highs, exceeding $2,000 per ounce.

Investors who had included gold in their long-term investment strategies as a hedge against economic downturns benefited from the surge in gold prices. The increase in gold's value helped to cushion the impact of declining stock markets and provided a stable source of returns amidst the market turmoil.

IX. Conclusion

A recap of the importance of Gold in trading and investing

Gold holds significant importance in trading and investing for several reasons. As a valued commodity with a long history, it serves as a store of wealth and a hedge against economic uncertainty. Gold's unique properties, such as its limited supply and intrinsic value, make it a reliable asset. It provides diversification benefits, reducing portfolio risk through its low correlation with other assets. Gold's appeal as a safe-haven asset during crises and its potential for long-term value preservation make it attractive to investors.

Furthermore, Gold's daily price fluctuations offer trading opportunities for those seeking short-term gains. Overall, Gold's importance lies in its ability to provide stability, act as a hedge, and offer potential returns in both trading and investing contexts.

Key takeaways for traders and investors looking to add Gold to their portfolios, including considerations for trading Gold with CFDs

When considering adding Gold to their portfolios, traders and investors should keep several key considerations in mind. Firstly, understanding one's investment goals and risk tolerance is crucial. Gold can act as a diversification tool and a hedge against market volatility, but various factors, including macroeconomic events, can influence its price.

For those considering trading gold with CFDs, it's essential to evaluate the advantages, such as leverage and flexibility, as well as the risks, including potential losses due to leverage and market volatility. Setting appropriate stop-loss orders can help manage risk effectively.

Moreover, conducting thorough due diligence on brokers and counterparties is vital to mitigating fraud risks. Tracking market news and trends is also essential for making informed trading decisions.

For long-term investors, Gold can be a value accumulator and a hedge against inflation and economic downturns. Considering the appropriate allocation to Gold based on one's portfolio objectives and maintaining a disciplined approach to rebalancing is critical.