- Shopify's Q1 2024 revenue grew by 23% year-over-year to $1.9 billion, with notable increases in key segments such as Merchant Solutions and Subscription Solutions.

- Shopify stock experienced modest performance in Q1 2024, with minimal price return compared to broader market indices like S&P 500 and NASDAQ.

- Shopify stands to benefit from global e-commerce growth, international expansion efforts, and advancements in enterprise and B2B segments.

- The technical outlook is bullish with a Shopify stock price target of $110 for 2024.

- Competition from platforms like WooCommerce and Squarespace presents challenges to Shopify's market dominance.

I. Shopify Q1 2024 Performance Analysis

A. Shopify Key Segments Performance

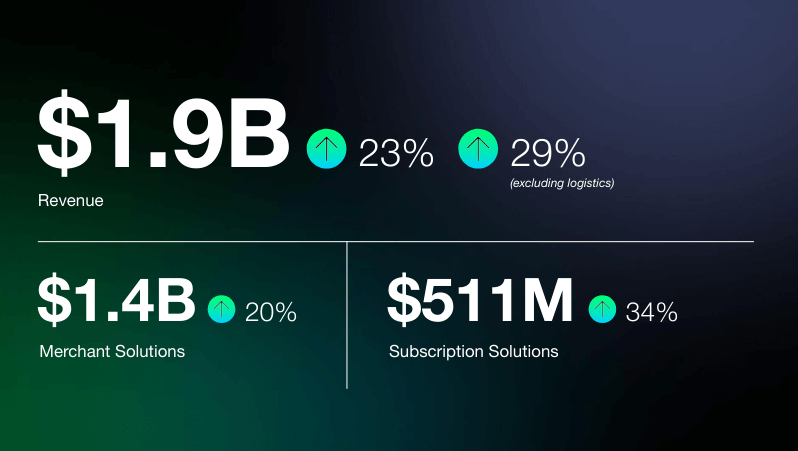

Financial Highlights:

Shopify reported a 23% increase in revenue compared to the prior year, reaching $1.9 billion. Adjusting for the sale of logistics businesses, revenue growth stood at 29%, demonstrating sustained momentum in the company's core operations. Gross profit surged by 33%, indicating strong operational efficiency and margin expansion. The gross margin for the quarter reached 51.4%, up from 47.5% in the first quarter of 2023, driven by strategic decisions such as the sale of logistics businesses and changes in pricing plans. Free cash flow margin doubled year-over-year to 12%, reaching $232 million, showcasing improved cash generation capabilities and financial health.

Source: Q1 2024 Earnings

Operational Performance:

Revenue from Merchant Solutions increased by 20% to $1.4 billion, propelled by the growth of Gross Merchandise Volume (GMV) and the continued penetration of Shopify Payments. Notably, GMV reached $60.9 billion, marking a 23% increase year-over-year. Revenue from Subscription Solutions grew by 34% to $511 million, driven by the expansion of the merchant base and pricing increases on standard subscription plans. Monthly Recurring Revenue (MRR) saw a significant uptick, reaching $151 million, with Shopify Plus contributing significantly to the growth.

Shopify Payments continued to strengthen its position, representing 60% of GMV processed in the quarter. Shop Pay, the accelerated checkout solution, experienced substantial growth, processing $14 billion in GMV and accounting for 39% of Gross Payments Volume. Shopify's omnichannel solution witnessed notable traction, particularly among larger retailers, with a 32% growth year-over-year in offline GMV. Investments in performance marketing for Point-of-Sale (POS) and feature enhancements contributed to this growth.

Technological Advancements:

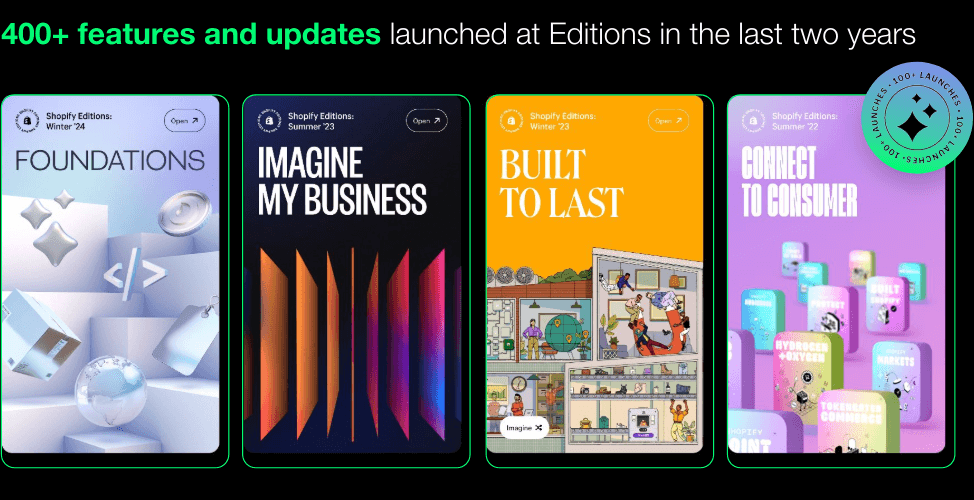

Product Development: Shopify maintained its pace of innovation, rolling out over 400 new features and updates to its platform in the past two years. Biannual product launches increased engagement and visibility among merchants and partners, reinforcing Shopify's leadership in commerce. The company continued to leverage AI through products like Shopify Magic, focusing on simplifying business operations and enhancing productivity. Future potential for AI in commerce remains promising, with ongoing efforts to explore deeper capabilities.

B. SHOP Stock Price Performance

Shopify (NYSE:SHOP) experienced modest stock price performance in Q1 2024, with opening and closing prices at $76.50 and $77.17, respectively. Despite highs of $91.56 and lows of $70.62, the overall price return was below 1%. This performance falls significantly short compared to broader market indices, with the S&P 500 (SPX) and NASDAQ (NDX) both boasting double-digit price returns at 11% and 10%, respectively, during the same period. Shopify stock held a market cap of over $100 as of March 31, 2024.

Source: trendingview.com

II. Shopify Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with Growth Potential:

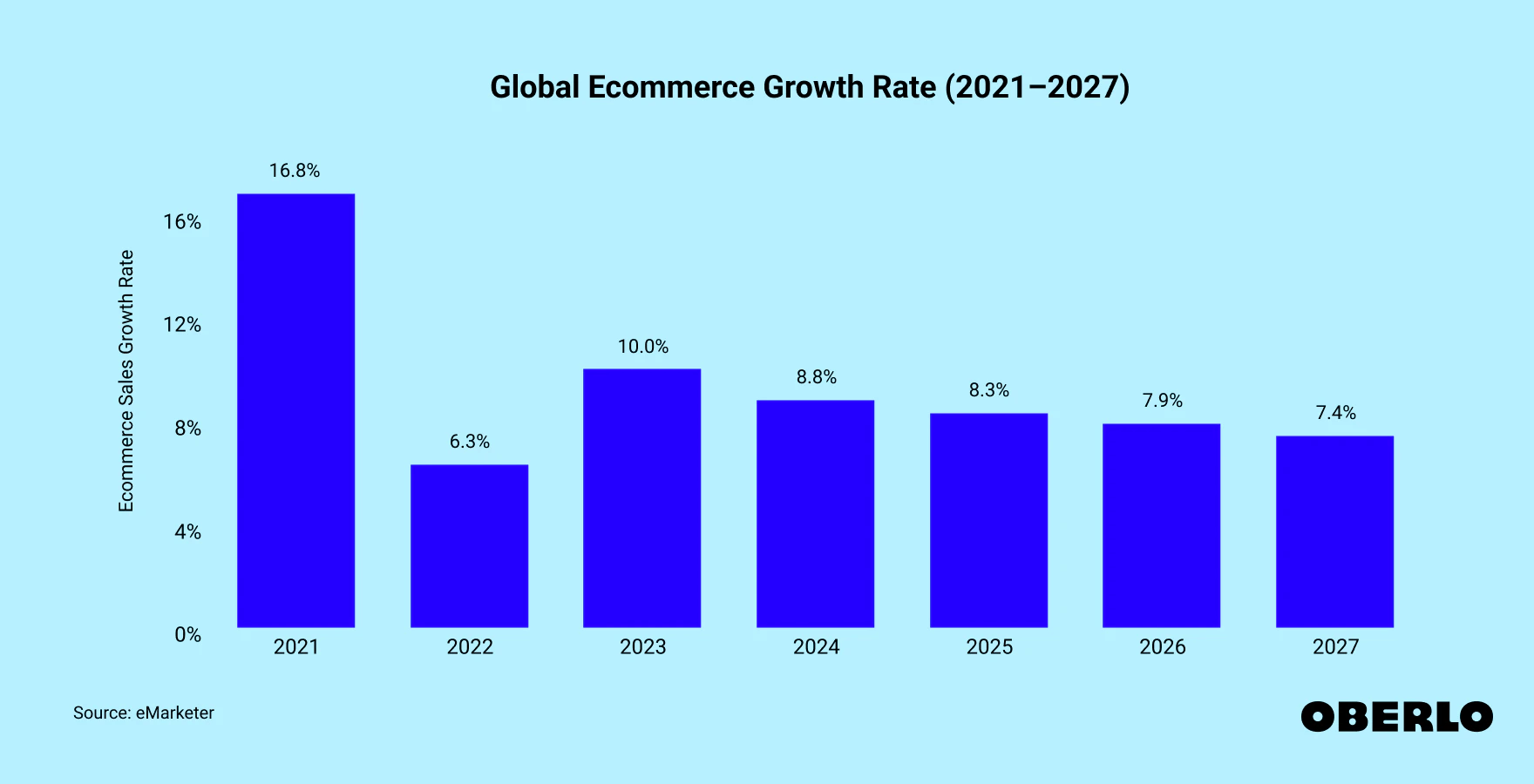

E-commerce Market Expansion: With a forecasted global e-commerce sales growth rate of 8.8% in 2024, Shopify stands to benefit from this upward trend. The US alone is expected to witness a significant increase in e-commerce revenue, presenting a favorable environment for Shopify's growth trajectory.

Source: oberlo.com

International Expansion: Shopify's focus on international markets, particularly in Europe, demonstrates a proactive approach to tapping into global opportunities. With a consistent growth rate above 35% in international GMV over the past quarters, Shopify is poised to leverage its localization efforts and tailored solutions to cater to diverse market preferences.

Enterprise and B2B Segments: Significant strides in attracting enterprise-level brands and B2B merchants indicate untapped potential. Noteworthy is Shopify's recognition as a leader in the B2B commerce platform, signaling credibility and competitiveness in serving diverse business needs.

Point-of-Sale Innovations: Investments in point-of-sale solutions, witnessed through a 32% growth in offline GMV year-over-year, highlight Shopify's commitment to omnichannel strategies. Enhanced features and customizable options drive adoption among large, multi-location merchants, further strengthening Shopify's market position.

B. Expansions and Strategic Initiatives:

Research and Development (R&D) Investments: Shopify's emphasis on product innovation, evidenced by the rollout of over 400 new features and updates within two years, underscores its commitment to staying ahead of market demands. Continued investments in R&D, particularly in AI-driven solutions like Shopify Magic, offer promising avenues for enhancing merchant experiences and driving efficiency.

Source: Q1 2024 Earnings

Partnerships and Collaborations: Collaborations with renowned brands like COACH and strategic initiatives such as the introduction of Shop Pay off-platform signal Shopify's efforts to expand its ecosystem and offer value-added services to merchants. Moreover, partnerships in international markets and the introduction of cross-border solutions like Markets Pro facilitate seamless global expansion for merchants, further fueling Shopify's growth trajectory.

Source: Seekingalpha.com

III. SHOP Stock Forecast 2024

A. Shopify Stock Prediction: Technical Analysis

The Shopify stock forecast for 2024 projects an average price target of $110.00 by the end of 2024, derived from the momentum of change-in-polarity over the mid- to short-term, projected over Fibonacci extension levels. An optimistic SHOP stock price target of $125.00 is also suggested based on the price momentum of the current swing over similar time frames.

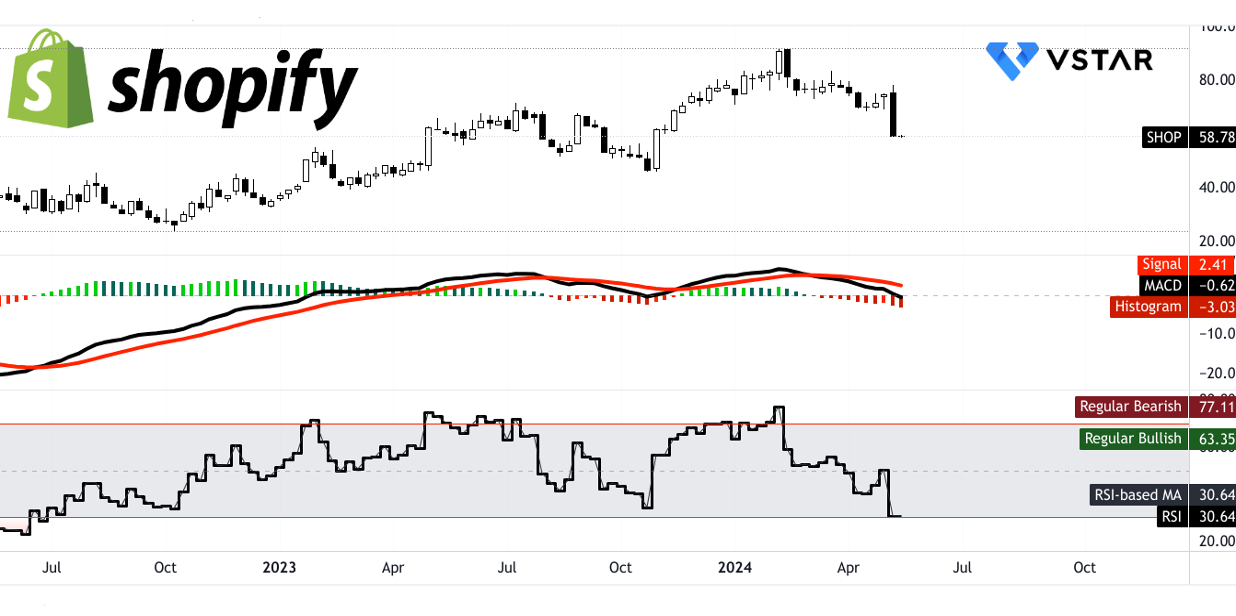

Currently priced at $58.78, the stock exhibits a downward trend, as indicated by its modified exponential moving averages, with a trendline at $74.35 and a baseline at $74.20. Primary resistance stands at $63.58, while the core resistance is identified at $110.00. Conversely, core support lies at $39.30. These levels are crucial for traders to monitor as they indicate potential turning points in the stock's trajectory.

Source: trendingview.com

Looking at the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD), RSI value of 30.64, the stock is currently in extreme bearish territory (oversold), with its RSI line trending downward. However, it signals an ideal zone to initiate systematic long-positions. Whereas, the MACD indicators confirm this bearish sentiment, with the MACD line below the signal line and a negative MACD histogram indicating increasing bearish strength.

Source: trendingview.com

B. Shopify Price Prediction: Fundamental Analysis

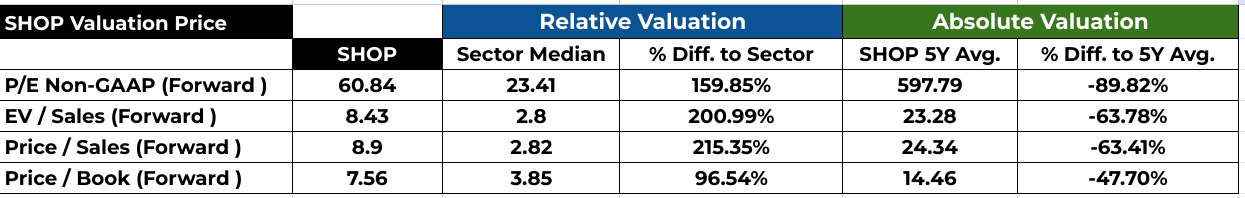

Shopify's fundamental analysis reveals a mixed picture. Its P/E ratio of 60.84, significantly higher than the sector median of 23.41, suggests overvaluation. However, relative to its own five-year average, it's down by 89.82%, indicating potential stabilization.

Source: Analyst's Compilation

Similarly, other ratios like EV/Sales, Price/Sales, and Price/Book show significant premiums compared to sector averages but improvements relative to historical data.

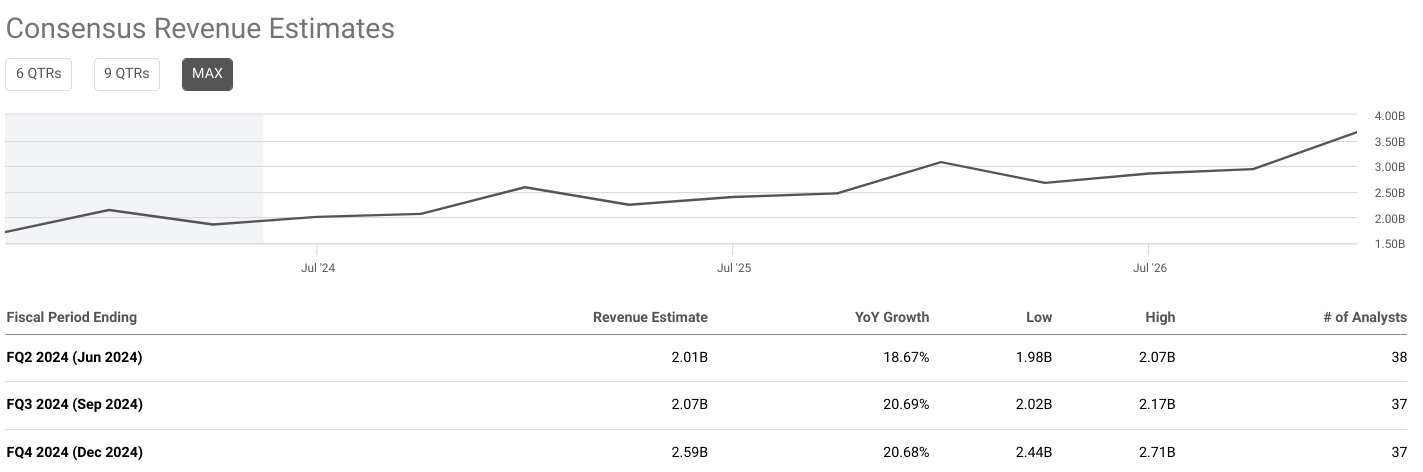

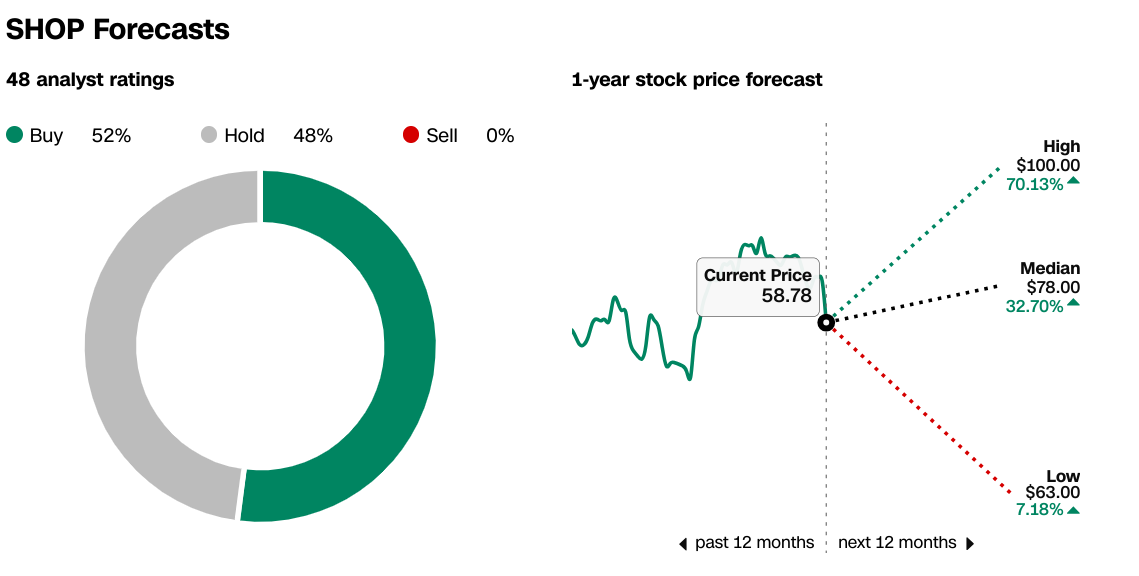

SHOP Price Target

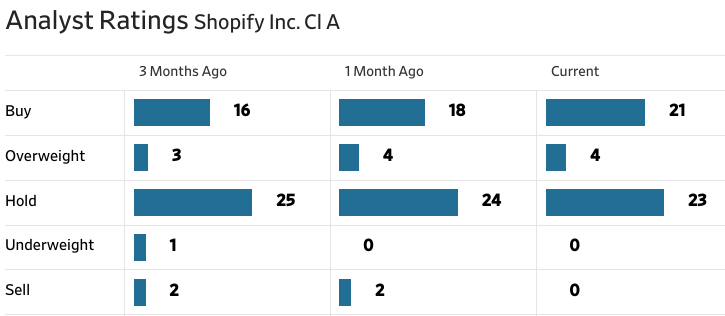

Analyst recommendations demonstrate bullish sentiment, with an increasing number of buy ratings and a median Shopify price target of $78, reflecting an upside potential from the current price of $58.78.

Source: WSJ.com

Source: CNN.com

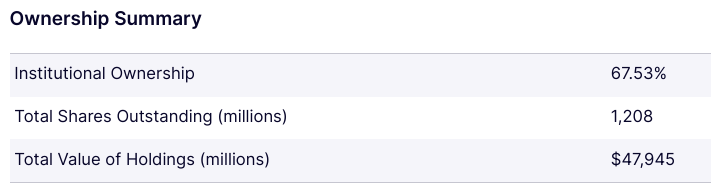

C. SHOP Stock Predictions: Market Sentiment

Market sentiment indicators are mixed. Institutional ownership stands at a robust 67.53%, reflecting confidence from large investors. However, the short interest of 16.3 million shares (2.26% of total shares outstanding) suggests some investors are betting against the stock. Yet, with just over two days to cover, this short interest may not pose an immediate threat. Overall, while fundamentals indicate potential overvaluation, bullish analyst sentiments and strong institutional holdings signal optimism for Shopify's future performance.

Source: Nasdaq.com

IV. Shopify Stock Forecast 2024: Challenges & Risk Factors

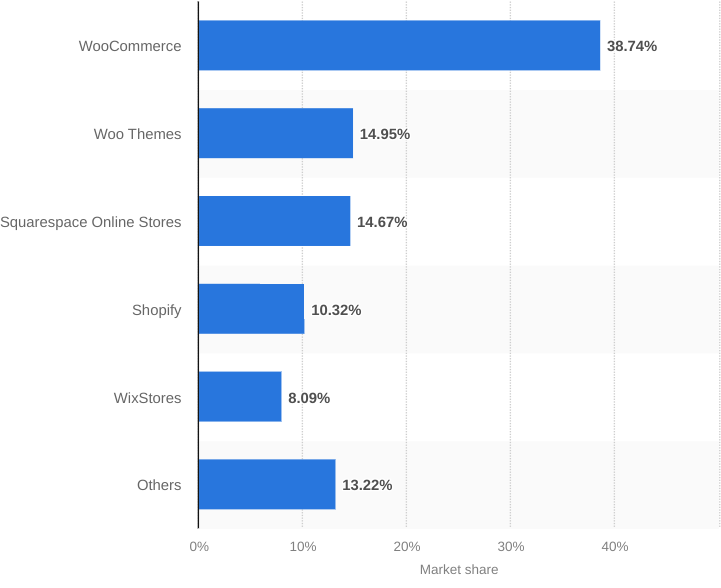

Shopify Competitors

Shopify's dominance in the e-commerce software market faces competition from platforms like WooCommerce, Woo Themes, and Squarespace Online Stores. WooCommerce, with a market share of 38.74%, poses a significant challenge to Shopify's 10.32% share. Squarespace's growing presence, especially in website building, could also encroach on Shopify's territory. Moreover, the emergence of new competitors or advancements from existing ones could further intensify competition.

Market share of leading e-commerce software platforms and technologies worldwide as of 2023

Source: statista.com

Credit Risk:

While Shopify manages credit risk through diversified merchant bases and partnerships with creditworthy institutions, concentration risk remains a concern. Despite efforts to mitigate risks associated with Shopify Capital, uncertainties persist, particularly regarding the performance of insurance policies with Export Development Canada. A failure in risk management could lead to financial setbacks and undermine investor confidence. Notably, there are no individual merchants holding 10% or more of topline or receivables.

In conclusion, considering Shopify's sustained revenue growth, technological innovations, and market leadership, SHOP stock is a buy for those seeking exposure to the e-commerce sector's potential.

For traders interested in short-term opportunities, trading Shopify stock through Contracts for Difference (CFDs) on platforms like VSTAR could provide flexibility and leverage, especially given the stock's price fluctuations.

VSTAR offers a user-friendly platform for both pro traders and beginners, with access to a wide range of markets including currencies, stocks, indices, crypto, and commodities. Its low trading fees and institutional-level trading experience make it a viable option for those looking to trade Shopify stock CFDs or other assets.